VINCI - 2005 annual report

VINCI - 2005 annual report

VINCI - 2005 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Based on this position, a 1% increase in interest rates would generate extra<br />

financial expenses of €49 million.<br />

Such an increase in interest rates would conversely also result in comparable<br />

greater income from the Group’s cash surpluses, which amounted<br />

to 5.5 billion at 31 December <strong>2005</strong>.<br />

26.2 LIQUIDITY AND FINANCIAL RATINGS<br />

26.2.1 Liquidity position<br />

The Group’s liquidity position at 31 December <strong>2005</strong> was €9.4 billion,<br />

taking account of cash and cash-management financial assets of €5.4 billion<br />

and unused credit facilities of €4 billion (see detail in Note 25.3.1 and<br />

25.3.2).<br />

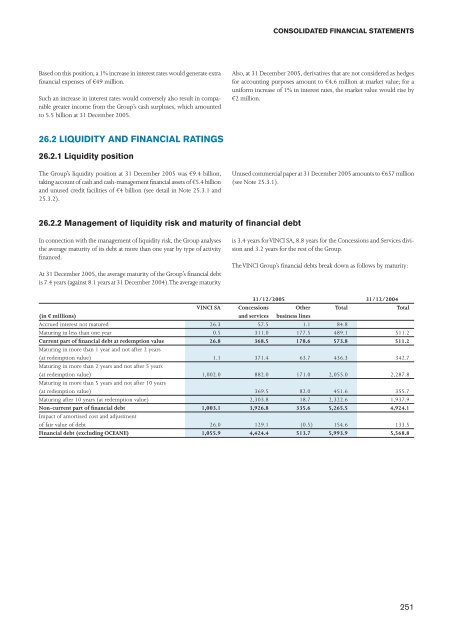

26.2.2 Management of liquidity risk and maturity of financial debt<br />

In connection with the management of liquidity risk, the Group analyses<br />

the average maturity of its debt at more than one year by type of activity<br />

financed.<br />

At 31 December <strong>2005</strong>, the average maturity of the Group’s financial debt<br />

is 7.4 years (against 8.1 years at 31 December 2004). The average maturity<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Also, at 31 December <strong>2005</strong>, derivatives that are not considered as hedges<br />

for accounting purposes amount to €4.6 million at market value; for a<br />

uniform increase of 1% in interest rates, the market value would rise by<br />

€2 million.<br />

Unused commercial paper at 31 December <strong>2005</strong> amounts to €657 million<br />

(see Note 25.3.1).<br />

is 3.4 years for <strong>VINCI</strong> SA, 8.8 years for the Concessions and Services division<br />

and 3.2 years for the rest of the Group.<br />

The <strong>VINCI</strong> Group’s financial debts break down as follows by maturity:<br />

31/12/<strong>2005</strong> 31/12/2004<br />

<strong>VINCI</strong> SA Concessions Other Total Total<br />

(in € millions) and services business lines<br />

Accrued interest not matured 26.3 57.5 1.1 84.8<br />

Maturing in less than one year 0.5 311.0 177.5 489.1 511.2<br />

Current part of financial debt at redemption value 26.8 368.5 178.6 573.8 511.2<br />

Maturing in more than 1 year and not after 2 years<br />

(at redemption value) 1.1 371.4 63.7 436.3 342.7<br />

Maturing in more than 2 years and not after 5 years<br />

(at redemption value) 1,002.0 882.0 171.0 2,055.0 2,287.8<br />

Maturing in more than 5 years and not after 10 years<br />

(at redemption value) 369.5 82.0 451.6 355.7<br />

Maturing after 10 years (at redemption value) 2,303.8 18.7 2,322.6 1,937.9<br />

Non-current part of financial debt 1,003.1 3,926.8 335.6 5,265.5 4,924.1<br />

Impact of amortised cost and adjustment<br />

of fair value of debt 26.0 129.1 (0.5) 154.6 133.5<br />

Financial debt (excluding OCEANE) 1,055.9 4,424.4 513.7 5,993.9 5,568.8<br />

251