What will your legacy be? (UK)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

LEGACY GIVING<br />

A lasting tribute<br />

WE’RE HERE TO HELP<br />

THE QUEEN’S COLLEGE<br />

Legacy gifts to Queen’s can <strong>be</strong> given for the area<br />

of greatest need, known as our general charitable<br />

purposes, or for a specific purpose.<br />

Supporting our Students<br />

Legacy gifts can <strong>be</strong> given to support scholarships,<br />

the Choir or other student activities. Recent <strong>legacy</strong> gifts<br />

have <strong>be</strong>en given to buy books, establish a new Medical<br />

Sciences scholarship, and to support the Honoré<br />

Scholarship in Law.<br />

For more information about leaving a gift to Queen’s in<br />

<strong>your</strong> <strong>will</strong>, please contact:<br />

Catherine House<br />

Legacy Giving Officer<br />

catherine.house@queens.ox.ac.uk<br />

Tel: +44 (0)1865 279218<br />

WHAT WILL YOUR<br />

LEGACY BE?<br />

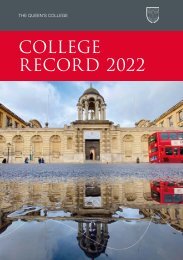

Transforming our Historic Buildings<br />

In 2021, the College received a <strong>be</strong>quest from<br />

Walter Ellis (PPE,1955) for building refurbishments<br />

and maintenance. Donations towards the<br />

preservation and enhancement of our buildings<br />

help to complete important projects such as the<br />

New Library and the Porters’ Lodge.<br />

Safeguarding our Tutorial System<br />

Legacy gifts of any amount can <strong>be</strong> given for a<br />

specific academic Fellowship or to the Academic<br />

Excellence Fund, which supports the Tutorial System.<br />

Fred Brittenden’s (Modern History, 1946) <strong>legacy</strong> gift<br />

fully endowed a History Fellowship at Queen’s, which is<br />

now named in his honour.<br />

Dr Meleisa Ono George, Brittenden Fellow in History<br />

Thank you for <strong>your</strong> support<br />

both today and in the future.<br />

www.queens.ox.ac.uk/supportqueens/leave-a-gift-in-<strong>your</strong>-<strong>will</strong><br />

<strong>UK</strong> registered charity 1142553<br />

Theinformation in this publication is not intended as legal, financial, or<br />

tax advice. We encourage you to discuss <strong>your</strong> giving options with <strong>your</strong> own<br />

legal and financial advisors.<br />

All photos unless otherwise stated: John Cairns<br />

Leaving a gift in <strong>your</strong> <strong>will</strong> is a longlasting<br />

and meaningful way to invest in<br />

the future of The Queen’s College.

LEGACY GIVING<br />

Investing in the future<br />

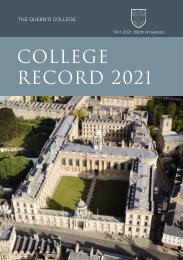

Legacy gifts have transformed Queen’s over the<br />

centuries. Starting with Ro<strong>be</strong>rt de Eglesfield and<br />

Queen Philippa in 1341, and continuing through the<br />

following seven centuries, these deeply personal gifts<br />

have enriched our students’ experience, developed<br />

our excellence in research and teaching, enhanced our<br />

historic buildings, and sustained the College community.<br />

‘Every <strong>legacy</strong> gift is an investment<br />

in the future of Queen’s and the<br />

next generation of students and<br />

researchers. We are most grateful.’<br />

– Dr Claire Craig, The Provost<br />

Legacy gifts are invested as part of the College’s<br />

endowment, where they join the generous gifts made<br />

by previous generations of Old Mem<strong>be</strong>rs and Friends.<br />

All <strong>legacy</strong> gifts are carefully stewarded so that they<br />

have a lasting impact – creating sustained income<br />

to support the current and future mem<strong>be</strong>rs of the<br />

Queen’s community.<br />

Recent <strong>legacy</strong> gifts have included support for the<br />

Library to purchase books and to digitise historical<br />

material in the Special Collections and Archives.<br />

Photo: Gareth Ardron<br />

PLANNING<br />

YOUR GIFT<br />

Legacy gifts are used to support our students<br />

achieve their ambitions and prepare for their futures.<br />

Thank you for <strong>your</strong> interest in leaving a gift in <strong>your</strong> <strong>will</strong> to<br />

Queen’s. We always advise speaking to a legal adviser<br />

when planning a <strong>legacy</strong> gift, so that <strong>your</strong> <strong>will</strong> meets<br />

<strong>your</strong> needs, supports <strong>your</strong> family and loved ones, and<br />

takes advantage of any tax <strong>be</strong>nefits from making a<br />

charitable gift.<br />

A gift in <strong>your</strong> <strong>will</strong> can <strong>be</strong> any amount and given as:<br />

• A fixed amount of money (pecuniary <strong>legacy</strong>)<br />

• A percentage, or the whole, of <strong>your</strong> estate<br />

(residuary <strong>legacy</strong>)<br />

• A particular object, asset or property<br />

(specific <strong>legacy</strong>).<br />

Photo: Edmund Blok<br />

PREPARING YOUR<br />

WORDING<br />

Here is sample wording for including Queen’s in <strong>your</strong><br />

<strong>will</strong> or living trust.<br />

‘I give________ (the whole, an amount or a percentage<br />

share) of my estate to the Provost and Scholars of<br />

The Queen’s College in the University of Oxford to <strong>be</strong><br />

used for__________, and I declare that the receipt of the<br />

Provost or other duly authorised officer shall <strong>be</strong> a full and<br />

sufficient discharge to my Executors.’<br />

If you have already made a <strong>will</strong>, you can add a gift to<br />

Queen’s by using a simple codicil. Please contact us<br />

for an example document.<br />

THE TABERDARS’ SOCIETY<br />

The Ta<strong>be</strong>rdars’ Society honours the<br />

generosity of those who intend to leave a gift to<br />

Queen’s in their <strong>will</strong>s. Our annual luncheon and<br />

other events give mem<strong>be</strong>rs the opportunity to meet<br />

old and new friends, and to learn about the latest<br />

developments at College. If you would like to join<br />

the Ta<strong>be</strong>rdars’ Society, we would <strong>be</strong> delighted to<br />

hear from you.<br />

Photo: David Fisher<br />

The Queen’s College is a charity and gifts left in <strong>your</strong><br />

<strong>will</strong> to Queen’s are exempt from <strong>UK</strong> inheritance tax.<br />

If more than 10% of <strong>your</strong> net estate is given to charity,<br />

the overall tax rate is reduced from 40% to 36%. More<br />

information about <strong>UK</strong> tax relief when leaving gifts to<br />

charity in <strong>your</strong> <strong>will</strong>: https://bit.ly/3ONaIK6<br />

Meeting the College Librarian, Dr Matthew Shaw,<br />

at the Ta<strong>be</strong>rdars’ Society Luncheon in 2023.