GPERAK-AnnualReport2009 (1MB).pdf - Bursa Malaysia

GPERAK-AnnualReport2009 (1MB).pdf - Bursa Malaysia GPERAK-AnnualReport2009 (1MB).pdf - Bursa Malaysia

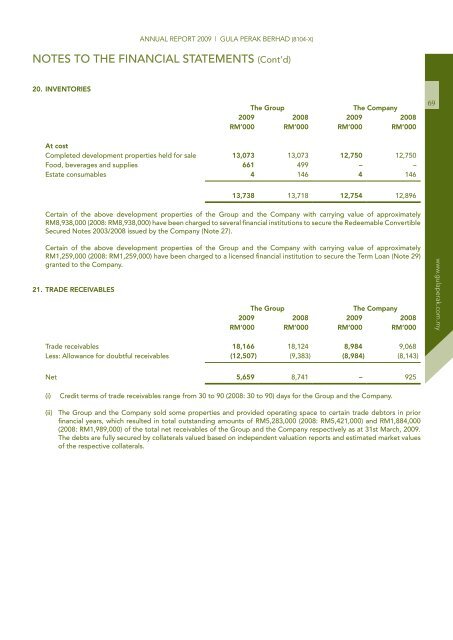

annual report 2009 | Gula peraK BerHaD (8104-X) NOTES TO THE FINANCIAL STATEMENTS (Cont’d) 20. INvENTORIES The Group The Company 2009 2008 2009 2008 RM’000 RM’000 RM’000 RM’000 At cost Completed development properties held for sale 13,073 13,073 12,750 12,750 Food, beverages and supplies 661 499 – – Estate consumables 4 146 4 146 13,738 13,718 12,754 12,896 Certain of the above development properties of the Group and the Company with carrying value of approximately RM8,938,000 (2008: RM8,938,000) have been charged to several financial institutions to secure the Redeemable Convertible Secured Notes 2003/2008 issued by the Company (Note 27). Certain of the above development properties of the Group and the Company with carrying value of approximately RM1,259,000 (2008: RM1,259,000) have been charged to a licensed financial institution to secure the Term Loan (Note 29) granted to the Company. 21. TRADE RECEIvABLES The Group The Company 2009 2008 2009 2008 RM’000 RM’000 RM’000 RM’000 Trade receivables 18,166 18,124 8,984 9,068 Less: Allowance for doubtful receivables (12,507) (9,383) (8,984) (8,143) Net 5,659 8,741 – 925 (i) Credit terms of trade receivables range from 30 to 90 (2008: 30 to 90) days for the Group and the Company. (ii) The Group and the Company sold some properties and provided operating space to certain trade debtors in prior financial years, which resulted in total outstanding amounts of RM5,283,000 (2008: RM5,421,000) and RM1,884,000 (2008: RM1,989,000) of the total net receivables of the Group and the Company respectively as at 31st March, 2009. The debts are fully secured by collaterals valued based on independent valuation reports and estimated market values of the respective collaterals. 69 www.gulaperak.com.my

www.gulaperak.com.my 70 22. OTHER RECEIvABLES, DEPOSITS AND PREPAyMENTS annual report 2009 | Gula peraK BerHaD (8104-X) NOTES TO THE FINANCIAL STATEMENTS (Cont’d) The Group The Company 2009 2008 2009 2008 RM’000 RM’000 RM’000 RM’000 Other receivables - sale of land 9,350 7,807 9,350 7,807 - others 2,626 44,843 – 41,552 11,976 52,650 9,350 49,359 Less: Allowance for doubtful receivables (1,859) (1,859) (859) (859) Net 10,117 50,791 8,491 48,500 Deposits 5,099 4,708 4,538 4,518 Prepayments 558 989 478 478 Tax recoverable 8 7 – – 23. CASH AND CASH EQUIvALENTS 15,782 56,495 13,507 53,496 Cash and cash equivalents included in the cash flow statement comprise the following balance sheet amounts: The Group The Company 2009 2008 2009 2008 RM’000 RM’000 RM’000 RM’000 Deposits with licensed banks 2,342 9,420 89 8,775 Cash and bank balances 1,516 2,393 146 987 Less: Deposits with licensed banks pledged (89) (86) (89) (86) Deposits in sinking fund account – (8,689) – (8,689) 3,769 3,038 146 987 Certain deposits with licensed banks of the Group and of the Company of RM89,000 (2008: RM86,000) are pledged to financial institutions as security for the bank guarantee facilities granted to the Company. The average effective interest rates of deposits as at balance sheet date are as follows: The Group The Company 2009 2008 2009 2008 % % % % Deposits with licensed banks 3.50 3.33 3.50 3.33 Deposits of the Group and of the Company have an average maturity of 12 (2008: 12) months.

- Page 19 and 20: www.gulaperak.com.my 18 RELATIONSHI

- Page 21 and 22: www.gulaperak.com.my 20 KEy PROCESS

- Page 23 and 24: www.gulaperak.com.my 22 AUDIT COMMI

- Page 25 and 26: www.gulaperak.com.my 24 annual repo

- Page 27 and 28: www.gulaperak.com.my 26 OTHER INFOR

- Page 29 and 30: www.gulaperak.com.my 28 FINANCIAL S

- Page 31 and 32: www.gulaperak.com.my 30 DIRECTORS

- Page 33 and 34: www.gulaperak.com.my 32 DIRECTORS

- Page 35 and 36: www.gulaperak.com.my 34 Report on O

- Page 37 and 38: www.gulaperak.com.my 36 BALANCE SHE

- Page 39 and 40: www.gulaperak.com.my 38 STATEMENTS

- Page 41 and 42: www.gulaperak.com.my 40 CASH FLOW S

- Page 43 and 44: www.gulaperak.com.my 42 CASH FLOW S

- Page 45 and 46: www.gulaperak.com.my 44 annual repo

- Page 47 and 48: www.gulaperak.com.my 46 annual repo

- Page 49 and 50: www.gulaperak.com.my 48 annual repo

- Page 51 and 52: www.gulaperak.com.my 50 annual repo

- Page 53 and 54: www.gulaperak.com.my 52 5. SEGMENT

- Page 55 and 56: www.gulaperak.com.my 54 9. LOSS BEF

- Page 57 and 58: www.gulaperak.com.my 56 10. DIRECTO

- Page 59 and 60: www.gulaperak.com.my 58 12. (LOSS)/

- Page 61 and 62: www.gulaperak.com.my 60 14. PROPERT

- Page 63 and 64: www.gulaperak.com.my 62 14. PROPERT

- Page 65 and 66: www.gulaperak.com.my 64 14. PROPERT

- Page 67 and 68: www.gulaperak.com.my 66 17. INvESTM

- Page 69: www.gulaperak.com.my 68 18. PROPERT

- Page 73 and 74: www.gulaperak.com.my 72 annual repo

- Page 75 and 76: www.gulaperak.com.my 74 annual repo

- Page 77 and 78: www.gulaperak.com.my 76 29. BORROwI

- Page 79 and 80: www.gulaperak.com.my 78 annual repo

- Page 81 and 82: www.gulaperak.com.my 80 33. AMOUNT

- Page 83 and 84: www.gulaperak.com.my 82 36. FINANCI

- Page 85 and 86: www.gulaperak.com.my 84 ANALYSIS OF

- Page 87 and 88: www.gulaperak.com.my 86 GROUP PROPE

- Page 89 and 90: Fold this flap for sealing 2nd fold

annual report 2009 | Gula peraK BerHaD (8104-X)<br />

NOTES TO THE FINANCIAL STATEMENTS (Cont’d)<br />

20. INvENTORIES<br />

The Group The Company<br />

2009 2008 2009 2008<br />

RM’000 RM’000 RM’000 RM’000<br />

At cost<br />

Completed development properties held for sale 13,073 13,073 12,750 12,750<br />

Food, beverages and supplies 661 499 – –<br />

Estate consumables 4 146 4 146<br />

13,738 13,718 12,754 12,896<br />

Certain of the above development properties of the Group and the Company with carrying value of approximately<br />

RM8,938,000 (2008: RM8,938,000) have been charged to several financial institutions to secure the Redeemable Convertible<br />

Secured Notes 2003/2008 issued by the Company (Note 27).<br />

Certain of the above development properties of the Group and the Company with carrying value of approximately<br />

RM1,259,000 (2008: RM1,259,000) have been charged to a licensed financial institution to secure the Term Loan (Note 29)<br />

granted to the Company.<br />

21. TRADE RECEIvABLES<br />

The Group The Company<br />

2009 2008 2009 2008<br />

RM’000 RM’000 RM’000 RM’000<br />

Trade receivables 18,166 18,124 8,984 9,068<br />

Less: Allowance for doubtful receivables (12,507) (9,383) (8,984) (8,143)<br />

Net 5,659 8,741 – 925<br />

(i) Credit terms of trade receivables range from 30 to 90 (2008: 30 to 90) days for the Group and the Company.<br />

(ii) The Group and the Company sold some properties and provided operating space to certain trade debtors in prior<br />

financial years, which resulted in total outstanding amounts of RM5,283,000 (2008: RM5,421,000) and RM1,884,000<br />

(2008: RM1,989,000) of the total net receivables of the Group and the Company respectively as at 31st March, 2009.<br />

The debts are fully secured by collaterals valued based on independent valuation reports and estimated market values<br />

of the respective collaterals.<br />

69<br />

www.gulaperak.com.my