You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

charged in the income statement and the net interest paid in the statement of cash flows for<br />

2011 by £0.6 million (FY 2010: £0.1 million; FY 2009: £2.3 million). Similarly, for 2011, a<br />

100 basis point increase in market interest rates would result in a decrease of £10.9 million<br />

(FY 2010: £11.5 million; FY 2009: £3.2 million) in the fair value of <strong>Vesuvius</strong>’ net debt and<br />

a 100 basis point decrease in market interest rates would result in an increase of<br />

£11.7 million (FY 2010: £12.3 million; FY 2009: £3.3 million) in the fair value of<br />

<strong>Vesuvius</strong>’ net debt.<br />

(b) Liquidity risk<br />

Liquidity risk is the risk that <strong>Vesuvius</strong> might have difficulties in meeting its financial<br />

obligations. <strong>Vesuvius</strong> manages this risk by ensuring that it maintains sufficient levels of<br />

committed borrowing facilities and cash and cash equivalents to ensure that it can meet its<br />

operational cash flow requirements and any maturing financial liabilities, while at all times<br />

operating within its financial covenants. The level of operational headroom provided by<br />

<strong>Vesuvius</strong>’ committed borrowing facilities is reviewed at least annually as part of <strong>Vesuvius</strong>’<br />

three year planning process. Where this process indicates a need for additional finance, this<br />

is normally addressed 12 to 18 months in advance by means of either additional committed<br />

bank facilities or raising finance in the capital markets.<br />

As at 31 December 2011, <strong>Vesuvius</strong> had committed borrowing facilities of £883.7 million<br />

(FY 2010: £855.4 million; FY 2009: £876.2 million), of which £339.5 million (FY 2010:<br />

£350.0 million; FY 2009: £350.0 million) were undrawn. <strong>Vesuvius</strong>’ borrowing<br />

requirements were met by $440m of issued US Private Placement loan notes (“USPP”) and<br />

a multi-currency committed syndicated bank facility of £600 million (FY 2010: £573.2<br />

million; FY 2009: £674.9 million). The USPP loan notes were repayable $190 million in<br />

May 2012, $110 million in FY 2017, and $140 million in FY 2020. The syndicated bank<br />

facility comprises a £600 million revolving credit facility. The facility is repayable in April<br />

2016. The commitment will reduce from £600 million to £425 million from the date of the<br />

Demerger.<br />

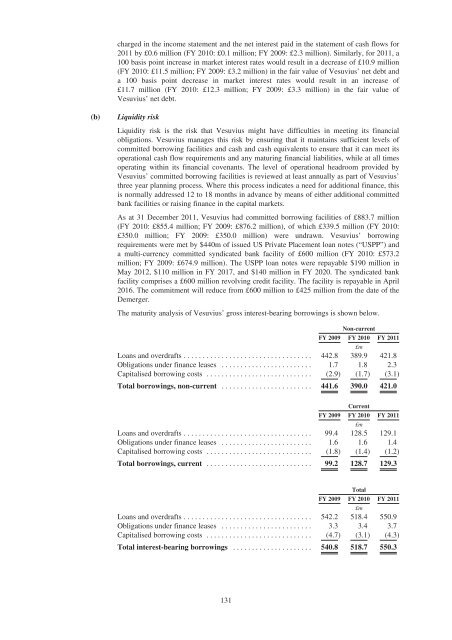

The maturity analysis of <strong>Vesuvius</strong>’ gross interest-bearing borrowings is shown below.<br />

FY 2009<br />

Non-current<br />

FY 2010<br />

£m<br />

FY 2011<br />

Loans and overdrafts .................................. 442.8 389.9 421.8<br />

Obligations under finance leases ........................ 1.7 1.8 2.3<br />

Capitalised borrowing costs ............................ (2.9) (1.7) (3.1)<br />

Total borrowings, non-current ........................ 441.6 390.0 421.0<br />

Current<br />

FY 2009 FY 2010 FY 2011<br />

£m<br />

Loans and overdrafts .................................. 99.4 128.5 129.1<br />

Obligations under finance leases ........................ 1.6 1.6 1.4<br />

Capitalised borrowing costs ............................ (1.8) (1.4) (1.2)<br />

Total borrowings, current ............................ 99.2 128.7 129.3<br />

Total<br />

FY 2009 FY 2010 FY 2011<br />

£m<br />

Loans and overdrafts .................................. 542.2 518.4 550.9<br />

Obligations under finance leases ........................ 3.3 3.4 3.7<br />

Capitalised borrowing costs ............................ (4.7) (3.1) (4.3)<br />

Total interest-bearing borrowings ..................... 540.8 518.7 550.3<br />

131