3-Year EUR 1-Delta Certificates on a Russian Equity Basket - jpv.ch

3-Year EUR 1-Delta Certificates on a Russian Equity Basket - jpv.ch

3-Year EUR 1-Delta Certificates on a Russian Equity Basket - jpv.ch

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CONTACT/ INFO<br />

3-<str<strong>on</strong>g>Year</str<strong>on</strong>g> <str<strong>on</strong>g>EUR</str<strong>on</strong>g> 1-<str<strong>on</strong>g>Delta</str<strong>on</strong>g> <str<strong>on</strong>g>Certificates</str<strong>on</strong>g> <strong>on</strong> a <strong>Russian</strong><br />

<strong>Equity</strong> <strong>Basket</strong><br />

- NON-US INVESTORS ONLY - NON-PRINCIPAL PROTECTED -<br />

Indicative Terms and C<strong>on</strong>diti<strong>on</strong>s as of Februar 8, 2011 (Versi<strong>on</strong> 2.00)<br />

All material herein is for discussi<strong>on</strong> purposes <strong>on</strong>ly and is <strong>on</strong>ly a summary. Reference should be made to the Prospectus, whi<strong>ch</strong> c<strong>on</strong>tains the <strong>on</strong>ly<br />

legally binding terms of the <str<strong>on</strong>g>Certificates</str<strong>on</strong>g> and other informati<strong>on</strong> related to the Issue. The Prospectus is obtainable free of <strong>ch</strong>arge from the Issuer/Lead<br />

Manager/Certificate Agent. Before investing in the Securities you should read the risk factors described under Risk Informati<strong>on</strong> below and in the<br />

Prospectus. The Final Terms may describe additi<strong>on</strong>al risk factors relating to the Securities.<br />

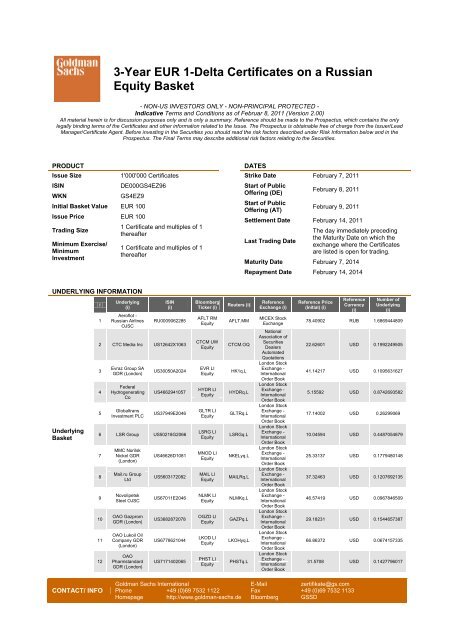

PRODUCT<br />

Issue Size 1'000'000 <str<strong>on</strong>g>Certificates</str<strong>on</strong>g><br />

ISIN DE000GS4EZ96<br />

WKN GS4EZ9<br />

Initial <strong>Basket</strong> Value <str<strong>on</strong>g>EUR</str<strong>on</strong>g> 100<br />

Issue Price <str<strong>on</strong>g>EUR</str<strong>on</strong>g> 100<br />

Trading Size<br />

Minimum Exercise/<br />

Minimum<br />

Investment<br />

UNDERLYING INFORMATION<br />

Underlying<br />

<strong>Basket</strong><br />

i<br />

1<br />

1 Certificate and multiples of 1<br />

thereafter<br />

1 Certificate and multiples of 1<br />

thereafter<br />

Underlying<br />

(i)<br />

Aeroflot -<br />

<strong>Russian</strong> Airlines<br />

OJSC<br />

ISIN<br />

(i)<br />

RU0009062285<br />

2 CTC Media Inc US12642X1063<br />

3<br />

4<br />

5<br />

Evraz Group SA<br />

GDR (L<strong>on</strong>d<strong>on</strong>)<br />

Federal<br />

Hydrogenerating<br />

Co<br />

Globaltrans<br />

Investment PLC<br />

US30050A2024<br />

US4662941057<br />

US37949E2046<br />

6 LSR Group US50218G2066<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

MMC Norilsk<br />

Nickel GDR<br />

(L<strong>on</strong>d<strong>on</strong>)<br />

Mail.ru Group<br />

Ltd<br />

Novolipetsk<br />

Steel OJSC<br />

OAO Gazprom<br />

GDR (L<strong>on</strong>d<strong>on</strong>)<br />

OAO Lukoil Oil<br />

Company GDR<br />

(L<strong>on</strong>d<strong>on</strong>)<br />

OAO<br />

Pharmstandard<br />

GDR (L<strong>on</strong>d<strong>on</strong>)<br />

US46626D1081<br />

US5603172082<br />

US67011E2046<br />

US3682872078<br />

US6778621044<br />

US7171402065<br />

Bloomberg<br />

Ticker (i)<br />

AFLT RM<br />

<strong>Equity</strong><br />

CTCM UW<br />

<strong>Equity</strong><br />

EVR LI<br />

<strong>Equity</strong><br />

HYDR LI<br />

<strong>Equity</strong><br />

GLTR LI<br />

<strong>Equity</strong><br />

LSRG LI<br />

<strong>Equity</strong><br />

MNOD LI<br />

<strong>Equity</strong><br />

MAIL LI<br />

<strong>Equity</strong><br />

NLMK LI<br />

<strong>Equity</strong><br />

OGZD LI<br />

<strong>Equity</strong><br />

LKOD LI<br />

<strong>Equity</strong><br />

PHST LI<br />

<strong>Equity</strong><br />

Reuters (i)<br />

AFLT.MM<br />

CTCM.OQ<br />

HK1q.L<br />

HYDRq.L<br />

GLTRq.L<br />

LSRGq.L<br />

NKELyq.L<br />

MAILRq.L<br />

NLMKq.L<br />

GAZPq.L<br />

LKOHyq.L<br />

PHSTq.L<br />

Goldman Sa<strong>ch</strong>s Internati<strong>on</strong>al<br />

Ph<strong>on</strong>e +49 (0)69 7532 1122<br />

Homepage http://www.goldman-sa<strong>ch</strong>s.de<br />

DATES<br />

Strike Date February 7, 2011<br />

Start of Public<br />

Offering (DE)<br />

Start of Public<br />

Offering (AT)<br />

February 8, 2011<br />

February 9, 2011<br />

Settlement Date February 14, 2011<br />

Last Trading Date<br />

E-Mail zertifikate@gs.com<br />

Fax +49 (0)69 7532 1133<br />

Bloomberg GSSD<br />

The day immediately preceding<br />

the Maturity Date <strong>on</strong> whi<strong>ch</strong> the<br />

ex<strong>ch</strong>ange where the <str<strong>on</strong>g>Certificates</str<strong>on</strong>g><br />

are listed is open for trading.<br />

Maturity Date February 7, 2014<br />

Repayment Date February 14, 2014<br />

Reference<br />

Ex<strong>ch</strong>ange (i)<br />

MICEX Stock<br />

Ex<strong>ch</strong>ange<br />

Nati<strong>on</strong>al<br />

Associati<strong>on</strong> of<br />

Securities<br />

Dealers<br />

Automated<br />

Quotati<strong>on</strong>s<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

Reference Price<br />

(Initial) (i)<br />

Reference<br />

Currency<br />

(i)<br />

Number of<br />

Underlying<br />

(i)<br />

78.40902 RUB 1.6869444809<br />

22.62601 USD 0.1992249505<br />

41.14217 USD 0.1095631627<br />

5.15592 USD 0.8742693582<br />

17.14002 USD 0.26299069<br />

10.04594 USD 0.4487054879<br />

25.33137 USD 0.1779480148<br />

37.32463 USD 0.1207692135<br />

46.57419 USD 0.0967846509<br />

29.18231 USD 0.1544657387<br />

66.86372 USD 0.0674157335<br />

31.5708 USD 0.1427796017

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

CONTACT/ INFO<br />

OAO TMK GDR<br />

(L<strong>on</strong>d<strong>on</strong>)<br />

OJSC Magnit<br />

GDR (L<strong>on</strong>d<strong>on</strong>)<br />

OJSC Me<strong>ch</strong>el<br />

ADR (New York)<br />

OJSC Oil<br />

Company<br />

Rosneft GDR<br />

(L<strong>on</strong>d<strong>on</strong>)<br />

OJSC Polyus<br />

Gold GDR<br />

(L<strong>on</strong>d<strong>on</strong>)<br />

Petropavlovsk<br />

PLC<br />

US87260R2013<br />

US55953Q2021<br />

US5838401033<br />

US67812M2070<br />

US6781291074<br />

GB0031544546<br />

19 Polymetal JSC US7317892021<br />

20<br />

Sberbank of<br />

Russia<br />

US80585Y1001<br />

21 Severstal OAO US8181503025<br />

22<br />

Sistema JSFC<br />

GDR (L<strong>on</strong>d<strong>on</strong>)<br />

US48122U2042<br />

23 Strabag SE AT000000STR1<br />

24 Tatneft US6708312052<br />

25<br />

26<br />

TransC<strong>on</strong>tainer<br />

OAO<br />

United Co<br />

RUSAL PLC<br />

US8935561006<br />

JE00B5BCW814<br />

27 Uralkali US91688E2063<br />

28<br />

29<br />

30<br />

VTB Bank<br />

OJSC GDR<br />

(L<strong>on</strong>d<strong>on</strong>)<br />

Vimpelcom Ltd<br />

Sp<strong>on</strong>-ADR<br />

X5 Retail Group<br />

N.V. GDR<br />

(L<strong>on</strong>d<strong>on</strong>)<br />

US46630Q2021<br />

US92719A1060<br />

US98387E2054<br />

TMKS LI<br />

<strong>Equity</strong><br />

MGNT LI<br />

<strong>Equity</strong><br />

MTL UN<br />

<strong>Equity</strong><br />

ROSN LI<br />

<strong>Equity</strong><br />

PLZL LI<br />

<strong>Equity</strong><br />

POG LN<br />

<strong>Equity</strong><br />

PMTL LI<br />

<strong>Equity</strong><br />

SBNA GY<br />

<strong>Equity</strong><br />

SVST LI<br />

<strong>Equity</strong><br />

SSA LI<br />

<strong>Equity</strong><br />

STR AV<br />

<strong>Equity</strong><br />

ATAD LI<br />

<strong>Equity</strong><br />

TRCN LI<br />

<strong>Equity</strong><br />

486 HK<br />

<strong>Equity</strong><br />

URKA LI<br />

<strong>Equity</strong><br />

VTBR LI<br />

<strong>Equity</strong><br />

VIP UN<br />

<strong>Equity</strong><br />

FIVE LI<br />

<strong>Equity</strong><br />

TRMKq.L<br />

MGNTq.L<br />

MTL.N<br />

ROSNq.L<br />

PLZLq.L<br />

POG.L<br />

PMTLq.L<br />

SBERq.DE<br />

CHMFq.L<br />

SSAq.L<br />

STRV.VI<br />

TATNxq.L<br />

TRCNq.L<br />

0486.HK<br />

URKAq.L<br />

VTBRq.L<br />

VIP.N<br />

PJPq.L<br />

Goldman Sa<strong>ch</strong>s Internati<strong>on</strong>al<br />

Ph<strong>on</strong>e +49 (0)69 7532 1122<br />

Homepage http://www.goldman-sa<strong>ch</strong>s.de<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

New York<br />

Stock<br />

Ex<strong>ch</strong>ange<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

Frankfurt<br />

Stock<br />

Ex<strong>ch</strong>ange<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

Vienna Stock<br />

Ex<strong>ch</strong>ange<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

H<strong>on</strong>g K<strong>on</strong>g<br />

Stock<br />

Ex<strong>ch</strong>ange<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

New York<br />

Stock<br />

Ex<strong>ch</strong>ange<br />

L<strong>on</strong>d<strong>on</strong> Stock<br />

Ex<strong>ch</strong>ange -<br />

Internati<strong>on</strong>al<br />

Order Book<br />

20.60916 USD 0.2187215376<br />

26.55439 USD 0.1697521944<br />

33.68815 USD 0.1338057023<br />

8.71583 USD 0.5171815238<br />

32.43053 USD 0.1389945497<br />

10.79395 GBP 0.2592251203<br />

17.55164 USD 0.2568231325<br />

288.30603 <str<strong>on</strong>g>EUR</str<strong>on</strong>g> 0.0115617885<br />

18.23569 USD 0.2471892924<br />

26.22715 USD 0.1718702609<br />

21.83249 <str<strong>on</strong>g>EUR</str<strong>on</strong>g> 0.1526776572<br />

41.1038 USD 0.1096654593<br />

10.99831 USD 0.40985073<br />

12.8675 HKD 2.7262482999<br />

39.37098 USD 0.1144921117<br />

6.67501 USD 0.6753048253<br />

14.37433 USD 0.3135915108<br />

43.15439 USD 0.104454429<br />

GENERAL INFORMATION<br />

Certificate Right Ea<strong>ch</strong> Certificate entitles the holder, in accordance with the respective Terms and<br />

C<strong>on</strong>diti<strong>on</strong>s of the <str<strong>on</strong>g>Certificates</str<strong>on</strong>g>, to receive an amount in <str<strong>on</strong>g>EUR</str<strong>on</strong>g> <strong>on</strong> Repayment Date equal to:<br />

n<br />

�� i 1<br />

ReferencePrice(Final)<br />

(i)<br />

N (i) �<br />

FXRate(Final)<br />

(i)<br />

whereby<br />

N (i) Number of Underlying (i) in the Underlying <strong>Basket</strong><br />

n number of Underlyings in the Underlying <strong>Basket</strong><br />

FX Rate (Final) (i) The <str<strong>on</strong>g>EUR</str<strong>on</strong>g> /Reference Currency (i) rate based <strong>on</strong> the mid-closing <str<strong>on</strong>g>EUR</str<strong>on</strong>g>/Reference Currency (i)<br />

ex<strong>ch</strong>ange rate defined as a Reference Currency (i) amount per 1 <str<strong>on</strong>g>EUR</str<strong>on</strong>g> as fixed by WM-Company<br />

and published <strong>on</strong> the related Reuters page <strong>on</strong> the Valuati<strong>on</strong> Date. In case the Reference Currency<br />

(i) is <str<strong>on</strong>g>EUR</str<strong>on</strong>g> the FX Rate (Final)(i) is 1.<br />

Reference Price (i) The official closing price of the Underlying (i) as determined at and published by the Reference<br />

Ex<strong>ch</strong>ange (i)<br />

Reference Price (Initial) (i) A price of the Underlying (i) <strong>on</strong> the Strike Date determined in the discreti<strong>on</strong> of the Issuer<br />

Reference Price (Final) (i) The Reference Price (i) <strong>on</strong> the Valuati<strong>on</strong> Date<br />

E-Mail zertifikate@gs.com<br />

Fax +49 (0)69 7532 1133<br />

Bloomberg GSSD

Trading Day (i) Su<strong>ch</strong> day <strong>on</strong> whi<strong>ch</strong> all Reference Ex<strong>ch</strong>ange(s) (i) is/are s<strong>ch</strong>eduled to be open for trading for<br />

its/their respective regular trading sessi<strong>on</strong>(s)<br />

Valuati<strong>on</strong> Date In respect of ea<strong>ch</strong> Underlying (i) the Maturity Date. If su<strong>ch</strong> date is not a Trading Day (i), the<br />

following Trading Day (i) shall be the Valuati<strong>on</strong> Date for the Underlying (i).<br />

Business Days Frankfurt am Main<br />

Listing Applicati<strong>on</strong> will be made to include the <str<strong>on</strong>g>Certificates</str<strong>on</strong>g> in the Segment Scoa<strong>ch</strong> Premium of the<br />

Frankfurt Stock Ex<strong>ch</strong>ange (Scoa<strong>ch</strong>) and in the regulated unofficial market (Freiverkehr) of the<br />

Stuttgart Stock Ex<strong>ch</strong>ange (EUWAX), in ea<strong>ch</strong> case for c<strong>on</strong>tinuous trading.<br />

Sec<strong>on</strong>dary Trading The Issuer expects to make a market in the <str<strong>on</strong>g>Certificates</str<strong>on</strong>g> <strong>on</strong> Reuters page DEGS4EZ9=GSIL and<br />

<strong>on</strong> the Internet page http://www.goldman-sa<strong>ch</strong>s.de<br />

Issue Size The Issuer reserves the right to increase the Issue Size at any time.<br />

ISSUER INFORMATION<br />

Issuer Goldman, Sa<strong>ch</strong>s & Co. Wertpapier GmbH, Frankfurt, Germany<br />

Certificate Agent Goldman, Sa<strong>ch</strong>s & Co. oHG,<br />

Lead Manager Goldman, Sa<strong>ch</strong>s & Co. oHG,<br />

Calculati<strong>on</strong> Agent Goldman Sa<strong>ch</strong>s Internati<strong>on</strong>al, L<strong>on</strong>d<strong>on</strong>, UK<br />

Guarantor The Goldman Sa<strong>ch</strong>s Group, Inc., Delaware, USA<br />

Guarantor Rating A1 (Moody's)/ A (Standard & Poor's)<br />

Depository Clearstream Banking AG, Frankfurt am Main<br />

Fees payable by GS:<br />

A selling commissi<strong>on</strong> may have been paid by Goldman Sa<strong>ch</strong>s Internati<strong>on</strong>al or any of its affiliates (collectively, “GS”) in relati<strong>on</strong> to this<br />

transacti<strong>on</strong>. Please refer to the Final Terms for further details.<br />

OFFERING INFORMATION<br />

These <str<strong>on</strong>g>Certificates</str<strong>on</strong>g> have not been and will not be registered under the U.S. Securities Act of 1933. These <str<strong>on</strong>g>Certificates</str<strong>on</strong>g> may not be<br />

offered or sold within the United States or to, or for the benefit of, United States Pers<strong>on</strong>s (as defined in Regulati<strong>on</strong> S under the<br />

Securities Act). This Document may not be distributed in the United States.<br />

Informati<strong>on</strong> for German investors: This document is neither a sales prospectus in terms of the German Securities Sales<br />

Prospectus Act, nor a prospectus in terms of the German Securities Prospectus Act or general civil law, and may not be interpreted<br />

as su<strong>ch</strong>. Reference should be made to the published base prospectus including any supplements thereto and the final terms<br />

relating to the <str<strong>on</strong>g>Certificates</str<strong>on</strong>g> (together referred to as the "Prospectus"), whi<strong>ch</strong> c<strong>on</strong>tain the <strong>on</strong>ly legally binding terms of the<br />

<str<strong>on</strong>g>Certificates</str<strong>on</strong>g>. The final terms relating to the <str<strong>on</strong>g>Certificates</str<strong>on</strong>g> will be published in Germany <strong>on</strong> the first day of the public offering by being<br />

made available free of <strong>ch</strong>arge at Goldman, Sa<strong>ch</strong>s & Co. oHG, Messeturm, 60308 Frankfurt am Main. In additi<strong>on</strong>, the base<br />

prospectus, any supplements thereto and the final terms will be available for investors from the first day of the public offering in<br />

electr<strong>on</strong>ic form <strong>on</strong> the issuer's, offeror's and paying agent's website www.goldman-sa<strong>ch</strong>s.de. The public offering of the <str<strong>on</strong>g>Certificates</str<strong>on</strong>g><br />

in Germany is expected to commence <strong>on</strong> the date stated above as the Start of Public Offering (DE).<br />

Informati<strong>on</strong> for Austrian investors: This informati<strong>on</strong> serves marketing purposes and does neither represent a prospectus in terms<br />

of civil law nor a prospectus in terms of the Austrian Capital Market Act and must not be c<strong>on</strong>strued as su<strong>ch</strong>. The <strong>on</strong>ly legally<br />

binding and prevailing informati<strong>on</strong> <strong>on</strong> the offer is c<strong>on</strong>tained in the published base prospectus including any supplements thereto and<br />

in the published final terms. The base prospectus, any supplements thereto and the final terms are available for investors from the<br />

working day prior to the first day of the public offering in electr<strong>on</strong>ic form <strong>on</strong> the issuer's, offeror's and paying agent's website<br />

www.goldman-sa<strong>ch</strong>s.de. Paper copies are available for investors at the issuer's registered office, MesseTurm, Friedri<strong>ch</strong>-Ebert-<br />

Anlage 49, 60308 Frankfurt am Main, without <strong>ch</strong>arges and up<strong>on</strong> request. The public offering of the <str<strong>on</strong>g>Certificates</str<strong>on</strong>g> in Austria is<br />

expected to commence <strong>on</strong> the date stated above as the Start of Public Offering (AT).<br />

The investor acknowledges that the <str<strong>on</strong>g>Certificates</str<strong>on</strong>g> are, if and as l<strong>on</strong>g as no public offer takes place in Austria in c<strong>on</strong>formity with the<br />

Austrian Capital Market Act, distributed in Austria <strong>on</strong>ly to qualified investors, as defined in § 1/1/5a of the Austrian Capital Market<br />

Act<br />

You understand that no acti<strong>on</strong> has been taken by GS to permit a public offering of the Securities in any jurisdicti<strong>on</strong> other than the<br />

<strong>on</strong>es stated above.<br />

You agree that: (i) you will not offer, sell or deliver any of the Securities described in this material in any jurisdicti<strong>on</strong>, except in<br />

compliance with all applicable laws, and (ii) you will take, at your own expense, whatever acti<strong>on</strong> is required to permit your pur<strong>ch</strong>ase<br />

and resale of the Securities.<br />

RISK INFORMATION<br />

CONTACT/ INFO<br />

Goldman Sa<strong>ch</strong>s Internati<strong>on</strong>al<br />

Ph<strong>on</strong>e +49 (0)69 7532 1122<br />

Homepage http://www.goldman-sa<strong>ch</strong>s.de<br />

E-Mail zertifikate@gs.com<br />

Fax +49 (0)69 7532 1133<br />

Bloomberg GSSD

THESE SECURITIES ARE NOT PRINCIPAL PROTECTED. THERE IS A RISK THAT YOU COULD LOSE ALL OF YOUR<br />

INVESTMENT.<br />

Volatility: These Securities are volatile instruments. Volatility refers to the degree of unpredictable <strong>ch</strong>ange over time of a certain<br />

variable in this case the price, performance or investment return of a financial asset. Volatility does not imply directi<strong>on</strong> of the price<br />

or investment returns. An instrument that is volatile is likely to increase or decrease in value more often and/or to a greater extent<br />

than <strong>on</strong>e that is not volatile.<br />

Leverage: These Securities are subject to leverage. Where an investment is subject to leverage, the effective exposure to the<br />

underlying asset or payment reference is increased. Leverage may expose investors to increased losses where the value of<br />

underlying asset falls. Leverage can be embedded in derivative comp<strong>on</strong>ents of complex financial instruments.<br />

Combining investment types: These Securities may have some or all of the <strong>ch</strong>aracteristics of debt and derivatives instruments.<br />

These elements could interact to produce both an enhanced possibility of loss of the initial investment or an enhanced return.<br />

Investment return: The price of these Securities and the income generated, if any, may go down or up. You may realize losses<br />

<strong>on</strong> any investment made and you may get back nothing at all. You should read the base prospectus and the applicable final terms<br />

for the final terms and c<strong>on</strong>diti<strong>on</strong>s and for a descripti<strong>on</strong> of related risks. Risks include, but are not limited to, the following:<br />

• The market price of the Securities may be influenced by many unpredictable factors, including ec<strong>on</strong>omic c<strong>on</strong>diti<strong>on</strong>s, the<br />

creditworthiness of GS, the value of any underlyers and certain acti<strong>on</strong>s taken by GS (see C<strong>on</strong>flict of Interests below).<br />

Accordingly, if you sell your Securities prior to maturity you may receive less than the issue price of the Securities.<br />

• In the case of Securities referencing <strong>on</strong>e or more indices or other underlying assets (collectively, the “Underlyings”), <strong>ch</strong>anges in<br />

the price of the Securities may not correlate to <strong>ch</strong>anges in the value of the Underlyings; any declines or gains in the value of <strong>on</strong>e<br />

Underlying may be more than offset by movements in the value of other Underlyings.<br />

• The price of these Securities may be adversely affected by trading and other transacti<strong>on</strong>s by GS relating to the Securities and/or<br />

any Underlyings<br />

• The price of these Securities could be significantly impacted by determinati<strong>on</strong>s that GS may make in its sole discreti<strong>on</strong> from time<br />

to time as calculati<strong>on</strong> agent and/or index sp<strong>on</strong>sor, as the case may be.<br />

Relevant Informati<strong>on</strong>: GS may, by virtue of its status as an underwriter, advisor or otherwise, possess or have access to<br />

informati<strong>on</strong> relating to these Securities, and/or any Underlyings and any derivative instruments referencing them (together<br />

“Relevant Instruments”). GS will not be obliged to disclose any su<strong>ch</strong> Relevant Informati<strong>on</strong> to you.<br />

No Ex<strong>ch</strong>ange Guarantee nor C<strong>on</strong>tract Ownership: These Securities are not guaranteed by an ex<strong>ch</strong>ange nor does it result in the<br />

ownership of any futures c<strong>on</strong>tracts.<br />

No Liquidity: There may be no market for these Securities. An investor must be prepared to hold them until the Maturity Date. GS<br />

may, but is not obliged to, make a market. If it does, it may cease at any time without notice.<br />

Valuati<strong>on</strong>: Assuming no <strong>ch</strong>ange in market c<strong>on</strong>diti<strong>on</strong>s or other factors, the value of these Securities <strong>on</strong> the Repayment Date may<br />

be significantly less than the executi<strong>on</strong> price <strong>on</strong> the trade date. If you unwind your investment early, you may receive less than the<br />

stated redempti<strong>on</strong> amount.<br />

Price Discrepancy: Any price quoted for these Securities by GS may differ significantly from (i) the Securities’ value determined<br />

by reference to GS pricing models and (ii) any price quoted by a third party.<br />

Foreign Ex<strong>ch</strong>ange: Foreign currency denominated Securities are subject to fluctuati<strong>on</strong>s in ex<strong>ch</strong>ange rates that could have an<br />

adverse effect <strong>on</strong> the value or price of, or income derived from, the investment.<br />

DISCLAIMER<br />

C<strong>on</strong>flict of Interests: GS may from time to time be an active participant <strong>on</strong> both sides of the market for the Relevant Instruments at<br />

any time and have l<strong>on</strong>g or short positi<strong>on</strong>s in, or buy and sell Relevant Instruments (<strong>on</strong> a principal basis or otherwise) identical or<br />

related to those menti<strong>on</strong>ed herein. GS’ hedging and trading activities with respect to the Securities may affect the value of other<br />

Relevant Instruments and vice versa. GS may be calculati<strong>on</strong> agent or sp<strong>on</strong>sor of Underlyings and as su<strong>ch</strong> may make<br />

determinati<strong>on</strong>s affecting the value of the Securities.<br />

No Offer: This term sheet is not final. It has been prepared for discussi<strong>on</strong> purposes <strong>on</strong>ly. It is not an offer to buy the Securities<br />

described within or enter into any agreement. Neither GS, nor any of their officers or employees is soliciting any acti<strong>on</strong> based up<strong>on</strong><br />

it. Finalised terms and c<strong>on</strong>diti<strong>on</strong>s are subject to further discussi<strong>on</strong> and negotiati<strong>on</strong> and also to GS internal legal, compliance and<br />

credit approval.<br />

No Representati<strong>on</strong>: GS makes no representati<strong>on</strong>s as to (a) the suitability of the Securities for any particular investor (b) the<br />

appropriate accounting treatment or possible tax c<strong>on</strong>sequences of investing in the Securities or (c) the future performance of the<br />

Securities either in absolute terms or relative to competing investments. Changes in the creditworthiness or performance of the<br />

Securities or any Underlyer may affect the value of the Securities and could result in it redeeming or being valued at zero.<br />

CONTACT/ INFO<br />

Goldman Sa<strong>ch</strong>s Internati<strong>on</strong>al<br />

Ph<strong>on</strong>e +49 (0)69 7532 1122<br />

Homepage http://www.goldman-sa<strong>ch</strong>s.de<br />

E-Mail zertifikate@gs.com<br />

Fax +49 (0)69 7532 1133<br />

Bloomberg GSSD

Not Complete Informati<strong>on</strong>: This term sheet does not completely describe the merits and risks of the Securities and will, if a<br />

transacti<strong>on</strong> results, be superseded by final legal documentati<strong>on</strong> whi<strong>ch</strong> may c<strong>on</strong>tain deemed representati<strong>on</strong>s by investors regarding,<br />

am<strong>on</strong>g other things, offer, resale and hedging of the Securities.<br />

No Advice: This material should not be c<strong>on</strong>strued as investment, financial, strategic, legal, regulatory, accounting or tax advice. It<br />

does not take into account the particular investment objectives, financial situati<strong>on</strong> or needs of individual clients. Certain<br />

transacti<strong>on</strong>s, including those involving futures, opti<strong>on</strong>s and high yield securities, give rise to substantial risk and are not suitable for<br />

all investors. Accordingly clients should c<strong>on</strong>sider whether the Securities described herein are suitable for their particular<br />

circumstances and should c<strong>on</strong>sult their own accounting, tax, investment and legal advisors before investing. GS is acting as an<br />

arm’s-length c<strong>on</strong>tractual counterparty and not as an advisor or fiduciary. GS does not accept any resp<strong>on</strong>sibility to update any<br />

opini<strong>on</strong>s or other informati<strong>on</strong> c<strong>on</strong>tained in this material.<br />

Representati<strong>on</strong>: If a transacti<strong>on</strong> arises as a result of this term sheet you agree that you will not offer, sell or deliver the Securities in<br />

any jurisdicti<strong>on</strong> except under circumstances that will result in compliance with the applicable laws thereof, and that you will take at<br />

your own expense whatever acti<strong>on</strong> is required to permit your pur<strong>ch</strong>ase and resale of the Securities. EEA standard selling<br />

restricti<strong>on</strong>s apply.<br />

European Distributi<strong>on</strong>: This material has been prepared for the recipient by the <strong>Equity</strong> Derivatives Divisi<strong>on</strong> of Goldman Sa<strong>ch</strong>s<br />

Internati<strong>on</strong>al (“GSI”) and is not the product of the resear<strong>ch</strong> department. GSI is authorized and regulated by the Financial Services<br />

Authority.<br />

No prospectus: This document is not, and under no circumstances is to be c<strong>on</strong>strued as a prospectus or advertisement.<br />

Disclosure of Informati<strong>on</strong>: No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means or (ii)<br />

redistributed without GS prior written c<strong>on</strong>sent. However, GS agrees that, subject to applicable law, any and all aspects of the<br />

Securities that are necessary to support any U.S. federal income tax benefits, may be disclosed without GS imposing any limitati<strong>on</strong><br />

of any kind.<br />

No bank deposits: The Securities are not bank deposits insured or guaranteed by the United States Federal Deposit Insurance<br />

Corporati<strong>on</strong>, the Deposit Insurance Fund or any other governmental agency or deposit protecti<strong>on</strong> fund run by public, private or<br />

community banks. The Securities are guaranteed by the Guarantor and the Guarantee will rank pari passu with all other unsecured<br />

and unsubordinated indebtedness of the Guarantor.<br />

SALES RESTRICTION<br />

United States: THIS PRODUCT HAS NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE U.S. SECURITIES ACT OF<br />

1933, AS AMENDED (THE “SECURITIES ACT”). THE SECURITIES MAY NOT BE OFFERED OR SOLD WITHIN THE UNITED<br />

STATES OF AMERICA OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, ANY UNITED STATES PERSONS (AS SUCH TERMS<br />

ARE DEFINED IN THE SECURITIES ACT), UNLESS AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE<br />

SECURITIES ACT IS AVAILABLE. THIS DOCUMENT MAY NOT BE DISTRIBUTED IN THE UNITED STATES.<br />

United Kingdom: This term sheet is for informati<strong>on</strong> purposes <strong>on</strong>ly and does not c<strong>on</strong>stitute an invitati<strong>on</strong> or offer to underwrite,<br />

subscribe for or otherwise acquire or dispose of any securities in any jurisdicti<strong>on</strong>. This term sheet is <strong>on</strong>ly addressed to and directed<br />

at pers<strong>on</strong>s outside the United Kingdom and pers<strong>on</strong>s in the United Kingdom who have professi<strong>on</strong>al experience in matters related to<br />

investments or who are high net worth pers<strong>on</strong>s within article 12(5) of the Financial Services and Markets Act 2000 (Financial<br />

Promoti<strong>on</strong>) Order 2005 (all su<strong>ch</strong> pers<strong>on</strong>s together being referred to as “Relevant Pers<strong>on</strong>s”) and must not be acted <strong>on</strong> or relied <strong>on</strong><br />

by other pers<strong>on</strong>s in the United Kingdom. Any investment or investment activity to whi<strong>ch</strong> this document relates is available <strong>on</strong>ly to<br />

Relevant Pers<strong>on</strong>s and will be engaged in <strong>on</strong>ly with Relevant Pers<strong>on</strong>s. This term sheet is not a prospectus for the purposes of the<br />

prospectus rules of the United Kingdom Financial Services Authority but is an advertisement.<br />

Distributi<strong>on</strong> to other European Ec<strong>on</strong>omic Area (“EEA”) Countries: In relati<strong>on</strong> to ea<strong>ch</strong> member state of the European Ec<strong>on</strong>omic<br />

Area whi<strong>ch</strong> has implemented the Prospectus Directive (ea<strong>ch</strong>, a “Relevant Member State”), ea<strong>ch</strong> pur<strong>ch</strong>aser of the Securities<br />

represents and agrees that with effect from and including the date <strong>on</strong> whi<strong>ch</strong> the Prospectus Directive is implemented in that<br />

Relevant Member State (the “Relevant Implementati<strong>on</strong> Date”) it has not made and will not make an offer of the Securities to the<br />

public in that Relevant Member State prior to the publicati<strong>on</strong> of a prospectus in relati<strong>on</strong> to the Securities whi<strong>ch</strong> has been approved<br />

by the competent authority in that Relevant Member State or, where appropriate, approved in another Relevant Member State and<br />

notified to the competent authority in that Relevant Member State, all in accordance with the Prospectus Directive, except that it<br />

may, with effect from and including the Relevant Implementati<strong>on</strong> Date, make an offer of Securities to the public in that Relevant<br />

Member State:<br />

� to any legal entity whi<strong>ch</strong> is a qualified investor as defined in the Prospectus Directive;<br />

� to fewer than 100 or, if the Relevant Member State has implemented the relevant provisi<strong>on</strong> of the 2010 PD Amending<br />

Directive, 150, natural or legal pers<strong>on</strong>s (other than qualified investors as defined in the Prospectus Directive);<br />

� in any other circumstances falling within Article 3(2) of the Prospectus Directive,<br />

provided that no su<strong>ch</strong> offer of Securities shall require GS to publish a prospectus pursuant to Article 3 of the Prospectus Directive or<br />

supplement a prospectus pursuant to Article 16 of the Prospectus Directive.<br />

For the purposes of the provisi<strong>on</strong> above, the expressi<strong>on</strong> an “offer of Securities to the public” in relati<strong>on</strong> to any Securities in any<br />

Relevant Member State means the communicati<strong>on</strong> in any form and by any means of sufficient informati<strong>on</strong> <strong>on</strong> the terms of the offer<br />

and the Securities to be offered so as to enable an investor to decide to pur<strong>ch</strong>ase or subscribe the Securities, as the same may be<br />

CONTACT/ INFO<br />

Goldman Sa<strong>ch</strong>s Internati<strong>on</strong>al<br />

Ph<strong>on</strong>e +49 (0)69 7532 1122<br />

Homepage http://www.goldman-sa<strong>ch</strong>s.de<br />

E-Mail zertifikate@gs.com<br />

Fax +49 (0)69 7532 1133<br />

Bloomberg GSSD

varied in that Member State by any measure implementing the Prospectus Directive in that Member State the expressi<strong>on</strong><br />

“Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the<br />

extent implemented in the Relevant Member State) and includes any relevant implementing measure in the Relevant Member State<br />

and the expressi<strong>on</strong> “2010 PD Amending Directive” means Directive 2010/73/EC.<br />

In c<strong>on</strong>necti<strong>on</strong> with its distributi<strong>on</strong> in the United Kingdom and the European Ec<strong>on</strong>omic Area, this material has been issued and approved by<br />

Goldman Sa<strong>ch</strong>s Internati<strong>on</strong>al whi<strong>ch</strong> is authorized and regulated by the Financial Services Authority; it is not a resear<strong>ch</strong> report and not a product<br />

of the Goldman Sa<strong>ch</strong>s resear<strong>ch</strong> department.<br />

CONTACT/ INFO<br />

Goldman Sa<strong>ch</strong>s Internati<strong>on</strong>al<br />

Ph<strong>on</strong>e +49 (0)69 7532 1122<br />

Homepage http://www.goldman-sa<strong>ch</strong>s.de<br />

E-Mail zertifikate@gs.com<br />

Fax +49 (0)69 7532 1133<br />

Bloomberg GSSD