Monitoring of Fire Code Sales Tax - BFP Region 4A

Monitoring of Fire Code Sales Tax - BFP Region 4A

Monitoring of Fire Code Sales Tax - BFP Region 4A

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

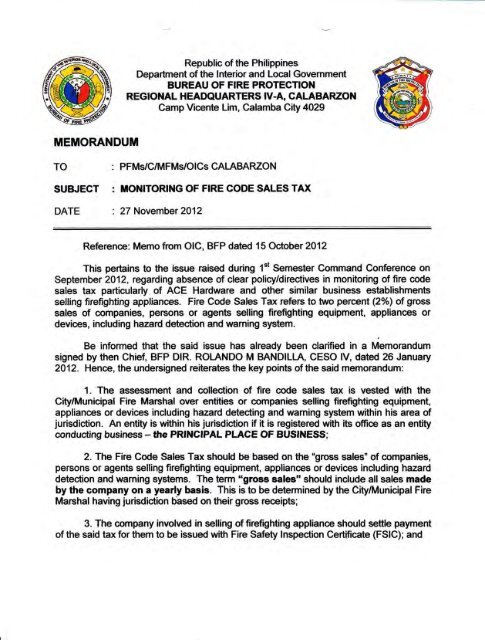

MEMORANDUM<br />

Republic <strong>of</strong> the Philippines<br />

Deparhent <strong>of</strong> the lnterior and Local Govemmer{<br />

BUNEAU OF FIRE PROTECTIOI{<br />

REGIONAL HEADCIUARTERS IY-4, CALABARZON<br />

Camp Mcente Um, Calamba City 4029<br />

TO : PFMSIC/MFMs/OICs CAISBARZON<br />

SU&TECT : iiONlTORlt{G OF FIRE CODE SALES TAX<br />

DATE : 27 November 2012<br />

Referene: Memo from OlC, <strong>BFP</strong> dated 15 October2Al2<br />

This pertains to the issue raised during 1"t Sernqster Command Conference on<br />

September 2A12, regarding absence <strong>of</strong> clear policy/directives in monitoring <strong>of</strong> fire code<br />

sales tax particularly <strong>of</strong> ACE Hardware and other similar business establishments<br />

selling firefighting applianes. <strong>Fire</strong> <strong>Code</strong> <strong>Sales</strong> <strong>Tax</strong> rebrs to ttrro percent {2Ya) <strong>of</strong> gross<br />

sales <strong>of</strong> companies, persons or agents selling firefighting equipment, appliances or<br />

devies, including hazard detection and waming system.<br />

Be informed that the said issue has already been clarified in a Uiemorandum<br />

signed by then Chief, <strong>BFP</strong> DlR. ROLANDO M BAND|L|S, CESO lV, dated 26 January<br />

2012. Hence, the undersigned reiterates the key points <strong>of</strong> thesaid rnemorandum:<br />

1. The assessment and collection <strong>of</strong> fire code sales tax is vested wtth the<br />

City/Municipal <strong>Fire</strong> Marshal orrer entities or mmpanies selling firefighting equipment,<br />

appliances or devices including hazard detecting and waming system within his area <strong>of</strong><br />

jurisdiction. An entity is within his jurisdiction if it is registered with its <strong>of</strong>fice as an entity<br />

conducting business - the PRINCIPAL PLACE OF BUSINESS;<br />

2. The <strong>Fire</strong> <strong>Code</strong> <strong>Sales</strong> <strong>Tax</strong> should be bassd on the "gross sales" <strong>of</strong> mmpanies,<br />

persons or agents selling firefighting equipment, appliances or devices including hazard<br />

detection and warning systems. The term "grose eales'f should include allsales made<br />

by the company on a yeariy basis. This is to be determined by the eityitrrlunicipai <strong>Fire</strong><br />

Marchal having lurisdiction bbsed on their gross reeipts;<br />

3. The company involved in selling <strong>of</strong> firefighting appliance should settle payment<br />

<strong>of</strong> the said tax for them to be issued with <strong>Fire</strong> Safety lnspection Certificate (FSIC); and

€<br />

4. For 'branches or bcal <strong>of</strong>fioes" such ae in the casc <strong>of</strong> ACE Hardrrare, the<br />

mangmladminisffator, in addition to oher fte csde rquirements, shall shorfl I prod<br />

that firs code sah ts( hs altaady been sGt$od by $eir main or principal <strong>of</strong>fi€ b€fse<br />

ftey will be granbd wtsl FSIC.<br />

For guidance, tnforfiidion aild wid€6t dissernirdion.<br />

BY T}IE AUT}ICHIITY OF CSUPT ilMTA D CUARTEL, CEO VI: