ANNUAL REPORT 2006 - DG Hyp

ANNUAL REPORT 2006 - DG Hyp

ANNUAL REPORT 2006 - DG Hyp

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management Report<br />

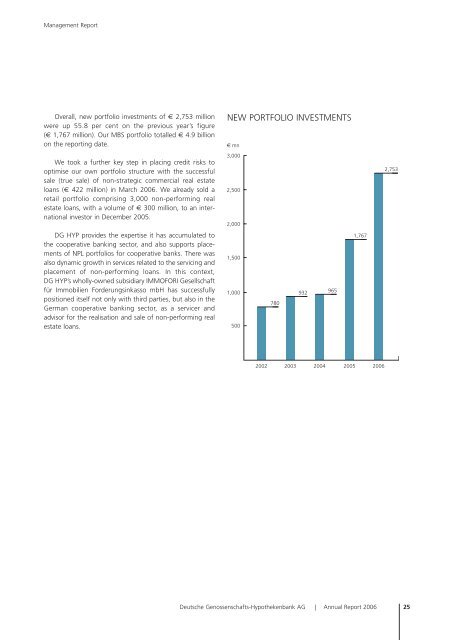

Overall, new portfolio investments of € 2,753 million<br />

were up 55.8 per cent on the previous year’s figure<br />

(€ 1,767 million). Our MBS portfolio totalled € 4.9 billion<br />

on the reporting date.<br />

We took a further key step in placing credit risks to<br />

optimise our own portfolio structure with the successful<br />

sale (true sale) of non-strategic commercial real estate<br />

loans (€ 422 million) in March <strong>2006</strong>. We already sold a<br />

retail portfolio comprising 3,000 non-performing real<br />

estate loans, with a volume of € 300 million, to an international<br />

investor in December 2005.<br />

<strong>DG</strong> HYP provides the expertise it has accumulated to<br />

the cooperative banking sector, and also supports placements<br />

of NPL portfolios for cooperative banks. There was<br />

also dynamic growth in services related to the servicing and<br />

placement of non-performing loans. In this context,<br />

<strong>DG</strong> HYP’s wholly-owned subsidiary IMMOFORI Gesellschaft<br />

für Immobilien Forderungsinkasso mbH has successfully<br />

positioned itself not only with third parties, but also in the<br />

German cooperative banking sector, as a servicer and<br />

advisor for the realisation and sale of non-performing real<br />

estate loans.<br />

NEW PORTFOLIO INVESTMENTS<br />

€ mn<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

780<br />

Deutsche Genossenschafts-<strong>Hyp</strong>othekenbank AG | Annual Report <strong>2006</strong><br />

932<br />

965<br />

1,767<br />

2002 2003 2004 2005 <strong>2006</strong><br />

2,753<br />

25