Purchasing and Financing 2024

Purchasing- and Financial Management For 2nd year CATS learners. Aligned to the outcomes of the German accredited certification: “Industrie Kaufmann/frau”.

Purchasing- and Financial Management

For 2nd year CATS learners.

Aligned to the outcomes of the German accredited certification: “Industrie Kaufmann/frau”.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5. SOURCES OF FINANCE<br />

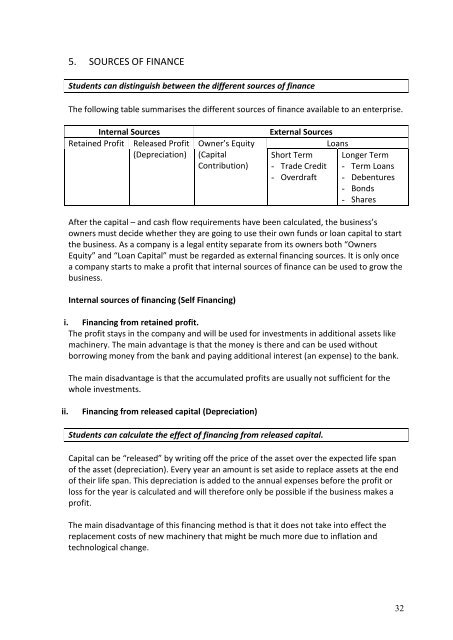

Students can distinguish between the different sources of finance<br />

The following table summarises the different sources of finance available to an enterprise.<br />

Internal Sources<br />

Retained Profit Released Profit<br />

(Depreciation)<br />

Owner’s Equity<br />

(Capital<br />

Contribution)<br />

External Sources<br />

Loans<br />

Short Term Longer Term<br />

- Trade Credit - Term Loans<br />

- Overdraft - Debentures<br />

- Bonds<br />

- Shares<br />

After the capital – <strong>and</strong> cash flow requirements have been calculated, the business’s<br />

owners must decide whether they are going to use their own funds or loan capital to start<br />

the business. As a company is a legal entity separate from its owners both “Owners<br />

Equity” <strong>and</strong> “Loan Capital” must be regarded as external financing sources. It is only once<br />

a company starts to make a profit that internal sources of finance can be used to grow the<br />

business.<br />

Internal sources of financing (Self <strong>Financing</strong>)<br />

i. <strong>Financing</strong> from retained profit.<br />

The profit stays in the company <strong>and</strong> will be used for investments in additional assets like<br />

machinery. The main advantage is that the money is there <strong>and</strong> can be used without<br />

borrowing money from the bank <strong>and</strong> paying additional interest (an expense) to the bank.<br />

The main disadvantage is that the accumulated profits are usually not sufficient for the<br />

whole investments.<br />

ii.<br />

<strong>Financing</strong> from released capital (Depreciation)<br />

Students can calculate the effect of financing from released capital.<br />

Capital can be “released” by writing off the price of the asset over the expected life span<br />

of the asset (depreciation). Every year an amount is set aside to replace assets at the end<br />

of their life span. This depreciation is added to the annual expenses before the profit or<br />

loss for the year is calculated <strong>and</strong> will therefore only be possible if the business makes a<br />

profit.<br />

The main disadvantage of this financing method is that it does not take into effect the<br />

replacement costs of new machinery that might be much more due to inflation <strong>and</strong><br />

technological change.<br />

32