Purchasing and Financing 2024

Purchasing- and Financial Management For 2nd year CATS learners. Aligned to the outcomes of the German accredited certification: “Industrie Kaufmann/frau”.

Purchasing- and Financial Management

For 2nd year CATS learners.

Aligned to the outcomes of the German accredited certification: “Industrie Kaufmann/frau”.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8. FINANCING RULES<br />

Students underst<strong>and</strong> the importance of responsible financing decisions.<br />

The decision of how to finance an asset in a company is closely related to its expected<br />

lifetime. L<strong>and</strong> <strong>and</strong> buildings are kept as assets for a very long time, while cash funds <strong>and</strong><br />

stocks are turned over quickly. Long term financing options should only be used if it will<br />

take long to reconvert the asset into money. Consequently, fixed assets should preferably<br />

be financed by Owner’s Equity, while loan capital should be applied to the financing of<br />

current assets as the returns from sales can then be used to pay the creditors.<br />

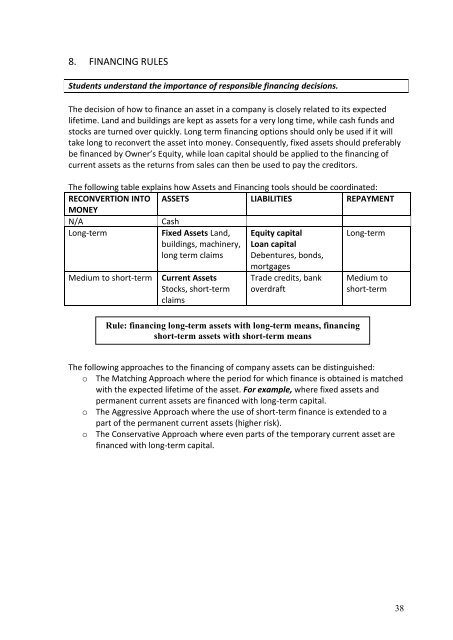

The following table explains how Assets <strong>and</strong> <strong>Financing</strong> tools should be coordinated:<br />

RECONVERTION INTO ASSETS LIABILITIES REPAYMENT<br />

MONEY<br />

N/A<br />

Cash<br />

Long-term<br />

Fixed Assets L<strong>and</strong>,<br />

buildings, machinery,<br />

long term claims<br />

Equity capital<br />

Loan capital<br />

Debentures, bonds,<br />

Long-term<br />

Medium to short-term<br />

Current Assets<br />

Stocks, short-term<br />

claims<br />

mortgages<br />

Trade credits, bank<br />

overdraft<br />

Rule: financing long-term assets with long-term means, financing<br />

short-term assets with short-term means<br />

Medium to<br />

short-term<br />

The following approaches to the financing of company assets can be distinguished:<br />

o The Matching Approach where the period for which finance is obtained is matched<br />

with the expected lifetime of the asset. For example, where fixed assets <strong>and</strong><br />

permanent current assets are financed with long-term capital.<br />

o The Aggressive Approach where the use of short-term finance is extended to a<br />

part of the permanent current assets (higher risk).<br />

o The Conservative Approach where even parts of the temporary current asset are<br />

financed with long-term capital.<br />

38