BOARD MEETING MINUTES Iowa Finance Authority Presentation ...

BOARD MEETING MINUTES Iowa Finance Authority Presentation ...

BOARD MEETING MINUTES Iowa Finance Authority Presentation ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Darlys Baum, Vice Chair<br />

Carmela Brown, Treasurer<br />

Heather Armstrong<br />

David Greenspon<br />

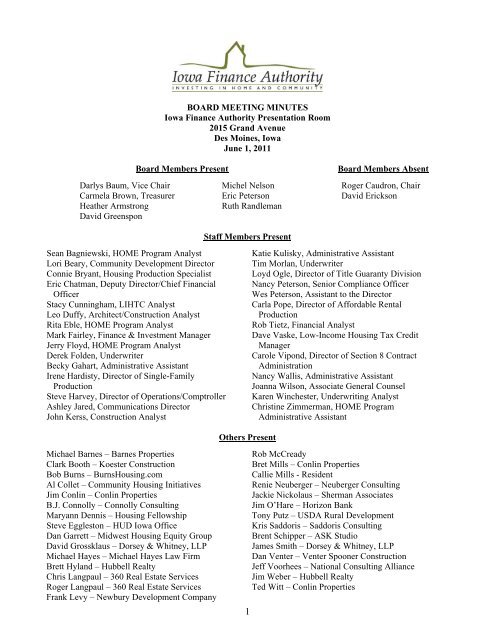

<strong>BOARD</strong> <strong>MEETING</strong> <strong>MINUTES</strong><br />

<strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> <strong>Presentation</strong> Room<br />

2015 Grand Avenue<br />

Des Moines, <strong>Iowa</strong><br />

June 1, 2011<br />

Board Members Present Board Members Absent<br />

Sean Bagniewski, HOME Program Analyst<br />

Lori Beary, Community Development Director<br />

Connie Bryant, Housing Production Specialist<br />

Eric Chatman, Deputy Director/Chief Financial<br />

Officer<br />

Stacy Cunningham, LIHTC Analyst<br />

Leo Duffy, Architect/Construction Analyst<br />

Rita Eble, HOME Program Analyst<br />

Mark Fairley, <strong>Finance</strong> & Investment Manager<br />

Jerry Floyd, HOME Program Analyst<br />

Derek Folden, Underwriter<br />

Becky Gahart, Administrative Assistant<br />

Irene Hardisty, Director of Single-Family<br />

Production<br />

Steve Harvey, Director of Operations/Comptroller<br />

Ashley Jared, Communications Director<br />

John Kerss, Construction Analyst<br />

Michael Barnes – Barnes Properties<br />

Clark Booth – Koester Construction<br />

Bob Burns – BurnsHousing.com<br />

Al Collet – Community Housing Initiatives<br />

Jim Conlin – Conlin Properties<br />

B.J. Connolly – Connolly Consulting<br />

Maryann Dennis – Housing Fellowship<br />

Steve Eggleston – HUD <strong>Iowa</strong> Office<br />

Dan Garrett – Midwest Housing Equity Group<br />

David Grossklaus – Dorsey & Whitney, LLP<br />

Michael Hayes – Michael Hayes Law Firm<br />

Brett Hyland – Hubbell Realty<br />

Chris Langpaul – 360 Real Estate Services<br />

Roger Langpaul – 360 Real Estate Services<br />

Frank Levy – Newbury Development Company<br />

Michel Nelson<br />

Eric Peterson<br />

Ruth Randleman<br />

Staff Members Present<br />

Others Present<br />

1<br />

Roger Caudron, Chair<br />

David Erickson<br />

Katie Kulisky, Administrative Assistant<br />

Tim Morlan, Underwriter<br />

Loyd Ogle, Director of Title Guaranty Division<br />

Nancy Peterson, Senior Compliance Officer<br />

Wes Peterson, Assistant to the Director<br />

Carla Pope, Director of Affordable Rental<br />

Production<br />

Rob Tietz, Financial Analyst<br />

Dave Vaske, Low-Income Housing Tax Credit<br />

Manager<br />

Carole Vipond, Director of Section 8 Contract<br />

Administration<br />

Nancy Wallis, Administrative Assistant<br />

Joanna Wilson, Associate General Counsel<br />

Karen Winchester, Underwriting Analyst<br />

Christine Zimmerman, HOME Program<br />

Administrative Assistant<br />

Rob McCready<br />

Bret Mills – Conlin Properties<br />

Callie Mills - Resident<br />

Renie Neuberger – Neuberger Consulting<br />

Jackie Nickolaus – Sherman Associates<br />

Jim O’Hare – Horizon Bank<br />

Tony Putz – USDA Rural Development<br />

Kris Saddoris – Saddoris Consulting<br />

Brent Schipper – ASK Studio<br />

James Smith – Dorsey & Whitney, LLP<br />

Dan Venter – Venter Spooner Construction<br />

Jeff Voorhees – National Consulting Alliance<br />

Jim Weber – Hubbell Realty<br />

Ted Witt – Conlin Properties

Call to Order<br />

Vice Chair Baum called to order the June 1, 2011, regular monthly meeting of the <strong>Iowa</strong> <strong>Finance</strong><br />

<strong>Authority</strong> (IFA) Board of Directors at 11:02 a.m. Roll call was taken and a quorum was established with<br />

the following Board members present: Armstrong, Baum, Brown, Greenspon, Nelson, Peterson and<br />

Randleman.<br />

Review of Minutes<br />

May 3, 2011, Board Training Session<br />

Vice Chair Baum introduced the minutes of the May 3, 2011, training session of the IFA Board of<br />

Directors.<br />

MOTION: On a motion by Ms. Randleman and a second by Mr. Peterson, the Board approved the<br />

minutes of the May 3, 2011, training session of the IFA Board.<br />

May 4, 2011, Board Meeting<br />

Vice Chair Baum introduced the minutes of the May 4, 2011, regular monthly meeting of the IFA Board<br />

of Directors.<br />

MOTION: On a motion by Mr. Nelson and a second by Ms. Armstrong, the Board approved the<br />

minutes of the May 4, 2011, regular monthly meeting of the IFA Board.<br />

Housing<strong>Iowa</strong><br />

AFFORDABLE RENTAL PRODUCTION<br />

Resolution HI 11-04, 2011 Low-Income Housing Tax Credit (LIHTC) & HOME Awards<br />

Mr. Vaske thanked the developers who submitted applications for the current funding round. He then<br />

introduced the tax credit staff and briefly explained the process used to review and score the<br />

applications.<br />

Mr. Vaske introduced the resolution allocating joint awards under the Low-Income Housing Tax Credit<br />

Program and the HOME Program. He highlighted the projects recommended for funding by using a<br />

PowerPoint presentation to share basic information about each project.<br />

MOTION: Ms. Armstrong made a motion to approve the resolution authorizing the award of 2011 tax<br />

credits and HOME Program funding to the projects listed on Exhibit A of the resolution. On a second by<br />

Mr. Greenspon, a vote was taken with the following results: YES: Armstrong, Baum, Brown,<br />

Greenspon, Nelson and Peterson; No: None; ABSTAIN: Randleman. Ms. Randleman submitted a<br />

letter stating that prior to being appointed to the IFA Board, she had signed, as Mayor of Carlisle, a<br />

letter of support for a project in Carlisle that applied for tax credits. [See attached letter]. The Board<br />

approved Resolution HI 11-04 on a majority vote.<br />

Resolution HI 11-05, HOME Awards<br />

Ms. Pope introduced the HOME staff who reviewed and scored all applications for HOME funding,<br />

including those requesting LIHTC funding and those requesting only HOME funds. She reviewed the<br />

statistics of the 11 projects recommended for funding and said that those 11 projects will serve 184<br />

households with a total of $3,534,407 in funding.<br />

MOTION: Mr. Nelson made a motion to approve the resolution allocating 2011 HOME Program<br />

funding to the projects listed on Exhibit A of the resolution. On a second by Mr. Greenspon, the Board<br />

unanimously approved Resolution HI 11-05.<br />

2

Administration<br />

SUMMARY & OVERVIEW<br />

In the absence of Director Jamison, there was no report.<br />

ACCOUNTING AND FINANCE<br />

Review of Financial Statement<br />

Mr. Harvey presented the April 2011 financial results, reporting that as a housing agency, year-to-date<br />

net operating income of $8,999,091 is favorable to budget by $4,391,670.<br />

Mr. Harvey noted that State Revolving Fund year-to-date net operating income of $39,557,152 is<br />

$14,328,057 favorable to budget.<br />

MOTION: On a motion by Ms. Brown and a second by Ms. Armstrong, the Board unanimously<br />

accepted the April 2011 financial statement.<br />

Review of FY12 Budget<br />

Mr. Harvey introduced the proposed IFA budget for FY12 by presenting brief details for IFA as a<br />

housing agency and for the State Revolving Fund (SRF) Program. Mr. Harvey explained that the budget<br />

for IFA as a housing agency is based on a net operating income of $6.2 million, which is 37 percent<br />

below the FY11 forecast. He stated that the SRF budget is based on a net operating income of $23.7<br />

million.<br />

MOTION: On a motion by Mr. Peterson and a second by Ms. Randleman, the Board unanimously<br />

approved the budget for FY12.<br />

Resolution FIN 11-08, Authorizing Proceedings for Single-Family Bond Issue – New Issue Bond<br />

Program (NIBP)<br />

Mr. Fairley reminded the Board that IFA is a participant in the US Treasury Department’s New Issue<br />

Bond Program, under which Housing <strong>Finance</strong> Agencies may issue bonds to be sold to the US Treasury<br />

at favorable rates. He stated that IFA has accumulated sufficient amounts ($42 million) of single-family<br />

mortgage reservations to issue a bond to fund the mortgages. Mr. Fairley provided details of the<br />

proposed structure and timing of the bond issue, which is expected to be not more than $80 million of<br />

tax-exempt bonds. He said the total is more likely to be $40 – $50 million and will be priced in June<br />

2011 and closed in July 2011.<br />

MOTION: Ms. Brown made a motion to approve the resolution adopting and approving Series<br />

Resolutions relating to Single-Family Mortgage Revenue Bonds (Mortgage-Backed Securities Program)<br />

and authorizing the issuance, sale and delivery of IFA’s Single-Family Mortgage Revenue Bonds<br />

pursuant to such Series Resolutions; authorizing the execution and delivery of one or more Purchase<br />

Contracts and a Continuing Disclosure Agreement; authorizing the release of proceeds and establishing<br />

certain terms of not to exceed [$48,000,000] of Single-Family Mortgage Revenue Bonds, 2009 Series 3;<br />

and delegating certain responsibilities to the Executive Director for finalizing certain matters, forms and<br />

contents of certain documents. On a second by Mr. Nelson, the Board unanimously approved Resolution<br />

FIN 11-08.<br />

LEGAL<br />

Notice of Intended Action: Military Homeownership Assistance (MHOA) Program<br />

Ms. Hardisty explained that the IFA Board approved rules for the MHOA Program in 2010, but that an<br />

error was made in the copy when the rules were submitted. She explained that because of that error, staff<br />

is asking the Board to approve a Notice of Intended Action to make some amendments. Ms. Hardisty<br />

said the two changes relate to the retroactive period for facilitating lenders participating in the program,<br />

and the allowance for a potential home buyer to use alternate financing if that person did not qualify for<br />

a fixed rate, fully amortizing mortgage.<br />

3

MOTION: On a motion by Mr. Greenspon and a second by Ms. Armstrong, the Board unanimously<br />

approved the Notice of Intended Action for the Military Homeownership Assistance Program.<br />

LEGISLATIVE<br />

Mr. Peterson briefly reviewed legislation that had changed slightly since his last report. He said that<br />

since the Legislature has been busy with the budget, there has been very little movement on any other<br />

legislation recently.<br />

Mr. Peterson reported that the Board materials included a copy of a letter that was sent by Governor<br />

Branstad to every member of the <strong>Iowa</strong> delegation requesting that they seek an extension for the<br />

Midwestern Disaster Area Bond deadline, which is set to expire at the end of 2012.<br />

COMMUNICATIONS<br />

Ms. Jared introduced Ms. Becky Gahart, who has been an intern with IFA and will now be working<br />

part-time in communications and part-time with the I-JOBS program.<br />

Ms. Jared announced that IFA has submitted an application to participate in HUD’s Emergency<br />

Homeowner Loan Program (EHLP). She said IFA should receive a response by mid-June and that the<br />

program must be initiated by July 1. Ms. Jared noted that the program should assist about 577<br />

homeowners in <strong>Iowa</strong> who are at risk of foreclosure.<br />

Ms. Jared reported that the work with Strategic America on branding and logo options is progressing<br />

well.<br />

Ms. Jared reminded the Board and guests that IFA’s 2011 Housing<strong>Iowa</strong> Conference will be held<br />

September 7-8 at the Des Moines Marriott Downtown, featuring both educational sessions and<br />

nationally renowned professional development training session that will be available to attendees for the<br />

price of registration. She stated that Liz Bramlet would present sessions focusing primarily on tax credit<br />

compliance, while the National Center for Housing Management (NCHM) would provide sessions on<br />

fair housing, Section 8 Contract Administration compliance, and HUD’s new Enterprise Income<br />

Verification (EIV) system.<br />

Community Development Programs<br />

ECONOMIC DEVELOPMENT LOAN PROGRAM<br />

Resolution ED 11-12A, GMT Corporation Project<br />

Ms. Beary introduced an application and inducement resolution for $14,445,000 of <strong>Iowa</strong> <strong>Finance</strong><br />

<strong>Authority</strong> Economic Development Revenue Bonds for the GMT Corporation Project in Waverly and<br />

<strong>Iowa</strong> City. She said the bonds will be used to construct a new building and for the purchase of<br />

equipment. Ms. Beary explained that GMT Corporation is a contract manufacturer specializing in<br />

machining large iron castings and the fabrication of large steel assemblies. She noted that the project<br />

will require an allocation of Midwestern Disaster Area Bonds.<br />

MOTION: Mr. Greenspon made a motion to adopt the resolution approving an application for<br />

$14,445,000 of <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Economic Development Revenue Bonds (GMT Corporation<br />

Project), Series 2011, for GMT Corporation or a related party (the “Borrower”), and evidencing the<br />

intent to proceed with the issuance of $14,445,000 of Economic Development Revenue Bonds. On a<br />

second by Ms. Armstrong, the Board unanimously adopted Resolution ED 11-12A.<br />

Resolution ED 11-13A, Eddyville Chlor-Alkali Project<br />

Ms. Beary introduced an application and inducement resolution for $130,000,000 of <strong>Iowa</strong> <strong>Finance</strong><br />

<strong>Authority</strong> Midwestern Disaster Area Revenue Bonds for the Eddyville Chlor-Alkali Project for Harris &<br />

4

Ford, LLC. She reported that the bonds will be used to construct a chlor-alkali manufacturing facility for<br />

the production of caustic soda, hydrochloric acid and bleach, and that the plant will be constructed near<br />

the Cargill facility in Eddyville who will be a significant customer for the products. Ms. Beary noted<br />

that Harris & Ford, whose corporate headquarters is located in Indianapolis, Indiana, is a major<br />

distributor of chemicals, ingredients and related products to food, cosmetic, pharmaceutical, water and<br />

industrial customers. She said that the project will require an allocation of Midwestern Disaster Area<br />

Bonds.<br />

MOTION: Mr. Peterson made a motion to adopt the resolution approving an application for<br />

$130,000,000 of <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Midwestern Disaster Area Revenue Bonds (Eddyville—Chlor-<br />

Alkali Project), Series 2011, for Harris & Ford, LLC (the “Borrower”), and evidencing the intent to<br />

proceed with the issuance of $130,000,000 of Midwestern Disaster Area Revenue Bonds. On a second<br />

by Ms. Brown, the Board unanimously adopted Resolution ED 11-13A.<br />

Resolution ED 11-14A, Diocese of Sioux City Project<br />

Ms. Beary introduced an application and inducement resolution for $9,955,000 of <strong>Iowa</strong> <strong>Finance</strong><br />

<strong>Authority</strong> Revenue Bonds for the Diocese of Sioux City. She said the bonds will be used to refinance<br />

outstanding bonds issued in 1999 and 2000. Ms. Beary explained that because The Diocese of Sioux<br />

City is a 501c(3) nonprofit corporation, the project will not require an allocation of Private Activity<br />

Bond Cap.<br />

MOTION: Ms. Armstrong made a motion to adopt the resolution approving an application for<br />

$9,955,000 of <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Nonprofit Facility Revenue Refunding Bonds (Diocese of Sioux<br />

City Project), Series 2011, for Diocese of Sioux City (the “Borrower”), and evidencing the intent to<br />

proceed with the issuance of $9,955,000 of Nonprofit Facility Revenue Refunding Bonds. On a second<br />

by Ms. Randleman, the Board unanimously adopted Resolution ED 11-14A.<br />

Public Hearing for ED Loan 11-06, Cargill Construction Project<br />

Ms. Beary asked the Board to hold a public hearing regarding the issuance of an amount not to exceed<br />

$200,000,000 of <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Midwestern Disaster Area Economic Development Revenue<br />

Bonds for the Cargill, Incorporated Project. She stated that the bonds will be used for the acquisition,<br />

construction and/or expansion of facilities in Bloomfield, Ottumwa, Cedar Rapids, Eddyville, Fort<br />

Dodge and Mason City. Ms. Beary noted that the Board adopted the inducement resolution on May 4,<br />

2011.<br />

Vice Chair Baum opened the public hearing at 12:05 p.m. regarding the issuance of an amount not to<br />

exceed $200,000,000 of <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Midwestern Disaster Area Economic Development<br />

Revenue Bonds for the Cargill, Incorporated Project. Ms. Beary said IFA had received no verbal or<br />

written comments regarding the project. There being no comments from the audience, Vice Chair Baum<br />

closed the public hearing at 12:06 p.m.<br />

Resolution ED 11-06B, Cargill Construction and Expansion Project<br />

Ms. Beary distributed a revised version of Resolution ED 11-06B, noting that a minor change had been<br />

made in the sixth paragraph on page 2 in the name of the Borrower’s Representative.<br />

Ms. Beary introduced the resolution for $200,000,000 <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Midwestern Disaster<br />

Area Economic Development Revenue Bonds for the Cargill, Incorporated Project. She said the project<br />

will require an allocation of Midwestern Disaster Area Bonds.<br />

MOTION: Mr. Nelson made a motion to adopt the resolution authorizing the issuance in one or more<br />

series of not to exceed $200,000,000 of <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Midwestern Disaster Area Economic<br />

Development Revenue Bonds (Cargill, Incorporated Project), Series 2011A and Series 2011B, for the<br />

5

purpose of making a loan to assist the borrower in the acquisition, construction and equipping of a<br />

project; authorizing the execution and delivery of certain financing documents pertaining to the project;<br />

authorizing an assignment of certain financing documents for further securing the payment of the bonds;<br />

authorizing the sale of the bonds; authorizing the appointment of a trustee; and related matters. On a<br />

second by Ms. Armstrong, the Board unanimously adopted Resolution ED 11-06B.<br />

Public Hearing for ED Loan 11-07, Kahl Home Project<br />

Ms. Beary asked the Board to hold a public hearing regarding the issuance of an amount not to exceed<br />

$26,000,000 of <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Variable Rate Health Facility Revenue Bonds for the Kahl<br />

Home Project in Davenport. She reported that the bonds will be used to construct a new 135-bed skilled<br />

nursing facility, and that the borrower is Kahl Home for the Aged and Infirm, a 501c(3) nonprofit<br />

corporation. Ms. Beary noted that the Board adopted the inducement resolution on May 4, 2011.<br />

Vice Chair Baum opened the public hearing at 12:08 p.m. regarding the issuance of an amount not to<br />

exceed $26,000,000 of <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Variable Rate Health Facility Revenue Bonds for the<br />

Kahl Home Project in Davenport. Ms. Beary said IFA had received no verbal or written comments<br />

regarding the project. There being no comments from the audience, Vice Chair Baum closed the public<br />

hearing at 12:09 p.m.<br />

Resolution ED 11-07B, Kahl Home Project<br />

Ms. Beary introduced a resolution for $26,000,000 of <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Variable Rate Health<br />

Facility Revenue Bonds for the Kahl Home Project in Davenport.<br />

MOTION: Ms. Randleman made a motion to adopt the resolution authorizing the issuance of not to<br />

exceed $26,000,000 of <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Variable Rate Health Facility Bonds (The Kahl Home<br />

Project), Series 2011, for the purpose of making a loan to assist the borrower in the acquisition,<br />

construction and equipping of a project; authorizing the execution and delivery of certain financing<br />

documents pertaining to the project; authorizing an assignment of certain financing documents for<br />

further securing the payment of the bonds; authorizing the sale of the bonds; authorizing the<br />

appointment of a trustee; and related matters. On a second by Mr. Peterson, the Board unanimously<br />

adopted Resolution ED 11-07B.<br />

Public Hearing for ED Loan 11-10, Solon Nursing Care Center Project<br />

Ms. Beary asked the Board to hold a public hearing regarding the issuance of an amount not to exceed<br />

$3,600,000 of <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Midwestern Disaster Area Revenue Bonds for the Solon Nursing<br />

Care Center Project. She explained that the bonds will be used to construct a 12-bed skilled nursing unit<br />

and a 12-bed dementia unit connected to the borrower’s existing facility in addition to remodeling the<br />

current kitchen and dining room. Ms. Beary said the Board approved the inducement resolution on May<br />

4, 2011.<br />

Vice Chair Baum opened the public hearing at 12:10 p.m. regarding the issuance of an amount not to<br />

exceed $3,600,000 of <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Midwestern Disaster Area Revenue Bonds for the Solon<br />

Nursing Care Center Project. Ms. Beary said IFA had received no verbal or written comments regarding<br />

the project. There being no comments from the audience, Vice Chair Baum closed the public hearing at<br />

12:11 p.m.<br />

Resolution ED 11-10B, Solon Nursing Care Center Project<br />

Ms. Beary introduced a resolution for $3,600,000 of <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong> Midwestern Disaster Area<br />

Revenue Bonds for the Solon Nursing Care Center Project. She noted that the project will require an<br />

allocation of Midwestern Disaster Area Bonds.<br />

6

MOTION: Ms. Armstrong made a motion to adopt the resolution authorizing the issuance of not to<br />

exceed $3,600,000 of Midwestern Disaster Area Revenue Bonds (Solon Nursing Care Center Inc.<br />

Project) for the purpose of making a loan to assist the borrower in the acquisition and construction of a<br />

project; authorizing the execution and delivery of certain financing documents pertaining to the project;<br />

authorizing an assignment of certain financing documents for further securing the payment of the bonds;<br />

authorizing the sale of the bonds; and related matters. On a second by Ms. Brown, the Board voted<br />

unanimously to adopt Resolution ED 11-10B.<br />

Title Guaranty Division (TGD)<br />

Mr. Ogle reported that TG’s revenue this fiscal year has exceeded the previous fiscal year at least 9 of<br />

the past 11 months. He said the commercial business also continues to grow.<br />

Mr. Ogle announced that TGD would hold its annual Settlement Services Conference on June 23, 2011,<br />

at the Sheraton West Des Moines.<br />

Miscellaneous Items<br />

Receive Comments from General Public<br />

Vice Chair Baum opened the public comment period and asked if anyone in the audience would like to<br />

address the Board. There being no audience members wishing to address the Board, Vice Chair Baum<br />

closed the public comment period.<br />

Adjournment<br />

There being no further business, on a motion by Ms. Armstrong and a second by Ms. Randleman, the<br />

June 1, 2011, meeting of the IFA Board of Directors adjourned at 12:17 p.m.<br />

Dated this 6th day of July 2011.<br />

Respectfully submitted: Approved as to form:<br />

David D. Jamison Roger J. Caudron, Chair<br />

Executive Director/Board Secretary <strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong><br />

<strong>Iowa</strong> <strong>Finance</strong> <strong>Authority</strong><br />

S:\Administration\Board\Minutes\Minutes 2011\6-1-11Minutes.doc<br />

7