VINCI - 2005 annual report

VINCI - 2005 annual report

VINCI - 2005 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

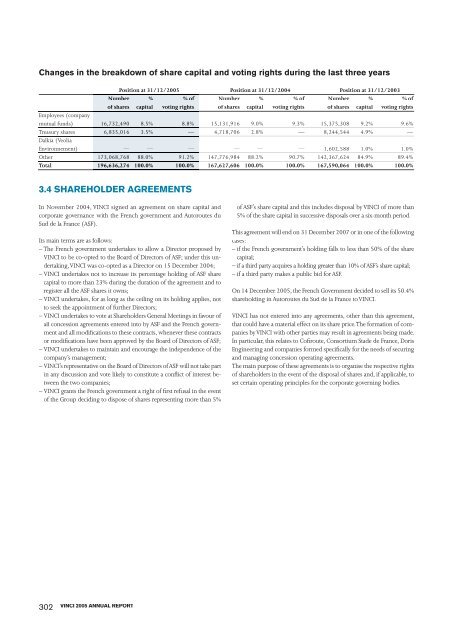

Changes in the breakdown of share capital and voting rights during the last three years<br />

Position at 31/12/<strong>2005</strong> Position at 31/12/2004 Position at 31/12/2003<br />

Number % % of Number % % of Number % % of<br />

of shares capital voting rights of shares capital voting rights of shares capital voting rights<br />

Employees (company<br />

mutual funds) 16,732,490 8.5% 8.8% 15,131,916 9.0% 9.3% 15,375,308 9.2% 9.6%<br />

Treasury shares<br />

Dalkia (Veolia<br />

6,835,016 3.5% — 4,718,706 2.8%<br />

— 8,244,544 4.9%<br />

—<br />

Environnement) — — — — — — 1,602,588 1.0% 1.0%<br />

Other 173,068,768 88.0% 91.2% 147,776,984 88.2% 90.7% 142,367,624 84.9% 89.4%<br />

Total 196,636,274 100.0% 100.0% 167,627,606 100.0% 100.0% 167,590,064 100.0% 100.0%<br />

3.4 SHAREHOLDER AGREEMENTS<br />

In November 2004, <strong>VINCI</strong> signed an agreement on share capital and<br />

corporate governance with the French government and Autoroutes du<br />

Sud de la France (ASF).<br />

Its main terms are as follows:<br />

– The French government undertakes to allow a Director proposed by<br />

<strong>VINCI</strong> to be co-opted to the Board of Directors of ASF; under this undertaking,<br />

<strong>VINCI</strong> was co-opted as a Director on 15 December 2004;<br />

– <strong>VINCI</strong> undertakes not to increase its percentage holding of ASF share<br />

capital to more than 23% during the duration of the agreement and to<br />

register all the ASF shares it owns;<br />

– <strong>VINCI</strong> undertakes, for as long as the ceiling on its holding applies, not<br />

to seek the appointment of further Directors;<br />

– <strong>VINCI</strong> undertakes to vote at Shareholders General Meetings in favour of<br />

all concession agreements entered into by ASF and the French government<br />

and all modifi cations to these contracts, whenever these contracts<br />

or modifi cations have been approved by the Board of Directors of ASF;<br />

– <strong>VINCI</strong> undertakes to maintain and encourage the independence of the<br />

company’s management;<br />

– <strong>VINCI</strong>’s representative on the Board of Directors of ASF will not take part<br />

in any discussion and vote likely to constitute a confl ict of interest between<br />

the two companies;<br />

– <strong>VINCI</strong> grants the French government a right of fi rst refusal in the event<br />

of the Group deciding to dispose of shares representing more than 5%<br />

302<br />

<strong>VINCI</strong> <strong>2005</strong> ANNUAL REPORT<br />

of ASF’s share capital and this includes disposal by <strong>VINCI</strong> of more than<br />

5% of the share capital in successive disposals over a six-month period.<br />

This agreement will end on 31 December 2007 or in one of the following<br />

cases:<br />

– if the French government’s holding falls to less than 50% of the share<br />

capital;<br />

– if a third party acquires a holding greater than 10% of ASF’s share capital;<br />

– if a third party makes a public bid for ASF.<br />

On 14 December <strong>2005</strong>, the French Government decided to sell its 50.4%<br />

shareholding in Autoroutes du Sud de la France to <strong>VINCI</strong>.<br />

<strong>VINCI</strong> has not entered into any agreements, other than this agreement,<br />

that could have a material effect on its share price. The formation of companies<br />

by <strong>VINCI</strong> with other parties may result in agreements being made.<br />

In particular, this relates to Cofi route, Consortium Stade de France, Doris<br />

Engineering and companies formed specifi cally for the needs of securing<br />

and managing concession operating agreements.<br />

The main purpose of these agreements is to organise the respective rights<br />

of shareholders in the event of the disposal of shares and, if applicable, to<br />

set certain operating principles for the corporate governing bodies.