CPT V24P7-Art1 (Content).pmd - Taxmann

CPT V24P7-Art1 (Content).pmd - Taxmann

CPT V24P7-Art1 (Content).pmd - Taxmann

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

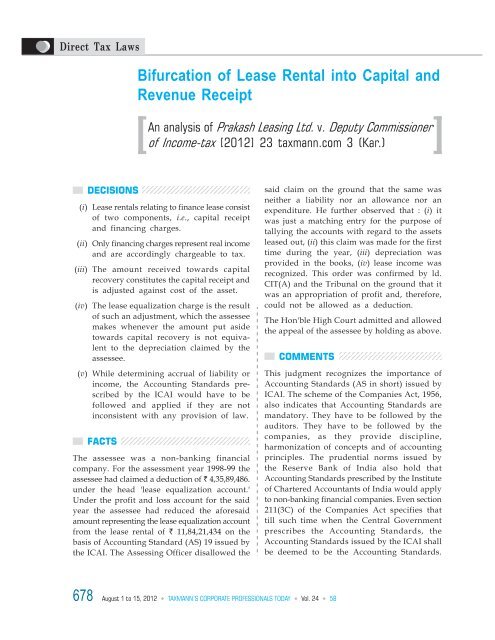

Direct Tax Laws<br />

678<br />

DECISIONS<br />

Bifurcation of Lease Rental into Capital and<br />

Revenue Receipt<br />

An analysis of Prakash Leasing Ltd. v. Deputy Commissioner<br />

of Income-tax [2012] 23 taxmann.com 3 (Kar.)<br />

(i) Lease rentals relating to finance lease consist<br />

of two components, i.e., capital receipt<br />

and financing charges.<br />

(ii) Only financing charges represent real income<br />

and are accordingly chargeable to tax.<br />

(iii) The amount received towards capital<br />

recovery constitutes the capital receipt and<br />

is adjusted against cost of the asset.<br />

(iv) The lease equalization charge is the result<br />

of such an adjustment, which the assessee<br />

makes whenever the amount put aside<br />

towards capital recovery is not equivalent<br />

to the depreciation claimed by the<br />

assessee.<br />

(v) While determining accrual of liability or<br />

income, the Accounting Standards prescribed<br />

by the ICAI would have to be<br />

followed and applied if they are not<br />

inconsistent with any provision of law.<br />

FACTS<br />

12345678901234567890123456<br />

12345678901234567890123456<br />

12345678901234567890123456<br />

1234567890123456789012345678901<br />

1234567890123456789012345678901<br />

1234567890123456789012345678901<br />

The assessee was a non-banking financial<br />

company. For the assessment year 1998-99 the<br />

assessee had claimed a deduction of ` 4,35,89,486.<br />

under the head 'lease equalization account.'<br />

Under the profit and loss account for the said<br />

year the assessee had reduced the aforesaid<br />

amount representing the lease equalization account<br />

from the lease rental of ` 11,84,21,434 on the<br />

basis of Accounting Standard (AS) 19 issued by<br />

the ICAI. The Assessing Officer disallowed the<br />

said claim on the ground that the same was<br />

neither a liability nor an allowance nor an<br />

expenditure. He further observed that : (i) it<br />

was just a matching entry for the purpose of<br />

tallying the accounts with regard to the assets<br />

leased out, (ii) this claim was made for the first<br />

time during the year, (iii) depreciation was<br />

provided in the books, (iv) lease income was<br />

recognized. This order was confirmed by ld.<br />

CIT(A) and the Tribunal on the ground that it<br />

was an appropriation of profit and, therefore,<br />

could not be allowed as a deduction.<br />

The Hon'ble High Court admitted and allowed<br />

the appeal of the assessee by holding as above.<br />

COMMENTS<br />

August 1 to 15, 2012 u TAXMANN’S CORPORATE PROFESSIONALS TODAY u Vol. 24 u 58<br />

1234567890123456789012345<br />

1234567890123456789012345<br />

1234567890123456789012345<br />

This judgment recognizes the importance of<br />

Accounting Standards (AS in short) issued by<br />

ICAI. The scheme of the Companies Act, 1956,<br />

also indicates that Accounting Standards are<br />

mandatory. They have to be followed by the<br />

auditors. They have to be followed by the<br />

companies, as they provide discipline,<br />

harmonization of concepts and of accounting<br />

principles. The prudential norms issued by<br />

the Reserve Bank of India also hold that<br />

Accounting Standards prescribed by the Institute<br />

of Chartered Accountants of India would apply<br />

to non-banking financial companies. Even section<br />

211(3C) of the Companies Act specifies that<br />

till such time when the Central Government<br />

prescribes the Accounting Standards, the<br />

Accounting Standards issued by the ICAI shall<br />

be deemed to be the Accounting Standards.

![“FORM NO. 3CEB [See rule 10E] Report from an ... - Taxmann](https://img.yumpu.com/45480232/1/190x245/form-no-3ceb-see-rule-10e-report-from-an-taxmann.jpg?quality=85)