You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MAGAZINE<br />

VADO E TORNO EDIZIONI<br />

www.vadoetorno.com<br />

www.vadoetornoweb.com<br />

www.sustainabletruckvan.com<br />

VADOETORNO SUPPLEMENT<br />

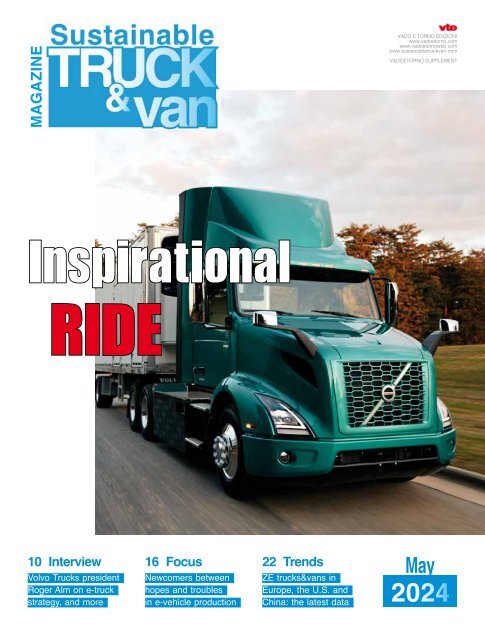

Inspirational<br />

RIDE<br />

10 Interview<br />

Volvo Trucks president<br />

Roger Alm on e-truck<br />

strategy, and more<br />

16 Focus<br />

Newcomers between<br />

hopes and troubles<br />

in e-vehicle production<br />

22 Trends<br />

ZE trucks&vans in<br />

Europe, the U.S. and<br />

China: the latest data<br />

May<br />

<strong>2024</strong>

VISIT US AT<br />

TRANSPOTEC LOGITEC <strong>2024</strong><br />

MAY 8-11 • MILAN, ITALY<br />

HALL 24P STAND E01 F08<br />

MAY <strong>2024</strong><br />

sustainabletruckvan.com<br />

CONTENTS<br />

Awards<br />

8 SUSTAINABLE TRUCK OF THE YEAR<br />

The winning vehicles of the <strong>2024</strong> edition<br />

E–SERIES<br />

THE<br />

ELECTRIC<br />

EDGE<br />

IN URBAN<br />

AND INNER-CITY<br />

DELIVERY<br />

16<br />

FOLLOW SUSTAINABLE TRUCK&VAN ON:<br />

Face-to-face<br />

10 LEADING THE TRANSITION<br />

Roger Alm, President of Volvo Trucks<br />

12 BIGGER THAN EVER<br />

Organizing ACT Expo: Lawren Markle<br />

14 NO TIME TO LOSE<br />

Anja van Niersen, CEO of the JV Milence<br />

Focus<br />

16 IT’S A TOUGH GAME<br />

ZE truck&van manufacturers at a crossroads<br />

Trends<br />

22 WAITING FOR THE SPARK<br />

Analysing ZE registrations in three key areas<br />

Preview<br />

28 THE LONGER THE BETTER<br />

The newly introduced Volvo FH Aero range<br />

32 HERO OF THE TWO WORLDS<br />

The launch of the new Mercedes eSprinter<br />

36<br />

Insight<br />

36 FRENCH STYLE BATTERIES<br />

Inside Forsee Power’s gigafactory in Poitiers<br />

Smart Tests<br />

40 BORN ELECTRIC<br />

Behind the wheel of a Mercedes eActros 400<br />

With E-Series, Thermo King hits the town with a new,<br />

all-electric refrigeration unit for electric light<br />

commercial vehicles. With energy efficiency at the heart<br />

of the new design, it’s built to bring out the best in electric<br />

performance, and deliver it straight to the city center.<br />

44 THAT DRIVING FEELING<br />

Nissan Townstar EV, right for the city<br />

Columns<br />

6 At a glance 48 Techno 49 Infrastructure<br />

DISCOVER THE NEW E-SERIES AT<br />

TKELECTRICEDGE.COM<br />

FIND YOUR NEAREST THERMO KING DEALER AT<br />

DEALERS.THERMOKING.COM<br />

40<br />

A growing editorial platform<br />

In addition to our STV newsletter, out on Wednesdays,<br />

we’ve launched a new weekly initiative, shared with<br />

our sister platforms. Find out more and join us! p.4<br />

3

NEWS GOOD START<br />

SUSTAINABLE TRUCK&VAN: A GROWING EDITORIAL PLATFORM<br />

Energy transition has its thorns<br />

CHALLENGES, TRENDS, INTERVIEWS AND MORE: WHAT'S IN THIS ISSUE<br />

Here we are, again.<br />

Following the pleasant<br />

appetizer of our first issue,<br />

we sit down at the table and<br />

really begin a journey that<br />

we look forward to tackling<br />

together with you readers.<br />

This year, our plan is made of<br />

two publications. In addition<br />

to this one, which you will<br />

find being distributed at ACT<br />

Expo, Las Vegas, we will have<br />

a fall issue distributed, among<br />

others, at IAA Transportation,<br />

Hanover.<br />

In this issue, we try to<br />

take stock of the obstacles,<br />

sometimes impossible to<br />

overcome, that may face those<br />

who want to be players in<br />

the new mobility in freight<br />

transport. Especially when<br />

it comes to newcomers or<br />

young start-ups, often struggling with starting series production,<br />

establishing a suitable supply chain or, more simply, with a lack of<br />

liquidity. Then again, a true revolution like energy transition needs<br />

to be gradual. As numbers do not lie, we have tried to put things in<br />

order by analyzing market trends in Europe, the U.S. and China.<br />

Without neglecting the heart of our magazine, the vehicles. Like the<br />

Volvo that stands out on our cover, or the ones we tested in our smart<br />

tests. Besides, three interviews with leading players in the transition,<br />

well distributed among vehicle manufacturers, infrastructure<br />

specialists and event organizers.<br />

We close with a new feature that we introduced just a few weeks ago,<br />

the Movin’ Ahead newsletter released each week in collaboration<br />

with our sister platforms <strong>Sustainable</strong> Bus and Powertrain<br />

International. Movin’ Ahead (on the right the QR code to subscribe<br />

for free) aims to provide an up-to-date perspective on the evolution<br />

of the commercial transportation, power and energy sectors.<br />

MOVIN’ AHEAD<br />

SUBSCRIBE HERE<br />

GO TO OUR WEBSITE AND JOIN<br />

OUR COMMUNITY OF ABOUT<br />

20,000 PROFESSIONALS<br />

WORLDWIDE<br />

Charging<br />

forward<br />

to accelerate the world’s<br />

transition to eMobility<br />

One drives all.<br />

Our Integrated Drive Module<br />

simplifies the electrification<br />

of all kinds of vehicles.<br />

4

AT A GLANCE<br />

MAN IS THE FIRST MANUFACTURER TO ANNOUNCE SUCH DEVELOPMENT<br />

Hydrogen ICE truck in small series<br />

THE TRUCK WILL BE AVAILABLE IN SELECTED MARKETS BY 2025<br />

QUANTRON DESIGN AWARD, THE FIRST EDITION HELD IN MARCH<br />

That's how ZE trucks will look like<br />

THE CONTEST ATTRACTED 35 APPLICATIONS FROM OVER 10 COUNTRIES<br />

MAN is about to develop small truck series with hydrogen<br />

internal combustion engine by 2025. The so-called<br />

hTGX will be initially produced in about 200 units<br />

for special applications and distributed in selected<br />

customers in Germany, the Netherlands, Norway,<br />

Iceland and some more non-European countries. Indeed,<br />

the German manufacturer is the first one to come up<br />

with the news of a small series truck equipped with<br />

hydrogen-powered ICE. The MAN hTGX is conceived to<br />

be an alternative zero-emission drive variant for special<br />

applications, for example for transporting heavy goods<br />

– such as construction work, tank transport or timber<br />

transport.<br />

In fact, according to MAN, the hydrogen drive is<br />

particularly suitable for special transport tasks that require<br />

a special axle configuration or where there is no space for<br />

the battery on the frame due to the need for truck body<br />

work.<br />

The MAN hTGX offers high payloads and maximum ranges<br />

of up to 600 km in its initially offered 6×2 and 6×4 axle<br />

variants. The H45 hydrogen combustion engine used has an<br />

output of 383 kW (520 hp) and a torque of 2500 Nm at 900-<br />

1300 rpm. The direct injection of hydrogen into the engine<br />

ensures particularly fast power delivery. With hydrogen<br />

compressed to 700 bar (CG H2) and a tank capacity of 56<br />

kg, the vehicle can be refuelled in less than 15 minutes. “The<br />

hydrogen combustion engine H45 is based on the proven<br />

D38 diesel engine and is produced at the engine and battery plant in<br />

Nuremberg. The use of familiar technology enables us to enter the<br />

market at an early stage and thus provides a decisive impetus for the<br />

ramp-up of the hydrogen infrastructure. With the hTGX, we have<br />

now added an attractive product to our zero-emission portfolio,”<br />

commented Friedrich Baumann, Executive Board Member of MAN<br />

Truck & Bus and responsible for Sales & Customer Solution.<br />

AUTONOMOUS ID. BUZZ<br />

Following an extensive road<br />

testing pilot phase in Germany<br />

and the USA, Volkswagen ADMT,<br />

a Volkswagen AG organization,<br />

is announcing a cooperation<br />

agreement with the Israeli<br />

technology company Mobileye<br />

Global Inc. The latter will develop<br />

and supply software, hardware<br />

components and digital maps for<br />

the self-driving ID. Buzz.<br />

Volkswagen aims to develop<br />

an autonomous Level 4<br />

service vehicle for large-scale<br />

production. The target is to use<br />

this vehicle in the commercial<br />

sector, for mobility and transport<br />

services in Europe and the<br />

USA. Volkswagen ADMT aims<br />

to develop the fully electric<br />

autonomous ID. Buzz by 2026.<br />

.A preview of the hTGX developed by MAN.<br />

Assets for sale<br />

U.S.-based electric truck manufacturer Canoo<br />

announced the acquisition of valuable and<br />

advanced manufacturing assets belonged to no<br />

longer existing e-van manufacturer Arrival “at<br />

deep discount”, as written in the official press<br />

note. As stated by Canoo itself, the company’s<br />

strategy “in acquiring new and unused equipment<br />

at pennies on the dollar (80%+ discount),<br />

reduces capital expenditures by tens of millions<br />

of dollars, enhancing equity value”.<br />

The purchased assets will be collected into<br />

more than 20 containers and shipped by sea to<br />

Canoo’s manufacturing facilities in Oklahoma.<br />

“Our current strategy will save our shareholders<br />

tens of millions of dollars, which today, is not<br />

properly reflected in the value of our company.<br />

We remain focused on capital discipline and the<br />

smartest way to invest and create value,” said<br />

Tony Aquila, Investor, Executive Chairman, and<br />

CEO of Canoo.<br />

With a successful online ceremony, German ZE truck specialist<br />

Quantron celebrated in March the first edition of its Design Award.<br />

With the goal of attracting young talents with fresh perspectives,<br />

the event served as a platform to challenge the status quo of the<br />

European transportation and logistics sector with forward-thinking yet<br />

practical ideas. The competition managed to attracted 35 applications,<br />

representing more than 10 different countries and 20 prestigious<br />

universities and design schools.<br />

After a thorough selection process, the panel selected three top<br />

winners and awarded one honourable mention award. The first place<br />

went to Siddhartha Dutt from CCS (College for Creative Studies),<br />

Detroit, USA. Ana Alvarez Maestro (University of Navarra, Spain)<br />

finished second, and Lorenzo Benzoni from IED (Istituto Europeo di<br />

Design), Turin, Italy, was third. Moreover, a special mention went to<br />

George (Siu Fung Lau), also from IED, Turin.<br />

“The design briefing was creating a modular concept for a future<br />

heavy hydrogen fuel cell powered truck and its ecosystem. You<br />

can clearly see the result of the evaluations in the winning projects,<br />

based on the 4 main criteria, which are: Reflecting The Design Brief,<br />

Innovation & Creativity, Presentation & Visualisation, Feasibility<br />

& Compatibility with QaaS”, told us Quantron Design & Strategy<br />

Manager, Koorosh Shojaei the president of the Jury. “Designing<br />

a zero-emission truck differs mainly due to the need to integrate<br />

alternative powertrain solutions like hydrogen fuel cells or electric<br />

batteries, necessitating reimagined vehicle architecture and advanced<br />

energy and cooling management systems. This entails optimizing<br />

aerodynamics and weight to maximize efficiency and range while<br />

addressing refueling or charging infrastructure needs. The primary<br />

goal is to minimize environmental impact by reducing greenhouse<br />

emissions and pollutants associated with traditional diesel trucks”.<br />

There’s more about the idea behind the projects: “The other main<br />

focus of the QUANTRON Design Award <strong>2024</strong> has been the<br />

possibility of considering a tractor unit with and without a cabin”,<br />

added Koorosh Shojaei.<br />

DIAMOND ECHO ROADSHOW<br />

It’s called Renault Trucks E-Tech<br />

Diamond Echo (pictured below)<br />

the special version of a Renault<br />

Trucks electric heavy vehicle<br />

that is touring Europe for the<br />

first time. The truck, featuring<br />

a unique electroluminescent<br />

design, started its journey on<br />

11 April <strong>2024</strong>, from the Bourgen-Bresse<br />

plant, where it was<br />

manufactured. The electric<br />

truck is travelling<br />

more than 10,000<br />

kilometres across<br />

seven countries<br />

(France, Switzerland, Germany,<br />

Belgium, the Netherlands, Spain,<br />

United Kingdom), making over<br />

60 stops to meet the transport<br />

community and demonstrate<br />

the operational reality of electric<br />

mobility. The Diamond Echo<br />

is painted with light, and is the<br />

result of a collaboration with<br />

drivers and design specialists.<br />

Based on Lumilor technology,<br />

the paint glows<br />

when subjected<br />

to an electrical<br />

stimulus.<br />

The ZE truck project presented by Siddharta<br />

Dutt from CCS, Detroit, awarded for its<br />

“comprehensive approach, reflecting the full<br />

potential of design brief”.<br />

Welcome, Flexis SAS!<br />

Renault Group, Volvo and logistics operator CMA<br />

CGM have officially unveiled Flexis SAS, the new<br />

joint venture created with the aim of developing<br />

an innovative, software-based platform for a line<br />

of native electric vans. The partners have given<br />

themselves two years to define and strengthen<br />

the structure before moving on to mass<br />

production of the vans.<br />

Renault and Volvo share 45 percent ownership,<br />

with CMA CGM<br />

holding the remaining<br />

10 percent. Also<br />

announced at the<br />

official launch, held<br />

at the beginning of<br />

April, was the new<br />

CEO of Flexis, who<br />

will be Philippe<br />

Divry, while Krishnan<br />

Sundararajan will take over as COO. The<br />

electric LCVs will be assembled on a new<br />

skateboard-type platform, which will offer great<br />

modularity to fit various different body types at a<br />

competitive cost, and will introduce major safety<br />

improvements. One of the vehicles produced by<br />

Flexis at Renault’s Sandouville plant will be a<br />

stepvan, presumably modeled after those popular<br />

in the U.S. market.<br />

6<br />

7

AWARDS<br />

STY <strong>2024</strong>: THE WINNING VEHICLES<br />

IT'S GREAT<br />

TO BE<br />

CONFIDENT<br />

Once again, two vehicles awarded out of three are electric. The path<br />

to sustainability seems quite clear among the LCVs, as well as in<br />

the distribution truck segment. As for heavy-duty trucks, some issues<br />

still need to be solved. However, the signals coming from OEMs<br />

make us think that the turning point may be close.<br />

Let’s start by saying that energy transition<br />

will certainly happen, although probably<br />

not quite on schedule. At least not for<br />

everyone. As the figures say, above 3.5 tons<br />

it’s more difficult to have a boost, right now.<br />

One of the reasons is that, as soon as you get<br />

out of the cities, the range is often insufficient,<br />

the charging times long and the transportation<br />

costs prohibitive. Nevertheless, the the vehicles<br />

awarded at the <strong>Sustainable</strong> Truck of the<br />

Year in the latest editions show that the trend<br />

is quite clear, at least in two categories out of<br />

three. The Tractor category still awaits for the<br />

first electric winner. This year, the MAN TGX<br />

18.520 achieved a stunning result in terms of<br />

efficiency in the Supertest conducted by our<br />

sister platform Vado e Torno, breaking the 4<br />

km per liter threshold. With a wide choice in<br />

terms of configurations and 5 power ratings<br />

available up to 480 hp, the DAF XD Electric<br />

picks up the DNA of the now famous New<br />

Generation.<br />

Finally, the IVECO eDaily is the heir of a true<br />

urban freight icon, featuring significant advancements<br />

in terms of available range, connectivity<br />

options ans ADAS.<br />

Watch the awarding<br />

ceremony<br />

Awarded vehicles<br />

The latest MAN<br />

TGX 18.520 won<br />

the <strong>Sustainable</strong><br />

Truck of the<br />

Year award<br />

in the Tractor<br />

category. The<br />

most sustainable<br />

distribution truck<br />

was the DAF XD<br />

Electric. IVECO<br />

won the STY in the<br />

<strong>Van</strong> category with<br />

the new eDaily.<br />

tractor <strong>2024</strong> distribution <strong>2024</strong> van <strong>2024</strong><br />

9

FACE-TO-FACE<br />

VOLVO TRUCKS PRESIDENT, ROGER ALM<br />

TAKING THE LEAD<br />

With quite impressive<br />

e-truck market<br />

shares in both<br />

Europe and North America,<br />

Volvo Trucks is a benchmark<br />

in medium- and heavy-duty<br />

vehicle electrification. Nevertheless,<br />

the Swedish brand’s<br />

overall strategy does not neglect<br />

renewable fuels or biogas,<br />

with hydrogen on the<br />

background. Starting from the<br />

market figures, Volvo Trucks<br />

President Roger Alm takes<br />

stock of the current situation<br />

and future development.<br />

Almost half of the electric<br />

trucks sold last year in Europe<br />

are Volvo trucks, with<br />

about 40 percent share in<br />

North America, as well.<br />

Can we say that Volvo is almost<br />

the only ones building<br />

and delivering them, or is it<br />

due to the company’s particularly<br />

aggressive business<br />

strategy?<br />

“Of course, I won’t talk about<br />

our competitors or what they<br />

are doing. We are focused on<br />

“We have to take the legislation for<br />

what it is and then adapt accordingly.<br />

Let’s think of what’s been done with<br />

the different emissions standards for<br />

ICEs. As manufacturers, we have<br />

invested a lot in new technologies to<br />

meet the standards”.<br />

the Paris agreement and Science-based<br />

targets and that is<br />

one thing, but we also believe<br />

in the philosophy of sustainability<br />

and zero emissions, in<br />

order to reduce the pollution<br />

and hand over the situation<br />

to the next generations in a<br />

better shape than we have<br />

today. In 2019 we started the<br />

serial production of our first<br />

electrical trucks, and then<br />

we had the development of<br />

other models coming out. Today<br />

we’ve got six models into<br />

serial production and in the<br />

month of May we will go up<br />

to 8 models”.<br />

What about the vehicle<br />

availability, then?<br />

“Thousands of Volvo trucks<br />

are out in customer operations<br />

driving down and delivering<br />

goods every day. If we<br />

sum up the number of kilometers<br />

that all our e-trucks have<br />

been doing, it’s around 35<br />

Born in 1962,<br />

Roger Alm<br />

is currently<br />

Executive<br />

Vice President<br />

of Volvo<br />

Group, and<br />

President of<br />

Volvo Trucks.<br />

Employed<br />

since 1989,<br />

he boasts<br />

quite a long<br />

experience<br />

within the<br />

Volvo Group.<br />

millions of kilometers, more<br />

or less 900 laps around the<br />

world”.<br />

Volvo will participate in the<br />

ACT Expo in May. Can you<br />

tell us how the North American<br />

market is different<br />

compared to the European<br />

market?<br />

“We’re talking about different<br />

items and different<br />

things, however at the end of<br />

the day, it’s up to customers<br />

and to legislators to make<br />

the transformation happen, in<br />

both cases. Moreover, several<br />

customers, so transporters or<br />

transport buyers, are global<br />

and operate both in Europe<br />

and in North America. As for<br />

ACT Expo, I’m glad I’ll be<br />

there as a keynote speaker,<br />

and I believe the exhibition is<br />

quite strong nowadays”.<br />

Volvo Trucks has focused<br />

very strongly on electric<br />

mobility, although an open<br />

door has been left open on<br />

gas. With the Green Deal on<br />

the brakes, given the high<br />

costs as well, and with the<br />

next European Parliament<br />

most likely less skewed toward<br />

decarbonization, what<br />

will be the company’s priorities?<br />

“I do hope that everybody is<br />

focused on a more sustainable<br />

future and then legislations<br />

will come accordingly. I refer<br />

for example to CO 2<br />

taxes,<br />

which will help accelerate the<br />

transformation and promote<br />

the shift to battery electric or<br />

fuel cell trucks, or even go towards<br />

the adoption of renewable<br />

fuels, for instance. About<br />

the legislation, we cannot do<br />

so much, but we need to take<br />

the legislation for what it is<br />

and then adapt accordingly,<br />

which we have been doing<br />

so far. Let’s think of what’s<br />

been done with the different<br />

emissions standards for combustion<br />

engines. As manufacturers,<br />

we have invested into<br />

new technology to meet the<br />

emissions legislations in a<br />

very successful way and that<br />

is what we are doing as well”.<br />

With the new FH Aero<br />

range, Volvo has definitely<br />

taken a step forward. Offering<br />

a new ICE on the FH<br />

16 might be considered as a<br />

confirmation that diesel will<br />

still have a long life. Is that<br />

the case?<br />

“I think it is a natural move<br />

in the current transformation.<br />

We’re not changing our<br />

strategy, but rather following<br />

it. To get to net zero we must<br />

rely on different solutions. Although<br />

we believe that most<br />

of the volumes will be made<br />

by battery electric trucks, this<br />

is not the only viable solution.<br />

We’ll have the fuel cells, then<br />

hydrogen, or combustion engines<br />

running on biogas, or<br />

something else like renewable<br />

fuels. We can say it’s a multi-technology<br />

approach. Back<br />

to the Aero truck range, we’re<br />

very proud of the truck design,<br />

but also in terms of safety features<br />

and fuel consumption. I<br />

have big hopes regarding this<br />

new model range”.<br />

The Euro 7 standard is expected<br />

to come into force<br />

with significant changes<br />

compared to the very first<br />

proposal. As a manufacturer,<br />

is Volvo happy with the<br />

current proposal? Why?<br />

“With the Aero range, we’re not<br />

changing our strategy. To get to<br />

net zero, we must rely on different<br />

solutions: electric trucks, fuel cells,<br />

combustion engines running on<br />

biogas or renewable fuels. It’s a<br />

multi-technology approach”.<br />

“First, I’d say it’s positive<br />

that all the manufacturers<br />

are working on reducing CO 2<br />

emissions. That’s the main<br />

target, and there are several<br />

ways to do that. Euro 7 is one<br />

of these. At the end of the day,<br />

we want to reduce CO 2<br />

emissions<br />

in the fastest possible<br />

way. We’re positive that this<br />

is happening. Also, it needs<br />

to be clear what we need to<br />

do as manufacturers to meet<br />

the legislation of the Euro 7<br />

standard”.<br />

Together with Daimler and<br />

Traton, Volvo has launched<br />

the Milence charging infrastructure<br />

project. Some are<br />

skeptical about the projects,<br />

and someone recently said<br />

‘stop dreaming’ when talking<br />

of megawatt charging.<br />

What is your response to<br />

that?<br />

“Let me put the thing in this<br />

way. We all know that there is<br />

limited charging capacity in<br />

Europe. Of course, we need<br />

to build a density of charging<br />

points that should be similar<br />

to the one we have today<br />

when it comes to fuel stations.<br />

Milence is one way to improve<br />

this charging point density.<br />

The availability of charging<br />

stations is the one of the main<br />

requirements for the customers<br />

to consider working with<br />

electric trucks”.<br />

10<br />

11

FACE-TO-FACE<br />

THE ORGANIZERS OF ACT EXPO, LAS VEGAS<br />

BIGGER THAN EVER<br />

With a remarkable<br />

conference programme<br />

and hundreds<br />

of exhibitors, ACT Expo<br />

<strong>2024</strong> is probably the most<br />

awaited sustainable transportation<br />

event in North America.<br />

Lawren Markle, director<br />

of media relations at GNA, a<br />

TRC Company, helps us understand<br />

the secret behind the<br />

success of this exhibition.<br />

We’re just ahead of this<br />

year’s edition. In terms of<br />

booked space, exhibitor<br />

involvement, and visitors,<br />

what are your expectations<br />

regarding ACT Expo <strong>2024</strong>?<br />

I can tell you it’s going to be<br />

the largest expo floor ever. We<br />

have 350 exhibitors and sponsors,<br />

with about 200 vehicles<br />

on display. Until a few years<br />

ago, ACT Expo was a tiny<br />

corner at Long Beach convention<br />

center. It grew about 50%<br />

every year and finally we had<br />

to move to Anaheim last year,<br />

and now Las Vegas, where we<br />

have much more space, be-<br />

“The show is in its mainstream, with<br />

fleets talking to other fleets about<br />

what they’re doing when it comes to<br />

electrification. We moved it to Vegas<br />

because we needed more space,<br />

so I’d suggest the visitors to wear<br />

comfortable shoes this year!”.<br />

cause we are growing so fast.<br />

Last year we had over 12,000<br />

visitors, this year we might<br />

get closer to 18,000, so a<br />

steady and consistent growth<br />

over the years. At ACT Expo<br />

we’ll see a very good mix of<br />

technology.<br />

Last year, the exhibition was<br />

held in Anaheim, while this<br />

year Las Vegas is the chosen<br />

venue. Why have you decided<br />

such change?<br />

We needed to have more<br />

space for vehicles, exhibitors<br />

and attendees. This was the<br />

main reason why we moved<br />

the exhibition to Las Vegas.<br />

Las Vegas convention center<br />

is quite big, though, so I’d<br />

suggest wearing comfortable<br />

shoes this year! Jokes aside, I<br />

think the show is in its mainstream,<br />

with fleets talking to<br />

other fleets about what they’re<br />

doing when it comes to electrification.<br />

Lawren Markle<br />

is director<br />

of media<br />

relations at<br />

GNA, a TRC<br />

Company, the<br />

organizers of<br />

ACT Expo, to<br />

be held in Las<br />

Vegas from<br />

20 to 23 May,<br />

<strong>2024</strong>.<br />

What are the major trends<br />

and topics to be discussed<br />

this year as for clean transportation<br />

advancements at<br />

ACT Expo?<br />

Funding is a big part of the<br />

program. Professionals often<br />

don’t know how to deal with<br />

incentives, tax credits and<br />

so on, and coming to ACT<br />

Expo can be a good way to<br />

be aware.<br />

Another trending topic is hydrogen,<br />

now seen as a viable<br />

solution mainly for fleets.<br />

We’re seeing some companies<br />

focusing their attention<br />

on building up hydrogen<br />

refueling infrastructure<br />

in strategic locations along<br />

the main freight corridors in<br />

North America for heavy-duty<br />

trucks. It’s exciting to see<br />

it coming.<br />

The last edition placed emphasis<br />

on component manufacturers.<br />

Will this be the<br />

case again this year?<br />

As the market matures, we<br />

are seeing more and more<br />

finished, commercial vehicles<br />

and ready-to-use fueling<br />

and charging products, which<br />

are both of great interest to<br />

fleets. There are still a fair<br />

amount of components being<br />

displayed, such as fuel cells,<br />

e-axles, engines and other<br />

components. Furthermore, the<br />

conference is becoming more<br />

“The big OEMs will be there, such as<br />

Volvo Trucks, Navistar, Daimler Truck<br />

North America, Mack Trucks, Peterbilt,<br />

Kenworth. Even Tesla will have a<br />

speaker at ACT Expo, and some more<br />

companies like Nikola will participate<br />

with a dedicated booth”.<br />

and more international, with<br />

numerous exhibitors coming<br />

from Europe and Asia, too.<br />

Can you please name some<br />

of the major OEMs that<br />

confirmed their participation<br />

in this year’s edition?<br />

The big companies will be<br />

there, such as Volvo Trucks,<br />

Navistar, Daimler Truck North<br />

America, Mack Trucks, Peterbilt,<br />

Kenworth, and I’m sure<br />

I’m forgetting some of them.<br />

All the big names will be<br />

there. On stage we’ve assembled<br />

all the big truck makers<br />

together talking on the same<br />

panel about electrification,<br />

strategies, reducing emissions,<br />

and more. Even Tesla<br />

will have a speaker at ACT<br />

Expo. Some more companies,<br />

like Nikola for instance, will<br />

be there with their own booth.<br />

In terms of products, we do<br />

expect new truck reveals.<br />

What effect is the Inflation<br />

Reduction Act having on the<br />

industry?<br />

The bigger picture is that a lot<br />

of activities are happening at<br />

the State level now. You have<br />

some great federal incentives<br />

too, such as the Inflation Reduction<br />

Act, which allow for<br />

big investments. Moreover, a<br />

dozen states have adopted the<br />

Advanced Clear Trucks rule.<br />

That rule requires manufacturers<br />

to sell an increasing<br />

percentage of zero emission<br />

trucks.<br />

Also, the Advanced Clean<br />

Fleets rule is a sort of sister<br />

rule implemented in January,<br />

requiring many fleets to<br />

buy zero emission vehicles.<br />

Fleets are starting to realize<br />

that change is coming, and<br />

“Funding is a big part of the ehibition<br />

program, as professionals often don’t<br />

know how to deal with incentives, tax<br />

credits and so on. Another trending<br />

topic is hydrogen, now seen as a<br />

viable solution for many fleets. It’s<br />

exciting to see it coming”.<br />

investments are needed, now.<br />

Regardless of what happens<br />

with the national elections at<br />

the White House or the Senate,<br />

this transition is under<br />

way.<br />

So, you don’t foresee a<br />

change of direction after the<br />

next election in the U.S.<br />

I think that what will happen<br />

at the national elections<br />

does not imply a big change<br />

because you have these long<br />

investment cycles like the Inflation<br />

Reduction Act or the<br />

Infrastructure Investment and<br />

Jobs Act with tons of money<br />

targeted towards to the transportation<br />

sector in order to<br />

promote zero- or ultra-low<br />

emissions. And in terms of<br />

fleets, they have an increasing<br />

number of options in both<br />

equipment and funding options<br />

to make these transition<br />

projects happen.<br />

What are your plans to keep<br />

the exhibition lively?<br />

We created a market here<br />

with ACT Expo for all the<br />

professionals involved in zero-emission<br />

vehicles. The<br />

show almost makes the market.<br />

Naturally, the exhibition<br />

is going to attract companies<br />

from all over the world. The<br />

percentage of foreign exhibitors<br />

is steadily growing and<br />

it’s exciting to see.<br />

12<br />

13

FACE-TO-FACE<br />

MILENCE, CEO VAN NIERSEN SPEAKING<br />

NO TIME TO LOSE<br />

The ultimate target is<br />

quite ambitious, as<br />

well as crucial for<br />

the future of zero emission<br />

long-haul transportation in<br />

Europe. Milence, the joint<br />

venture shared by Volvo,<br />

Daimler Truck and Traton,<br />

gathering nearly all the European<br />

truck manufacturers,<br />

seems to be the only viable<br />

option to get a charging corridor<br />

along the main road<br />

commercial routes.<br />

Anja van Niersen is the CEO<br />

of the young company. The<br />

one holding quite a big responsibility.<br />

Nevertheless,<br />

the road ahead is clear, and<br />

the very first stage was set<br />

some years ago, with the official<br />

inauguration of the truck<br />

charging hub in Venlo, in the<br />

Netherlands, open to the vehicles<br />

of all brands.<br />

The newly inaugurated hub<br />

in Venlo was huge news, at<br />

the end of last year. How’s<br />

the hub doing, some months<br />

later?<br />

“In addition to cooperation between all<br />

stakeholders, we need bold decisions<br />

from the European administration.<br />

Over-regulation is slowing down the<br />

transition and the market needs a<br />

system of notification, planning and<br />

anticipation”.<br />

At the heart of Milence’s<br />

mission is a commitment to<br />

a fossil-free future for road<br />

transport.<br />

To achieve this, Milence is<br />

developing its network with<br />

a focus on creating green<br />

corridors for road transport<br />

connecting key logistics hubs.<br />

The opening of the Venlo<br />

charging hub is the first step<br />

towards realising this vision,<br />

and we are pleased to see that<br />

since its launch in December<br />

last year, it is already ahead<br />

of plan in terms of utilisation.<br />

We have already announced<br />

the development of the second<br />

phase, which should be operational<br />

in the coming weeks.<br />

This expansion will double<br />

the number of loading bays,<br />

allowing more trucks to use<br />

our hub on a daily basis.<br />

Looking at the following<br />

months, what are the next<br />

steps of the Milence project?<br />

After serving<br />

as CEO and<br />

Chairman of<br />

the Board<br />

of a major<br />

EV charging<br />

network<br />

provider, Anja<br />

van Niersen<br />

was appointed<br />

CEO of the<br />

newborn<br />

Milence in<br />

July 2022.<br />

Is there any new hub inauguration<br />

ahead?<br />

As our target is to deploy at<br />

least 1,700 charging points by<br />

2027, we need to move at full<br />

speed which is what we currently<br />

do. There are a number<br />

of hubs in development and<br />

construction phase with two<br />

major openings planned in<br />

Q2: in France, near Rouen<br />

and in Belgium at the Port of<br />

Antwerp-Bruges. This last one<br />

will be the biggest hub we will<br />

open this year with the separate<br />

sites and a total of 30<br />

charging bays.<br />

What are the main challenges<br />

when it comes to designing<br />

new public charging<br />

hubs in Europe? Finding<br />

the right location, ensuring<br />

the necessary power supply,<br />

getting all the red tape done,<br />

finding the money, or else?<br />

The transition to electrification<br />

still faces some challenges,<br />

but these can be overcome<br />

with the right strategies and<br />

policies. One of the most<br />

important is future-proofing<br />

electricity grids to support the<br />

increased demand for electric<br />

vehicles. This, together with<br />

the complexities of sharing<br />

data between different systems<br />

and ensuring full interoperability,<br />

are key elements in the<br />

new ecosystem that needs to<br />

be designed. Increasing the<br />

“Our partnerships to develop<br />

megawatt charging systems marks<br />

a significant leap forward in the field<br />

of EV charging. This technology isn’t<br />

just about faster charging: it’s about<br />

enabling long-haul electric trucks to<br />

operate seamlessly across Europe”.<br />

number of parking spaces that<br />

can accommodate both rest<br />

areas and charging facilities,<br />

as well as the deployment of<br />

the megawatt charging system,<br />

will ensure the acceleration<br />

of EV charging.<br />

We know Milence is working<br />

with valuable partners<br />

(Hitachi Energy, for instance)<br />

to develop megawatt<br />

charging systems for the<br />

coming years. Would this be<br />

the actual breakthrough for<br />

long-haul electric truck development<br />

and penetration<br />

in the market? Or even lower<br />

power systems are suitable,<br />

in your opinion?<br />

Our partnership with Hitachi<br />

Energy and others to<br />

develop megawatt charging<br />

systems marks a significant<br />

leap forward in the field of<br />

EV charging. This technology<br />

isn’t just about faster charging;<br />

it’s about enabling longhaul<br />

electric trucks to operate<br />

seamlessly across Europe.<br />

While megawatt charging is<br />

at the forefront, we recognise<br />

that the Combined Charging<br />

System (CCS) technology<br />

will continue to be used and<br />

have a key role in providing<br />

versatile charging solutions.<br />

Together, these technologies<br />

meet a wide range of needs,<br />

facilitating both quick stops<br />

and overnight charging in<br />

different locations.<br />

As said, Milence has communicated<br />

the ambitious<br />

target of building over 1,700<br />

high power charging points<br />

in Europe by 2027. Do you<br />

believe this is still an achievable<br />

target? Why?<br />

Yes, we are still very confident<br />

“The transition to electrification still<br />

faces some challenges, which can<br />

be overcome with the right strategies<br />

and policies. One of the most<br />

important is future-proofing electricity<br />

grids to support the increased<br />

demand for electric vehicles”.<br />

that we can meet this target,<br />

given the pace we are on and<br />

the number of sites we have<br />

already contacted and are<br />

developing. There is still a<br />

lot of work to be done and<br />

we are using all the learning<br />

from the first hubs we open<br />

to make sure we improve and<br />

move faster for the others.<br />

But working with the market<br />

is key. In addition to cooperation<br />

between all stakeholders,<br />

we need strong commitment<br />

and bold decisions from the<br />

European administration.<br />

Over-regulation is slowing<br />

down the transition and the<br />

market needs a system of notification,<br />

planning and anticipation.<br />

From your perspective, are<br />

the manufacturers involved<br />

in the joint venture showing<br />

the right commitment and<br />

support to reach the initial<br />

targets?<br />

The joint venture is a clear<br />

commitment by our shareholders<br />

to electrification. By<br />

working closely together, we<br />

can leverage each other’s<br />

strengths and accelerate this<br />

transition. This joint effort<br />

will not only ensure the realisation<br />

of our project goals,<br />

but will also give the market<br />

confidence and enable the introduction<br />

of electric vehicles<br />

in road transport.<br />

14<br />

15

FOCUS<br />

EV: HOPES AND TROUBLES<br />

IT'S A TOUGH<br />

Volta Trucks<br />

Tesla<br />

Arrival<br />

GAME<br />

Nikola Motors<br />

Challenges ahead.<br />

Nikola Motors,<br />

Tesla, Volta<br />

Trucks, Arrival,<br />

Hyzon Motors,<br />

Rivian, Canoo,<br />

Tevva. Eight<br />

companies, eight<br />

different stories,<br />

each of them with<br />

interesting meaning<br />

and consequences.<br />

The life of<br />

newcomers is not<br />

that easy.<br />

Energy transition in the truck world brings<br />

with it a change that it is no exaggeration<br />

to call radical. From the production<br />

of vehicles to their marketing; from after-sales<br />

service to the overall management of trucks<br />

and vans, a new world is opening up. A world<br />

that has inevitably attracted the attention of<br />

entrepreneurs and investors, who are eager to<br />

test their skills in the design and manufacturing<br />

of innovative vehicles, flanking and, therefore,<br />

challenging traditional manufacturers.<br />

However, the transition from the initial phase<br />

of vehicle design and prototyping to the crucial<br />

phase of vehicle marketing and production is<br />

a quantum leap.<br />

It is not enough to collect an electric motor<br />

and various components to assemble a vehicle<br />

to be then launched on the market; much<br />

more is needed in order to be successful. Not<br />

to mention that sales of electric trucks are not<br />

taking off, at least not as fast as hoped, as we<br />

mention elsewhere. Here are eight stories of<br />

failure, hope and resilience.<br />

Tevva<br />

Exploiting the wave of electrification, several newcomers have tried<br />

to approach the challenging and competitive scenario of commercial<br />

and industrial vehicles. Some have succeeded, others continue to<br />

struggle for survival and some have thrown in the towel. Let’s try to<br />

take stock of the current, although ever changing situation.<br />

16<br />

Rivian<br />

Canoo<br />

Hyzon Motors<br />

17

The end of the partnership with Iveco, inaugurated<br />

in 2019, has decisively reshaped Nikola’s business:<br />

no more expansion plans in Europe, but focus on<br />

the North American market. At the same time, the<br />

Arizona-based manufacturer has decisively focused<br />

on hydrogen, creating the Hyla brand and aiming<br />

to promote a dedicated ecosystem. In 2023, Nikola<br />

manufactured 42 hydrogen-powered trucks and sold<br />

35 of them, according to a report earlier this year.<br />

And it was not a long ago that the first Hyla-branded<br />

hydrogen filling station opened in California.<br />

The stock market, however, is suffering: for the<br />

second time in less than a year, Nikola is facing<br />

the risk of ‘delisting’ from the Nasdaq index of the<br />

American stock exchange, due to the low price of<br />

the company’s shares. And the reputation damage<br />

generated by the Trevor Milton affair - the company<br />

founder sentenced to four years in prison and now<br />

no longer involved in the business - continues to<br />

weigh on the brand’s development.<br />

ARRIVAL<br />

THE END OF<br />

A DREAM<br />

NIKOLA MOTORS<br />

BETWEEN HYDROGEN<br />

AND DELISTING RISK<br />

VOLTA TRUCKS<br />

WILL IT RISE<br />

FROM THE ASHES?<br />

The failure of the Volta Trucks project took<br />

everyone a little by surprise. The Swedish<br />

manufacturer’s adventure seemed to be<br />

well underway, with many expressions of<br />

interest and pre-orders collected (suffice it<br />

to mention the now famous 1,500 vehicles<br />

booked by DB Schenker). However, issues<br />

related to Proterra, a battery supplier that<br />

was itself affected by liquidity problems,<br />

scuppered (almost) everything. The<br />

investment fund Luxor Capital Group took<br />

over the brand and promised a second<br />

life. However, a (major) downsizing of the<br />

initial plans seems inevitable, since most of<br />

the almost one thousand employees have<br />

found new jobs and even founder Carl-<br />

Magnus Norden has announced via social<br />

media that he is starting a new business,<br />

which is also linked to sustainable mobility.<br />

Lately, the ‘new’ Volta Trucks announced<br />

the signing of a further agreement with<br />

Steyr Automotive to restart vehicle<br />

production.<br />

Manufacturing electric vans, but also buses and cars, in agile microfactories<br />

spread across several European countries. Moreover, replacing<br />

the (now many) disused factories scattered across Europe. An absolutely<br />

revolutionary project, to say the least, which foundered in the face of<br />

harsh reality and the difficulty of ‘becoming’ manufacturers. The first<br />

bad signs came with the step back of the first CEO, Denis Sverdlov,<br />

which was followed by news of workforce downsizing in Great Britain.<br />

Then, Arrival announced that the company was leaving the bus and car<br />

business to focus on manufacturing electric vans for the North American<br />

market only. This is little, in truth, to think of a rosy future, and not even<br />

cash injections from investors managed to save the day. Thus, February<br />

brought the news of the opening of bankruptcy proceedings. Too bad.<br />

TESLA<br />

THAT SEMI<br />

IS A MISTERY<br />

When it comes to Tesla and its fatherin-chief,<br />

Elon Musk, the verbal clashes<br />

between enthusiasts and detractors<br />

become heated. It applies to cars, a<br />

business in which Tesla is undoubtedly<br />

reaping commercial success, and even<br />

more so to trucks. The American electric<br />

vehicle manufacturer’s famous Semi<br />

was announced back in 2017, with a<br />

promise to go on sale two years later<br />

and to guarantee 800 kilometres on one<br />

charge. Things didn’t exactly turn out<br />

that way and since then the first official<br />

news of the truck came in late 2022,<br />

with the delivery of the first vehicle<br />

to PepsiCo and the start of some road<br />

tests. At the beginning of last year, Tesla<br />

announced its intention to invest $3.6<br />

billion in its own production facility<br />

for the Semi’s mass production. Since<br />

then, little else has happened, with the<br />

exception of the ever-present ‘deep<br />

throats’ ready to wreck the project and<br />

Musk’s plans to start series production<br />

in <strong>2024</strong>. The mystery deepens.<br />

18<br />

19

TEVVA<br />

ELECTRIC AND HYDROGEN<br />

MADE-IN-UK<br />

First of all: the Tevva project is alive and kicking, although<br />

it seems to be proceeding in slow motion compared to<br />

initial proclamations. Tevva is a British start-up that has<br />

been able to design electric trucks that can be fitted with<br />

fuel cells capable of acting as range extenders and thus<br />

increase the vehicle range. An idea applicable, according to<br />

initial plans, to truck models of different class and overall<br />

weight. In fact, also due to a relatively long development<br />

process and approval times, the only model actually on<br />

the market is a 7.5 tonne truck intended for mainly urban<br />

distribution, which has been approved for Great Britain<br />

and Europe. With the ‘mystery’, as far as the company<br />

structure is concerned, of the merger agreement with<br />

ElectraMeccanica, which was first announced and then<br />

withdrawn. An agreement that would have guaranteed a<br />

calmer future for Tevva and for which there are still legal<br />

consequences.<br />

RIVIAN<br />

A COMPLICATED<br />

MARRIAGE<br />

Uniquely shaped electric vans, available for both freight and passenger<br />

transport. Quite a simple idea, in theory, that of the American start-up<br />

founded in 2017, which has lived these first years always on the razor’s<br />

edge. Numerous budgets in the red threatened to undermine the<br />

confidence of investors who had allowed the entire industrial project<br />

to get off the ground. What allowed Canoo to stay on the market were<br />

the orders it received from a number of US retail giants, from Walmart<br />

(4,500 vehicles) to Zeeba (3,000), to Kingbee, a vehicle rental company<br />

that pre-ordered as many as 9,300 vans. Canoo has started delivering<br />

the vans this year and announced other important agreements,<br />

including one with the U.S. Postal Service and one with NASA for the<br />

supply of some passenger vans. These agreements are breathing life<br />

into the whole project.<br />

CANOO<br />

LOOKING<br />

FOR TRUST<br />

Amazon’s firepower makes anything, or almost<br />

anything, possible. Even making an electric van<br />

tailored to one’s needs. It was 2019 when the<br />

e-commerce giant struck a deal with Rivian, a<br />

manufacturer based in Irvine, California, for<br />

the exclusive supply of electric commercial<br />

vehicles. The deal was fueled by Amazon<br />

with an investment of around 700 million,<br />

with the stated goal of purchasing as many as<br />

100,000 electric vehicles by 2030 as part of<br />

the overall plan to reduce emissions generated<br />

by transport and logistics activities. Lately,<br />

the partnership has continued, but last year<br />

Rivian began trying to dissolve the exclusive<br />

agreement that bound it to Amazon. The reason<br />

is quickly stated: orders have so far fallen far<br />

short of the admirable intentions, generating<br />

losses in the manufacturer’s balance sheet.<br />

Thus, Rivian’s Electric commercial van (ECV) has<br />

been available on the market since last autumn.<br />

Amazon remains an important partner, but not<br />

the only one for the Californian manufacturer.<br />

HYZON MOTORS<br />

ALL-IN ON HYDROGEN<br />

Since its foundation, Hyzon Motors has rhymed<br />

with hydrogen. Founded at the end of the last<br />

decade with the specific aim of facilitating the<br />

decarbonisation of heavy transport, Hyzon<br />

manufactures and supplies fuel cell-powered<br />

trucks. Based in upstate New York, the company<br />

has branches in Europe (HQs are in the<br />

Netherlands), Asia and Australia. A number of<br />

Hyzon trucks are currently operating in the US,<br />

Europe and Australia: in 2023, Hyzon claimed<br />

to have delivered 19 hydrogen-powered trucks<br />

to three continents in a year described by CEO<br />

Parker Meeks as complex. It is no mystery<br />

that the whole hydrogen-powered transport<br />

ecosystem is struggling to take off for various<br />

reasons, from the cost of fuel to technology<br />

development to the limited availability of<br />

refueling stations. For Hyzon, as well as for Nikola,<br />

the fear of ‘delisting’ from the Nasdaq index for<br />

the company’s excessively low share price has<br />

been raised in recent weeks. Parallel to vehicles,<br />

Hyzon is working on the production of fuel<br />

cells that promise high performance. Business<br />

diversification may benefit the company’s health.<br />

20<br />

21

TRENDS<br />

ZERO-EMISSION STATS<br />

WAITING<br />

FOR THE<br />

SPARK<br />

22<br />

Let’s clear up any doubts right away: 2023<br />

was not the ‘boom’ year for zero-emission<br />

commercial vehicles, which continue<br />

to represent, almost everywhere globally,<br />

rather low percentages of the total number of<br />

vehicles registered. As always, however, carefully<br />

analysing market figures helps us to better<br />

understand the trends at work, and imagine<br />

what the near future might look like.<br />

We are aware that regulatory developments,<br />

especially but not only in the area of incentive<br />

policies, may tip the balance one way or the<br />

other. Similarly, any upheavals in the roadmaps<br />

that have so far been mapped out by political<br />

decision-makers (more specifically, the composition<br />

of the new European Parliament that will<br />

emerge from the June elections or the ‘colour’<br />

of the next US administration) can undoubtedly<br />

alter the picture.<br />

Comforted by registration statistics, we try to analyse the evolution<br />

of the zero-emission commercial vehicle market in Europe, the<br />

USA and China, which are perhaps the three most significant<br />

areas globally. With quite different dynamics and one point in<br />

common between the three markets. Growth.<br />

Being unable to predict the future, we have<br />

preferred to play it safe and analyse what happened<br />

last year in what can be considered the<br />

three most significant areas of the world in<br />

terms of the spread of electric vehicles, namely<br />

Europe, the United States and China. An analysis<br />

supported by some of the most authoritative<br />

international associations or research bodies<br />

(ACEA and ICCT for Europe; CALSTART<br />

for the United States, and Interact Analysis for<br />

China) who provided us with data, graphs and<br />

even opinions. A note before we dive into the<br />

statistics: the data for the EU and China refer<br />

to the end of 2023, so they look at the entire<br />

calendar year. As for the United States, the latest<br />

available data are as of June 2023.<br />

23

TRENDS<br />

OUR QUALITY SOURCES<br />

New EU commercial<br />

vehicle registrations<br />

1.0%<br />

Trends and insights on light and heavy vehicle registrations<br />

in the European market come from ACEA, the association<br />

that brings together the major vehicle manufacturers. It is<br />

currently chaired by Renault Group’s CEO, Luca De Meo.<br />

On the ohter hand, ICCT, the International Council on Clean<br />

Transportation, which operates on a global scale, is also<br />

very active in monitoring the market, especially for zeroemission<br />

vehicles.<br />

The U.S. zero-emission truck market figures are provided<br />

by CALSTART, a mission-driven, industry organization<br />

focused on transportation decarbonization and clean air<br />

for all, with its periodic report ‘Zeroing in Zero Emission<br />

Trucks’. A close and competent look at the Chinese market<br />

is provided by the international research institute Interact<br />

Analysis, which operates in various markets, including the<br />

commercial mobility market, with regular reports on the<br />

Chinese context provided by senior specialists like Yvonne<br />

Zhang or Shirly Zhu.<br />

Europe: growth at slow speed<br />

Let’s start with the big picture: in Europe, registrations<br />

of vans (up to 3.5 tonnes) and trucks<br />

(over 3.5 tonnes) increased last year. According<br />

to ACEA, almost 347,000 trucks (+16.3%)<br />

and about 1.5 million LCVs (+56.8%) were<br />

registered in the 27 countries of the Union.<br />

EU: ZE sales share by vehlcle type<br />

and reglon of manufacturer<br />

Heavy trucks<br />

Zero-emission sales share<br />

0.8%<br />

0.6%<br />

0.4%<br />

0.2%<br />

0%<br />

0.9%<br />

2015 2017 2019 2021 2023<br />

Light and medium trucks<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Source: ICCT<br />

4.8%<br />

2015 2017 2019 2021 2023<br />

1,600,000<br />

1,400,000<br />

1,200,000<br />

1,000,000<br />

800,000<br />

600,000<br />

400,000<br />

200,000<br />

0<br />

Source: ACEA<br />

2022 2023<br />

The European market of commercial<br />

vehicles was quite positive in 2023, with<br />

remarkable growth both in the light and<br />

heavy-duty segments. The share of ZE<br />

vehicles is growing in both segments,<br />

although remaining quite small.<br />

So, it is an overall healthy market, certainly recovering<br />

from the somewhat stuttering last few<br />

years. Again according to ACEA data, there<br />

were 5,279 ‘electrically chargeable’ trucks,<br />

i.e. electric or plug-in hybrid, over 3.5 tons in<br />

2023. They are almost equally divided between<br />

medium-duty and heavy-duty, a 234% increase<br />

U.S. ZET Deployments by<br />

Vehicle Model Year (2017-June 2023)<br />

18.000<br />

16.000<br />

14.000<br />

12.000<br />

10.000<br />

8.000<br />

6.000<br />

4.000<br />

2.000<br />

Deployments by Model Year<br />

Cumulative Total<br />

0<br />

2017 2018 2019 2020 2021 2022 H1 2023<br />

Model Year<br />

ZETs are defined as Class 2b-8 commercial vehicles, including<br />

cargo vans, MD step vans, MD trucks, HD trucks, refuse trucks,<br />

and yard tractors.<br />

Data source: CALSTART research<br />

<strong>Van</strong>s<br />

Trucks<br />

year-on-year, with the Dutch and German markets<br />

characterised by the highest increase and<br />

accounting for about 60% of the overall market.<br />

Seemingly large numbers, but the share<br />

of electric trucks in the total is only 1.5%, still<br />

up from 0.8% in 2022. Electric vans, on the<br />

other hand, gained two percentage points of the<br />

total, rising from 5.4% to 7.4%, an increase of<br />

56.8% year-on-year thanks mainly to countries<br />

such as the Netherlands, Spain and France.<br />

A slightly different picture is offered by ICCT,<br />

the International Council on Clean Transportation,<br />

which in its latest report offers a subdivision<br />

into heavy trucks (with a total mass above<br />

12 tonnes) and ‘light and medium trucks’ (from<br />

3.5 to 12 tonnes), with the first category going<br />

from 820 units registered in 2022 to 2,600 in<br />

2023 (0.9% of the total). Looking at individual<br />

EU countries, Germany and France dominate<br />

with around 30% of the total respectively,<br />

ahead of the Netherlands (11%) and Sweden<br />

(10%). Interestingly, Volvo Trucks has 42%<br />

of the market share, with Renault Trucks just<br />

above 30%; both of them are well above their<br />

share when looking at the conventional truck<br />

market. The only other manufacturer with a<br />

share above 10% is Mercedes-Benz.<br />

The second category, light and medium, grew<br />

by a good 28% compared to 2022 for a total<br />

of 3,100 registrations in Europe, about half of<br />

which were in Germany. In terms of vehicle<br />

types, almost 60% belong to 4x2 wagons and<br />

the remainder to 4x2 vans. Market leader in<br />

this segment is Ford E-Transit, with just under<br />

40% of total registrations, ahead of Fiat Professional<br />

and Maxus, respectively above 20%<br />

and above 10%. Then IVECO and Mercedes,<br />

whose market shares among conventional vehicles<br />

have ample room for growth.<br />

USA, the market is still young<br />

It is worth repeating that in this case, the data<br />

compiled by CALSTART refer to the first<br />

half of 2023. Considering all ZE vehicles of<br />

3.5 tons and up, just over six thousand units<br />

(6,088) were registered in the first half of last<br />

year, compared to an overall result in 2022 of<br />

just under 10 thousand. The US market is still<br />

a very young one, if we consider that the total<br />

number of ZE trucks registered up to June 2023<br />

is 17,734 units, with the vast majority consisting<br />

of the ‘cargo vans’ category, i.e. models<br />

with a mass between about 3.5 and 4.5 tonnes.<br />

It’s a trend that hasn’t changed in the first six<br />

months of 2023, with 5,297 cargo vans registered<br />

compared to, say, 441 heavy-duty trucks<br />

made available nationwide: different numbers<br />

for the two fastest-growing segments, albeit for<br />

very different reasons, as Jacob Richard, Technical<br />

Project Manager, Trucks at CALSTART,<br />

explains. “Cargo vans have limited market<br />

barriers with smaller batteries, lower upfront<br />

costs, high production volumes and ideal duty<br />

cycle capabilities, which makes them an ideal<br />

segment for electrification today. HD Trucks,<br />

on the other hand, are seeing greater incentives<br />

Top brands.<br />

In 2023, 42% of<br />

heavy-duty electric<br />

trucks sold in<br />

Europe were Volvo,<br />

and 30% were<br />

Renault Trucks<br />

models. Belonging<br />

to the same group,<br />

the overall share is<br />

quite high. The only<br />

other manufacturer<br />

with a share above<br />

10% is Mercedes-<br />

Benz. Things<br />

might change in<br />

the next years,<br />

when some more<br />

manufacturers<br />

enter the market<br />

and start delivery<br />

their vehicles.<br />

24<br />

25

TRENDS<br />

U.S. ZET Deployments and Market Share by Segment (As of June 2023)<br />

Vehicle Segment ZET Deployments Total Stock ZET Market Share<br />

Cargo <strong>Van</strong> 14,400 3.687.740 .39%<br />

MD Step <strong>Van</strong> 843 266.866 .32%<br />

MD Truck 442 3.573.915 .01%<br />

HD Truck 867 5,104.926 .02%<br />

Refuse 48 118,135 .04%<br />

Yard Tractor 1.134 23.437 4.84%<br />

Total 17,734 12,775,019 .14%<br />

Source: CALSTART<br />

Below one.<br />

According to<br />

the latest data<br />

released by<br />

CALSTART, the<br />

share of zeroemission<br />

vehicles<br />

in the overall<br />

market in the U.S.<br />

remains small,<br />

below 1%, as<br />

shown in the chart<br />

above. Below, a<br />

couple of trucks<br />

of the newlyintroduced<br />

Daimler<br />

Truck EV brand<br />

for LCVs in North<br />

America, Rizon.<br />

26<br />

and more push to decarbonize as a lot of those<br />

vehicles are domiciled in disadvantaged communities,<br />

particularly around ports”.<br />

Talking about incentives, in order to imagine<br />

future trends, it is crucial to assess the impact<br />

of the Advanced Clean Trucks (ACT) regulation,<br />

adopted by 11 federal states and requiring<br />

manufacturers to sell an increasing percentage<br />

of zero-emission vehicles over time. “California,<br />

being the first to adopt the regulation<br />

in 2022, has already surpassed its truck sales<br />

goal two years ahead of schedule and states<br />

that have passed the Advanced Clean Trucks<br />

(ACT) regulation account for 38 percent of all<br />

ZET deployments despite making up just 25<br />

percent of all truck registrations”, says Jacob<br />

Richard. Another hot issue is that of infrastructure,<br />

on which the investment plan envisioned<br />

by the Biden-Harris administration is focused<br />

with the promotion of several dedicated projects.<br />

“Access to charging is a prominent consideration<br />

for fleets interested in going electric”,<br />

says Richard. “There will be fleets for<br />

which it doesn’t make sense to purchase and<br />

install their own chargers or lease their depots,<br />

but they will need en-route charging facilities”.<br />

China. Towards a mature market<br />

The situation of zero-emission commercial<br />

vehicles in China is quite different from what<br />

has been described so far. There, the ‘boom’,<br />

at least in terms of numbers, has been expe-<br />

New energy truck sales in China in 2023: the top ten OEMs<br />

Ranking OEM Sales(Units) YoY Market Share<br />

1 Geely 30.396 95% 20.9%<br />

2 Seres 12.956 156% 8.9%<br />

3 Dongfeng 10.044 4% 6.9%<br />

4 Foton 9.846 24% 6.8%<br />

5 SAIC Motor 6.248 7% 4.3%<br />

6 XCMG 6,182 110% 4.2%<br />

7 Yutong 6.092 37% 4.2%<br />

8 Guanaxi Auto 5.429 10% 3.7%<br />

9 SANY 5.334 27% 3.7%<br />

10 Shineray 5.149 2% 3 5%<br />

Others 47.896 32 9%<br />

Source: Interact Analysis<br />

rienced in recent years, many more manufacturers<br />

are on the market with zero-emission<br />

vehicles, and government incentives have<br />

already been provided and have now been<br />

partially reduced. In 2023 (a figure that also<br />

includes buses), registrations of ‘new energy’<br />

commercial vehicles, as by the Chinese definition,<br />

exceeded 308 thousand, up about 30%. A<br />

large part of these, of course, relate to LCVs<br />

(242 thousand, up more than 46%), while registered<br />

new energy trucks are around 34,000,<br />

a 36% increase for a market share of 5.5%.<br />

Interestingly, more than 3,600 fuel cell trucks<br />

were registered in China in 2023: these figures<br />

are unimaginable elsewhere in the world, although<br />

according to Yvonne Zhang, Research<br />

Associate at Interact Analysis and an expert on<br />

the Chinese market, the performance of fuel<br />

cell vehicles has been “below expectations”<br />

due to “lack of infrastructure and delays in<br />

the provision of subsidies”. Hybrid trucks are<br />

also growing strongly, +270% and more than<br />

5,300 units registered last year. Also according<br />

to Yvonne Zhang, this increase is due to the<br />

advantages of this type of vehicle, i.e. “lower<br />

cost and flexible charging compared to battery<br />

electric vehicles, as the national subsidy for<br />

BEVs was withdrawn”. For the current year,<br />

the penetration of new energy trucks is expected<br />

to continue its growth, reaching “7 percent<br />

of the total market, with a total of over 200,000<br />

units registered this year”.<br />

Looking at manufacturers, last year more than<br />

190 companies sold new energy trucks in China,<br />

with 67% of the market in the hands of the<br />

top 10 brands. “Geely, Foton, Dongfeng and<br />

Series are leading players in the new energy<br />

light-duty truck market. SANY, XCMG and<br />

Geely are big players for heavy-duty trucks<br />

and Yutong Group and Infore Enviro are top<br />

two vendors in the medium-duty truck market”,<br />

confirms Yvonne Zhang. “Overall, these<br />

major suppliers who are also leading players in<br />

the ICE truck market, remain in lead in recent<br />

couple of years and we have not foreseen any<br />

emerging new players yet in the market”.<br />

Start-up.<br />

Young Chinese<br />

start-up Windrose<br />

Technology is<br />

working with the<br />

global retailer<br />

Decathlon on a<br />

hughly promising<br />

e-truck model, quite<br />

similar to the Tesla<br />

Semi.<br />

27

PREVIEW<br />

VOLVO FH AERO<br />

THE LONGER<br />

THE BETTER<br />

It has emerged from the starting blocks<br />

of <strong>2024</strong> with a sprint worthy of the best<br />

hundred-metre runner launched towards<br />

a prestigious goal, with all the strength and<br />

weight of its history, tradition and above all the<br />

technological know-how that has always characterised<br />

its actions. Over the years, Volvo has<br />

never renounced to innovation, not as an end<br />

in itself and less so flaunted as an easy slogan,<br />

but rather as an element capable of improving<br />

the level of efficiency and safety that are the<br />

hallmark of Volvo Trucks products.<br />

Extended cab, reduced fuel consumption<br />

In short, for the Gothenburg-based manufacturer,<br />

a sprint start that tastes like a breakaway,<br />

such as to force its competitors into hot<br />

pursuit. In order, and almost at the same time,<br />

to enrich the Swedish brand’s offerings came<br />

the FM Low entry, the first exclusively electric<br />

vehicle (see the dedicated box), the new 17-litre<br />

diesel engine with top power of 780 bhp<br />

and, of course, the FH Aero series.<br />

The FH Aero is the perfect synthesis of this.<br />

Starting, of course, from the basis of the iconic<br />

FH, the designers in Gothenburg have changed<br />

the cab size, lengthening it at the front by 240<br />

millimetres. A possibility granted by virtue of<br />

the amendment introduced by the European<br />

Commission regarding the limit gauge (and<br />

already exploited by DAF for its XG). In this<br />

way, the refined aerodynamics, achieved by<br />

improving the drag coefficient, combined with<br />

the digital camera monitor system (with automatic<br />

panoramic function following the trailer<br />

when turning), has resulted in a cut in energy<br />

consumption and emissions of up to 5 percent.<br />

FH Aero is also Electric and Gas<br />

The new Volvo Aero will be available, as early<br />

as <strong>2024</strong>, in four different versions: FH Aero,<br />

FH Aero Electric, FH Aero gas, FH16 Aero.<br />

So, not an exercise in style intended as a simple<br />

special edition, but a genuine line of heavy<br />

roadsters, within which, moreover, it is possible<br />

to choose between different powertrain<br />

technologies: diesel, gas, electric. And with all<br />

the safety and comfort features that, in the case<br />

With the unprecedented variant in the FH range, Volvo is setting the<br />

new benchmark for heavy-duty trucks. The cab is 24 cm longer, with<br />

refined aerodynamics and elegant lines, while fuel consumption is cut<br />

by up to 5 percent in the ICE trucks. All this is available in four<br />

versions, including full electric.<br />

28<br />

29

PREVIEW<br />

BORN ELECTRIC<br />

In its own way, the Volvo FM Low entry is a first. It is the<br />

first Volvo truck designed and built solely with electric<br />

drive. Based on the FM series, the Volvo FM Low entry is<br />

a vehicle whose characteristics make it perfectly suited to<br />

the wide variety of uses in urban areas of large and small<br />

cities: from waste collection to distribution to construction.<br />

The access and the correspondingly low driving position of<br />

the cab, which has been moved forward, provide the driver<br />

with an excellent view that translates into greater safety.<br />

Ergonomics, comfort and use of space on board are other<br />

hallmarks of the Volvo FM Low entry. The truck will be<br />

produced from the second quarter of <strong>2024</strong>, and will initially<br />

be available in Europe, Turkey, Australia, and South Korea.<br />

The Aero concept.<br />

Aero is a word that<br />

deliberately invokes<br />

the concept of<br />

aerodynamics, so<br />

the heavy-duty<br />

FH truck definitely<br />

changes its face.<br />

And there’s more,<br />

as the cab is made<br />

longer by 240 mm,<br />

further refining the<br />

lines and design<br />

in search of the<br />

best air penetration<br />

coefficient.<br />

of the FH Aero, are so many strong points:<br />

from the further improved I-See, to the dragfree<br />

disc brakes, i.e. without parasitic clutch<br />

for better braking capacity, from the intuitive<br />

infotainment to the microwave oven.<br />

“Our most efficient truck ever”<br />

A flagship vehicle, which Volvo Trucks president<br />

Roger Alm himself describes as “our most<br />