BALANCE SHEET AS OF DECEMBER 31, 2004 - Raiffeisen

BALANCE SHEET AS OF DECEMBER 31, 2004 - Raiffeisen

BALANCE SHEET AS OF DECEMBER 31, 2004 - Raiffeisen

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

46<br />

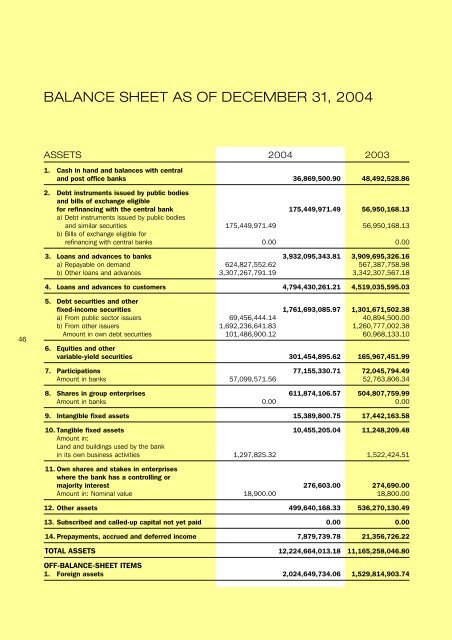

<strong>BALANCE</strong> <strong>SHEET</strong> <strong>AS</strong> <strong>OF</strong> <strong>DECEMBER</strong> <strong>31</strong>, <strong>2004</strong><br />

<strong>AS</strong>SETS <strong>2004</strong> 2003<br />

1. Cash in hand and balances with central<br />

and post office banks 36,869,500.90 48,492,528.86<br />

2. Debt instruments issued by public bodies<br />

and bills of exchange eligible<br />

for refinancing with the central bank 175,449,971.49 56,950,168.13<br />

a) Debt instruments issued by public bodies<br />

and similar securities 175,449,971.49 56,950,168.13<br />

b) Bills of exchange eligible for<br />

refinancing with central banks 0.00 0.00<br />

3. Loans and advances to banks 3,932,095,343.81 3,909,695,326.16<br />

a) Repayable on demand 624,827,552.62 567,387,758.98<br />

b) Other loans and advances 3,307,267,791.19 3,342,307,567.18<br />

4. Loans and advances to customers 4,794,430,261.21 4,519,035,595.03<br />

5. Debt securities and other<br />

fixed-income securities 1,761,693,085.97 1,301,671,502.38<br />

a) From public sector issuers 69,456,444.14 40,894,500.00<br />

b) From other issuers 1,692,236,641.83 1,260,777,002.38<br />

Amount in own debt securities 101,486,900.12 60,968,133.10<br />

6. Equities and other<br />

variable-yield securities 301,454,895.62 165,967,451.99<br />

7. Participations 77,155,330.71 72,045,794.49<br />

Amount in banks 57,099,571.56 52,763,806.34<br />

8. Shares in group enterprises 611,874,106.57 504,807,759.99<br />

Amount in banks 0.00 0.00<br />

9. Intangible fixed assets 15,389,800.75 17,442,163.58<br />

10. Tangible fixed assets 10,455,205.04 11,248,209.48<br />

Amount in:<br />

Land and buildings used by the bank<br />

in its own business activities 1,297,825.32 1,522,424.51<br />

11. Own shares and stakes in enterprises<br />

where the bank has a controlling or<br />

majority interest 276,603.00 274,690.00<br />

Amount in: Nominal value 18,900.00 18,800.00<br />

12. Other assets 499,640,168.33 536,270,130.49<br />

13. Subscribed and called-up capital not yet paid 0.00 0.00<br />

14. Prepayments, accrued and deferred income 7,879,739.78 21,356,726.22<br />

TOTAL <strong>AS</strong>SETS 12,224,664,013.18 11,165,258,046.80<br />

<strong>OF</strong>F-<strong>BALANCE</strong>-<strong>SHEET</strong> ITEMS<br />

1. Foreign assets 2,024,649,734.06 1,529,814,903.74

LIABILITIES <strong>2004</strong> 2003<br />

1. Amounts owed to banks 4,822,395,015.98 4,2<strong>31</strong>,750,682.39<br />

a)Repayable on demand 2,387,818,563.02 1,923,159,092.08<br />

b) With agreed maturities or notice periods 2,434,576,452.96 2,308,591,590.<strong>31</strong><br />

2. Amounts owed to customers 4,025,595,292.53 3,818,822,953.07<br />

a)Savings deposits, including: 1,248,434,453.76 1,222,287,066.67<br />

aa) Repayable on demand 0.00 0.00<br />

bb) With agreed maturities or notice periods 1,248,434,453.76 1,222,287,066.67<br />

b)Other liabilities, including: 2,777,160,838.77 2,596,535,886.40<br />

aa) Repayable on demand 1,716,268,880.95 1,769,630,933.43<br />

bb) With agreed maturities or notice periods 1,060,891,957.82 826,904,952.97<br />

3. Debt evidenced by certificates 1,834,535,<strong>31</strong>5.90 1,687,430,048.68<br />

a) Debt securities issued 1,228,860,848.72 1,176,607,525.96<br />

b) Other securitized liabilities 605,674,467.18 510,822,522.72<br />

4. Other liabilities 494,539,805.58 528,284,046.71<br />

5. Prepayments, accrued and deferred income 38,151,186.56 28,564,258.20<br />

6. Provisions 62,340,492.16 48,910,973.28<br />

a) Provisions for severance payments 14,228,928.39 10,665,390.74<br />

b) Provisions for pensions 19,401,597.61 13,756,409.76<br />

c) Provisions for tax 0.00 165,000.00<br />

d) Other 28,709,966.16 24,324,172.78<br />

6.A General provisions for bad debt 0.00 0.00<br />

7, Subordinated liabilities 133,869,000.00 67,869,000.00<br />

8. Supplementary capital 248,951,795.48 206,056,282.56<br />

9. Subscribed capital 199,197,300.00 199,197,300.00<br />

10. Capital reserves 181,700,795.68 181,700,795.68<br />

a) Appropriated 181,700,795.68 181,700,795.68<br />

b) Unappropriated 0.00 0.00<br />

11. Revenue reserves 26,477,265.95 15,090,125.51<br />

a) Statutory reserves 19,919,730.00 14,121,198.68<br />

b) Reserves required under the articles of association 0.00 0.00<br />

c) Other reserves 6,557,535.95 968,926.83<br />

Amount in: Appropriated reserves under § 225 Par. 5<br />

Austrian Commercial Code 276,603.00 274,690.00<br />

12. Liability reserves under § 23 Par. 6 Austrian Banking Act 140,447,414.56 134,677,922.67<br />

13. Profit and loss account 0.00 0.00<br />

14. Untaxed reserves 16,463,332.80 16,903,658.05<br />

a)Valuation reserve arising from special depreciation allowances 16,463,332.80 16,463,668.01<br />

b)Other untaxed reserves 0.00 439,990.04<br />

Amount in: aa) Unallocated 0.00 0.00<br />

bb) Investment allowances under § 10 Income Tax Act 1988 0.00 439,990.04<br />

cc) Unallocated 0.00 0.00<br />

dd) Transfer reserve under § 12 Income Tax Act 1988 0.00 0.00<br />

TOTAL LIABILITIES 12,224,664,013.18 11,165,258,046.80<br />

(Off-balance-sheet items – see next page)<br />

47<br />

47

48<br />

<strong>BALANCE</strong> <strong>SHEET</strong> <strong>AS</strong> <strong>OF</strong> <strong>DECEMBER</strong> <strong>31</strong>, <strong>2004</strong><br />

LIABILITIES <strong>2004</strong> 2003<br />

<strong>OF</strong>F-<strong>BALANCE</strong>-<strong>SHEET</strong> ITEMS<br />

1. Contingent liabilities 471,502,290.95 352,836,550.37<br />

Amount in:<br />

a)Acceptances and endorsements arising<br />

from discounted bills of exchange 0.00 0.00<br />

b)Guarantees and other collateral security 471,391,025.95 352,657,635.37<br />

2. Credit commitments 1,725,143,535.11 1,246,901,653.62<br />

Amount in: Liabilities from repo transactions 54,845,409.47 0.00<br />

3. Liabilities from fiduciary activities 4,727,840.<strong>31</strong> 5,296,445.27<br />

4. Eligible capital under § 23 Par. 14 713,224,161.48 673,277,344.47<br />

Amount in: Capital under § 23 Par. 14 No. 7 19,690,100.83 20,679,611.50<br />

5. Capital required under § 22 Par. 1 495,090,965.68 456,029,736.84<br />

Amount in: Capital required under<br />

§ 22 Par. 1 No. 1 and 4 475,400,864.85 432,589,282.49<br />

6. Foreign liabilities 1,523,736,455.60 799,742,752.37<br />

7. Hybrid capital under § 24 Par, 2 No. 5 and 6 0.00 0.00

PR<strong>OF</strong>IT AND LOSS ACCOUNT <strong>2004</strong><br />

<strong>2004</strong> 2003<br />

1. + Interest receivable and similar income 364,020,878.96 372,096,504.62<br />

Amount from: Fixed-income securities 72,8<strong>31</strong>,279.24 51,237,729.88<br />

2. – Interest payable and similar expenses 270,457,609.25 284,502,626.20<br />

I. NET INTEREST INCOME 93,563,269.71 87,593,878.42<br />

3. + Interest from securities and equity interests 34,970,915.90 25,971,676.88<br />

a)Income from equities, other equity stakes<br />

and variable-yield securities 11,180,337.85 6,927,668.01<br />

b)Income from associated enterprises 2,003,818.05 1,396,864.07<br />

c) Income from group enterprises 21,786,760.00 17,647,144.80<br />

4. +Commissions earned 72,690,967.28 63,252,851.40<br />

5. – Commissions expended 19,561,525.18 18,383,504.57<br />

6. +/– Dealing income/expenses 10,513,072.01 7,253,067.14<br />

7. +Other operating income 14,755,6<strong>31</strong>.21 13,682,132.88<br />

II. OPERATING INCOME 206,932,330.93 179,370,102.15<br />

8. – General administrative expenses 127,723,706.27 114,801,535.25<br />

a) Personnel costs 74,956,652.70 63,587,970.96<br />

Amount in:<br />

aa) Wages and salaries 47,914,633.36 45,828,137.55<br />

bb) Statutory social security contributions,<br />

pay-related levies and compulsory contributions 12,1<strong>31</strong>,546.42 11,543,375.59<br />

cc) Other employee benefits 1,218,129.<strong>31</strong> 1,050,687.90<br />

dd) Pensions 3,749,465.30 3,635,672.13<br />

ee) Allocations for pension provisions 5,645,187.85 1,466,978.07<br />

ff) Expenses for severance payments and<br />

contributions to employee pension funds 4,297,690.46 63,119.72<br />

b) Other administrative expenses 52,767,053.57 51,213,564.29<br />

9. – Depreciation and amortization in respect of<br />

balance sheet items 9 and 10 5,623,553.07 5,465,861.99<br />

10. – Other operating expenses 2,236,593.03 190,069.82<br />

III. OPERATING EXPENSES 135,583,852.37 120,457,467.06<br />

IV. OPERATING PR<strong>OF</strong>IT 71,348,478.56 58,912,635.09<br />

(carried forward to next page)<br />

49

50<br />

PR<strong>OF</strong>IT AND LOSS ACCOUNT <strong>2004</strong><br />

<strong>2004</strong> 2003<br />

(carried forward)<br />

IV. OPERATING PR<strong>OF</strong>IT 71,348,478.56 58,912,635.09<br />

11./12.+/– Balance of closings/allocations<br />

to provisions for bad debt, contingent liabilities<br />

and commitments –33,240,602.<strong>31</strong> –30,116,237.40<br />

13./14.+/– Balance of writeup/writedown of securities<br />

classified as fixed asset investments,<br />

and shares in associated and group enterprises 426,149.43 1,453,959.81<br />

V. PR<strong>OF</strong>IT ON ORDINARY ACTIVITIES 38,534,025.68 30,250,357.50<br />

15. + Extraordinary income 0.00 0.00<br />

Amount in: Withdrawals from reserves<br />

for bad/doubtful debt 0.00 0.00<br />

16. – Extraordinary expenses 0.00 0.00<br />

Amount in: Allocations from reserves<br />

for bad/doubtful debt 0.00 0.00<br />

17. +/– Extraordinary result<br />

(subtotal items 15 and 16) 0.00 0.00<br />

18. – Taxes on income –138,550.34 0.00<br />

19. – Other taxes, not under item 18 206,268.94 7,283.82<br />

VI. PR<strong>OF</strong>IT AND LOSS AFTER EXTRAORDINARY<br />

ITEMS AND TAX 38,466,307.08 30,243,073.68<br />

20. +/– Changes in reserves –16,716,307.08 –8,078,073.68<br />

Amount in:<br />

Allocations to liability reserves 5,769,491.89 2,503,042.76<br />

Withdrawals from liability reserves 0.00 0.00<br />

VII. PR<strong>OF</strong>IT / LOSS AFTER RESERVE MOVEMENTS 21,750,000.00 22,165,000.00<br />

21. +/– Profit / loss carried forward 0.00 0.00<br />

22. +/– Income transferred –21,750,000.00 –22,165,000.00<br />

VIII. PR<strong>OF</strong>IT / LOSS 0.00 0.00

NOTES ON THE ACCOUNTS*<br />

A. ACCOUNTING POLICIES<br />

The annual financial statements were drawn up in accordance with generally accepted accounting principles and with the<br />

general requirements to present a true and fair view of the state of the company’s assets, finances and earnings.<br />

The accounting, valuation and reporting of individual items were carried out in accordance with the general provisions of the<br />

Austrian Commercial Code, the Austrian Companies Act and the applicable sections of the Austrian Banking Act in their<br />

respective current versions.<br />

B. REPORT <strong>OF</strong> EARNINGS<br />

A taxable entity was formed according to the earnings transfer contract between RAIFFEISEN-HOLDING<br />

NIEDERÖSTERREICH-WIEN reg.Gen.m.b.H. (hereafter R-Holding) and RAIFFEISENLANDESBANK NIEDERÖSTERREICH- WIEN AG<br />

(hereafter RLB AG). As a result of this agreement, the total annual profits of RLB AG were paid to R-Holding. Therefore, the<br />

annual balance shows neither a profit nor a loss.<br />

C. ACCOUNTING CONVENTIONS AND VALUATION METHODS<br />

APPLIED IN THE <strong>BALANCE</strong> <strong>SHEET</strong> AND PR<strong>OF</strong>IT AND LOSS ACCOUNT<br />

I. Assets and liabilities quoted in foreign currencies were entered as of the balance sheet date using ECB reference rates.<br />

Foreign currency items where no ECB reference rate can be applied were quoted with market middle rates from reference<br />

banks.<br />

II. To the extent that interest rate swaps, options, foreign exchange futures and other derivative instruments are not used in<br />

hedging transactions treated for the purpose of valuation as part of the underlying transactions, a portfolio value is applied,<br />

that is, all similar financial instruments are grouped in portfolios. For each individual transaction in the portfolio, the current<br />

market value is determined as of the balance sheet date. The resulting positive and negative market values are netted<br />

out. If the overall market value of the portfolio is negative, a liability item in that amount is entered in the balance sheet.<br />

Financial derivatives held as trading assets are assessed at market value.<br />

The fair value to be included under § 237a of the Austrian Commercial Code is the amount at which financial instruments<br />

can be bought or sold on fair terms as of the balance sheet date. If exchange prices were available, they were used for<br />

the purpose of valuation. For financial instruments without an exchange price, fair values were calculated using internal<br />

valuation methods with current market parameters, in particular the present value method and option pricing models.<br />

III. Securities held as financial assets are valued according to the modified lower-of-cost-or-market value principle.<br />

In accordance with § 2 Par. 3 of Trustee Securities Regulations, securities serving as cover for trustee accounts are shown<br />

as part of fixed assets and valued strictly at the lower of cost or market.<br />

In accordance with § 56 Par. 2 of the Austrian Banking Act, the premium on securities acquired above par and held as<br />

financial assets is written down pro rata temporis.<br />

* Disclosures subject to statutory reporting requirements<br />

51

52<br />

Securities held as financial assets and acquired below par are written up in accordance with § 56 Par. 3 of the Austrian<br />

Banking Act.<br />

Unlisted securities held as current assets are valued strictly at the lower of cost or market value.<br />

Listed securities treated as current assets are shown at market value.<br />

IV. Individual value adjustments or provisions are made for identifiable risks with respect to borrowers.<br />

V. The option of choosing the form of valuation provided for under § 57 Par. 1 of the Austrian Banking Act was not exercised.<br />

VI. Equity interests are valued at acquisition cost unless persistent losses or a reduction in equity requires a writedown to fair<br />

value as of the balance sheet date.<br />

VII. Intangible fixed assets, land and buildings as well as fixtures, fittings and equipment are valued at acquisition or construction<br />

cost less scheduled depreciation. Scheduled depreciation is applied on a straight-line basis. The rates of depreciation vary<br />

between 2 percent and 33.3 percent for intangible assets, 2 percent and 4 percent for property, and 5 percent and<br />

33.3 percent for movable assets. Capitalized goodwill is amortized on the basis of conservative estimates of a useful<br />

economic life of 2 to 15 years. Extraordinary depreciation is applied in cases of expected long-term impairment. Minor assets<br />

are written off completely in the year of acquisition.<br />

VIII. Premiums or discounts on the bank’s own issues are written back over the term of the debt. Other issuing expenses are<br />

written off immediately.<br />

IX. The provision for pensions, severance payments, partial retirement and anniversary funds was calculated for <strong>2004</strong> using<br />

the principles of the projected unit credit method under I<strong>AS</strong> 19 (revised 2002) with due consideration of the corridor<br />

approach. According to the Austrian Chamber of Chartered Public Accountants, the application of this method is in line<br />

with the regulations of the Austrian Commercial Code. RLB AG plans to prepare its annual accounts in accordance with<br />

International Financial Reporting Standards (IFRS) starting in 2005. For the sake of simplicity and cost-cutting, therefore,<br />

the valuation method for social capital was adjusted. The transition gave rise to a one-time difference of EUR 8.3 million,<br />

which was recorded immediately as an expense in the <strong>2004</strong> accounts.<br />

The biometric calculation bases used for all social capital provisions are the AVÖ 1999-P tables for pension insurance (Pagler<br />

& Pagler) in the version for salaried employees. The provisions were calculated with due attention to the youngest legal<br />

retirement age for men and women. For the partial retirement provision, the financing period selected was the time from<br />

approval to the start of retirement.<br />

For the actuarial calculation of pension obligations, an interest rate of 4.75 percent was assumed for active employees,<br />

as was a pension-relevant salary raise of 4.5 percent for employees remunerated under a collective agreement and 3 percent<br />

for employees not remunerated under a collective agreement. The parameters for retirees include an interest rate of 4.75 percent<br />

and an expected pension increase of 2 percent. No employee turnover assumptions were taken into consideration.<br />

In calculating the provisions for severance payments for employees hired before or during the year 2002, for partial<br />

retirement and for anniversary funds, an interest rate of 4.75 percent was assumed, as was a salary raise of 4.5 percent

for employees remunerated under a collective agreement and 3 percent for employees not remunerated under a collective<br />

agreement. Except in the case of the partial retirement provision, turnover rates commensurate to employment time were used.<br />

Other provisions were entered using reasonable and prudent business accounting principles to cover all recognizable risks<br />

as of the balance sheet date as well as liabilities which are uncertain in terms of type and amount.<br />

X. Liabilities are shown at the higher of original book value or the amount repayable.<br />

XI. Under the new Austrian reporting regulations introduced in <strong>2004</strong> in conjunction with § 43 (2) Annex 2, Part 2 of the Austrian<br />

Banking Act, the name and content of profit and loss account item 8. a) ff) “Expenses for severance pay and contributions<br />

to employee pension funds“ were changed (previously “Allocations for severance payment provisions“). A detailed<br />

presentation can be found in the notes on the profit and loss account. The figure from the previous year was not adjusted.<br />

D. NOTES ON <strong>BALANCE</strong> <strong>SHEET</strong> ITEMS<br />

I. Analysis of maturities<br />

1. Breakdown of residual maturities for loans and advances to and balances with banks and non-banks not repayable on<br />

demand (under § 64 Par. 1 No. 4 of the Austrian Banking Act):<br />

Banks Non-banks<br />

EUR '000 <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

a) Up to 90 days 1,843,992 1,483,454 1,545,416 1,814,128<br />

b) 90 days to 1 year 927,664 1,358,730 504,467 392,604<br />

c) 1 to 5 years 273,119 161,926 1,342,938 1,110,105<br />

d) More than 5 years 262,493 338,198 1,235,139 1,006,069<br />

2. Breakdown of residual maturities for amounts owed to banks and non-banks not repayable on demand (under § 64 Par. 1<br />

No. 4 of the Austrian Banking Act):<br />

Banks Non-banks<br />

EUR '000 <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

a) Up to 90 days 728,456 697,484 1,011,997 896,839<br />

b) 90 days to 1 year 1,278,497 1,354,774 255,827 332,913<br />

c) 1 to 5 years 161,543 70,707 611,888 495,396<br />

d) More than 5 years 266,080 185,626 429,614 324,044<br />

53

54<br />

3. Debt securities and other fixed-income securities maturing during the year following the balance sheet date and debt<br />

securities issued under § 64 Par. 1 No. 7 of the Austrian Banking Act:<br />

EUR '000 <strong>2004</strong> 2003<br />

a) Receivables arising from debt securities and other<br />

fixed-income securities 85,735 137,028<br />

b) Liabilities arising from debt securities issued 216,637 220,797<br />

II. Securities<br />

1. Breakdown of listed securities under § 64 Par. 1 No. 10 of the Austrian Banking Act:<br />

2. Financial investments under § 64 Par. 1 No. 11 of the Austrian Banking Act:<br />

Listed Unlisted<br />

EUR '000 <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

a) Debt securities and<br />

other fixed-income securities 1,761,693 1,209,857 0 91,814<br />

Equities and other<br />

variable-yield securities 126,306 30,040 0 51,385<br />

b) Participations 4,6<strong>31</strong> 0 0 0<br />

c) Shares in group enterprises 0 0 0 0<br />

Breakdown of listed securities treated as fixed assets and indicated under “Debt and other fixed-income securities” as well<br />

as “Equities and other variable-yield securities”:<br />

EUR '000 <strong>2004</strong> 2003<br />

a) Debt securities and other fixed-income securities 664,923 352,0<strong>31</strong><br />

b) Equities and other variable-yield securities 0 30,000<br />

Assets were classified by the responsible bodies as fixed or current on a case-by-case basis.

III. Fixed assets<br />

1. The development of fixed assets and a breakdown of depreciation amounts for the year in question are set out in the statement<br />

of fixed assets (Annex 1).<br />

IV. Other assets<br />

This item includes accrued interest receivable in the amount of EUR 410.729 million (2003: EUR 482.125 million) which<br />

does not become due until after the balance sheet date.<br />

V. Equity capital and similar liabilities<br />

1. Disclosure under § 23 Par. 15 in conjunction with § 64 Par. 1 No. 6 of the Austrian Banking Act:<br />

EUR '000 <strong>2004</strong> 2003<br />

a) Supplementary capital 248,952 206,056<br />

Amount bank-owned 9,013 2,351<br />

b) Subordinated liabilities 133,869 67,869<br />

Amount bank-owned 14 72<br />

Supplementary capital is defined pursuant to § 23 Par. 7 of the Austrian Banking Act. Subordinated liabilities are defined<br />

pursuant to § 23 Par. 8 of the Austrian Banking Act.<br />

2. Disclosure under § 64 Par. 1 No. 5 and 6 of the Austrian Banking Act:<br />

2.1.Subordinated liabilities<br />

The subordinated capital indicated below was added during the reporting period and exceeds 10 percent of total subordinated<br />

capital at the end of the previous business year:<br />

Subordinated capital is defined pursuant to § 23 Par. 8 of the Austrian Banking Act.<br />

EUR ‘000 Amount Interest rate Due date Special call privilege<br />

a) Subordinated callable 5.05 percent<br />

<strong>Raiffeisen</strong> fixed interest bond Issuer’s<br />

<strong>2004</strong>–2016/17 private placement 5,000 5.05% Aug. 18, 2016 call privilege<br />

b) Subordinated 4.5 percent–6 percent<br />

<strong>Raiffeisen</strong> step-up bond Issuer’s<br />

<strong>2004</strong>–2019/21 12,000 *) Sept. 9, 2019 call privilege<br />

c) Subordinated 5.15 percent <strong>Raiffeisen</strong><br />

fixed-interest bond <strong>2004</strong>–2019/23 Issuer’s<br />

Private placement 4,000 5.05% Sept. 23, 2019 call privilege<br />

55

56<br />

d) Subordinated <strong>Raiffeisen</strong><br />

money market floater <strong>2004</strong>–2012/25 15,000 **) Sept. 27, 2012 None<br />

e) Subordinated 4.80 percent–5.00 percent<br />

callable <strong>Raiffeisen</strong> step-up bond Issuer’s<br />

2005-2025/1 Private placement 30,000 ***) Jan. 7, 2025 call privilege<br />

*) First period in term (Sept. 9. <strong>2004</strong>–Sept. 8, 2009): 4.5 percent; second period in term (Sept. 9. 2009–Sept. 8, 2019): 6 percent<br />

**) The interest rate is set at 0.5 percent above the 3-month EURIBOR on a quarterly basis. The rate is determined<br />

two banking days before the beginning of each interest period. Interest is calculated in quarterly interest periods starting on September 27, <strong>2004</strong>.<br />

***) First period in term (Jan. 7. 2005 – January 6, 2015): 4.8 percent; second period in term (Jan. 7, 2015 – Jan. 5, 2025): 5 percent<br />

The bonds were issued as tap issues.<br />

2.2.Supplementary capital<br />

The supplementary capital indicated below was added during the reporting period and, in conjunction with the subordinated<br />

capital listed under No. 2.1, exceeds 10 percent of the total subordinated capital at the end of the previous business year:<br />

EUR ‘000 Amount Interest rate Due date Special call privilege<br />

a) <strong>Raiffeisen</strong> 4.55 percent<br />

supplementary capital bond<br />

<strong>2004</strong>–2014/7 34,488 4.55% April 8, 2014 None<br />

b) <strong>Raiffeisen</strong> supplementary capital<br />

floater <strong>2004</strong>–2012/12 5,000 *) May 22, 2012 None<br />

c) <strong>Raiffeisen</strong> supplementary capital<br />

EURIBOR floater <strong>2004</strong>–2019/28<br />

Private placement 28,000 **) Dec. <strong>31</strong>, 2019 None<br />

*) The interest rate for the first interest period (May 25, <strong>2004</strong> – Nov. 21, <strong>2004</strong>) is 3.8 percent. The interest rate for all further periods is set on a semi-annual basis as follows:<br />

The rate is equal to the 6-month EURIBOR, with the minimum rate being 3.8 percent and the maximum 5.875 percent. This rate is determined<br />

two banking days before the beginning of each interest period. Interest is calculated starting on May 25, <strong>2004</strong> in semi-annual interest periods.<br />

**) The interest rate is set at 33 basis points above the 3-month EURIBOR on a quarterly basis. This rate is determined two banking days before the beginning<br />

of each interest period. Interest is calculated starting on November 16, <strong>2004</strong> in quarterly interest periods.<br />

Subordinated capital is defined pursuant to § 23 Par. 7 of the Austrian Banking Act.<br />

These bonds were issued as tap issues.

VI. Other liabilities<br />

This item includes accrued interest payable in the amount of EUR 389.470 million (2003: EUR 454.111 million) which<br />

does not become due until after the balance sheet date. The item also includes a liability in the amount of<br />

EUR 21.750 million (2003: EUR 22.165 million) from the earnings transfer contract.<br />

VII. Untaxed reserves<br />

1. Valuation reserve arising from special depreciation allowances:<br />

Changes in valuation reserves are reported in Annex 2.<br />

VIII. Supplementary information<br />

1. The assets include EUR 2,221.986 million (2003: 1,844.723 million) in foreign currencies, and liabilities include EUR<br />

673.498 million (2003: 448.574 million) in foreign currencies.<br />

2. Securities trading book<br />

RLB maintains a securities trading book pursuant to § 2 No. 35 of the Austrian Banking Act.<br />

The trading book positions consist of securities and other financial instruments. Standard instruments in inter-bank transactions<br />

are not included.<br />

The nominal value of fixed-income securities in the trading book as of the balance sheet date was EUR 161.603 million<br />

(2003: EUR 48.928 million).<br />

The portfolio also contains 73,792 shares (2003: 80,251) from various issuers with a value of EUR 974 million<br />

(2003: EUR 963 million).<br />

In addition, the portfolio contains 163,413 investment certificates from various funds (2003: 14,965) with a market value<br />

of EUR 72.712 million (2003: EUR 1.446 million).<br />

The other financial transactions in the trading book are reported below in accordance with § 237a of the Austrian<br />

Commercial Code in conjunction with § 64 Par. 1 No. 3 of the Austrian Banking Act.<br />

57

58<br />

3. Disclosure regarding financial instruments under § 237a of the Austrian Commercial Code in conjunction with § 64 Par.<br />

1 No. 3 of the Austrian Banking Act:<br />

3.1. Type and extent of derivative financial instruments:<br />

The nominal values of all forward transactions not yet concluded as of the balance sheet date as well as the accompanying<br />

fair values are indicated in the table below:<br />

<strong>2004</strong> NOMINAL AMOUNTS MARKET VALUES<br />

Banking Trading<br />

EUR '000<br />

Total of all<br />

book book Total positive negative<br />

open forward transactions 14,373,806 29,112,005 43,485,811 472,065 –391,835<br />

a) Interest rate contracts<br />

(exchange contracts)<br />

11,591,992 26,751,500 38,343,492 405,557 –337,648<br />

Futures – call 0 0 0 0 0<br />

Futures – put<br />

(OTC products)<br />

0 63,800 63,800 292 0<br />

Interest swaps 10,895,774 26,581,700 37,477,474 401,813 –333,680<br />

Forward rate agreements (FRAs) - call 150,782 0 150,782 175 0<br />

Forward rate agreements (FRAs) - put 146,832 0 146,832 0 –146<br />

Interest options – call contracts 190,912 28,000 218,912 3,277 0<br />

Interest options – put contracts 207,692 78,000 285,692 0 –3,822<br />

b) Foreign exchange contracts 2,750,680 2,358,505 5,109,185 65,972 –53,651<br />

(OTC products)<br />

Currency futures<br />

Currency swaps and<br />

281,205 0 281,205 8,533 –9,572<br />

interest/currency swaps 2,414,243 144,713 2,558,956 34,087 –21,058<br />

Currency options – call contracts 27,616 1,074,271 1,101,887 23,352 0<br />

Currency options – put contracts 27,616 1,139,521 1,167,137 0 –23,021<br />

c) Securities-related transactions <strong>31</strong>,134 2,000 33,134 536 –536<br />

(OTC products)<br />

Equity / index options – call contracts 15,567 1,000 16,567 536 0<br />

Equity / index options – put contracts 15,567 1,000 16,567 0 –536

2003 NOMINAL AMOUNTS MARKET VALUES<br />

Banking Trading<br />

EUR ‘000<br />

Total of all<br />

book book Total positive negative<br />

open forward transactions 19,280,332 74,002,500 93,282,832 608,519 –582,037<br />

a) Interest rate contracts<br />

(exchange contracts)<br />

17,098,964 64,495,294 81,594,258 237,000 –207,108<br />

Futures – call 0 0 0 0 0<br />

Futures – put<br />

(OTC products)<br />

0 10,600 10,600 7 0<br />

Interest swaps 16,638,438 64,<strong>31</strong>4,694 80,953,132 235,277 –205,073<br />

Forward rate agreements (FRAs) - call 158,353 80,000 238,353 0 –115<br />

Forward rate agreements (FRAs) - put 158,353 90,000 248,353 145 0<br />

Interest options – call contracts 45,903 0 45,903 1,571 0<br />

Interest options – put contracts 97,917 0 97,917 0 –1,920<br />

b) Foreign exchange contracts 2,142,091 9,503,208 11,645,299 370,494 –373,927<br />

(OTC products)<br />

Currency futures<br />

Currency swaps and<br />

69,988 95,851 165,839 7,713 –7,408<br />

interest/currency swaps 1,946,091 8,026,155 9,972,246 342,595 –347,586<br />

Currency options – call contracts 63,006 730,112 793,118 20,186 0<br />

Currency options – put contracts 63,006 651,090 714,096 0 –18,933<br />

c) Securities-related transactions 39,277 3,998 43,275 1,025 –1,002<br />

(OTC products)<br />

Equity / index options – call contracts 19,883 1,999 21,882 1,025 0<br />

Equity / index options – put contracts 19,394 1,999 21,393 0 –1,002<br />

The nominal and market values are derived from the totals of all purchase and sale contracts (without netting out). The<br />

market values are indicated here as “dirty prices“ (market value including interest accruals/deferrals).<br />

All of the instruments indicated are traded both for the bank’s own account and for customers.<br />

4. As of the balance sheet date, the item “Amounts owed to customers” included EUR 2,412,451.40 (2003: EUR<br />

2,663,592.00) in trustee savings deposits.<br />

59

60<br />

5. Assets pledged as collateral pursuant to § 64 Par. 1 No. 8 of the Austrian Banking Act<br />

As of the balance sheet date, fixed-income securities with a nominal value of EUR 153.669 million (2003: EUR 130.840 million)<br />

and loans and advances amounting to EUR 232.059 million (2003: EUR 160.514 million) were pledged as collateral for<br />

the following transactions:<br />

EUR ‘000 <strong>2004</strong> 2003<br />

Loans and advances assigned in favor of the Oesterreichische Kontrollbank AG 96,277 7,974<br />

Loans and advances assigned in favor of the European Investment Bank 82,902 96,584<br />

Reserve stock for funded bonds issued 72,378 75,285<br />

Bonds deposited at the OeKB for EIB loans 24,000 0<br />

Bonds deposited at the OeKB as a clearing link for German Stock Exchange (Xetra trading) 23,000 23,000<br />

Guarantee for derivatives trading at Deutsche Bank, Frankfurt (cash depot) 22,200 0<br />

Bundesanleihe pledged in favor of R-Wohnbaubank AG 15,994 15,261<br />

Guarantee for derivatives trading at Barclays Bank, London (cash depot) 13,450 14,930<br />

“ARTIS” deposit at the Austrian National Bank (OeNB) 7,152 7,878<br />

Guarantee for derivatives trading at Societé Générale, Paris (cash depot) 6,200 0<br />

Reserve stock for savings deposits held in trustee accounts 6,145 7,599<br />

Deposit arranged in favor of the Oesterreichische Kontrollbank AG 5,000 1,817<br />

Guarantee for derivatives trading at J.P. Morgan Securities Ltd, London (cash depot) 3,940 9,000<br />

Guarantee for derivatives trading at ABN Amro Bank, Amsterdam (cash depot) 3,610 0<br />

Guarantee for derivatives trading at Dresdner Bank, Frankfurt (cash depot) 2,100 0<br />

Initial margin for futures at J.P. Morgan Securities Ltd, London (cash depot) 1,380 854<br />

Guarantee for derivatives trading at the Royal Bank of Scotland, London (cash depot) 0 14,480<br />

Guarantee for derivatives trading at Westdeutsche Landesbank, Dusseldorf (cash depot) 0 9,932<br />

Guarantee for derivatives trading at BNP Paribas S.A., Paris (cash depot) 0 4,620<br />

Guarantee for derivatives trading at Credit Suisse First Boston, London (cash depot) 0 2,140<br />

Liabilities from reinsurance cover to secure pension claims in the amount of EUR 76 million (2003: EUR 0 million) are<br />

pledged.

E. NOTES ON THE PR<strong>OF</strong>IT AND LOSS ACCOUNT<br />

I. Expenses pursuant to § 64 Par. 1 No. 13 of the Austrian Banking Act for subordinated liabilities and supplementary capital<br />

amounted to EUR 15.849 million (2003: EUR 15.216 million).<br />

II. “Other operating income” and “Other operating expenses” in the profit and loss account include the following material<br />

income and expenditure items in accordance with § 64 Par. 1 No. 12 of the Austrian Banking Act and § 237 No. 5 of the<br />

Austrian Commercial Code:<br />

III. Under the new Austrian reporting regulations introduced in <strong>2004</strong> in conjunction with § 43 (2) Annex 2, Part 2 of the Austrian<br />

Banking Act, the name and content of profit and loss account item 8. a) ff) “Expenses for severance pay and contributions<br />

to employee pension funds“ were changed (previously “Allocations for severance payment provisions“). In the annual<br />

accounts for 2003 and previous years, this position was only referred to as “Allocations for severance payment provisions.”<br />

In the <strong>2004</strong> accounts, this item is composed of the following:<br />

F. SUPPLEMENTARY INFORMATION<br />

I. The average number of employees was as follows:<br />

Expenses Income<br />

EUR ‘000 <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

<strong>Raiffeisen</strong> group services 8,650 7,763<br />

Reimbursed staff expenses 3,386 2,869<br />

Book values of disposed tangible and fixed assets 110 124<br />

Damage 680 23<br />

Sales bonuses 900 0<br />

EUR ‘000 <strong>2004</strong> 2003<br />

Allocations for severance payment provisions *) 3,552 63<br />

Expenses for severance payments 667 764<br />

Contributions to employee pension funds 79 24<br />

Total 4,298 851<br />

*) EUR 2.5 million of this difference can be attributed to the transition from the financial mathematics approach to the actuarial calculation method under I<strong>AS</strong> 19.<br />

<strong>2004</strong> 2003<br />

Salaried 935.20 900.04<br />

Non-salaried 0.00 0.00<br />

61

62<br />

II. Loans to members of the Management Board and Supervisory Board<br />

As of December <strong>31</strong>, <strong>2004</strong>, outstanding loans to members of the Management Board totaled EUR 164 million<br />

(2003: EUR 135 million). Loans and advances to members of the Supervisory Board totaled EUR 87 million<br />

(2003: EUR 161 million).<br />

There were no liabilities under guarantee for these persons. Amounts lent to the Supervisory Board include loans and<br />

advances to employees delegated to the Supervisory Board by the Works Council.<br />

The maturities and terms of these loans conform to normal banking practices. In the reporting period, members of the<br />

Management Board repaid EUR <strong>31</strong> million (2003: EUR 29 million), while members of the Supervisory Board repaid EUR 75<br />

million (2003: EUR 24 million).<br />

III. Expenses for severance payments and pensions<br />

Expenses for severance payments and pensions relate to the following profit and loss account items: Wages and salaries,<br />

Pension expenses, Allocations to provisions for pensions and Expenses for severance payments and contributions to<br />

employee pension funds, and any additional payment obligations to ÖPAG in addition to the one-off contribution to the<br />

ÖPAG pension fund.<br />

Expenses for severance payments and pensions for senior management amounted to EUR 6.6<strong>31</strong> million (2003: EUR<br />

4.740 million), and for other employees EUR 6.879 million (2003: EUR 1.080 million).<br />

Senior management is defined pursuant to § 80 Par. 1 of the Austrian Companies Act.<br />

IV. Management Board and Supervisory Board emoluments<br />

Emoluments paid to members of the Management Board amounted to EUR 1.597 million (2003: EUR 1.055 million) for<br />

the year in question. A total of EUR 50 million (2003: EUR 50 million) was paid to members of the Supervisory Board.<br />

Total remuneration to former executive officers (of the former RLB reg.Gen.m.b.H.) and their surviving heirs amounted to<br />

EUR 790 million (2003: EUR 776 million).<br />

V. Members of the Management and Supervisory Boards - see next page.

GOVERNING BODIES<br />

MANAGEMENT BOARD<br />

Chairman:<br />

Peter PÜSPÖK<br />

Deputy Chairman:<br />

Robert GRUBER<br />

Managing Directors:<br />

Georg KRAFT-KINZ<br />

Gerhard REHOR<br />

SUPERVISORY BOARD<br />

Chairman:<br />

Christian KONRAD<br />

Deputy Chairman:<br />

Johann VIEGH<strong>OF</strong>ER<br />

Members:<br />

Anton BODENSTEIN<br />

Erwin CSAR<br />

Leopold DANZER<br />

Franz HUBINGER<br />

Gerhard PREISS<br />

Christian RESCH<br />

Delegated by the Works Council:<br />

Harald KERN<br />

Anton HECHTL<br />

Wolfgang EINSPIELER<br />

Sibylla WACHSLER<br />

State Commissioners:<br />

Alfred LEJSEK<br />

Silvia ZENDRON<br />

63

64<br />

ANNEX 1 TO THE NOTES:<br />

STATEMENT <strong>OF</strong> FIXED <strong>AS</strong>SETS <strong>2004</strong><br />

Acquisition / Additions Disposals<br />

construction Post-hoc in in<br />

costs change business business<br />

Fixed asset items Jan. 1, <strong>2004</strong> in A/C costs year year<br />

Securities<br />

Assets 2 a Public debt securities<br />

and similar securities 33,967,527.02 0.00 102,242,500.00 27,000,000.00<br />

Assets 3 b Other loans and advances<br />

to banks 6,500,000.00 0.00 25,000,000.00 0.00<br />

Assets 4 Loans and advances to customers 7,519,359.46 0.00 12,922,949.10 0.00<br />

Assets 5 Debt securities and<br />

other fixed-income securities<br />

a) From public-sector issuers 26,384,600.00 0.00 0.00 0.00<br />

b) From other issuers 326,039,416.82 0.00 721,503,236.52 412,927,458.61<br />

Assets 6 Equities and other variable-yield<br />

securities 30,000,000.00 0.00 0.00 30,000,000.00<br />

Securities subtotal 430,410,903.30 0.00 861,668,685.62 469,927,458.61<br />

Participations<br />

Assets 7 Participations 72,178,646.63 0.00 7,968,476.25 2,671,438.03<br />

Amount in banks 52,896,595.20 0.00 4,780,765.00 423,664.78<br />

Assets 8 Shares in group enterprises 505,102,088.92 0.00 107,654,846.58 0.00<br />

Amount in banks 0.00 0.00 0.00 0.00<br />

Assets 4 Undisclosed interests included<br />

in loans and advances to customers 6,540,555.08 0.00 0.00 2,906,913.37<br />

Assets 11 Own shares or stakes 274,690.00 0.00 1,913.00 0.00<br />

Participations subtotal 584,095,980.63 0.00 115,625,235.83 5,578,351.40<br />

Assets<br />

Assets 9 Intangible fixed assets 35,635,956.22 –81,149.30 1,<strong>31</strong>6,437.99 502,840.07<br />

Assets 10 Tangible fixed assets 27,290,275.34 –849.00 1,771,638.49 1,094,715.63<br />

Amount in land and buildings<br />

used by the bank in its own<br />

activities 2,039,020.77 0.00 19,810.51 53,218.14<br />

Assets<br />

subtotal 62,926,2<strong>31</strong>.56 –81,998.30 3,088,076.48 1,597,555.70<br />

Total 1,077,433,115.49 –81,998.30 980,381,997.93 477,103,365.71

Transfers (+/–) Acquisition / Depreciin<br />

construction Cumulated Book value Book value ation in<br />

business costs depreci- as of from business<br />

year Dec. <strong>31</strong>, <strong>2004</strong> Write-ups ation Dec. <strong>31</strong>, <strong>2004</strong> 2003 year<br />

0.00 109,210,027.02 0.00 – 57,800.46 109,267,827.48 33,967,526.05 – 57,801.43<br />

–6,500,000.00 25,000,000.00 0.00 0.00 25,000,000.00 6,500,000.00 0.00<br />

0.00 20,442,308.56 0.00 393,543.73 20,048,764.83 7,519,359.46 393,543.73<br />

0.00 26,384,600.00 0.00 283,442.11 26,101,157.89 26,036,000.00 – 65,157.89<br />

6,500,000.00 641,115.194.73 0.00 2,292,966.57 638,822,228.16 325,995,159.40 2,249,726.57<br />

0.00 0.00 0.00 0.00 0.00 30,000,000.00 0.00<br />

0.00 822,152,130.<strong>31</strong> 0.00 2,912,151.95 819,239,978.36 430,018,044.91 2,520,<strong>31</strong>0.98<br />

588,500.00 78,064,184.85 0.00 908,854.14 77,155,330.71 72,045,794.49 776,002.00<br />

0.00 57,253,695.42 0.00 154,123.86 57,099,571.56 52,763,806.34 21,335.00<br />

–588,500.00 612,168,435.50 0.00 294,328.93 611,874,106.57 504,807,759.99 0.00<br />

0.00 0.00 0.00 0.00 0.00 0.00 0.00<br />

0.00 3,633,641.71 0.00 519,214.05 3,114,427.66 5,394,068.80 99,456.04<br />

0.00 276,603.00 0.00 0.00 276,603.00 274,690.00 0.00<br />

0.00 694,142,865.06 0.00 1,722,397.12 692,420,467.94 582,522,<strong>31</strong>3.28 875,458.04<br />

0.00 36,368,404.84 1,821.00 20,980,425.09 15,389,800.75 17,442,163.58 3,171,902.79<br />

0.00 27,966,349.20 389.94 17,511,534.10 10,455,205.04 11,248,209.48 2,453,861.22<br />

0.00 2,005,613.14 0.00 707,787.82 1,297,825.32 1,522,424.51 209,817.91<br />

0.00 64,334,754.04 2,210.94 38,491,959.19 25,845,005.79 28,690,373.06 5,625,764.01<br />

0.00 1,580,629,749.41 2,210.94 43,126,508.26 1,537,505,452.09 1,041,230,7<strong>31</strong>.25 9,021,533.03<br />

65

66<br />

ANNEX 2 TO THE NOTES:<br />

STATEMENT <strong>OF</strong> VALUED RESERVES <strong>2004</strong><br />

Participations<br />

under § 12 Income Tax Act 1988<br />

Assets 7<br />

Assets 8<br />

As of: Changes due to Addition (+) Withdrawal (–) As of:<br />

Jan. 1, <strong>2004</strong> restructuring Disposals (–) Dec. <strong>31</strong>, <strong>2004</strong><br />

(+/–) Transfers (+/–)<br />

Participations 830,072.88 0.00 0.00 0.00 830,072.88<br />

Amount in banks 827,482.07 0.00 0.00 0.00 827,482.07<br />

Shares in group enterprises 15,496,054.63 0.00 0.00 0.00 15,496,054.63<br />

Participations subtotal 16,326,127.51 0.00 0.00 0.00 16,326,127.51<br />

Assets under § 8<br />

Income Tax Act 1988<br />

Assets 10<br />

Tangible fixed assets<br />

Amount in land and buildings<br />

used by the bank in its own<br />

104.68 0.00 0.00 –69.78 34.90<br />

activities 0.00 0.00 0.00 0.00 0.00<br />

Assets under § 12<br />

Income Tax Act 1988<br />

Assets 10<br />

Assets<br />

Tangible fixed assets<br />

Amount in land and buildings<br />

used by the bank in its own<br />

137,435.82 0.00 0.00 –265.43 137,170.39<br />

activities 0.00 0.00 0.00 0.00 0.00<br />

subtotal 137,540.50 0.00 0.00 –335.21 137,205.29<br />

Total 16,463,668.01 0.00 0.00 –335.21 16,463,332.80

CONFIRMATION <strong>OF</strong> THE MANAGEMENT BOARD<br />

The Management Board approved this annual report during a board meeting on February 21, 2005.<br />

THE MANAGEMENT BOARD<br />

Chairman of the Management Board Deputy Chairman<br />

Peter PÜSPÖK Robert GRUBER<br />

Managing Director Managing Director<br />

Georg KRAFT-KINZ Gerhard REHOR<br />

AUDITOR’S CONFIRMATION<br />

Since there are no objections to report, the auditors grant an unqualified audit certificate in accordance<br />

with § 274 Par. 1 Austrian Commercial Code to the unabbreviated German version of RAIFFEISENLANDESBANK<br />

NIEDERÖSTERREICH-WIEN AG’s annual report as of December <strong>31</strong>, <strong>2004</strong>.<br />

After due examination, we certify that the accounting practices and annual financial statements comply with applicable legal regulations.<br />

The financial statements present, in compliance with Austrian generally accepted accounting principles, a true and fair view of the<br />

assets and liabilities, the financial position and the results of operations of the company. The operational review is consistent with<br />

the annual financial statements.<br />

Vienna, March 1, 2005<br />

ÖSTERREICHISCHER RAIFFEISENVERBAND<br />

Olaf FUCHS<br />

Association auditor<br />

EXTERNAL AUDITOR’S CERTIFICATE<br />

We have audited the financial statements of <strong>Raiffeisen</strong>landesbank Niederösterreich-Wien AG, Vienna, as of December <strong>31</strong>, <strong>2004</strong>,<br />

as prepared by the Managing Directors of <strong>Raiffeisen</strong>landesbank Niederösterreich-Wien AG, Vienna,<br />

in accordance with Austrian Commercial Code in the valid edition.<br />

Our audit was conducted in accordance with the legal regulations and professional duties.<br />

At the end of our audit we can therefore issue on the financial statements as of December <strong>31</strong>, <strong>2004</strong><br />

of <strong>Raiffeisen</strong>landesbank Niederösterreich-Wien AG, Vienna,<br />

the unqualified audit opinion<br />

according to § 274 par. 1 Austrian Commercial Code (HGB).<br />

"Based on our audit performed in accordance with our professional duties, the accounting records and the financial statements for<br />

the fiscal year <strong>2004</strong> comply with the legal regulations in Austria. The financial statements present, in compliance with Austrian<br />

generally accepted accounting principles, a true and fair view of the assets and liabilities, the financial position and the results of<br />

operations of the company. The management report corresponds with the financial statements."<br />

Vienna, March 1, 2005<br />

ERNST & YOUNG<br />

WIRTSCHAFTSPRÜFUNGSGESELLSCHAFT MBH<br />

Alfred BROGYÁNYI Elisabeth GL<strong>AS</strong>ER<br />

Auditor Auditor<br />

In accordance with § 277 Par. 2 of the Austrian Commercial Code, the financial statements will also be published in the Official<br />

Gazette of the Wiener Zeitung and in the <strong>Raiffeisen</strong> Zeitung.<br />

67

68<br />

1,004 EMPLOYEES<br />

A<br />

B<br />

Adler Harald, Adler Yvonne, Aescht Martin, Afsharpour Hengameh, Ahrer Franz, Aixberger Johann, Alleithner Margit, Amon Johann, Angster<br />

Stefan, Aniwandter Erhard, Appel Andreas, Artacker Ewald, Aschauer Manfred, Assfall Monika, Atzmüller Erwin, Auer Otto, Ausobsky Wolfgang,<br />

Bachinger Elisabeth, Bachofner Claudia, Bachtrod Erika, Bäk Edith, Bäumel Monika, Baier Eva Maria, Bammer Silvia, Baranowska Wiktoria,<br />

Barosch Petra, Bartl Christian, Bauer Andreas, Bauer Franziska, Bauer Georg, Bauer Klaus, Bauer Reinhard, Bauer Sabine, Bauer Silke,<br />

Baumgartner Klaudia, Bayer Claudia, Bayr Silvia, Beinhart Thomas, Beißer Karina, Beneder Caroline, Beran Ursula, Berariu Alice, Bergaus<br />

Isabella, Berger Marianne, Berger Sabine, Berger Waltraud, Berghold Barbara, Bergmann Pia, Bergner Peter, Bermann Eva, Bernsteiner Andrea,<br />

Bernsteiner Johannes, Berthold Markus, Bertolas Isabella, Bestmann Jörg, Bichl Martin, Biegel Dieter, Bilger Maria-Gabriele, Bilina Gabriele,<br />

Binder Eva-Maria, Binder Helga, Binder Susanne, Binder-Gerö Josef, Bitterhof Günther, Bittlingmayer Sarita, Blazek Maria, Bleininger Günther,<br />

Blümel Petra, Böck Manuela, Böhm Patrick, Böhm Wolfgang, Böhnisch Günther, Boes Alfred, Boigner Petra, Bonk Jochen, Brandenberger Josef,<br />

Brandstetter Karin, Brandtner Cornelia, Brasnic Ana, Braun Christian, Braun Gunnar, Braunseis Thomas, Braunsteiner Gerda, Braunsteiner<br />

Walter, Breiner Jeaninne, Brenner Hildegund, Bretschneider Walter, Breuer Mathias, Brodmann Beate, Bronneck Gitta, Bruckner Gerd,<br />

Brunhuber Manuela, Bubik Sabrina, Buchberger-Vilanek Irene, Buchgraber Anita, Buchgraber Christoph, Buchinger Arnold, Buchleitner Josef,<br />

Buchmayer-Exl Reinhard, Buchwieser Wolfgang, Buhl Josef, Bukowski Roland, Bukowski Sabina, C Cabak Sonja, Cafourek Alexander, Caltik<br />

Gabriela, Candussi Karin, Casapicola Alexander, Cerkez Irma, Chory Bernd, Cimbal Sylvia, Conrad Renate, Csiky Andrea, Czvitkovich Gertrude,<br />

D Dampier Daniela, Dancsecs Carina, Danzinger Matthias, Darrer Konrad, Denk Dieter, Deutenhauser Josef, Deutsch Karin, Devich Josef, Dierl<br />

Maria, Dippolt Wilhelm, Direder Thomas, Dirnberger Martin, Dobrohruschka Rita, Donath Heinz, Doninger Theresia, Doppler Walter, Dorn Nicole,<br />

Drechsler Monika, Dunkler Philipp, Dutka Martina, Dvorak Sonja, Dworak Gabriele, E Eberhardt Andreas, Eckhardt Sabine, Eckhardt-Kral Ingrid,<br />

Eder Barbara, Eder Christian, Eder Johann, Eder Margarete, Eder Regina, Eder Roland, Ederer Maria, Ehrismann Uwe, Eichinger Robert,<br />

Einspieler Wolfgang, Elsinger Heinz, Endres Sabine, Enengl Raimund, Enter Gabriele, Erber Josef, Ercher Sylvia, Erhart Thomas, Erker Renate,<br />

Ertl Albert, Exner Alexander, F Farnik Richard, Feiertag Eva, Fekete Sabine, Feldhofer Susanne, Fesl Karin, Feucht Harald, Fiala Monika, Fischer<br />

Beate, Fischer Monika, Fischer Robert, Flandorfer Walpurga, Flenner Silvia, Förster Peter, Forbach Sebastian, Forstner Roland, Frank Christine,<br />

Frauwallner Gertrude, Frei Johannes, Fremuth Beate, Frey Christina, Freytag Nicole, Friedberger Barbara, Fritz Markus, Fröhlich Werner,<br />

Fromwald Mario, Fuchs Edith, Fuchs Klaus, Fuchs Markus, Fuchs Martha, Fuchs Yvonne, Führer Horst, Fürnkranz Brigitte, Fürst Helmut,<br />

Futschek Johannes, G Gaider Peter, Galbavy Bettina, Gallee Johann, Gansterer Margareta, Gartler Barbara, Gartner-Nasskau Renate, Gebhart<br />

Karin, Geebauer Martina, Geißler Tim, Gepperth Johann, Gerber Jörg, Gerczei Manuel, Gerhard Peter, Geyer Edeltraud, Geyer Katharina, Gfrerer<br />

Christiane, Giefing Gaston, Giefing Sabine, Glasl Harald, Gloger Karin, Gmeiner Barbara, Götsch Alfred, Götz-Bandin Tina, Götzinger Gertraude,<br />

Gogl Andreas, Gollner Theresia, Grabatsch Christina, Grabmaier Gundula, Graf Claudia, Graf Michael, Graf Reinhold, Grafendorfer Alexandra,<br />

Grasel Michael, Grass Silvia, Grasser Wolfgang, Green Sieglinde, Greimel Alfred, Gröchenig Sylvia, Groß Karl, Großebner Reinhold, Großkopf<br />

Georg, Großmaier Erwin, Gruber Günter, Gruber Johann, Gruber Manfred, Gruber Robert, Grüneis Günther, Gschwindl Karl, Gube Sabine, Guca<br />

Andrea, Gugl Andreas, Gusenbauer Birgit, H Haas Günther, Haberl Ute, Hahnl Irene, Haidn Herwig, Hain Günther, Haindl Herbert, Hainthaler<br />

Andrea, Hainzl Friedrich, Hajek Alexandra, Hakel Stefan, Hammer Manfred, Hanifl Matthias, Hanisch Daniela, Hanni Christian, Hanreich Wilfried,<br />

Hanzl Christian, Hanzl Karl, Harant Elisabeth, Hardegg Michaela, Harrauer Renate, Haschka Susanne, Haslauer Christa, Hauck Elisabeth,<br />

Hauptmann Günter, Hauser Anita, Haydn Maria, Hazdra-Choura Ingrid, Hebein Natascha, Hechenblaikner Johanna, Hechtl Anton, Heidl Martina,<br />

Heidrich Bernd, Heiter-Habermann Birgit, Hellein Michaela, Hellmich Patrick, Henein-Hanke Ingrid, Heneis Franz, Hergeth Stefan, Hermann<br />

Andreas, Herrmann Verena, Hief Peter, Hillebrand Gabriele, Himmelmaier Barbara, Hinterberger Robert, Hinterbuchinger Michaela, Hirschvogl<br />

Ursula, Hoche Angelika, Hochfelsner Julia, Hochmann Andrea, Hochrainer Werner, Hochsteger Thomas, Hocke Werner, Höfner Martina,<br />

Höglinger Josef, Höller Inge, Hölzl Christian, Hörler Elisabeth, Hofbauer Claudia, Hofbauer Doris, Hofbauer Franz, Hofer Eva, Hofer Michael, Hofer<br />

Ulrike, Hoffelner Gernot, Hoffmann Birgit, Hoffmann Martha, Hoffmann Sandra, Hofmann Anna, Hofmann Armin, Hofmann Birgit, Hofmann<br />

Stefan, Hofmeister Alfred, Hofstetter Wolfgang, Hofstötter Gerda, Hohenegger Karin, Hollstein Astrid, Holoubek Antonio, Holubar Sonja, Holzer<br />

Josef, Hons Rosita, Hopf Andreas, Hoppel Ingrid, Horak Gabriela, Horak Robert, Horer Manfred, Horvath Stefan, Horvath Susanne, Houszka<br />

Karin, Hrobacz Claudia, Hub Maria, Huber Andrea, Huber Nicole, Huber Wolfgang, Hubinger Alexander, Hudak Karoline, Hübner Manüla, Hütter<br />

Ferdinand, Hüttmair Erich, Huger Katharina, Hummer Stephanie, Hums Martina, Hurter Sabine, I Ibounik Michael, Ignatovski Petra, Immervoll<br />

Johann, Indrak Markus, Indrak-Tomes Daniela, Infanger Karl, Ivanovsky-Schönborn Sonja, J Jaklitsch Helmut, Jakob Franz, Jakob Ingrid, Jaksch<br />

Renate, Janecek Johann, Janko Martin, Jankovic Jutta, Janosik Ernst, Jauk Stefan, Jenkner Christian, Jeschko Johannes, Jordan Wolfgang,<br />

Jovicic Mirjana, Jung Claudia, Jung Gabriele, Jungmayer Jürgen, K Kagerer Engelbert, Kaintz Dietmar, Kainz Gerlinde, Kaipel Kathrin, Kalenda<br />

Hermann, Kalt Gabriele, Kaltenecker Martina, Kamellander Harald, Kamellander Petra, Kammergrabner Barbara, Kammerhofer-Gartner Irene,<br />

Kantor Christoph, Kapfer Stefan, Karall Andrea, Kargl Josef, Karlik Peter, Karlik Thomas, Kattner Franz, Kauder Silvia, Kdolsky Michael, Kellner<br />

Alfred, Kern Harald, Kern Katharina Andrea, Kerschbaumer Gertrude, Keusch Ursula, Kier Wolfgang, Kieslinger Claudia, Kindermann Sabine,<br />

Kirchknopf Judith, Kirnbauer Andreas, Kitzinger Gerhard, Klaghofer René, Klamert Christian, Klauhs Doris, Klaus Gunter, Kleedorfer Herbert,<br />

Klinger Marcus, Klug Erika, Klug Eva-Maria, Knechtl Karl, Knoglinger Joachim, Kölbl Stephan, Köllerer Andrea, Köllner Manfred, Körbl Andreas,<br />

Koger Doris, Kogler Karina, Kohl Daniela, Kohl Manfred, Koisser Angelika, Kokanovic Danica, Kolar Gabriele, Kolar Uwe, Koller Brigitta, Koller<br />

Michaela, Kollmann Daniela, Kopacek Brigitte, Kornfeind Roman, Kornfeld Maria, Korntheil Monika, Korunka Martina, Kraft Werner, Kraft-Kinz<br />

Georg, Krajnik Gerda, Krammer Andrea, Krammer Christoph, Krammer Erwin, Krammer Günter, Krammer Ingrid, Kraus Hildegard, Krausz Karin,<br />

Krc Anita, Krejci Wolfgang, Kremlicka Veronika, Kremser Ludwig, Kremser Ludwig, Krenn Lukas, Krenn Michael, Kreuzer Ida, Kreuzmann Karin,<br />

Krischke Bernhard, Krischke Renate, Krispel Rudolf, Kriz Daniela, Krombholz Manuela, Kromes Johann, Kronberger Ingeborg, Kropik Karin,<br />

Krouzek Pia, Krukenfellner Susanne, Kudjelka Harald, Kuhnert Wolfgang, Kukula Angela, Kulic Katarina, Kumhofer Sandra, Kunagl Andreas,<br />

Kunagl-Fennesz Elfriede, Kurta Eveline, Kux Gabriel-Peter, L La Hok Tuen, Lackinger Wolfgang, Lackner Alexander, Lagsteiner Robert, Lang<br />

Christian, Lang Christoph, Lang Elfriede, Langer Nikolaus, Lanner Gabriele, Laszmann Marion, Lauer Maria, Laya-Laufersweiler Sabrina, Lehner

Sandra, Lehner-Jettmar Peter, Lehofer Wolfgang, Leidenfrost-Nowak Kurt, Leidnix Erich, Leiner Daniela, Leist Harald, Leitner Johann, Lenarcic<br />

Karin, Leodolter Rudolf, Leretz Julia, Liebhart Christoph, Lindbichler Marion, Lippitsch Johann, Litzka Martina, Lochner Franziska, Löscher Peter,<br />

Loidolt Andreas, Lorenz Gerlinde, Losos Walter, Loydl Erich, Ludik Eduard, Luger Bettina, Lukas Stefan, Luntzer Christina, Lutz Thomas,<br />

Lutzmayer Bernadette, M Machala Sonja, Machan Andrea, Mader Gregor, Maderic Sabine, Mahn Elfriede, Maimer Wilhelm, Maleschek<br />

Alexandra, Malzer Erich, Mandl Barbara, Mang Monika, Mannsberger Beate, Mantler Josef, Manzenreiter Doris, Marhold Gabriela, Marihart<br />

Doris, Markel Christina, Markl Kurt, Marschalek Friedrich, Martinovic Andrea, Marvan Daniela, Matuschek Martina, Mayerweck Brigitte, Mayr<br />

Felix, Mayrl Martin, Meinecke Astrid, Meltsch Martina, Meraner Manfred, Mercsanits Sabine, Merta Heidemarie, Messetler Eva, Messner<br />

Michaela, Metzl Tanja, Meyer Christian, Meyer Manfred, Mezera Stefan, Michlits Harald, Mickl Franz, Miletits Eszter, Milkovits Marion, Milla<br />

Silvia, Milletich Barbara, Mitsch Edith, Mock Christian, Mock Erhard, Möller Britta, Mörzinger Sabine, Monnier Etienne, Mosgöller Karl, Motzko<br />

Maria, Mühl Eva-Maria, Mühler Evelyn, Müller Elisabeth, Müller Gerald, Müller Heidrun, Müller Heinz, Müller Martina, Müller-Nowak Annemarie,<br />

Müller-Tröster Thomas, Müllner Stefan, Müllner Thomas, Murnberger Maria, Muskovich Franz, Musso Maria, Mycinski Barbara, N Naame<br />

Gabriel, Nagel Sabine, Nagl Gernot, Nagl Judith, Naglmeier Gerald, Nebily Barbara, Nebily Johann, Nedjelik Maximilian, Nemeth Christian,<br />

Nemeth Gisela, Neubauer Karin, Neubauer Werner, Neuberger Brigitta, Neudorfer Christa, Neuhauser Herbert, Neuhauser Sabine, Newet<br />

Susanna, Nicolussi-Moretto Guido, Niedereder Sonja, Niedermayr Jürgen, Nikitscher Nicole, Niziolek Birgit, Nöbauer Christoph, Novak Eva<br />

Maria, Novak Peter, Novotny Gerhard, Nowak Cornelia, O Obenaus Nicole, Obenaus Sonja, Oberhuber Petra, Öllerer Werner, Öllerer Werner,<br />

Öllermayr Petra, Österreicher Gerhard, Ohswald Christian, Ondra Stefan, O'Sullivan Gabriella, Ott Christina, P Paces Peter, Pachinger Bärbel,<br />

Paclt Alexandra, Palasser Birgit, Pammer Doris, Pannosch Birgit, Papst-Tastel Regine, Partinger Franziska, Patzl Wolfram, Paul Gerhard, Paun<br />

Sonja, Paur Gertrude, Pavlicek Martina, Pechgraber Bernhard, Pelech Wolfgang, Pelzmann Andrea, Penold Judith, Perchthaler Thomas, Perschl<br />

Heidelinde, Pfeffer Eva, Pfeffer Heinz, Pfeiffer Karin, Pfingstgräf Peter, Pflug Irene, Philippitsch Udo, Pichler Franz, Pichler Maria, Pichler<br />

Michaela, Pietschmann Dieter, Piewald Josef, Pilekic Marta, Piller Elfriede-Helene, Pillwein Christian, Pils Bernhard, Pipal Manuela, Pirkfellner<br />

Harald, Plachwitz Heidemarie, Plessl Maria, Ploner Michael, Pöcher Martina, Pokan Silvia, Pokorny Claudia, Poliakoff Alexandre, Pollak Martina,<br />

Ponstingl Erich, Popp Sandra, Posa-Markaryan Jbid, Pospischil Martin, Prader Olivia, Prechtl Marion, Preininger Claus Jürgen, Preiskorn Gabriele,<br />

Prepost-Liebhard Sylvia, Prießnitz Eveline, Prinz Maria, Prirsch Ferdinand, Pröglhöf Peter, Prusnik-Dragosits Heinz-Peter, Pühringer Reinhard,<br />

Püspök Peter, Punz Gerhard, Putz Alexander, R Rabl Petra, Raditsch Eva, Radl Herbert, Rak Bernhard, Rakic Slobodan, Rakowitz-Sagmeister<br />

Andrea, Rammel Michaela, Ramsauer Peter, Ransmayr Gerhard, Rapatz Hans, Rappan Petra, Raschbauer Dagmar, Rathfux Andrea, Rausch<br />

Christian, Rauter Nina, Redl Dorothea, Regner Natascha, Regner Sigrid, Rehor Gerhard, Reichardt-Dirnberger Birgit, Reichel Manuela,<br />

Reismüller Manfred, Reitenbach Michael, Reiter Monika, Reithofer Monika, Remsberger Christian, Resch Anton, Retzer Gertraud, Richtar<br />

Eduard, Riedel Gerhard, Riedl Claudia, Rieger Mathias, Rilke Reinhard, Ritter Markus, Rittler Helene, Rittsteuer Christiane, Robor Marcus Julian,<br />

Roch Dieter, Rochacz Paulina, Rötzer Dieter, Rohacek Astrid, Roseano Nina, Rosenberger Andreas, Rosner Marietta, Rott Jakob, Rueff Michael,<br />

Ruisz Adelheid, Rupp Pierre, Rupp Sabine, Ruprich-Eggner Dorothee, Rußegger Wolfgang, S Sacher Andreas, Sacher Markus, Sadleder Christa,<br />

Salenka Wolfgang, Samer Gabriele, Sarklet Romana, Schäfer Erich, Schätz Iris, Schall Anita, Schallerböck Birgit, Schallmayer Karl, Schardinger<br />

Sandra, Scharfetter Iris, Schatzinger Edith, Schauer Andrea, Schausberger Kurt, Schebach Margit, Schediwy Werner, Scheichenberger Martin,<br />

Schein Christian, Schicker Verena, Schikowitz Markus, Schiller Alexander, Schiller Petra, Schiller Roland, Schindler Peter, Schiruk Elisabeth,<br />

Schittenhelm Christoph, Schlosser Roman, Schmalzl Katrin, Schmid Manfred, Schmidl Sonja, Schmidt Friedrich, Schmiedel Rene, Schmutz Andrea,<br />

Schnakl Johann, Schneider Alexander, Schnizer Elisabeth, Schnürer Ursula, Schober Sibylle, Schoder Harald, Schöfmann Peter, Schölm Sonja,<br />

Schönberger Günter, Schöpfer Monika, Scholz Martin, Schottmann Regina, Schräfl Philipp, Schraik Wolfgang, Schramm Martina, Schreiner Hans,<br />

Schrenk Erich, Schröfl Philipp, Schubert Franz, Schütt Marc, Schuh Andrea, Schuh Barbara, Schuh Margit, Schuster Barbara, Schuster Edeltraud,<br />

Schwab-Bigler Sabine, Schwaiger Reinhard, Schwarz Peter, Schwarz Ulrike, Schwarzbauer Roman, Schweiger Daniel, Schweinhammer Dagmar,<br />

Schweitzer Martina, Schwendenwein Markus, Schwischei Siegfried, Segall Elisabeth, Sehorz Martina, Seibold Ursula, Seidel Ingrid, Seidl Eva Maria,<br />

Seidl Gerold, Seifner Sonja, Seiter Elisabeth, Serles Werner, Siebert Sabine, Sieder Gabriela, Siegel Petra, Siegel Sabine, Sieghardt-Schmidt Petra,<br />

Siegl Barbara, Simanek Marie-Therese, Simlinger Monika, Sinkovits Albert, Skoumal Patricia, Slavik Petra, Smitha Herbert, Smutny Sonja, Sobotka<br />

Karin, Sollinger Christian, Sona Stefanie, Sonai Sonja, Span Barbara, Spanring Martina, Spiegel Michaela, Sporrer Brigitte, Stadnikow Sascha,<br />

Stangl Christian, Stangl Gertrude, Stark Christian, Starkl Wolfgang, Stary Gabriela, Steger Maria-Theresia, Steibl Günter, Steinbrugger Andreas,<br />

Steiner Ingrid, Stepan Georg, Steurer Erwin, Stiasny Stefan, Stimac Christina, Stocker Elisabeth, Stöckl Andrea, Stöffl Eva, Stöger Manuela, Stöger<br />

Maria, Stora Yvonne, Straka Friedrich, Stransky Angela, Stranzl Walter, Strasser Pamela, Straßnig Josef, Strau Wolfgang, Strubreiter Thomas,<br />

Strycek Marion, Stummer Franz, Stummvoll Doris, Stusak Günther, Suchentrunk Isolde, Supper Franz, Svaton Brigitte, Svoboda Thomas, Szakusits<br />

Manfred, Szeidel Josefa, Szekely Hippolyt, Szloboda Walter, T Tamegger Helmut, Tanriverdi Manuela, Tatschl Eva, Taubitz Gabriele, Tausz Gerald,<br />

Thaler Johann, Thomann Heidemarie, Thurner Rosa, Töpfl Günther, Toifl Andreas, Toifl Martina, Tomaschek Lucia, Tomazic Nina, Toth Petra, Tragschitz<br />

Anton, Traschler Petra, Trausmüller Eva, Trautmann Wolfgang, Trcka Andrea, Trettler Franz, Tröster Alexandra, Trunner Daniela, Tschank Claudia,<br />

Tscherkassky Andrea, Tschrepitsch Bernhard, Tschrepitsch Günther, Tuchny Sabrina, Tuider Herbert, Tunkl Christian, Turek Ulrike, Tutsch Michael, U<br />

Uher Christoph, Uhl Ulrike, Ullram Erich, Urbanek Friedrich Harald, V Valentin-Schilling Sabine, Vandrovec Susanne, Vartok Robert, Vasilico Michael,<br />

Vass Marion, Vavrousek Thomas, Veith Enrico, Veits Georg, Vesely Claudia, Vetter Daniela, Vock Christine, Vogt Christina, Vogt Elisabeth, Vorhemus<br />

Bernhard, Vorpahl Karin, Votypka Patricia, Votypka Rudolf, Voulgaris Anastasios, Vsetecka Christian, W Wachlowski Evelin, Wachsler Sibylla, Wacker<br />

Sonja, Wagner Florian, Wagner Martin, Wagner Robert, Wailzer Susanna, Wais Christian, Waitz Christa, Wald Thomas, Walenta Robert, Walla Astrid,<br />

Wallner Herta, Wallner Katharina, Wanieczek Peter, Watzek Katharina, Weber Andreas, Wechselberger Bettina, Wecko Bettina, Weger Annette, Weger<br />

Thomas, Wegl Elisa, Wehofsky Claudia, Weidinger Gerhard, Weimann Thomas, Weinmann Gabriele, Weiser Beatrix, Weiss Brigitte, Weiss Gudrun,<br />

Weiß Lothar, Weiss Sylvia, Weiß Rainer, Wendelin Norbert, Wenger Harald, Wenisch Helmut, Wentseis Franz, Wenzina Christian, Wesel Erwin, Wessely<br />

Lieselotte, Westermayr Claudia, Wetzel Wilfried, Wiesinger Elisabeth, Wiesler Christian, Wiesler Sabine, Willert Doris, Wiltsch Michael, Windisch<br />

Wolfgang, Winkelhofer Jutta, Winkler Maria, Winkler Philipp, Winter Helene, Winter Helmut, Winter Maria, Wirsta Michael, Wisgrill Heinz, Wistl Claudia,<br />

Withalm Michael, Witschel Brigitte, Witting Ulrike, Wittmann Robert, Wögenstein Claudia, Wöginger Alicia, Wöhry Petra, Wokrinek Leo, Wolf Eva-Maria,<br />

Wolfram Bernhard, Wollner Markus, Woltron Fabienne, Wonisch Irene, Writze Matthias, Wurzinger-Salazar Marianne, Wutte Sandra, Z Zachl Gerhard,<br />

Zainzinger Andreas, Zakostelsky Eva Maria, Zakoucz Margit, Zangerl Michaela, Zechmeister Carmen, Zechmeister Silvia, Zederbauer Christine,<br />

Zeininger Gerlinde, Zeitlinger-Krcmar Sonja, Zernatto Rosanna, Zieger Gerhard, Zimmermann Hubert, Zintl Brigitte, Zlabinger Josefine, Zweckmayr Angelika<br />

69