Purchasing and Financing 2024

Purchasing- and Financial Management For 2nd year CATS learners. Aligned to the outcomes of the German accredited certification: “Industrie Kaufmann/frau”.

Purchasing- and Financial Management

For 2nd year CATS learners.

Aligned to the outcomes of the German accredited certification: “Industrie Kaufmann/frau”.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

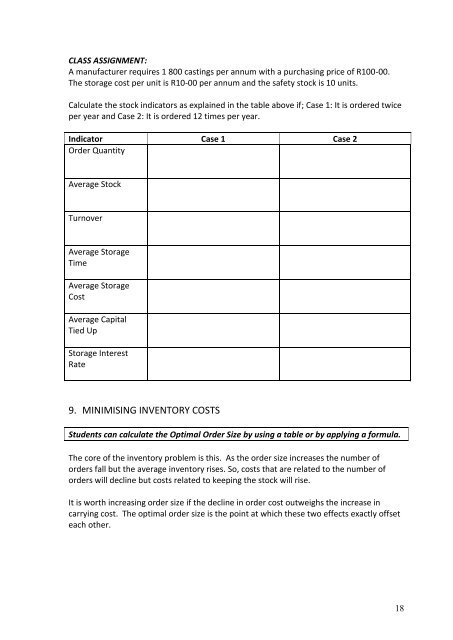

CLASS ASSIGNMENT:<br />

A manufacturer requires 1 800 castings per annum with a purchasing price of R100-00.<br />

The storage cost per unit is R10-00 per annum <strong>and</strong> the safety stock is 10 units.<br />

Calculate the stock indicators as explained in the table above if; Case 1: It is ordered twice<br />

per year <strong>and</strong> Case 2: It is ordered 12 times per year.<br />

Indicator Case 1 Case 2<br />

Order Quantity<br />

Average Stock<br />

Turnover<br />

Average Storage<br />

Time<br />

Average Storage<br />

Cost<br />

Average Capital<br />

Tied Up<br />

Storage Interest<br />

Rate<br />

9. MINIMISING INVENTORY COSTS<br />

Students can calculate the Optimal Order Size by using a table or by applying a formula.<br />

The core of the inventory problem is this. As the order size increases the number of<br />

orders fall but the average inventory rises. So, costs that are related to the number of<br />

orders will decline but costs related to keeping the stock will rise.<br />

It is worth increasing order size if the decline in order cost outweighs the increase in<br />

carrying cost. The optimal order size is the point at which these two effects exactly offset<br />

each other.<br />

18