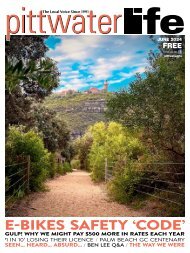

Pittwater Life January 2024 Issue

LOCAL GUIDE: 193 THINGS TO DO 1991‘DEVELOPMENT ONSLAUGHT’ FEARS / BEACHES ACHIEVERS HOLIDAY CROSSWORD + PUZZLES / BARRENJOEY BOATSHED THE WAY WE WERE / HOT PROPERTY / SEEN... HEARD... ABSURD...

LOCAL GUIDE: 193 THINGS TO DO

1991‘DEVELOPMENT ONSLAUGHT’ FEARS / BEACHES ACHIEVERS

HOLIDAY CROSSWORD + PUZZLES / BARRENJOEY BOATSHED

THE WAY WE WERE / HOT PROPERTY / SEEN... HEARD... ABSURD...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

epeated at the following year’s<br />

AGM, it prepares the ground for<br />

a board spill.<br />

Another iconic Australian<br />

company to suffer a similar fate<br />

at its AGM was Qantas. Qantas<br />

copped a massive 83% vote<br />

against its remuneration report<br />

caused by their spat with the<br />

media and Federal government<br />

and the subsequent brand damage<br />

as former CEO Alan Joyce<br />

exited the company.<br />

Both Woolworths and Qantas<br />

also received criticism from a<br />

range of stakeholders for entering<br />

the ‘Voice’ debate as highprofile<br />

supporters of the ‘Yes’<br />

side. Of course, they weren’t<br />

alone and were joined in this endeavour<br />

by companies such as<br />

BHP, Rio and Wesfarmers who<br />

each contributed $2 million to<br />

the cause. It’s a tricky business<br />

for companies to pick sides in<br />

what is essentially a question of<br />

conscience with a binary win or<br />

lose outcome; you run the risk<br />

of upsetting a substantial portion<br />

of your customer base.<br />

Why spend millions on<br />

sponsorships, charities and<br />

causes? According to GivingLarge,<br />

a research provider<br />

in the area of corporate philanthropy<br />

(whose reports ironically<br />

are not free), the top 50 corporate<br />

philanthropists have for the<br />

first time topped $1.5 billion in<br />

donations.<br />

According to their report<br />

dated 30 November which<br />

also appeared in the AFR:<br />

“Woolworths says philanthropy<br />

is also a focus for directors.<br />

Woolworths recorded a near<br />

tripling of its giving program<br />

this year, to $122 million. ‘Our<br />

board takes a very keen interest<br />

in our philanthropic agenda<br />

as it is a key part of the wider<br />

group’s purpose, in which everyone<br />

at Woolworths Group has<br />

a part to play. Food relief activity<br />

is discussed regularly with<br />

the board,’ says Woolworths<br />

chief sustainability officer Alex<br />

Holt. Woolworths attributes the<br />

surge in giving mainly to the<br />

ability, for the first time, to accurately<br />

value the amount of<br />

food donated to its food rescue<br />

partners, such as OzHarvest,<br />

Foodbank and FareShare. The<br />

value of food donated accounted<br />

for $76 million of the increase,<br />

while the remainder came from<br />

a rise in financial contributions,<br />

Holt notes.”<br />

Elsewhere in the report there<br />

was insight into what moti-<br />

The Local Voice Since 1991<br />

vates some companies over<br />

and above the pure marketing<br />

effect: “The rise in corporate<br />

giving comes as surveys show<br />

younger employees increasingly<br />

want to work at companies<br />

whose values are aligned with<br />

theirs. [Our giving program] is...<br />

a retention tool.”<br />

So, it’s a feel-good factor for<br />

the staff and management. Putting<br />

some humanity over the<br />

top of the cold corporate bones,<br />

so to speak. The only problem,<br />

and it was a big problem for<br />

both Woolworths and Qantas,<br />

is that all the causes, philanthropic<br />

endeavours and corporate<br />

giving are worth nothing to<br />

your brand when you are vulnerable<br />

to claims that you have<br />

been diddling your suppliers,<br />

staff and customers for years.<br />

Eventually, the public does<br />

get around to seeing these feelgood<br />

efforts by big companies<br />

behaving badly for what they<br />

are worth and that’s very little<br />

unless you happen to be the<br />

direct beneficiary of the donation<br />

or cause.<br />

Unless they are very large,<br />

shareholders – ultimate owners<br />

of the business – have little or<br />

no access to management or<br />

directors of corporations. In<br />

the main they must resort to<br />

the angry email or voting at<br />

the annual general meeting. If<br />

last year was anything to go<br />

by the scorecard for corporate<br />

Australia this reporting season<br />

was bad, as Sumeyya Ilanbey<br />

noted in The SMH on 15 December:<br />

“Australian investors have<br />

made history this year, issuing<br />

a strike against the remuneration<br />

reports of 32 companies,<br />

the highest ever backlash. They<br />

didn’t believe the performance<br />

of companies they had invested<br />

in justified the exorbitant wages<br />

and bonuses of executives.”<br />

Brian Hrnjak B Bus CPA (FPS) is<br />

a Director of GHR Accounting<br />

Group Pty Ltd, Certified Practising<br />

Accountants. Office: Suite 12,<br />

Ground Floor, 20 Bungan Street<br />

Mona Vale NSW.<br />

Phone: 02 9979-4300.<br />

Web: ghr.com.au and altre.com.au<br />

Email: brian@ghr.com.au<br />

These comments are general<br />

advice only and are not intended as<br />

a substitute for professional advice.<br />

This article is not an offer or<br />

recommendation of any securities<br />

or other financial products offered<br />

by any company or person.<br />

JANUARY <strong>2024</strong> 59<br />

Business <strong>Life</strong>