VINCI - 2005 annual report

VINCI - 2005 annual report

VINCI - 2005 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

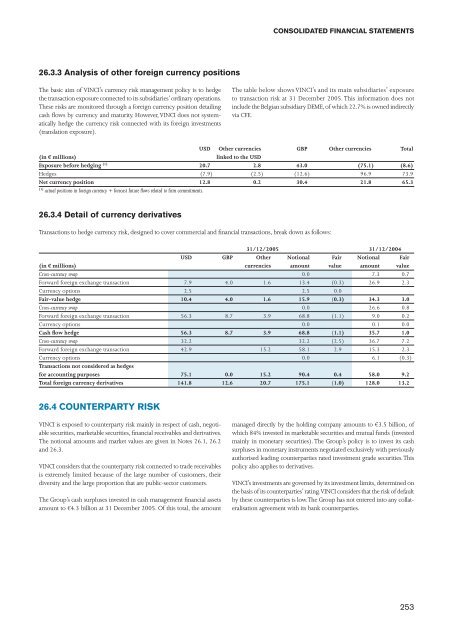

26.3.3 Analysis of other foreign currency positions<br />

The basic aim of <strong>VINCI</strong>’s currency risk management policy is to hedge<br />

the transaction exposure connected to its subsidiaries’ ordinary operations.<br />

These risks are monitored through a foreign currency position detailing<br />

cash flows by currency and maturity. However, <strong>VINCI</strong> does not systematically<br />

hedge the currency risk connected with its foreign investments<br />

(translation exposure).<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

The table below shows <strong>VINCI</strong>’s and its main subsidiaries’ exposure<br />

to transaction risk at 31 December <strong>2005</strong>. This information does not<br />

include the Belgian subsidiary DEME, of which 22.7% is owned indirectly<br />

via CFE.<br />

USD Other currencies GBP Other currencies Total<br />

(in € millions) linked to the USD<br />

Exposure before hedging (1) 20.7 2.8 43.0 (75.1) (8.6)<br />

Hedges (7.9) (2.5) (12.6) 96.9 73.9<br />

Net currency position 12.8 0.2 30.4 21.8 65.3<br />

(1) actual positions in foreign currency + forecast future flows related to firm commitments.<br />

26.3.4 Detail of currency derivatives<br />

Transactions to hedge currency risk, designed to cover commercial and financial transactions, break down as follows:<br />

31/12/<strong>2005</strong> 31/12/2004<br />

USD GBP Other Notional Fair Notional Fair<br />

(in € millions) currencies amount value amount value<br />

Cross-currency swap 0.0 7.3 0.7<br />

Forward foreign exchange transaction 7.9 4.0 1.6 13.4 (0.3) 26.9 2.3<br />

Currency options 2.5 2.5 0.0<br />

Fair-value hedge 10.4 4.0 1.6 15.9 (0.3) 34.3 3.0<br />

Cross-currency swap 0.0 26.6 0.8<br />

Forward foreign exchange transaction 56.3 8.7 3.9 68.8 (1.1) 9.0 0.2<br />

Currency options 0.0 0.1 0.0<br />

Cash flow hedge 56.3 8.7 3.9 68.8 (1.1) 35.7 1.0<br />

Cross-currency swap 32.2 32.2 (2.5) 36.7 7.2<br />

Forward foreign exchange transaction 42.9 15.2 58.1 2.9 15.3 2.3<br />

Currency options 0.0 6.1 (0.3)<br />

Transactions not considered as hedges<br />

for accounting purposes 75.1 0.0 15.2 90.4 0.4 58.0 9.2<br />

Total foreign currency derivatives 141.8 12.6 20.7 175.1 (1.0) 128.0 13.2<br />

26.4 COUNTERPARTY RISK<br />

<strong>VINCI</strong> is exposed to counterparty risk mainly in respect of cash, negotiable<br />

securities, marketable securities, financial receivables and derivatives.<br />

The notional amounts and market values are given in Notes 26.1, 26.2<br />

and 26.3.<br />

<strong>VINCI</strong> considers that the counterparty risk connected to trade receivables<br />

is extremely limited because of the large number of customers, their<br />

diversity and the large proportion that are public-sector customers.<br />

The Group’s cash surpluses invested in cash management financial assets<br />

amount to €4.3 billion at 31 December <strong>2005</strong>. Of this total, the amount<br />

managed directly by the holding company amounts to €3.5 billion, of<br />

which 84% invested in marketable securities and mutual funds (invested<br />

mainly in monetary securities). The Group’s policy is to invest its cash<br />

surpluses in monetary instruments negotiated exclusively with previously<br />

authorised leading counterparties rated investment grade securities. This<br />

policy also applies to derivatives.<br />

<strong>VINCI</strong>’s investments are governed by its investment limits, determined on<br />

the basis of its counterparties’ rating. <strong>VINCI</strong> considers that the risk of default<br />

by these counterparties is low. The Group has not entered into any collateralisation<br />

agreement with its bank counterparties.<br />

253