Group structure - BWT Group

Group structure - BWT Group

Group structure - BWT Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

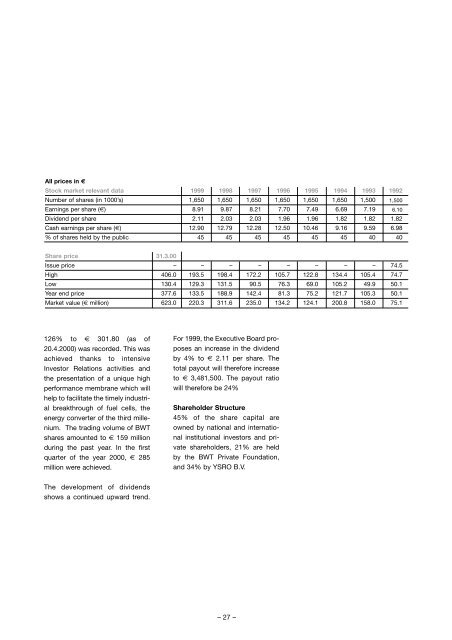

All prices in €<br />

Stock market relevant data 1999 1998 1997 1996 1995 1994 1993 1992<br />

Number of shares (in 1000’s) 1,650 1,650 1,650 1,650 1,650 1,650 1,500 1,500<br />

Earnings per share (€) 8.91 9.87 8.21 7.70 7.49 6.69 7.19 6.10<br />

Dividend per share 2.11 2.03 2.03 1.96 1.96 1.82 1.82 1.82<br />

Cash earnings per share (€) 12.90 12.79 12.28 12.50 10.46 9.16 9.59 6.98<br />

% of shares held by the public 45 45 45 45 45 45 40 40<br />

Share price 31.3.00<br />

Issue price – – – – – – – – 74.5<br />

High 406.0 193.5 198.4 172.2 105.7 122.8 134.4 105.4 74.7<br />

Low 130.4 129.3 131.5 90.5 76.3 69.0 105.2 49.9 50.1<br />

Year end price 377.6 133.5 188.9 142.4 81.3 75.2 121.7 105.3 50.1<br />

Market value (€ million) 623.0 220.3 311.6 235.0 134.2 124.1 200.8 158.0 75.1<br />

126% to € 301.80 (as of<br />

20.4.2000) was recorded. This was<br />

achieved thanks to intensive<br />

Investor Relations activities and<br />

the presentation of a unique high<br />

performance membrane which will<br />

help to facilitate the timely industrial<br />

breakthrough of fuel cells, the<br />

energy converter of the third millenium.<br />

The trading volume of <strong>BWT</strong><br />

shares amounted to € 159 million<br />

during the past year. In the first<br />

quarter of the year 2000, € 285<br />

million were achieved.<br />

The development of dividends<br />

shows a continued upward trend.<br />

For 1999, the Executive Board proposes<br />

an increase in the dividend<br />

by 4% to € 2.11 per share. The<br />

total payout will therefore increase<br />

to € 3,481,500. The payout ratio<br />

will therefore be 24%<br />

Shareholder Structure<br />

45% of the share capital are<br />

owned by national and international<br />

institutional investors and private<br />

shareholders, 21% are held<br />

by the <strong>BWT</strong> Private Foundation,<br />

and 34% by YSRO B.V.<br />

– 27 –