compañía anónima nacional teléfonos de venezuela - Cantv

compañía anónima nacional teléfonos de venezuela - Cantv

compañía anónima nacional teléfonos de venezuela - Cantv

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COMPAÑÍA ANÓNIMA NACIONAL<br />

TELÉFONOS DE VENEZUELA (CANTV)<br />

AND SUBSIDIARIES<br />

FINANCIAL AND OPERATING ANNUAL REPORT<br />

FOR THE YEAR ENDED DECEMBER 31, 2007

TABLE OF CONTENTS<br />

Page<br />

INTRODUCTION .............................................................................................................................. 1<br />

SECTION I. INFORMATION ON THE COMPANY ........................................................................ 5<br />

SECTION II. CAPITAL STOCK AND CORPORATE GOVERNANCE.............................................. 17<br />

SECTION III. TELECOMMUNICATIONS REGULATORY FRAMEWORK.......................................... 32<br />

SECTION IV. FINANCIAL AND OPERATING INFORMATION ........................................................ 38<br />

SECTION V. LITIGATION ...................................................................................................... 52<br />

SECTION VI. TRADING INFORMATION.................................................................................... 57<br />

SECTION VII. ADDITIONAL INFORMATION................................................................................ 61<br />

SECTION VIII. EXHIBITS ......................................................................................................... 72

Introduction<br />

As used in this financial and operating report for the year en<strong>de</strong>d December 31, 2007,<br />

unless the context otherwise requires, “we”, “us”, “our” and the “Company” means Compañía<br />

Anónima Nacional Teléfonos <strong>de</strong> Venezuela (CANTV) and its consolidated subsidiaries, and<br />

“CANTV” means Compañía Anónima Nacional Teléfonos <strong>de</strong> Venezuela (CANTV). Unless<br />

otherwise specified, all references in this report to “bolivars” or “Bs.” are to Venezuelan<br />

“bolívares”, the legal ten<strong>de</strong>r currency of the Bolivarian Republic of Venezuela (“Venezuela” or<br />

“the Republic”).<br />

CANTV has filed an annual report on Form 20-F with the United States Securities and<br />

Exchange Commission (“SEC”) since 1997. Its most recent annual report on Form 20-F was<br />

filed on May 18, 2007, for the year en<strong>de</strong>d December 31, 2006. The annual report on Form 20-F<br />

for the year en<strong>de</strong>d December 31, 2007 was not filed with the SEC because, on June 30, 2008,<br />

CANTV filed a request to <strong>de</strong>register from the SEC and terminate its reporting obligations. The<br />

purpose of this report is to present certain financial and operating information which is similar to<br />

the information that would have been inclu<strong>de</strong>d in the Form 20-F for the year en<strong>de</strong>d December<br />

31, 2007 if CANTV had been required to file it with the SEC.<br />

On June 30, 2008, CANTV filed a Form 15F with the SEC to <strong>de</strong>register its Class D<br />

shares (including the Class D shares represented by its American Depositary Shares) from the<br />

SEC and terminate its reporting obligations un<strong>de</strong>r the U.S. Securities Exchange Act of 1934 (the<br />

“Exchange Act”) pursuant to Rule 12h-6 un<strong>de</strong>r the Exchange Act. Subject to a number of<br />

conditions, Rule 12h-6 permits <strong>de</strong>registration of a class of registered securities if the average<br />

daily trading volume (“ADTV”) of a class in United States for a recent 12-month period has been<br />

no greater than 5% of the ADTV of the class on a worldwi<strong>de</strong> basis for the same period.<br />

CANTV’s reporting obligations un<strong>de</strong>r the Exchange Act (including the obligation to file the<br />

annual report on Form 20-F that would have otherwise been due in June 30, 2008) were<br />

suspen<strong>de</strong>d immediately upon filing of the Form 15F. The <strong>de</strong>registration and termination of<br />

reporting will become effective 90 days after the filing (unless the Form 15F is earlier withdrawn<br />

by CANTV).<br />

On January 8, 2007, the Presi<strong>de</strong>nt of the Republic announced Venezuela’s intention to<br />

nationalize CANTV, in or<strong>de</strong>r to recover one of the companies with highest strategic value for the<br />

nation’s integral <strong>de</strong>velopment. On February 12, 2007, the Republic entered into a<br />

“Memorandum of Un<strong>de</strong>rstanding” with Verizon Communications Inc. (“Verizon”) and Verizon’s<br />

wholly-owned subsidiary GTE Venholdings B.V. (“GTE Venholdings”) to acquire Verizon’s<br />

equity stake CANTV, which represented approximately 28.51% of the outstanding equity share<br />

capital of CANTV.<br />

On April 8 and 9, 2007, respectively, the Republic commenced concurrent public ten<strong>de</strong>r<br />

offers (each an “Offer” and collectively the “Offers”) in Venezuela to purchase any and all shares<br />

of CANTV’s outstanding capital stock, other than those already owned by the Republic, and in<br />

the United States to purchase any and all of CANTV’s outstanding American Depositary Shares<br />

(“ADSs”), each representing seven Class D shares. The purchase price paid in the U.S. Offer<br />

was U.S.$14.84791 per ADS. The purchase price paid in the Venezuelan Offer was the bolivar<br />

equivalent of U.S.$2.12113 per share based on the official exchange rate for the sale of dollars<br />

established by the Banco Central <strong>de</strong> Venezuela (the “Central Bank of Venezuela”) as of the<br />

settlement date for the Venezuelan Offer on the Bolsa <strong>de</strong> Valores <strong>de</strong> Caracas (the “Caracas<br />

Stock Exchange”). The Offers expired on May 8, 2007.<br />

1

On May 16, 2007, the Republic announced that it had purchased, through the Ministerio<br />

<strong>de</strong>l Po<strong>de</strong>r Popular para las Telecomunicaciones y la Informática (the “Ministry of the Popular<br />

Power for Telecommunications and Information Technology”), 61,257,605 ADSs (representing<br />

an aggregate of 428,803,235 Class D shares) ten<strong>de</strong>red in the U.S. Offer, and 197,949,721<br />

common shares ten<strong>de</strong>red in the Venezuelan Offer. Payment for the common shares and ADSs<br />

was ma<strong>de</strong> on or about May 21, 2007. The common shares and ADSs acquired by the Republic<br />

pursuant to the Offers (which inclu<strong>de</strong>d all of the shares and ADSs previously owned by<br />

Verizon), together with the 51,900,000 Class B shares already held by the Banco <strong>de</strong> Desarrollo<br />

Económico y Social <strong>de</strong> Venezuela (“BANDES”) (the Venezuelan Bank for Economic and Social<br />

Development) and the Ministerio <strong>de</strong>l Po<strong>de</strong>r Popular para la Infraestructura (the “Ministry of the<br />

Popular Power for Infrastructure”), represented an aggregate of approximately 86.2% of the<br />

outstanding shares of CANTV’s capital stock owned by the Republic.<br />

On June 18, 2007, the New York Stock Exchange (the “NYSE”) filed a notification with<br />

the SEC to <strong>de</strong>-list the ADSs from the NYSE. The <strong>de</strong>-listing became effective on June 28, 2007.<br />

As <strong>de</strong>scribed above, on June 30, 2008, CANTV filed a Form 15F with the SEC to <strong>de</strong>register<br />

from the SEC and terminate its reporting obligations un<strong>de</strong>r the Exchange Act pursuant to Rule<br />

12h-6.<br />

On March 31, 2008, the Republic entered into a purchase agreement with Renaissance<br />

Technologies LLC (“Renaissance”) to acquire 3,613,996 ADSs (representing 25,297,972 Class<br />

D shares) of CANTV owned by Renaissance. The acquisition was consummated on April 4,<br />

2008. The consi<strong>de</strong>ration paid to Renaissance consisted of a purchase price U.S.$11.27 per<br />

ADS, plus and an amount equal to the ordinary and extraordinary divi<strong>de</strong>nds, aggregating<br />

U.S.$2.88 per ADS, <strong>de</strong>clared by an Ordinary Sharehol<strong>de</strong>rs’ Assembly on March 31, 2008. As a<br />

result of the consummation of the Renaissance transaction, the Republic acquired 25,297,972<br />

Class D shares which, together with 626,752,956 Class D shares owned by the Republic,<br />

through the Ministry of the Popular Power for Telecommunications and Information Technology,<br />

and the 51,900,000 Class B shares held by BANDES and the Ministry of the Popular Power for<br />

Infrastructure, represent an aggregate of 89.4% of the outstanding common shares of CANTV<br />

which are owned by the Republic. As of June 26, 2008, all Class D shares owned by the<br />

Republic were converted into Class B shares pursuant to a provision of CANTV’s by-laws.<br />

On March 31, 2008, the Republic announced that as a result of its acquisition of ADSs<br />

from Renaissance, Venezuelan law requires the Republic to offer to purchase any and all of the<br />

other outstanding ADSs and Class D shares of CANTV not already owned by the Republic on<br />

the date the offer commences (i) at a price, payable in U.S. dollars, of U.S.$11.27 per ADS for<br />

ADSs, and (ii) at a price, payable in bolivars, of the Bolivar equivalent of U.S.$1.61 per share,<br />

calculated at the official exchange rate in the Republic for the sale of U.S. dollars by the Central<br />

Bank of Venezuela, in effect on the date of the settlement of the offer in a special session on the<br />

Caracas Stock Exchange, for shares that are not represented by ADSs (being the U.S.$11.27<br />

per ADS price divi<strong>de</strong>d by seven to reflect that each ADS represents seven Class D shares). It is<br />

contemplated that hol<strong>de</strong>rs of CANTV’s Class C shares will be able to participate in the offer by<br />

converting their Class C shares into Class D shares in accordance with the procedure<br />

established in CANTV’s by-laws. As of the date of this report, it is CANTV’s un<strong>de</strong>rstanding that<br />

the Republic is continuing to consi<strong>de</strong>r an appropriate structure for the transaction, and that it will<br />

continue to make available updated information as it becomes available.<br />

2

The Company’s consolidated financial statements comply in full and have been prepared<br />

in accordance with International Financial Reporting Standards (“IFRS”), issued by the<br />

International Accounting Standards Board (“IASB”), which inclu<strong>de</strong>: (i) IFRS, (ii) International<br />

Accounting Standards (“IAS”) and (iii) International Financial Reporting Interpretations<br />

Committee (“IFRIC”) or the former Standing Interpretations Committee (“SIC”) rules, and un<strong>de</strong>r<br />

the historical cost convention.<br />

Pursuant to Resolution No. 157-2004 published in the Official Gazette of Venezuela No.<br />

38,085 dated December 13, 2004, the Comisión Nacional <strong>de</strong> Valores (the “CNV”) (the<br />

Venezuelan National Securities Commission) resolved that companies offering securities to the<br />

public un<strong>de</strong>r the Venezuelan Capital Markets Law must prepare and present their financial<br />

statements in accordance with IFRS beginning January 1, 2006, with IFRS becoming effective<br />

on January 1, 2005. On December 8, 2005, the CNV issued Resolution No. 177-2005, which<br />

postponed the requirement to prepare financial statements un<strong>de</strong>r IFRS until the Fe<strong>de</strong>ración<br />

Venezolana <strong>de</strong> Colegios <strong>de</strong> Contadores Públicos <strong>de</strong> Venezuela (“FCCPV”) (the Venezuelan<br />

Fe<strong>de</strong>ration of Public Accountants) adopts IFRS as accounting principles generally accepted in<br />

Venezuela. However, early adoption of IFRS is permitted upon compliance with certain<br />

requirements. Accordingly, the Company adopted IFRS for the preparation of consolidated<br />

financial statements as of and for the year en<strong>de</strong>d December 31, 2005 for the first time.<br />

In January 2004, the FCCPV <strong>de</strong>ci<strong>de</strong>d to adopt IFRS and its interpretations, issued by<br />

the IASB. The FCCPV resolved that the initial adoption date of these standards for entities that<br />

offer securities to the public, will be established by the CNV, the regulatory body of public<br />

companies. The FCCPV established that the Venezuelan generally accepted accounting<br />

principles will be <strong>de</strong>signated by the symbol “VEN-FRS”. During 2005, the Company adopted<br />

IFRS which are different from VEN-FRS; therefore, the Company is currently analyzing the<br />

possible effects that the VEN-FRS could have on the consolidated financial statements.<br />

However, until the CNV issues a statement regarding this adoption plan, it is not possible to<br />

<strong>de</strong>termine the potential effects.<br />

On March 6, 2007, as published in the Official Gazette of Venezuela No. 38.638, the<br />

Decree with Status of Law regarding monetary conversion (“the Monetary Conversion Law”)<br />

was approved. Beginning January 1, 2008, the Monetary Conversion Law establishes a system<br />

whereby the current monetary unit, the “Bolivar” (“Bs.”), would replaced by a new unit, the<br />

“Bolivar Fuerte” (“Strong Bolivar”) (“Bs.F.”) which is the equivalent of Bs. 1,000.00. The Decree<br />

with Status of Law establishes that beginning on such date, all prices of goods and services,<br />

salaries, pensions, <strong>de</strong>bt, payment obligations, taxes, stock quotes in exchange markets,<br />

exchange rates, rates and tariffs, amounts contained in financial statements or any other<br />

accounting documents and, in general, any or reference expressed in local currency would be<br />

expressed in the new currency.<br />

On June 6, 2007, the Central Bank of Venezuela issued Resolution No. 07-06-02<br />

relating to the Rules for Monetary Conversion and Rounding, published in the Official Gazette of<br />

Venezuela No. 38.711. This resolution establishes, among other matters, that financial<br />

statements that are for periods en<strong>de</strong>d before January 1, 2008 but that will be approved after<br />

such date, must be prepared and presented in current Bs. as of December 31, 2007. For<br />

comparison with future periods, the amounts stated in such financial statements must be<br />

converted into Bs.F. using the equivalency established un<strong>de</strong>r the new law.<br />

3

On January, 24, 2008, the Central Bank of Venezuela issued Resolution No. 08-01-02<br />

which establishes that, beginning January 1, 2008, any comparison of statistical or accounting<br />

information with previous years must be ma<strong>de</strong> in the same monetary unit. Thus, financial<br />

information from year prior to 2008 which was originally expressed in Bs. must be converted into<br />

Bs.F. by dividing their amounts by 1,000.00, or alternatively, the financial information for 2008<br />

which is originally expressed in Bs.F. may be converted into Bs. by multiplying the amounts by<br />

1,000.00. Since the Company’s financial statements as of December 31, 2007 are expressed in<br />

Bs., solely for comparison purposes, any amounts in this report relating to 2008 originally<br />

expressed in Bs.F., have been converted into Bs. by multiplying such amounts by 1,000.00.<br />

All the information presented in this report with respect to business strategy, plans and<br />

trends, as well as the consolidated financial statements, have been prepared based on the<br />

Company’s current strategic business plan for the period 2008-2013 approved by the Board of<br />

Directors on February 12, 2008.<br />

The consolidated financial statements as of December 31, 2007 have been prepared<br />

based on events and facts known as of March 10, 2008, the date on which the Board of<br />

Directors approved their issuance.<br />

4

Introduction<br />

Section I. Information on the Company<br />

CANTV is the primary provi<strong>de</strong>r of telecommunications services in Venezuela, and the<br />

owner of a nationwi<strong>de</strong> basic telecommunications network, through which it provi<strong>de</strong>s local,<br />

domestic and international wireline telephone services, as well as private network, data<br />

networks, public telephony and rural telephony services. In addition, CANTV provi<strong>de</strong>s other<br />

telecommunications services, including national wireless communications, Internet access and<br />

publication of telephone directories through its principal subsidiaries: Telecomunicaciones<br />

Movilnet, C.A. (“Movilnet”), CANTV.Net, C.A. (“CANTV.Net”) and C.A. Venezolana <strong>de</strong> Guías<br />

(“Caveguías”).<br />

The purpose of the Company is to administer, <strong>de</strong>velop, establish and exploit<br />

telecommunication networks and ren<strong>de</strong>r telecommunications and information technology<br />

services that inclu<strong>de</strong> such service as: local fixed telephony and domestic and international long<br />

distance telephone services, radiotelephony, mobile cellular services, Internet, value-ad<strong>de</strong>d,<br />

transportation, transmission of and access to data networks, distribution by subscription, radio<br />

messages, radio <strong>de</strong>termination, land mobile radio communication, maritime radio<br />

communication, aeronautical radio communication, meteorological support, <strong>de</strong>velopment of<br />

content and telephone directory; to acquire and market telecommunications and information<br />

technology media and equipment; to lease circuits, collection services, billing and other services<br />

to third parties; to adopt and provi<strong>de</strong> new services established by technical advances in the<br />

telecommunications field; to issue bonds and obligations in accordance with legal requirements;<br />

to enter into agreements with foreign administrations or companies in all matters concerning<br />

Company activities in or<strong>de</strong>r to promote international integration; to participate in international<br />

associations, institutes or groups <strong>de</strong>dicated to perfecting telecommunications or to scientific and<br />

technological research; to participate in international organizations with expertise in<br />

telecommunications and to promote and create companies which it wholly or partly owns, in<br />

Venezuela or in other countries, to conduct activities related and connected to its corporate<br />

purpose, as well as to promote companies that are State-owned of whose production is for<br />

societal purposes, or cooperatives or any other type of entity associated with socially-oriented<br />

economy.<br />

CANTV is a “<strong>compañía</strong> <strong>anónima</strong>” incorporated in Venezuela as Compañía Anónima<br />

Nacional Teléfonos <strong>de</strong> Venezuela (CANTV) on June 20, 1930. CANTV is registered in the<br />

Registro Mercantil Primero <strong>de</strong>l Distrito Fe<strong>de</strong>ral y Estado Miranda (First Registry of Commerce of<br />

the Fe<strong>de</strong>ral District and State of Miranda) un<strong>de</strong>r file number 405. CANTV’s registered office is<br />

located at Avenida Libertador, Centro Nacional <strong>de</strong> Telecomunicaciones, Nuevo Edificio<br />

Administrativo, Piso 1, Apartado Postal 1226, Caracas, Venezuela 1010 (Telephone: +58 212<br />

500 6800). CANTV’s Internet website address is http://www.cantv.com.ve. The information on<br />

CANTV’s website is not incorporated in this document.<br />

History<br />

CANTV was incorporated on June 20, 1930 by private investors to operate certain<br />

telecommunications services. In 1953, CANTV was nationalized and remained un<strong>de</strong>r control of<br />

the Republic until 1991.<br />

5

In December 1991, the Republic, through the Fondo <strong>de</strong> Inversiones <strong>de</strong> Venezuela<br />

(“FIV”) (the Venezuelan Investment Fund) (currently BANDES), sold 40% of the equity share<br />

capital of CANTV to VenWorld Telecom, C.A. (“VenWorld”), a company organized un<strong>de</strong>r the<br />

laws of Venezuela originally by consortium led by GTE Corporation (currently Verizon), for a<br />

purchase price of U.S.$1,885 million.<br />

In November 1996, the Republic sold 348,100,000 Class D shares representing 34.8%<br />

of the equity share capital of CANTV in an international public offering.<br />

On February 25, 2002, the sharehol<strong>de</strong>rs of VenWorld approved a plan of liquidation<br />

pursuant to which Class A shares would be distributed to each of the VenWorld sharehol<strong>de</strong>rs on<br />

March 4, 2002.<br />

On January 8, 2007, the Presi<strong>de</strong>nt of the Republic announced Venezuela’s intention to<br />

nationalize several companies, including CANTV. On February 12, 2007, the Republic entered<br />

into the Memorandum of Un<strong>de</strong>rstanding with Verizon and Verizon’s subsidiary GTE<br />

Venholdings to acquire Verizon’s equity stake in CANTV, which represented approximately<br />

28.51% of the outstanding equity share capital of CANTV.<br />

On April 8 and 9, 2007, respectively, the Republic commenced concurrent public ten<strong>de</strong>r<br />

offers in Venezuela to purchase any and all shares of CANTV’s outstanding capital stock, other<br />

than those already owned by the Republic, and in the United States to purchase any and all of<br />

CANTV’s outstanding ADSs, each representing seven Class D shares. The purchase price paid<br />

in the U.S. Offer was U.S.$14.84791 per ADS. The purchase price paid in the Venezuelan<br />

Offer was the bolivar equivalent of U.S.$2.12113 per share based on the official exchange rate<br />

for the sale of dollars established by the Central Bank of Venezuela as of the settlement date for<br />

the Venezuelan Offer on the Caracas Stock Exchange. The Offers expired on May 8, 2007.<br />

On May 16, 2007, the Republic announced that it had purchased, through the Ministry of<br />

the Popular Power for Telecommunications and Information Technology, 61,257,605 ADSs<br />

(representing an aggregate of 428,803,235 Class D shares) ten<strong>de</strong>red in the U.S. Offer, and<br />

197,949,721 common shares ten<strong>de</strong>red in the Venezuelan Offer. Payment for the common<br />

shares and ADSs was ma<strong>de</strong> on or about May 21, 2007. The common shares and ADSs<br />

acquired by the Republic pursuant to the Offers (which inclu<strong>de</strong>d all of the shares and ADSs<br />

previously owned by Verizon), together with the 51,900,000 Class B shares already held by<br />

BANDES and the Ministry of the Popular Power for Infrastructure, represented an aggregate of<br />

approximately 86.2% of the outstanding shares of CANTV’s capital stock owned by the<br />

Republic.<br />

On March 31, 2008, the Republic entered into a purchase agreement with Renaissance<br />

to acquire 3,613,996 ADSs (representing 25,297,972 Class D shares) of CANTV owned by<br />

Renaissance. The acquisition was consummated on April 4, 2008. The consi<strong>de</strong>ration paid to<br />

Renaissance consisted of a purchase price U.S.$11.27 per ADS, plus and an amount equal to<br />

the ordinary and extraordinary divi<strong>de</strong>nds, aggregating U.S.$2.88 per ADS, <strong>de</strong>clared by an<br />

Ordinary Sharehol<strong>de</strong>rs’ Assembly on March 31, 2008. As a result of the consummation of the<br />

Renaissance transaction, the Republic acquired 25,297,972 Class D shares which, together<br />

with 626,752,956 Class D shares owned by the Republic, through the Ministry of the Popular<br />

Power for Telecommunications and Information Technology, and the 51,900,000 Class B<br />

shares held by BANDES and the Ministry of the Popular Power for Infrastructure, represent an<br />

aggregate of 89.4% of the outstanding common shares of CANTV which are owned by the<br />

6

Republic. As of June 26, 2008, all Class D shares owned by the Republic were converted into<br />

Class B shares pursuant to a provision of CANTV’s by-laws.<br />

On March 31, 2008, the Republic announced that as a result of its acquisition of ADSs<br />

from Renaissance, Venezuelan law requires the Republic to offer to purchase any and all of the<br />

other outstanding ADSs and Class D shares of CANTV not already owned by the Republic on<br />

the date the offer commences (i) at a price, payable in U.S. dollars, of U.S.$11.27 per ADS for<br />

ADSs, and (ii) at a price, payable in bolivars, of the Bolivar equivalent of U.S.$1.61 per share,<br />

calculated at the official exchange rate in the Republic for the sale of U.S. dollars by the Central<br />

Bank of Venezuela, in effect on the date of the settlement of the offer in a special session on the<br />

Caracas Stock Exchange, for shares that are not represented by ADSs (being the U.S.$11.27<br />

per ADS price divi<strong>de</strong>d by seven to reflect that each ADS represents seven Class D shares). It is<br />

contemplated that hol<strong>de</strong>rs of CANTV’s Class C shares will be able to participate in the offer by<br />

converting their Class C shares into Class D shares in accordance with the procedure<br />

established in CANTV’s by-laws. As of the date of this report, it is CANTV’s un<strong>de</strong>rstanding that<br />

the Republic is continuing to consi<strong>de</strong>r an appropriate structure for the transaction, and that it will<br />

continue to make available updated information as it becomes available.<br />

On June 18, 2007, the NYSE filed a notification with the SEC to <strong>de</strong>-list the ADSs from<br />

the NYSE. The <strong>de</strong>-listing became effective on June 28, 2007.<br />

On June 30, 2008, CANTV filed a Form 15F with the SEC to <strong>de</strong>register its Class D<br />

shares (including the Class D shares represented by its ADSs) from the SEC and terminate its<br />

reporting obligations un<strong>de</strong>r the Exchange Act pursuant to Rule 12h-6 un<strong>de</strong>r the Exchange Act.<br />

Subject to a number of conditions, Rule 12h-6 permits <strong>de</strong>registration of a class of registered<br />

securities if the ADTV of a class in United States for a recent 12-month period has been no<br />

greater than 5% of the ADTV of the class on a worldwi<strong>de</strong> basis for the same period. CANTV’s<br />

reporting obligations un<strong>de</strong>r the Exchange Act (including the obligation to file the annual report<br />

on Form 20-F that would have otherwise been due in June 30, 2008) were suspen<strong>de</strong>d<br />

immediately upon filing of the Form 15F. The <strong>de</strong>registration and termination of reporting will<br />

become effective 90 days after the filing (unless the Form 15F is earlier withdrawn by CANTV).<br />

Organizational Structure<br />

2007:<br />

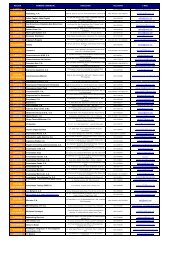

The following table shows the principal subsidiaries of the Company as of December 31,<br />

Name of Subsidiary Registered office<br />

7<br />

%<br />

Ownership<br />

Telecomunicaciones Movilnet, C.A. Caracas, Venezuela 100%<br />

Compañía Anónima Venezolana <strong>de</strong> Guías<br />

(Caveguías)<br />

Caracas, Venezuela 80%<br />

CANTV.Net, C.A. Caracas, Venezuela 100%<br />

INVERCANTV, S.A. Caracas, Venezuela 100%<br />

CANTV Finance, LTD. Grand Cayman, Cayman<br />

Islands<br />

100%<br />

CANTV International, LTD. Grand Cayman, Cayman<br />

Islands<br />

100%

Movilnet was incorporated on March 24, 1992. Its mains purpose is to manage, provi<strong>de</strong>,<br />

<strong>de</strong>velop and exploit cellular services, transportation services, ground mobile radio<br />

communications and establishment and use of telecommunications networks.<br />

CANTV.Net was incorporated on January 26, 1994. Its main purpose is to offer valuead<strong>de</strong>d<br />

telecommunications services, including Internet access and voice mail, among others. In<br />

addition, it provi<strong>de</strong>s consulting, engineering, and management of private and public networks.<br />

Caveguías was incorporated on November 12, 1975. Its main activity is the<br />

<strong>de</strong>velopment and an sale of advertising space in the telephone directories that it publishes and<br />

distributes.<br />

CANTV as a State-Owned Company<br />

With the nationalization of CANTV, Venezuela recovered one of the companies with the<br />

highest strategic value to the integral <strong>de</strong>velopment of the country. This initiative placed the<br />

leading provi<strong>de</strong>r of telecommunications services in the service of all Venezuelans.<br />

The Venezuelan Government ratified its commitment to the achievement of the Plena<br />

Soberanía y Auto<strong>de</strong>terminación <strong>de</strong> la Nación (“Full Sovereignty Plan and Self-Determination of<br />

the Nation”), to take telecommunications services to every corner of the country.<br />

The Company, as a Venezuelan State-owned entity, will contribute <strong>de</strong>cisively to the<br />

process of inclusion and social transformation in Venezuela, in or<strong>de</strong>r to guarantee<br />

communication rights to the people, through the <strong>de</strong>mocratization of telecommunications and the<br />

use of information and communication technologies as tools to further that nation’s social,<br />

economic, political, territorial and cultural knowledge and <strong>de</strong>velopment, as well as national<br />

security.<br />

The Company will contribute to achievement of the strategic objectives of the<br />

Venezuelan State, supporting its transformation through the use of technology. Likewise, it will<br />

tend to result in the expansion of national production capacity, promoting technological<br />

sovereignty, the organic connection of different economic entities and the participation of the<br />

Po<strong>de</strong>r Popular (Popular Power or power of the people) in the Company’s activities. In addition,<br />

CANTV will further the involvement of all of its workers in the task of bringing about social<br />

inclusion and stimulate their commitment to and i<strong>de</strong>ntification with the Company’s objectives.<br />

As a State-owned entity serving the Venezuelan people, the Company has set as its<br />

goal to offer basic telephony, Internet and other services to population centers which have until<br />

now been exclu<strong>de</strong>d, with significant investment programs to address the nation’s<br />

telecommunications needs.<br />

One of the first benefits of nationalization is the strengthening and expansion of our<br />

infrastructure as a result of the integration of all the fiber-optic networks of other State-owned<br />

entities with CANTV’s network, in or<strong>de</strong>r to <strong>de</strong>dicate them to providing nationwi<strong>de</strong><br />

telecommunications services. As a result of this alliance among institutions, the Company will<br />

operate in the first phase a total of 14,062 kilometers of fiber optics, almost double the 7,737<br />

kilometers that it had when it was a private company. With the integration of the State<br />

networks, 88% of the population will be covered, which will promote national integration. In<br />

8

addition, CANTV will operate the telecommunications capacity of the Simón Bolívar Satellite,<br />

which is to be launched in September 2008, allowing Venezuela to have its own satellite<br />

capacity fore the first time, which will facilitate the provision of telecommunications services in<br />

regions with difficult access.<br />

Through all of these initiatives, CANTV is leveraging the <strong>de</strong>velopment and<br />

transformation of Venezuela and meeting its social commitment to the State, the community, its<br />

workers and its retirees, in the quest for the collective good and supreme social happiness.<br />

Company Strategy<br />

When the nationalization of CANTV was completed on May 21 2007, the new<br />

management began to <strong>de</strong>fine the Company’s new strategic orientation centered on the<br />

nonwaivable principle of access to telecommunications as a fundamental human right. The new<br />

strategic orientation will promote the creation of a social structure based on values of equality,<br />

solidarity, participation and coresponsibility and will take telecommunications and information<br />

technology services to every corner of the country. These objectives have been incorporated in<br />

the Company’s mission and vision statements, which are <strong>de</strong>scribed below:<br />

Mission: “We are the strategic company of the Venezuelan state operating and<br />

supplying integral telecommunications and information technology solutions, coresponsible for<br />

the sovereignty and transformation of the nation, focused on strengthening the power of the<br />

people and the integration of the region, capable of serving with quality, efficiency and efficacy<br />

and with the participation of the people in a leading role, and contributing to the supreme social<br />

happiness”.<br />

Vision: “To be socialist company operating and supplying integral telecommunications<br />

and information technology solutions, recognized for its innovative capacity, enabler of<br />

sustainable <strong>de</strong>velopment and national and regional integration, committed to the<br />

<strong>de</strong>mocratization of knowledge, the collective well-being, the efficiency of the State and national<br />

sovereignty.”<br />

Based on these concepts, CANTV has <strong>de</strong>fined the following strategic objectives:<br />

Democratize service with social justice. Access to telecommunications is a<br />

fundamental human right. CANTV is rapidly expanding its geographic coverage to inclu<strong>de</strong> all<br />

segments of the population. Pursuant to the National Plan, CANTV will take<br />

telecommunications and information technology to every citizen, where, how and when nee<strong>de</strong>d,<br />

relying on the robust interconnection of State networks with CANTV’s access and transportation<br />

network. CANTV favors participation and cooperation with other operators to work together to<br />

provi<strong>de</strong> all sectors of the population with opportunities to access all services. CANTV also<br />

supports new socio-economic actors in the industry. Empresas <strong>de</strong> Producción Social (“Social<br />

Production Companies”), cooperatives and new types of organizations are being introduced into<br />

the supply chain, in or<strong>de</strong>r to pave the way toward building a socialist economy. CANTV will<br />

reinvest the majority of its profits to address the telecommunications needs of the Venezuelan<br />

people.<br />

9

Be a lea<strong>de</strong>r in service quality, product portfolio and client service. CANTV will<br />

focus on offering innovative products and services <strong>de</strong>signed to meet the needs of individuals,<br />

homes, organized communities, enterprises and corporations, as well as the Venezuelan State.<br />

Our competitive advantage will resi<strong>de</strong> in:<br />

• The capacity to effectively address the needs and expectations of the population;<br />

• The capacity to <strong>de</strong>velop the necessary products and services to meet the different<br />

needs of the population and to improve their quality of life, taking advantage of<br />

innovative technologies in the industry;<br />

• A solid and efficient network of service channels; and<br />

• A distinctive <strong>de</strong>dication to customer service.<br />

Guarantee the capacity of the Company to be self- financed. The Company will<br />

optimize the benefits it provi<strong>de</strong>s to society by <strong>de</strong>veloping various corporate plans to ensure its<br />

economic profitability. A healthy cost structure combined with efficient procedures will produce<br />

advantages that can be transferred to society and will enable CANTV to maintain and expand its<br />

operations. By continually seeking operational efficiency and including organized communities<br />

in its management activities, the Company will ensure continual review of its internal procedures<br />

and reasonable management of its resources.<br />

Strengthen the power and participation of the people. Through the Mesas Técnicas<br />

<strong>de</strong> Telecomunicaciones (“Technical Telecommunications Tables”), CANTV will promote the<br />

growing leading role being played by organized communities in the i<strong>de</strong>ntification, <strong>de</strong>sign,<br />

implementation and management of the most appropriate solutions to meet their needs. The<br />

Company will turn these communities into strategic allies for service supply. CANTV will work<br />

together with the Consejos Comunales (“Communal Councils”), the principal form of the<br />

community self-management mo<strong>de</strong>l that the Venezuelan State is promoting to empower the<br />

people, in or<strong>de</strong>r to generate growth which is accompanied by a mutual commitment between<br />

CANTV and the people. CANTV supports the new Esquemas Asociativos Solidarios (“Mutually<br />

Binding Cooperative Production Mo<strong>de</strong>ls”) promoted by the Venezuela State and will leverage its<br />

extraordinary purchasing and hiring capacity to become one of the main <strong>de</strong>velopers of these<br />

production mo<strong>de</strong>ls, progressively <strong>de</strong>legating the business support activities to them.<br />

Become a socialist State-owned company. Honesty, efficiency, and an integral public<br />

service vocation are the foundation for the implementation of a mo<strong>de</strong>l of socialist public servant<br />

that will do away with the traditional concept of a public official. As a State-owned company,<br />

CANTV is adjusting to the legal framework of the public sector, making room for Mutually<br />

Binding Cooperative Production Mo<strong>de</strong>ls, promoting the leading role increasingly played by its<br />

workers and furthering a socialist labor mo<strong>de</strong>l.<br />

Advance toward technological sovereignty. CANTV will enable national <strong>de</strong>velopment<br />

of human talent, technical solutions, technological innovation and products and services in the<br />

telecommunications and information technology sector that will contribute to the nation’s<br />

in<strong>de</strong>pen<strong>de</strong>nce. In or<strong>de</strong>r to achieve this objective, specific actions will be carried out to promote<br />

the transfer of technological knowledge in the agreements for alliances and assistance that it<br />

enters into, which will plant the seeds for endogenous <strong>de</strong>velopment of the Venezuelan<br />

telecommunications and information technology industry. Additionally, the implementation of<br />

Decree 3,390 for Free Software, relating to the free use of software in public administration, will<br />

promote technological sovereignty.<br />

10

Leverage the transformation of the State. CANTV will assist in the implementation of<br />

electronic Government by the use of technology in public management through the following<br />

contributions:<br />

• Optimizing the coordination and integration among public administration entities in all<br />

sectors and geographic regions, improving their response to social needs;<br />

• Participation of citizens in the <strong>de</strong>sign, implementation, execution and control of public<br />

policy;<br />

• Offering public servants the necessary tools to improve service to Venezuelans; and<br />

• Streamlining relationships with the suppliers and partners of public institutions to<br />

improve their operational efficiency and the effectiveness of their use of budgetary<br />

resources.<br />

Support national and international integration. With CANTV’s nationalization, the<br />

Venezuelan State can count on a telecommunications network of national reach that supports<br />

State security and <strong>de</strong>fense functions. The Company will take the necessary steps to integrate<br />

the State-owned networks, creating a communications platform that will facilitate interaction<br />

between Venezuelan citizens and the State, in or<strong>de</strong>r to guarantee complete inclusion<br />

nationwi<strong>de</strong>. By becoming a communications platform with and among Venezuela’s regional<br />

allies, CANTV is promoting <strong>de</strong>velopment in a setting of international integration and<br />

cooperation.<br />

Property, Plant and Equipment, and Capital Expenditures<br />

The Company’s property consists principally of network facilities, land and structures<br />

required to provi<strong>de</strong> telecommunications services. As of December 31, 2007, the Company’s<br />

property, plant and equipment, net of accumulated <strong>de</strong>preciation was comprised of network<br />

facilities (64.1%), buildings and facilities (17.6%), equipment and other assets (7.2%) and<br />

construction work in progress (11.1%).<br />

The Company provi<strong>de</strong>s telecommunications services in Venezuela through a full-service<br />

telecommunications network. As of December 31, 2007, the Company maintains 4,999,630<br />

access lines in service and 9,501,796 wireless subscribers. The percentage of digital access<br />

lines installed in the Company’s network is 93.6% as of December 31, 2007. All of the<br />

Company’s international and domestic long distance switches are digital.<br />

The Company ma<strong>de</strong> capital expenditures of approximately U.S.$456 million, U.S.$553<br />

million and U.S.$715 million in 2005, 2006 and 2007, respectively. The Company is planning<br />

capital expenditures of approximately U.S.$1,110 million in 2008, and are directed towards<br />

<strong>de</strong>velopment and network expansion to support growth of the Company’s customer base (41%),<br />

administration (14%), overhead (2%), network and maintenance (36%) and systems (7%). The<br />

Company fun<strong>de</strong>d, through internally generated cash, its 2007 capital expenditures. Capital<br />

expenditures in the 2008 to 2013 planning period as approved in 2008 will <strong>de</strong>pend on the<br />

economic environment and will continue to be directed towards network optimization, systems<br />

platforms and the launch of new services. The Company began the <strong>de</strong>ployment of its Global<br />

System for Mobile Communications (“GSM”) network during 2007 and plans to continue to focus<br />

its capital investments on high growth wireless, broadband Internet and Evolution-Data<br />

Optimized (“EvDO”) services, data transmission, substitution of public telephones and<br />

mo<strong>de</strong>rnization of analog switches.<br />

11

Capital investments during 2007 inclu<strong>de</strong>d: (i) the expansion of the Company’s Co<strong>de</strong><br />

Division Multiple Access (“CDMA-1X”) network footprint to support projected <strong>de</strong>mand in mobile<br />

and fixed wireless services; (ii) <strong>de</strong>ployment of the new mobile GSM network; (iii) <strong>de</strong>ployment of<br />

backbone and data networks to sustain the growth in the Company’s Asymmetrical Digital<br />

Subscriber Lines (“ADSL”) and other data product lines; (iv) the integration and transformation<br />

of the Company’s information systems; (v) <strong>de</strong>ployment of EvDO technology for wireless<br />

broadband services; and (iv) substitution of analog switches with multi-service access no<strong>de</strong>s to<br />

support service enhancements and increase operating efficiency.<br />

Business Overview<br />

Fixed Telephony<br />

Local and Domestic Long Distance Services<br />

The Company’s revenues from local and domestic long distance telephone services<br />

consist of installation charges and charges for new lines, basic monthly recurring charges,<br />

usage charges, public telephony usage, and equipment sales. All traffic is measured and billed<br />

based on duration and, in the case of domestic long distance calls different tariffs apply based<br />

on the time of day when the call is ma<strong>de</strong>. A local and international call impulse is generated<br />

every 60 seconds, while call impulses for domestic long distance calls is generated every<br />

second. Nighttime consumption is less expensive than daytime consumption.<br />

The Company offers Domestic Long Distance plans, Noches y Fines <strong>de</strong> Semana Libre<br />

(“Free Nights and Weekends”) and Plan Nacional 3000 (“National Plan 3000”). The Free Nights<br />

and Weekends plan offers special rates for calls placed between 8:00 p.m. and 7:59 a.m. from<br />

Monday through Thursday, and on weekends from Friday at 8:00 p.m. until Monday at 7:59 a.m.<br />

The National Plan 3000 inclu<strong>de</strong>s 3,000 seconds for a monthly fixed payment and a special rate<br />

for each additional second for domestic long distance calls.<br />

Public Telephony<br />

As of December 31, 2007, the Company owned and operated 115,060 public telephone<br />

lines, located throughout Venezuela. Users of public telephones in Venezuela pay for calls<br />

based on the duration and <strong>de</strong>stination of the call. CANTV bills all public telephone calls at a flat<br />

per minute charge. Domestic long distance calls from public telephones are charged based<br />

upon the time of day and the duration of the call at the non-resi<strong>de</strong>ntial rate. International long<br />

distance call rates are the same tariffs applied to non-resi<strong>de</strong>ntial international long distance<br />

calls.<br />

Telecommunication Centers<br />

The Company facilitates public access to telecommunications services via its<br />

Telecommunication Centers program.<br />

Telecommunication Centers are operated by third parties as franchises or strategic<br />

allies, with technical support from the Company. These Telecommunication Centers provi<strong>de</strong><br />

local, domestic long distance and international long distance telecommunications services,<br />

Internet access, equipment sales, sale of prepaid cards, mailing services and copying and<br />

12

faxing services. Telecommunication Center franchises have grown to 855 as of December<br />

2007, a 13.2% increase over December 2006.<br />

The Company is required to pay commissions as sales incentives established by type<br />

and volume of services ren<strong>de</strong>red by the Telecommunication Centers in its own installations.<br />

Rural Service<br />

As of December 31, 2007, the Company had 292 satellite-based lines serving rural<br />

areas with satellite technology. The Company also provi<strong>de</strong>s rural services through wireless<br />

systems and by microwave radio-based stations.<br />

International Long Distance Services<br />

Revenues from international telephone services are primarily <strong>de</strong>rived from (i) charges to<br />

subscribers in Venezuela for outgoing calls (a portion of which the Company must pay to other<br />

international operators for calls carried on their networks once outsi<strong>de</strong> Venezuela) and<br />

(ii) access charges paid by other international telecommunications operators for incoming calls<br />

originating outsi<strong>de</strong> Venezuela and carried through the Company’s network in Venezuela. The<br />

Company charges its customers for outgoing international long distance calls based on the<br />

<strong>de</strong>stination country, duration and time of day of the call and whether the call is direct-dial or<br />

operator assisted. International long distance rates do not vary between resi<strong>de</strong>ntial and<br />

non-resi<strong>de</strong>ntial customers, except for Cuba, Japan, Greece, Hong Kong, Honduras and the U.S.<br />

State of Hawaii.<br />

The Company provi<strong>de</strong>s international services through submarine cables, satellite and<br />

microwave links. The Company has two international digital switches, both located in Caracas.<br />

The Company’s largest international traffic routes are between Venezuela and North<br />

America (the United States, Mexico and Canada) and South America (Colombia), which<br />

accounted for approximately 84% of 2007 international traffic.<br />

Wireless Services<br />

The Company, through its wholly-owned subsidiary Movilnet, provi<strong>de</strong>d wireless<br />

communication services in areas that covered approximately 87.8% of Venezuela’s population<br />

as of December 31, 2007.<br />

Wireless service is one of the Company’s fastest growing businesses. As of<br />

December 31, 2007, Movilnet reached 9,501,796 subscribers, which represented an estimated<br />

market share of 39.9%, according to figures published by the Comisión Nacional <strong>de</strong><br />

Telecomunicaciones (“CONATEL”) (the Venezuelan National Telecommunications<br />

Commission).<br />

Usage charges are based on a “calling party pays” principle un<strong>de</strong>r which Movilnet’s<br />

customers are charged only for calls they originate, with the exception of international roaming<br />

charges <strong>de</strong>rived from customers receiving calls when they are outsi<strong>de</strong> Venezuela. Wireless<br />

service customers are charged an activation fee, a basic monthly charge, special fees and<br />

usage fees on a per-minute basis and per-second basis.<br />

13

Movilnet provi<strong>de</strong>s a number of services and products, such as: voice mail, Short<br />

Message Service (“SMS”), Multimedia Messaging Service (“MMS”), call forwarding, call waiting,<br />

caller ID, conferencing, international long distance, international roaming, emergency number,<br />

vi<strong>de</strong>o streaming, among others. In addition Movilnet provi<strong>de</strong>s Global Positioning System<br />

(“GPS”) satellite technology that provi<strong>de</strong>s vehicle tracking via the Internet, wireless broadband<br />

service through EvDO, Windows Mobile services, and BlackBerry service (a Research in Motion<br />

Ltd. tra<strong>de</strong>marked product), which allows customers to stay connected with wireless access to<br />

email, corporate data, Internet and organizer features through the phone.<br />

Movilnet is continually <strong>de</strong>veloping applications to support its migration strategy into<br />

advanced data services. In November 2002, Movilnet launched a nationwi<strong>de</strong> CDMA-1X<br />

technology platform which provi<strong>de</strong>s digital cellular services and broadband wireless data<br />

transmission and Internet access. CDMA-1X technology affords the Company the flexibility to<br />

combine both fixed and wireless services un<strong>de</strong>r the same platform and allows for a more<br />

efficient use of voice spectrum. Movilnet is the pioneer in offering EvDO mobile broadband in<br />

Venezuela and is the second carrier to provi<strong>de</strong> this advanced service in Latin America.<br />

During 2007, the Company began the <strong>de</strong>ployment of its GSM network, which will coexist<br />

with its current CDMA-1X. The Company believes it will be able to strengthen its market share<br />

position. The Company expects that this new technology will be in commercial operation at the<br />

end of 2008.<br />

The Company markets its wireless services through a network of authorized agents and<br />

the Company’s commercial offices. The Company has agreements with third parties to act as<br />

exclusive authorized agents to capture and provi<strong>de</strong> wireless services and equipment to new<br />

customers.<br />

Other Telecommunications-Related Services<br />

Data Transmission<br />

The Company’s data transmission services are provi<strong>de</strong>d through high-capacity private<br />

links. The Company has implemented Virtual Private Network (“VPN”) technology and intends<br />

to encourage its use by private line customers. VPN technology should enable the Company to<br />

provi<strong>de</strong> higher quality <strong>de</strong>dicated services while improving network efficiency.<br />

In 2000, CANTV introduced ADSL technology, which allows simultaneous voice and<br />

data traffic on the same line. As of December 31, 2007, the Company had 735,507 ADSL<br />

subscribers, which reflects a 63.6% increase as compared to 2006.<br />

Internet Access<br />

The Company provi<strong>de</strong>s Internet access service through its wholly-owned subsidiary,<br />

CANTV.Net. CANTV.Net provi<strong>de</strong>s broadband access through its product, Acceso a Banda<br />

Ancha (“ABA”) (Broadband Access) via ADSL and nationwi<strong>de</strong> one-number dial-up Internet<br />

access as well as international Internet roaming capabilities. CANTV.Net is the largest Internet<br />

service provi<strong>de</strong>r in Venezuela, serving 848,917 subscribers as of December 31, 2007. In<br />

addition to Internet access, subscribers may choose from an array of products such as web<br />

14

hosting, Intranet <strong>de</strong>velopment, VPN, e-commerce solutions, among others. In addition,<br />

CANTV.Net also provi<strong>de</strong>s Internet access through prepaid cards.<br />

In June 2006, the Company launched a wireless broadband Internet access offer<br />

exclusively for its ABA broadband subscribers, using Wireless Fi<strong>de</strong>lity (“Wi-Fi”) technology,<br />

called Zona ABA Wi-Fi (“Wi-Fi ABA Zone”). The Company provi<strong>de</strong>s 62 wireless access points<br />

(“hotspots”) nationwi<strong>de</strong>, including 40 hotspots in Caracas.<br />

Value-Ad<strong>de</strong>d Services and Other Services<br />

The Company offers an array of value-ad<strong>de</strong>d services and other services, including voice<br />

mail, call waiting, call forwarding, call blocking, caller ID, speed dialing, toll-free and 800-number<br />

services, vi<strong>de</strong>o conferencing, audio text, 900 services, computer network management,<br />

outsourcing of telecommunications networks, and other intelligent network and data capabilities.<br />

Directory Information Services<br />

The Company provi<strong>de</strong>s telephone directory information services through its 80%-owned<br />

subsidiary Caveguías (the remaining 20% is owned by an affiliate of a major newspaper<br />

publisher in Venezuela). Caveguías publishes telephone directories (“White Pages”) and<br />

business directories (“Yellow Pages”). It also operates an Internet portal that provi<strong>de</strong>s on-line<br />

access to the Company’s directories. Other directory services offered inclu<strong>de</strong>: (i) Travel Gui<strong>de</strong>,<br />

which provi<strong>de</strong>s tourism information; (ii) Mobile Gui<strong>de</strong>, which gives cellular users access to<br />

commercial information and local, regional and national services; (iii) specialized gui<strong>de</strong>s for<br />

shopping malls, entertainment and events, aesthetics and beauty; (iv) Oil Gui<strong>de</strong>, which provi<strong>de</strong>s<br />

information on the oil industry; and (v) City Maps, which allows city map search to facilitate<br />

address searches. Caveguías <strong>de</strong>rives revenues from sales of advertising space in its printed<br />

and electronic directories. Advertisers in the Company’s printed telephone directories are<br />

charged an annual fee, which varies <strong>de</strong>pending on the size of the advertisement placed and the<br />

circulation of the edition of the directory in which such advertisement is published.<br />

Competition<br />

Competition in services provi<strong>de</strong>d by the Company may arise from a variety of existing<br />

competitors and new entrants, including telecommunications service provi<strong>de</strong>rs from other<br />

countries.<br />

In January 1991, CONATEL granted the first cellular concession to Telcel, C.A.<br />

(“Movistar”).<br />

In December 1996, Infonet Re<strong>de</strong>s <strong>de</strong> Información, C.A. (“Infonet”) was granted a rural<br />

concession to provi<strong>de</strong> multiple services to population centers with 5,000 or fewer inhabitants in<br />

eight western states of Venezuela. In January 1998, two additional companies were granted<br />

multiple service concessions. Corporación Digitel C.A. (“Digitel”), was granted a concession to<br />

provi<strong>de</strong> services in seven central states and Digicel, C.A. (“Digicel”) was granted a concession<br />

to provi<strong>de</strong> services in six eastern states.<br />

15

On January 19, 2006, Telvenco S.A. (“Telvenco”), a subsidiary of Cisneros Group of<br />

Companies, agreed to acquire Venezuelan mobile operator Digitel from Telecom Italia Mobile<br />

International N.V. (“TIM International”). On May 18, 2006, CONATEL approved the transaction<br />

and also inclu<strong>de</strong>d the merger of the assets of two regional carriers, Infonet and Digicel. Digitel<br />

continues as the surviving entity after the merger. Digitel provi<strong>de</strong>s digital fixed wireless and<br />

cellular services, where it competes with services provi<strong>de</strong>d by the Company.<br />

On November 28, 2007, CONATEL granted Movilnet and Movistar with cellular<br />

concessions for the use of the radioelectric service in the 1900 MHz band which will allow these<br />

companies to provi<strong>de</strong> new services, including third generation services un<strong>de</strong>r GSM.<br />

In May 2008, CONATEL granted Digitel a cellular concession for the use of the<br />

radioelectric service in the 900 MHz band to expand its services un<strong>de</strong>r GSM. Digitel’s network<br />

has been un<strong>de</strong>r GSM in the 900 MHz band since its beginnings.<br />

As of June 30, 2008, the Venezuelan telecommunications market is composed by: of<br />

fixed local telephone and public telephony service provi<strong>de</strong>rs, such as CANTV, Movistar, Digitel,<br />

Veninfotel Comunicaciones Vitcom, C.A. (“Veninfotel”) and Corporación Telemic, C.A.<br />

(“Intercable”); domestic long distance service provi<strong>de</strong>rs, such as CANTV, Movistar, Digitel,<br />

Veninfotel, Telecomunicaciones NGTV, S.A. (“New Global Telecom”), 123.com.ve, C.A.<br />

(“123.com.ve”), Multiphone Venezuela, C.A. (“Multiphone”) and Totalcom Venezuela C.A.<br />

(“Totalcom”); international long distance service provi<strong>de</strong>rs, such as CANTV, Movistar, Digitel,<br />

Veninfotel, New Global Telecom, 123.com.ve, Multiphone, LD Telecom Comunicaciones C.A.<br />

(“LD Telecom”) and Convergia Venezuela, S.A. (“Convergia”); wireless service provi<strong>de</strong>rs, such<br />

as Movilnet, Movistar, and Digitel; data transmission service provi<strong>de</strong>rs, such as CANTV,<br />

Movistar, New Global Telecom, Totalcom, Global Crossing Venezuela B.V. (“Global Crossing”),<br />

Comsat Venezuela, C.A. (“Comsat”), Telecomunicaciones Bantel, C.A. (“Bantel”), NetUno, C.A.<br />

(“NetUno”), Procesamiento Electrónico <strong>de</strong> Datos, S.A. (“Procedatos”), Satélites y<br />

Telecomunicaciones, C.A. (“Satelca”), Genesis Telecom, C.A. (“Genesis Telecom”), E-Quant<br />

Venezuela, S.A. (“E-Quant”), Charter Communications International <strong>de</strong> Venezuela C.A.<br />

(“Charter International”), Zulia Electrónica, C.A. (“Zulia Electrónica”) and MCI <strong>de</strong> Venezuela,<br />

C.A. (“MCI Venezuela”); Internet service provi<strong>de</strong>rs, such as CANTV.Net, Movistar, Etheron<br />

Servicios, C.A. (“Etheron”), Genesis Telecom, New Global Telecom, Totalcom, NetUno,<br />

Procedatos, E-Quant, Comsat, Charter International, Intercable, SuperCable ALK Inter<strong>nacional</strong>,<br />

S.A. (“SuperCable”), Centro Nacional <strong>de</strong> Tecnologías <strong>de</strong> Información (“CNTI”), IFX Networks<br />

Venezuela S.R.L. (“IFX Networks”), Dayco Telecom, C.A. (“Daycohost”); Global Crossing,<br />

World Tel-Fax Electronics, C.A. (“World Tel-Fax”), MCI Venezuela, Sprint International, S.R.L.<br />

(“Sprint International”), IP Net, C.A. (“IP Net”), Gold Data, C.A. (“Gold Data”), AT&T Global<br />

Network Services Venezuela, LLC (“AT&T Venezuela”), Atos Origin IT Servicios <strong>de</strong> Venezuela,<br />

S.A. (“Atos Origin Venezuela”) and Viptel Communications, C.A. (“Viptel”); satellite operator<br />

Globalstar <strong>de</strong> Venezuela (“Globalstar”); paging operators, such as Telemensajes<br />

Metropolitanos, C.A. (“Telemensajes Metropolitanos”) and Elca Telecomunicaciones, C.A.<br />

(“Elca Telecomunicaciones”); trunking service provi<strong>de</strong>rs, such as Movistar, Procedatos, Satelca,<br />

Elca Telecomunicaciones, Americatel Sistemas <strong>de</strong> Comunicación, C.A. (“Americatel”), Radio<br />

Móvil Digital Venezuela, C.A. (“Radio Móvil Digital”), Comunicaciones Móviles EDC, C.A.<br />

(“Conmóvil”) and Evcon Telecomunicaciones, C.A. (“Evcon”); radio<strong>de</strong>termination services<br />

provi<strong>de</strong>rs, such as Movilnet, Sistemas Timetrak, C.A. (“Sistemas Timetrack”), Scada Com<br />

System, S.A. (“Scada Com System”) and Vehicle Security Resources <strong>de</strong> Venezuela, C.A.<br />

(“Vehicle Security Resources”); and cable TV operators, such as SuperCable, NetUno,<br />

Intercable, Vearco Telecom, C.A. (“Vearco”), Sistemas Cablevisión, C.A. (“Cablevisión”) and<br />

Galaxy Entertainment <strong>de</strong> Venezuela, C.A. (“DirecTV”).<br />

16

In 2004, the Venezuelan Government incorporated CVG Telecomunicaciones (currently<br />

“Telecom Venezuela”), a telephone company to provi<strong>de</strong> data transmission and other services<br />

through fiber-optics and Internet protocol platforms in north-central Venezuela and the Guayana<br />

region, located in the southeast of Venezuela. On August 14, 2007, Telecom Venezuela<br />

became a company un<strong>de</strong>r the direction of the Ministry of the Popular Power for<br />

Telecommunications and Information Technology (the Republic, through the Ministry of the<br />

Popular Power for Telecommunications and Information Technology, is the principal<br />

sharehol<strong>de</strong>r of CANTV).<br />

The scope of increased competition and any corresponding adverse effect on the<br />

Company’s results will <strong>de</strong>pend on a variety of factors, such as business strategies and financial<br />

and technical capabilities of potential competitors, prevailing market conditions, and the<br />

effectiveness of the Company’s efforts to prepare for increased competition.<br />

Corporate Image<br />

The Company promotes its image through advertisements based on nationwi<strong>de</strong> mass<br />

campaigns via television, radio and print media. In 2007, following the nationalization, CANTV<br />

changed the colors of its corporate logo, incorporating the colors of the Venezuelan flag, and<br />

launched the new slogan “mueve la fibra <strong>nacional</strong>” (“moves the national fiber”). Movilnet also<br />

adopted the new slogan “la señal que nos une” (“the signal that unifies us”). Both phrases are<br />

aligned with the Company’s new mission, vision and values, and represent the nationalistic<br />

spirit.<br />

Major Sharehol<strong>de</strong>rs<br />

Section II. Capital Stock and Corporate Governance<br />

The following table sets forth CANTV’s capital stock as of December 31, 2007:<br />

17<br />

Class<br />

Number of<br />

shares<br />

Ownership<br />

Percentage<br />

Bolivarian Republic of Venezuela, through the Ministry of the Popular Power for<br />

Telecommunications and Information Technology<br />

D 626,752,956 79.62%<br />

Venezuelan Economic and Social Development Fund Bank (BANDES) B 51,899,999 6.59%<br />

Bolivarian Republic of Venezuela, through Ministry of the Popular Power for Infrastructure B 1 -<br />

Company employees and retirees (1) C 44,334,550 5.63%<br />

Others (2) D 64,153,343 8.16%<br />

787,140,849<br />

(1) Class C shares inclu<strong>de</strong> shares held in trust for distribution to employees at the Company’s discretion. The trust for<br />

benefit of employees held 2,883,099 Class C shares at December 31, 2007. For accounting purposes these shares<br />

are consi<strong>de</strong>red treasury shares.<br />

(2) Inclu<strong>de</strong>s Class D shares held by The Bank of New York as Depositary for ADSs of CANTV, each of which represents<br />

seven Class D shares.

As of December 31, 2007, the Company estimates that 4,994,936 ADSs were held in the<br />

United States, representing approximately 54,5% of the total Class D shares outstanding<br />

(excluding Class D shares held by the Republic, through the Ministry of the Popular Power for<br />

Telecommunications and Information Technology).<br />

On May 21, 2008, an Extraordinary Sharehol<strong>de</strong>rs’ Assembly approved amen<strong>de</strong>d and<br />

restated by-laws which, among other things, set forth classes of shares comprising CANTV’s<br />

share capital and its divi<strong>de</strong>nd policy. Un<strong>de</strong>r the new by-laws, the share capital of CANTV<br />

consists of three classes of shares, <strong>de</strong>signated as Class B, Class C and Class D.<br />

Class B shares may only be owned by the Republic and other Venezuelan public sector<br />

entities. The transfer of Class D shares to the Republic will cause such transferred shares to be<br />

automatically converted into an equal number of Class B shares upon transfer of the shares.<br />

Class C shares may be owned by active workers of the Company with a contract for an<br />

in<strong>de</strong>terminate period of time and workers retired from the Company, heirs of Class C<br />

sharehol<strong>de</strong>rs who received the shares in succession, trusts and benefit plans established for the<br />

benefit of workers or retired workers of the Company, and former workers and former spouses<br />

of Class C sharehol<strong>de</strong>rs who received the shares through partition of marital property and<br />

hol<strong>de</strong>rs of these Class C shares prior to the filing of the new by-laws in the Registry of<br />

Commerce.<br />

Class D shares are held by different sharehol<strong>de</strong>rs and are registered in the capital<br />

markets.<br />

The by-laws state that each share of CANTV, regardless of class <strong>de</strong>signation, is entitled<br />

to one vote on all matters submitted for the approval for CANTV’s sharehol<strong>de</strong>rs at a<br />

Sharehol<strong>de</strong>rs’ Assembly. In general, matters submitted to vote at a Sharehol<strong>de</strong>rs’ Assembly will<br />

be adopted only if a majority of the hol<strong>de</strong>rs of the shares present at such Sharehol<strong>de</strong>rs’<br />

Assembly vote in favor of such matters.<br />

Record hol<strong>de</strong>rs of ordinary shares are registered in CANTV’s share register, which is<br />

administered on behalf of CANTV by Banco Venezolano <strong>de</strong> Crédito, S.A.C.A., as transfer agent,<br />

and registered in Venezuela. In the United States the Depositary acts as transfer agent and<br />

registrar in respect of hol<strong>de</strong>rs of ADSs.<br />

On January 8, 2007, the Presi<strong>de</strong>nt of the Republic announced Venezuela’s intention to<br />

nationalize several companies, including CANTV. On February 12, 2007, the Republic entered<br />

into the Memorandum of Un<strong>de</strong>rstanding with Verizon and Verizon’s subsidiary GTE<br />

Venholdings to acquire Verizon’s equity stake in CANTV, which represented approximately<br />

28.51% of the outstanding equity share capital of CANTV.<br />

On April 8 and 9, 2007, respectively, the Republic commenced concurrent public ten<strong>de</strong>r<br />

offers in Venezuela to purchase any and all shares of CANTV’s outstanding capital stock, other<br />

than those already owned by the Republic, and in the United States to purchase any and all of<br />

CANTV’s outstanding ADSs, each representing seven Class D shares. The purchase price paid<br />

in the U.S. Offer was U.S.$14.84791 per ADS. The purchase price paid in the Venezuelan<br />

Offer was the bolivar equivalent of U.S.$2.12113 per share based on the official exchange rate<br />

for the sale of dollars established by the Central Bank of Venezuela as of the settlement date for<br />

the Venezuelan Offer on the Caracas Stock Exchange. The Offers expired on May 8, 2007.<br />

18

On May 16, 2007, the Republic announced that it had purchased, through the Ministry of<br />

the Popular Power for Telecommunications and Information Technology, 61,257,605 ADSs<br />

(representing an aggregate of 428,803,235 Class D shares) ten<strong>de</strong>red in the U.S. Offer, and<br />

197,949,721 common shares ten<strong>de</strong>red in the Venezuelan Offer. Payment for the common<br />

shares and ADSs was ma<strong>de</strong> on or about May 21, 2007. The common shares and ADSs<br />

acquired by the Republic pursuant to the Offers (which inclu<strong>de</strong>d all of the shares and ADSs<br />

previously owned by Verizon), together with the 51,900,000 Class B shares already held by<br />

BANDES and the Ministry of the Popular Power for Infrastructure, represented an aggregate of<br />

approximately 86.2% of the outstanding shares of CANTV’s capital stock owned by the<br />

Republic.<br />

On March 31, 2008, the Republic entered into a purchase agreement with Renaissance<br />

to acquire 3,613,996 ADSs (representing 25,297,972 Class D shares) of CANTV owned by<br />

Renaissance. The acquisition was consummated on April 4, 2008. The consi<strong>de</strong>ration paid to<br />

Renaissance consisted of a purchase price U.S.$11.27 per ADS, plus and an amount equal to<br />

the ordinary and extraordinary divi<strong>de</strong>nds, aggregating U.S.$2.88 per ADS, <strong>de</strong>clared by an<br />

Ordinary Sharehol<strong>de</strong>rs’ Assembly on March 31, 2008. As a result of the consummation of the<br />

Renaissance transaction, the Republic acquired 25,297,972 Class D shares which, together<br />

with 626,752,956 Class D shares owned by the Republic, through the Ministry of the Popular<br />

Power for Telecommunications and Information Technology, and the 51,900,000 Class B<br />

shares held by BANDES and the Ministry of the Popular Power for Infrastructure, represent an<br />

aggregate of 89.4% of the outstanding common shares of CANTV which are owned by the<br />

Republic. As of June 26, 2008, all Class D shares owned by the Republic were converted into<br />

Class B shares pursuant to a provision of CANTV’s by-laws.<br />

On March 31, 2008, the Republic announced that as a result of its acquisition of ADSs<br />

from Renaissance, Venezuelan law requires the Republic to offer to purchase any and all of the<br />

other outstanding ADSs and Class D shares of CANTV not already owned by the Republic on<br />

the date the offer commences (i) at a price, payable in U.S. dollars, of U.S.$11.27 per ADS for<br />

ADSs, and (ii) at a price, payable in bolivars, of the Bolivar equivalent of U.S.$1.61 per share,<br />

calculated at the official exchange rate in the Republic for the sale of U.S. dollars by the Central<br />

Bank of Venezuela, in effect on the date of the settlement of the offer in a special session on the<br />

Caracas Stock Exchange, for shares that are not represented by ADSs (being the U.S.$11.27<br />

per ADS price divi<strong>de</strong>d by seven to reflect that each ADS represents seven Class D shares). It is<br />

contemplated that hol<strong>de</strong>rs of CANTV’s Class C shares will be able to participate in the offer by<br />

converting their Class C shares into Class D shares in accordance with the procedure<br />

established in CANTV’s by-laws. As of the date of this report, it is CANTV’s un<strong>de</strong>rstanding that<br />

the Republic is continuing to consi<strong>de</strong>r an appropriate structure for the transaction, and that it will<br />

continue to make available updated information as it becomes available.<br />

On June 18, 2007, the NYSE filed a notification with the SEC to <strong>de</strong>-list the ADSs from<br />

the NYSE. The <strong>de</strong>-listing became effective on June 28, 2007.<br />

On June 30, 2008, CANTV filed a Form 15F with the SEC to <strong>de</strong>register its Class D<br />

shares (including the Class D shares represented by its ADSs) from the SEC and terminate its<br />

reporting obligations un<strong>de</strong>r the Exchange Act pursuant to Rule 12h-6 un<strong>de</strong>r the Exchange Act.<br />

Subject to a number of conditions, Rule 12h-6 permits <strong>de</strong>registration of a class of registered<br />

securities if the ADTV of a class in United States for a recent 12-month period has been no<br />

greater than 5% of the ADTV of the class on a worldwi<strong>de</strong> basis for the same period. CANTV’s<br />

reporting obligations un<strong>de</strong>r the Exchange Act (including the obligation to file the annual report<br />

on Form 20-F that would have otherwise been due in June 30, 2008) were suspen<strong>de</strong>d<br />

19

immediately upon filing of the Form 15F. The <strong>de</strong>registration and termination of reporting will<br />

become effective 90 days after the filing (unless the Form 15F is earlier withdrawn by CANTV).<br />

Divi<strong>de</strong>nds<br />

The Venezuelan Co<strong>de</strong> of Commerce, the Venezuelan Capital Markets Law and the<br />

standards issued by the CNV regulate the Company’s ability to pay divi<strong>de</strong>nds. The Venezuelan<br />

Co<strong>de</strong> of Commerce establishes that divi<strong>de</strong>nds shall be paid solely out of liquid and collected<br />

earnings <strong>de</strong>rived from financial statements from a closed fiscal year. The Venezuelan Capital<br />

Markets Law stipulates that the Company must distribute annually no less than 50% of its net<br />

annual income to its stockhol<strong>de</strong>rs, after income tax and legal reserve <strong>de</strong>ductions. Likewise, the<br />

Venezuelan Capital Markets Law establishes that at least 25% of such 50% shall be distributed<br />