CPT V24P7-Art1 (Content).pmd - Taxmann

CPT V24P7-Art1 (Content).pmd - Taxmann

CPT V24P7-Art1 (Content).pmd - Taxmann

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

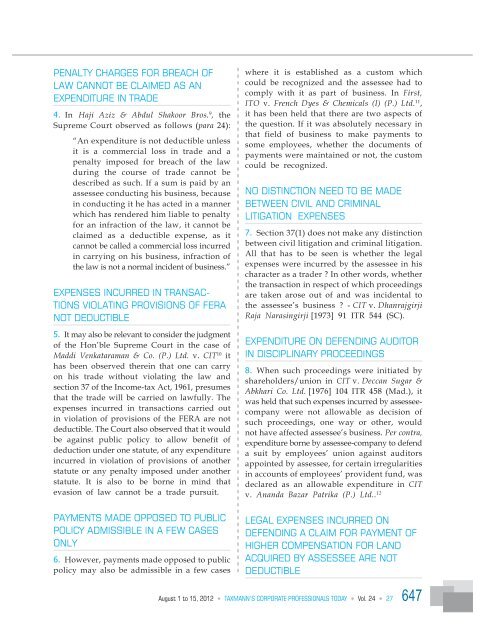

PENALTY CHARGES FOR BREACH OF<br />

LAW CANNOT BE CLAIMED AS AN<br />

EXPENDITURE IN TRADE<br />

4. In Haji Aziz & Abdul Shakoor Bros. 9 , the<br />

Supreme Court observed as follows (para 24):<br />

“An expenditure is not deductible unless<br />

it is a commercial loss in trade and a<br />

penalty imposed for breach of the law<br />

during the course of trade cannot be<br />

described as such. If a sum is paid by an<br />

assessee conducting his business, because<br />

in conducting it he has acted in a manner<br />

which has rendered him liable to penalty<br />

for an infraction of the law, it cannot be<br />

claimed as a deductible expense, as it<br />

cannot be called a commercial loss incurred<br />

in carrying on his business, infraction of<br />

the law is not a normal incident of business.”<br />

EXPENSES INCURRED IN TRANSAC-<br />

TIONS VIOLATING PROVISIONS OF FERA<br />

NOT DEDUCTIBLE<br />

5. It may also be relevant to consider the judgment<br />

of the Hon’ble Supreme Court in the case of<br />

Maddi Venkataraman & Co. (P.) Ltd. v. CIT 10 it<br />

has been observed therein that one can carry<br />

on his trade without violating the law and<br />

section 37 of the Income-tax Act, 1961, presumes<br />

that the trade will be carried on lawfully. The<br />

expenses incurred in transactions carried out<br />

in violation of provisions of the FERA are not<br />

deductible. The Court also observed that it would<br />

be against public policy to allow benefit of<br />

deduction under one statute, of any expenditure<br />

incurred in violation of provisions of another<br />

statute or any penalty imposed under another<br />

statute. It is also to be borne in mind that<br />

evasion of law cannot be a trade pursuit.<br />

PAYMENTS MADE OPPOSED TO PUBLIC<br />

POLICY ADMISSIBLE IN A FEW CASES<br />

ONLY<br />

6. However, payments made opposed to public<br />

policy may also be admissible in a few cases<br />

where it is established as a custom which<br />

could be recognized and the assessee had to<br />

comply with it as part of business. In First,<br />

ITO v. French Dyes & Chemicals (I) (P.) Ltd. 11 ,<br />

it has been held that there are two aspects of<br />

the question. If it was absolutely necessary in<br />

that field of business to make payments to<br />

some employees, whether the documents of<br />

payments were maintained or not, the custom<br />

could be recognized.<br />

NO DISTINCTION NEED TO BE MADE<br />

BETWEEN CIVIL AND CRIMINAL<br />

LITIGATION EXPENSES<br />

7. Section 37(1) does not make any distinction<br />

between civil litigation and criminal litigation.<br />

All that has to be seen is whether the legal<br />

expenses were incurred by the assessee in his<br />

character as a trader ? In other words, whether<br />

the transaction in respect of which proceedings<br />

are taken arose out of and was incidental to<br />

the assessee’s business ? - CIT v. Dhanrajgirji<br />

Raja Narasingirji [1973] 91 ITR 544 (SC).<br />

EXPENDITURE ON DEFENDING AUDITOR<br />

IN DISCIPLINARY PROCEEDINGS<br />

8. When such proceedings were initiated by<br />

shareholders/union in CIT v. Deccan Sugar &<br />

Abkhari Co. Ltd. [1976] 104 ITR 458 (Mad.), it<br />

was held that such expenses incurred by assesseecompany<br />

were not allowable as decision of<br />

such proceedings, one way or other, would<br />

not have affected assessee’s business. Per contra,<br />

expenditure borne by assessee-company to defend<br />

a suit by employees’ union against auditors<br />

appointed by assessee, for certain irregularities<br />

in accounts of employees’ provident fund, was<br />

declared as an allowable expenditure in CIT<br />

v. Ananda Bazar Patrika (P.) Ltd.. 12<br />

LEGAL EXPENSES INCURRED ON<br />

DEFENDING A CLAIM FOR PAYMENT OF<br />

HIGHER COMPENSATION FOR LAND<br />

ACQUIRED BY ASSESSEE ARE NOT<br />

DEDUCTIBLE<br />

August 1 to 15, 2012 u TAXMANN’S CORPORATE PROFESSIONALS TODAY u Vol. 24 u 27<br />

647

![“FORM NO. 3CEB [See rule 10E] Report from an ... - Taxmann](https://img.yumpu.com/45480232/1/190x245/form-no-3ceb-see-rule-10e-report-from-an-taxmann.jpg?quality=85)