April 2024 CSQ

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

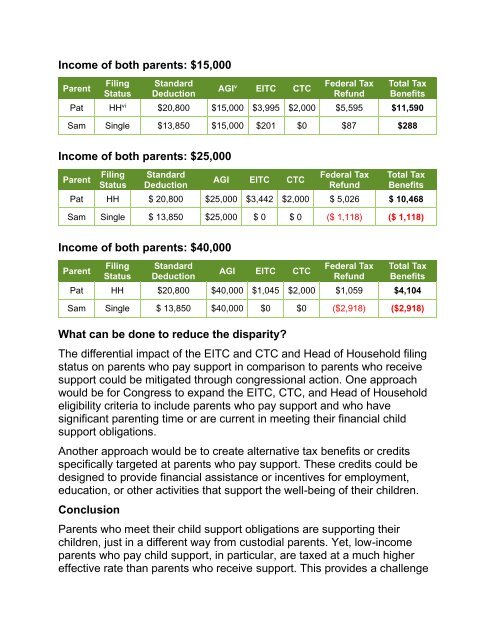

Income of both parents: $15,000<br />

Parent<br />

Filing<br />

Status<br />

Standard<br />

Deduction<br />

AGI v EITC CTC<br />

Federal Tax<br />

Refund<br />

Total Tax<br />

Benefits<br />

Pat HH vi $20,800 $15,000 $3,995 $2,000 $5,595 $11,590<br />

Sam Single $13,850 $15,000 $201 $0 $87 $288<br />

Income of both parents: $25,000<br />

Parent<br />

Filing<br />

Status<br />

Standard<br />

Deduction<br />

AGI EITC CTC<br />

Federal Tax<br />

Refund<br />

Total Tax<br />

Benefits<br />

Pat HH $ 20,800 $25,000 $3,442 $2,000 $ 5,026 $ 10,468<br />

Sam Single $ 13,850 $25,000 $ 0 $ 0 ($ 1,118) ($ 1,118)<br />

Income of both parents: $40,000<br />

Parent<br />

Filing<br />

Status<br />

Standard<br />

Deduction<br />

AGI EITC CTC<br />

Federal Tax<br />

Refund<br />

Total Tax<br />

Benefits<br />

Pat HH $20,800 $40,000 $1,045 $2,000 $1,059 $4,104<br />

Sam Single $ 13,850 $40,000 $0 $0 ($2,918) ($2,918)<br />

What can be done to reduce the disparity?<br />

The differential impact of the EITC and CTC and Head of Household filing<br />

status on parents who pay support in comparison to parents who receive<br />

support could be mitigated through congressional action. One approach<br />

would be for Congress to expand the EITC, CTC, and Head of Household<br />

eligibility criteria to include parents who pay support and who have<br />

significant parenting time or are current in meeting their financial child<br />

support obligations.<br />

Another approach would be to create alternative tax benefits or credits<br />

specifically targeted at parents who pay support. These credits could be<br />

designed to provide financial assistance or incentives for employment,<br />

education, or other activities that support the well-being of their children.<br />

Conclusion<br />

Parents who meet their child support obligations are supporting their<br />

children, just in a different way from custodial parents. Yet, low-income<br />

parents who pay child support, in particular, are taxed at a much higher<br />

effective rate than parents who receive support. This provides a challenge