GPERAK-AnnualReport2009 (1MB).pdf - Bursa Malaysia

GPERAK-AnnualReport2009 (1MB).pdf - Bursa Malaysia GPERAK-AnnualReport2009 (1MB).pdf - Bursa Malaysia

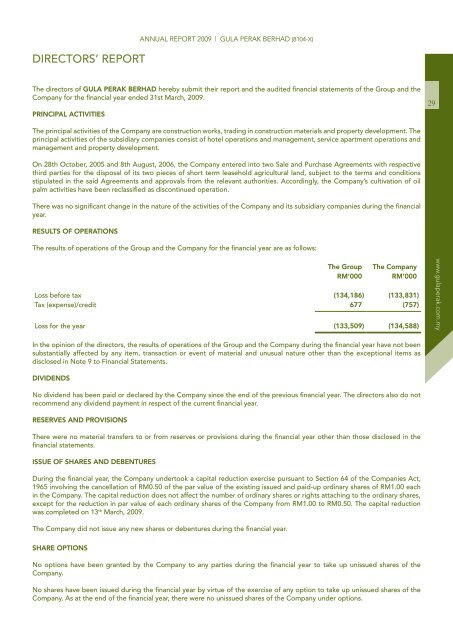

DIRECTORS’ REPORT annual report 2009 | Gula peraK BerHaD (8104-X) The directors of GULA PERAK BERHAD hereby submit their report and the audited financial statements of the Group and the Company for the financial year ended 31st March, 2009. PRINCIPAL ACTIvITIES The principal activities of the Company are construction works, trading in construction materials and property development. The principal activities of the subsidiary companies consist of hotel operations and management, service apartment operations and management and property development. On 28th October, 2005 and 8th August, 2006, the Company entered into two Sale and Purchase Agreements with respective third parties for the disposal of its two pieces of short term leasehold agricultural land, subject to the terms and conditions stipulated in the said Agreements and approvals from the relevant authorities. Accordingly, the Company’s cultivation of oil palm activities have been reclassified as discontinued operation. There was no significant change in the nature of the activities of the Company and its subsidiary companies during the financial year. RESULTS OF OPERATIONS The results of operations of the Group and the Company for the financial year are as follows: The Group The Company RM’000 RM’000 Loss before tax (134,186) (133,831) Tax (expense)/credit 677 (757) Loss for the year (133,509) (134,588) In the opinion of the directors, the results of operations of the Group and the Company during the financial year have not been substantially affected by any item, transaction or event of material and unusual nature other than the exceptional items as disclosed in Note 9 to Financial Statements. DIvIDENDS No dividend has been paid or declared by the Company since the end of the previous financial year. The directors also do not recommend any dividend payment in respect of the current financial year. RESERvES AND PROvISIONS There were no material transfers to or from reserves or provisions during the financial year other than those disclosed in the financial statements. ISSUE OF SHARES AND DEBENTURES During the financial year, the Company undertook a capital reduction exercise pursuant to Section 64 of the Companies Act, 1965 involving the cancellation of RM0.50 of the par value of the existing issued and paid-up ordinary shares of RM1.00 each in the Company. The capital reduction does not affect the number of ordinary shares or rights attaching to the ordinary shares, except for the reduction in par value of each ordinary shares of the Company from RM1.00 to RM0.50. The capital reduction was completed on 13 th March, 2009. The Company did not issue any new shares or debentures during the financial year. SHARE OPTIONS No options have been granted by the Company to any parties during the financial year to take up unissued shares of the Company. No shares have been issued during the financial year by virtue of the exercise of any option to take up unissued shares of the Company. As at the end of the financial year, there were no unissued shares of the Company under options. 29 www.gulaperak.com.my

www.gulaperak.com.my 30 DIRECTORS’ REPORT (Cont’d) OTHER FINANCIAL INFORMATION annual report 2009 | Gula peraK BerHaD (8104-X) Before the income statements and balance sheets of the Group and the Company were made out, the directors took reasonable steps: (a) to ascertain that proper action had been taken in relation to the writing off of bad receivables and the making of allowance for doubtful receivables, and have satisfied themselves that all known bad receivables had been written off and that adequate allowance had been made for doubtful receivables; and (b) to ensure that any current assets which were unlikely to realise their book values in the ordinary course of business have been written down to their estimated realisable values. During the financial year ended 31st March 2009, the Group and the Company have incurred net loss of RM133,509,000 and RM134,588,000 respectively, and have a net current liabilities of RM316,786,000 and RM281,807,000 respectively as of that date. These conditions cast doubt about the Group’s and the Company’s ability to continue as a going-concern. The directors however are of the opinion that the Group and the Company would be able to generate cash flows necessary for the Group and the Company to operate profitably in the future upon the finalisation of the negotiations for variations of the terms of the Redeemable Convertible Secured Notes 2003/2008 as mentioned in Note 27 to the Financial Statements and consequently, the realisation of assets and settlement of liabilities will occur in the ordinary course of business. Other than as stated above, at the date of this report, the directors are not aware of any circumstances: (a) which would render the amount written off for bad receivables or the amount of allowance for doubtful receivables in the financial statements of the Group and the Company inadequate to any substantial extent; or (b) which would render the values attributed to current assets in the financial statements of the Group and the Company misleading; or (c) which have arisen which render adherence to the existing method of valuation of assets or liabilities of the Group and the Company misleading or inappropriate; or (d) not otherwise dealt with in this report or financial statements which would render any amount stated in the financial statements of the Group and the Company misleading. At the date of this report, there does not exist: (a) any charge on the assets of the Group and the Company which has arisen since the end of the financial year which secures the liability of any other person; or (b) any contingent liability of the Group and the Company which has arisen since the end of the financial year. No contingent or other liability has become enforceable or is likely to become enforceable within the period of twelve months after the end of the financial year which, in the opinion of the directors, will or may substantially affect the ability of the Group and the Company to meet their obligations as and when they fall due. In the opinion of the directors, no item, transaction or event of a material and unusual nature has arisen in the interval between the end of the financial year and the date of this report which is likely to affect substantially the results of operations of the Group and the Company for the succeeding financial year.

- Page 1 and 2: Gula Perak Berhad (8104-X) (Incorpo

- Page 3 and 4: www.gulaperak.com.my 2 annual repor

- Page 5 and 6: www.gulaperak.com.my 4 Note annual

- Page 7 and 8: www.gulaperak.com.my 6 ANUAR BIN DA

- Page 9 and 10: www.gulaperak.com.my 8 DATUK RAHIM

- Page 11 and 12: www.gulaperak.com.my 10 DATO’ MUS

- Page 13 and 14: www.gulaperak.com.my 12 CHAIRMAN’

- Page 15 and 16: www.gulaperak.com.my 14 annual repo

- Page 17 and 18: www.gulaperak.com.my 16 BOARD COMMI

- Page 19 and 20: www.gulaperak.com.my 18 RELATIONSHI

- Page 21 and 22: www.gulaperak.com.my 20 KEy PROCESS

- Page 23 and 24: www.gulaperak.com.my 22 AUDIT COMMI

- Page 25 and 26: www.gulaperak.com.my 24 annual repo

- Page 27 and 28: www.gulaperak.com.my 26 OTHER INFOR

- Page 29: www.gulaperak.com.my 28 FINANCIAL S

- Page 33 and 34: www.gulaperak.com.my 32 DIRECTORS

- Page 35 and 36: www.gulaperak.com.my 34 Report on O

- Page 37 and 38: www.gulaperak.com.my 36 BALANCE SHE

- Page 39 and 40: www.gulaperak.com.my 38 STATEMENTS

- Page 41 and 42: www.gulaperak.com.my 40 CASH FLOW S

- Page 43 and 44: www.gulaperak.com.my 42 CASH FLOW S

- Page 45 and 46: www.gulaperak.com.my 44 annual repo

- Page 47 and 48: www.gulaperak.com.my 46 annual repo

- Page 49 and 50: www.gulaperak.com.my 48 annual repo

- Page 51 and 52: www.gulaperak.com.my 50 annual repo

- Page 53 and 54: www.gulaperak.com.my 52 5. SEGMENT

- Page 55 and 56: www.gulaperak.com.my 54 9. LOSS BEF

- Page 57 and 58: www.gulaperak.com.my 56 10. DIRECTO

- Page 59 and 60: www.gulaperak.com.my 58 12. (LOSS)/

- Page 61 and 62: www.gulaperak.com.my 60 14. PROPERT

- Page 63 and 64: www.gulaperak.com.my 62 14. PROPERT

- Page 65 and 66: www.gulaperak.com.my 64 14. PROPERT

- Page 67 and 68: www.gulaperak.com.my 66 17. INvESTM

- Page 69 and 70: www.gulaperak.com.my 68 18. PROPERT

- Page 71 and 72: www.gulaperak.com.my 70 22. OTHER R

- Page 73 and 74: www.gulaperak.com.my 72 annual repo

- Page 75 and 76: www.gulaperak.com.my 74 annual repo

- Page 77 and 78: www.gulaperak.com.my 76 29. BORROwI

- Page 79 and 80: www.gulaperak.com.my 78 annual repo

DIRECTORS’ REPORT<br />

annual report 2009 | Gula peraK BerHaD (8104-X)<br />

The directors of GULA PERAK BERHAD hereby submit their report and the audited financial statements of the Group and the<br />

Company for the financial year ended 31st March, 2009.<br />

PRINCIPAL ACTIvITIES<br />

The principal activities of the Company are construction works, trading in construction materials and property development. The<br />

principal activities of the subsidiary companies consist of hotel operations and management, service apartment operations and<br />

management and property development.<br />

On 28th October, 2005 and 8th August, 2006, the Company entered into two Sale and Purchase Agreements with respective<br />

third parties for the disposal of its two pieces of short term leasehold agricultural land, subject to the terms and conditions<br />

stipulated in the said Agreements and approvals from the relevant authorities. Accordingly, the Company’s cultivation of oil<br />

palm activities have been reclassified as discontinued operation.<br />

There was no significant change in the nature of the activities of the Company and its subsidiary companies during the financial<br />

year.<br />

RESULTS OF OPERATIONS<br />

The results of operations of the Group and the Company for the financial year are as follows:<br />

The Group The Company<br />

RM’000 RM’000<br />

Loss before tax (134,186) (133,831)<br />

Tax (expense)/credit 677 (757)<br />

Loss for the year (133,509) (134,588)<br />

In the opinion of the directors, the results of operations of the Group and the Company during the financial year have not been<br />

substantially affected by any item, transaction or event of material and unusual nature other than the exceptional items as<br />

disclosed in Note 9 to Financial Statements.<br />

DIvIDENDS<br />

No dividend has been paid or declared by the Company since the end of the previous financial year. The directors also do not<br />

recommend any dividend payment in respect of the current financial year.<br />

RESERvES AND PROvISIONS<br />

There were no material transfers to or from reserves or provisions during the financial year other than those disclosed in the<br />

financial statements.<br />

ISSUE OF SHARES AND DEBENTURES<br />

During the financial year, the Company undertook a capital reduction exercise pursuant to Section 64 of the Companies Act,<br />

1965 involving the cancellation of RM0.50 of the par value of the existing issued and paid-up ordinary shares of RM1.00 each<br />

in the Company. The capital reduction does not affect the number of ordinary shares or rights attaching to the ordinary shares,<br />

except for the reduction in par value of each ordinary shares of the Company from RM1.00 to RM0.50. The capital reduction<br />

was completed on 13 th March, 2009.<br />

The Company did not issue any new shares or debentures during the financial year.<br />

SHARE OPTIONS<br />

No options have been granted by the Company to any parties during the financial year to take up unissued shares of the<br />

Company.<br />

No shares have been issued during the financial year by virtue of the exercise of any option to take up unissued shares of the<br />

Company. As at the end of the financial year, there were no unissued shares of the Company under options.<br />

29<br />

www.gulaperak.com.my