VINCI - 2005 annual report

VINCI - 2005 annual report VINCI - 2005 annual report

28.3 OTHER RELATED PARTIES The information on equity-accounted companies is given in Note 17.2. VINCI has recognised an expense of €0.6 million in 2005 for services in respect of strategic consultancy, development and assistance, provided by Soficot and AM Conseil. The Company also has normal business relationships with companies of 256 VINCI 2005 ANNUAL REPORT which the executives are Directors of VINCI, in particular UBS, Merill Lynch and Nexity. In addition, VINCI has recognised an expense of €0.4 million in 2005 for catering services provided by the catering company Soficot-SRC (now called Société Gastronomique de l’Etoile). 29. CONTRACTUAL OBLIGATIONS AND OTHER COMMITMENTS MADE AND RECEIVED The contractual obligations and other commitments made and received are analysed as follows: (in € millions) 31/12/2005 31/12/2004 Contractual obligations Operating leases 703.8 447.4 Purchase and capital expenditure obligations (1) 167.6 157.2 Capital expenditure obligations connected with the acquisition of ASF (2) 9,100.0 Other commitments made Sureties and guarantees 314.6 305.3 Collateral securities 341.6 185.2 Joint and several guarantees covering unconsolidated partnerships 123.3 129.8 Other 38.9 44.5 Other commitments received Personal sureties 56.5 61.4 Collateral securities 4.6 6.0 Other 36.8 37.4 (1) Excluding investments relating to concession contracts (see Note 13.2). (2) See Key events (Note A.1.2). Moreover, the Group’s commitments made and received in respect of concession contracts, construction contracts and items not recognised regarding retirement obligations are disclosed in: 29.1 CONTRACTUAL OBLIGATIONS Operating lease commitments amounted to €703.8 million at 31 December 2005 (against €447.4 million at 31 December 2004). Of this, €510.7 million was for property (against €299.9 million at 31 December 2004) and €193.1 million for movable items (against €147.5 million at 31 December 2004). – Note 13.2 in respect of concession contracts; – Note 20.2 in respect of construction contracts; – Note 23 in respect of unrecognised items on retirement benefit obligations. The purchase and capital expenditure obligations relate principally to VINCI Immobilier in connection with investment promises relating to the rehabilitation of the Renault site at Boulogne Billancourt and the OPAC operation at rue Lecourbe in Paris.

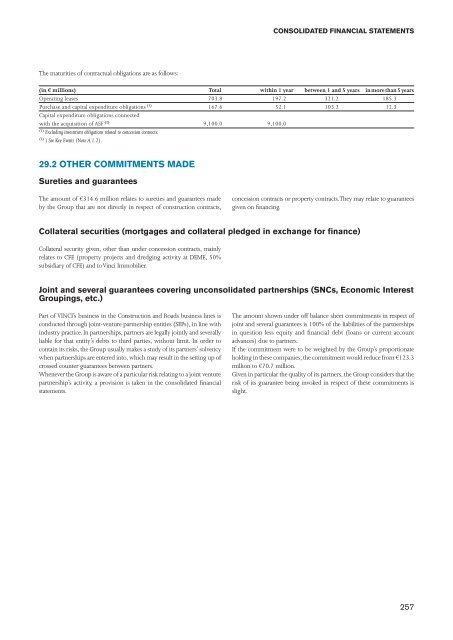

The maturities of contractual obligations are as follows: CONSOLIDATED FINANCIAL STATEMENTS (in € millions) Total within 1 year between 1 and 5 years in more than 5 years Operating leases 703.8 197.2 321.2 185.3 Purchase and capital expenditure obligations (1) 167.6 52.1 103.2 12.3 Capital expenditure obligations connected with the acquisition of ASF (2) 9,100.0 9,100.0 (1) Excluding investment obligations related to concession contracts. (2) ) See Key Events (Note A.1.2). 29.2 OTHER COMMITMENTS MADE Sureties and guarantees The amount of €314.6 million relates to sureties and guarantees made by the Group that are not directly in respect of construction contracts, concession contracts or property contracts. They may relate to guarantees given on financing. Collateral securities (mortgages and collateral pledged in exchange for finance) Collateral security given, other than under concession contracts, mainly relates to CFE (property projects and dredging activity at DEME, 50% subsidiary of CFE) and to Vinci Immobilier. Joint and several guarantees covering unconsolidated partnerships (SNCs, Economic Interest Groupings, etc.) Part of VINCI’s business in the Construction and Roads business lines is conducted through joint-venture partnership entities (SEPs), in line with industry practice. In partnerships, partners are legally jointly and severally liable for that entity’s debts to third parties, without limit. In order to contain its risks, the Group usually makes a study of its partners’ solvency when partnerships are entered into, which may result in the setting up of crossed counter guarantees between partners. Whenever the Group is aware of a particular risk relating to a joint venture partnership’s activity, a provision is taken in the consolidated financial statements. The amount shown under off balance sheet commitments in respect of joint and several guarantees is 100% of the liabilities of the partnerships in question less equity and financial debt (loans or current account advances) due to partners. If the commitment were to be weighted by the Group’s proportionate holding in these companies, the commitment would reduce from €123.3 million to €70.7 million. Given in particular the quality of its partners, the Group considers that the risk of its guarantee being invoked in respect of these commitments is slight. 257

- Page 209 and 210: - Hedge of a net investment in a fo

- Page 211 and 212: 1.2.2 Breakdown of revenue by locat

- Page 213 and 214: FY 2004 CONSOLIDATED FINANCIAL STAT

- Page 215 and 216: FY 2004 CONSOLIDATED FINANCIAL STAT

- Page 217 and 218: 4. SEGMENT INFORMATION BY GEOGRAPHI

- Page 219 and 220: 5.3 SHARE-BASED PAYMENTS The expens

- Page 221 and 222: The income arising in the period fr

- Page 223 and 224: E. NOTES TO THE BALANCE SHEET 10. I

- Page 225 and 226: 12.2 IMPAIRMENT LOSSES ON OTHER NON

- Page 227 and 228: CONSOLIDATED FINANCIAL STATEMENTS 1

- Page 229 and 230: 15. LEASED ASSETS Property, plant a

- Page 231 and 232: CONSOLIDATED FINANCIAL STATEMENTS 1

- Page 233 and 234: 20. CONSTRUCTION CONTRACTS 20.1 FIN

- Page 235 and 236: The changes in capital in 2005 brea

- Page 237 and 238: CONSOLIDATED FINANCIAL STATEMENTS I

- Page 239 and 240: CONSOLIDATED FINANCIAL STATEMENTS 2

- Page 241 and 242: Changes in the period CONSOLIDATED

- Page 243 and 244: 24. PROVISIONS During the period, c

- Page 245 and 246: By business line, the analysis of n

- Page 247 and 248: . Other bonds Other bonds break dow

- Page 249 and 250: d. Finance leases The table below s

- Page 251 and 252: 25.3.2 Cash and cash management fin

- Page 253 and 254: CONSOLIDATED FINANCIAL STATEMENTS T

- Page 255 and 256: Based on this position, a 1% increa

- Page 257 and 258: 26.3.3 Analysis of other foreign cu

- Page 259: 28. TRANSACTIONS WITH RELATED PARTI

- Page 263 and 264: 31. REMUNERATION AND RELATED BENEFI

- Page 265 and 266: promissory notes issued by Intertou

- Page 267 and 268: CONSOLIDATED FINANCIAL STATEMENTS I

- Page 269 and 270: (h) Reclassification under operatin

- Page 271 and 272: 1.5 SUMMARIES OF IMPACTS OF RESTATE

- Page 273 and 274: 2.3.2 Goodwill CONSOLIDATED FINANCI

- Page 275 and 276: 2.3.6 Fair value of derivatives CON

- Page 277 and 278: 2.4 RECONCILIATION OF BALANCE SHEET

- Page 279 and 280: 2.4.6 Trade and other current payab

- Page 281 and 282: CONSOLIDATED FINANCIAL STATEMENTS 4

- Page 283 and 284: K. MAIN CONSOLIDATED COMPANIES AT 3

- Page 285 and 286: CONSOLIDATED FINANCIAL STATEMENTS C

- Page 287 and 288: CONSOLIDATED FINANCIAL STATEMENTS R

- Page 289 and 290: 1.3 OTHER FINANCIAL TRANSACTIONS Th

- Page 291 and 292: 3.2 EQUITY PARENT COMPANY FINANCIAL

- Page 293 and 294: 5. NET FINANCIAL DEBT The holding c

- Page 295 and 296: PARENT COMPANY FINANCIAL STATEMENTS

- Page 297 and 298: PARENT COMPANY FINANCIAL STATEMENTS

- Page 299 and 300: PARENT COMPANY FINANCIAL STATEMENTS

- Page 301 and 302: Meeting are determined by the Share

- Page 303 and 304: 3. INFORMATION ON VINCI’S SHARE C

- Page 305 and 306: 3.3 BREAKDOWN OF SHARE CAPITAL AND

- Page 307 and 308: 3.5 THE VINCI SHARE AND THE STOCK M

- Page 309 and 310: 3. FEES OF THE STATUTORY AUDITORS P

The maturities of contractual obligations are as follows:<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

(in € millions) Total within 1 year between 1 and 5 years in more than 5 years<br />

Operating leases 703.8 197.2 321.2 185.3<br />

Purchase and capital expenditure obligations (1) 167.6 52.1 103.2 12.3<br />

Capital expenditure obligations connected<br />

with the acquisition of ASF (2) 9,100.0 9,100.0<br />

(1) Excluding investment obligations related to concession contracts.<br />

(2) ) See Key Events (Note A.1.2).<br />

29.2 OTHER COMMITMENTS MADE<br />

Sureties and guarantees<br />

The amount of €314.6 million relates to sureties and guarantees made<br />

by the Group that are not directly in respect of construction contracts,<br />

concession contracts or property contracts. They may relate to guarantees<br />

given on financing.<br />

Collateral securities (mortgages and collateral pledged in exchange for finance)<br />

Collateral security given, other than under concession contracts, mainly<br />

relates to CFE (property projects and dredging activity at DEME, 50%<br />

subsidiary of CFE) and to Vinci Immobilier.<br />

Joint and several guarantees covering unconsolidated partnerships (SNCs, Economic Interest<br />

Groupings, etc.)<br />

Part of <strong>VINCI</strong>’s business in the Construction and Roads business lines is<br />

conducted through joint-venture partnership entities (SEPs), in line with<br />

industry practice. In partnerships, partners are legally jointly and severally<br />

liable for that entity’s debts to third parties, without limit. In order to<br />

contain its risks, the Group usually makes a study of its partners’ solvency<br />

when partnerships are entered into, which may result in the setting up of<br />

crossed counter guarantees between partners.<br />

Whenever the Group is aware of a particular risk relating to a joint venture<br />

partnership’s activity, a provision is taken in the consolidated financial<br />

statements.<br />

The amount shown under off balance sheet commitments in respect of<br />

joint and several guarantees is 100% of the liabilities of the partnerships<br />

in question less equity and financial debt (loans or current account<br />

advances) due to partners.<br />

If the commitment were to be weighted by the Group’s proportionate<br />

holding in these companies, the commitment would reduce from €123.3<br />

million to €70.7 million.<br />

Given in particular the quality of its partners, the Group considers that the<br />

risk of its guarantee being invoked in respect of these commitments is<br />

slight.<br />

257