VINCI - 2005 annual report

VINCI - 2005 annual report VINCI - 2005 annual report

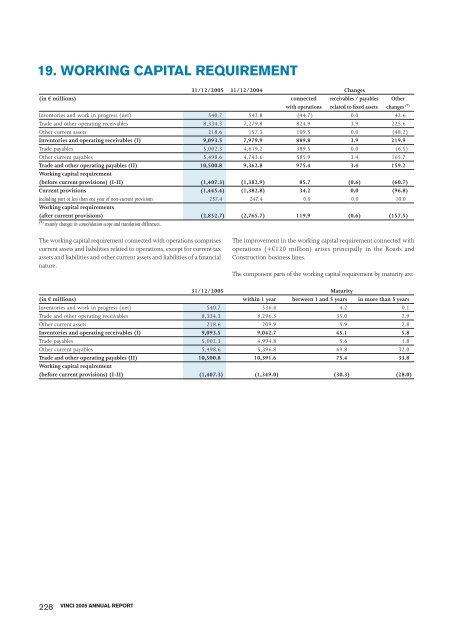

19. WORKING CAPITAL REQUIREMENT 31/12/2005 31/12/2004 Changes (in € millions) connected receivables / payables Other with operations related to fixed assets changes (*) Inventories and work in progress (net) 540.7 542.8 (44.7) 0.0 42.6 Trade and other operating receivables 8,334.3 7,279.8 824.9 3.9 225.6 Other current assets 218.6 157.3 109.5 0.0 (48.2) Inventories and operating receivables (I) 9,093.5 7,979.9 889.8 3.9 219.9 Trade payables 5,002.3 4,619.2 389.5 0.0 (6.5) Other current payables 5,498.6 4,743.6 585.9 3.4 165.7 Trade and other operating payables (II) 10,500.8 9,362.8 975.4 3.4 159.2 Working capital requirement (before current provisions) (I-II) (1,407.3) (1,382.9) 85.7 (0.6) (60.7) Current provisions (1,445.4) (1,382.8) 34.2 0.0 (96.8) including part at less than one year of non-current provisions 257.4 247.4 0.0 0.0 10.0 Working capital requirements (after current provisions) (2,852.7) (2,765.7) 119.9 (0.6) (157.5) (*) mainly changes in consolidation scope and translation differences. The working capital requirement connected with operations comprises current assets and liabilities related to operations, except for current tax assets and liabilities and other current assets and liabilities of a financial nature. 228 VINCI 2005 ANNUAL REPORT The improvement in the working capital requirement connected with operations (+€120 million) arises principally in the Roads and Construction business lines. The component parts of the working capital requirement by maturity are: 31/12/2005 Maturity (in € millions) within 1 year between 1 and 5 years in more than 5 years Inventories and work in progress (net) 540.7 536.4 4.2 0.1 Trade and other operating receivables 8,334.3 8,296.3 35.0 2.9 Other current assets 218.6 209.9 5.9 2.8 Inventories and operating receivables (I) 9,093.5 9,042.7 45.1 5.8 Trade payables 5,002.3 4,994.8 5.6 1.8 Other current payables 5,498.6 5,396.8 69.8 32.0 Trade and other operating payables (II) 10,500.8 10,391.6 75.4 33.8 Working capital requirement (before current provisions) (I-II) (1,407.3) (1,349.0) (30.3) (28.0)

20. CONSTRUCTION CONTRACTS 20.1 FINANCIAL INFORMATION ON CONSTRUCTION CONTRACTS Cost incurred plus recognised profits less recognised losses and intermediate invoicing is determined on a contract by contract basis. If this amount is positive, it is shown on the line Construction contracts in progress, assets. If negative, it is shown on the line Construction contracts in progress, liabilities. CONSOLIDATED FINANCIAL STATEMENTS Advances are the amounts received before the corresponding work has been performed. The terms of their repayment depend on the specific provisions of each contract. Most frequently, these advances are maintained throughout the contract regardless of the amount of work carried out or in progress. (in € millions) 31/12/2005 31/12/2004 Construction contracts in progress, assets 995.5 926.2 Construction contracts in progress, liabilities (914.9) (892.9) Construction contracts in progress, net 80.6 33.3 Costs incurred plus profits recognised to date less losses recognised to date 20,630.7 18,019.5 Less invoices issued (20,550.1) (17,986.2) Construction contracts in progress, net 80.6 33.3 Advances received from customers (432.6) (371.2) 20.2 COMMITMENTS GIVEN AND RECEIVED UNDER CONSTRUCTION CONTRACTS The Group gives and receives guarantees (personal surety) in connection with its construction contracts, which break down as follows: 31/12/2005 31/12/2004 (in € millions) Given Received Given Received Performance guarantees 1,777.9 271.8 1,682.2 165.4 Performance bonds 563.8 113.4 529.0 99.2 Retentions 1,518.2 298.0 1,411.7 277.3 Deferred payments to subcontractors 679.2 157.0 603.4 83.6 Deferred payments to suppliers 116.4 2.9 57.5 4.2 Bid bonds 33.1 11.7 35.5 10.9 Total 4,688.6 854.8 4,319.3 640.6 The increase in commitments given under these construction contracts (+8.5%) is linked to the increase in activity in the Construction, Roads and Energies business lines in 2005 (+11.3%). The guarantees given are mainly issued to guarantee construction work in progress. Whenever events such as late completion or disputes concerning the execution of a contract make it likely that a liability covered by a guarantee will materialise, a provision is taken in respect of that liability. In general, any risk of loss in connection with performance under a commitment given by VINCI or its subsidiaries results in a provision being recognised in the Group’s financial statements, under the rules in force. VINCI therefore considers that the off balance sheet commitments above are unlikely to have a significant impact on Group assets. It should also be remembered that, opposite the commitments given, the Group has an order book of firm orders accepted by customers which undertake, under the contract terms, to pay for work as it is carried out. In the context of their works activity, companies in the Group benefit from guarantees given by financial institutions on the instructions of their co-contractors or subcontractors or their parent company. Lastly, VINCI also grants two-year and ten-year warranties in its normal course of business. These warranties are covered by provisions estimated on a statistical basis having regard to expenses incurred in the past or on an individual basis in the case of any major problems identified. These commitments are therefore not included in the above table. 229

- Page 181 and 182: Outside France, VINCI Energies’ r

- Page 183 and 184: 1.3 NET PROFIT Net profi t attribut

- Page 185 and 186: The Group’s fi nancial structure

- Page 187 and 188: 1.3 CONCESSIONS The main risks in c

- Page 189 and 190: C. INSURANCE 1. GENERAL POLICY Give

- Page 191 and 192: D. OTHER INFORMATION 1. INVESTMENT

- Page 193 and 194: CONSOLIDATED FINANCIAL STATEMENTS C

- Page 195 and 196: CONSOLIDATED FINANCIAL STATEMENTS E

- Page 197 and 198: STATEMENT OF CHANGES IN CONSOLIDATE

- Page 199 and 200: 2.2 EARLY REDEMPTION OF THE 2002-20

- Page 201 and 202: 1.1 FIRST-TIME ADOPTION OF IFRS - M

- Page 203 and 204: Joint venture partnerships created

- Page 205 and 206: - when borrowing is not intended to

- Page 207 and 208: Cash management financial assets Ca

- Page 209 and 210: - Hedge of a net investment in a fo

- Page 211 and 212: 1.2.2 Breakdown of revenue by locat

- Page 213 and 214: FY 2004 CONSOLIDATED FINANCIAL STAT

- Page 215 and 216: FY 2004 CONSOLIDATED FINANCIAL STAT

- Page 217 and 218: 4. SEGMENT INFORMATION BY GEOGRAPHI

- Page 219 and 220: 5.3 SHARE-BASED PAYMENTS The expens

- Page 221 and 222: The income arising in the period fr

- Page 223 and 224: E. NOTES TO THE BALANCE SHEET 10. I

- Page 225 and 226: 12.2 IMPAIRMENT LOSSES ON OTHER NON

- Page 227 and 228: CONSOLIDATED FINANCIAL STATEMENTS 1

- Page 229 and 230: 15. LEASED ASSETS Property, plant a

- Page 231: CONSOLIDATED FINANCIAL STATEMENTS 1

- Page 235 and 236: The changes in capital in 2005 brea

- Page 237 and 238: CONSOLIDATED FINANCIAL STATEMENTS I

- Page 239 and 240: CONSOLIDATED FINANCIAL STATEMENTS 2

- Page 241 and 242: Changes in the period CONSOLIDATED

- Page 243 and 244: 24. PROVISIONS During the period, c

- Page 245 and 246: By business line, the analysis of n

- Page 247 and 248: . Other bonds Other bonds break dow

- Page 249 and 250: d. Finance leases The table below s

- Page 251 and 252: 25.3.2 Cash and cash management fin

- Page 253 and 254: CONSOLIDATED FINANCIAL STATEMENTS T

- Page 255 and 256: Based on this position, a 1% increa

- Page 257 and 258: 26.3.3 Analysis of other foreign cu

- Page 259 and 260: 28. TRANSACTIONS WITH RELATED PARTI

- Page 261 and 262: The maturities of contractual oblig

- Page 263 and 264: 31. REMUNERATION AND RELATED BENEFI

- Page 265 and 266: promissory notes issued by Intertou

- Page 267 and 268: CONSOLIDATED FINANCIAL STATEMENTS I

- Page 269 and 270: (h) Reclassification under operatin

- Page 271 and 272: 1.5 SUMMARIES OF IMPACTS OF RESTATE

- Page 273 and 274: 2.3.2 Goodwill CONSOLIDATED FINANCI

- Page 275 and 276: 2.3.6 Fair value of derivatives CON

- Page 277 and 278: 2.4 RECONCILIATION OF BALANCE SHEET

- Page 279 and 280: 2.4.6 Trade and other current payab

- Page 281 and 282: CONSOLIDATED FINANCIAL STATEMENTS 4

19. WORKING CAPITAL REQUIREMENT<br />

31/12/<strong>2005</strong> 31/12/2004 Changes<br />

(in € millions) connected receivables / payables Other<br />

with operations related to fixed assets changes (*)<br />

Inventories and work in progress (net) 540.7 542.8 (44.7) 0.0 42.6<br />

Trade and other operating receivables 8,334.3 7,279.8 824.9 3.9 225.6<br />

Other current assets 218.6 157.3 109.5 0.0 (48.2)<br />

Inventories and operating receivables (I) 9,093.5 7,979.9 889.8 3.9 219.9<br />

Trade payables 5,002.3 4,619.2 389.5 0.0 (6.5)<br />

Other current payables 5,498.6 4,743.6 585.9 3.4 165.7<br />

Trade and other operating payables (II) 10,500.8 9,362.8 975.4 3.4 159.2<br />

Working capital requirement<br />

(before current provisions) (I-II) (1,407.3) (1,382.9) 85.7 (0.6) (60.7)<br />

Current provisions (1,445.4) (1,382.8) 34.2 0.0 (96.8)<br />

including part at less than one year of non-current provisions 257.4 247.4 0.0 0.0 10.0<br />

Working capital requirements<br />

(after current provisions) (2,852.7) (2,765.7) 119.9 (0.6) (157.5)<br />

(*) mainly changes in consolidation scope and translation differences.<br />

The working capital requirement connected with operations comprises<br />

current assets and liabilities related to operations, except for current tax<br />

assets and liabilities and other current assets and liabilities of a financial<br />

nature.<br />

228<br />

<strong>VINCI</strong> <strong>2005</strong> ANNUAL REPORT<br />

The improvement in the working capital requirement connected with<br />

operations (+€120 million) arises principally in the Roads and<br />

Construction business lines.<br />

The component parts of the working capital requirement by maturity are:<br />

31/12/<strong>2005</strong> Maturity<br />

(in € millions) within 1 year between 1 and 5 years in more than 5 years<br />

Inventories and work in progress (net) 540.7 536.4 4.2 0.1<br />

Trade and other operating receivables 8,334.3 8,296.3 35.0 2.9<br />

Other current assets 218.6 209.9 5.9 2.8<br />

Inventories and operating receivables (I) 9,093.5 9,042.7 45.1 5.8<br />

Trade payables 5,002.3 4,994.8 5.6 1.8<br />

Other current payables 5,498.6 5,396.8 69.8 32.0<br />

Trade and other operating payables (II) 10,500.8 10,391.6 75.4 33.8<br />

Working capital requirement<br />

(before current provisions) (I-II) (1,407.3) (1,349.0) (30.3) (28.0)