2023 Q1 In Review - Integrity Wealth Advisors, Ventura & Ojai, California

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Future<br />

FINANCIAL<br />

four-year college<br />

PLANNING:<br />

costs<br />

COLLEGE COSTS<br />

How much College costs to invest<br />

The younger the child, the more college is likely to cost. Add up four years per child, and it equals one of a family’s See largest how much expenses. you should start investing or already have invested, based on a child<br />

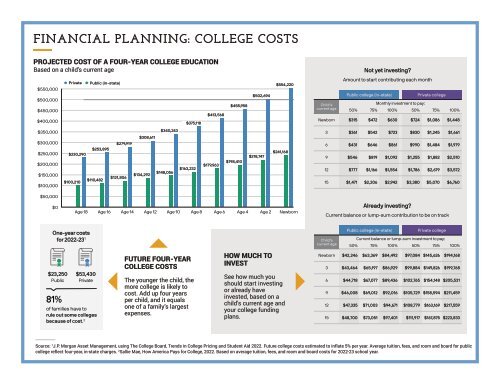

PROJECTED COST OF A FOUR-YEAR Projected cost COLLEGE of a four-year EDUCATION college education<br />

Based on a child's current age<br />

$550,000<br />

$500,000<br />

$450,000<br />

$400,000<br />

$350,000<br />

$300,000<br />

$250,000<br />

$200,000<br />

Private<br />

$230,290<br />

College costs<br />

Public (in-state)<br />

$253,895<br />

$150,000<br />

$110,482<br />

uals one of a family’s largest $100,210 expenses.<br />

$100,000<br />

$279,919<br />

$121,806<br />

based on child’s current age 1 $502,694<br />

$455,958<br />

$413,568<br />

$375,118<br />

$340,243<br />

$308,611<br />

$241,168<br />

$134,292<br />

$198,410<br />

$179,963<br />

$163,232<br />

How $148,056 much to invest<br />

$218,747<br />

$554,220<br />

Public college (in-state)<br />

Private college<br />

One-year costs<br />

Child’s for 2022-23 1<br />

Monthly investment to pay:<br />

current age<br />

50% 75% 100% 50% 75% 100%<br />

$23,2503 $53,430 $361 $542 $723 $830 $1,245 $1,661<br />

Public Private<br />

6 $431 $646 $861 $990 $1,484 $1,979<br />

81%<br />

Not yet investing?<br />

Amount to start contributing each month<br />

Newborn $315 $472 $630 $724 $1,086 $1,448<br />

9 $546 $819 $1,092 $1,255 $1,882 $2,510<br />

of families have to<br />

rule 12 out some colleges $777 $1,166 $1,554 $1,786 Saving $2,679 and investing $3,572<br />

because of cost. 2<br />

15 $1,471 $2,206 $2,942 $3,380 $5,070 $6,760<br />

See how much you should start investing or already have invested, based on a child’s current age and your college funding plans.<br />

Current ba<br />

Child’s<br />

current age<br />

P<br />

Newborn $42<br />

3 $43<br />

6 $4<br />

9 $46<br />

12 $47<br />

15 $48<br />

4<br />

$554,220<br />

$241,168<br />

8<br />

$50,000<br />

$0<br />

Source: J.P. Morgan Asset Management. Based on average tuition, fees, and room and board costs for 2022-<br />

Age 18 Age 16 Age 14 Age 12 Age 10 Age 8 Age 6 Age 4 Age 2 Newborn<br />

and Student Aid 2022. Costs estimated to inflate 5% per year. This hypothetical example illustrates the future<br />

Amount to start contributing each month<br />

investments Current with balance no additional or lump-sum contributions contribution for different time to be periods, on track assuming an annual investment retu<br />

does not represent the performance of any particular investment. Different assumptions will result in outcom<br />

1. J.P. Morgan Asset Management, using The College Board, Trends in College Pricing and Student Aid 2022. Future college costs estimated to inflate less than 5% the per figures year. shown. These figures do not reflect the impact of fees or expenses that would be paid b<br />

Average tuition, fees, and room and board for public college reflect four-year, in-state charges.<br />

A plan of regular investment cannot ensure a profit or protect against a loss in a declining market.<br />

Public college (in-state)<br />

Private college<br />

Public college (in-state)<br />

Private college<br />

2. Sallie Mae, How America Pays for College, 2022.<br />

One-year costs<br />

for 2022-23 1<br />

$23,250<br />

Public<br />

$53,430<br />

Private<br />

81%<br />

of families have to<br />

rule out some colleges<br />

because of cost. 2<br />

Child’s<br />

current age<br />

FUTURE FOUR-YEAR<br />

COLLEGE COSTS<br />

The younger the child, the<br />

more college is likely to<br />

cost. Add up four years<br />

per child, and it equals<br />

one of a family’s largest<br />

expenses.<br />

Not yet investing?<br />

Monthly investment to pay:<br />

50% 75% 100% 50% 75% 100%<br />

HOW MUCH TO<br />

INVEST<br />

Newborn $315 $472 $630 $724 $1,086 $1,448<br />

3 $361 $542 $723 $830 $1,245 $1,661<br />

See how much you<br />

should start investing<br />

or already have<br />

invested, based on a<br />

child’s current age and<br />

your college funding<br />

plans.<br />

6 $431 $646 $861 $990 $1,484 $1,979<br />

9 $546 $819 $1,092 $1,255 $1,882 $2,510<br />

12 $777 $1,166 $1,554 $1,786 $2,679 $3,572<br />

15 $1,471 $2,206 $2,942 $3,380 $5,070 $6,760<br />

Already investing?<br />

Child’s<br />

Current balance or lump-sum investment to pay:<br />

current age<br />

50% 75% 100% 50% 75% 100%<br />

21<br />

Newborn $42,246 $63,369 $84,492 $97,084 $145,626 $194,168<br />

3 $43,464 $65,197 $86,929 $99,884 $149,826 $199,768<br />

6 $44,718 $67,077 $89,436 $102,765 $154,148 $205,531<br />

9 $46,008 $69,012 $92,016 $105,729 $158,594 $211,459<br />

12 $47,335 $71,003 $94,671 $108,779 $163,169 $217,559<br />

15 $48,700 $73,051 $97,401 $111,917 $167,875 $223,833<br />

2<br />

Newborn<br />

Source: J.P. Morgan Asset Management. Based on average tuition, fees, and room and board costs for 2022-23 school year, The College Board, Trends in College Pricing<br />

Source: 1 J.P. Morgan Asset Management, using The College Board, and Student Trends Aid in 2022. College Costs Pricing estimated and to Student inflate 5% Aid per 2022. year. Future This hypothetical college costs example estimated illustrates to the inflate future 5% values per year. of different Average regular tuition, monthly fees, investments and room and board lump-sum for public<br />

college reflect four-year, in-state charges. 2 investments with no additional contributions for different time periods, assuming an annual investment return of 6%, compounded monthly. This hypothetical example<br />

Sallie Mae, How America Pays for College, 2022. Based on average tuition, fees, and room and board costs for 2022-23 school year.<br />

does not represent the performance of any particular investment. Different assumptions will result in outcomes different from this example. Your results may be more or<br />

less than the figures shown. These figures do not reflect the impact of fees or expenses that would be paid by a 529 plan participant. Such costs would lower performance.<br />

A plan of regular investment cannot ensure a profit or protect against a loss in a declining market.<br />

ge costs estimated to inflate 5% per year.<br />

21