greatlink global real estate securities fund - Great Eastern

greatlink global real estate securities fund - Great Eastern

greatlink global real estate securities fund - Great Eastern

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fund Details version 12 (Errors & Omissions excepted)<br />

With effect from 1 July 2011<br />

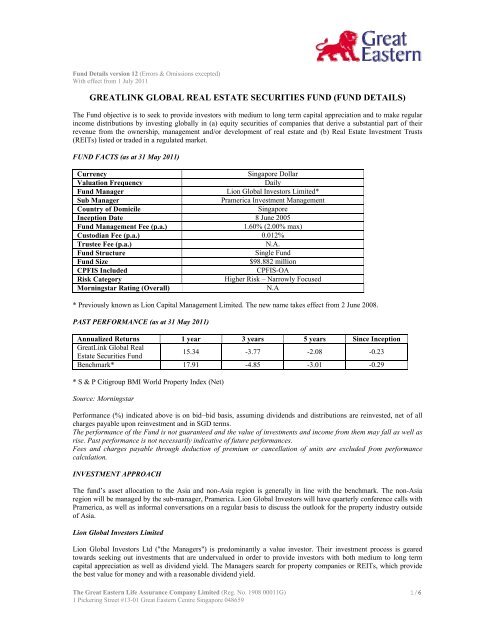

GREATLINK GLOBAL REAL ESTATE SECURITIES FUND (FUND DETAILS)<br />

The Fund objective is to seek to provide investors with medium to long term capital appreciation and to make regular<br />

income distributions by investing <strong>global</strong>ly in (a) equity <strong>securities</strong> of companies that derive a substantial part of their<br />

revenue from the ownership, management and/or development of <strong>real</strong> <strong>estate</strong> and (b) Real Estate Investment Trusts<br />

(REITs) listed or traded in a regulated market.<br />

FUND FACTS (as at 31 May 2011)<br />

Currency Singapore Dollar<br />

Valuation Frequency Daily<br />

Fund Manager Lion Global Investors Limited*<br />

Sub Manager Pramerica Investment Management<br />

Country of Domicile Singapore<br />

Inception Date 8 June 2005<br />

Fund Management Fee (p.a.) 1.60% (2.00% max)<br />

Custodian Fee (p.a.) 0.012%<br />

Trustee Fee (p.a.) N.A.<br />

Fund Structure Single Fund<br />

Fund Size $98.882 million<br />

CPFIS Included CPFIS-OA<br />

Risk Category Higher Risk – Narrowly Focused<br />

Morningstar Rating (Overall) N.A<br />

* Previously known as Lion Capital Management Limited. The new name takes effect from 2 June 2008.<br />

PAST PERFORMANCE (as at 31 May 2011)<br />

Annualized Returns 1 year 3 years 5 years Since Inception<br />

<strong>Great</strong>Link Global Real<br />

Estate Securities Fund<br />

15.34 -3.77 -2.08 -0.23<br />

Benchmark* 17.91 -4.85 -3.01 -0.29<br />

* S & P Citigroup BMI World Property Index (Net)<br />

Source: Morningstar<br />

Performance (%) indicated above is on bid−bid basis, assuming dividends and distributions are reinvested, net of all<br />

charges payable upon reinvestment and in SGD terms.<br />

The performance of the Fund is not guaranteed and the value of investments and income from them may fall as well as<br />

rise. Past performance is not necessarily indicative of future performances.<br />

Fees and charges payable through deduction of premium or cancellation of units are excluded from performance<br />

calculation.<br />

INVESTMENT APPROACH<br />

The <strong>fund</strong>’s asset allocation to the Asia and non-Asia region is generally in line with the benchmark. The non-Asia<br />

region will be managed by the sub-manager, Pramerica. Lion Global Investors will have quarterly conference calls with<br />

Pramerica, as well as informal conversations on a regular basis to discuss the outlook for the property industry outside<br />

of Asia.<br />

Lion Global Investors Limited<br />

Lion Global Investors Ltd ("the Managers") is predominantly a value investor. Their investment process is geared<br />

towards seeking out investments that are undervalued in order to provide investors with both medium to long term<br />

capital appreciation as well as dividend yield. The Managers search for property companies or REITs, which provide<br />

the best value for money and with a reasonable dividend yield.<br />

The <strong>Great</strong> <strong>Eastern</strong> Life Assurance Company Limited (Reg. No. 1908 00011G) 1/6<br />

1 Pickering Street #13-01 <strong>Great</strong> <strong>Eastern</strong> Centre Singapore 048659

Fund Details version 12 (Errors & Omissions excepted)<br />

With effect from 1 July 2011<br />

All the <strong>securities</strong> will be selected on the basis of a combination of top-down and bottom-up analysis, with a stronger<br />

emphasis on the latter. The understanding on the economic outlook of the countries and the sub-sector that the<br />

companies operate in, through macro analysis, will be used as inputs in the stock analysis. The bottom-up stock<br />

selection process focuses on selecting stocks with long term growth prospects, have good management who can create<br />

value for the shareholders, and/or are undervalued as a result of market inefficiencies.<br />

The Managers' country/macro analysis will consider factors such as macro <strong>fund</strong>amentals, liquidity, market dynamics<br />

and market valuations in evaluating the country performance and outlook. Other non-quantifiable factors are also<br />

considered, such as political and social factors. Combining the input from the country analysis with industry dynamics<br />

within the country allows us to have an in-depth understanding of the sector, including that of the sub-sectors. The<br />

Managers then constantly monitor the factors that drive them. Conversations with and reports published by Pramerica<br />

and property consultants are also important source of information on the sector performance and outlook.<br />

At Lion Global Investors, risk management is built into the portfolio construction process, taking into consideration<br />

country and individual stock weightings relative to the benchmark. Portfolio risk is controlled through diversification at<br />

the company and country level to minimize unintended bets and to maximize return/risk potential.<br />

Pramerica Investment Management<br />

Each quarter, the Global Investment Committee of the <strong>real</strong> <strong>estate</strong> arm of Pramerica Investment Management -<br />

Pramerica Real Estate Investors (Pramerica) meets to set the allocation between regions and monitor the performance<br />

and risk characteristics of the portfolio. The committee may also meet more frequently if market conditions warrant or<br />

if deemed necessary by the judgment of the portfolio managers.<br />

Pramerica's investment process begins with the Global Investment Committee. This committee is comprised of five of<br />

Pramerica's top <strong>real</strong> <strong>estate</strong> investment professionals across the globe, including the C.E.O., head of Global Research<br />

and head of Global Chief Risk and Investment Officer. The primary function of the committee is to review and set the<br />

<strong>global</strong> investment allocation of the <strong>fund</strong> based on an analysis of macroeconomic conditions, capital markets, relative<br />

valuation and private <strong>real</strong> <strong>estate</strong> <strong>fund</strong>amentals in each region. The committee also reviews and monitors performance of<br />

the <strong>fund</strong> as well as all risk characteristics of the <strong>fund</strong> including country risk, property sector allocations, volatility<br />

relative to the benchmark, and benchmark drift.<br />

Once the <strong>global</strong> allocations are set, the portfolio managers employ a "bottom up" <strong>fund</strong>amental investment analysis. The<br />

portfolio managers use a proprietary quantitative model to rank the investment universe for the best risk adjusted<br />

investment opportunities. The model makes a relative assessment of each company's current valuation, financial<br />

strength, growth prospects, liquidity, operating efficiency and market sentiment. The model serves as a tool to guide the<br />

portfolio managers to opportunities and to spend more time performing <strong>fund</strong>amental investment analysis. With the<br />

reduced universe, Pramerica focuses on how each company fits into the macroeconomic landscape and their overall<br />

assessment of the <strong>real</strong> <strong>estate</strong> markets formed with the aid of their award winning <strong>global</strong> investment research team.<br />

Pramerica then performs quantitative and qualitative <strong>fund</strong>amental investment analysis on the remaining names. Their<br />

analysis includes an assessment of the management team, company strategy and position within industry, the<br />

underlying <strong>real</strong> <strong>estate</strong> assets using their proprietary database of <strong>real</strong> <strong>estate</strong> transactions, company financial statements,<br />

"street" estimates and company corporate governance. Critical to Pramerica's process of selecting <strong>securities</strong> is the input<br />

of their <strong>real</strong> <strong>estate</strong> transaction professionals located throughout the world who buy and sell <strong>real</strong> <strong>estate</strong> every day and<br />

provide them with "<strong>real</strong> time" data on <strong>real</strong> <strong>estate</strong> <strong>fund</strong>amentals, capital markets and management team evaluations.<br />

Pramerica also further evaluates the net asset value of the company, discounted cash flows and relative valuation.<br />

Pramerica selects the opportunities that provide the best risk adjusted return potential. On a daily basis, portfolio<br />

managers meet to discuss investment opportunities, sales candidates and overall portfolio strategy and characteristics.<br />

INVESTMENT SCOPE<br />

The <strong>fund</strong> will not invest in any direct <strong>real</strong> <strong>estate</strong> assets, only indirect investments through publicly traded Real Estate<br />

Investment Trusts (REITs) and publicly-traded Real Estate Operating Companies (REOCs). In aggregate the <strong>fund</strong> shall<br />

be invested <strong>global</strong>ly across three major continental regions, namely, the Americas, Europe and Asia including<br />

Australasia. This would provide significant geographic diversification. Within each region, the <strong>fund</strong> shall be invested in<br />

multiple countries and sub-sectors, namely, office, retail, industrial, lodging, etc.<br />

The <strong>Great</strong> <strong>Eastern</strong> Life Assurance Company Limited (Reg. No. 1908 00011G) 2/6<br />

1 Pickering Street #13-01 <strong>Great</strong> <strong>Eastern</strong> Centre Singapore 048659

Fund Details version 12 (Errors & Omissions excepted)<br />

With effect from 1 July 2011<br />

Publicly listed <strong>real</strong> <strong>estate</strong> operating companies and <strong>real</strong> <strong>estate</strong> investment trusts are permissible investments. There are<br />

no specific country restrictions.<br />

Additionally, cash management instruments for the purposes of managing surplus cash are also permissible<br />

investments. Derivatives maybe used for efficient portfolio management and hedging purposes.<br />

DIVIDEND POLICY<br />

It is the current intention of the Manager to make annual distributions to Holders provided that there is distributable<br />

income and/or capital gains for that period. Holders should note that the annual distributions (if any), whether out of<br />

capital or otherwise, may have the effect of lowering the net asset value of the <strong>fund</strong>. There is no guarantee, assurance<br />

and/or certainty that the Managers' intention to make the annual distribution will be achieved. The right to vary the<br />

frequency and/or amount of the annual distributions, if any, will be at the Managers' absolute discretion.<br />

INFORMATION ON THE MANAGER AND SUB-MANAGER<br />

Lion Global Investors Limited<br />

Lion Global Investors Limited, one of the largest asset management companies in Southeast Asia, is 70% owned by<br />

<strong>Great</strong> <strong>Eastern</strong> Holdings Limited and 30% owned by Orient Holdings Private Limited, a wholly-owned subsidiary of<br />

OCBC Bank.<br />

The Managers have a total staff strength of about 141 with about 50 experienced investment professionals including<br />

portfolio managers, analysts and traders managing assets of about S$29.0 billion as at 31 March 2011. The Managers<br />

offer a comprehensive suite of investment products covering all asset classes and their clients include government and<br />

government-linked corporations, public and private companies, charitable organisations and individual investors.<br />

The Managers have an experienced team of investment professionals dedicated to regional and <strong>global</strong> equities and<br />

fixed income markets. The average years of experience of each member of the investment team spans more than 10<br />

years. The Managers’ investment capabilities are greatly enhanced by its specialised teams of experienced analysts and<br />

investment managers. The Managers’ approach to investment is team-based and research-intensive, combining in-depth<br />

market insights with comprehensive sector knowledge.<br />

The Managers have been managing collective investment schemes and discretionary <strong>fund</strong>s in Singapore since 1987 and<br />

investment-linked product <strong>fund</strong>s since 1996. In addition, the Managers have a proven track record of achieving<br />

consistently good performance. Since 1999, the Managers have won a total of 117 awards for investments in local,<br />

regional and <strong>global</strong> markets and across asset classes. The Managers were awarded Best Fund Group over 3 years -<br />

Mixed Asset Group at the Edge-Lipper Singapore Funds Awards from 2006 to 2009, and Best Fund Group (5 Year) at<br />

the Standard & Poor’s 2007 Singapore Fund Awards. Please refer to the Managers’ website at<br />

www.lion<strong>global</strong>investors.com for the full list of awards.<br />

Investors should note that the past performance of the Managers is not necessarily indicative of the future performance<br />

of the Managers.<br />

Pramerica Investment Management<br />

The total (net) AUM for Pramerica Investment Management as of 31 March, 2011 was $569M. Pramerica Real Estate<br />

Investors, which is the <strong>real</strong> <strong>estate</strong> investment arm of Pramerica Investment Management, has been managing <strong>global</strong> <strong>real</strong><br />

<strong>estate</strong> <strong>fund</strong>s for over 30 years. As at 31 March, 2011, total <strong>global</strong> gross and net assets under management were $46.4B<br />

and $28.4B, respectively, while investments in Global Real Estate Securities were $1,360M.<br />

In early 2010, Pramerica's US Domiciled Global Mutual Fund was given 5-star recognition by Morningstar, their<br />

highest rating. The Fund also is ranked in the top 10% of <strong>fund</strong>s for the 5-year track record versus the Lipper peer<br />

group, and is featured amongst the #1 Ranked Real Estate Equity Funds by Zacks.<br />

SOFT DOLLAR COMMISSIONS OR ARRANGEMENTS<br />

Lion Global Investors Limited<br />

The Managers receive and enter into soft dollar commissions or arrangements used to support investment decision<br />

The <strong>Great</strong> <strong>Eastern</strong> Life Assurance Company Limited (Reg. No. 1908 00011G) 3/6<br />

1 Pickering Street #13-01 <strong>Great</strong> <strong>Eastern</strong> Centre Singapore 048659

Fund Details version 12 (Errors & Omissions excepted)<br />

With effect from 1 July 2011<br />

making and these include research and advisory services, economic and political analyses, portfolio analyses, data and<br />

quotation services and computer hardware and software.<br />

The Managers only accept or enter into soft dollar commissions or arrangements if such soft dollar commissions or<br />

arrangements shall, in the opinion of the Managers, reasonably assist them in the management of the Fund, and further<br />

shall ensure at all times that such transactions are executed on the best available terms taking into account the relevant<br />

market at the time for transactions of the kind and size concerned and that no unnecessary trades are entered into in<br />

order to qualify for such soft-dollar commissions or arrangements.<br />

Pramerica Investment Management<br />

Pramerica Real Estate Investors does not engage in soft dollar arrangements whereby a portion of clients' <strong>securities</strong><br />

transactions are directed for credits which are used to pay for brokerage related products and/or services. Pramerica<br />

does receive sell-side research from some of the brokerage firms where trades are executed.<br />

CONFLICTS OF INTEREST<br />

Lion Global Investors Limited<br />

The Managers and the Trustee are not in any positions of conflict in relation to the Fund. The Managers and the Trustee<br />

shall conduct all transactions with or for the Fund at arm’s length. The Managers are of the view that they are not in a<br />

position of conflict in managing their other <strong>fund</strong>s as each of the <strong>fund</strong>s and the Fund has its own investment universe,<br />

investment objectives and investment restrictions, separate and distinct from each of the other <strong>fund</strong>s. The Managers are<br />

obligated by the provisions of each respective trust deed to observe strictly such separate and distinct investment<br />

mandate for each of the <strong>fund</strong>s. In the event the various <strong>fund</strong>s place orders for the same <strong>securities</strong> as the Fund, the<br />

Managers shall endeavour as far as possible to allocate such <strong>securities</strong> among the <strong>fund</strong>s in a fair manner based on a prorata<br />

basis.<br />

Associates of the Trustee may be engaged to provide financial, banking or brokerage services to the Fund. Such<br />

services, where provided, will be on an arm’s length basis.<br />

Pramerica Investment Management<br />

There are no noteworthy conflicts of interest that arise from the <strong>fund</strong> and management by Pramerica Real Estate<br />

Investors.<br />

(a) The Fund does not acquire any interest in direct property assets. Only publicly traded <strong>securities</strong> are considered for<br />

this investment universe.<br />

(b) Pramerica will not acquire any interest in the ILP <strong>fund</strong>.<br />

(c) Pramerica has no affiliation with any service provider to the <strong>fund</strong>.<br />

(d) Pramerica manages other <strong>fund</strong>s that invest in <strong>real</strong> <strong>estate</strong> <strong>securities</strong> and may have a similar investment strategy.<br />

Pramerica has a standard allocation policy that is based upon the individual <strong>fund</strong> investment criteria and pro-rata<br />

allocations among <strong>fund</strong>s with similar investment mandates.<br />

RISKS<br />

General Risks<br />

Investors should consider and satisfy themselves as to the risks of investing in the Fund. Generally, some of the risk<br />

factors that should be considered by the investors of the Fund are market, derivatives, liquidity, political, repatriation,<br />

regulatory, currency and market risks, and risks associated with investments in debt <strong>securities</strong> which are default and<br />

interest rate risks.<br />

An investment in the Fund is meant to product returns over the medium to long-term. Investors should not expect to<br />

obtain short-term gains from such investment.<br />

The <strong>Great</strong> <strong>Eastern</strong> Life Assurance Company Limited (Reg. No. 1908 00011G) 4/6<br />

1 Pickering Street #13-01 <strong>Great</strong> <strong>Eastern</strong> Centre Singapore 048659

Fund Details version 12 (Errors & Omissions excepted)<br />

With effect from 1 July 2011<br />

Investors should note that the value of Units, and the income accruing to the Units, may fall or rise and that investors<br />

may not get back their original investment.<br />

Specific Risks<br />

(a) Market Risks<br />

The performance of this Fund will be impacted by general economic conditions, general <strong>real</strong> <strong>estate</strong> market conditions<br />

and general market conditions facing publicly traded <strong>securities</strong>. The Fund will diversify its holdings <strong>global</strong>ly to<br />

mitigate the impact of poor <strong>real</strong> <strong>estate</strong> market conditions and/or poor public <strong>securities</strong> market conditions in any given<br />

region. In the event market conditions are poor across the globe, the <strong>fund</strong> may experience a loss.<br />

The portfolio managers in PREI have worked with their research team to categorize each country that the Fund may<br />

invest in based on political and country risk assessments. The Fund will not invest in countries with high political and<br />

country risk and will be constrained in its ability to invest in countries with moderate political and country risk.<br />

The Fund may experience a loss if <strong>global</strong> interest rates experience a significant increase. This would have the impact of<br />

making investment alternatives like bonds look relatively more attractive. Over the long term the correlation between<br />

<strong>global</strong> <strong>real</strong> <strong>estate</strong> equity <strong>securities</strong> and <strong>global</strong> bonds is quite low. Often times, a rising rate environment is accompanied<br />

by economic expansion which allows <strong>real</strong> <strong>estate</strong> companies --- particularly those with short term leases to grow rents<br />

which results in dividend growth. In addition, a significant rise in interest rates may drive levered buyers out of the <strong>real</strong><br />

<strong>estate</strong> market and provide more opportunities for public <strong>real</strong> <strong>estate</strong> companies to grow their FFO per share through<br />

acquisitions.<br />

(b) Credit Risks<br />

The Fund will invest primarily in publicly traded equity <strong>securities</strong>. The Portfolio Managers will closely monitor each<br />

portfolio holding's capital structure and ability to meet fixed obligations as well as cover its dividend.<br />

(c) Liquidity Risks<br />

The Fund may hold a diversified portfolio of exchange traded public equity <strong>securities</strong>. Careful consideration will be<br />

given to liquidity for each security included in the portfolio. Portfolio Managers will consider the size of the investment<br />

relative to the trading volume of each underlying security.<br />

(d) Currency Risks<br />

The <strong>fund</strong> is denominated in Singapore dollars but there is no foreign exchange hedging program for the underlying<br />

assets where they could be in foreign currencies. Hence, policyholders shall be exposed to foreign exchange risks. As<br />

the investments of the Fund may be denominated in foreign currencies, fluctuations of the exchange rates of foreign<br />

currencies against the base currency of the Fund (i.e. the Singapore Dollar) may affect the value of the Units in the<br />

Fund.<br />

(e) Real Estate Risks<br />

There are special risks considerations associated with investing in the <strong>securities</strong> of companies principally engaged in<br />

the <strong>real</strong> <strong>estate</strong> industry. These risks include: the cyclical nature of <strong>real</strong> <strong>estate</strong> values, risk related to general and local<br />

economic conditions, overbuilding and increased competition, increases in property taxes and operating expenses,<br />

demographic trends and variations in rental income, changes in zoning laws, casualty or condemnation losses,<br />

environmental risks, regulatory limitations on rents, changes in neighborhood values, related party risks, changes in the<br />

appeal of properties to tenants, increases in interest rates and other <strong>real</strong> <strong>estate</strong> capital market influences.<br />

EXPENSE RATIO<br />

Expense ratio is calculated in accordance with the Investment Management Association of Singapore's guidelines on<br />

the disclosure of expense ratios and based on the figures in the <strong>fund</strong>'s latest relevant audit report. The expense ratio for<br />

the period 1 January 2010 to 31 December 2010 is 1.67%.<br />

The following expenses are excluded from the calculation of expense ratio: charges for insurance coverage, brokerage<br />

and other transaction costs associated with the purchase and sales of investments, performance fees, foreign exchange<br />

gains and losses, front−end or back−end loads arising from the purchase or sale of other <strong>fund</strong>s, tax deducted at source<br />

or arising from income received, and dividend and distributions paid to unit holders.<br />

TURNOVER RATIO<br />

Turnover ratio means a ratio calculated based on the lesser of purchases or sales expressed as a percentage of over<br />

'average net asset value'. Where 'average net asset value' means the net asset value for each day averaged over, as far as<br />

The <strong>Great</strong> <strong>Eastern</strong> Life Assurance Company Limited (Reg. No. 1908 00011G) 5/6<br />

1 Pickering Street #13-01 <strong>Great</strong> <strong>Eastern</strong> Centre Singapore 048659

Fund Details version 12 (Errors & Omissions excepted)<br />

With effect from 1 July 2011<br />

possible, the same period used for calculating the expense ratio. The turnover ratio for the period 1 January 2010 to 31<br />

December 2010 is 39.64%.<br />

The <strong>Great</strong> <strong>Eastern</strong> Life Assurance Company Limited (Reg. No. 1908 00011G) 6/6<br />

1 Pickering Street #13-01 <strong>Great</strong> <strong>Eastern</strong> Centre Singapore 048659