Vigorous sales spur more outlet growth - Value Retail News

Vigorous sales spur more outlet growth - Value Retail News

Vigorous sales spur more outlet growth - Value Retail News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

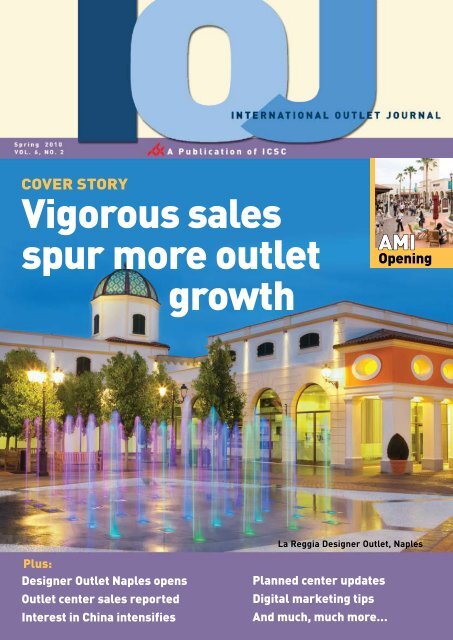

COVER STORY<br />

<strong>Vigorous</strong> <strong>sales</strong><br />

<strong>spur</strong> <strong>more</strong> <strong>outlet</strong><br />

<strong>growth</strong><br />

Plus:<br />

Designer Outlet Naples opens<br />

Outlet center <strong>sales</strong> reported<br />

Interest in China intensifies<br />

Planned center updates<br />

Digital marketing tips<br />

And much, much <strong>more</strong>…<br />

AMI<br />

Opening<br />

La Reggia Designer Outlet, Naples

STYLISH SOLUTION<br />

FOR EXCESS STOCK<br />

More luxury brands than ever before<br />

are turning to McArthurGlen’s<br />

designer <strong>outlet</strong> villages for a stylish<br />

and profitable solution for excess<br />

stock. Our 19 villages across Europe<br />

showcase great brands to 75 million<br />

customers a year in thoughtfully<br />

designed environments.<br />

And there’s <strong>more</strong>.We have new<br />

<strong>outlet</strong>s under way in Hamburg and<br />

Athens, and we are expanding six<br />

of our existing centres near Naples,<br />

Venice, Rome, Florence, Düsseldorf,<br />

Berlin andVienna.<br />

To learn <strong>more</strong> about how we<br />

can help your business improve<br />

cashflow, contactVictor Busser<br />

on +44 (0)20 7535 2300 or<br />

v.busser@mcarthurglen.com.<br />

www.mcarthurglengroup.com<br />

ALBERTA FERRETTI<br />

ARMANI<br />

BALLANTYNE<br />

BALLY<br />

BLUMARINE<br />

BRIONI<br />

BULGARI<br />

BURBERRY<br />

CALVIN KLEIN<br />

COSTUME NATIONAL<br />

DOLCE & GABBANA<br />

ERMENEGILDO ZEGNA<br />

ESCADA<br />

ETRO<br />

FENDI<br />

GUCCI<br />

JIL<br />

SANDER<br />

KENZO<br />

LA PERLA<br />

MARNI<br />

MISSONI<br />

MONCLER<br />

MULBERRY<br />

NICOLE FARHI<br />

PAUL SMITH<br />

POLO RALPH LAUREN<br />

PRADA<br />

ROBERTO CAVALLI<br />

SERGIO ROSSI<br />

TAG HEUER<br />

TOMMY HILFIGER<br />

TRUSSARDI<br />

VALENTINO<br />

VERSACE

PAGE 4 PAGE 8<br />

PAGE 19<br />

STAFF<br />

PETER ShARPE<br />

ICSC ChaIrman<br />

International Outlet Journal is a publication for the<br />

non-U.S. factory <strong>outlet</strong> industry. Copyright © 2010<br />

In s I d e<br />

CONTENTS<br />

Vol. 6 No. 2 SPRING 2010<br />

MARCuS WIlD<br />

ICSC ChaIrman, EUrOPEan<br />

advISOry bOard<br />

MIChAEl P. KERChEVAl<br />

ICSC PrESIdEnt and CEO<br />

RuDOlPh E. MIlIAN, SCSM, SCMD<br />

ICSC SEnIOr vP<br />

ICSC EuROPE<br />

London, +44 20 7976 3100<br />

icsc.europe@icsc.org<br />

ICSC/IOJ<br />

2519 n. mcmullen booth rd.<br />

Suite 510-356<br />

Clearwater, FL 33761<br />

+1 727 781 7557<br />

lINDA huMPhERS<br />

Editor in Chief ext. 3<br />

lhumphers@icsc.org<br />

RANDY GDOVIN<br />

art director ext. 4<br />

rgdovin@icsc.org<br />

KAREN KNObElOCh<br />

advertising Prod. mgr. ext. 2<br />

kknobeloch@icsc.org<br />

SAllY STEPhENSON<br />

Senior advertising Executive<br />

+1 847 835 1617<br />

Fax: +1 847 835 5196<br />

sstephenson@icsc.org<br />

4 Sales for 2009 are reported for European centers<br />

8 McArthurGlen’s fifth Italian project opens<br />

10 Sosnowiec a winner; two Turkish FOCs are<br />

short listed for awards<br />

12 Asia Report: Chinese FOCs aren’t Western<br />

clones<br />

13 Exclusive to IOJ: 27 existing and 14<br />

planned Chinese FOCs<br />

14 Chelsea Japan opens its eighth <strong>outlet</strong> center<br />

in Japan<br />

16 Progress on 10 phase 1 centers and four<br />

expansions<br />

18 <strong>News</strong> Notes: leasing news, management<br />

changes and <strong>more</strong>…<br />

20 Trade Report: ORDA calls for transparency<br />

22 Deborah Clark talks about digital marketing<br />

Advertiser Index<br />

Fashion house ..................................... bC<br />

Globe Outlets ........................................ 15<br />

Gva Outlets ............................................. 5<br />

henderson Global Investors ............... IbC<br />

mcarthurGlen ......................................IFC<br />

neinver ................................................. 11<br />

value retail ............................................ 7<br />

vrn-Global Outlet news ...................... 21<br />

SPRiNg 2010 INteRNatIONaL OutLet JOuRNaL 3

COvER STORy<br />

Outlet Center Sales<br />

<strong>Value</strong> <strong>Retail</strong>’s<br />

global approach<br />

builds <strong>sales</strong><br />

<strong>Value</strong> <strong>Retail</strong>’s marketing to international<br />

shoppers is paying off.<br />

For 2009 the developer’s nine <strong>outlet</strong><br />

villages in Europe welcomed <strong>more</strong> than<br />

25 million international visitors who<br />

helped produce a 52-percent increase in<br />

tax-refunded <strong>sales</strong> compared to 2008.<br />

Shoppers from Southeast Asia<br />

produced a 76-percent increase in<br />

tax-refunded <strong>sales</strong>, and shoppers from<br />

China nearly doubled their spending to a<br />

97-percent increase in tax refunds.<br />

Southeast Asians represent 9 percent<br />

of <strong>Value</strong> <strong>Retail</strong>’s tax-refunded <strong>sales</strong>, and<br />

Chinese visitors represent 24 percent<br />

of those <strong>sales</strong>. China is <strong>Value</strong> <strong>Retail</strong>’s<br />

fastest-growing non-EU market.<br />

Collectively, in Q4 2009 the Villages recorded<br />

an average spend per tax refunded<br />

transaction of €281. Brazilians purchase<br />

the most in the tax-refund category, with<br />

an average spend of €297 per transaction,<br />

an increase of 6 percent compared to Q4<br />

2008. Southeast Asians have an average<br />

spend of €243, up 4 percent from 2008.<br />

Dalton Park sees<br />

solid <strong>growth</strong><br />

ING’s Dalton Park ended 2009 on a<br />

high note with total <strong>sales</strong> for January to<br />

December up 8.5 percent, and comparative<br />

space <strong>sales</strong> up 8 percent. Spend per<br />

head was up by 4 percent, and footfall also<br />

increased by 4 percent (2.3 million through<br />

the door versus 2.2 million in 2008).<br />

Paul Donaghue, area manager for Marks<br />

& Spencer, says he is delighted with the<br />

performance of the Dalton Park unit.<br />

“The Marks & Spencer <strong>outlet</strong> store<br />

at Dalton Park delivered its best-ever<br />

Christmas trading and also broke quite a<br />

<strong>sales</strong> record on the way. Despite the current<br />

challenging economic environment,<br />

M&S <strong>outlet</strong> at Dalton Park delivered a<br />

vast like-for-like <strong>sales</strong> <strong>growth</strong>. We’ve also<br />

experienced a big increase in customer<br />

conversion and average spend values in<br />

the past 12 months.”<br />

4 INteRNatIONaL OutLet JOuRNaL SPRiNg 2010<br />

ING’s seven-year-old Dalton Park <strong>outlet</strong> center in Murton, England saw healthy increases<br />

in both <strong>sales</strong> and footfall for 2009.<br />

The 160,000-sf center, which opened<br />

in 2003, is in Murton, England, 30 minutes<br />

from Newcastle.<br />

Land Securities sees<br />

7 percent holiday boost<br />

Two <strong>outlet</strong> properties in the UK, the<br />

320,000-sf Galleria in Hatfield and the<br />

324,030-sf Gunwharf Quays in Portsmouth,<br />

each saw a 7 percent increase in<br />

<strong>sales</strong> during the Christmas trading period.<br />

Both <strong>outlet</strong> centers are owned and<br />

managed by Land Securities and have<br />

continued to flourish despite the overall<br />

economy.<br />

Gunwharf Quays, which opened in<br />

2000, saw a 4.4 percent increase in footfall<br />

over Christmas compared with 2008,<br />

with many retailers reporting record <strong>sales</strong>.<br />

The Galleria, which opened in 1998,<br />

saw spend per head up 7 percent and<br />

leisure <strong>sales</strong> up <strong>more</strong> than 8 percent<br />

year-on-year for the fourth quarter.<br />

even bad weather<br />

doesn’t dampen<br />

Bideford <strong>sales</strong><br />

January trading figures for Atlantic<br />

Village in Bideford, England, were up 20<br />

percent compared to 2009. The 95,000sf<br />

center, owned by Development<br />

Securities PLC and leased by Realm, has<br />

been riding a crest of new openings and<br />

higher footfall. In 2009, Café Lily’s, M&S<br />

Outlet, Hush Puppies and Yeomans Outdoors<br />

opened in the center, and Cotton<br />

Traders increased its space to become its<br />

largest unit in the UK.<br />

Even a spell of bad weather in early<br />

January – which forced the 10-yearold<br />

center to close for almost two days<br />

-- didn’t significantly affect <strong>sales</strong>, says<br />

center manager Jane McLeod.<br />

“We’re bucking the trend with our retail<br />

performance,” she says. “We have seen<br />

a significant upturn in <strong>sales</strong>, especially on<br />

luggage, footwear and outdoor clothing<br />

ranges. With such a good start to the year<br />

we can only see it getting better. Obviously<br />

our trading success has not gone unnoticed<br />

… we already have a number of blue chip<br />

brands lined up to join us in 2010.”<br />

Kids clothes fly<br />

at McG centers<br />

McArthurGlen’s seven UK designer<br />

<strong>outlet</strong> centers enjoyed strong Christmas<br />

trading, despite suffering through the<br />

coldest winter in decades.<br />

From Nov. 30, 2009 to Jan. 3, 2010,<br />

<strong>sales</strong> increased 4 percent at McArthur-<br />

Glen’s seven centers compared to the same<br />

selling period last year. The real portfolio<br />

(Continued on page 6)

expertise<br />

Nobody knows Outlets better<br />

Current projects in:<br />

• Bulgaria • Czech Republic • Denmark • Germany<br />

• Hungary • Italy • Poland • Romania • Russia • Serbia<br />

• Slovenia • Spain • Switzerland • Ukraine<br />

For <strong>more</strong> information please contact:<br />

Brendon O’Reilly,<br />

Director, GVA Grimley Ltd.<br />

+44 (0)7831 381 405<br />

brendon.o’reilly@gvagrimley.co.uk<br />

www.gvagrimley.co.uk/<strong>outlet</strong>s

COvER STORy<br />

(Continued from page 4)<br />

hero was childrenswear. Sales jumped 63<br />

percent in that category as families looked<br />

to stretch their pound further.<br />

Boxing Day <strong>sales</strong> on Dec. 26, 2009<br />

were buoyant, as well, with Cheshire<br />

Oaks Designer Outlet near Chester<br />

experiencing an increase of <strong>more</strong> than<br />

20 percent compared to Boxing Day<br />

2008.<br />

The number of <strong>sales</strong> transactions for<br />

the period rose by 10 percent compared<br />

with the same period last year, and<br />

designer collections performed particularly<br />

well, with <strong>sales</strong> up 20 percent as<br />

Sunny skies have been shining on Park<br />

Avenue Fashion Outlet in Bilbao, Spain.<br />

The 200,000-sf <strong>outlet</strong> center produced<br />

a 12 percent increase in like-for-like <strong>sales</strong><br />

for 2009, and the scheme welcomed<br />

almost 3 million visitors last year, a 16<br />

percent increase compared to 2008.<br />

Park Avenue is a component of Megapark<br />

Barakaldo, which was acquired by<br />

Resolution Property in 2006 and is managed<br />

by Jones Lang LaSalle. Megapark is<br />

the largest retail and leisure destination in<br />

Spain. The project includes an 11-screen<br />

multiplex and IMAX cinema; 929,000 sf<br />

of big box retail and free covered parking<br />

with direct access to stores.<br />

Michel Nangia, senior manager at<br />

Resolution Property, attributes the<br />

growing success of the <strong>outlet</strong> center,<br />

which opened in 2007, to the company’s<br />

management style.<br />

“Our proactive, hands-on asset management<br />

approach has significantly helped us<br />

navigate what has been a tough time this<br />

past year,” he says, adding that Resolution’s<br />

attention to detail has been noticed and<br />

appreciated by the center tenants.<br />

For instance, Egoitz Barturen, store<br />

manager at Puma says, “Although we<br />

have been trading in the center for only<br />

14 months, the results regarding footfall,<br />

capture rate and <strong>sales</strong> could not be any better.<br />

Our 2009 was superb, and the forecast<br />

for 2010 has the same positive trend not<br />

only for our chain, but for the whole <strong>outlet</strong><br />

center here at the Megapark.”<br />

Javier Anton, coordinator of GEOX in<br />

Northern Spain, says his productivity expectations<br />

have been exceeded. “Our 2009<br />

6 INteRNatIONaL OutLet JOuRNaL SPRiNg 2010<br />

shoppers embraced party attire. Overall,<br />

holiday footfall rose by 1.5 percent.<br />

McArthurGlen Designer Outlets are<br />

located in Ashford, Bridgend, Chester,<br />

Livingston, East Midlands, Swindon and<br />

York.<br />

Sales, footfall<br />

soar for Neinver<br />

Neinver, the second largest operator<br />

in Europe (after Henderson Global Outlet<br />

Mall Fund), has posted a 28 percent<br />

increase in turnover for 2009 compared<br />

with 2008. Additionally, footfall at Nein-<br />

Anatomy of an Increase:<br />

Park Avenue’s success based on data and teamwork<br />

results have been very positive, exceeding<br />

expectations, and quite impressive, considering<br />

the generalized and negative situation<br />

of retailers in this economy.”<br />

One tool Resolution has used to help<br />

retailers increase their <strong>sales</strong> has been the<br />

simple employment of traffic counters.<br />

“We installed bespoke counters<br />

[supplied by PFM] at the entrance of<br />

the center and in every store,” Nangia<br />

explains. “All of our retailers provide us<br />

with their turnover figures, and when<br />

combined with the footfall flow into<br />

their stores, we’re able to calculate the<br />

<strong>sales</strong> conversion rate.<br />

“This information is entered into<br />

PFM’s website, which then provides us<br />

with a weekly report with key perfor-<br />

ver’s 11 <strong>outlet</strong> centers in Italy, Germany,<br />

Spain, Poland and Portugal increased by<br />

11 percent to 30 million visitors compared<br />

to 27 million in 2008.<br />

“The good results registered in 2009<br />

show that the <strong>outlet</strong> concept continues<br />

to strengthen in Europe as one of the<br />

retail concepts that consumers like best,”<br />

says CEO Manuel Lagares. “We’ve seen<br />

this sector’s appeal gradually intensify for<br />

the last two years.”<br />

Neinver also manages the Irus European<br />

<strong>Retail</strong> Property Fund, which focuses<br />

on the acquisition of <strong>outlet</strong> centers and<br />

other retail assets across Europe. c<br />

Resolution Property attributes the success of Park Avenue, a component of the<br />

Megapark Barakaldo in Bilbao, Spain, to the company’s hands-on management and use of<br />

technology to help drive <strong>sales</strong> and footfall.<br />

mance indicators. The report highlights<br />

the key strengths at the center and alerts<br />

us to any problems at an early stage,<br />

enabling us to work closely with our retailers<br />

to assist them in improving their<br />

<strong>sales</strong> conversion rates.”<br />

The center management team frequently<br />

meets with tenants, he says, working<br />

with chains to drive <strong>sales</strong> through marketing<br />

support, signage and other initiatives.<br />

Park Avenue’s catchment within a<br />

90-minute drive is 3.5 million people, including<br />

<strong>more</strong> than 1 million living within<br />

15 minutes of the project. The average<br />

household income for the market is 28<br />

percent higher than the national average.<br />

The market’s average household spend<br />

on retail goods is €11,616. c

NaPlES<br />

mcarthurGlen goes neapolitan<br />

with La reggia designer Outlet<br />

la Reggia Designer Outlet’s architecture reflects the Rococo style of the Royal Palace,<br />

La Reggia di Caserta, built by the Bourbon kings, as well as the Mediterranean styles<br />

and Byzantine domes seen on the nearby Amalfi Coast.<br />

8 INteRNatIONaL OutLet JOuRNaL SPRiNg 2010<br />

The center also has<br />

an impressive solar<br />

system to handle<br />

its energy demands.<br />

by linda humphers<br />

Editor in Chief<br />

More than 100,000 people who<br />

attended the February opening<br />

of McArthurGlen’s fifth designer<br />

center in Italy demonstrated that<br />

Italians are anything but blasé about the<br />

<strong>outlet</strong> concept. And they’re certainly<br />

not blasé about how McArthurGlen<br />

defines <strong>outlet</strong> retailing.<br />

La Reggia Designer Outlet is in Marcianise,<br />

near Caserta in the Campania<br />

region, 30 km north of Naples. Mount<br />

Vesuvius bides her time in the background;<br />

a gazillion pizzerias keep the 5.5<br />

million people living within 90 minutes of<br />

the center well fed, and the Naples airport<br />

is just 20 minutes away. Besides being<br />

Italy’s most populous region, Campania<br />

is also a popular destination, attracting 21<br />

million tourists each year, who are lured<br />

by the Amalfi Coast, Sorrento, and the<br />

islands of Capri and Ischia, as well as the<br />

historic remains of Pompeii.<br />

The 17,500-m 2 phase 1 opened 80<br />

percent leased with strong fashion brands<br />

and a selection of cafes and restaurants,<br />

including well-known local names. Among<br />

those brands to open in the first phase<br />

are Blumarine, Calvin Klein, Gianfranco<br />

Ferré, Hugo Boss, Liu Jo, Patrizia Pepe,<br />

Pinko, Pollini, Replay and Valentino.<br />

The 9,000-m 2 phase 2 is already<br />

under way, with the first half opening<br />

later this year and the second half in the<br />

second quarter of 2011. The center will<br />

have 140 stores when completed.<br />

Campania is the most densely populated<br />

region in Italy, with 5.5 million<br />

inhabitants living within a 90-minute<br />

drive of the center.<br />

La Reggia Designer Outlet, which is<br />

McArthurGlen’s 19th designer out

let village in Europe, includes one of<br />

Europe’s biggest solar energy projects<br />

in a retail scheme, with 2,700 m 2 of<br />

solar panels integrated into the roof.<br />

The panels will produce sufficient solar<br />

power to satisfy 30 percent of the centre’s<br />

energy demands.<br />

McArthurGlen chairman J.W. Kaempfer<br />

says, “It is with great pride that<br />

we open our fifth designer <strong>outlet</strong> in<br />

a country which is home to so many<br />

famous international fashion brands and<br />

which is also one of the top countries in<br />

the world for tourism.”<br />

Jacopo Mazzei, CEO and President of<br />

RDM-Gruppo Fingen, McArthurGlen’s<br />

joint venture partner in Italy, says: “This is<br />

the fifth center we have developed jointly<br />

with McArthurGlen since we opened<br />

Italy’s first designer <strong>outlet</strong> in Serravalle in<br />

2000, and which has now become Europe’s<br />

largest designer <strong>outlet</strong>. Campania<br />

is an ideal location, given the size of the<br />

catchment, the importance of the region’s<br />

tourism, and the center’s location adjacent<br />

to the Naples-Rome motorway.”<br />

McArthurGlen’s other designer <strong>outlet</strong><br />

villages in Italy are Serravalle Designer<br />

Outlet near Milan; Castel Romano Designer<br />

Outlet near Rome; Barberino Designer<br />

Outlet near Florence; and Veneto<br />

Designer Outlet near Venice. The five<br />

Italian centers will total 150,000 m 2<br />

once La Reggia is completed. c<br />

A good selection of cafes and restaurants, many opened by local celebrity chefs, is an<br />

important element at McArthurGlen’s La Reggia Designer Outlet.<br />

lA REGGIA DESIGNER OuTlETS TENANT lIST<br />

Amina Rubinacci<br />

Aspesi<br />

Baci & Abbracci Factory<br />

Store<br />

Bagatelle<br />

Baldinini<br />

Ballantyne<br />

Bialetti Industrie<br />

Bikkembergs<br />

Blumarine<br />

Bric’s<br />

Brooksfield<br />

Calvin Klein Collection<br />

Calvin Klein Jeans<br />

Calvin Klein Underwear<br />

Calzedonia – Intimissimi –<br />

Tezenis<br />

Camper<br />

Celyn B – Elisabetta Franchi<br />

Cerruti 1881<br />

Corso Roma<br />

Cotton Belt<br />

David Mayer Namen<br />

Desiree<br />

Diesel<br />

Dixie<br />

Escada<br />

Fabi<br />

Ferre<br />

Ferre Freddy<br />

Gas<br />

Gattinoni<br />

Golden Lady<br />

Guess<br />

Gutteridge<br />

Hangar Eighteen<br />

Harmont & Blaine<br />

Il Gufo<br />

Kathy Van Zeeland<br />

Levi’s<br />

Lui-Jo<br />

Luisa Spagnoli<br />

Massimo Rebecchi<br />

Maui Bear<br />

Merrell<br />

Modus Beauty Store<br />

Motostore<br />

Nannini<br />

Napapuri<br />

Nautica<br />

Parah<br />

Patrizia Pepe Firenze<br />

Pinko<br />

Piquadro<br />

Pirelli<br />

Pollini<br />

Pupa<br />

RCR<br />

Replay<br />

Rifle<br />

Tailor Club<br />

The End<br />

Timberland<br />

Tommy Hilfiger<br />

Tosca Blu<br />

Valentino<br />

VFG – Valentino Factory<br />

Store<br />

Watch & See<br />

Yamamay<br />

SPRiNg 2010 INteRNatIONaL OutLet JOuRNaL 9

aWaRDS<br />

FOCs are finalists For iCSC awards<br />

Two <strong>outlet</strong> centers in Turkey are<br />

among the finalists in ICSC’s<br />

2010 European Shopping<br />

Centre Awards. The 2010 awards<br />

will be presented at the 35th ICSC<br />

European Conference, 28-29 April<br />

2010 in Prague, The Czech Republic.<br />

In total, 19 of 32 entries made it onto<br />

the short list. The categories are:<br />

l small new centers (less than 30,000 m 2 )<br />

l medium new centers (30,000 – 45,000 m 2 )<br />

l large new centers (45,000 – 80,000 m 2 )<br />

l very large centers (Over 80,000 m 2 )<br />

l refurbishments and extensions<br />

l and specialized centers.<br />

The Turkish <strong>outlet</strong> projects, both in<br />

Istanbul, were nominated in the specialized<br />

category.<br />

The 44,149-m 2 Optimum Outlet has<br />

157 stores and is located in the rapidly<br />

developing Anatolian side of Istanbul.<br />

Renaissance Development owns the<br />

center, which opened in 2008.<br />

Bayraktar Group’s 106,000-m 2 Via<br />

Port Outlet Shopping, which opened<br />

in 2008, has 183 stores throughout its<br />

open design concept. c<br />

FH Sosnowiec wins CEE honors<br />

Fashion house Outlet Centre Sosnowiec opened in Poland in 2008, and it’s awardwinning<br />

expansion opened in 2009.<br />

10 INteRNatIONaL OutLet JOuRNaL SPRiNg 2010<br />

Renaissance Development’s Optimum Outlet is on the rapidly developing Anatolian<br />

side of Istanbul.<br />

bayraktar Group’s Via Port Outlet Shopping is a marvel of shopping and dining in an<br />

open-air setting with nearly 200 shops and cafes.<br />

Fashion house Outlet Centre<br />

Sosnowiec Phase 3 has been<br />

named Factory Outlet of the Year<br />

by EuropaProperty magazine’s CEE <strong>Retail</strong><br />

Real Estate Awards.<br />

Fashion House Outlet Centre Gdansk<br />

Phase 2 and Designer Outlet Center<br />

Salzburg were short-listed for the award.<br />

The Fashion House centers, both in Poland,<br />

are owned by Polonia Property Funds<br />

and were developed by Fashion House,<br />

which continues to manage and lease them.<br />

MacArthurGlen is the developer of the<br />

Salzburg center, a redevelopment project<br />

that opened in Austria in September 2009.<br />

The awards, now in their second year,<br />

honor retailing in Central and Eastern<br />

Europe in 27 categories. c

aSia<br />

Chinese <strong>outlet</strong> centers<br />

aren’t Western clones<br />

by linda humphers<br />

Editor in Chief<br />

At least three U.S.-based companies<br />

are providing <strong>outlet</strong> expertise<br />

and consulting – up to a<br />

point – to Chinese developers planning<br />

to open <strong>outlet</strong> centers in the People’s<br />

Republic. The U.S. companies are:<br />

l Chicago-based Urban <strong>Retail</strong> Properties,<br />

through its Urban <strong>Retail</strong> Asia office<br />

and assisted by <strong>outlet</strong> veteran Ron Simkin,<br />

is consulting with Shanghai Textile<br />

on a project scheduled to open in 2011<br />

l Leto Consulting, whose principals<br />

include Peter Leckerling and <strong>outlet</strong> veteran<br />

Phil Palisoul, is providing planning,<br />

leasing and management consulting to<br />

two Chinese developers<br />

l Horizon Group Properties, which<br />

operates five U.S. <strong>outlet</strong> centers, is working<br />

with a Chinese developer to open as<br />

many as eight <strong>outlet</strong> projects.<br />

According to Peter Leckerling, managing<br />

director of Leto Consulting, the<br />

global economic crisis has had little effect<br />

on development in many Chinese provinces.<br />

Taking the lead from the central<br />

government in Beijing, which in November<br />

of 2008 announced a €430 billion<br />

stimulus package, government officials<br />

are encouraging developers to increase<br />

the pace of <strong>outlet</strong> development.<br />

“As the <strong>outlet</strong> model isn’t urban,”<br />

Leckerling explains, “<strong>outlet</strong> centers can<br />

be built on many non-urban plots that<br />

the government has released for public<br />

auction. This is enticing since China’s<br />

urban land is often overpriced and<br />

always overcrowded.”<br />

Leckerling adds that most Chinese<br />

<strong>outlet</strong> centers don’t embrace the <strong>outlet</strong>village<br />

footprint used in the U.S. and European<br />

Union countries. Instead, Chinese<br />

<strong>outlet</strong> centers are usually large buildings<br />

subdivided into numerous squares, typically<br />

ranging from 300 sf to 500 sf.<br />

Further<strong>more</strong>, the tenants are primarily<br />

either developer-owned stores filled<br />

with goods bought at wholesale, or<br />

12 INteRNatIONaL OutLet JOuRNaL SPRiNg 2010<br />

Shanghai Textile is redeveloping<br />

12 buildings in the Yangpu section of<br />

Shanghai, China’s second-largest city.<br />

The <strong>outlet</strong> center will be in a 36,000-m 2<br />

structure on the site.<br />

shops run by local franchisees who<br />

pay percentage rent only.<br />

There are exceptions, of course. The<br />

tenants at Shanghai Outlets in Qingpu<br />

are legitimate national franchisees of international<br />

brands such as Nike, Adidas,<br />

Zegna, Esprit, Nine West, Hugo Boss,<br />

Benetton and others.<br />

“But many brands realize that customers<br />

in secondary cities don’t have<br />

the purchasing power to make an <strong>outlet</strong><br />

store profitable,” Leckerling says. “So<br />

these non-traditional <strong>outlet</strong>s have allowed<br />

development to move forward in<br />

the secondary markets.”<br />

China’s unique approach to development<br />

and tenanting is initially daunting<br />

to Westerners, even those who’ve been<br />

in the <strong>outlet</strong> business for a long time.<br />

Gary Skoien, CEO of Horizon Group<br />

Properties told IOJ that he first started<br />

looking at China on his own, without<br />

a partner. “Then I realized that I could<br />

spend the rest of my life trying to figure<br />

it out,” he says.<br />

Horizon formed a partnership in February<br />

with a publicly traded real estate firm<br />

that specializes in commercial and residential<br />

development. Three unnamed sites are<br />

currently under control and five additional<br />

sites are under study, Skoien says.<br />

In contrast with Horizon Group,<br />

Urban <strong>Retail</strong> has been doing business<br />

in China for several years. The partnership<br />

with Shanghai Textile Company will<br />

result in the redevelopment of a centuryold<br />

factory into Shanghai Fashion Center.<br />

The <strong>outlet</strong>-retail portion of the project<br />

is one of six elements in the complex,<br />

the others being food and beverage, a<br />

theater, a VIP club, office space and a<br />

hotel. The site, in the Yangpu district,<br />

has 12 buildings, and the <strong>outlet</strong>s will be<br />

in a three-level, 36,000-m 2 structure.<br />

The developer’s main hope is that the<br />

center will be a catalyst for returning<br />

Shanghai to its former status as a global

fashion capital.<br />

According to Scott Chen, CEO for<br />

Urban <strong>Retail</strong> Asia, leasing is progressing<br />

well. “We are in active negotiations with<br />

a wide range of prospective tenants,<br />

such as Dior, Celine, Burberry, Coach<br />

and lots of other brands.”<br />

Leto Consulting has been working<br />

since 2009 with CRED Real Estate<br />

Group to develop one of Shanghai’s<br />

first suburban regional projects, the<br />

65,000-m 2 Trendworld Mall. About 55<br />

percent of the GLA will be a mix of<br />

traditional retail and <strong>outlet</strong> stores.<br />

The reason for the mix, Leckerling<br />

says, is “our research showed that the<br />

local customer’s purchasing power is<br />

<strong>more</strong> in line with factory <strong>outlet</strong> pricepoints.<br />

In this way, international brands<br />

are still be able to tap into a very strong<br />

Outlet Centers in China<br />

27 existing <strong>outlet</strong> projects, 11 planned to open within 2 years (listed by opening date)<br />

name of mall m2 of GLa, GS or Land Opening date Location developer<br />

beijing Yansha Outlets 19,832 m2 GLa 2002 beijing yansha<br />

Shanghai Qingpu Outlets 110,000 m2 GS 2006 Shanghai bailian<br />

harbin Yansha Outlets 32,000 m2 GLa 2006 harbin, heilongjiang yansha<br />

Foxtown 68,000 m2 GS 2006 Shanghai Studio Silvio tarchini<br />

Guangzhou Teemal ThC 18,000 m2 GS 2006 Guangzhou, Guangdong<br />

Suzhou CS heshun Outlets 50,000 m2 GLa 2007 Suzhou, Jiangsu CSLand<br />

Chengdu MGS Outlets 50,000 m2 Land 2007 Chengdu, Sichuan mGS<br />

Shangjie Yaxing Outlets 40,000 m2 GLa 2007 Zhengzhou, henan yaxing<br />

Zhangjiagang hong Kong City Outlets 30,000 m2 GLa 2007 Zhangjiagang, Jiangsu<br />

Aika Outlets 15,000 m2 GS 2008 beijing aika<br />

Kosmall 13,000 m2 GS 2008 hefei, anhui Kosmall<br />

West Outlets 80,000 m2 GS 2008 Chongqing taiwan Pacific Group<br />

Zhengzhou Yaxing Outlets 60,000 m2 GLa 2008 Zhengzhou, henan yaxing<br />

hangzhou EX Outlets 8,000 m2 GLa 2008 hangzhou, Zhejiang<br />

Chongqing Windsor Outlets 33,000 m2 GS 2009 Chongqing CGr<br />

Changchun Eurasia Outlets 25,000 m2 GS 2009 Changchun, Jilin Eurasia Group<br />

Energetic Orient brand Discount Shopping Plaza 68,000 m2 GS 2009 beijing Oriental Foundation<br />

Zhengzhou Kingcity Outlets 30,000 m2 GLa 2009 Zhengzhou, henan Powerlong<br />

beijing Scitech Premium Outlet Mall 150,000 m2 GS 2009 beijing Scitech<br />

Meilanhu Outlets 70,000 m2 GS 2009 Shanghai<br />

Jiangsu Wanhe Outlets Park 600,000 m2 GS 2009 Changzhou, Jiangsu<br />

Shanghai Fashion Center Global Outlets Park 120,000 m2 GS 2009 Shanghai<br />

Chengdu Times Outlet 44,000 m2 GS 2009 Chengdu, Sichuan Wharf holdings<br />

Tongxiang hong Kong City Outlets 60,000 m2 GS 2010 tongxiang, Zhejiang houyuan<br />

Qingdao Kingcity Outlets 38,000 m2 GS 2010 Qingdao, Shandong Powerlong<br />

Ningbo Outlets 2010 ningbo, Zhejiang Zhejiang Power<br />

Nantong Outlets 30,000 m2 GLa 2010 nantong, Jiangsu Xintonghai<br />

*PlANNED OuTlET PROJECTS IN ChINA<br />

Outlet China - South China Flagship Center 652,915 m2 Land 2010 Foshan, Guangdong Outlets China Ltd<br />

Outlet China - East China Flagship Center 1,300,000 m2 Land 2010 huzhou, Zhejiang Outlets China Ltd<br />

Changsha Outlets 160,000 m2 GLa 2010 Changsha, hunan richly Field<br />

Tianjin Florence Town Outlets 400,000 m2 Land 2010 tianjin Waitex<br />

Changshu Outlets 84,000 m2 GS 2010 Changshu, Jiangsu Zhongtai<br />

haining Outlets 75,000 m2 GLa 2011 haining, Zhejiang bailian<br />

haixi Outlets 2,000,000 m2 Land 2011 Fuzhou, Fujian richly Field<br />

Ningbo Outlets Project NTD 110,000 m2 Land 2011 ningbo, Zhejiang Shanshan, mitsui, Itochu<br />

Jiangyin Outlets 2011 Jiangyin, Jiangsu<br />

consumer market.”<br />

Leto is also working with a development<br />

group in Ningbo’s Fenghua town,<br />

the ancestral home of Chiang Kai-shek,<br />

near the beautiful Tingxia Lake.<br />

“The project will be called an <strong>outlet</strong><br />

center,” Leckerling says, “but the model<br />

is <strong>more</strong> Chinese, with substantial food,<br />

beverage and entertainment options<br />

included.” c<br />

Shanghai Fashion Outlets 36,000 m2 GLa 2011 Shanghai Shanghai textile Company<br />

Wealth Outlets 13,000 m2 GS planned nanchang, Jiangxi hongkelong<br />

*horizon Group Properties’ eight sites aren’t listed as no details were available by press time.<br />

Source: Information for this chart comes to IOJ courtesy of yiqun Wang, who is an intern in the research department at ICSC in new york. his family’s business,<br />

Zaihang, offers retail consulting services to developers in China and was a partner on a planned <strong>outlet</strong> center in ningbo.<br />

SPRiNg 2010 INteRNatIONaL OutLet JOuRNaL 13

aSia<br />

Chelsea Japan opens<br />

ami Premium Outlets<br />

The center is the<br />

developer’s eighth<br />

<strong>outlet</strong> center to<br />

open in nine years.<br />

Simon Property Group has<br />

decided to skip developing retail<br />

centers in China, at least for now,<br />

but its subsidiary, Chelsea Japan, continues<br />

making strides in Japan.<br />

In July 2009, Chelsea Japan opened<br />

Ami Premium Outlets, its eighth <strong>outlet</strong><br />

center in Japan. CJ is a joint venture<br />

of Simon Property Group (40 percent<br />

ownership) and Mitsubishi Estate Co.,<br />

Ltd. (60 percent ownership).<br />

Ami Premium Outlets opened on a<br />

bright day and was greeted, as usual,<br />

by thousands of Japanese shoppers<br />

eagerly waiting for speeches to end<br />

and ribbons to be cut so they could<br />

begin shopping. Videos on YouTube<br />

tell the tale.<br />

The center’s 225,000-sf phase 1<br />

opened fully leased with 100 tenants,<br />

including Adidas, Diesel, Fauchon,<br />

Lanvin en Bleu, Mayson Grey, Ray Ban,<br />

True Religion and Viaggio Blue. Additional<br />

phases could bring the center to<br />

a 360,000-sf build-out.<br />

Ami Premium Outlets is in Ibaraki<br />

Prefecture, about 35 miles or a 50-minute<br />

drive northeast of central Tokyo. The<br />

41-acre site lies near the Ami-Higashi<br />

interchange on the Ken-O Expressway<br />

(Metropolitan Inter-City Expressway), 11<br />

miles from Tsukuba and 20 miles from<br />

Narita International Airport.<br />

About 11 million people live within a<br />

30-mile radius of Ami.<br />

Chelsea Japan’s 2.1 million-sf portfolio<br />

includes Gotemba Premium Outlets<br />

and Sano Premium Outlets (both serving<br />

Tokyo); Rinku Premium Outlets<br />

(Osaka); Kobe-Sanda Premium Outlets<br />

(Kobe-Osaka); Sendai-Izumi Premium<br />

Outlets (Sendai); Toki Premium<br />

Outlets (Nagoya) and Tosu Premium<br />

Outlets (Fukuoka). c<br />

14 INteRNatIONaL OutLet JOuRNaL SPRiNg 2010<br />

Chelsea Japan’s 225,000-sf Ami Premium Outlets opened fully leased with 100 tenants.<br />

AMI PREMIuM OuTlET TENANT lIST<br />

Ace<br />

Adidas<br />

Asics<br />

Barclay<br />

BCBG Maxazria<br />

Beams<br />

Billabong<br />

Brooks Brothers<br />

Castelbajac<br />

Ciaopanic<br />

Citizen<br />

Coach<br />

Cole Haan<br />

Combi<br />

Crazy Crepes<br />

Cricket<br />

Delifrance<br />

Diesel<br />

Dou Dou<br />

Edwin<br />

Elle Paris<br />

Energie<br />

Enoteca D’oro Premio<br />

Fauchon<br />

Fossil<br />

Fukuske<br />

Gap<br />

Global Work<br />

Gotcha<br />

Hakka<br />

Hawkins<br />

Hush Puppies<br />

Jayro<br />

Jin’s<br />

Journal Standard<br />

Junmen<br />

Kaneki<br />

Katharine Hamnett<br />

Keawjai<br />

Kihachi Soft Cream<br />

Kim Kim Jang<br />

Kobe Motomachi Doria<br />

Lafuma<br />

Lanvin en Bleu<br />

Laundry<br />

Lego<br />

Lowrys Farm<br />

Madras<br />

Marithé François Girbaud<br />

Max & Co.<br />

Mayson Grey<br />

McGregor<br />

Michel Klein<br />

Millet<br />

Miss Sixty<br />

Mitsumine<br />

Miyatake Sanuki Seimensho<br />

MK Michel Klein Homme<br />

Moussy<br />

Nara Camicie<br />

New Yorker<br />

Nice Claup<br />

Nine West<br />

Off & On<br />

Op<br />

OshKosh B’Gosh<br />

Override<br />

Pageboy<br />

Pal Zileri<br />

Plaza<br />

Ra-men Ichiya<br />

Ray Cassin<br />

Ray-Ban<br />

Rienda<br />

Rockport<br />

Rodeo Crowns<br />

Ru OlOl<br />

Sally Scott<br />

Sandaya Honten<br />

Schiatti<br />

Seiko<br />

Sly<br />

Spick and Span<br />

St. Cousair<br />

Sylvanian Families<br />

Tachikichi<br />

Taylormade<br />

T-fal<br />

TGM<br />

Tommy Hilfiger<br />

Topkapi<br />

Triumph<br />

True Religion Brand Jeans<br />

Tsumori Chisato<br />

Tully’s Coffee<br />

Under Armour<br />

Union Station<br />

Urban Research<br />

Vans<br />

Vérité<br />

Viaggio Blu<br />

Vicky<br />

Visaruno OlOl<br />

W Closet

PlaNNED CENTERS UPDaTE<br />

Neinver developing<br />

Six phase 1 projects<br />

NEINVER IS GOING to be busy for the<br />

next two years developing one center<br />

in Spain, one center in Portugal, two in<br />

France and two in Poland. The Spanish<br />

developer will also be expanding four<br />

existing centers. By the end of 2012,<br />

AS OF MID-FEbRuARY, Norwegian<br />

Outlet Center was 90 percent leased<br />

and well on its way to a June opening.<br />

Located in Vestby, the 118,400-sf<br />

planned center is 25 minutes from<br />

the Oslo city center and nine minutes<br />

from Tusenfryd, Norway’s largest<br />

amusement park. The center is<br />

on the E6, within an hour’s drive of<br />

35 percent of Norway’s population.<br />

Developer of the project is<br />

Norwegian Outlet, whose principal is<br />

°<br />

Adne Sondral, ° an Olympic medalist in<br />

the 1,500-meter speed skating event.<br />

He won the gold<br />

medal in 1998 at<br />

Nagano and the silver<br />

medal in 1992 in<br />

Albertville. During<br />

the2010Olympicsin<br />

°<br />

Vancouver, Sondral<br />

was a speed skating<br />

commentator<br />

for a Norwegian<br />

sportscast.<br />

IOJ caught up<br />

°<br />

with Sondral dur-<br />

ing the 2010<br />

Winter Olympics in<br />

February to ask the<br />

burning question,<br />

“Which is harder,<br />

winning an Olympic<br />

medal or opening<br />

an <strong>outlet</strong> center?”<br />

16 INteRNatIONaL OutLet JOuRNaL SPRiNg 2010<br />

Neinver will manage 354,400 m 2 of <strong>outlet</strong><br />

GLA in six European countries.<br />

The 12,600-m 2 first phase of Factory<br />

La Coruña in the province of Galicia,<br />

in northwestern Spain, will open during<br />

the 4th quarter of 2010. The center,<br />

which is just 2 km from the airport and<br />

9 km from Coruña, will be Neinver’s<br />

fifth in Spain. Neinver plans a second<br />

Norwegian Outlet is<br />

Olympian’s next goal<br />

when I really want something I give it<br />

everything I have. I did so with skating<br />

and I am doing so in setting up<br />

Norwegian Outlet. It has been challenging<br />

at times with financial crises<br />

and regulatory problems, but skating<br />

had other challenges.<br />

“In my experience if you really want<br />

something, you will make it happen.<br />

Norwegian Outlet seems to be one of<br />

the <strong>more</strong> successful <strong>outlet</strong> endeavors<br />

in Europe, considering that it’s <strong>more</strong><br />

than 90 percent leased four months<br />

before the opening. But we still have<br />

to work hard to<br />

drive revenue and<br />

to make our tenants<br />

as profitable<br />

as possible. I have<br />

always needed<br />

clear goals in life.<br />

Right now, the success<br />

of Norwegian<br />

Outlet is my Olympic<br />

medal.”<br />

Signed tenants<br />

include Abecita,<br />

Arts & Crafts,<br />

Bergans, Bjorn<br />

Borg, Coast, Karen<br />

Miller, Columbia,<br />

°<br />

°<br />

Adne Sondral, who is developing Doite, Follestad,<br />

Norwegian Outlets, won the 1998 Gant, Helly Hansen,<br />

Olympic gold medal in speed skating House of Brands,<br />

in Nagano, Japan.<br />

Hoyer, Hugo Boss,<br />

“Winning the Olympics was my big IC Companys, Josef Seibel, Le Creuset,<br />

dream since I was a small child,” Levis,Lillevinkel,Mexx,MXDC,NoaNoa,<br />

° Sondral says. “I had to work hard Norrona, Peak Performance, Polarn<br />

for 20 years to reach that goal. It’s o Prylet, Puma, QuickSilver, Read,<br />

possible to build an <strong>outlet</strong> village SamsoeSamsoe, SEB, Timberland,<br />

within a shorter period of time. But Tommy Hilfiger, Triumph and Vans. c<br />

phase of 8,900 m 2 as well.<br />

In France, Neinver is developing in<br />

partnership with MAB Development<br />

the 18,000-m 2 Honfleur The Style<br />

Outlets. The site is on the western coast<br />

of Normandy, near the beach at Pont<br />

de Normandie. The center will open in<br />

spring 2011.<br />

Also in France, Roppenheim The<br />

Style Outlets is scheduled to open during<br />

the 4th quarter 2011. The 25,500-m 2<br />

scheme is in the Alsace region of northeast<br />

France, next to the French-German<br />

border, 46 km north of Strasbourg.<br />

Neinver’s development partner MAB<br />

acquired the site in October from Freeport,<br />

which had pre-let <strong>more</strong> than 30<br />

percent of the space.<br />

In Portugal, Algarve The Style Outlets<br />

is scheduled to open in 2012. The<br />

23,000-m 2 center, which will be Neinver’s<br />

second in Portugal, is near Faro,<br />

famous for its beaches, flamingoes and<br />

high influx of visitors.<br />

In Poland, Neinver will open Factory<br />

Krakow and Factory Warsaw, both<br />

36,000 m 2 .<br />

Neinver will add 14,000 m 2 to Vila<br />

do Conde in Portugal; 4,400 m 2 to<br />

Zweibrücken in Germany; 3,800 m 2 to<br />

Vicolungo in Italy; and 3,000 m 2 to Factory<br />

Sevilla Aeropuerto in Spain.<br />

local community<br />

gets preview of<br />

Soltau Outlet<br />

GVA OuTlETS and Mutschler Development<br />

Group got a positive response from<br />

the community at a recent preview outlining<br />

the plans for the 10,000-m 2 Soltau<br />

Outlet set to open in 2011 in Germany.<br />

The preview included an accounting<br />

of the center’s design and prospective<br />

tenants, plus the impact the scheme will<br />

have on the area’s employment, revenue<br />

and tourism. In the audience were local<br />

government officials, the mayor and key<br />

councilors, business owners and tourism<br />

representatives.<br />

The center site is in the Luneburger<br />

Heide region near the cities of Hamburg,<br />

Bremen and Hanover. It is across<br />

from Heide-Park, one of the largest<br />

theme parks in northern Germany, and<br />

along the A7 motorway, accessible to the<br />

area’s 2 million annual visitors.

“The key factor here is that this is a<br />

new retail concept for the area,” says<br />

Brendon O’Reilly, director of GVA<br />

Outlets, “so it is important that everyone<br />

understand the concept and how<br />

it works. It is also important that the<br />

benefits are explained and misguided<br />

fears are laid to rest, as there is always<br />

confusion between out-of-town retail<br />

parks and <strong>outlet</strong> centers, which operate<br />

in a very different way.<br />

“The community now understands<br />

and is delighted that we are coming.<br />

Considering how difficult planning permission<br />

can be for <strong>outlet</strong>s in Germany,<br />

this support is a real achievement.”<br />

Ferrara FOC plans<br />

November opening<br />

A NOVEMbER opening is planned for<br />

Costruzioni Generali Italia’s Occhiobello<br />

Outlet Village. The 12,800-m 2 center<br />

will be home to 74 tenants, predominately<br />

Italian and French brands.<br />

OOV is in the town of Occhiobello,<br />

between Veneto and Emilia Romagna.<br />

The site will serve two of the provinces<br />

with the highest per capita disposable<br />

income in Italy, 20 minutes from<br />

Rovigo and five minutes from Ferrara.<br />

The catchment includes some 3 million<br />

people residing in Padua, Bologna and<br />

Venice. The site, on A13 Padua-Bologna<br />

Highway, has full planning approvals.<br />

In Cannes in November, Francesco<br />

Bordignon, of consultant Kboard, said<br />

the scheme was 45 percent leased.<br />

“The demographics of the area are<br />

<strong>more</strong> like Northern Europe,” he told<br />

IOJ. “It’s not like Southern Italy.”<br />

ING to expand<br />

Dalton Park<br />

ChIlDRENSWEAR retailer Designer<br />

Kidz opened earlier this year at ING<br />

Real Estate’s Dalton Park in Murton,<br />

England.<br />

But the big news at the 160,000-sf<br />

center is that planning has begun for a<br />

€27 million expansion. Last year ING<br />

dropped efforts to sell the project,<br />

which had brought interest but no<br />

proper offers, and instead decided to<br />

go ahead with a major expansion. The<br />

second phase, expected to create up to<br />

Work is progressing on the 25,000-m 2 first phase of Sicilia Outlet Village,<br />

as seen from this photo taken on Feb. 4. Located in the middle of Sicily, one<br />

hour from Taormina and 90 minutes from Palermo, the scheme will open in the<br />

autumn. Premium <strong>Retail</strong> and Gruppo Percassi are developing the center.<br />

500 jobs, will include a cinema, supermarket,<br />

hotel and petrol station.<br />

Dalton Park, which opened in 2003,<br />

has weathered the recession and is now<br />

in good shape with footfall up 6 percent<br />

and <strong>sales</strong> up 10 percent (see page 4).<br />

ING hopes to gain approval for the<br />

expansion this year and begin working<br />

on it by the end of 2011. The center,<br />

just off the A19 on the site of Murton<br />

Colliery, was originally granted outline<br />

planning permission in 2001.<br />

FOCs in Japan,<br />

Korea expand<br />

ChElSEA JAPAN opened the<br />

176,000-sf phase 2 of Kobe-Sanda<br />

Premium Outlets in December, adding<br />

90 new tenants. The center now totals<br />

180 stores and 371,000 sf. New tenants<br />

include Armani, Helmut Lang, A Bathing<br />

Ape and Dsquared2, as well as a full<br />

range of men’s brands, including Edifice<br />

and Paul Smith.<br />

Chelsea Japan also broke ground on<br />

phase 3 of Toki Premium Outlets on<br />

Oct. 29, 2009. This expansion will add<br />

another 30 stores, bringing the total<br />

to 140. The 231,000-sf center, which<br />

opened in 2005, is located in the Toki<br />

Plasma Research Park.<br />

Shinsegae Chelsea opened a small<br />

expansion of Yeoju Premium Outlets<br />

(Korea) on Dec. 18, 2009. The 15 new<br />

stores include Bally, Michael Kors, Moschino,<br />

Loro Piana, Leonard, Nina Ricci,<br />

Tumi and Issey Miyake. The center is 36<br />

miles southeast of Seoul.<br />

Moulin de Nailloux<br />

gets new owner<br />

before it opens<br />

IN FEbRuARY, the European property<br />

investment company Corio acquired<br />

75 percent of the planned Moulin de<br />

Nailloux in Toulouse, France, from developer<br />

COGEP. The acquisition price<br />

was €44 million.<br />

The <strong>outlet</strong> center’s 22,100-m 2 first<br />

phase is set to open in June 2011. The<br />

new-construction <strong>outlet</strong> village, in<br />

Chemin du Gril, Le Moulin, 30 km<br />

south of Toulouse, was 50 percent<br />

leased as of March 1. An 8,800-m 2<br />

phase 2 will open in 2014.<br />

COGEP retains 25 percent ownership,<br />

and its subsidiary Advantil will<br />

continue leasing, marketing and managing<br />

the center, including the planned<br />

second phase. Corio has first rights to<br />

acquire the remaining 25 percent of the<br />

property in 2016.<br />

As of Dec. 31, 2009, Corio’s €5.7 billion<br />

portfolio included 1.5 million m 2 in<br />

105 projects, of which 91 are shopping<br />

centers. The company’s pipeline portfolio<br />

includes approximately 18 phase 1<br />

projects and 14 expansions. c<br />

SPRiNg 2010 INteRNatIONaL OutLet JOuRNaL 17

NEWS NOTES<br />

Whiteley Village<br />

To be leveled<br />

WhEN WhITElEY Village Outlet<br />

Shopping opened in Hampshire in<br />

November 1999, it was the 18 th <strong>outlet</strong><br />

scheme to open in England. Six months<br />

later, the 324,030-sf Gunwharf Quays<br />

opened in Portsmouth, just 15 minutes<br />

south of Whitely Village. The smaller<br />

center never got much traction, and it is<br />

now slated for demolishment.<br />

Planners have given a green light<br />

to a €112 million scheme on the<br />

site. Whiteley Co-Owners, developers<br />

of the new project, will tear down<br />

Whiteley Village, causing at least<br />

18 INteRNatIONaL OutLet JOuRNaL SPRiNg 2010<br />

one council member, probably not<br />

a developer, to wonder what was<br />

wrong with the existing buildings.<br />

The new development is designed<br />

to be <strong>more</strong> in tune with local needs<br />

– that is, not focused on <strong>outlet</strong>s –<br />

and will include shops, restaurants,<br />

cafes, a community theater, a library<br />

and a community hall.<br />

Australian DFO<br />

portfolio for sale<br />

Direct Factory Outlets has put its<br />

portfolio of eight DFO <strong>outlet</strong> centers<br />

and three conventional schemes on<br />

the selling block. The Australian<br />

The Outlet at bridgewater Park had a set-back recently when approval for a Tesco<br />

was denied.<br />

The Outlet regroups,<br />

names new manager<br />

The Outlet at Bridgewater Park<br />

in Banbridge, N. Ireland, has new<br />

management. Glenrye Properties<br />

Services, which runs Ireland’s largest<br />

mall, the 80,000-m 2 Dundrum Shopping<br />

Centre outside Dublin, took over management<br />

of The Outlet on Jan. 1.<br />

Land Securities, which previously<br />

managed The Outlet, is still involved in<br />

the overall project. When first conceived,<br />

Bridgewater Park was to be a 1.2<br />

million-sf complex, with phase 1 being<br />

the 19,000-m 2 <strong>outlet</strong> center.<br />

Phase 2 was envisioned with another<br />

40,000 m 2 of retail, which apparently<br />

already had approvals, a drive-through<br />

restaurant, hotel, petrol station, additional<br />

parking and a 52,336-m 2 business<br />

park.<br />

However, in late 2009, approval to<br />

build a 12,000-m 2 Tesco was denied<br />

on the grounds that Bridgewater Park<br />

would turn Banbridge’s town center into<br />

a ghost town. The turn-down was a big<br />

blow for Bridgewater developer GML<br />

Estates, a joint venture of Orana Group<br />

and Land Securities.<br />

In early February, GML confirmed that<br />

it is seeking a judicial review of the decision<br />

with the High Court in Belfast. c<br />

company, founded in 1996 by David<br />

Goldberger and David Weiland, is<br />

looking for a buyer or investor. The<br />

centers are actually warehouses with<br />

subdivided spaces for retailers.<br />

According to a report in the<br />

Australian Financial Review, Jones<br />

Lang LaSalle is marketing the portfolio,<br />

which brings in €986 million in<br />

annual revenue.<br />

DFO will either sell the centers<br />

outright or sell the centers and<br />

retain management. Weiland and<br />

Goldberger, who own houses next<br />

door to each other in the upmarket<br />

suburb of Toorak, were jointly listed<br />

on last year’s BRW Rich 200 with a<br />

fortune of €468 million.<br />

The pair is best known for founding<br />

the discount petrol chain Solo in 1974,<br />

before selling it 15 years later for a<br />

reported €131 million. They now own<br />

the petrol wholesaler Liberty Oil.<br />

DFO centers are in Melbourne,<br />

Sydney, Brisbane, Canberra and<br />

Cairns, and are planned for Hobart,<br />

Townsville and Perth as well as outside<br />

of Australia.<br />

Rathdowney sees<br />

losses for 2009<br />

AWG PROPERTY SAYS that its<br />

Rathdowney Designer Outlet in Laois,<br />

Ireland, lost €5.4 million in 2009, of<br />

which €4.6 million was a depreciation<br />

of the asset.<br />

However, the nine-year-old center<br />

achieved a net operating profit of<br />

€127,685 for the year.<br />

AWG points to tenant concessions<br />

on rent at the 100,000-sf center as<br />

one of the culprits for the loss. The<br />

developer added in a statement that<br />

the recent difficult economy in Ireland<br />

had made “attracting and retaining<br />

quality tenants very challenging.”<br />

The opening of <strong>Value</strong> <strong>Retail</strong>’s<br />

upscale Kildare Village in 2006 probably<br />

hasn’t helped Rathdowney’s <strong>sales</strong><br />

and footfall, either. The 125,000-sf<br />

Kildare Village is one hour northeast<br />

of Rathdowney, and less than an hour<br />

from Dublin’s city center.

Prada opens in<br />

McArthurGlen’s<br />

Roermond FOC<br />

ICONIC luXuRY brand Prada opened<br />

at McArthurGlen’s Designer Outlet<br />

Roermond, on Feb. 12. Prada has two<br />

other <strong>outlet</strong> stores at McArthurGlen<br />

centers, at Serravalle Designer Outlet<br />

near Milan and at Barberino Designer<br />

Outlet near Florence. The Roermond<br />

store is the brand’s first <strong>outlet</strong> store<br />

in a European Union country other<br />

than Italy.<br />

Prada joins such luxury brands<br />

at Roermond as Armani, Burberry,<br />

Dolce & Gabbana, Escada, Gucci, Hugo<br />

Boss, Loro Piana, Polo Ralph Lauren,<br />

Salvatore Ferragamo and Zegna.<br />

Designer Outlet Roermond, near<br />

Düsseldorf, is in the Netherlands but<br />

many of the center’s 3.5 million annual<br />

shoppers live in Germany.<br />

McArthurGlen plans to open a 7,000m<br />

2 expansion of the 28,000-m 2 center<br />

in 2011. DOR is co-owned by<br />

McArthurGlen and Henderson Global<br />

Investors’ European Outlet Mall Fund.<br />

However, Henderson isn’t involved in<br />

the expansion.<br />

DOR is one of Europe’s top-performing<br />

<strong>outlet</strong> centers, according to<br />

a ranking compiled by commercial<br />

real estate consultant CBRE and<br />

German-based research organization<br />

Ecostra. The ranking is based<br />

on responses from brands surveyed<br />

about their turnover performance at<br />

60 <strong>outlet</strong> centers.<br />

New tenants<br />

take space<br />

at Alpenrhein<br />

AlPENRhEIN VIllAGE in Landquart,<br />

Switzerland signed up several new<br />

tenants this winter. Italian jeans brand<br />

Diesel will open in the fourth-largest<br />

retail space at the 226,020-sf center<br />

in April. The 3,350-sf unit is oppo-<br />

Italian luxury brand Prada chose McArthurGlen/Henderson Global Outlet Fund’s<br />

Designer Outlet Roermond for one of its few <strong>outlet</strong>s outside Italy.<br />

site Sarar at the center’s northern<br />

entrance. Other new tenant signings<br />

in February include Victorinox,<br />

Lavazza and Envy Sports.<br />

Alpenrhein Village, which opened<br />

in October 2009, is owned by ING<br />

Real Estate and is managed by GVA<br />

Grimley Outlet Services.<br />

Gap opens at<br />

Junction One<br />

AMERICAN bRAND Gap opened Jan.<br />

20 at Junction One International<br />

Outlet Shopping Centre in Antrim,<br />

N. Ireland. Already trading in <strong>more</strong><br />

than 180 full-price and <strong>outlet</strong> locations<br />

in the U.K., Ireland and France,<br />

the 6,000-sf unit is Gap’s second<br />

<strong>outlet</strong> store on the island of Ireland.<br />

Other tenants in the 245,000-sf center<br />

include Marks & Spencer, Clarks,<br />

Next, Nike and Adidas, as well as<br />

designer brands Austin Reed, Mexx<br />

and Moss.<br />

Since opening in May 2004,<br />

Junction One has attracted <strong>more</strong><br />

than 15 million visitors, drawn by the<br />

scheme’s 3,000 parking spaces, 70<br />

stores and 10 cafes.<br />

Junction One is owned by CUSP,<br />

the Kennedy Group and Dunalastair<br />

(Ireland) Ltd. c<br />

Gap Outlet recently joined Mexx, Tom Tailor, Nike, Adidas and <strong>more</strong> than 65 other <strong>outlet</strong><br />

shops at Junction One International Outlet Shopping Centre in Antrim, N. Ireland.<br />

SPRiNg 2010 INteRNatIONaL OutLet JOuRNaL 19

OUTlET TRaDE gROUPS<br />

ORDA’s big question:<br />

Can we share data?<br />

by brendon O’Reilly,<br />

President, ORDa<br />

Outlet <strong>Retail</strong>ers and<br />

Developers association<br />

Sales density? How far do<br />

consumers travel for a discount?<br />

Cap rate? Service charge? Product<br />

supply? Best brand penetration? Is this a<br />

good <strong>outlet</strong> site? Is cannibalization really<br />

a problem?<br />

I’ve been<br />

involved in the<br />

<strong>outlet</strong> industry for<br />

the last 17 years,<br />

and have been a<br />

developer, a tenant<br />

and a consultant<br />

O’Reilly<br />

to <strong>more</strong> than 50<br />

centers. There are<br />

often many questions, but regardless of<br />

whether you’re a tenant, a developer or<br />

an investor, the issues aren’t that different.<br />

However, as the sector grows, some<br />

questions become harder to answer.<br />

The buzz word or buzz phrase of the<br />

Italian trade<br />

group to submit<br />

IOJ column<br />

ThE FACTORY OuTlETS’ Advisory<br />

Committee of the Italian National<br />

Council of Shopping Centers will<br />

launch its industry-update column<br />

in the Summer 2010 IOJ. The<br />

Italian <strong>outlet</strong>-industry trade group<br />

was introduced by Filippo Maffioli in<br />

October 2009 at the ICSC European<br />

Factory Outlet Conference in Milan.<br />

The new column will help the<br />

global <strong>outlet</strong> community keep track<br />

of the Italian FOC industry by providing<br />

information about local market<br />

trends, the committee’s goals<br />

and activities and its links with the<br />

analogous associations and trade<br />

groups around the world.<br />

20 INteRNatIONaL OutLet JOuRNaL SPRiNg 2010<br />

last year has been due diligence. Funding<br />

partners at any level need validated<br />

numbers and facts to be able to provide<br />

financing for inventory, development<br />

and investments.<br />

The lack of information within the<br />

sector is preventing new entrants and<br />

slowing down the <strong>growth</strong> of future<br />

developments and brands. To truly understand<br />

the wide and diverse nature of<br />

the benefits of an <strong>outlet</strong> strategy and the<br />

significant profit and investment return<br />

that can be achieved, we need to find<br />

ways to demonstrate it.<br />

There are lots of big questions that<br />

must be addressed, but where can we<br />

find answers?<br />

There is no one-stop shop for <strong>outlet</strong><br />

industry information, research or figures.<br />

In the U.S., though, ICSC was able to<br />

conduct an <strong>outlet</strong>-center <strong>sales</strong> index for<br />

five years in the 1990s and an <strong>outlet</strong>chain<br />

<strong>sales</strong> index for several years,<br />

ending in 2006. In January, through the<br />

efforts of the U.S. trade group DOCR,<br />

an Outlet Research Subcommittee was<br />

created. This subcommittee will greatly<br />

benefit the U.S. <strong>outlet</strong> sector.<br />

Though the surveys on <strong>outlet</strong>-center<br />

performance conducted by CBRE and<br />

Ecostra are finding <strong>more</strong> participants<br />

each year, there is still plenty of room<br />

for improvement.<br />

So, why the paucity of information in<br />

Europe?<br />

The answer is simple. In the past developers<br />

didn’t want to show their cards,<br />

and brands didn’t want to talk about<br />

their <strong>sales</strong> and lease deals. We think<br />

those attitudes may be shifting.<br />

Outlet <strong>Retail</strong>ers and Developers Association<br />

was established by a group of<br />

brands, developers and consultants for<br />

one main purpose: to provide a platform<br />

for sharing information that will help us<br />

all – both new and existing entrants –<br />

make better decisions.<br />

Due diligence has caused developers<br />

and brands to rethink their information<br />

strategy and to look at ways of sharing<br />

<strong>more</strong> data in return for having access to<br />

facts and figures that can help their business<br />

develop and grow.<br />

The ORDA web site was launched at<br />

the ICSC/IOJ European Outlet Conference<br />

in October in Milan and the hits<br />

have been growing week by week. Later<br />

this year we will launch the first newsletter<br />

for members.<br />

Please take some time to look at<br />

the site – www.orda-<strong>outlet</strong>s.com – and<br />

register for future info, or contact me at<br />

brendon.o’reilly@gvagrimley.co.uk. c<br />

Brendon O’Reilly is the director of GVA<br />

Grimley Outlet Services.<br />

Save This Date!<br />

October 13-14, Milan<br />

2010 ICSC EuropEan<br />

FaCtory outlEt ConFErEnCE<br />

Why brands love Outlets<br />

l Presentations by top brands<br />

l Case Studies<br />

l research

SAMPlE AD<br />

ACTuAl SIZE<br />

120 pixels by 90 pixels

WiTH THiS iN MiND<br />

bring brands alive through<br />

strategic digital marketing<br />

by Deborah Owen-Ellis Clark<br />

AS A STRATEGIC marketer, I<br />

find that keeping up with digital<br />

progress is a challenge, albeit a<br />

stimulating one. Invariably a number of<br />

questions spring to my mind:<br />

How do virtual conversations affect<br />

physical conversations?<br />

How do we effectively<br />

use digital technology?<br />

How do we measure it?<br />

How do we manage it?<br />

Or do we even need<br />

to measure, use and<br />

manage it?<br />

These questions still<br />

remain largely unknown<br />

because of a lack of<br />

robust data.<br />

The world has grown<br />

smaller with the dawn of<br />

the internet, yet it also<br />

seems <strong>more</strong> disparate when it comes to<br />

technology. For example, while entire<br />

nations are waiting to see the newest mobile<br />

device or e-reader, a village in India<br />

is marking 25 years without electricity<br />

(The national grid was laid, but the village<br />

has no finances to pay for service).<br />

Nevertheless, a lack of electricity is<br />

not hampering progress. The advent of<br />

mobile technology is enabling people<br />

to connect globally and many emerging<br />

economies are leapfrogging various<br />

Owen-Ellis Clark<br />

22 INteRNatIONaL OutLet JOuRNaL WiNTER 2010<br />

stages on the path to technological<br />

enlightenment. There are no landlines<br />

or computers for them – PDAs are the<br />

device of choice because they function<br />

as computers, with mobility and access<br />

to the virtual world.<br />

In marketing there has been a<br />

paradigm shift in how we communicate<br />

with our customers from<br />

“push” to “pull” marketing.<br />

Incredibly, in the<br />

space of a few of years<br />

there has been a shift in<br />

locus of control – now<br />

consumers are in charge.<br />

Customers are choosing<br />

whether or not to engage<br />

with a brand. Via the<br />

internet they freely voice<br />

opinions, giving both endorsements<br />

and critiques.<br />

This viral communication<br />

is speedy and it’s global.<br />

This progress is exciting, daunting and<br />

dynamic. We need to embrace digital<br />

technology. We ignore it at our peril. As<br />

marketers and business development<br />

experts, we have a duty to our retailers, investors<br />

and our customers, to keep abreast<br />

of the latest mode of conversation. Thus,<br />

we must integrate digital and virtual activity<br />

into our marketing strategies.<br />

As always, a balanced approach is<br />

essential. Yes, we need to keep the<br />

traditional media, too. But we can also<br />

enliven our brands by initiating internet<br />

dialogue for special offers and product<br />

endorsements. I know this works. An<br />

initiative for an <strong>outlet</strong> center in the UK<br />

on Facebook recently generated a 10-fold<br />

response above other similar initiatives.<br />

But that is just anecdotal evidence.<br />

One challenge we face is the ability to<br />

measure the effectiveness of our strategies<br />

and campaigns. I suggest that we<br />

all start by being willing to experiment,<br />

explore, ask questions, record results<br />

and share each other’s findings.<br />

We in the <strong>outlet</strong> sector are perfectly<br />

poised to become leaders – leaders who<br />

use digital marketing in the most effective<br />

and integrated way. c<br />

Contact Deborah Owen-Ellis Clark at<br />

Deborah@thebeegroup.co.uk .<br />

Deborah Owen-Ellis Clark, M.A.,<br />

M.C.I.M., F.R.S.A., is the director of<br />

Bee Group Strategic Marketing and<br />

Business Development Consultancy.<br />

Her previous experience includes<br />

stints as marketing director for Land<br />

Securities’ Gunwharf Quays and UK<br />

franchise manager for Levi Strauss<br />

UK Ltd.<br />

2010 IOJ Calendar<br />

ICSC european Conference<br />

April 28-29, Clarion Congress<br />

Hotel, Prague, Czech Republic<br />

ICSC ReCon<br />

May 23-25, Las Vegas<br />

VRN Fall Outlet Deal Making<br />

September 27-28, Secaucus,<br />

N.J.<br />

ICSC european Factory Outlet<br />

Conference<br />

October 13-14, Milan