VINCI - 2005 annual report

VINCI - 2005 annual report VINCI - 2005 annual report

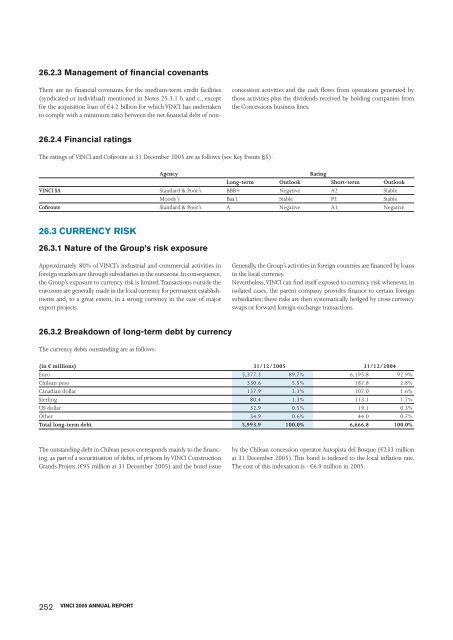

26.2.3 Management of financial covenants There are no financial covenants for the medium-term credit facilities (syndicated or individual) mentioned in Notes 25.3.1 b. and c., except for the acquisition loan of €4.2 billion for which VINCI has undertaken to comply with a minimum ratio between the net financial debt of non- 26.2.4 Financial ratings The ratings of VINCI and Cofiroute at 31 December 2005 are as follows (see Key Events §5): (in € millions) 31/12/2005 31/12/2004 Euro 5,377.3 89.7% 6,195.8 92.9% Chilean peso 330.6 5.5% 187.8 2.8% Canadian dollar 137.9 2.3% 107.0 1.6% Sterling 80.4 1.3% 113.1 1.7% US dollar 32.9 0.5% 19.1 0.3% Other 34.9 0.6% 44.0 0.7% Total long-term debt 5,993.9 100.0% 6,666.8 100.0% 252 VINCI 2005 ANNUAL REPORT concession activities and the cash flows from operations generated by those activities plus the dividends received by holding companies from the Concessions business lines. Agency Rating Long-term Outlook Short-term Outlook VINCI SA Standard & Poor’s BBB+ Negative A2 Stable Moody’s Baa1 Stable P2 Stable Cofiroute Standard & Poor’s A Negative A1 Negative 26.3 CURRENCY RISK 26.3.1 Nature of the Group’s risk exposure Approximately 80% of VINCI’s industrial and commercial activities in foreign markets are through subsidiaries in the eurozone. In consequence, the Group’s exposure to currency risk is limited. Transactions outside the eurozone are generally made in the local currency for permanent establishments and, to a great extent, in a strong currency in the case of major export projects. 26.3.2 Breakdown of long-term debt by currency The currency debts outstanding are as follows: The outstanding debt in Chilean pesos corresponds mainly to the financing, as part of a securitisation of debts, of prisons by VINCI Construction Grands Projets (€95 million at 31 December 2005) and the bond issue Generally, the Group’s activities in foreign countries are financed by loans in the local currency. Nevertheless, VINCI can find itself exposed to currency risk whenever, in isolated cases, the parent company provides finance to certain foreign subsidiaries; these risks are then systematically hedged by cross currency swaps or forward foreign exchange transactions. by the Chilean concession operator Autopista del Bosque (€233 million at 31 December 2005). This bond is indexed to the local inflation rate. The cost of this indexation is - €6.9 million in 2005.

26.3.3 Analysis of other foreign currency positions The basic aim of VINCI’s currency risk management policy is to hedge the transaction exposure connected to its subsidiaries’ ordinary operations. These risks are monitored through a foreign currency position detailing cash flows by currency and maturity. However, VINCI does not systematically hedge the currency risk connected with its foreign investments (translation exposure). CONSOLIDATED FINANCIAL STATEMENTS The table below shows VINCI’s and its main subsidiaries’ exposure to transaction risk at 31 December 2005. This information does not include the Belgian subsidiary DEME, of which 22.7% is owned indirectly via CFE. USD Other currencies GBP Other currencies Total (in € millions) linked to the USD Exposure before hedging (1) 20.7 2.8 43.0 (75.1) (8.6) Hedges (7.9) (2.5) (12.6) 96.9 73.9 Net currency position 12.8 0.2 30.4 21.8 65.3 (1) actual positions in foreign currency + forecast future flows related to firm commitments. 26.3.4 Detail of currency derivatives Transactions to hedge currency risk, designed to cover commercial and financial transactions, break down as follows: 31/12/2005 31/12/2004 USD GBP Other Notional Fair Notional Fair (in € millions) currencies amount value amount value Cross-currency swap 0.0 7.3 0.7 Forward foreign exchange transaction 7.9 4.0 1.6 13.4 (0.3) 26.9 2.3 Currency options 2.5 2.5 0.0 Fair-value hedge 10.4 4.0 1.6 15.9 (0.3) 34.3 3.0 Cross-currency swap 0.0 26.6 0.8 Forward foreign exchange transaction 56.3 8.7 3.9 68.8 (1.1) 9.0 0.2 Currency options 0.0 0.1 0.0 Cash flow hedge 56.3 8.7 3.9 68.8 (1.1) 35.7 1.0 Cross-currency swap 32.2 32.2 (2.5) 36.7 7.2 Forward foreign exchange transaction 42.9 15.2 58.1 2.9 15.3 2.3 Currency options 0.0 6.1 (0.3) Transactions not considered as hedges for accounting purposes 75.1 0.0 15.2 90.4 0.4 58.0 9.2 Total foreign currency derivatives 141.8 12.6 20.7 175.1 (1.0) 128.0 13.2 26.4 COUNTERPARTY RISK VINCI is exposed to counterparty risk mainly in respect of cash, negotiable securities, marketable securities, financial receivables and derivatives. The notional amounts and market values are given in Notes 26.1, 26.2 and 26.3. VINCI considers that the counterparty risk connected to trade receivables is extremely limited because of the large number of customers, their diversity and the large proportion that are public-sector customers. The Group’s cash surpluses invested in cash management financial assets amount to €4.3 billion at 31 December 2005. Of this total, the amount managed directly by the holding company amounts to €3.5 billion, of which 84% invested in marketable securities and mutual funds (invested mainly in monetary securities). The Group’s policy is to invest its cash surpluses in monetary instruments negotiated exclusively with previously authorised leading counterparties rated investment grade securities. This policy also applies to derivatives. VINCI’s investments are governed by its investment limits, determined on the basis of its counterparties’ rating. VINCI considers that the risk of default by these counterparties is low. The Group has not entered into any collateralisation agreement with its bank counterparties. 253

- Page 205 and 206: - when borrowing is not intended to

- Page 207 and 208: Cash management financial assets Ca

- Page 209 and 210: - Hedge of a net investment in a fo

- Page 211 and 212: 1.2.2 Breakdown of revenue by locat

- Page 213 and 214: FY 2004 CONSOLIDATED FINANCIAL STAT

- Page 215 and 216: FY 2004 CONSOLIDATED FINANCIAL STAT

- Page 217 and 218: 4. SEGMENT INFORMATION BY GEOGRAPHI

- Page 219 and 220: 5.3 SHARE-BASED PAYMENTS The expens

- Page 221 and 222: The income arising in the period fr

- Page 223 and 224: E. NOTES TO THE BALANCE SHEET 10. I

- Page 225 and 226: 12.2 IMPAIRMENT LOSSES ON OTHER NON

- Page 227 and 228: CONSOLIDATED FINANCIAL STATEMENTS 1

- Page 229 and 230: 15. LEASED ASSETS Property, plant a

- Page 231 and 232: CONSOLIDATED FINANCIAL STATEMENTS 1

- Page 233 and 234: 20. CONSTRUCTION CONTRACTS 20.1 FIN

- Page 235 and 236: The changes in capital in 2005 brea

- Page 237 and 238: CONSOLIDATED FINANCIAL STATEMENTS I

- Page 239 and 240: CONSOLIDATED FINANCIAL STATEMENTS 2

- Page 241 and 242: Changes in the period CONSOLIDATED

- Page 243 and 244: 24. PROVISIONS During the period, c

- Page 245 and 246: By business line, the analysis of n

- Page 247 and 248: . Other bonds Other bonds break dow

- Page 249 and 250: d. Finance leases The table below s

- Page 251 and 252: 25.3.2 Cash and cash management fin

- Page 253 and 254: CONSOLIDATED FINANCIAL STATEMENTS T

- Page 255: Based on this position, a 1% increa

- Page 259 and 260: 28. TRANSACTIONS WITH RELATED PARTI

- Page 261 and 262: The maturities of contractual oblig

- Page 263 and 264: 31. REMUNERATION AND RELATED BENEFI

- Page 265 and 266: promissory notes issued by Intertou

- Page 267 and 268: CONSOLIDATED FINANCIAL STATEMENTS I

- Page 269 and 270: (h) Reclassification under operatin

- Page 271 and 272: 1.5 SUMMARIES OF IMPACTS OF RESTATE

- Page 273 and 274: 2.3.2 Goodwill CONSOLIDATED FINANCI

- Page 275 and 276: 2.3.6 Fair value of derivatives CON

- Page 277 and 278: 2.4 RECONCILIATION OF BALANCE SHEET

- Page 279 and 280: 2.4.6 Trade and other current payab

- Page 281 and 282: CONSOLIDATED FINANCIAL STATEMENTS 4

- Page 283 and 284: K. MAIN CONSOLIDATED COMPANIES AT 3

- Page 285 and 286: CONSOLIDATED FINANCIAL STATEMENTS C

- Page 287 and 288: CONSOLIDATED FINANCIAL STATEMENTS R

- Page 289 and 290: 1.3 OTHER FINANCIAL TRANSACTIONS Th

- Page 291 and 292: 3.2 EQUITY PARENT COMPANY FINANCIAL

- Page 293 and 294: 5. NET FINANCIAL DEBT The holding c

- Page 295 and 296: PARENT COMPANY FINANCIAL STATEMENTS

- Page 297 and 298: PARENT COMPANY FINANCIAL STATEMENTS

- Page 299 and 300: PARENT COMPANY FINANCIAL STATEMENTS

- Page 301 and 302: Meeting are determined by the Share

- Page 303 and 304: 3. INFORMATION ON VINCI’S SHARE C

- Page 305 and 306: 3.3 BREAKDOWN OF SHARE CAPITAL AND

26.2.3 Management of financial covenants<br />

There are no financial covenants for the medium-term credit facilities<br />

(syndicated or individual) mentioned in Notes 25.3.1 b. and c., except<br />

for the acquisition loan of €4.2 billion for which <strong>VINCI</strong> has undertaken<br />

to comply with a minimum ratio between the net financial debt of non-<br />

26.2.4 Financial ratings<br />

The ratings of <strong>VINCI</strong> and Cofiroute at 31 December <strong>2005</strong> are as follows (see Key Events §5):<br />

(in € millions) 31/12/<strong>2005</strong> 31/12/2004<br />

Euro 5,377.3 89.7% 6,195.8 92.9%<br />

Chilean peso 330.6 5.5% 187.8 2.8%<br />

Canadian dollar 137.9 2.3% 107.0 1.6%<br />

Sterling 80.4 1.3% 113.1 1.7%<br />

US dollar 32.9 0.5% 19.1 0.3%<br />

Other 34.9 0.6% 44.0 0.7%<br />

Total long-term debt 5,993.9 100.0% 6,666.8 100.0%<br />

252<br />

<strong>VINCI</strong> <strong>2005</strong> ANNUAL REPORT<br />

concession activities and the cash flows from operations generated by<br />

those activities plus the dividends received by holding companies from<br />

the Concessions business lines.<br />

Agency Rating<br />

Long-term Outlook Short-term Outlook<br />

<strong>VINCI</strong> SA Standard & Poor’s BBB+ Negative A2 Stable<br />

Moody’s Baa1 Stable P2 Stable<br />

Cofiroute Standard & Poor’s A Negative A1 Negative<br />

26.3 CURRENCY RISK<br />

26.3.1 Nature of the Group’s risk exposure<br />

Approximately 80% of <strong>VINCI</strong>’s industrial and commercial activities in<br />

foreign markets are through subsidiaries in the eurozone. In consequence,<br />

the Group’s exposure to currency risk is limited. Transactions outside the<br />

eurozone are generally made in the local currency for permanent establishments<br />

and, to a great extent, in a strong currency in the case of major<br />

export projects.<br />

26.3.2 Breakdown of long-term debt by currency<br />

The currency debts outstanding are as follows:<br />

The outstanding debt in Chilean pesos corresponds mainly to the financing,<br />

as part of a securitisation of debts, of prisons by <strong>VINCI</strong> Construction<br />

Grands Projets (€95 million at 31 December <strong>2005</strong>) and the bond issue<br />

Generally, the Group’s activities in foreign countries are financed by loans<br />

in the local currency.<br />

Nevertheless, <strong>VINCI</strong> can find itself exposed to currency risk whenever, in<br />

isolated cases, the parent company provides finance to certain foreign<br />

subsidiaries; these risks are then systematically hedged by cross currency<br />

swaps or forward foreign exchange transactions.<br />

by the Chilean concession operator Autopista del Bosque (€233 million<br />

at 31 December <strong>2005</strong>). This bond is indexed to the local inflation rate.<br />

The cost of this indexation is - €6.9 million in <strong>2005</strong>.