Wealden Times | WT265 | June 2024 | Education Supplement inside

The lifestyle magazine for Kent & Sussex - Inspirational Interiors, Fabulous Fashion, Delicious Dishes

The lifestyle magazine for Kent & Sussex - Inspirational Interiors, Fabulous Fashion, Delicious Dishes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

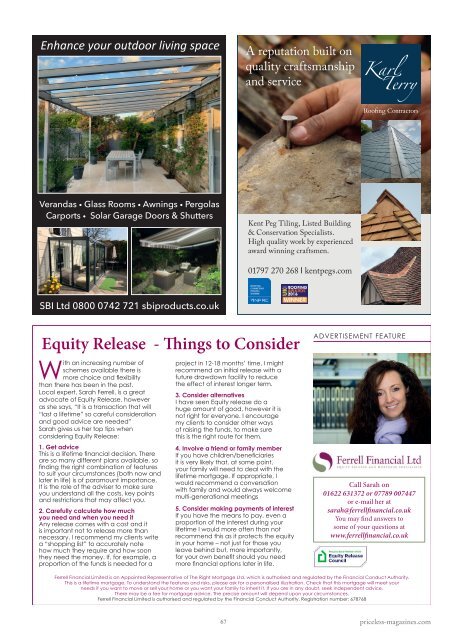

Enhance Do you need your shelter outdoor and living shade?<br />

space<br />

A reputation built on<br />

quality craftsmanship<br />

and service<br />

Verandas • Glass • Rooms • Awnings • • Pergolas<br />

Carports • Solar • Garage Doors & Shutters & Shutters<br />

Kent Peg Tiling, Listed Building<br />

& Conservation Specialists.<br />

High quality work by experienced<br />

award winning craftsmen.<br />

exibility<br />

s she says,<br />

d advice<br />

le, so findnd<br />

later<br />

ou underecessary.<br />

h they ree<br />

funds is<br />

ease with<br />

t for evmake<br />

ily will<br />

a congs.<br />

SBI SBI Ltd Ltd 0800 0742 721 sbiproducts.co.uk<br />

Equity Release - Things to Consider<br />

01797 270 268 l kentpegs.com<br />

SBIWT244.indd 1 27/07/2022 KarlTerryWT229.indd 11:26<br />

1 07/05/2021 12:40<br />

W<br />

ith an increasing number of<br />

schemes available there is<br />

more choice and flexibility<br />

than there has been in the past.<br />

Local expert, Sarah Ferrell, is a great<br />

advocate of Equity Release, however<br />

as she says, “It is a transaction that will<br />

“last a lifetime” so careful consideration<br />

and good advice are needed”<br />

Sarah gives us her top tips when<br />

considering Equity Release:<br />

1. Get advice<br />

This is a lifetime financial decision. There<br />

are so many different plans available, so<br />

finding the right combination of features<br />

to suit your circumstances (both now and<br />

later in life) is of paramount importance.<br />

It is the role of the adviser to make sure<br />

you understand all the costs, key points<br />

and restrictions that may affect you.<br />

2. Carefully calculate how much<br />

you need and when you need it<br />

Any release comes with a cost and it<br />

is important not to release more than<br />

necessary. I recommend my clients write<br />

a “shopping list” to accurately note<br />

how much they require and how soon<br />

they need the money. If, for example, a<br />

proportion of the funds is needed for a<br />

project in 12-18 months’ time, I might<br />

recommend an initial release with a<br />

future drawdown facility to reduce<br />

the effect of interest longer term.<br />

3. Consider alternatives<br />

I have seen Equity release do a<br />

huge amount of good, however it is<br />

not right for everyone. I encourage<br />

my clients to consider other ways<br />

of raising the funds, to make sure<br />

this is the right route for them.<br />

4. Involve a friend or family member<br />

If you have children/beneficiaries<br />

it is very likely that, at some point,<br />

your family will need to deal with the<br />

lifetime mortgage. If appropriate, I<br />

would recommend a conversation<br />

with family and would always welcome<br />

multi-generational meetings<br />

5. Consider making payments of interest<br />

If you have the means to pay, even a<br />

proportion of the interest during your<br />

lifetime I would more often than not<br />

recommend this as it protects the equity<br />

in your home – not just for those you<br />

leave behind but, more importantly,<br />

for your own benefit should you need<br />

more financial options later in life.<br />

ADVERTISEMENT FEATURE<br />

Call Sarah on<br />

01622 631372 or 07789 007447<br />

or e-mail her at<br />

sarah@ferrellfinancial.co.uk<br />

You may find answers to<br />

some of your questions at<br />

www.ferrellfinancial.co.uk<br />

Ferrell Financial Limited is an Appointed Representative of The Right Mortgage Ltd, which is authorised and regulated by the Financial Conduct Authority.<br />

This is a lifetime mortgage. To understand the features and risks, please ask for a personalised illustration. Check that this mortgage will meet your<br />

needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.<br />

There may be a fee for mortgage advice. The precise amount will depend upon your circumstances.<br />

Ferrell Financial Limited is authorised and regulated by the Financial Conduct Authority. Registration number: 678768<br />

lifetime I<br />

home –<br />

fit should 67<br />

priceless-magazines.com