Debtfree Issue 202402 - DB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

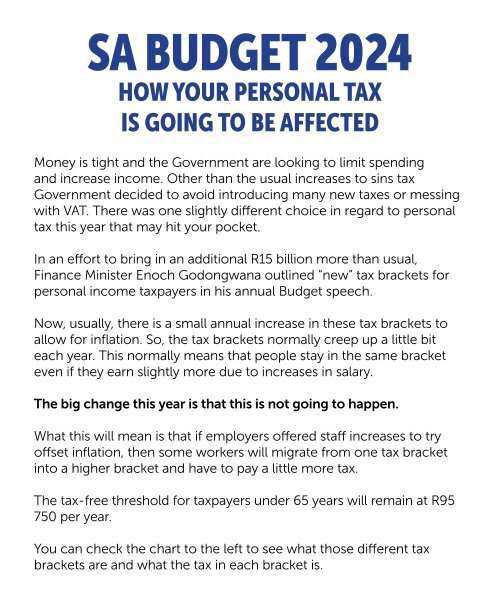

SA BUDGET 2024<br />

HOW YOUR PERSONAL TAX<br />

IS GOING TO BE AFFECTED<br />

Money is tight and the Government are looking to limit spending<br />

and increase income. Other than the usual increases to sins tax<br />

Government decided to avoid introducing many new taxes or messing<br />

with VAT. There was one slightly different choice in regard to personal<br />

tax this year that may hit your pocket.<br />

In an effort to bring in an additional R15 billion more than usual,<br />

Finance Minister Enoch Godongwana outlined “new” tax brackets for<br />

personal income taxpayers in his annual Budget speech.<br />

Now, usually, there is a small annual increase in these tax brackets to<br />

allow for inflation. So, the tax brackets normally creep up a little bit<br />

each year. This normally means that people stay in the same bracket<br />

even if they earn slightly more due to increases in salary.<br />

The big change this year is that this is not going to happen.<br />

What this will mean is that if employers offered staff increases to try<br />

offset inflation, then some workers will migrate from one tax bracket<br />

into a higher bracket and have to pay a little more tax.<br />

The tax-free threshold for taxpayers under 65 years will remain at R95<br />

750 per year.<br />

You can check the chart to the left to see what those different tax<br />

brackets are and what the tax in each bracket is.