- Page 1 and 2:

Prospectus relating to the offer un

- Page 3 and 4:

4.3.3 Risks associated with the per

- Page 5 and 6:

20.4. Audit of annual financial inf

- Page 7 and 8:

6.5 Stabilisation..................

- Page 9 and 10:

Banca dell’Umbria Banca dell’Um

- Page 11 and 12:

Issuer or UniCredit or the Company

- Page 13 and 14:

Germany, and between January 14, 20

- Page 15 and 16:

UniCredit Family Financing Bank Uni

- Page 17 and 18:

CDO Acronym of Collateralized Debt

- Page 19 and 20:

well as the negative “prudential

- Page 21 and 22:

RWA (Risk-weighted asset) Value wei

- Page 23 and 24:

(h) Counterpart risk; (i) Risks ass

- Page 25 and 26:

Since its creation, the Group has c

- Page 27 and 28:

For greater information on the UniC

- Page 29 and 30:

OPERATING PROFIT (millions of €)

- Page 31 and 32:

The members of the Board of Directo

- Page 33 and 34:

Article 2441, first, second and thi

- Page 35 and 36:

− notification that the investor

- Page 37 and 38:

Selected financial information on t

- Page 39 and 40:

• statutory financial statements

- Page 41 and 42:

1. PARTIES RESPONSIBLE 1.1 Parties

- Page 43 and 44:

consolidated interim report as of t

- Page 45 and 46:

The reclassified income statement f

- Page 47 and 48:

Trading, hedging and fair value inc

- Page 49 and 50:

at 12.31.2008 Notional value 28,772

- Page 51 and 52:

4. RISK FACTORS - 51 - RISK FACTORS

- Page 53 and 54:

- 53 - RISK FACTORS Since the finan

- Page 55 and 56:

- 55 - RISK FACTORS 2009 did not em

- Page 57 and 58:

- 57 - RISK FACTORS liquidity facil

- Page 59 and 60:

- 59 - RISK FACTORS which €1,686

- Page 61 and 62:

- 61 - RISK FACTORS Increases in th

- Page 63 and 64:

- 63 - RISK FACTORS Some of the met

- Page 65 and 66:

- 65 - RISK FACTORS Regional Court

- Page 67 and 68:

- 67 - RISK FACTORS Dalmata S.r.l.

- Page 69 and 70:

- 69 - RISK FACTORS • Vanderbilt

- Page 71 and 72:

- 71 - RISK FACTORS It is maintaine

- Page 73 and 74:

- 73 - RISK FACTORS With reference

- Page 75 and 76:

- 75 - RISK FACTORS related supplem

- Page 77 and 78:

- 77 - RISK FACTORS expressly adher

- Page 79 and 80:

4.1.17 Risks associated with activi

- Page 81 and 82:

- 81 - RISK FACTORS The UniCredit G

- Page 83 and 84:

- 83 - RISK FACTORS effects on the

- Page 85 and 86:

- 85 - RISK FACTORS 4.2.5 Risks ass

- Page 87 and 88:

- 87 - RISK FACTORS For further inf

- Page 89 and 90:

5 INFORMATION ON THE COMPANY 5.1. H

- Page 91 and 92:

What is more, in August 2004 Pionee

- Page 93 and 94:

(B) The merger transactions with th

- Page 95 and 96:

Register on September 25, 2007 and

- Page 97 and 98:

December 2007 UniCredit reached an

- Page 99 and 100:

Real Estate subsequently transferre

- Page 101 and 102:

associated with liabilities which a

- Page 103 and 104:

Total 3,781 4,003 4,186 3,086 -5.5%

- Page 105 and 106:

PIRELLI PEKAO REAL ESTATE SP. Z O.O

- Page 107 and 108:

a structure by sector of activities

- Page 109 and 110:

Total 2,680 5,616 5,458 10,510 8,21

- Page 111 and 112:

(ii) credit, debit and prepaid card

- Page 113 and 114:

The CIB business segment focuses on

- Page 115 and 116:

markets and corporate treasury sale

- Page 117 and 118:

econstructed INCOME STATEMENT FIGUR

- Page 119 and 120:

The table below discloses the main

- Page 121 and 122:

For the purposes of assessing the r

- Page 123 and 124:

(the available margin is provided b

- Page 125 and 126:

these shares, provided that the sha

- Page 127 and 128:

and up-dates on the basis of the pr

- Page 129 and 130:

(i) the granting of authorizations

- Page 131 and 132:

- 131 -

- Page 133 and 134:

Private Banking Business Unit (whic

- Page 135 and 136:

Piedmont 466 2,716 17 2 Puglia 173

- Page 137 and 138:

Europe (including Germany and Austr

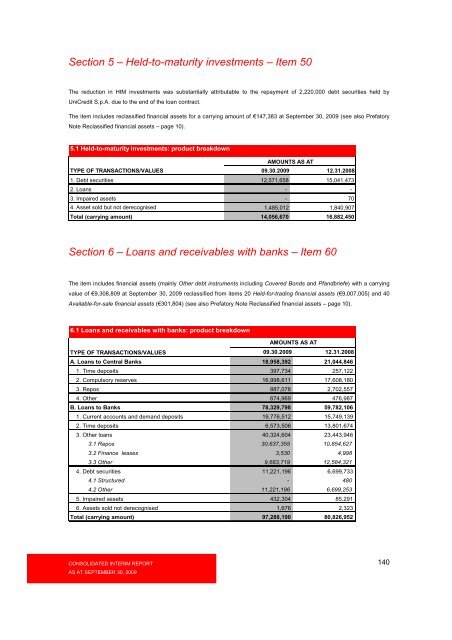

- Page 139 and 140:

(b) PMI, for corporations with an a

- Page 141 and 142:

With regards to loans 19 , as at Ju

- Page 143 and 144:

and services, combining a unique ge

- Page 145 and 146:

• the guidelines, policies and st

- Page 147 and 148:

countries), with reference to the m

- Page 149 and 150:

• the introduction, within the ne

- Page 151 and 152:

Real estate risk consists of potent

- Page 153 and 154:

7. ORGANISATIONAL STRUCTURE 7.1. Gr

- Page 155 and 156:

- 155 -

- Page 157 and 158:

7.2. Issuer’s subsidiaries The fo

- Page 159 and 160:

NAME REGISTERED OFFICE COUNTRY ACTI

- Page 161 and 162:

NAME ASPRA FINANCE S.P.A. ITALY REG

- Page 163 and 164:

NAME REGISTERED OFFICE COUNTRY PEKA

- Page 165 and 166:

NAME REGISTERED OFFICE COUNTRY ACTI

- Page 167 and 168:

NAME REGISTERED OFFICE COUNTRY UNIC

- Page 169 and 170:

ARGENTAURUS IMMOBILIEN- VERM IETUNG

- Page 171 and 172:

• Tangible assets: breakdown of a

- Page 173 and 174:

The information regarding intangibl

- Page 175 and 176:

Vienna Donau-City Wed Donau - City

- Page 177 and 178:

9. REPORT ON THE OPERATIONAL AND FI

- Page 179 and 180:

slowdown in both German and, more s

- Page 181 and 182:

this Chapter refer to these changes

- Page 183 and 184:

• 2009 − Retail − Corporate &

- Page 185 and 186:

longer intended for trading due to

- Page 187 and 188:

illion, an increase of approximatel

- Page 189 and 190:

REGULATORY CAPITAL 09.30.2009 12.31

- Page 191 and 192:

capital requirements for market ris

- Page 193 and 194:

as per the accounting standards app

- Page 195 and 196:

At the end of 2008, available-for-s

- Page 197 and 198:

Non-financial companies 3,138 1,961

- Page 199 and 200:

and demand deposits 2.2 Time deposi

- Page 201 and 202:

derecognised Total (Carrying value)

- Page 203 and 204:

The coverage ratio (or the ratio be

- Page 205 and 206:

Situation as at 31.12.2007 Notional

- Page 207 and 208:

As at September 30, 2009, similar c

- Page 209 and 210:

In its role as sponsor, the Group s

- Page 211 and 212:

showed a great deal of volatility,

- Page 213 and 214:

The Group does not have any mortgag

- Page 215 and 216:

B.2 Financial assets designated at

- Page 217 and 218:

During Q3 2009, UniCredit Real Esta

- Page 219 and 220:

Total 8,175 8,049 9,105 6,872 1.6%

- Page 221 and 222:

Total interest income is, for the t

- Page 223 and 224:

(millions of €) % Change Fee and

- Page 225 and 226:

Net hedging income (loss) (millions

- Page 227 and 228:

Administrative expenses for personn

- Page 229 and 230:

consolidation were attributable sol

- Page 231 and 232:

The cost of credit risk (calculated

- Page 233 and 234:

eing completed on October 1, 2007.

- Page 235 and 236:

and Romania). Growth in the Poland

- Page 237 and 238:

( in millions of Euros) % Change Ne

- Page 239 and 240:

markets recorded in 2007 (Croatia,

- Page 241 and 242:

Gross profit therefore stands at

- Page 243 and 244:

amounting to € 1,222 million in a

- Page 245 and 246:

1. Deposits from banks 152,437 1,94

- Page 247 and 248:

usiness segments have posted result

- Page 249 and 250:

(in millions of €) % Change Opera

- Page 251 and 252:

(in millions of €) RECONCILIATION

- Page 253 and 254:

100. Income (Losses) from sale or r

- Page 255 and 256:

100. Income (Losses) from sale or r

- Page 257 and 258:

This result should not be considere

- Page 259 and 260:

10.2. Information regarding the fin

- Page 261 and 262:

5.00% 02.01.2016 applicable not app

- Page 263 and 264:

HVB Lux Geldilux - TS - 2005 tradit

- Page 265 and 266:

10.3. Indication of the financial r

- Page 267 and 268:

12. INFORMATION ON EXPECTED TRENDS

- Page 269 and 270:

14. ADMINISTRATION, MANAGEMENT OR S

- Page 271 and 272:

Quadrante Europa (Platform for logi

- Page 273 and 274:

esearch on the strategies of multin

- Page 275 and 276:

Director; he is a Member of the Boa

- Page 277 and 278:

the Management Board of Bank Austri

- Page 279 and 280:

Alessandro Profumo Giovanni Belluzz

- Page 281 and 282:

Manfred Bischoff Enrico Tommaso Cuc

- Page 283 and 284:

Donato Fontanesi Francesco Giacomin

- Page 285 and 286:

Marianna Li Calzi Salvatore Ligrest

- Page 287 and 288:

Banca SANPAOLO IMI S.p.A. Member of

- Page 289 and 290:

Mischek Privatstiftung Member of th

- Page 291 and 292:

The members of the Board of Statuto

- Page 293 and 294:

Massimo Livatino. Degree in Economi

- Page 295 and 296:

CSP Società Consortile a r.l. Chai

- Page 297 and 298:

Giuseppe Verrascina Interpump Group

- Page 299 and 300:

Eastern Europe. In November 2001 he

- Page 301 and 302:

Group and merger with the Capitalia

- Page 303 and 304:

Reninvest SA Member of the Board of

- Page 305 and 306:

Fondazione Ugo Foscolo (UniCredit &

- Page 307 and 308:

- on the Warsaw Stock Exchange in r

- Page 309 and 310:

Person Position description Compens

- Page 311 and 312:

Person Position description Compens

- Page 313 and 314:

Other key management personnel, lis

- Page 315 and 316:

Friedrich Kadrnoska Director April

- Page 317 and 318:

External Auditors, as well as the s

- Page 319 and 320:

- put in place a set of regulations

- Page 321 and 322:

1 shares received in 2009 following

- Page 323 and 324:

(c) “Discount Share”: at the en

- Page 325 and 326:

subsidiaries - direct or indirect -

- Page 327 and 328:

For that which concerns the informa

- Page 329 and 330:

customers Other assets 45 - 16 - -

- Page 331 and 332:

The following table provides detail

- Page 333 and 334:

November 2008 December 2008 January

- Page 335 and 336:

20. FINANCIAL INFORMATION REGARDING

- Page 337 and 338:

Balance Sheet In the following tabl

- Page 339 and 340:

A. 1. OPERATING ACTIVITIES Operatio

- Page 341 and 342:

On April 30, 2009, the ordinary ses

- Page 343 and 344:

losses in the matter or, if this pe

- Page 345 and 346:

International Industrial Participat

- Page 347 and 348:

debited to the plaintiff’s accoun

- Page 349 and 350:

Accordingly, the plaintiff requeste

- Page 351 and 352:

Zagrebačka maintains that the plai

- Page 353 and 354:

In fact, the bank believes it has c

- Page 355 and 356:

In the meantime, HVB, which believe

- Page 357 and 358:

Madoff In December 2008, Bernard L.

- Page 359 and 360:

standards, no provisions were made

- Page 361 and 362:

Investigations by the Polish Tax Au

- Page 363 and 364:

In addition, BiFin conducted an ins

- Page 365 and 366:

21. ADDITIONAL INFORMATION 21.1. Eq

- Page 367 and 368:

The Board of Directors resolved: i)

- Page 369 and 370:

medium-term incentive system for Gr

- Page 371 and 372:

09.18.2008 September 16, 2008 6,683

- Page 373 and 374:

01.04.2008 December 31, 2007 6,682,

- Page 375 and 376:

10.02.2006 September 15, 2006 5,218

- Page 377 and 378:

Only shareholders that individually

- Page 379 and 380:

financial or insurance sectors, in

- Page 381 and 382:

Pursuant to Section 27 of the Artic

- Page 383 and 384:

Additionally, the Shareholders’ M

- Page 385 and 386:

If these provisions are violated, a

- Page 387 and 388:

the interest held by UniCredit in B

- Page 389 and 390:

22.7. Agreement for the sale by BA

- Page 391 and 392:

First Contribution, shares of the O

- Page 393 and 394:

23. INFORMATION ORIGINATING FROM TH

- Page 395 and 396:

25. INFORMATION ON EQUITY INVESTMEN

- Page 397 and 398:

S. NAME MEDIOBANCA BANCA DI CREDITO

- Page 399 and 400:

List of the Main Companies Subject

- Page 401 and 402:

SECOND SECTION - 401 -

- Page 403 and 404:

2. RISK FACTORS For a description o

- Page 405 and 406:

3.4 Reasons for the Offer and Use o

- Page 407 and 408:

With reference to the voting right,

- Page 409 and 410:

Some general information about the

- Page 411 and 412:

esolution following the one pertain

- Page 413 and 414:

shareholders, and the companies and

- Page 415 and 416:

Non Qualifying Holdings contribute

- Page 417 and 418:

Capital gains realised by resident

- Page 419 and 420:

4.11.2 Germany The following sectio

- Page 421 and 422:

and is an employee of the Company.

- Page 423 and 424:

Shares acquired before December 31,

- Page 425 and 426:

deducted to the extent to which the

- Page 427 and 428:

4.11.3 Poland The following summary

- Page 429 and 430:

In order to eliminate the double ta

- Page 431 and 432:

are subject to taxation on the disp

- Page 433 and 434:

donation or the acceptance of inher

- Page 435 and 436:

ending dates, by submitting a reque

- Page 437 and 438:

The Shares subscribed before the en

- Page 439 and 440:

and Australia, and in the other Exc

- Page 441 and 442:

€135,000,000, then extended to

- Page 443 and 444:

6. ADMISSION TO TRADING AND TRADING

- Page 445 and 446:

8. EXPENSES LINKED TO THE OFFER 8.1

- Page 447 and 448:

10. ADDITIONAL INFORMATION 10.1 Con

- Page 449 and 450:

Consolidated Interim Report as at S

- Page 451:

3 Consolidated Interim Report as at

- Page 455 and 456:

Contents 7 Consolidated Interim Rep

- Page 457 and 458:

Changes made to enable proper compa

- Page 459 and 460:

11 >> Consolidated Interim Report T

- Page 461 and 462:

Notes 13 Interim Report on Operatio

- Page 463 and 464:

Highlights 15 >> Interim Report on

- Page 465 and 466:

17 >> Interim Report on Operations

- Page 467 and 468:

19 >> Interim Report on Operations

- Page 469 and 470:

Results by Business Segment 21 >> I

- Page 471 and 472:

UniCredit Share SHARE INFORMATION S

- Page 473 and 474:

25 >> Interim Reports on Operations

- Page 475 and 476:

27 >> Interim Reports on Operations

- Page 477 and 478:

Operating Profit Breakdown 29 >> In

- Page 479 and 480:

Non-Interest Income 31 >> Interim R

- Page 481 and 482:

Net Profit attributable to the Grou

- Page 483 and 484:

Profit before Taxes 35 >> Interim R

- Page 485 and 486:

Capital Ratios 37 >> Interim Report

- Page 487 and 488:

39 >> Interim Report on Operations

- Page 489 and 490:

Risks connected with raising funds

- Page 491 and 492:

Retail Introduction 43 >> Group Res

- Page 493 and 494:

45 >> Group Results Retail Retail p

- Page 495 and 496:

47 >> Group Results Retail The SRT

- Page 497 and 498:

Retail Network Austria 49 >> Group

- Page 499 and 500:

Asset Gathering 51 >> Group Results

- Page 501 and 502:

53 >> Group Results Corporate & Inv

- Page 503 and 504:

Strategies and Product Lines Financ

- Page 505 and 506:

57 >> Group Results Corporate & Inv

- Page 507 and 508:

59 >> Group Results Private Banking

- Page 509 and 510:

61 >> Group Results Private Banking

- Page 511 and 512:

It is not currently possible to est

- Page 513 and 514:

65 >> Group Results Asset Managemen

- Page 515 and 516:

67 >> Group Results Central Eastern

- Page 517 and 518:

69 >> Group Results Central Eastern

- Page 519 and 520:

71 >> Group Results Central Eastern

- Page 521 and 522:

73 >> Group Results Poland’s Mark

- Page 523 and 524:

Further Information 75 >> Group Res

- Page 525 and 526:

77 >> Group Results The combination

- Page 527 and 528:

New Group external growth initiativ

- Page 529 and 530:

Transactions to dispose of equity i

- Page 531 and 532:

Steps to Strengthen Capital 83 >> G

- Page 533:

Outlook 85 >> Group Results Despite

- Page 537 and 538: 89 RELASEMESTRALE CONSOLIDATA >> Co

- Page 539 and 540: Liabilities and shareholders' equit

- Page 541 and 542: 93 RELASEMESTRALE CONSOLIDATA >> Co

- Page 543 and 544: 95 RELASEMESTRALE CONSOLIDATA >> Co

- Page 545: CONSOLIDATED CASH FLOW STATEMENT (i

- Page 548 and 549: 100

- Page 550 and 551: Part A) Accounting Policies A1) Gen

- Page 552 and 553: Section 3 - Consolidation Scope and

- Page 554 and 555: Investments in subsidiaries, compan

- Page 556 and 557: NAME MAIN OFFICE CONSOLIDATED INTER

- Page 558 and 559: NAME MAIN OFFICE CONSOLIDATED INTER

- Page 560 and 561: NAME MAIN OFFICE DELPHA IMMOBILIEN-

- Page 562 and 563: NAME MAIN OFFICE GRUNDSTUCKSAKTIENG

- Page 564 and 565: NAME MAIN OFFICE CONSOLIDATED INTER

- Page 566 and 567: NAME MAIN OFFICE CONSOLIDATED INTER

- Page 568 and 569: NAME MAIN OFFICE CONSOLIDATED INTER

- Page 570 and 571: NAME MAIN OFFICE CONSOLIDATED INTER

- Page 572 and 573: NAME MAIN OFFICE CONSOLIDATED INTER

- Page 574 and 575: NAME MAIN OFFICE CONSOLIDATED INTER

- Page 576 and 577: NAME MAIN OFFICE CONSOLIDATED INTER

- Page 578 and 579: NAME MAIN OFFICE CONSOLIDATED INTER

- Page 580 and 581: NAME MAIN OFFICE CONSOLIDATED INTER

- Page 582 and 583: Section 4 - Subsequent Events No ev

- Page 584 and 585: 136

- Page 586 and 587: Part B) Consolidated Balance Sheet

- Page 590 and 591: Section 12 - Property, plant and eq

- Page 592 and 593: The CGU is the lowest level at whic

- Page 594 and 595: Section 15 - Non-current assets and

- Page 596 and 597: Section 3 - Debt securities in issu

- Page 598 and 599: Section 15 - Shareholders’ Equity

- Page 600 and 601: 152

- Page 602 and 603: Part C) - Consolidated Income State

- Page 604 and 605: Section 3 - Dividend income and sim

- Page 606 and 607: Section 8 - Impairment losses - Ite

- Page 608 and 609: Section 12 - Provisions for risks a

- Page 610 and 611: 162

- Page 612 and 613: Part D - Segment Reporting (amounts

- Page 614 and 615: A - Primary Segment Segment Reporti

- Page 616 and 617: 168

- Page 618 and 619: Part E - Risks ad related risk mana

- Page 620 and 621: Quantitative Information A. Credit

- Page 622 and 623: A.1.3 Balance sheet exposure to ban

- Page 624 and 625: Information on Structured Credit Pr

- Page 626 and 627: Retention by the Group of the first

- Page 628 and 629: Securitized assets broken down by a

- Page 630 and 631: The following table shows exposure

- Page 632 and 633: The residual life of sponsored cond

- Page 634 and 635: Structured credit product exposures

- Page 636 and 637: The Group’s portfolio includes th

- Page 638 and 639:

A financial instrument is regarded

- Page 640 and 641:

The following table gives the amoun

- Page 642 and 643:

Here follows the breakdown of balan

- Page 644 and 645:

The following graphs analyze the ba

- Page 646 and 647:

Currently, clockwise and counter-cl

- Page 648 and 649:

Sensitivity to the volatility of in

- Page 650 and 651:

Section 3 - Liquidity risk Managing

- Page 652 and 653:

Organizational structure Senior Man

- Page 654 and 655:

B. Legal Risks There are a number o

- Page 656 and 657:

Cirio In April 2004 the Extraordina

- Page 658 and 659:

Divania S.r.l In the first half of

- Page 660 and 661:

Mario Malavolta On July 2009 Mr. Ma

- Page 662 and 663:

Hypo Real Estate AG and Hypo Real E

- Page 664 and 665:

Squeeze-out of minority shareholder

- Page 666 and 667:

In addition, several proceedings ha

- Page 668 and 669:

220

- Page 670 and 671:

Part F - Information on Shareholder

- Page 672 and 673:

Section 2 - Shareholders’ equity

- Page 674 and 675:

B. Quantitative information Regulat

- Page 676 and 677:

228

- Page 678 and 679:

Part H - Related-party transactions

- Page 680 and 681:

232

- Page 682 and 683:

Part I) Share-Based Payments A. Qua

- Page 684 and 685:

236

- Page 686 and 687:

Annex 1 - Reconciliation of Condens

- Page 688 and 689:

CONSOLIDATED INCOME STATEMENT (€

- Page 690 and 691:

Annex 2 - Definition of Terms and A

- Page 692 and 693:

- Pillar 1: while the objective of

- Page 694 and 695:

Cost of risk The ratio between loan

- Page 696 and 697:

Hedge Fund Speculative mutual inves

- Page 698 and 699:

Liquidity risk The risk of the comp

- Page 700 and 701:

Purchase Companies Vehicle used by

- Page 702 and 703:

UCITS - Undertaking for Collective

- Page 704 and 705:

256

- Page 706 and 707:

258

- Page 708:

260