2011 Annual Report - Wellington Institute of Technology

2011 Annual Report - Wellington Institute of Technology

2011 Annual Report - Wellington Institute of Technology

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

lues mission vision accountability integr<br />

rms partnership team work customer foc<br />

stainability institution business industr<br />

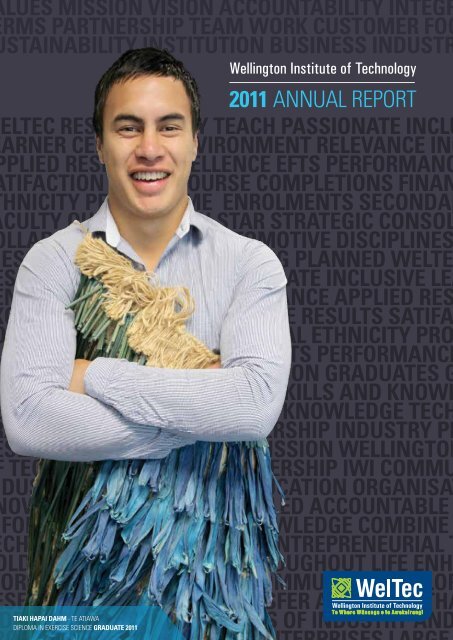

<strong>Wellington</strong> <strong>Institute</strong> <strong>of</strong> <strong>Technology</strong><br />

<strong>2011</strong> annual report<br />

eltec responsibilty teach passionate inclu<br />

arner cent red environment relevance inc<br />

plied respect excellence efts performanc<br />

tifaction value course completions finan<br />

hnicity programme enrolments secondar<br />

culty qualification star strategic consol<br />

llaboration solid automotive disciplines<br />

ess operating counselling planned welte<br />

sponsibilty teach passionate inclusive lea<br />

ntred environment relevance applied res<br />

cellence efts performance results satifa<br />

urse completions financial ethnicity pro<br />

lence efts perfo ellence efts performance<br />

rfo collabora vision mission graduates g<br />

izens with world-class skills and knowl<br />

nerate value-add applied knowledge tech<br />

ansfer solutions partnership industry pr<br />

search organisations mission wellington<br />

technology work partnership iwi commu<br />

dustries pr<strong>of</strong>essions education organisat<br />

owledgeable highly skilled accountable<br />

formed accessadapt knowledge combine<br />

chnical ability creative entrepreneurial t<br />

ld collar able learn throughout life enha<br />

orkplace productivity community develop<br />

search knowledge transfer activities tha<br />

tiaki hapai dahm - te atiawa dress Diploma in exercise science directly graduate <strong>2011</strong><br />

the needs <strong>of</strong> industry and

VISION AND MISSION<br />

VISION<br />

Our graduates are global citizens with world-class skills and knowledge.<br />

We also generate value-add through applied knowledge and technology transfer<br />

solutions in partnership with industry, pr<strong>of</strong>essions and research organisations.<br />

MISSION<br />

<strong>Wellington</strong> <strong>Institute</strong> <strong>of</strong> <strong>Technology</strong>’s mission is to work in partnership with iwi,<br />

communities, industries, pr<strong>of</strong>essions and other education organisations to deliver:<br />

1<br />

2<br />

VALUES<br />

ACCOUNTABILITY<br />

AND INTEGRITY<br />

In terms <strong>of</strong> what we are; what<br />

and how we teach; how we relate<br />

to students, industry and each<br />

other; how we take responsibility<br />

for our actions and our<br />

commitment to critical enquiry<br />

and academic freedom.<br />

Knowledgeable, highly skilled and accountable graduates who:<br />

� Are well informed and able to access, use and adapt knowledge;<br />

� Combine high level technical ability with creative/entrepreneurial thinking<br />

(i.e. “gold collar” workers);<br />

� Are able to learn throughout life; and<br />

� Enhance workplace productivity and community development.<br />

Research and knowledge transfer activities that:<br />

� Address directly the needs <strong>of</strong> industry and pr<strong>of</strong>essions (as voiced by<br />

enterprises large and small);<br />

� Support seamless approaches that build critical mass and depth <strong>of</strong><br />

expertise regionally, nationally and internationally; and<br />

� Build a community and enterprise culture embodying productivity<br />

and sustainability.<br />

CUSTOMER FOCUS<br />

Being passionate about customers<br />

and students. Looking for improvement<br />

and efficiencies in our service. Being a<br />

place that is inclusive, where diversity is<br />

recognised. Providing a learner-centred<br />

environment marked by relevance, applied<br />

learning and respect.<br />

COMMITMENT TO HIGH<br />

PERFORMANCE AND<br />

PROFESSIONALISM<br />

Each individual, each day, aiming<br />

for excellence.<br />

TEAM WORK<br />

Contributing to an effective and<br />

supportive team environment,<br />

using and fostering creativity<br />

and innovation.<br />

PARTNERSHIP<br />

With business and industry; with<br />

iwi; with students and with fellow<br />

providers.<br />

SUSTAINABILITY<br />

Of the Institution; <strong>of</strong> ourselves; and<br />

<strong>of</strong> the environment.

miles Ovia – bachelor <strong>of</strong> creative<br />

technologies graduate <strong>2011</strong><br />

FiOna Breen – bachelor <strong>of</strong> hospitality management graduate <strong>2011</strong><br />

04<br />

06<br />

06<br />

08<br />

10<br />

14<br />

16<br />

18<br />

20<br />

22<br />

26<br />

28<br />

30<br />

32<br />

34<br />

36<br />

37<br />

38<br />

Overview <strong>of</strong> <strong>2011</strong><br />

Council Member Pr<strong>of</strong>iles<br />

Council Structure<br />

Executive Management Team<br />

Industry Advisory Committee<br />

Chairperson’s <strong>Report</strong><br />

Training and qualifications vital to the<br />

Hospitality Industry – RUTH PRETTY<br />

Rebuilding Christchurch<br />

“WelTec – important to the region”<br />

– FRAN WILDE<br />

Chief Executive’s <strong>Report</strong><br />

Commitment to industry partnership<br />

– MIKE KERR<br />

Fronde’s vision for graduate possibilities<br />

– IAN CLARKE<br />

Working partnership for youth<br />

– KERRY LEggETT<br />

WelTec Connect Ltd<br />

Technical support for big ideas<br />

– JOSEPH VAN LIEMPT<br />

Our people and Our environment<br />

Showcasing Maori Contemporary Art<br />

– BARRY TE WHATU<br />

Business plan performance<br />

40 Research<br />

42<br />

44<br />

46<br />

48<br />

51<br />

NEC research fellow<br />

– TODD COCHRANE<br />

Creative research<br />

– LORRAINE RASTORFER<br />

Research supports clear and<br />

robust relationship – SUSAN TOWNSHEND<br />

Statement <strong>of</strong> Objectives and Service<br />

Performance<br />

Financial Statements<br />

76 Responsibilities<br />

77<br />

Independent Auditor’s <strong>Report</strong><br />

81 Acronyms

7%<br />

13%<br />

5%<br />

9%<br />

9%<br />

12%<br />

5%<br />

6%<br />

5%<br />

5%<br />

12%<br />

2%<br />

6%<br />

14%<br />

FUNDINg STUDENT STATISTICS<br />

3%<br />

2%<br />

2%<br />

3%<br />

1%<br />

32%<br />

67%<br />

54%<br />

By Source<br />

Student Achievement<br />

Component (SAC) 67%<br />

Industry Training<br />

Organisations (ITO) 13%<br />

International 7%<br />

STAR 6%<br />

Youth guarantee 2%<br />

Full Fee 2%<br />

Trades Academy 2%<br />

Adult and Community<br />

Education (ACE) 1%<br />

By Region<br />

Lower Hutt 32%<br />

<strong>Wellington</strong> 28%<br />

Central North Island 10%<br />

Upper Hutt 9%<br />

Porirua 5%<br />

Upper North Island 5%<br />

South Island 5%<br />

Kapiti Coast 3%<br />

Wairarapa 3%<br />

By Ethnicity<br />

NZ European/Pakeha 54%<br />

New Zealand Maori 14%<br />

Asian 12%<br />

Pacific Islander 9%<br />

European 5%<br />

Other 6%<br />

560 School <strong>of</strong> Hospitality<br />

559 School <strong>of</strong> Engineering<br />

550 School <strong>of</strong> Automotive <strong>Technology</strong><br />

407 School <strong>of</strong> Health Services<br />

352 School <strong>of</strong> Information <strong>Technology</strong><br />

328 School <strong>of</strong> Business and Administration<br />

296 STAR<br />

247 School <strong>of</strong> Social Services and Sector Engagement<br />

238 School <strong>of</strong> Foundation Studies, Languages and Adult Education<br />

28%<br />

644 School <strong>of</strong> Construction<br />

225 School <strong>of</strong> Creative Technologies<br />

184 School <strong>of</strong> Hair, Beauty and Make-up<br />

Age<br />

Under 21 44%<br />

21 – 24 23%<br />

25 – 35 18%<br />

35+ 15%<br />

Highest Entry Qualification<br />

NCEA Level 2 26%<br />

(6TH FORM CERTIFICATE)<br />

No Record 20%<br />

(NO FORMAL SECONDARY SCHOOL<br />

QUALIFICATION ON RECORD)<br />

NCEA Level 1 17%<br />

(SCHOOL CERTIFICATE)<br />

NCEA Level 3 17%<br />

(BURSARY OR SCHOLARSHIP)<br />

Overseas Qualification 13%<br />

14+ Credits 5%<br />

(14 OR MORE CREDITS AT ANY LEvEL)<br />

Other 2%<br />

gender<br />

Male 64%<br />

Female 36%<br />

77 Trades Academy<br />

EFTs<br />

0 50 100 150 200 250 300 350 400 450 500 550 600 650<br />

15%<br />

18%<br />

13%<br />

36%<br />

17%<br />

5%<br />

2%<br />

44%<br />

64%<br />

26%<br />

17%<br />

23%<br />

20%

2009<br />

8,700<br />

Students<br />

2010<br />

10,600<br />

Students<br />

SATISFACTION RESULTS<br />

90%<br />

Student Satisfaction<br />

ADDINg VALUE<br />

<strong>2011</strong><br />

10,385 = 4,669<br />

Students<br />

EFTS<br />

Students aged under 25 studied<br />

96%<br />

Employer Satisfaction<br />

STRONG<br />

FINANCIAL PERFORMANCE<br />

5% Return<br />

The Tertiary Education Commission (TEC) has again awarded<br />

WelTec a low risk rating for its financial performance.<br />

on Total Income<br />

Strong cashflow and<br />

working capital<br />

$1,455,000 Budget $2,765,000 Net Pr<strong>of</strong>it<br />

4<br />

CAMPUSES<br />

<strong>of</strong> total EFTS studied at<br />

Levels 4 – 7<br />

<strong>of</strong> all the Level 4-7 EFTS<br />

delivered in <strong>2011</strong>.<br />

Petone, <strong>Wellington</strong>,<br />

Christchuch, Auckland<br />

70%<br />

<strong>of</strong> WelTec graduates<br />

reported they were in<br />

employment or going on<br />

to further study.<br />

(as reported soon after<br />

graduation)<br />

EDUCATIONAL<br />

PERFORMANCE<br />

INDICATORS<br />

76% Course<br />

Completions<br />

Level 1-2 65%<br />

Level 3-4 78%<br />

62%<br />

Level 1-2 60%<br />

Level 3-4 64%<br />

40%<br />

INDUSTRY 65%<br />

16<br />

Industry advisory committees involving<br />

small to large companies across <strong>Wellington</strong>.<br />

Level 1-2 66%<br />

Level 3-4 58%<br />

Level 5-6 75%<br />

Level 7-8 81%<br />

Qualification<br />

Completions<br />

Level 5-6 72%<br />

Level 7-8 50%<br />

Progression to<br />

Higher Level<br />

Study<br />

Retained in<br />

Study<br />

Level 5-6 64%<br />

Level 7-8 74%

COUNCIL MEMBERS<br />

ROgER SOWRY<br />

ONZM<br />

CHAIRPERSON<br />

Roger Sowry was a Member <strong>of</strong><br />

Parliament from 1990 to 2005,<br />

firstly representing the Kapiti<br />

electorate, then as a National<br />

list MP. Roger retired from<br />

Parliament in 2005 moving to<br />

become Chief Executive <strong>of</strong><br />

Arthritis New Zealand. He is<br />

a member <strong>of</strong> the Electricity<br />

Authority.<br />

Roger is also a member <strong>of</strong> the<br />

<strong>Institute</strong> <strong>of</strong> Directors.<br />

06 | WELLINgTON INSTITUTE OF TECHNOLOgY<br />

DR ALAN BARKER<br />

DEPUTY CHAIRPERSON<br />

Dr Alan Barker is a Senior<br />

Consultant with MartinJenkins.<br />

He has extensive international<br />

and domestic experience in<br />

public sector reform, strategic<br />

planning, organisation review<br />

and financial management.<br />

Alan has worked for a number<br />

<strong>of</strong> education related Institutions<br />

such as the TEC, MOE, NZQA,<br />

and Tairawhiti Polytechnic,<br />

as well as a number <strong>of</strong> other<br />

public sector entities.<br />

ADvISORY COMMITTEES<br />

(CHAIRS)<br />

Alcohol and Drug – Tim Harding<br />

Automotive <strong>Technology</strong> – Richard Eyles<br />

Built Environment – Peter Degerholm<br />

Business – Charles gilmore<br />

Community Support Services and<br />

Community vocational Learning Skills<br />

Rosanne Johnston<br />

Counselling and Trauma Studies<br />

David Waters<br />

Creative Technologies – Laurence greig<br />

Engineering – Michael Kerr<br />

Exercise Science – Mike Ryan<br />

Funeral Services<br />

Pr<strong>of</strong>. Mike Markfell-Jones<br />

Hospitality – Ruth Pretty<br />

Information <strong>Technology</strong> – Peter Ramsey<br />

Pasifika – Linda Sissons<br />

Plumbing – Colleen Upton<br />

<strong>Wellington</strong> Trades Acdemy – Alan Peck<br />

Youth Development – John Harrington<br />

PETER PRESTON<br />

Peter has an early background<br />

in civil engineering (BE<br />

Degree) followed by<br />

a strong commercial<br />

background including senior<br />

management roles in BP<br />

NZ Ltd and directorships in<br />

related companies. He is a<br />

pr<strong>of</strong>essional company director<br />

and a Fellow <strong>of</strong> both the IOD<br />

(<strong>Institute</strong> <strong>of</strong> Directors) and<br />

the Institution <strong>of</strong> Pr<strong>of</strong>essional<br />

Engineers <strong>of</strong> New Zealand.<br />

VAUgHAN RENNER<br />

Vaughan has an MBA, and<br />

science and engineering<br />

qualifications. He runs his own<br />

businesses and has strong<br />

commercial, strategic planning<br />

and IT skills. Vaughan has a<br />

background in governance<br />

(currently including; The<br />

Employers Chamber <strong>of</strong><br />

Commerce Central, Business<br />

NZ, and Standards New<br />

Zealand). He is a member <strong>of</strong><br />

the <strong>Institute</strong> <strong>of</strong> Directors.<br />

ACADEMIC BOARD<br />

Alan Cadwallader – Academic Director<br />

Alan Peck – Executive Dean,<br />

Faculty <strong>of</strong> Trades and <strong>Technology</strong><br />

Barbara Kelly – Academic Registrar<br />

Colin Porthouse – Academic Staff<br />

Representative<br />

Diane Langman – Academic Staff<br />

Representative<br />

Hinemoa Priest – Kaiwhakahaere Maori<br />

Julia Hennessy – Executive Dean,<br />

Faculty <strong>of</strong> Health, Business and Service<br />

Industries<br />

Linda Sissons – Chief Executive<br />

Mick Jays – Academic Staff Representative<br />

Nikita Snedden – Student Association<br />

Representative

DENNIS SHARMAN<br />

Dennis owns and operates<br />

Sharman Consulting Limited<br />

a consultancy company<br />

that delivers comprehensive<br />

technology services to small<br />

and medium sized businesses.<br />

Dennis has just completed<br />

his term as Chair <strong>of</strong> the board<br />

<strong>of</strong> New Zealand <strong>Institute</strong> <strong>of</strong><br />

Technologies. Dennis holds<br />

a number <strong>of</strong> Directorships,<br />

including government<br />

appointments to the Combined<br />

Council <strong>of</strong> Whitireia and WelTec<br />

and is also a founding member<br />

<strong>of</strong> the Board <strong>of</strong> Mana Tiaki.<br />

CHIEF ExECUTIvE’S<br />

REvIEW COMMITTEE<br />

Roger Sowry – Chair<br />

Alan Barker<br />

Peter Preston<br />

SUZANNE SNIVELY<br />

ONZM<br />

Suzanne Snively, formerly a partner at<br />

PricewaterhouseCoopers in <strong>Wellington</strong>, is the<br />

Managing Director <strong>of</strong> strategic and economic<br />

advice company, MoreMedia Enterprises.<br />

Suzanne is appointed to the Health Research<br />

Council by the Minister <strong>of</strong> Health Tony Ryall<br />

and Chairs the Agri-women Development<br />

Trust and Transparency International. She is<br />

Chief Judge <strong>of</strong> the Electra Business Awards.<br />

Previous directorships included the Reserve<br />

Bank <strong>of</strong> New Zealand. She is a member <strong>of</strong><br />

the <strong>Institute</strong> <strong>of</strong> Directors and the New Zealand<br />

Association <strong>of</strong> Economists. Suzanne was<br />

awarded the Fulbright and Reserve Bank<br />

scholarships and was honoured by the Queen<br />

along with 100 women with a Women’s<br />

Suffrage medal.<br />

RISK AND AUDIT<br />

COMMITTEE<br />

Vaughan Renner – Chair<br />

Dennis Sharman<br />

Peter Steel<br />

PETER STEEL<br />

Peter has an economic and<br />

engineering background<br />

having worked for over 25<br />

years as a Consulting Engineer,<br />

becoming a Principal and<br />

Technical Director for Beca.<br />

He has strong commercial,<br />

governance and management<br />

experience from his work<br />

activities as well as a period<br />

as President <strong>of</strong> the <strong>Wellington</strong><br />

Regional Chamber <strong>of</strong><br />

Commerce. He is currently<br />

General Manager - Engineering<br />

& Standards for the<br />

Infrastructure and Engineering<br />

division <strong>of</strong> KiwiRail.<br />

WELTEC CONNECT<br />

LE CORDON BLEU<br />

NEW zEALAND INSTITUTE<br />

(DIRECTORS)<br />

Linda Sissions<br />

– WelTec Chief Executive<br />

Monsieur Andre Cointreau<br />

– President and CEO<br />

<strong>of</strong> Le Cordon Bleu International<br />

Paul McElroy<br />

– UCOL Chief Executive<br />

NANCY<br />

MCINTOSH-WARD<br />

Nancy holds an MBA and<br />

is a Chartered Accountant.<br />

She is the Chief Executive<br />

<strong>of</strong> the Karori Sanctuary Trust<br />

and has extensive financial,<br />

management, commercial,<br />

governance, tertiary education<br />

and marketing experience.<br />

Nancy is a member <strong>of</strong> the<br />

<strong>Institute</strong> <strong>of</strong> Directors.<br />

Peter Steel – Chair<br />

Dennis Sharman<br />

Nancy McIntosh-Ward<br />

Suzanne Snively<br />

<strong>2011</strong> ANNUAL REPORT |<br />

07

EXECUTIVE MANAgEMENT TEAM<br />

LINDA SISSONS, CNZM<br />

CHIEF ExECUTIvE<br />

Ph. D. (London)<br />

Diploma in Adult Education<br />

(Edinburgh)<br />

MA (1st class Honours)<br />

Advanced Management<br />

Programme (Harvard)<br />

Linda has been responsible for<br />

the strategic management and<br />

leadership <strong>of</strong> WelTec since 1999.<br />

Prior to joining WelTec she<br />

held university and <strong>Institute</strong> <strong>of</strong><br />

technology management roles<br />

in New Zealand and the United<br />

Kingdom.<br />

She represents the New<br />

Zealand Government on the<br />

Board <strong>of</strong> Governors <strong>of</strong> the<br />

Commonwealth <strong>of</strong> Learning,<br />

is on the Board <strong>of</strong> WorldSkills<br />

NZ, and is a Director <strong>of</strong> ESITO<br />

(Electricity Supply Industry<br />

Training Organisation). She has<br />

been a member <strong>of</strong> a number<br />

<strong>of</strong> Government commissions,<br />

including the Tertiary Education<br />

Advisory Commission.<br />

Linda holds a PhD from London<br />

University, is a graduate <strong>of</strong><br />

the Harvard Business School<br />

Advanced Management<br />

Programme and is a member <strong>of</strong><br />

the <strong>Institute</strong> <strong>of</strong> Directors.<br />

08 | WELLINgTON INSTITUTE OF TECHNOLOgY<br />

TIM ALLEN<br />

GENERAL MANAGER,<br />

BUSINESS DEvELOPMENT<br />

BA (Victoria University)<br />

Graduate Diploma in<br />

Marketing (Victoria<br />

University)<br />

Tim leads the development<br />

<strong>of</strong> new opportunities and<br />

the promotion <strong>of</strong> WelTec<br />

to meet its objectives. His<br />

areas <strong>of</strong> responsibility are<br />

marketing, international<br />

and WelTec Connect.<br />

During <strong>2011</strong> he led the<br />

establishment and growth<br />

<strong>of</strong> WelTec Connect, which<br />

has been highly successful<br />

in its engagement with<br />

industry on R&D and<br />

capability development.<br />

Tim has also led the<br />

further development <strong>of</strong><br />

WelTec’s partnerships<br />

with industry for student<br />

work placements notably<br />

cadetships.<br />

Tim has extensive<br />

commercial, marketing and<br />

international experience,<br />

gained through senior<br />

roles in a diverse range<br />

<strong>of</strong> industries including<br />

education, shipping, sports<br />

and horticulture.<br />

MARK BROADBENT<br />

HUMAN RESOURCES<br />

DIRECTOR<br />

BA (Victoria University)<br />

Diploma <strong>of</strong> Education<br />

(Guidance)<br />

Diploma (Youth<br />

and Development),<br />

(Commonwealth Youth<br />

Programme, Asia-Pacific)<br />

Centre Ernst & Young<br />

Executive programme<br />

Mark is responsible<br />

for WelTec’s human<br />

resources strategy and<br />

change management as<br />

well as human resources<br />

operations and capability<br />

development.<br />

With more than 25<br />

years’ experience in<br />

human resources, line<br />

management, and<br />

development roles Mark’s<br />

has worked in a wide range<br />

<strong>of</strong> organisations covering<br />

the not-for-pr<strong>of</strong>it sector,<br />

government, state-owned<br />

enterprises, and education.<br />

Mark is a member <strong>of</strong> the<br />

Human Resources <strong>Institute</strong><br />

<strong>of</strong> New Zealand.<br />

ALAN CADWALLADER<br />

ACADEMIC DIRECTOR<br />

MMgt (Massey University)<br />

MBA (Otago University)<br />

As Academic Director Alan<br />

is responsible for academic<br />

leadership at WelTec.<br />

His role is leading and<br />

managing academic policy<br />

development, including<br />

learning access, student<br />

support services and<br />

resources to ensure highquality<br />

student learning<br />

experience outcomes. His<br />

role also includes leading<br />

the <strong>Institute</strong>’s research<br />

activities.<br />

Nearly a decade in<br />

the tertiary sector is<br />

complemented by earlier<br />

pursuits in commerce<br />

and business. Alan has<br />

experience as a lecturer in<br />

business studies as well<br />

as head <strong>of</strong> school. His<br />

background in education<br />

for business management<br />

and his interest in New<br />

Zealand’s small business<br />

sector fit well with WelTec’s<br />

applied research and<br />

technology transfer<br />

contribution to business<br />

and industry.<br />

During 2010 and much <strong>of</strong><br />

<strong>2011</strong> Alan was a member<br />

<strong>of</strong> the Artena Society<br />

Board.

JAMES SMITH<br />

CHIEF FINANCIAL<br />

OFFICER<br />

BCA (Victoria University)<br />

CA (New Zealand <strong>Institute</strong><br />

<strong>of</strong> Chartered Accountants)<br />

James became the Chief<br />

Financial Officer in May<br />

<strong>2011</strong>. In this role he<br />

managed the financial<br />

planning and reporting<br />

systems and services, and<br />

provided quality financial<br />

and strategic advice to<br />

internal and external<br />

stakeholders. During <strong>2011</strong><br />

he was responsible for<br />

the Finance and Facilities<br />

& Procurement business<br />

units.<br />

James has over a decade<br />

<strong>of</strong> tertiary sector experience<br />

gained both at WelTec and<br />

The Open Polytechnic <strong>of</strong><br />

New Zealand.<br />

PETER COWPER<br />

CHIEF OPERATING<br />

OFFICER<br />

In <strong>2011</strong> the COO role<br />

involves managing the<br />

academic records and<br />

administration, information<br />

technology services,<br />

business intelligence and<br />

change management<br />

business areas. As well<br />

as these infrastructure and<br />

capability services, Peter’s<br />

responsibilities also include<br />

business process change<br />

initiatives for core student<br />

management.<br />

Peter brings many years’<br />

experience in leadership,<br />

managing complex<br />

and technical business<br />

operations, third-party<br />

supplier models and<br />

outsourcing, contract<br />

management and leading<br />

change. Peter’s previous<br />

roles include managing<br />

Telecom New Zealand’s<br />

operational and delivery<br />

business areas including<br />

leading large change<br />

projects. He was Head <strong>of</strong><br />

Science and Engineering<br />

at BRANZ Ltd, a building<br />

research organisation<br />

and he owns Quorum<br />

Group, a management and<br />

leadership consultancy<br />

practice.<br />

Peter is a Member <strong>of</strong> the<br />

Maritime New Zealand<br />

Authority, is a founding<br />

trustee <strong>of</strong> the Porirua Digital<br />

Trust and member <strong>of</strong> the<br />

New Zealand <strong>Institute</strong> <strong>of</strong><br />

Directors.<br />

MICHAEL HESP<br />

DIRECTOR,<br />

SPECIAL PROjECTS<br />

Master <strong>of</strong> Applied Finance<br />

(Victoria University)<br />

CA (New Zealand <strong>Institute</strong><br />

<strong>of</strong> Chartered Accountants)<br />

Michael began his new<br />

role, having previously<br />

been WelTec’s General<br />

Manager Corporate and<br />

Finance, in mid-<strong>2011</strong>.<br />

The role <strong>of</strong> Director,<br />

Special Projects is to<br />

provide advice on specific<br />

high priority strategy<br />

developments; manage<br />

investment and capital<br />

projects; and develop<br />

WelTec’s long-term campus<br />

plan.<br />

Previous experience for<br />

Michael includes a number<br />

<strong>of</strong> roles for Fletcher<br />

Construction; being a<br />

member <strong>of</strong> the team that<br />

privatised Works Property<br />

Services to become Serco<br />

Group NZ, then holding<br />

the roles <strong>of</strong> Corporate<br />

Services Director and<br />

Finance Director for Serco;<br />

Chief Financial Officer and<br />

Board Secretary for the<br />

New Zealand Wool Board;<br />

a number <strong>of</strong> consulting<br />

and contracting roles for<br />

organisations including<br />

the Department <strong>of</strong> Labour,<br />

Healthcare Otago,<br />

<strong>Wellington</strong> City Council,<br />

and the Correspondence<br />

School.<br />

Michael is a member<br />

New Zealand <strong>Institute</strong> <strong>of</strong><br />

Chartered Accountants.<br />

JULIA HENNESSY<br />

ExECUTIvE DEAN,<br />

FACULTY OF HEALTH,<br />

BUSINESS AND SERvICE<br />

INDUSTRIES<br />

BA (Victoria University)<br />

DipN (<strong>Wellington</strong><br />

Polytechnic)<br />

MEd (Victoria University)<br />

MMgt (Massey University)<br />

PG Dip HSM (Massey<br />

University)<br />

Julia has the overall<br />

responsibility for the<br />

management <strong>of</strong> the Faculty<br />

<strong>of</strong> Health, Business and<br />

Service Industries, which<br />

includes the schools<br />

<strong>of</strong> Health and Social<br />

Services; Business and<br />

Administration; Foundation<br />

and Adult Education;<br />

Hair, Beauty and Exercise<br />

Science; Hospitality<br />

and Tourism and the<br />

Childcare Centre. The<br />

Faculty delivers half <strong>of</strong> the<br />

academic programmes in<br />

WelTec, with delivery from<br />

multiple sites including<br />

Auckland and Christchurch.<br />

Prior to becoming<br />

Executive Dean Julia was<br />

previously Head <strong>of</strong> Centre<br />

<strong>of</strong> Health and Wellbeing at<br />

WelTec. She has also been<br />

General Manager, Mental<br />

Health and Addiction<br />

Service for Hutt Valley<br />

DHB and was also a senior<br />

advisor at the Ministry <strong>of</strong><br />

Health.<br />

Julia is a Ministerial<br />

appointment on the<br />

Nursing Council <strong>of</strong> New<br />

Zealand.<br />

ALAN J PECK,<br />

ONZM<br />

ExECUTIvE DEAN,<br />

FACULTY OF TRADES AND<br />

TECHNOLOGY<br />

BA (Auckland)<br />

Diploma in Strategic<br />

Studies (University <strong>of</strong><br />

NSW)<br />

Graduate (Royal College <strong>of</strong><br />

Defence Studies, London)<br />

Advanced Management<br />

Programme (Harvard)<br />

Alan has been Executive<br />

Dean <strong>of</strong> the Faculty <strong>of</strong><br />

Trades and <strong>Technology</strong><br />

since February 2009. He<br />

is responsible for WelTec’s<br />

schools <strong>of</strong> Information<br />

<strong>Technology</strong>, Creative<br />

<strong>Technology</strong>, Construction,<br />

Engineering, and<br />

Automotive <strong>Technology</strong>.<br />

He is also responsible for<br />

the Trades Academy, which<br />

opened in <strong>2011</strong>.<br />

Before joining the tertiary<br />

education sector in 2005,<br />

Alan served 40 years as<br />

an <strong>of</strong>ficer in the Royal<br />

New Zealand Navy, with<br />

a variety <strong>of</strong> appointments<br />

both at sea and ashore;<br />

in New Zealand and<br />

overseas. After leaving<br />

the Navy, Alan worked in<br />

the Ministry <strong>of</strong> Education,<br />

and the Tertiary Education<br />

Commission before joining<br />

WelTec.<br />

<strong>2011</strong> ANNUAL REPORT |<br />

09

INDUSTRY ADVISORY<br />

COMMITTEES <strong>2011</strong><br />

AlcOhOl ANd drug<br />

Tim Harding (Chairperson) – CEO, CareNZ<br />

Anna Nelson – Programme Manager, Matua Raki, National<br />

Addiction Workforce Development<br />

Christine McCarrison – Addictions Pr<strong>of</strong>essional Leader,<br />

Community Mental Health & Addictions Service, Hutt Valley DHB<br />

Denise Nassenstein – Alcohol and Drug Counsellor Community,<br />

Alcohol and Drug Service (CADS)<br />

Ian MacEwan – Executive Director, DAPAANZ<br />

Jude West – Central Region Practice Leader,<br />

Problem Gambling Foundation <strong>of</strong> New Zealand<br />

Major Stephen Scott – Director, <strong>Wellington</strong> Bridge Programme<br />

Mary Anne Cooke – Director,<br />

ABACUS, Counselling, Training & Supervision Ltd<br />

Maynard gilgen – Clinical Director, Ora Toa Mauoriora<br />

Murray Trenberth – CEO, WellTrust<br />

Rhonda Robertson – Consumer Advisor, Matua Raki, National<br />

Addiction Workforce Development<br />

Takurua Tawera – Clinical /Cultural Liaison, Te Hauora Runanga<br />

O Wairarapa Inc.<br />

Trish Chivers – Team Leader, Community Mental Health &<br />

Addictions Service, Hutt Valley DHB<br />

10 | WELLINgTON INSTITUTE OF TECHNOLOgY<br />

AuTOMOTIVE TEchNOlOgY<br />

Richard Eyles (Chairperson) – Workshop Owner,<br />

North City Automotives<br />

Bridie Hewison – Workshop Owner, Lees Auto Bodies (2007) Ltd<br />

Dave Wise – Trade Training Manager,<br />

NZ Army Trade Training School<br />

Dean McMillan – Workshop Owner, D E McMillan Ltd<br />

george Robinson – Sales Representative,<br />

Otbury Refinish Solutions<br />

Hus Kala – Workshop Owner, Hutt City Auto Electrical<br />

Jason Robertson – ITA, NZ MITO<br />

Michael Beattie – Student Representative,<br />

Automotive <strong>Technology</strong> Year 1 D<br />

Neil Butterfield – Workshop Owner, Porirua Autocrash Repairs<br />

Nick Mcguirr – ITA, NZ MITO<br />

Owen Woodman – Workshop Owner, Woodman Automotive<br />

Ross Wallace – National Training Manager, CablePrice NZ Ltd<br />

Steve Caithness – Workshop Owner, Sovereign Panel & Paint<br />

Steve gaskin – Workshop Owner, Rolrich Panel & Spray 1988 Ltd<br />

Verna Niao – Group Manager - Workforce Development,<br />

NZ MITO<br />

BuIlT ENVIrONMENT<br />

Peter Degerholm (Chairperson) – Director, Calderglen<br />

Dan Mcguinness – Director, McGuinness Building Contractors<br />

John granville – Executive Director, NZIQS<br />

Mike King – Senior Project Manager,<br />

Summerset Management Group<br />

Paul Bunkall – Director, Rawlinsons<br />

Russell Burley – Commercial Manager, Naylor Love<br />

Tony Sutherland – Director, Rider Levett Bucknall

BuSINESS<br />

Charles gilmore (Chairperson) – CEO, IndeServe Ltd<br />

Anne Hare – Financial Sector, NZX<br />

Bill Davies – Business Finance Support Manager,<br />

Central Region and Tyco Fire & Security New Zealand<br />

Brian Cowper – Agent, Hudson Recruitment<br />

Diana garrett – Programmes Manager,<br />

NZIM National Office<br />

Kanwardeep (Kanwar) Bedi – Independent Business Man,<br />

Own Company<br />

Kara Puketapu – Back up Iwi Representative, Te Runanganui o<br />

Taranaki whanui ki Te Upoko o Te Ika a Maui incorporated<br />

Leo Austin – Owner, Austin Associates Limited<br />

Neville Baker – Back up Iwi Representative, Te Runanganui o<br />

Taranaki whanui ki Te Upoko o Te Ika a Maui incorporated<br />

Robyn Horton – Owner, McDonalds Queensgate<br />

Teri Puketapu – Iwi Representative, Te Runanganui o Taranaki<br />

whanui ki Te Upoko o Te Ika a Maui incorporated<br />

cOMMuNITY SuPPOrT SErVIcES<br />

ANd cOMMuNITY VOcATIONAl<br />

lEArNINg SKIllS<br />

Rosanne Johnston (Chairperson) – Operations Manager,<br />

Te Korowai-Whariki/CCDHB<br />

Jo Mason – Service Systems Manager, Community Connections<br />

Linda Fisher – Operations Manager,<br />

Emerge Supported Employment Trust<br />

Mark Pearce – Qualifications Pathway Manager, Careerforce<br />

Maurice Priestley – Programme Coordinator, Inclusion & Disability<br />

Inclusion/Disability Capital Coast Health DHB<br />

Monika Divis – Manager (Learning & Research), Spectrum Care<br />

Rachel Cronin – Community Support/Health Promotion Coordinator<br />

Age Concern / ex student<br />

Vicki Wall – Clinical Manager, Dawn Trust<br />

cOuNSEllINg ANd<br />

TrAuMA STudIES<br />

David Waters (Chairperson) – Chief Executive,<br />

Ambulance New Zealand<br />

Helen Bowbyes – Guidance Counsellor, Naenae College<br />

Jayne O’Neill – Clinical Leader, Relationship Services<br />

Judy McCormack – Counsellor/Supervisor,<br />

The Counselling Group<br />

Linda Karlin – Counselling and Training Manager, Skylight<br />

Luana Murray – Senior Advisor,<br />

Relationship Services Whakawhanaungatanga<br />

Mari Cribb – Guidance Counsellor, Upper Hutt College<br />

crEATIVE TEchNOlOgIES<br />

Laurence greig (Chairperson) – Consultant, Workforce IP<br />

Annette Beattie – Digital Services Manager, Hutt City Libraries<br />

Bill Carden-Horton – Director, Billy Sushi<br />

Christine Doherty-Mcgregor – Assistant Curator,<br />

Expressions Art and Entertainment Centre<br />

Neville Parker – Designer, Designers <strong>Institute</strong> <strong>of</strong> NZ<br />

Simon Cr<strong>of</strong>t – <strong>Technology</strong> Teacher, Wainuiomata High School<br />

Steve La Hood – Director, Story Inc.<br />

<strong>2011</strong> ANNUAL REPORT |<br />

11

ENgINEErINg<br />

Michael Kerr (Chairperson) – Regional Manager (<strong>Wellington</strong>),<br />

BECA<br />

Bill Caradus – General Manager, Central Zone & <strong>Wellington</strong>,<br />

Fulton Hogan Ltd<br />

David Parle – Engineering Manager,<br />

Windsor Engineering Group Ltd<br />

Don Wills – Associate Director,Transmission & Distribution,<br />

AECOM<br />

grant Daniels – Electronics Wing Warrant Officer, NZ Army<br />

John Futter – Support Specialist Nanotechnology,<br />

National Isotope Centre, <strong>Institute</strong> <strong>of</strong> Geological and Nuclear<br />

Sciences, Rafter Laboratory<br />

Dr. Peter Davenport – Engineer, Eastern Consulting Ltd<br />

Richard Screech – Engineering Architect – Solutions Group,<br />

Alcatel-Lucent NZ Ltd<br />

Dr. Rod Badcock – Senior Research Engineer,<br />

Industrial Research Limited<br />

Ross Baker – Manager, Horokiwi Quarries<br />

Theo Klok – Locomotive Performance Engineer, Kiwirail<br />

ExErcISE ScIENcE<br />

Mike Ryan (Chairperson) – Regional Development Manager,<br />

Tennis Central<br />

Ben Montague – Club Manager, Lifestyle Gym<br />

David Lomax – Pastoral Care, Te Runanganui o Taranaki whanui<br />

ki Te Upoko o Te Ika a Maui incorporated<br />

Deslea Wrathall – Performance Services Manager,<br />

NZ Academy <strong>of</strong> Sport North Island<br />

gerry Salmon – Regional General Manager, Les Mills Gym<br />

Jason Hemson – General Manager, <strong>Wellington</strong> Rugby League<br />

Marcus Sherwood – Leisure Active Manager, Hutt City Council<br />

Mark O’Connor – General Manager Operations, Swim NZ<br />

Tracy Heron – Personal Trainer, Fitness consultant co-ordinator<br />

& Group Exercise instructor, Lifestyle Gym<br />

12 | WELLINgTON INSTITUTE OF TECHNOLOgY<br />

fuNErAl SErVIcES<br />

Pr<strong>of</strong> Mike Marfell-Jones (Chairperson) – Open Polytechnic <strong>of</strong> NZ<br />

– Representing Education<br />

Anne Mcguire – Self Employed, Gisborne – Representing<br />

Education, Maori<br />

Alistair Ferguson – Marsden House Funeral Directors, Nelson –<br />

Representing New Zealand Embalmers Association Inc.<br />

Danny Langstraat – Harbour City Funeral Home, Lower Hutt –<br />

Representing Funeral Directors Association <strong>of</strong> New Zealand Inc.<br />

Fiona gillespie – Trust Secretary<br />

John Peryer – Executive Officer, Tong and Peryer Limited,<br />

Havelock North – Independent<br />

John Duncan – Kapiti Coast Funeral Home, Paraparaumu –<br />

Representing Funeral Directors Association <strong>of</strong> New Zealand Inc.<br />

John Schipper – Vice-Chair, Davis Funeral Home, Auckland<br />

– Representing New Zealand Embalmers Association Inc.<br />

hOSPITAlITY<br />

Ruth Pretty (Chairperson) – Managing Director,<br />

Ruth Pretty Catering<br />

Anthony Dey – General Manager, Brentwood Hotel<br />

Bernd Lippman – Executive Chef,<br />

Museum <strong>of</strong> New Zealand Te Papa Tongarewa<br />

Eddie Wairau – Manager, Petone Working Men’s Club<br />

Francois Febvré – Proprietor, La Cloche<br />

georgina Noon – H R Manager,<br />

InterContinental <strong>Wellington</strong><br />

glen Curphey – Executive Chef, Brentwood Hotel<br />

gregory Keating – General Manager, Duxton Hotel<br />

Joanne Craughwell – Senior H R Manager,<br />

Accor Hospitality<br />

Kaye Paardekooper – Conference Organiser,<br />

Paardekooper and Associates<br />

Mark Angus – Hotel Manager, Bolton Hotel<br />

Mike Egan – Own Manager, Monsoon Poon<br />

Rachel Burt – H R Manager,<br />

City Life <strong>Wellington</strong> – A Heritage Hotel<br />

Sara Tucker – Regional Manager, Hospitality Association <strong>of</strong> NZ<br />

Sonia Tiatia – Schools Advisor, Hospitality Standards <strong>Institute</strong>

INfOrMATION TEchNOlOgY<br />

Peter Ramsey (Chairperson) – Private Contractor<br />

Alisdair McKenzie – Principal Consultant, IS Assurance Services<br />

Brian Rowe – Director, Examine Co. NZ<br />

Dr Donald Koh – BIT Monitor<br />

Dr Elozor Schneider – Information Systems / <strong>Technology</strong>,<br />

The Open Polytechnic <strong>of</strong> NZ Limited<br />

Jonathan Fry – Delivery Manager, Fronde Systems Group Ltd<br />

Kevin groves – Student Rep, WelTec<br />

Lester Abbey – Managing Director,<br />

Telemetry & Data Communications – Abbey Systems<br />

Mark Carroll – Ministry <strong>of</strong> Education<br />

Russell Kean – Engineering Consultancy,<br />

Opus Central Laboratories<br />

Sergius Kramar – Developer / Analyst,<br />

FMG Co. NZ (Advice and Insurance)<br />

PASIfIKA<br />

Linda Sissons (Chairperson) – Chief Executive, WelTec<br />

Aiono Mino Cleverley – Samoan Community<br />

Filipo Lui – Tokelauan Community<br />

Kerese Manueli – Fijian Community<br />

Tupu Araiti – Tongan Community<br />

Vei Lotaki – Tongan Community<br />

PluMBINg<br />

Colleen Upton (Chairperson) – General Manager,<br />

Hutt Gas & Plumbing Systems Ltd<br />

Dave Walker – Project Manager, Aquaheat Industries Ltd<br />

Derek Plimmer – Owner, Plimmer Plumbing Ltd<br />

Fiona gavriel – CEO, Master Plumbers Ltd<br />

Ian Elliott – CEO, Plumbing, Gasfitting, Drainlaying & Ro<strong>of</strong>ing ITO<br />

John Leen – Owner / CEO, John Leen Plumbing Ltd<br />

Malcolm Andrew – Manager, Duncan McGregor Ltd<br />

Ross Tait – Plumber & Gasfitter, K J Tait Ltd<br />

Stewart Weddell – Owner, Plumber 1<br />

Tony Wood – Manager, Masterlink Ltd<br />

WEllINgTON TrAdES AcAdEMY<br />

Alan Peck (Chairperson) – Executive Dean, WelTec<br />

Carrie Murdoch – Business NZ<br />

grant Jones – Principal, Newlands College<br />

John Bush – Wairarapa Workforce Development Trust<br />

Kerry Leggett – Vibe Lower Hutt<br />

Martin Isberg – Principal, Wainuiomata High School<br />

Richard Campbell – Principal, Paraparaumu College<br />

Ross Sinclair – Principal, Hutt Valley High School<br />

Sally Haughton – Principal, <strong>Wellington</strong> East Girls’ College<br />

Sue Roberts – Regional Chair CATE, Aotea College<br />

YOuTh dEVElOPMENT<br />

John Harrington (Chairperson) – National Coordinator,<br />

National Youth Workers Network Aotearoa<br />

Adrienne Bull – Manager Qualifications Development,<br />

Social Services ITO<br />

Andy Pilbrow – National Quality Services Manager,<br />

YMCA NZ National Office<br />

Bill Peace – Social Services Manager, Strive Community Trust<br />

Dawn Badco – AOD Youth Clinician, HVDHB<br />

Elizabeth Kerekere – Rangatahi Maori Consultant,<br />

Tiwhanawhana Trust<br />

Lloyd Martin – Coordinator, Praxis<br />

Maree Tukukino – Consultant, Kapuia Services Ltd<br />

Trish gledhill – Director/Executive Trustee,<br />

Kina Families & Addictions Trust<br />

<strong>2011</strong> ANNUAL REPORT |<br />

13

Whakarongo ake au<br />

Ki te tangi a te manu nei<br />

Tuuii, tuuii<br />

Tui, tuia<br />

Tuia I runga<br />

Tuia I raro<br />

Tuia I roto<br />

Tuia I whao<br />

Tihei mauri ora<br />

I listen<br />

To the cry <strong>of</strong> the bird<br />

The Tui<br />

Bind together, stitch together,<br />

weave together<br />

Those things from above<br />

Those things from below<br />

Those things from within us<br />

Those things from around us<br />

Behold the sacred breath <strong>of</strong> life<br />

14 | WELLINgTON INSTITUTE OF TECHNOLOgY<br />

CHAIRPERSON’S REPORT<br />

<strong>2011</strong>: Fulfilling our expectations<br />

Meeting the needs <strong>of</strong> students is core business for tertiary education<br />

Institutions and is always front-<strong>of</strong>-mind at WelTec. As a leader in the<br />

tertiary education sector and a key player in industry in the <strong>Wellington</strong><br />

region WelTec’s responsibilities also extend broadly into the wider<br />

community.<br />

As I indicated in the last <strong>Annual</strong> <strong>Report</strong>, <strong>2011</strong> was a year <strong>of</strong> building<br />

on the collaborative partnerships we have with other tertiary<br />

providers and business, diversifying our revenue streams and<br />

consolidating our financial position. These things, and more, have<br />

been achieved. The themes this year have been about consolidating<br />

and extending WelTec’s strong links with industry, contributing to<br />

productivity and economic growth in the <strong>Wellington</strong> region and <strong>of</strong>ten<br />

the rest <strong>of</strong> New Zealand.<br />

Student Body<br />

In <strong>2011</strong> WelTec exceeded its targets for student enrolments. Almost<br />

4,700 EFTS were achieved (Equivalent Full Time Students) equating<br />

to 10,385 students. Two thirds <strong>of</strong> these students were studying at<br />

level four and above. 77% were part-time. 60% were aged under 25<br />

representing a higher youth cohort studying at WelTec via initiatives<br />

such as WelTec’s Trades Academy, Youth guarantee and Tamaiti<br />

Whangai programmes.<br />

Most students were undertaking some form <strong>of</strong> work placement or<br />

work experience whilst they studied. 70% <strong>of</strong> WelTec graduates told<br />

us that they were either in work or undertaking further study soon<br />

after completing their qualification. This tells us, in an economic<br />

sense, that the products WelTec <strong>of</strong>fers are in demand.

Financial performance<br />

Strong financial performance was again achieved in <strong>2011</strong> through<br />

tight fiscal control and new revenue from delivering additional<br />

trades training through the government’s Skills for Canterbury<br />

initiative. WelTec’s Total Return on Income <strong>of</strong> 5% exceeded<br />

expectations with a Net Pr<strong>of</strong>it <strong>of</strong> $2.765M against a budgeted<br />

figure <strong>of</strong> $1.455M. As Council Chair I am very proud <strong>of</strong> this result,<br />

particularly given the current economic environment and I <strong>of</strong>fer my<br />

congratulations to staff for their efforts in this regard.<br />

Views <strong>of</strong> Stakeholders<br />

WelTec was awarded a “low risk” rating by the Tertiary Education<br />

Commission (TEC) in <strong>2011</strong> based on the prior year’s performance.<br />

Provisional Educational Performance Indicator results, also<br />

assessed by the TEC, showed that WelTec performed well in <strong>2011</strong>,<br />

achieving above the ITP sector median for all four indicators. This,<br />

along with NZQA’s External Evaluation and Review grade <strong>of</strong> “Highly<br />

Confident” awarded to WelTec for its educational performance<br />

indicates that the key funders and policy makers view the Institution<br />

as a high performer.<br />

Progress on the New Zealand Centre for Cuisine<br />

and Hospitality Excellence<br />

In 2010 we announced that WelTec’s award-winning School <strong>of</strong><br />

Hospitality would join with the internationally renowned Le Cordon<br />

Bleu New Zealand <strong>Institute</strong> and UCOL to create a centre for cuisine<br />

and hospitality excellence.<br />

This year construction progressed on the school, which will be<br />

based in the hospitality heart <strong>of</strong> central <strong>Wellington</strong> City. This<br />

represents a significant investment in <strong>Wellington</strong>’s hospitality<br />

industry. The centre will <strong>of</strong>fer world-class training facilities and<br />

attract local and international students to what is, arguably, New<br />

Zealand’s capital <strong>of</strong> hospitality. The new facilities themselves will<br />

add value and a focus to the area around lower Cuba St and there<br />

will be great benefits to the wider community through the growth in<br />

student numbers and business opportunities.<br />

With a collaborative approach and an international edge, the new<br />

centre will focus on excellence and will deliver WelTec’s unique and<br />

widely-acclaimed programmes including the Bachelor <strong>of</strong> Hospitality<br />

Management and the graduate Diploma in Event Management.<br />

Training will be <strong>of</strong>fered at all levels <strong>of</strong> employment across the<br />

hospitality sector.<br />

The new centre will open in September 2012.<br />

Students First<br />

Students First is an innovative collaboration with Whitireia<br />

Community Polytechnic. In <strong>2011</strong> WelTec and Whitireia together<br />

investigated the opportunities to collaborate for the benefit <strong>of</strong><br />

students and to improve efficiencies for both <strong>Institute</strong>s. Four<br />

collaborative options were identified and thoroughly investigated,<br />

including project-based collaboration, shared services, a merger<br />

and a strategic partnership. The strategic partnership model<br />

proved to be the strongest option, one that creates both a strategic<br />

and operational partnership between the two <strong>Institute</strong>s. It maintains<br />

two separate Institutions, with their own chief executives, but<br />

establishes a single combined council and joint academic board.<br />

When both Institutions took the strategic partnership proposal<br />

to stakeholders for consultation the feedback received was<br />

overwhelmingly one <strong>of</strong> agreement, giving WelTec and Whitireia the<br />

mandate to proceed.<br />

This approach is a first for the tertiary education sector in New<br />

Zealand. It will draw on the strengths <strong>of</strong> both <strong>Institute</strong>s to give<br />

students easier access to a diverse range <strong>of</strong> programmes; create<br />

distinctive, new centres <strong>of</strong> excellence that work closely with industry;<br />

provide a single strategic overview <strong>of</strong>, and stronger voice for,<br />

vocational tertiary education and be a one-stop-shop for industry in<br />

the greater <strong>Wellington</strong> region.<br />

The new combined council and joint academic board are now in<br />

place and WelTec and Whitireia have begun working together on a<br />

joint strategic plan and a range <strong>of</strong> initiatives to improve outcomes<br />

for students and industry and achieve efficiencies for both <strong>Institute</strong>s.<br />

The cultures, identities and practices <strong>of</strong> both WelTec and Whitireia will<br />

be retained while we work together to share resources, knowledge,<br />

expertise and best practice.<br />

Acknowledgements<br />

WelTec’s relationships with industry and its focus on contributing to<br />

productivity and economic growth remained a key focus for <strong>2011</strong>.<br />

This was exemplified through WelTec’s advisory committees who<br />

continued to have a key role across the Institution assisting with the<br />

design <strong>of</strong> new qualifications and updating existing programmes;<br />

<strong>of</strong>fering work placements and cadetships; and facilitating<br />

employment opportunities for graduates. Advisory Committees had<br />

a major role in the development <strong>of</strong> Students First and I thank the<br />

members for their time and contribution.<br />

I would like to formally recognise WelTec’s Chief Executive Dr<br />

Linda Sissons. Linda led and maintained the high performing<br />

status <strong>of</strong> WelTec in a challenging economic environment. In <strong>2011</strong><br />

she set the parameters for the Institution to successfully focus on<br />

student achievement; and to maximise WelTec’s and its graduates’<br />

contribution to the region’s productivity and economic growth. The<br />

Council and WelTec benefitted from Linda’s contribution to tertiary<br />

education at a national and international level through her Deputy<br />

Chairpersonship <strong>of</strong> the Commonwealth <strong>of</strong> Learning Board <strong>of</strong><br />

governors and her role as Chair <strong>of</strong> the New Zealand Metro group.<br />

Finally I acknowledge the contribution <strong>of</strong> fellow Councillors throughout<br />

<strong>2011</strong>, particularly their involvement in the Students First initiative.<br />

I am pleased to present you with the <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> for the<br />

<strong>Wellington</strong> <strong>Institute</strong> <strong>of</strong> <strong>Technology</strong>.<br />

Roger Sowry<br />

ONzM<br />

<strong>2011</strong> ANNUAL REPORT |<br />

15

16 | WELLINgTON INSTITUTE OF TECHNOLOgY

TRAININg AND<br />

QUALIFICATIONS VITAL<br />

TO THE HOSPITALITY<br />

INDUSTRY<br />

Renowned <strong>Wellington</strong> caterer, Ruth Pretty is Chair <strong>of</strong> WelTec’s<br />

Hospitality Advisory Committee and also holds an Honorary<br />

Bachelor in Hospitality Management from WelTec for her significant<br />

contribution to the <strong>Wellington</strong> region and the wider New Zealand<br />

food and hospitality sectors.<br />

Through her role on the advisory committee Ms Pretty works closely<br />

with WelTec’s hospitality leadership team, providing guidance and<br />

advice from an employer’s perspective. Her vision for the <strong>Wellington</strong><br />

hospitality sector is a vibrant and thriving industry that is an<br />

attractive career option for the region’s young people.<br />

“Cherie Freeman (Head <strong>of</strong> School <strong>of</strong> Hospitality) and her team are<br />

very open about the challenges and opportunities they face,” says<br />

Ms Pretty.<br />

We talk about the global issues and<br />

trends happening within our industry<br />

which in turn helps Cherie’s team in<br />

ensuring relevant courses that will<br />

deliver graduates our industry needs.<br />

Ms Pretty says the advisory committee was also a good forum<br />

for the industry to receive updates on WelTec’s new School <strong>of</strong><br />

Hospitality currently being built in <strong>Wellington</strong>. The School will also<br />

house WelTec’s joint venture partner, Le Cordon Bleu.<br />

“The new School <strong>of</strong> Hospitality will build on <strong>Wellington</strong>’s pr<strong>of</strong>ile<br />

as the culinary capital <strong>of</strong> New Zealand and will showcase the<br />

School and all it <strong>of</strong>fers. It will also be hugely beneficial in forging<br />

relationships with employers in our industry and providing the<br />

skilled hospitality staff required.<br />

Ms Pretty says WelTec’s School <strong>of</strong> Hospitality is a place that actively<br />

engages with industry leaders and works hard to understand and<br />

respond to what industry is looking for from its graduates.<br />

“The School is very open to ideas and the team has fantastic<br />

relationships with their tutors and students. The result is a very high<br />

standard in hospitality training.”<br />

“Training and qualifications are vital to the hospitality industry in<br />

New Zealand and it is great to see WelTec’s hospitality team build<br />

such a strong and vibrant presence within <strong>Wellington</strong>’s hospitality<br />

community.<br />

<strong>2011</strong> ANNUAL REPORT |<br />

17

REBUILDINg<br />

CHRISTCHURCH<br />

Restoring Christchurch will be a massive task, requiring an army<br />

<strong>of</strong> skilled tradespeople. So WelTec put its hand up to work with<br />

the government and industry to train the people needed to rebuild<br />

Christchurch.<br />

The TEC invited WelTec to expand our trades delivery to help<br />

meet Christchurch’s future building needs. Of the nine Institutions<br />

that shared the extra $7.5M funding, WelTec received by far the<br />

largest allocation – 25 percent <strong>of</strong> the total amount.<br />

18 | WELLINgTON INSTITUTE OF TECHNOLOgY<br />

WelTec’s Skills for Canterbury initiative now has<br />

100 extra young people learning trades skills and<br />

becoming ‘work ready’. This approach is getting<br />

ahead <strong>of</strong> the anticipated high demand for skilled<br />

workers from mid-2012, not just for Christchurch<br />

but also to help remedy the country’s leaky homes<br />

situation and the expected demand for new housing.<br />

As well as delivering these trades programmes from<br />

WelTec’s Petone campus, customised carpentry<br />

training facilities were set up in Wairarapa and Kapiti<br />

in conjunction with agencies in those areas. In Kapiti,<br />

we are working with Whitireia on these initiatives.<br />

This year, WelTec’s trades students also built two<br />

houses as part <strong>of</strong> their learning and these houses<br />

have been donated to Christchurch.

<strong>2011</strong> ANNUAL REPORT |<br />

19

20 | WELLINgTON INSTITUTE OF TECHNOLOgY

WELTEC – IMPORTANT<br />

TO THE REgION<br />

SAYS FRAN WILDE<br />

Renowned <strong>Wellington</strong>ian, the Hon Fran Wilde was recently awarded<br />

WelTec’s <strong>Technology</strong> Medal in recognition <strong>of</strong> her significant<br />

contribution to the region and community. Fran’s vision <strong>of</strong><br />

<strong>Wellington</strong> is shaped by her experience and hands-on involvement<br />

in the wider region.<br />

“It’s always easy to lapse into clichés but the ideas <strong>of</strong> prosperity<br />

and resilience spring to mind as fundamental. With our urban<br />

agglomeration (from <strong>Wellington</strong> City through the Hutt Valley and up<br />

through Porirua to Kapiti) we are already a city-region,” says Fran.<br />

Our city centres and garden suburbs,<br />

the coast that rings us and the easily<br />

accessible Wairarapa countryside give<br />

outstanding opportunities for a balanced<br />

quality <strong>of</strong> life. However, if we are to<br />

continue to be “the coolest little capital”<br />

we need to do some things differently.<br />

That includes creating the economic environment to generate the sort<br />

<strong>of</strong> jobs that will attract and hold younger people. “We need to deliver<br />

the interventions necessary to ensure our local communities, social<br />

networks and our large regional infrastructure are all future-pro<strong>of</strong>ed,<br />

so they are able to withstand whatever nature or the global economy<br />

might throw at us in the next century,” says Fran.<br />

“For me, this means literally getting our act together. There are many<br />

players - business, local communities, education, research and<br />

local government. Current fragmentation is recognised as a barrier<br />

to success and a number <strong>of</strong> sectors are moving towards a more<br />

strategic arrangement. The old adage “think global - act local” could<br />

well be adapted to “think regional - act local.”<br />

To achieve that vision, Fran recognises that tertiary education will be a<br />

critical lever for creating prosperity and resilience<br />

- for making <strong>Wellington</strong> the place people choose to live.<br />

“WelTec is right in the middle <strong>of</strong> the equation, with its focus on<br />

practical and relevant education.<br />

“WelTec bridges the gap between teaching and research, between<br />

academia and vocational training. It provides hundreds <strong>of</strong><br />

<strong>Wellington</strong>ians with the boost they need to succeed in the workforce.”<br />

In looking ahead at what workforce requirements will be needed Fran<br />

says the key is to have tertiary delivery that is agile and adaptable.<br />

“WelTec sits exactly on that spot and its responsiveness to the needs<br />

<strong>of</strong> commerce and industry is a characteristic that must be maintained<br />

and supported.”<br />

<strong>2011</strong> ANNUAL REPORT |<br />

21

22 | WELLINgTON INSTITUTE OF TECHNOLOgY

CHIEF EXECUTIVE’S REPORT<br />

Ma wai raa, e tau rima<br />

Te Whare Wananga o te<br />

Awakairangi<br />

Ma te tika<br />

Ma te pono<br />

Ma te aroha e<br />

<strong>2011</strong> was a big year at WelTec. Many initiatives, in development<br />

for some time, have come to fruition and are performing well.<br />

Our students continued to achieve great outcomes – both in their<br />

courses <strong>of</strong> study and by gaining recognition further afield. WelTec’s<br />

walls become ever more permeable as we continue to build on our<br />

relationships within industry, the community and the tertiary sector.<br />

WelTec’s longstanding working relationship with Te Runanganui<br />

O Taranaki Whanui Ki Te Upoko O Te Ika A Maui continued to<br />

strengthen in <strong>2011</strong>. A number <strong>of</strong> initiatives were pursued alongside<br />

the flagship Tamaiti Whangai programme (discussed later in this<br />

report). The Runanga has a well-developed strategic vision for<br />

the Hutt Valley, based on Maori values and practices. This vision<br />

involves key partners working together to actively build cohesive,<br />

strong and vibrant communities. The Runanga views WelTec as a<br />

key contributor to this vision and we view the relationship as critical<br />

to achieving successful outcomes for Maori.<br />

We are very pleased to report that WelTec exceeded the<br />

government’s four key education performance indicator targets<br />

this year. We acknowledge that these are important indicators <strong>of</strong><br />

a tertiary Institution’s success so we put considerable work and<br />

focus into these areas in 2010. The evidence <strong>of</strong> this effort is clear in<br />

<strong>2011</strong> and our students are the winners.<br />

Educational Performance Indicator <strong>2011</strong> 1<br />

YEAR 2010 <strong>2011</strong> (provisional)<br />

COURSE COMPLETION<br />

QUALIFICATION COMPLETION<br />

PROGRESSION TO HIGHER<br />

LEvEL<br />

RETENTION<br />

76% / 13TH<br />

MEDIAN 77%<br />

64% / 3RD<br />

MEDIAN 57%<br />

39% / 4TH<br />

MEDIAN 29%<br />

61% / 2ND<br />

MEDIAN 51%<br />

77% / 9TH<br />

MEDIAN 75%<br />

63% / 4TH<br />

MEDIAN 56%<br />

40% / 4TH<br />

MEDIAN 32%<br />

64% / 3RD<br />

MEDIAN 54%<br />

We also over-achieved on our domestic student number targets in<br />

<strong>2011</strong>. Other goals were harder to achieve, including international<br />

student numbers and revenue, because <strong>of</strong> the challenging<br />

economic environment. We report against all our Business Plan<br />

goals later in this document.<br />

1. SAC only as reported on TEC website<br />

Who will care for this place <strong>of</strong><br />

learning?<br />

This place called Awakairangi<br />

Integrity will<br />

Truth will<br />

And so too will love<br />

In highlighting some <strong>of</strong> our major achievements for the year I would<br />

like to acknowledge the many people who have contributed to these<br />

successes. It takes individual effort and commitment, with the support<br />

and collaboration <strong>of</strong> others, to achieve the results we have. Despite<br />

a year <strong>of</strong> change and challenge, the Executive Management Team<br />

(EMT) and staff have retained their focus on supporting student<br />

outcomes. I thank them for continuing this effort; the results are<br />

remarkable. I know I speak for our Council and my EMT colleagues<br />

in acknowledging the extraordinary support <strong>of</strong> our wider community<br />

– employers, industry, community leaders and strategic partners – in<br />

helping us fulfill our purpose.<br />

Positive industry relationships<br />

WelTec links with industry and employers in many ways. This year<br />

these links continued to grow and develop at all levels. From<br />

functions and events; to cadetships and scholarships; to advanced<br />

research and development, WelTec and employers work side-by-side<br />

increasing productivity and contributing to economic growth, with<br />

benefits for our students, the community and businesses.<br />

The <strong>2011</strong> Employer Satisfaction survey results showed that<br />

<strong>Wellington</strong> employers continue to be very positive about the training<br />

and education provided by WelTec. WelTec’s training continues to<br />

be seen as relevant by employers with 96% saying they were very<br />

satisfied or satisfied with the relevance <strong>of</strong> our qualifications.<br />

The majority <strong>of</strong> employers surveyed viewed WelTec’s qualifications<br />

as relevant to their needs with graduates considered work ready.<br />

Employers commented that the strength <strong>of</strong> the relationship<br />

with staff has a major influence over how they view WelTec and<br />

encourages their involvement in WelTec’s programmes. The<br />

continued uncertainty <strong>of</strong> both the international and national climate<br />

continues to impact on employers influencing decisions to take<br />

on new graduates and apprentices. Countering this is the view<br />

<strong>of</strong> employers who consistently endorse the value <strong>of</strong> having work<br />

experience components in programmes. This has a positive impact<br />

on employment opportunities.<br />

<strong>2011</strong> ANNUAL REPORT |<br />

23

WelTec’s Advisory Committees<br />

Driven by industry, these committees give us valuable links into<br />

industry and provide us with important insights that guide our<br />

planning. For example, this year the Creative <strong>Technology</strong> advisory<br />

committee reported growth in the film and television business in<br />

<strong>Wellington</strong>. Likewise, the Hospitality and Construction advisory<br />

committees anticipate skill shortages. We responded to these needs<br />

with additional programmes and student places.<br />

The Mayors <strong>of</strong> both <strong>Wellington</strong> and Hutt cities announced they are<br />

keen to see the area as a hub for innovation and technology and<br />

recognised that WelTec has an important role in attracting and<br />

supporting business here.<br />

The events we host and attend, as well as working relationships,<br />

contribute to the strength, longevity and creativity <strong>of</strong> our relationships.<br />

We greatly exceeded our target <strong>of</strong> significant events over the year<br />

with impressive turnouts and great conversations.<br />

Further afield, staff from the School <strong>of</strong> Creative Technologies,<br />

supported by WelTec Connect, delivered an intensive two-week<br />

course at Hong Kong Cyberport, a creative digital community<br />

that nurtures start-ups. Cyberport is owned by the Hong Kong<br />

government. The trip cemented a relationship with Cyberport<br />

and introduced its young entrepreneurs to WelTec’s practical,<br />

interdisciplinary industry-based approach to working, taking them<br />

through an entire creative process from concept to presentation. The<br />

relationship has the potential to attract students in the future, as well<br />

as a unique teaching and learning experience for WelTec tutors.<br />

Celebrating student success<br />

It was a good year for industry recognition in the form <strong>of</strong> awards and<br />

recognition. Hospitality students won the prestigious Toque d’Or<br />

competition and the Fonterra Proud to be a Chef competition; earned<br />

a rare international excellence award from City and guilds as well<br />

as a range <strong>of</strong> other scholarships and prizes. Creative Technologies<br />

students received accolades at their exhibition, COLLIDEOSCOPE,<br />

at the Academy <strong>of</strong> Fine Arts in <strong>Wellington</strong> where many works were<br />

sold to collectors and two students received job <strong>of</strong>fers. Bachelor <strong>of</strong><br />

Information <strong>Technology</strong> students won the <strong>2011</strong> National Netriders<br />

Networking competition.<br />

A Diploma <strong>of</strong> Beauty Therapy student won the best student award<br />

at the New Zealand Beauty Awards. A WelTec bricklaying apprentice<br />

won the silver trowel award as the top year-three apprentice at the<br />

Bricklayer <strong>of</strong> the Year awards.<br />

Quiet achievers include those students at levels 1-3 who improved<br />

their literacy and numeracy skills. The Tertiary Education Commission<br />

(TEC) recognised the efficacy <strong>of</strong> the WelTec approach to embedding<br />

literacy and numeracy at this level. WelTec is the only <strong>Institute</strong> <strong>of</strong><br />

technology or polytechnic (ITP) to meet the TEC target for literacy and<br />

numeracy, resulting in WelTec being pr<strong>of</strong>iled in the TEC’s assessment<br />

tool video clip as representing best practice in the sector.<br />

24 | WELLINgTON INSTITUTE OF TECHNOLOgY<br />

A supportive learning environment<br />

This year we again combined forces with Te Ati Awa to mentor<br />

young Maori with our Tamaiti Whangai initiative. The focus for Tamaiti<br />

Whangai is supporting Maori students to complete their studies and<br />

get a qualification that leads to employment. This is achieved by<br />

encouraging students to excel at their studies as well as their sport;<br />

promoting culture and wellness and leadership; removing barriers to<br />

learning and feelings <strong>of</strong> isolation by taking a team approach to study.<br />

Feedback from students participating in Tamaiti Whangai is that the<br />

programme has developed their sense <strong>of</strong> personal responsibility, their<br />

confidence in themselves and their concern for others. The NZQA, in<br />

its quality assurance review <strong>of</strong> WelTec, described Tamaiti Whangai as<br />

‘impressive’ and noted that the programme has led to increases in<br />

students’ educational performance and significant gains in their selfconfidence,<br />

attitudes to learning, and work-readiness.<br />

With a Maori roll <strong>of</strong> 16 percent <strong>of</strong> the total student population,<br />

initiatives such as Tamaiti Whangai are increasingly important and<br />

we are looking at ways to expand the programme in response to<br />

demand.<br />

To support the Skills for Canterbury initiative and provide opportunities<br />

for young Maori, Te Puni Kokiri provided 40 scholarships for Maori<br />

students to study trades finishing courses in tiling; bricklaying and<br />

blocklaying; pre-trade painting, landscape construction; plumbing<br />

and gasfitting.<br />

Putting students into business<br />

Integrating work experience with tertiary study is a key feature <strong>of</strong><br />

WelTec’s programmes and adds value to student learning and<br />

employment outcomes for both student and employer. During the<br />

year WelTec appointed an Industry Partnerships Coordinator to<br />

increase the range <strong>of</strong> cadetships and work placements available to<br />

WelTec students.<br />

Achievements in <strong>2011</strong> included the creation <strong>of</strong> new cadetships<br />

with several organisations including NEC and IRL. Longer-term<br />

relationships continue to grow. This year’s Fronde Cadet Scheme<br />

was the largest yet, with eight first-year students enjoying the benefits<br />

<strong>of</strong> scholarships and work experience.<br />

WelTec also placed students through grow <strong>Wellington</strong>’s Summer <strong>of</strong><br />

Tech programme and created a number <strong>of</strong> project-based internships.<br />

Feedback from industry clients has been very positive about the value<br />

that WelTec students on work placement bring to their companies.<br />

<strong>Wellington</strong> Trades Academy<br />

<strong>2011</strong> was the first year <strong>of</strong> operation <strong>of</strong> the <strong>Wellington</strong> Trades<br />

Academy, established to deliver vocational trades and technology,<br />

as well as general educational, qualifications in partnership with<br />

secondary schools. Thirty schools are now working with the Academy<br />

and in <strong>2011</strong> we had 78 students simultaneously enrolled at WelTec<br />