Winter 2008 Issue - Value Retail News

Winter 2008 Issue - Value Retail News

Winter 2008 Issue - Value Retail News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

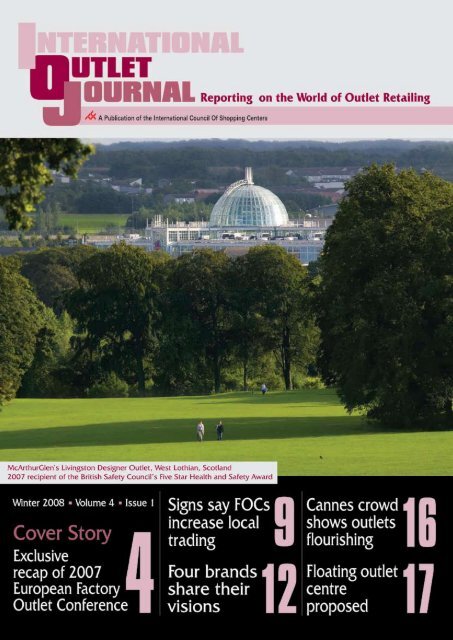

Outlet enthusiasm strengthens<br />

Outlet executives share research, tips, trends at conference<br />

More than 150 people from 28 countries across three continents<br />

attended the 2007 European Outlet Conference held at the Landmark<br />

Hotel in London in October. The event was hosted by the<br />

International Council of Shopping Centers and its publications, <strong>Value</strong><br />

<strong>Retail</strong> <strong>News</strong> and the International Outlet Journal. Sponsors of the<br />

two-day conference were GVA Grimley Outlet Services, Henderson<br />

Global Investors, ING Real Estate and Aareal Bank.<br />

The continuing evolution of the outlet retail sector was apparent<br />

as delegates expressed widely differing views on issues such as centre<br />

State of the Global Outlet Industry<br />

Brendon O’Reilly, GVA Grimley Outlet Services<br />

David Ober, Partner, PA Outlet Management Services<br />

OppOrtunities waiting<br />

all arOund the glObe<br />

Across Europe, with its population<br />

of 459 million people in the Euro-<br />

pean Union, there are 142 factory<br />

outlet centres trading in 25 countries with<br />

a further 34 FOCs proposed to open within<br />

the next 12 to 18 months, according to<br />

figures announced by Brendon O’Reilly of<br />

GVA Grimley Outlet Services.<br />

As borders across Europe open up, the<br />

concept is quickly taking hold in more<br />

countries as these New Europeans become<br />

increasingly brand-aware.<br />

“With Polish workers moving to the UK<br />

and other Western European countries for<br />

employment,” O’Reilly said, “the country<br />

they leave behind has opened its borders<br />

to workers from the Ukraine. Now they<br />

are discovering for themselves the delights<br />

of brand shopping in the new Polish factory<br />

outlet centres.”<br />

The Ukraine has huge potential for European<br />

developers, he added, pointing out<br />

that “with a population of over 58 million,<br />

many of whom are hugely aspirational,<br />

there are currently no factory outlet centres<br />

open there, although two are proposed.”<br />

However, some countries are reaching<br />

outlet saturation. The UK has 48 factory<br />

outlet centres with one more at Gloucester<br />

Quays due to open in early 2009.<br />

That’s no indication that the sector is<br />

washed up in Western Europe, though. <strong>Retail</strong>ers<br />

are taking note of their competitors’<br />

success in factory outlet centres and are<br />

asking for their own piece of the action.<br />

O’Reilly highlighted apparel retailers<br />

Fat Face and Tula and UK department<br />

store John Lewis, all of which are now<br />

establishing outlet chains.<br />

InternatIonal outlet Journal u <strong>Winter</strong> <strong>2008</strong><br />

In Western Europe, he said, that nation<br />

of brand-shoppers called Italy has<br />

room for growth. “Currently in this<br />

country there are 17 outlet centres with<br />

three more proposed in a population of<br />

58.5 million. In Ireland, too, with a<br />

population of just 4 million, the number of<br />

people with a significantly high disposable<br />

income indicates expansion potential.”<br />

The jewel in the crown of opportunities,<br />

according to O’Reilly, is Germany.<br />

Despite a challenging planning regimen,<br />

the recent relaxations in the country’s<br />

Sunday trading laws have heralded an upsurge<br />

in development interest. Currently<br />

Germany has just five outlet centres with<br />

five proposed in a country which has a<br />

population of over 82 million.<br />

O’Reilly also highlighted a 25 percent<br />

growth in the number of recent transactions<br />

in European factory outlet centres<br />

by predominantly institutional funding.<br />

David Ober presented a vision of a<br />

vibrant outlet centre industry in the<br />

U.S., where every one of its top 30 outlet<br />

centres is in expansion mode and where<br />

brands are looking for more opportunities.<br />

Ober is a partner in U.S.-based PA<br />

Outlet Management and president of the<br />

industry trade group Developers of Outlet<br />

Centers & <strong>Retail</strong>ers.<br />

Speaking of outlet development outside<br />

the U.S., Ober said the Asian outlet sector<br />

includes nine centres in China, Japan and<br />

Korea, totalling 5.3 million sf.<br />

With six centres in Turkey, one in<br />

Dubai and 16 in Australia, New Zealand<br />

and South Africa, the factory outlet centre<br />

is now a truly global phenomenon, he<br />

branding and tenant-landlord partnerships during the conference’s<br />

10 seminars and keynote presentation – often followed by lively<br />

conversation and debate during the socializing/networking functions.<br />

The programme was filled with trends, research, case studies and<br />

ideas, all specifically related to this forward-thinking, global factory<br />

outlet industry.<br />

London-based writer Nicky Godding has provided IOJ with<br />

an exclusive recap of the programme’s educational sessions, which<br />

follows on the next few pages.<br />

Brendon O’Reilly<br />

David Ober<br />

said. But the emerging outlet centre industry<br />

elsewhere in the world should learn<br />

from the U.S. experience where developers<br />

and retailers took many years to trust each<br />

other enough to work together. n

Balanced Scorecard:<br />

Building Brands And Business<br />

James Kirby, Fund Manager, Henderson Global Investors<br />

Outlets perfOrm during<br />

ecOnOmic dOwnturns<br />

Henderson Global Investors’ Outlet<br />

Mall Fund, currently working<br />

with operator McArthurGlen and<br />

worth e 850 million, is targeted to grow<br />

to e1.5 billion over the next few years.<br />

Henderson’s outlet mall strategy is to own<br />

those centres that are the best in their class,<br />

regionally strong, with suitable catchment<br />

areas and GLA over 20,000 m².<br />

The recent turbulence in the markets<br />

– due to the credit squeeze, high oil prices<br />

and increasing competition from High<br />

Street – could slow Henderson’s ambitions,<br />

according to fund manager James<br />

Kirby. He suspects interest rates will drop<br />

during the next few months.<br />

“Outlet centres are counter cyclical,”<br />

he said. “They tend to out perform<br />

other retail sectors in an economic<br />

downturn.”<br />

Another factor contributing to this<br />

not just the brands, it’s the experience,”<br />

is how Ken Gunn, associate<br />

“It’s<br />

director of CACI, sums up the way<br />

to succeed in the factory outlet sector.<br />

With so many new outlet centres<br />

opening (more are scheduled to open<br />

this year in Europe than in any year since<br />

the concept was first launched in Europe<br />

in 1984), Gunn said that outlet centres<br />

need to raise their game to successfully<br />

compete with town centres and each<br />

other for consumer spending.<br />

“I’m concerned that the number of<br />

schemes we have is threatening the unique<br />

proposition that was behind the original<br />

concept,” he said, adding that this concern<br />

will come into greater focus over the coming<br />

years as more centres open.<br />

“As shoppers have moved to larger<br />

centres offering more choice,” he said,<br />

“the investment has been concentrated<br />

in these centres and in new locations,<br />

including retail parks. As a result there<br />

InternatIonal outlet Journal u <strong>Winter</strong> <strong>2008</strong><br />

optimistic view is migration, which raises<br />

brand awareness. “There is 15 percent<br />

migration in the European Union, higher<br />

than the U.S.,” he said. “These immigrants<br />

tend to be well-qualified and<br />

aware of European brands.”<br />

However, recent competition from<br />

High Street and supermarket discounting<br />

has focused the fund, and Kirby warns<br />

that outlet centres must retain their point<br />

of difference to maintain their success.<br />

“Outlet centres need to be leading edge<br />

to compete with the full price sector and<br />

the Internet in the future,” he said. “That<br />

means competing on leasing, marketing,<br />

customer service, making outlet centres<br />

a brand and improving innovation and<br />

technology.”<br />

According to figures released at the<br />

conference by Henderson, Poland and<br />

the UK have the highest outlet space<br />

Feasibility and the Consumer Proposition<br />

Ken Gunn, Associate Director, CACI<br />

Henrik Maris, Factory Outlets Consultancy<br />

Keep Outlets interesting<br />

Or risK lOsing shOppers<br />

has been a decline of smaller, less competitive<br />

centres as they struggle to find<br />

the investment to maintain their share<br />

of the pot. This has brought about a fundamental<br />

shift in shopping patterns from<br />

small to big, reducing the opportunity for<br />

smaller centres to attract the investment<br />

to change their situation.”<br />

Henrik Maris, president of Factory Outlets<br />

Consultancy, cautions that the High<br />

Street environment is moving into outlet<br />

centres, and the presence of too many<br />

department store clearance stores can be<br />

detrimental. “Outlet centres need to work<br />

closer with the true retail brands,” he said.<br />

Whilst the UK has a status quo, the<br />

continent is steaming ahead with new<br />

innovations, he added. “We should link<br />

centres to attractions not just catchment.<br />

Think about traditions in each market,<br />

because if people don’t know your brand,<br />

they often won’t buy it.”<br />

According to Gunn, maturing outlet<br />

James Kirby<br />

per capita, with over 10 million m² in<br />

Poland and around 9.75 million m² in<br />

the UK. Turkey has less than 2 million<br />

m² of outlet space.<br />

However, Kirby predicted that consumer<br />

spending will grow the most in the<br />

New European countries such as Estonia,<br />

Romania and the Slovakian Republic,<br />

with more modest growth in established<br />

markets such as the United Kingdom,<br />

Portugal and Switzerland. n<br />

Henrik Maris<br />

Ken Gunn<br />

centres will need to keep refreshing their<br />

offer. “People arrive at outlets centres in<br />

a happy mood – the industry’s job is to<br />

keep them that way.” n

Best Practices: Points for the Industry’s Future<br />

Lisa Wagner, The Mega Company<br />

Manuel Lagares, Managing Director, Neinver<br />

Ivor Peters, Managing Director, Primal PR<br />

Chris Warren, Partner, Cushman and Wakefield<br />

factOry Outlet standards:<br />

nuisance Or necessity?<br />

The establishment of hard and<br />

fast best practice standards could<br />

inhibit the outlet centre sector’s<br />

growth and jeopardise its future, according<br />

to the panellists in this session.<br />

“We see the free market approach as<br />

being better,” said Manuel Lagares of<br />

Neinver, “but it is clear that some industry<br />

standards need to be followed in order to<br />

please the customers.”<br />

Chris Warren of Cushman and Wakefield<br />

agreed. “The most important thing<br />

to consider when developing a new outlet<br />

centre is not to confuse the customer.”<br />

Chris Warren<br />

need to know your customer<br />

before you put your spade<br />

“You<br />

in the soil,” said Peter Noble of<br />

<strong>Value</strong> <strong>Retail</strong>, whose customers often travel<br />

thousands of miles to visit one of its outlet<br />

villages in the major cities in Europe.<br />

Noble also believes that viewing an<br />

outlet centre’s catchment by a 23 minute<br />

drive-time (an industry average) is way off<br />

the mark. <strong>Value</strong> <strong>Retail</strong> promotes its villages<br />

as serious tourism destinations – think 23<br />

hours rather than 23 minutes catchment.<br />

“We promote our villages to aspirational<br />

people, marketing ourselves as chic<br />

outlet shopping in Europe,” he said. “To<br />

InternatIonal outlet Journal u <strong>Winter</strong> <strong>2008</strong><br />

The panel concurred that a significant<br />

proportion of potential customers still<br />

don’t understand what an outlet centre is,<br />

and retailers could help this confusion by<br />

conforming to the accepted outlet-centre<br />

discount of 30 percent.<br />

In 1996 in Spain and in 2002 in Poland,<br />

Neinver set out to explain outlet retailing<br />

to its consumer. However, Neinver still feels<br />

that the concept isn’t fully understood.<br />

As shoppers become more savvy, the<br />

issue of made-for-outlet goods begins to<br />

pose questions in consumers’ minds.<br />

But Ivor Peters of Primal PR said<br />

Manuel Lagares Ivor Peters<br />

Closing the Gap in Branding and Positioning<br />

Peter Noble, Group Senior Leasing and Commercialisation<br />

Director, <strong>Value</strong> <strong>Retail</strong><br />

branding, pOsitiOning<br />

have the same gOal<br />

reach our target customer, we market our<br />

centres as destinations using dedicated<br />

tourism marketing experts within our<br />

marketing and communications teams.”<br />

To follow <strong>Value</strong> <strong>Retail</strong>’s example,<br />

outlet centres could attract their target<br />

audience by:<br />

l Marketing to higher social group<br />

women aged 25-60 who visit just once or<br />

twice a year with friends<br />

l Marketing to women who aren’t<br />

afraid to spend<br />

l Negotiating exclusive tie-ins with<br />

upmarket publishers, such as Conde Nast<br />

l Launching gift cards programmes<br />

consumers are always going to have questions.<br />

“In the future they will ask, ‘Is it<br />

green, ethical or fairly made?’”<br />

Lagares said, “Customers need to know<br />

what they are buying. Brands are proud<br />

of their name and they need to maintain<br />

their image.”<br />

Lisa Wagner of Bucharest-based Mega<br />

Company said that a few years ago in the<br />

U.S. there was an avalanche of negative<br />

publicity about whether outlet goods<br />

were inferior, so the industry launched a<br />

campaign and created a stamp of outlet<br />

authenticity. “It didn’t last long but the<br />

message got out that the industry was<br />

trying to police itself,” she said. “The time<br />

may be coming for the EU outlet industry<br />

to start policing itself.”<br />

Ultimately, the industry’s success lies in<br />

the partnership between tenants and landlords,<br />

Lagares said. “Our retailers know their<br />

business, and we don’t want to interfere,<br />

but exchanging information is important.<br />

By creating value for our brands, we are<br />

creating value for our customers.” n<br />

Lisa Wagner<br />

Peter Noble<br />

for the target customer<br />

And perhaps a change in perspective<br />

is necessary for a centre’s branding to<br />

precisely reflect its target customer.<br />

“At <strong>Value</strong> <strong>Retail</strong> we consider ourselves<br />

retailers working for retailers,” he said. “In<br />

the end, branding and positioning are the<br />

same thing.” n

John Drummond Mark Clark Neil Thompson Clive Woodger<br />

Centre Branding: What’s in a Name?<br />

John Drummond, Managing Director The Guinea Group<br />

Mark Clark, Business Development, GVA Grimley Outlet Services<br />

Neil Thompson, Chief Executive Officer, The Outlet Company<br />

Clive Woodger, Managing Director, SCG<br />

fOc branding reflects<br />

reputatiOn, emOtiOn<br />

Centre branding should begin<br />

long before the marketers are<br />

appointed; it must start right at<br />

the beginning of a project, embedded in<br />

the architect’s plan.<br />

“If the architects don’t know the proposition,<br />

what hope has the centre got?” said<br />

Clive Woodger, architect and managing<br />

director of SCG.<br />

Panellists hotly debated what branding<br />

means, with opinions differing on whether<br />

branding an outlet centre detracts from<br />

the retailers within it or whether people<br />

visit a centre because they know that its<br />

brand represents their own aspirations.<br />

Mark Clark of GVA Grimley felt that<br />

consumers didn’t need to be educated<br />

about a shopping centre. They just need<br />

to know how they will benefit from visiting<br />

one, and that’s what an outlet centre<br />

brand should convey, he said.<br />

Panellists agreed that a consumer’s reaction<br />

to a brand isn’t completely rational.<br />

“Branding is a product plus the emotional<br />

values invested in it by the consumer,” Clark<br />

said. “When we debate the factory outlet<br />

centre business, we hear much rational<br />

analysis of the likelihood of potential success<br />

Outlets’ Impact on Traditional <strong>Retail</strong><br />

Dr Joachim Will, Chief Executive Officer, Ecostra<br />

surprise! signs say<br />

Outlets increase sales<br />

Do outlet centres harm High<br />

Street?<br />

Outlet centres might be a<br />

niche market, but in Germany the sector<br />

is growing, despite its bumpy beginning<br />

there. In the late 1990s prevailing opinion<br />

was ardently against factory outlet<br />

centres, as they were seen as a threat to<br />

local retailing.<br />

The accusation rarely comes up anymore,<br />

largely due to positive results that<br />

changed the minds of the outlet-wary,<br />

said Dr. Joachim Will of Ecostra.<br />

In 2001, despite enormous opposition<br />

in the locality, Outlet Centres International<br />

opened Designer Outlets Zweibrücken<br />

(DOZ) in southwest Germany,<br />

“in the middle of nowhere,” Will said.<br />

Since opening, the Zweibrücken centre<br />

has attracted millions of visitors, has shown<br />

steady sales increases, is constantly refreshing<br />

its tenancy, and thanks to the recently<br />

relaxed German Sunday trading laws, it<br />

can now open 16 Sundays per year.<br />

So what happened to the local retailers<br />

who were supposed to be killed off by the<br />

outlet centre?<br />

According to Will, up to now there have<br />

been no town-planning consequences, no<br />

trading-down effects. The main streets<br />

have a high stability with persistent inquiry<br />

for stores, even while there are almost<br />

no empty retail units in Zweibrücken.<br />

The predicted drop of 20-30 percent<br />

of a new centre based on drive-time and<br />

demographics, but this research takes little<br />

account of a consumer’s mood swings.”<br />

Good branding cannot make up for<br />

deficiencies elsewhere in a centre, he said.<br />

Branding works well as long as everything<br />

else works equally well.<br />

“We are not a brand in the true, retailer,<br />

sense of the word,” Clark said. “But<br />

we behave like one.”<br />

Woodger warned panellists not to confuse<br />

branding and marketing.<br />

“Branding is about image and reputation<br />

– it’s what people say about you when<br />

you’ve left the room,” he said. “Right<br />

from the beginning, consumers will start<br />

to have a view about your centre, its<br />

developers, its managers as well as the<br />

retailers and the brands they sell.”<br />

He urged developers to look at their<br />

brands from every angle – how it looks on<br />

a text, on a Google search, on the website,<br />

in advertising – even on You Tube, and to<br />

involve the outlet centre’s stakeholders in<br />

its development. n<br />

Dr. Joachim Will<br />

in sales didn’t happen and there were<br />

no recognisable job losses. Whilst some<br />

retailers reported a small drop in sales,<br />

the overall effects were minor. Instead,<br />

it has boosted the city’s retailers’ determination<br />

to up their game and in<br />

(See Suprise!, page 10)<br />

<strong>Winter</strong> <strong>2008</strong> u InternatIonal outlet Journal

Surprise!<br />

(Continued from page 9)<br />

September 2007, a former city-centre<br />

Kaufhalle department store was converted<br />

to City Outlet, featuring 2,700<br />

m² of retail space over three floors selling<br />

toys, electrical goods and sportswear.<br />

Success of this new store has yet to be<br />

measured, but retailers are optimistic.<br />

However, other synergies envisaged by<br />

the outlet centre development company<br />

didn’t happen, and visitors didn’t flood<br />

from the outlet centre into the city.<br />

Now Zweibrücken has decided that<br />

having a successful outlet centre in the<br />

region isn’t such a bad thing after all and<br />

The Power of Footfall<br />

Karen Isman, Marketing Director, Chameleon <strong>Retail</strong> Consultancy<br />

Mike Davidson, <strong>Retail</strong> Operations Director, Land Securities<br />

Chris Green, Head of Marketing Communications, McArthurGlen<br />

Didier Harm, Managing Director-Leasing, MDG Europe<br />

universally agreed<br />

that fOOtfall is all<br />

Footfall is the single most important<br />

element of a shopping centre, along<br />

with the retailers themselves, according<br />

to Karen Isman of Chameleon<br />

<strong>Retail</strong> Consultancy.<br />

Continuing the debate begun in the<br />

previous session on branding, the panellists<br />

discussed whether the brand or the<br />

marketing campaign attracts the most<br />

visitors to a centre.<br />

According to McArthurGlen’s Chris<br />

Green, successful branding and marketing<br />

will increase quality footfall, not<br />

footfall overall. “We want visitors to find<br />

and buy the products they want, rather<br />

than attracting the tyre-kickers,” he said.<br />

McArthurGlen has reportedly decided<br />

not to heavily brand its centres, instead<br />

allowing the brands within the centre to<br />

speak for themselves.<br />

“It’s about quality of retailers and the<br />

10 InternatIonal outlet Journal u <strong>Winter</strong> <strong>2008</strong><br />

it now plans to position itself as “the<br />

outlet shopping region” with main attractions<br />

such as DOZ, City Outlet and<br />

traditional factory shopping in the village<br />

of Hauenstein, well known for its shoes.<br />

A similar energy boost to the city centre<br />

happened in Ingolstadt, where <strong>Value</strong><br />

<strong>Retail</strong> opened an outlet village in 2005.<br />

After the opening, a full-price shopping<br />

centre, City Arcaden, opened with 8,000<br />

m² of retail floor space and 38 stores. Up<br />

to now, there have been no store closings.<br />

However, unlike Zweibrücken, Ingolstadt<br />

retailers have reported more visits to their<br />

stores by those who have travelled long<br />

distances to shop at the outlet centre. A<br />

report on the effects of Ingolstadt Village<br />

experience of consumers within the centre,”<br />

he said. “People want to come back<br />

because they enjoy themselves.”<br />

Mike Davidson of Land Securities<br />

urged adoption of a loyalty scheme similar<br />

to one introduced at his UK outlet centre,<br />

Gunwharf Quays.<br />

“We now have more than 40,000<br />

people on our database, thanks to our<br />

loyalty card,” he said, explaining that<br />

the card was introduced when the centre<br />

opened, with the blessing of the retailers.<br />

The programme is now so successful that<br />

other partners outside the centre want to<br />

get involved.<br />

Didier Harm of MDG Europe agreed.<br />

“The best boosts to footfall are loyalty or<br />

outlet credit cards, and the tenant line-up<br />

within the centre.”<br />

Whether footfall can be increased<br />

by one-off events was open to debate,<br />

on the city centre concluded there was<br />

only a limited influence on local shopping.<br />

Instead, visitors to the outlet centre<br />

came from much further afield and those<br />

living in and around Ingolstadt continue<br />

to do their everyday shopping in the<br />

West Park shopping centre or in the city<br />

centre itself.<br />

If outlet centres have been perceived<br />

as a threat to city centres, they have galvanised<br />

local retailers into improvements<br />

they should have been making anyway. In<br />

Germany, city centres have seized the opportunity<br />

to market themselves to a much<br />

wider national and possibly international<br />

audience, promoting their own cultural<br />

offerings. n<br />

Mike Davidson Karen Isman Didier Harm<br />

Chris Green<br />

according to panellists, but they must<br />

benefit the retailer – a difficult thing to<br />

achieve.<br />

Davidson said that major events build<br />

awareness “but smaller events that happen<br />

regularly involving the local community<br />

are important because they attract<br />

the locals, who are your most frequent<br />

customers.”<br />

All agreed that different marketing<br />

methods were needed for different audiences,<br />

with one of the most effective<br />

being Web-based with selective emailing<br />

and downloadable vouchers. Advocacy<br />

marketing was also highlighted, where<br />

those on the database pass on offers to<br />

their friends.<br />

Research is absolutely vital, with the<br />

most successful centres conducting ongoing<br />

research to finesse their product<br />

and consumer offer.<br />

The relationship with retailers again<br />

came under the spotlight, with panellists<br />

bemoaning that there are always retailers<br />

who don’t get involved because they are<br />

concerned about the effect marketing will<br />

have on their full-price stores.<br />

“When we reassure them that they are<br />

targeting a new customer, not encouraging<br />

a full-price customer to an outlet<br />

centre, they are more inclined to get<br />

involved,” Green said. n

<strong>Retail</strong> Runway<br />

Moderator: Neil Chapman, Chief Executive Officer,<br />

Chameleon <strong>Retail</strong> Consultancy<br />

retail runway:<br />

4 brands share their visiOns<br />

Outlet retailers want amenities – air<br />

conditioning, plenty of stock-room<br />

space, large windows and a good<br />

location within the centre. In return, they<br />

say, they’ll deliver a great shopping experience<br />

for customers. Four brands shared their<br />

company’s strategies for creating good values<br />

for landlords and consumers, as well as their<br />

plans for expanding their chains.<br />

Puma<br />

Kristofer Jürgensen, International<br />

Expansion Manager, PUMA AG<br />

The Puma brand<br />

is based on<br />

three pillars: sport<br />

performance, sport<br />

lifestyle and sport<br />

fashion. Although<br />

Puma’s core is the<br />

sport performance<br />

line, the most in-<br />

Kristofer Jürgensen<br />

come comes from the sport lifestyle line.<br />

In the past, Puma was seen as the<br />

underdog against competitors such as<br />

Adidas and Nike, but it has recently developed<br />

a more aggressive development<br />

strategy and is determined to be one of<br />

the main footfall generators in a centre.<br />

Its retail mission for its full-price stores<br />

is to promote the Puma brand with no<br />

franchised stores. Its retail mission for its<br />

12 InternatIonal outlet Journal u <strong>Winter</strong> <strong>2008</strong><br />

factory outlet stores is to allow Puma to<br />

follow its full price strategy in its concept<br />

stores and secure effective distribution of<br />

excess inventory.<br />

The company plans to grow its business<br />

in Europe over the next few years and currently<br />

has franchised stores in countries<br />

such as Russia and Poland. It is keen to<br />

open in areas which it feels have the most<br />

potential, such as the Czech Republic,<br />

Hungary, Romania and Germany.<br />

Jürgensen says that the company is<br />

happy to sign up at the early development<br />

stage of an outlet centre and is looking for<br />

500-sf to 600-sf spaces in locations with<br />

good footfall.<br />

“We don’t see Puma outlets boosting<br />

our brand,” Jürgensen said, “but they<br />

don’t do us any harm. We have a profitability<br />

target, not a sell-through target.”<br />

Group SEB<br />

Franck Larzilliere, Vice President<br />

Home and Cook<br />

Group SEB is the world leader in small<br />

domestic equipment, according to<br />

Larzilliere, with sales around e 2.7 billion.<br />

It sells more irons, food processors, kettles<br />

and toasters than any other retailer in the<br />

world, and is a leading player in countries<br />

such as France, Spain, Portugal, Canada,<br />

Mexico, Russia and Turkey, as well as in<br />

Central Europe and the UK.<br />

Formed in 1957 in Burgundy, France,<br />

over the last three decades SEB has<br />

bought up a number of highly regarded<br />

brand names such as Moulinex, Rowenta<br />

and Krups and now has a roster of many<br />

international and local brands, including<br />

All-Clad. As a manufacturer – not as a<br />

retailer – the name SEB is only known in<br />

France and Belgium, but it employs nearly<br />

14,000 people in 51 countries<br />

SEB entered factory outlet retailing two<br />

years ago because it wanted direct access<br />

to consumers and to sell out-of-date products.<br />

Now the company has launched<br />

an ambitious expansion programme and<br />

expects to open 40 new stores in the next<br />

three years throughout the world.<br />

“Home and Cook is the name of our<br />

shop but our brands are more important,”<br />

said Franck Larzilliere. “We offer products<br />

which are not well represented in factory<br />

outlet centres.”<br />

The company also operates some factory<br />

outlet stores under the Lagostina and Tefal<br />

banners, but SEB is currently rebranding<br />

them as Home and Cook stores.<br />

Le Creuset<br />

Petra Schuler, Development<br />

Manager-Business & European<br />

<strong>Retail</strong>, Le Creuset<br />

Whilst Petra Schuler admits that<br />

L e C r e u -<br />

set isn’t perhaps<br />

the footfall driver<br />

that other retailers<br />

claim to be, she<br />

says that this upmarket<br />

cookware<br />

c o m p a n y a d d s<br />

value to a factory<br />

outlet centre.<br />

Petra Schuler<br />

Le Creuset is a private company founded<br />

in 1925 in Fresnov Le Grand, France,<br />

where the first cocotte, or casserole dish,<br />

was produced.<br />

Now it is a leading company in enamelled<br />

cast iron kitchenware, as well as wine<br />

and bar accessories, with 90 percent of its<br />

sales coming from exports to more than 60<br />

countries.<br />

Le Creuset has over 1,000 employees<br />

throughout the world in 17 commercial/<br />

marketing/distribution subsidiaries.<br />

In Europe the company currently operates<br />

21 outlet and two full-priced stores,<br />

and in the U.S., 50 outlet and three fullprice<br />

stores. Le Creuset also operates<br />

stores in South Africa, Japan and Korea.<br />

Le Creuset admits that new markets are<br />

(See Le Creuset, page 14)

Le Creuset<br />

(Continued from page 12)<br />

difficult for their business because people<br />

like to spend their money on clothes: “You<br />

can’t wear a Le Creuset around your neck,”<br />

Schuler said. So rather than blazing a trail<br />

into a new country, the company waits until<br />

the market is established and then looks<br />

at the factory outlet centres available. The<br />

company has a three-to-five year window<br />

to show a profit on its outlet stores.<br />

“We want to be in outlet centres that<br />

don’t impact our wholesale business but will<br />

improve our brand recognition,” she said.<br />

Outlet <strong>Retail</strong>ing, Past, Present and Future<br />

Brendon O’Reilly, Partner, GVA Grimley Outlet Services<br />

David Ober, Partner, PA Outlet Management Services<br />

Henrik Maris, President, Factory Outlet Consultancy<br />

Phil Cottingham, Portfolio Director, Land Securities<br />

Nicky Lovell, Head of Client Management, McArthurGlen<br />

harsh lessOns prOve<br />

Only the strOng survive<br />

After the summer’s credit crunch,<br />

factory outlet centre investors<br />

will only be looking for the ‘best<br />

in class.’ As a result there is bound<br />

to be consolidation within the sector,<br />

especially in the saturated UK market,<br />

although there is still room for growth<br />

Keynote Presentation:<br />

Improving Customer Care at Outlet Centres<br />

Ros Gardner, Customer Care Excellence<br />

plumbing the depths<br />

Of custOmer lOyalty<br />

People change their marriage partners<br />

more often than they change<br />

their banks, according to customer<br />

care expert Ros Gardner, who spent 27<br />

years with retailer Marks and Spencer in<br />

Human Resources and then as head of<br />

customer care.<br />

Her experience in handling returned<br />

goods and managing customer<br />

expectations, especially<br />

regarding Marks and<br />

Spencer’s most ubiquitous<br />

items – underpants and<br />

ladies’ knickers – means<br />

there isn’t much that a<br />

dissatisfied customer can say<br />

that will surprise her.<br />

What is beyond discussion<br />

is that there is little<br />

Ros Gardner<br />

1 InternatIonal outlet Journal u <strong>Winter</strong> <strong>2008</strong><br />

Sunglass Time<br />

Rags Davenport, Sales and<br />

Operations Manager, Sunglass Time<br />

Sunglass Time was founded by Michael<br />

Cooney in 1998 to help distribute<br />

surplus designer sunglass stocks at discounted<br />

prices in outlet malls and villages<br />

throughout Europe.<br />

The retailer opened its first shop in<br />

1999 in the McArthurGlen outlet centre<br />

in York, UK where it traded from a 150-sf<br />

kiosk. Selling a wide range of designer<br />

sunglasses, it now has 10 stores in UK<br />

outlet centres, three in Italy and one each<br />

in continental Europe.<br />

The better projects will survive, but<br />

tougher questions are likely to be asked<br />

about the validity of a project before<br />

money is invested, according to David<br />

Ober from the U.S.<br />

With the benefit of his U.S. experience,<br />

loyalty anymore, and as the internet has<br />

made people more informed, outlet centre<br />

retailers are going to have to work a great<br />

deal harder to engage successfully with<br />

their customers.<br />

The potential for improved customer<br />

care to positively impact business is not in<br />

doubt, but it requires knowledge, experience,<br />

drive and total commitment<br />

to make it happen<br />

successfully, Gardner says.<br />

Focussing on the challenge<br />

of internet shopping,<br />

still seen as a threat by<br />

many outlet centre retailers,<br />

Gardner urged them to<br />

embrace the new medium<br />

as a huge opportunity.<br />

“Any retailer not engag-<br />

in Holland, Belgium, Germany, Austria,<br />

Ireland and the Czech Republic.<br />

Now, Sunglass Time is the biggest<br />

sunglass outlet operator in Europe, consistently<br />

introducing new lines. It has also<br />

strengthened its winter offer with a wider<br />

range of goggles and sports glasses.<br />

Sunglass Time sees outlet shopping<br />

as a major growth area and is looking<br />

for areas of 350 sf to 500 sf in highfootfall,<br />

upmarket outlet centres.<br />

Southern Europe is a particular focus<br />

for the retailer, where it has recently<br />

experienced a 50 percent increase in<br />

comp-store sales. n<br />

Ober stated that some outlet centres<br />

fail, but “a centre won’t fail if its retailers<br />

support it.”<br />

Ober reminded the audience that in<br />

the U.S. 2001 recession, a number of<br />

outlet chains closed their doors. He<br />

urged factory outlet developers to think<br />

globally and invite retailers to the table at<br />

the planning stage in order to understand<br />

their expansion ambitions.<br />

E-commerce is still perceived as a<br />

threat to bricks and mortar retailers, but<br />

outlet retailing can be the beneficiary:<br />

When E-tailers over-order and undersell,<br />

the excess stock often ends up in<br />

outlet channels. The panel agreed that<br />

E-commerce won’t triumph over those<br />

outlet centres offering a destination<br />

experience. n<br />

ing with customers through the internet is<br />

putting themselves at a big disadvantage,”<br />

she said. “Your customer relates closely to<br />

shopping and when they can do that in<br />

the comfort of their own home, you have<br />

to make it worth their while to visit your<br />

centre when they have the choice of going<br />

elsewhere – or not going anywhere at all<br />

and having it delivered to them. Customer<br />

expectations are rising – tomorrow they<br />

will want something more, so using every<br />

means of communication is essential.”<br />

Ros described the four typical customer<br />

groups:<br />

l The loyal and satisfied are your<br />

advocates<br />

l The loyal but not satisfied feel like<br />

hostages and must be rescued<br />

l The not loyal and satisfied are mercenaries<br />

who will shop anywhere<br />

l The not loyal and not satisfied are<br />

terrorists who won’t be happy no matter<br />

what<br />

Ros urged outlet centres not to waste<br />

time trying to please the last group. “You<br />

can sack customers if they’re never going<br />

to benefit your business,” she said. “You’ll<br />

never convert them to advocates.” n

Cannes crowd shows outlets flourishing<br />

By Linda Humphers, Editor in Chief<br />

In the last four years of attending<br />

Mapic, ReedMidem’s<br />

annual retail convention in<br />

Cannes, I’ve seen evidence everywhere<br />

that factory outlet retailing<br />

is flourishing and growing in<br />

Europe.<br />

Though many outlet development<br />

companies have fallen away<br />

from exhibiting at the mid-November<br />

deal making event – Freeport,<br />

McArthurGlen and Promos<br />

among the exceptions – business<br />

was bustling with meetings held in<br />

cafés and yachts surrounding the<br />

Festival Centre.<br />

Colin Brooks, managing director<br />

of UK-based Realm Ltd.,<br />

organized an outlet-industry<br />

forum during Mapic to discuss<br />

issues affecting the sector’s ongoing<br />

success. On everyone’s mind is whether the outlet<br />

sector in Europe will follow the same<br />

growth patterns seen in the UK and<br />

in the U.S.<br />

Brooks theorizes that planning approvals<br />

will stave off over-saturation,<br />

but he was intrigued by the possible<br />

emergence of a tiered-tenant system<br />

similar to that seen in the U.S. He was<br />

Brooks<br />

referring to the evolution in the U.S.<br />

of three types of centres tenanted by<br />

outlet retailers: pure outlet centres, value-oriented centres<br />

(a significant number of outlet tenants complemented by<br />

off-price/discount/local retailers) and lifestyle centres (an<br />

upscale combination of outlet tenants and traditional retailers).<br />

“This delineation is interesting,” Brooks said. “<strong>Retail</strong>ers<br />

choose which of their concepts to put in a centre and the<br />

landlord’s job is to help them choose<br />

which concept is right for that centre.”<br />

As the conversation turned to the<br />

trend toward institutional ownership,<br />

Neil Varnham said that Henderson<br />

Global Investors’ initial, almost accidental<br />

acquisition of McArthurGlen<br />

projects has progressed into such a de-<br />

liberate strategy that the asset management<br />

firm has created a fund specifically<br />

for outlet centres.<br />

“We’re not in the business of taking risks,” said Varnham, who<br />

is the director of retail property for Henderson.<br />

“We protect our clients’ money.<br />

The outlets are a retail business, which is<br />

completely different from the retail real<br />

estate business.”<br />

Recognizing the paramount importance<br />

of brands, the group turned to Pieter Van<br />

Voorst Vader of Nike to explain how his<br />

company views its retail mission.<br />

Van Voorst Vader<br />

“Nike is very liquidation-driven, very<br />

1 InternatIonal outlet Journal u <strong>Winter</strong> <strong>2008</strong><br />

In November, Colin Brooks, far left, managing director of asset management firm<br />

Realm, organized a forum in Cannes to discuss issues pertinent to outlet retailing.<br />

Varnham<br />

disposal-driven,” said Vader, who is Nike’s real estate manager.<br />

“Nike Outlets isn’t yet a retail business. We produce maybe 10<br />

to 15 percent for the outlets in Europe, usually a white t-shirt<br />

with a swoosh. <strong>Retail</strong> is a silo, with opportunities filtering down<br />

at every level. Sensitivity is very important to us, but we judge<br />

it by each and every location.”<br />

Varnham said that sensitivity was a huge worry when McArthurGlen<br />

was opening Roermond Designer<br />

Outlet in The Netherlands. “The impact<br />

turned out to be that retailing in the city<br />

of Roermond actually improved after the<br />

centre opened,” he said.<br />

Like their ownership and tenanting,<br />

outlet centres are ushering in new designs.<br />

According to Mike Nagelsztajn, director of<br />

Nagelsztajn<br />

S&P Architects, early outlet centres were<br />

cost-driven and often poorly designed.<br />

“They were initially designed to look cheap,” he said, “but<br />

that’s changing, and other elements, such as the food offer,<br />

are really improving.”<br />

The group thought that <strong>Value</strong> <strong>Retail</strong>’s Bicester Village was a<br />

major influence on outlet-centre design in the UK and Europe,<br />

with its emphasis on reflecting the local market and creating an<br />

intimate, town-centre environment.<br />

Nigel Robson, director of Londonbased<br />

Resolution Property plc, said that<br />

developers in Sweden, Spain and elsewhere<br />

were doing a number of things to<br />

add integrity to their projects. “To gain<br />

credibility with the tenants,” he said,<br />

“we’re seeing more partnering with estab-<br />

lished factory outlet developers.”<br />

Varnham concurred and said that con-<br />

Robson<br />

tinued consolidation was a sure thing, with more acquisitions<br />

likely by the big three outlet investors – Morley Fund, Hermes<br />

and Henderson.<br />

“How will consolidation benefit retailers?” Vader asked.<br />

“Consolidation leads to efficiencies in the operations and<br />

marketing spend,” Varnham said, “and it drives down costs<br />

while driving up quality and standards.” n

<strong>News</strong> from Cannes<br />

McArthurGlen<br />

rebrands itself<br />

Now that McArthurGlen has come out<br />

of the outlet closet to help brands open fullprice<br />

stores, the developer has decided to<br />

launch a new image campaign for itself. According<br />

to marketing director Chris Green,<br />

McArthurGlen’s mantra is to solve problems<br />

for brands, whether that means helping<br />

them disposing of last season’s products or<br />

finding new channels of distribution.<br />

“We’re not just the outlet guys anymore,”<br />

Green said. “We really want to<br />

broaden the way brands think of us.”<br />

After thoroughly reviewing its own marketing<br />

process, McArthurGlen saw that it<br />

needed a completely integrated marketing<br />

picture that blended 40 different opportunities<br />

into a cohesive message.<br />

“This is all being developed with the<br />

retailers in mind,” said Green, who was an<br />

executive with Getty Images before joining<br />

the retail sector. “We work with over<br />

700 brands, so our business isn’t about the<br />

properties, it’s about the brands.”<br />

McArthurGlen has hired Vogue magazine<br />

photographer Christian Schuller to<br />

do the business-to-business and businessto-consumer<br />

art.<br />

Keeping up with OCI<br />

Although the opening of its second centre<br />

in Germany was just weeks away, Outlet<br />

Centres International’s Hans Dobke,<br />

Stefan Schafer and Regina Leitner were in<br />

Cannes, keeping their business ball rolling.<br />

Invitations to the 15 December opening<br />

of OCI’s Designer Outlets Wolfsburg had<br />

been posted, and Dobke, who is the director<br />

of OCI, was already talking about the<br />

centre’s planned 10,000-m² phase 2.<br />

“We’ll open phase 2 in summer/fall<br />

2009,” he said, adding that the expansion<br />

was already 20 percent preleased. The<br />

11,500-m² phase 1 opened 80 percent occupied<br />

and is expected to be 100 percent<br />

leased by this summer.<br />

OCI, with its eye on a third German<br />

outlet project, is in a bidding war for a<br />

site 50 to 75 miles south of Hamburg.<br />

The winning bid is scheduled to be<br />

announced mid-year. After revealing<br />

this news, Dobke casually mentioned a<br />

planned fourth site in Germany, but he<br />

wasn’t giving out any details.<br />

<strong>2008</strong> busy for Promos<br />

Filippo Maffioli, sales director of<br />

Brescia, Italy-based Promos, said that<br />

Palmanova Outlet Village in Udine, Italy,<br />

which was scheduled to open in February,<br />

will have an unusual phase 2 – the expan-<br />

McArthurGlen’s marketing director Chris Green stands in front of the developer’s<br />

new creative, unveiled at Mapic, shot by Vogue photographer Christian Schuller.<br />

sion will feature a hotel, resort, fitness<br />

centre and restaurants. “Phase 2 will<br />

open at the end of the year,” he said.<br />

Additionally, Promos’ Lake Malaren<br />

Outlets will open in Shanghai in March,<br />

and Pescara Outlet Village on the Adriatic<br />

Coast will open in the autumn.<br />

“And I’m getting married in <strong>2008</strong>,”<br />

Maffioli said. “It’s going to be a pretty<br />

busy year for me.”<br />

Floating outlet<br />

centre proposed<br />

Ubaldo De Vincentiis, president of<br />

Europ Invest, based in Italy and Belgium,<br />

was in Greece when he got the idea for<br />

the Luxury Outlet Ship.<br />

“In Greece, there are lots of islands<br />

and not much good shopping,” he said.<br />

“There are beautiful ports, but big ships<br />

can’t get into them. So I thought of a<br />

ship with 60 to 100 duty-free outlets that<br />

would not only be important because of<br />

tourism, but could offer special events,<br />

leisure and entertainment.”<br />

The ship is being built in Italy by a<br />

Greek company and is expected to launch<br />

Ubaldo De Vincentiis<br />

in 2009, he said. De Vincentiis hasn’t<br />

nailed down a lot of the venture’s details,<br />

but he isn’t worried. His affiliations with<br />

outlet projects in Serravalle, Valdicchiana,<br />

Pescara and Zagreb are always on the<br />

front end: “I start the process and then<br />

the developer takes over the leasing, marketing<br />

and management,” he said. “Once<br />

I sell the property, I’m out of it.”<br />

De Vincentiis has some sketchy ideas<br />

on where the ship will sail (from Russia to<br />

the Mediterranean) and definite ideas on<br />

who the tenants should be. “Of course,<br />

we need some recognized brands,” he<br />

said, “but I would like to bring together<br />

about 100 small manufacturers and have<br />

them create exclusive, made-for-outlet<br />

goods. This idea brings the possibility of<br />

growth to the hundreds of small manufacturers<br />

all over the world.<br />

“I don’t agree that an outlet centre has to<br />

copy McArthurGlen and <strong>Value</strong> <strong>Retail</strong>.”<br />

A new day dawns<br />

for Freeport Limited<br />

Now that the long process of obtaining<br />

new ownership has been completed,<br />

Iestyn Roberts and Chris Milliken of<br />

Freeport have been working on improving<br />

Freeport Limited’s projects in Sweden,<br />

Portugal and the Czech Republic,<br />

as well as gaining approvals for a new<br />

scheme in France.<br />

At Freeport Lisbon Designer Outlet, the<br />

cinema has reopened and a relaunch programme<br />

of the entire scheme is in place,<br />

as is a new centre manager. “For the first<br />

time we now have a local person managing<br />

the centre and we feel that he’ll build a lot<br />

of bridges with the tenants,” said Roberts,<br />

who is CEO of Freeport.<br />

Leisure activities at the Lisbon centre,<br />

(See Freeport, page 18)<br />

<strong>Winter</strong> <strong>2008</strong> u InternatIonal outlet Journal 17

<strong>News</strong> from Cannes Continued<br />

Freeport<br />

(Continued from page 17)<br />

including paintball, skateboarding and<br />

five-sided football, are doing well alongside<br />

traveling exhibitions and museum displays,<br />

he said. “I’m thinking of putting in a wax<br />

museum,” he said. “We have one in Excalibur<br />

(in the Czech Republic) that’s quite<br />

popular, especially the figures of Saddam<br />

Hussein and Arnold Schwarzenegger.”<br />

Freeport’s Excalibur is doing “hugely<br />

well,” Roberts adds, with footfall up 35<br />

percent and trading up 28 percent from last<br />

year. Roberts attributes much of the success<br />

to, again, a local centre manager who’s<br />

adept at reading the market and working<br />

with tenants. That centre is 90 percent<br />

leased and should be full soon, he says.<br />

At Freeport Kungsbacka in Sweden,<br />

trading is up 15 percent and the centre’s<br />

occupancy has grown to almost 90 percent.<br />

“An ICA supermarket is opening<br />

next door in March, and that will be good<br />

for us,” he said.<br />

Now that the outlet portfolio is owned by<br />

Carlysle Group – the deal closed on 3 September,<br />

2007 – Freeport is once again on the<br />

development track, according to Roberts.<br />

“We’ve pledged to rebuild the portfolio,<br />

mostly from ground-up development,” he<br />

said. “We have a strong base and we’re<br />

well-capitalized now. And after five years<br />

we’ve gotten our approvals for our Roppenheim-Alsace<br />

centre [in France]. We<br />

hope to start construction around Easter<br />

and open the centre in autumn 2009.”<br />

Roberts said Freeport was also looking<br />

at a couple of acquisitions, but “the prices<br />

are still too optimistic.”<br />

Land Securities set<br />

to de-merge itself<br />

Peppered with questions about Land Securities<br />

radical split plan, which came into<br />

public view in November during Mapic,<br />

portfolio director Phil Cottingham explained<br />

that the new structure would simply<br />

“formalize the way it already works.”<br />

Land Securities, the UK’s largest real<br />

estate investment trust, will take about<br />

a year to separate itself into three main<br />

iOJ calendar<br />

1 InternatIonal outlet Journal u <strong>Winter</strong> <strong>2008</strong><br />

divisions: a property<br />

outsourcing<br />

REIT, a retail<br />

REIT, and a London<br />

REIT focusing<br />

chiefly on the<br />

office market.<br />

“The de-merger<br />

should make<br />

each division<br />

more nimble,” Phil Cottingham<br />

Cottingham said. Land Securities is<br />

involved in three factory outlet centres:<br />

Gunwharf Quays in Portsmouth, The<br />

Galleria Outlet Centre in Hatfield, both<br />

in England, and The Outlet at Bridgewater<br />

Park in Banbridge, Northern<br />

Ireland.<br />

Working closely with tenants is crucial<br />

in the outlet arena, he said. “We operate<br />

on the premise that customers aren’t loyal,<br />

that they have to be wooed all the time,”<br />

he said. “So we train shop staff and provide<br />

big incentives for well-run stores.”<br />

The Outlet Company<br />

seeks new frontiers<br />

Neil Thompson, CEO of Warsaw-based<br />

The Outlet Company, said he’s looking to<br />

the Ukraine and Russia as the next frontier<br />

for Fashion House Outlet Centres.<br />

“We’ve got some sites under discussion,”<br />

he said.<br />

Pioneering the outlet concept in Eastern<br />

Europe has already turned profitable<br />

for Thompson and company, as evidenced<br />

by the sale of phases 1 and 2 of Fashion<br />

House Warsaw in August to AIB’s Polonia<br />

II Fund for e45 million. The sale of<br />

the centre’s phase 3 – which opened 23<br />

November with such tenants as Tchibo,<br />

Park Avenue, Villeroy and Boch, Gardeur<br />

and Vision Express – is expected to take<br />

place in the first half of this year.<br />

“We are currently in negotiations with<br />

a party for FH Gdansk and FH Sosnowiec,”<br />

Thompson said, declining to be<br />

more specific. “Work began last week<br />

on Sosnowiec’s second phase (opening in<br />

September) and we expect to start work<br />

in the spring on the phase 2 at Gdansk,<br />

<strong>2008</strong><br />

15 February Spring IOJ deadline<br />

21-22 February VRN Spring Outlet Deal Making (Orlando)<br />

16-18 April ICSC European Conference (Amsterdam)<br />

21 April Summer IOJ -deadline<br />

18-21 May ICSC Spring Convention (Las Vegas)<br />

15-16 September VRN Fall Outlet Deal Making (New Jersey)<br />

13-14 October <strong>2008</strong> European Outlet Conference (London)<br />

with the opening in spring 2009.”<br />

The Outlet Company and GVA<br />

Grimley Outlet Services will continue<br />

to lease, manage and operate the centers<br />

for the new owners.<br />

BVS Villages to be<br />

the next generation?<br />

Alain Van Hulle, Barbara Horatz and<br />

Robert Van Den Heuvel, all of BVS<br />

Company Store Villages, were making<br />

the rounds letting everyone know that<br />

groundwork has begun on Alpenrhein<br />

Outlet Village in Landquart, Switzerland,<br />

and that the groundbreaking will be in<br />

March. The opening is scheduled for the<br />

end of this year or early 2009.<br />

“We’re about 25 percent leased with<br />

major international, German, Swiss and<br />

Italian designer brands,” said BVS managing<br />

director Van Hulle. “It’s a nice mix<br />

and we have a well-balanced merchandising<br />

plan for both sides of the center.”<br />

Van Hulle said BVS’ villages will<br />

be the next generation in European<br />

outlet centres: “There have been four<br />

generations,” he said. “We started with<br />

regenerations, then went to strip centers<br />

and U-shapes, then to village styles,<br />

where most are now. Our centres will be<br />

leisure/outlet centres, designed to draw<br />

more people for longer periods.” n<br />

JOHN L BuCKSBAuM, SCSM<br />

Chairman<br />

MICHAEL P. KERCHEVAL<br />

President and CEO<br />

RuDOLPH E. MILIAN, SCSM, SCMD<br />

ICSC Senior VP<br />

JAy STARR<br />

ICSC Senior VP<br />

Florida oFFice +1 727 781-7557<br />

FaX +1 727 781-9717<br />

29399 U.S. Hwy. 19 N., Suite 370<br />

Clearwater, FL 33761<br />

LINDA HuMPHERS<br />

Editor in Chief, ext. 472<br />

lhumphers@icsc.org<br />

RANDy GDOVIN<br />

Art Director, ext. 451<br />

rgdovin@icsc.org<br />

KAREN KNOBELOCH<br />

Advertising Prod. Mgr., ext. 441<br />

kknobeloch@icsc.org<br />

SALLy STEPHENSON<br />

Senior Advertising Executive<br />

+1 847 835-1617<br />

Fax: +1 847 835-5196<br />

sstephenson@icsc.org<br />

International Outlet Journal is a quarterly publication for<br />

the non-U.S. factory outlet industry. Copyright © 2007