International Aquafeed Directory 2023-24

Welcome to the 27th edition of the International Aquafeed Directory & Buyers’ Guide 2023/24, the essential guide for everyone involved in the global aquafeed industry.

Last year I wrote about the effects of the war, and the challenges resulting from rising fuel costs, but the industry showed great resilience. The impact of inflation and reduced consumer spending dampened growth in the market at the beginning of the year, but an expected increase in aquaculture production will compensate for a mall decline in wild catches.

This edition contains information relating to 450+ businesses and over 850 products, coupled with useful and practical information including the extruder and expander guide.

We would like to take this opportunity to thank all the businesses that have contributed to the completion of this directory. I also hope that all of our readers across the world remain safe and well.

Welcome to the 27th edition of the International Aquafeed Directory & Buyers’ Guide 2023/24, the essential guide for everyone involved in the global aquafeed industry.

Last year I wrote about the effects of the war, and the challenges resulting from rising fuel costs, but the industry showed great resilience. The impact of inflation and reduced consumer spending dampened growth in the market at the beginning of the year, but an expected increase in aquaculture production will compensate for a mall decline in wild catches.

This edition contains information relating to 450+ businesses and over 850 products, coupled with useful and practical information including the extruder and expander guide.

We would like to take this opportunity to thank all the businesses that have contributed to the completion of this directory. I also hope that all of our readers across the world remain safe and well.

4 PRODUCT INDEX PRODUCT INDEX PRODUCT INDEX Plant, ascophyllum 34 Plasma 44 Pollack liver oil 41 Pollution control equipment 59 Polychaetes, frozen 44 Port facilities 68 Postconditioners 59 Potassium 40 Potato starch 43 Poultry 35 Poultry meals 44 PPE - Personal protective equipment 59 Prawn 36 PREMIXES 42 Premixes 42 Preservatives 35 Primary 46 PROBIOTICS 42 Probiotics 42 Process control automation 59 Process control, bulk loading 59 Process control, extrusion 59 Process control, fat coaters 59 Process control, pellet press 59 Process control, stock control 60 Process control, weighing 60 Product development services - aquatic feeds 68 Propyl gallate 32 PROTEINS & CARBOHYDRATES, PLANT 42 PROTEINS, ANIMAL 43 PROTEINS, INSECT 44 PROTEINS, MARINE 44 PROTEINS, MICROBIAL 45 Proteolitic 35 Proximity switches 60 Publications 68 Pulverisers 60 Pumps 60 PVC covers 60 Pyridoxine (B6) 46 Q, R » Pet Food extrusion » (floating) Aquafeed extrusion » Animal feed extrusion » Oil seed extraction » Cereal processing extrusion » Compacting » Pre-conditioning prior to other processes QUILLAIA 45 R&D aquatic feeds & nutrition 68 Rapeseed meal 43 Rapeseed oil 42 Redfish 36 Remote sensing 60 Rendering equipment/animal protein production equipment 60 Repair, maintenance and equipment 60 Riboflavin (B2) 46 Rice bran 43 Rice protein concentrate 43 Rice protein product 43 Roasters, soyabean/grain 60 Robot feeding 60 Roll repair, fluting & grinding 68 Roller bearings 60 Rolls, crumbler 60 Rolls, flaking 60 Rolls, mill 60 Rotary valves 60 Rotifer brachionus plicatilis cysts 32 S www.almex.nl Safety equipment 60 Safety signs 60 Salmon 36 Salmon meal 44 Salmon oil 41 Sample dividers & splitters 60 Samplers & probes 60 Samplers, bag 60 Samplers, bin 60 Samplers, bulk 60 Samplers, grain 60 Samplers, in-line 60 Samplers, truck core 60 Sampling & laboratory equipment 60 SAPONINS 45 Scan the QR-Code for more information EXTRUDER AND EXPANDER TECHNOLOGY YOU CAN TRUST Saponins 45 Sardine meal 44 Sardine oil 41 Scales, bagging-off 60 Scales, batching 60/62 Scales, check weighers 62 Scales, hopper 62 Scales, liquid 62 Scales, platform 62 Scales, portable 62 Scales, programmable 62 Scales, weighbridge 62 Scaling systems, minor bulk bag 62 Screeners, vibratory 62 Screens, hammermill 62 Screens, pellet 62 Screens, vibrating 62 Screens, wire 62 Sea Bream 36 Seabass 38 Seals, inflatable 62 Seaweed extracts 35 Secondhand equipment 62 Selenium 40 Separation, hull 62 Separators, apex 62 Separators, centrifugal 62 Separators, for non-ferrous metals 62 Separators, grader 62 Separators, gravity 62 Separators, liquids-solids 62 Separators, magnetic 62 SERVICES 66 Sewing machines 62 Shark liver oil 41 Ship loaders/unloaders 62 Short-neck clam oil 41 Shrimp 38 Shrimp head meal 44 Shrimp head solubles 45 Shrimp meal 45 Shrimp shell meal 45 Shrimp waste meal 45 Sifters 62/64 Sifters, centrifugal 64 Sifters, in-line, pneumatic 64 Sifters, rotary 64 Silicon 40 Silo maintenance and repairs 68 Silo tanker equipment 64 Silo weighing 64 Silos 64 Sizing equipment 64 Skipjack oil 41 Sludge processing equipment 64 Soya protein concentrate 43 Soya protein product 43 Soyabean cake 43 Soyabean meal, defatted 43 Soyabean meal, full fat 43 Soyabean oil 42 Speciality feed additives 35 Spirulina 31 Sporulated 42 Spouting 64 Spray dried haemoglobin powder 44 Spray, dried green 31 Spray, dried, high DHA 31 Squid liver meal 45 Squid liver oil 41 Squid mantle meal 45 Squid meal 45 Squid solubles 45 Squid viscera meal 45 Squilla meal 45 Starter feeds 38 Steam injection system 64 Sterilizers 64 Sterilizers, ultra violet 64 STEROLS 45 Storage plants, turnkey 64 Striped bass 38 Sturgeon 38 Sunflower oil 42 SURFACTANTS 45 Surfactants 45 Synthetic 34 Synthetic 34 Synthetic 34 Synthetic 41 Synthetic 45 T Tanks 64 Tapioca starch 43 Taurine (synthetic) 32 TBHQ 32 Temperature controls 64 Temperature measurement 64 Test kits, food-borne pathogen 64 Test kits, mycotoxin 64 Thiamin (B1) 46 Threonine 32 THYROPROTEIN 45 Thyroprotein 45 Tilapia 38 Towers 64 Toxin binders 34 Trace mineral premixes 41 TRACERS 45 Tracers for feeds & premixes 45 Trailers, bulk 64 Transport and shipping 68 Treatment tarpaulins 64 Trout 38 Trout eggs, fertilized 68 Truck bodies, pneumatic 64 Truck dumpers, hydraulic 64 Trucks, fork lift 64 Tryptophan 32 Tubifex, freeze dried 45 Tuna liver meal 45 Tuna meal 45 Tuna oil 41 Turbot 38 Turnkey design and installation - aquafeed mills 68 Turnkey design and installation - microalgae plant 68 U, V Ultra violet disinfection 64 VACCINES 45 Vaccines 45 Vacuum coating 64 Valine 32 Valve position indicators 66 Valves 66 Vanadium 41 V-belts 66 Vegetable protein product 43 Vibrators, truck, unloading 66 Vibrators, vibrating screens 66 Vibratory motors 66 Virus control system 66 Vitamin A 46 Vitamin B12 46 Vitamin C stabilized 46 Vitamin D3 46 Vitamin E 46 Vitamin K 46 Vitamin premixes 46 VITAMINS 45 W Waste compactors 66 Waste management services 68 Wastewater treatment equipment 66 Water conditioner 66 Waterproof garments 66 Weaning diets 38 Weigh hoppers/mixers 66 Weighbridges 66 Weighing & filling equipment 66 Weighing equipment, on-vehicle 66 WETTING AGENTS 46 Wetting agents 46 Wheat flour 43 Wheat gluten 43 Wheat middlings 43 Wheatgerm oil 42 Whey 44 White fish meal 45 Y, Z Yeast 45 YEAST 46 Yucca 32 Zeolites 32 ZEOLITES 46 Zeolites 46 Zinc 41 Zooplankton, dry 45 Zooplankton, freeze-dried 45 Zooplankton, frozen 45 INTERNATIONAL AQUAFEED DIRECTORY 2023/24

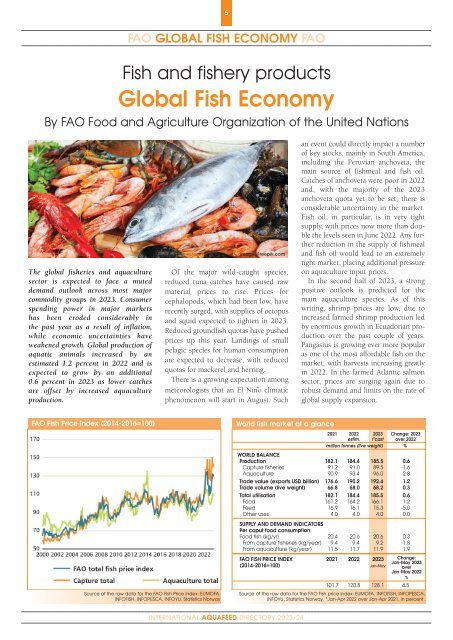

5 FAO GLOBAL FISH ECONOMY FAO Fish and fishery products Global Fish Economy By FAO Food and Agriculture Organization of the United Nations The global fisheries and aquaculture sector is expected to face a muted demand outlook across most major commodity groups in 2023. Consumer spending power in major markets has been eroded considerably in the past year as a result of inflation, while economic uncertainties have weakened growth. Global production of aquatic animals increased by an estimated 1.2 percent in 2022 and is expected to grow by an additional 0.6 percent in 2023 as lower catches are offset by increased aquaculture production. image: Freepik.com Of the major wild-caught species, reduced tuna catches have caused raw material prices to rise. Prices for cephalopods, which had been low, have recently surged, with supplies of octopus and squid expected to tighten in 2023. Reduced groundfish quotas have pushed prices up this year. Landings of small pelagic species for human consumption are expected to decrease, with reduced quotas for mackerel and herring. There is a growing expectation among meteorologists that an El Ninõ climatic phenomenon will start in August. Such an event could directly impact a number of key stocks, mainly in South America, including the Peruvian anchoveta, the main source of fishmeal and fish oil. Catches of anchoveta were poor in 2022 and, with the majority of the 2023 anchoveta quota yet to be set, there is considerable uncertainty in the market. Fish oil, in particular, is in very tight supply, with prices now more than double the levels seen in June 2022. Any further reduction in the supply of fishmeal and fish oil would lead to an extremely tight market, placing additional pressure on aquaculture input prices. In the second half of 2023, a strong positive outlook is predicted for the main aquaculture species. As of this writing, shrimp prices are low, due to increased farmed shrimp production led by enormous growth in Ecuadorian production over the past couple of years. Pangasius is growing ever more popular as one of the most affordable fish on the market, with harvests increasing greatly in 2022. In the farmed Atlantic salmon sector, prices are surging again due to robust demand and limits on the rate of global supply expansion. FAO Fish Price Index (2014-2016=100) World fish market at a glance 2021 2022 2023 Change: 2023 estim. fÊcast over 2022 million tonnes (live weight) % WORLD BALANCE Production 182.1 184.4 185.5 0.6 Capture fisheries 91.2 91.0 89.5 -1.6 Aquaculture 90.9 93.4 96.0 2.8 Trade value (exports USD billion) 176.6 190.2 192.4 1.2 Trade volume (live weight) 66.8 68.0 68.2 0.3 Total utilisation 182.1 184.4 185.5 0.6 Food 161.2 164.2 166.1 1.2 Feed 16.9 16.1 15.3 -5.0 Other uses 4.0 4.0 4.0 0.0 SUPPLY AND DEMAND INDICATORS Per caput food consumption: Food fish (kg/yr) 20.4 20.6 20.6 0.3 From capture fisheries (kg/year) 9.4 9.4 9.2 -1.8 From aquaculture (kg/year) 11.5 11.7 11.9 1.9 Source of the raw data for the FAO Fish Price Index: EUMOFA, INFOFISH, INFOPESCA, INFOYU, Statistics Norway FAO FISH PRICE INDEX 2021 2022 2023 (2014-2016=100) Jan-May Change: Jan-May 2023 over Jan-May 2022 % 101.7 120.8 128.1 4.5 Source of the raw data for the FAO Fish price index: EUMOFA, INFOFISH, INFOPESCA, INFOYU, Statistics Norway. *Jan-Apr 2022 over Jan-Apr 2021, in percent. INTERNATIONAL AQUAFEED DIRECTORY 2023/24

- Page 1 and 2: DIRECTORY & BUYERS’ GUIDE 2023/24

- Page 3 and 4: 1 CONTENTS CONTENTS CONTENTS WELCOM

- Page 5: 3 PRODUCT INDEX PRODUCT INDEX PRODU

- Page 9 and 10: 7 FAO GLOBAL FISH ECONOMY FAO where

- Page 11 and 12: 9 FAO GLOBAL FISH ECONOMY FAO LOBST

- Page 13 and 14: 11 FAO GLOBAL FISH ECONOMY FAO Appe

- Page 15 and 16: Join the fish revolution Phileo’s

- Page 17 and 18: 15 AQUACULTURE ASC AQUACULTURE Digi

- Page 19 and 20: 17 AQUACULTURE ASC AQUACULTURE ASC

- Page 21 and 22: 19 AQUACULTURE ASC AQUACULTURE Over

- Page 23 and 24: 21 COMPANY PROFILE OTTEVANGER COMPA

- Page 25 and 26: 23 COMPANY PROFILE EXTRU-TECH COMPA

- Page 27 and 28: 25 COMPANY PROFILE DR ECKEL COMPANY

- Page 29 and 30: 27 INTERNATIONAL AQUAFEED DIRECTORY

- Page 31 and 32: Complete solutions from a single so

- Page 33 and 34: From 0.5 to 30 mm. extrusion | expe

- Page 35 and 36: FEED & BIOFUEL INCREASED CAPACITY F

- Page 37 and 38: 35 PRODUCT GUIDE PRODUCT GUIDE PROD

- Page 39 and 40: 37 PRODUCT GUIDE PRODUCT GUIDE PROD

- Page 41 and 42: 39 PRODUCT GUIDE PRODUCT GUIDE PROD

- Page 43 and 44: COMPLETE, TAILORED FEED BLOCK DIETS

- Page 45 and 46: 43 Immunity, thanks to Algae Optimi

- Page 47 and 48: 45 PRODUCT GUIDE PRODUCT GUIDE PROD

- Page 49 and 50: 47 PRODUCT GUIDE PRODUCT GUIDE PROD

- Page 51 and 52: 49 PRODUCT GUIDE PRODUCT GUIDE PROD

- Page 53 and 54: Supporting growth with sustainable

- Page 55 and 56: Square silo experts Since 1988 Need

5<br />

FAO GLOBAL FISH ECONOMY FAO<br />

Fish and fishery products<br />

Global Fish Economy<br />

By FAO Food and Agriculture Organization of the United Nations<br />

The global fisheries and aquaculture<br />

sector is expected to face a muted<br />

demand outlook across most major<br />

commodity groups in <strong>2023</strong>. Consumer<br />

spending power in major markets<br />

has been eroded considerably in<br />

the past year as a result of inflation,<br />

while economic uncertainties have<br />

weakened growth. Global production of<br />

aquatic animals increased by an<br />

estimated 1.2 percent in 2022 and is<br />

expected to grow by an additional<br />

0.6 percent in <strong>2023</strong> as lower catches<br />

are offset by increased aquaculture<br />

production.<br />

image: Freepik.com<br />

Of the major wild-caught species,<br />

reduced tuna catches have caused raw<br />

material prices to rise. Prices for<br />

cephalopods, which had been low, have<br />

recently surged, with supplies of octopus<br />

and squid expected to tighten in <strong>2023</strong>.<br />

Reduced groundfish quotas have pushed<br />

prices up this year. Landings of small<br />

pelagic species for human consumption<br />

are expected to decrease, with reduced<br />

quotas for mackerel and herring.<br />

There is a growing expectation among<br />

meteorologists that an El Ninõ climatic<br />

phenomenon will start in August. Such<br />

an event could directly impact a number<br />

of key stocks, mainly in South America,<br />

including the Peruvian anchoveta, the<br />

main source of fishmeal and fish oil.<br />

Catches of anchoveta were poor in 2022<br />

and, with the majority of the <strong>2023</strong><br />

anchoveta quota yet to be set, there is<br />

considerable uncertainty in the market.<br />

Fish oil, in particular, is in very tight<br />

supply, with prices now more than double<br />

the levels seen in June 2022. Any further<br />

reduction in the supply of fishmeal<br />

and fish oil would lead to an extremely<br />

tight market, placing additional pressure<br />

on aquaculture input prices.<br />

In the second half of <strong>2023</strong>, a strong<br />

positive outlook is predicted for the<br />

main aquaculture species. As of this<br />

writing, shrimp prices are low, due to<br />

increased farmed shrimp production led<br />

by enormous growth in Ecuadorian production<br />

over the past couple of years.<br />

Pangasius is growing ever more popular<br />

as one of the most affordable fish on the<br />

market, with harvests increasing greatly<br />

in 2022. In the farmed Atlantic salmon<br />

sector, prices are surging again due to<br />

robust demand and limits on the rate of<br />

global supply expansion.<br />

FAO Fish Price Index (2014-2016=100)<br />

World fish market at a glance<br />

2021 2022 <strong>2023</strong> Change: <strong>2023</strong><br />

estim. fÊcast over 2022<br />

million tonnes (live weight) %<br />

WORLD BALANCE<br />

Production 182.1 184.4 185.5 0.6<br />

Capture fisheries 91.2 91.0 89.5 -1.6<br />

Aquaculture 90.9 93.4 96.0 2.8<br />

Trade value (exports USD billion) 176.6 190.2 192.4 1.2<br />

Trade volume (live weight) 66.8 68.0 68.2 0.3<br />

Total utilisation 182.1 184.4 185.5 0.6<br />

Food 161.2 164.2 166.1 1.2<br />

Feed 16.9 16.1 15.3 -5.0<br />

Other uses 4.0 4.0 4.0 0.0<br />

SUPPLY AND DEMAND INDICATORS<br />

Per caput food consumption:<br />

Food fish (kg/yr) 20.4 20.6 20.6 0.3<br />

From capture fisheries (kg/year) 9.4 9.4 9.2 -1.8<br />

From aquaculture (kg/year) 11.5 11.7 11.9 1.9<br />

Source of the raw data for the FAO Fish Price Index: EUMOFA,<br />

INFOFISH, INFOPESCA, INFOYU, Statistics Norway<br />

FAO FISH PRICE INDEX 2021 2022 <strong>2023</strong><br />

(2014-2016=100) Jan-May<br />

Change:<br />

Jan-May <strong>2023</strong><br />

over<br />

Jan-May 2022<br />

%<br />

101.7 120.8 128.1 4.5<br />

Source of the raw data for the FAO Fish price index: EUMOFA, INFOFISH, INFOPESCA,<br />

INFOYU, Statistics Norway. *Jan-Apr 2022 over Jan-Apr 2021, in percent.<br />

INTERNATIONAL AQUAFEED DIRECTORY <strong>2023</strong>/<strong>24</strong>