VINCI - 2005 annual report

VINCI - 2005 annual report VINCI - 2005 annual report

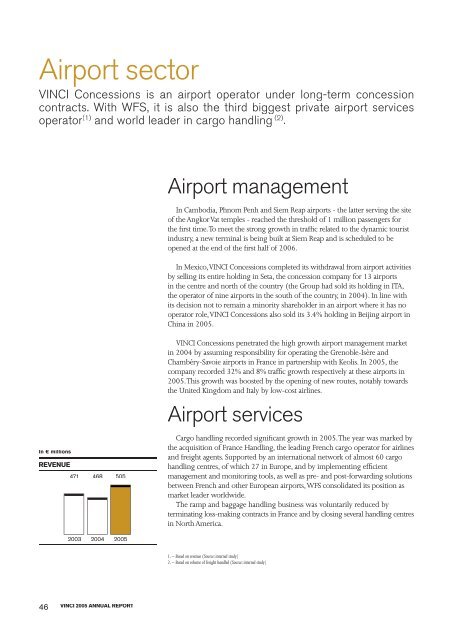

Airport sector VINCI Concessions is an airport operator under long-term concession contracts. With WFS, it is also the third biggest private airport services operator (1) and world leader in cargo handling (2) . In € millions REVENUE 46 471 2003 468 2004 505 2005 VINCI 2005 ANNUAL REPORT Airport management In Cambodia, Phnom Penh and Siem Reap airports - the latter serving the site of the Angkor Vat temples - reached the threshold of 1 million passengers for the fi rst time. To meet the strong growth in traffi c related to the dynamic tourist industry, a new terminal is being built at Siem Reap and is scheduled to be opened at the end of the fi rst half of 2006. In Mexico, VINCI Concessions completed its withdrawal from airport activities by selling its entire holding in Seta, the concession company for 13 airports in the centre and north of the country (the Group had sold its holding in ITA, the operator of nine airports in the south of the country, in 2004). In line with its decision not to remain a minority shareholder in an airport where it has no operator role, VINCI Concessions also sold its 3.4% holding in Beijing airport in China in 2005. VINCI Concessions penetrated the high growth airport management market in 2004 by assuming responsibility for operating the Grenoble-Isère and Chambéry-Savoie airports in France in partnership with Keolis. In 2005, the company recorded 32% and 8% traffi c growth respectively at these airports in 2005. This growth was boosted by the opening of new routes, notably towards the United Kingdom and Italy by low-cost airlines. Airport services Cargo handling recorded signifi cant growth in 2005. The year was marked by the acquisition of France Handling, the leading French cargo operator for airlines and freight agents. Supported by an international network of almost 60 cargo handling centres, of which 27 in Europe, and by implementing effi cient management and monitoring tools, as well as pre- and post-forwarding solutions between French and other European airports, WFS consolidated its position as market leader worldwide. The ramp and baggage handling business was voluntarily reduced by terminating loss-making contracts in France and by closing several handling centres in North America. 1. – Based on revenue (Source: internal study) 2. – Based on volume of freight handled (Source: internal study)

Above. VINCI Concessions has been managing Grenoble-Isère airport since 2004. The airport handled 270,000 passengers in 2005. 2. 3. 1. REVENUE BY BUSINESS LINE 1. Ramp and passenger 44% 2. Cargo 50% 3. Other services 6% Total 100% 2. 3. 4. 1. REVENUE BY GEOGRAPHICAL AREA 1. North America 40% 2. France 45% 3. Rest of Europe 13% 4. Rest of the world 2% Total 100% 47

- Page 1 and 2: ANNUAL REPORT 2005

- Page 3 and 4: EUROVIA VINCI CONSTRUCTION KEY 2005

- Page 5 and 6: VINCI, the world’s leading integr

- Page 7: VINCI gains new momentum With the A

- Page 10 and 11: Corporate management structures BOA

- Page 12 and 13: All business lines contributed to t

- Page 14 and 15: Complementary business lines operat

- Page 16 and 17: A growth course set by the concessi

- Page 18 and 19: VINCI share price up 47% in 2005 In

- Page 20 and 21: THE 2006 SHAREHOLDERS’ CALENDAR 1

- Page 22 and 23: 2005 Highlights Bernard Val, Chairm

- Page 24 and 25: 20 VINCI 2005 ANNUAL REPORT

- Page 26 and 27: 22 BUILDING AND MAKING A LONG-TERM

- Page 28 and 29: KEY FIGURES In € millions and as

- Page 30 and 31: VINCI CONCESSIONS WORLDWIDE EUROPE

- Page 32 and 33: Top. ASF and Escota operate a netwo

- Page 34 and 35: CONCESSIONS / ACTIVITÉ ASF recentl

- Page 36 and 37: CONCESSIONS / BUSINESS REPORT 32 VI

- Page 38 and 39: CONCESSIONS / BUSINESS REPORT Betwe

- Page 40 and 41: A86 : DISCREET DOWN TO THE FINEST D

- Page 42 and 43: The toll system of the future In Ma

- Page 44 and 45: Top. Some 41,000 vehicles a day tra

- Page 46 and 47: VINCI Park VINCI Park is present in

- Page 48 and 49: 44 VINCI 2005 ANNUAL REPORT and the

- Page 52: CONSTRUCTION CONCESSIONS CONSTRUCTI

- Page 55 and 56: ENERGY 51

- Page 57 and 58: A leader in energy and information

- Page 59 and 60: Top. For the Munich airport, German

- Page 61 and 62: Acquisitions 16 companies acquired

- Page 63 and 64: Top left. Design and implementation

- Page 65 and 66: VINCI Energies at the Zénith conce

- Page 67 and 68: ÉDITORIAL GRANIOU SUPPORTS NORTEL

- Page 70 and 71: 66 LEADER IN INFRASTRUCTURE CONSTRU

- Page 72 and 73: KEY FIGURES In € millions and as

- Page 74 and 75: EUROVIA / BUSINESS REPORT Brisk gro

- Page 76 and 77: MATERIALS: A STRATEGIC FACILITY IN

- Page 78 and 79: EUROVIA / BUSINESS REPORT NOxer ®

- Page 80 and 81: Top left. Roadworks in the village

- Page 82 and 83: EUROVIA / BUSINESS REPORT Design &

- Page 84: CONSTRUCTION EUROVIA CONSTRUCTION E

- Page 87 and 88: CONSTRUCTION 83

- Page 89 and 90: French market leader and a world ma

- Page 91 and 92: Above. The Granite tower under cons

- Page 93 and 94: VINCI Construction Grands Projets

- Page 95 and 96: ÉDITORIAL A BUILDING OF THE FUTURE

- Page 97 and 98: The fl oating swimming pool To meet

- Page 99 and 100: Civil engineering revenue +11.2 % S

Airport sector<br />

<strong>VINCI</strong> Concessions is an airport operator under long-term concession<br />

contracts. With WFS, it is also the third biggest private airport services<br />

operator (1) and world leader in cargo handling (2) .<br />

In € millions<br />

REVENUE<br />

46<br />

471<br />

2003<br />

468<br />

2004<br />

505<br />

<strong>2005</strong><br />

<strong>VINCI</strong> <strong>2005</strong> ANNUAL REPORT<br />

Airport management<br />

In Cambodia, Phnom Penh and Siem Reap airports - the latter serving the site<br />

of the Angkor Vat temples - reached the threshold of 1 million passengers for<br />

the fi rst time. To meet the strong growth in traffi c related to the dynamic tourist<br />

industry, a new terminal is being built at Siem Reap and is scheduled to be<br />

opened at the end of the fi rst half of 2006.<br />

In Mexico, <strong>VINCI</strong> Concessions completed its withdrawal from airport activities<br />

by selling its entire holding in Seta, the concession company for 13 airports<br />

in the centre and north of the country (the Group had sold its holding in ITA,<br />

the operator of nine airports in the south of the country, in 2004). In line with<br />

its decision not to remain a minority shareholder in an airport where it has no<br />

operator role, <strong>VINCI</strong> Concessions also sold its 3.4% holding in Beijing airport in<br />

China in <strong>2005</strong>.<br />

<strong>VINCI</strong> Concessions penetrated the high growth airport management market<br />

in 2004 by assuming responsibility for operating the Grenoble-Isère and<br />

Chambéry-Savoie airports in France in partnership with Keolis. In <strong>2005</strong>, the<br />

company recorded 32% and 8% traffi c growth respectively at these airports in<br />

<strong>2005</strong>. This growth was boosted by the opening of new routes, notably towards<br />

the United Kingdom and Italy by low-cost airlines.<br />

Airport services<br />

Cargo handling recorded signifi cant growth in <strong>2005</strong>. The year was marked by<br />

the acquisition of France Handling, the leading French cargo operator for airlines<br />

and freight agents. Supported by an international network of almost 60 cargo<br />

handling centres, of which 27 in Europe, and by implementing effi cient<br />

management and monitoring tools, as well as pre- and post-forwarding solutions<br />

between French and other European airports, WFS consolidated its position as<br />

market leader worldwide.<br />

The ramp and baggage handling business was voluntarily reduced by<br />

terminating loss-making contracts in France and by closing several handling centres<br />

in North America.<br />

1. – Based on revenue (Source: internal study)<br />

2. – Based on volume of freight handled (Source: internal study)