The New School of Business Building - University at Albany

The New School of Business Building - University at Albany

The New School of Business Building - University at Albany

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ALUMNI PROFILE<br />

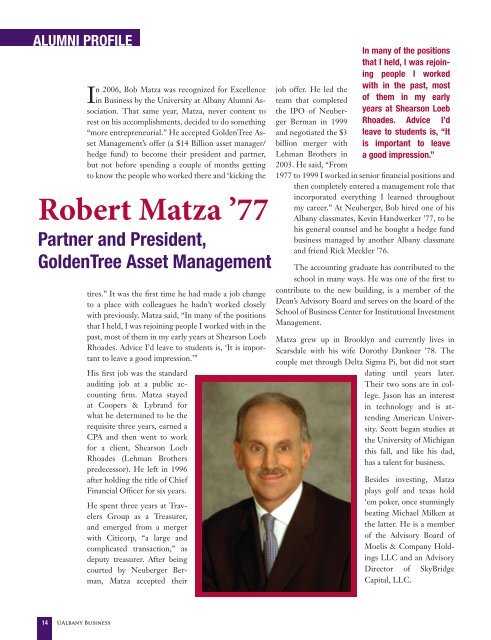

In 2006, Bob M<strong>at</strong>za was recognized for Excellence<br />

in <strong>Business</strong> by the <strong>University</strong> <strong>at</strong> <strong>Albany</strong> Alumni Associ<strong>at</strong>ion.<br />

Th<strong>at</strong> same year, M<strong>at</strong>za, never content to<br />

rest on his accomplishments, decided to do something<br />

“more entrepreneurial.” He accepted GoldenTree Asset<br />

Management’s <strong>of</strong>fer (a $14 Billion asset manager/<br />

hedge fund) to become their president and partner,<br />

but not before spending a couple <strong>of</strong> months getting<br />

to know the people who worked there and ‘kicking the<br />

Robert M<strong>at</strong>za ’77<br />

Partner and President,<br />

GoldenTree Asset Management<br />

14<br />

U<strong>Albany</strong> <strong>Business</strong><br />

tires.” It was the fi rst time he had made a job change<br />

to a place with colleagues he hadn’t worked closely<br />

with previously. M<strong>at</strong>za said, “In many <strong>of</strong> the positions<br />

th<strong>at</strong> I held, I was rejoining people I worked with in the<br />

past, most <strong>of</strong> them in my early years <strong>at</strong> Shearson Loeb<br />

Rhoades. Advice I’d leave to students is, ‘It is important<br />

to leave a good impression.’”<br />

His fi rst job was the standard<br />

auditing job <strong>at</strong> a public accounting<br />

fi rm. M<strong>at</strong>za stayed<br />

<strong>at</strong> Coopers & Lybrand for<br />

wh<strong>at</strong> he determined to be the<br />

requisite three years, earned a<br />

CPA and then went to work<br />

for a client, Shearson Loeb<br />

Rhoades (Lehman Brothers<br />

predecessor). He left in 1996<br />

after holding the title <strong>of</strong> Chief<br />

Financial Offi cer for six years.<br />

He spent three years <strong>at</strong> Travelers<br />

Group as a Treasurer,<br />

and emerged from a merger<br />

with Citicorp, “a large and<br />

complic<strong>at</strong>ed transaction,” as<br />

deputy treasurer. After being<br />

courted by Neuberger Berman,<br />

M<strong>at</strong>za accepted their<br />

job <strong>of</strong>fer. He led the<br />

team th<strong>at</strong> completed<br />

the IPO <strong>of</strong> Neuberger<br />

Berman in 1999<br />

and negoti<strong>at</strong>ed the $3<br />

billion merger with<br />

Lehman Brothers in<br />

2003. He said, “From<br />

In many <strong>of</strong> the positions<br />

th<strong>at</strong> I held, I was rejoining<br />

people I worked<br />

with in the past, most<br />

<strong>of</strong> them in my early<br />

years <strong>at</strong> Shearson Loeb<br />

Rhoades. Advice I’d<br />

leave to students is, “It<br />

is important to leave<br />

a good impression.”<br />

1977 to 1999 I worked in senior fi nancial positions and<br />

then completely entered a management role th<strong>at</strong><br />

incorpor<strong>at</strong>ed everything I learned throughout<br />

my career.” At Neuberger, Bob hired one <strong>of</strong> his<br />

<strong>Albany</strong> classm<strong>at</strong>es, Kevin Handwerker ’77, to be<br />

his general counsel and he bought a hedge fund<br />

business managed by another <strong>Albany</strong> classm<strong>at</strong>e<br />

and friend Rick Meckler ’76.<br />

<strong>The</strong> accounting gradu<strong>at</strong>e has contributed to the<br />

school in many ways. He was one <strong>of</strong> the fi rst to<br />

contribute to the new building, is a member <strong>of</strong> the<br />

Dean’s Advisory Board and serves on the board <strong>of</strong> the<br />

<strong>School</strong> <strong>of</strong> <strong>Business</strong> Center for Institutional Investment<br />

Management.<br />

M<strong>at</strong>za grew up in Brooklyn and currently lives in<br />

Scarsdale with his wife Dorothy Dankner ’78. <strong>The</strong><br />

couple met through Delta Sigma Pi, but did not start<br />

d<strong>at</strong>ing until years l<strong>at</strong>er.<br />

<strong>The</strong>ir two sons are in college.<br />

Jason has an interest<br />

in technology and is <strong>at</strong>tending<br />

American <strong>University</strong>.<br />

Scott began studies <strong>at</strong><br />

the <strong>University</strong> <strong>of</strong> Michigan<br />

this fall, and like his dad,<br />

has a talent for business.<br />

Besides investing, M<strong>at</strong>za<br />

plays golf and texas hold<br />

‘em poker, once stunningly<br />

be<strong>at</strong>ing Michael Milken <strong>at</strong><br />

the l<strong>at</strong>ter. He is a member<br />

<strong>of</strong> the Advisory Board <strong>of</strong><br />

Moelis & Company Holdings<br />

LLC and an Advisory<br />

Director <strong>of</strong> SkyBridge<br />

Capital, LLC.