Journal of African Business Issue 5

Welcome to The Journal of African Business - a unique guide to business and investment in Africa. Every edition carries editorial copy covering the following general topics, with a wide range of subjects within each broader economic sector: energy; mining and exploration; trade; finance; technology and tourism. In addition to this, special features on topical matters will be published periodically, along with country profiles. In this edition, the in-depth interview with Aggreko Head of Sales, Southern East Africa, Max Schiff, makes clear how important captive power is for the future viability of a wide variety of projects in Africa. As Schiff points out, the extractives industry has long been a leader in the application of captive power, given the remote location of many mining operations, but the flexibility and ESG advantages that captive power using renewables offers is making it an ever-more attractive option for many different sectors.

Welcome to The Journal of African Business - a unique guide to business and investment in Africa.

Every edition carries editorial copy covering the following general topics, with a wide range of subjects within each broader economic sector: energy; mining and exploration; trade; finance; technology and tourism.

In addition to this, special features on topical matters will be published periodically, along with country profiles.

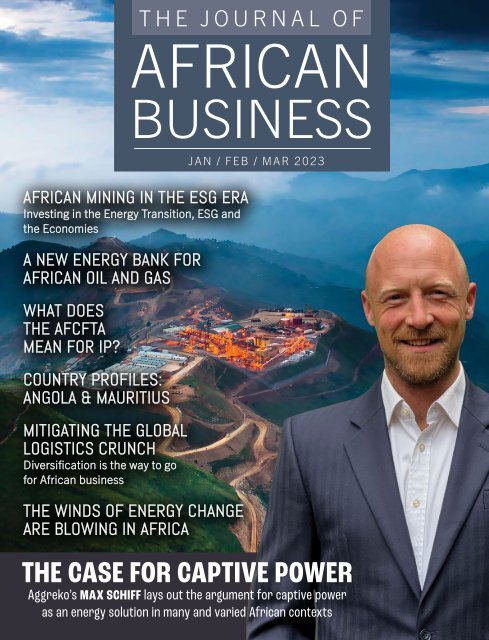

In this edition, the in-depth interview with Aggreko Head of Sales, Southern East Africa, Max Schiff, makes clear how important captive power is for the future viability of a wide variety of projects in Africa. As Schiff points out, the extractives industry has long been a leader in the application of captive power, given the remote location of many mining operations, but the flexibility and ESG advantages that captive power using renewables offers is making it an ever-more attractive option for many different sectors.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE JOURNAL OF<br />

AFRICAN<br />

BUSINESS<br />

AFRICAN MINING IN THE ESG ERA<br />

Investing in the Energy Transition, ESG and<br />

the Economies<br />

A NEW ENERGY BANK FOR<br />

AFRICAN OIL AND GAS<br />

WHAT DOES<br />

THE AFCFTA<br />

MEAN FOR IP?<br />

COUNTRY PROFILES:<br />

ANGOLA & MAURITIUS<br />

MITIGATING THE GLOBAL<br />

LOGISTICS CRUNCH<br />

Diversification is the way to go<br />

for <strong>African</strong> business<br />

THE WINDS OF ENERGY CHANGE<br />

ARE BLOWING IN AFRICA<br />

JAN / FEB / MAR 2023<br />

THE CASE FOR CAPTIVE POWER<br />

Aggreko’s MAX SCHIFF lays out the argument for captive power<br />

as an energy solution in many and varied <strong>African</strong> contexts

2023<br />

Future Fit –<br />

The year to be<br />

acknowledged<br />

The Gateway to learning is<br />

infinite… Get ahead <strong>of</strong> the<br />

curve and stand out from<br />

amongst the crowd through<br />

Executive Education at<br />

Wits <strong>Business</strong> School.<br />

Develop cutting-edge skills<br />

for revolutionary leaders.<br />

Be the change you wish to see! Join WBS – Executive Education Today!

EXECUTIVE<br />

EDUCATION<br />

Lead | Change | Transform<br />

C-Suite<br />

Management<br />

Development<br />

Leadership<br />

& coaching<br />

Executive<br />

Education<br />

Specialised<br />

Courses<br />

2 St Davids Place, Parktown, Johannesburg www.wbs.ac.za

FOREWORD<br />

<strong>Journal</strong> <strong>of</strong><br />

<strong>African</strong> <strong>Business</strong><br />

A unique guide to business and investment in Africa.<br />

Welcome to The <strong>Journal</strong> <strong>of</strong> <strong>African</strong> <strong>Business</strong>. The first issue <strong>of</strong> the journal was<br />

published in 2020 as an annual publication. Since then, the quarterly format has<br />

been adopted, giving our team more opportunities to bring readers up-to-date<br />

information and opinions and <strong>of</strong>fer our clients increased exposure at specific times<br />

<strong>of</strong> the year, either related to events and conferences or in conjunction with feature<br />

articles on specific topics.<br />

Every edition carries editorial copy covering the following general topics, with<br />

a wide range <strong>of</strong> subjects within each broader economic sector: energy; mining and<br />

exploration; trade; finance; technology and tourism.<br />

In addition to this, special features on topical matters will be published<br />

THE JOURNAL OF<br />

AFRICAN<br />

BUSINESS<br />

JAN / FEB / MAR 2023<br />

AFRICAN MINING IN THE ESG ERA<br />

Investing in the Energy Transition, ESG and<br />

the Economies<br />

A NEW ENERGY BANK FOR<br />

AFRICAN OIL AND GAS<br />

WHAT DOES<br />

THE AFCFTA<br />

MEAN FOR IP?<br />

COUNTRY PROFILES:<br />

ANGOLA & MAURITIUS<br />

MITIGATING THE GLOBAL<br />

LOGISTICS CRUNCH<br />

Diversification is the way to go<br />

for <strong>African</strong> business<br />

THE WINDS OF ENERGY CHANGE<br />

ARE BLOWING IN AFRICA<br />

THE CASE FOR CAPTIVE POWER<br />

Aggreko’s MAX SCHIFF lays out the argument for captive power<br />

as an energy solution in many and varied <strong>African</strong> contexts<br />

periodically, along with country pr<strong>of</strong>iles.<br />

The positive reception accorded the first<br />

issues <strong>of</strong> The <strong>Journal</strong> <strong>of</strong> <strong>African</strong> <strong>Business</strong><br />

was encouraging and we are optimistic<br />

that this publication and future issues will<br />

continue to meet the need for timely and<br />

relevant information in an exciting time for<br />

<strong>African</strong> business.<br />

In this edition, the in-depth interview<br />

with Aggreko Head <strong>of</strong> Sales, Southern<br />

East Africa, Max Schiff, makes clear how<br />

important captive power is for the future<br />

viability <strong>of</strong> a wide variety <strong>of</strong> projects in<br />

Africa. As Schiff points out, the extractives<br />

industry has long been a leader in the application <strong>of</strong> captive power, given the remote<br />

location <strong>of</strong> many mining operations, but the flexibility and ESG advantages that<br />

captive power using renewables <strong>of</strong>fers is making it an ever-more attractive option<br />

for many different sectors.<br />

The two pr<strong>of</strong>iled countries in this issue are Angola and Mauritius.<br />

FTI Consulting has done a deep-dive into the challenges facing the <strong>African</strong><br />

mining sector in the era <strong>of</strong> enhanced environmental, social and governance<br />

reporting (ESG), the report on which is published here.<br />

Another article notes that Afreximbank and the <strong>African</strong> Petroleum Producers<br />

Organization (APPO) have signed a memorandum <strong>of</strong> understanding (MoU) for the<br />

creation <strong>of</strong> a multi-billion-dollar energy bank while renewable energy is the topic<br />

<strong>of</strong> an International Finance Corporation (IFC) study on Africa’s immense onshore<br />

wind potential is immense.<br />

Two partners at Spoor & Fisher interrogate the Intellectual Property<br />

considerations <strong>of</strong> the <strong>African</strong> Continental Free Trade Area, while Philip<br />

Myburgh, Head <strong>of</strong> Trade and Africa-China, <strong>Business</strong> and Commercial Clients<br />

for Standard Bank, comments on multiple factors which have caused turmoil in<br />

trade and logistics.<br />

Finally, two articles examine different aspects <strong>of</strong> tourism in Africa today. A brand<br />

initiative to find the “Best Places in Africa” has been announced and Zimbabwe has<br />

a smart new hotel on the banks <strong>of</strong> the Zambezi River.<br />

Global Africa Network is a proudly <strong>African</strong> company which has been producing<br />

region-specific business and investment guides since 2004, including South <strong>African</strong><br />

<strong>Business</strong> and Nigerian <strong>Business</strong>, in addition to its online investment promotion<br />

platform www.globalafricanetwork.com<br />

JOHN YOUNG<br />

Editor, <strong>Journal</strong> <strong>of</strong> <strong>African</strong> <strong>Business</strong><br />

Email: john.young@gan.co.za<br />

Editor: John Young<br />

Publishing director: Chris Whales<br />

Managing director: Clive During<br />

Online editor: Christ<strong>of</strong>f Scholtz<br />

Design: Simon Lewis. Production: Yonella Ncaba<br />

Ad sales: Venesia Fowler, Tennyson Naidoo,<br />

Sam Oliver, Tahlia Wyngaard, Gavin van<br />

der Merwe, Graeme February, Shiko Diala,<br />

Gabriel Venter and Vanessa Wallace<br />

Administration & accounts: Charlene<br />

Steynberg, Kathy Wootton<br />

Distribution & circulation manager: Edward MacDonald<br />

The <strong>Journal</strong> <strong>of</strong> <strong>African</strong> <strong>Business</strong> is<br />

published by Global Africa Network Media (Pty) Ltd<br />

Company Registration No: 2004/004982/07<br />

Directors: Clive During, Chris Whales<br />

Physical address: 28 Main Road, Rondebosch 7700<br />

Postal: PO Box 292, Newlands 7701<br />

Tel: +27 21 657 6200 | Email: info@gan.co.za<br />

Website: www.globalafricanetwork.com<br />

2<br />

No portion <strong>of</strong> this book may be reproduced without<br />

written consent <strong>of</strong> the copyright owner. The opinions<br />

expressed are not necessarily those <strong>of</strong> The <strong>Journal</strong> <strong>of</strong><br />

<strong>African</strong> <strong>Business</strong> magazine, nor the publisher, none <strong>of</strong><br />

whom accept liability <strong>of</strong> any nature arising out <strong>of</strong>, or<br />

in connection with, the contents <strong>of</strong> this publication.<br />

The publishers would like to express thanks to those<br />

who support this publication by their submission <strong>of</strong><br />

articles and with their advertising. All rights reserved.<br />

Printing: FA Print<br />

Member <strong>of</strong> the Audit Bureau <strong>of</strong> Circulations

Mauritius gained independence from the United Kingdom in 1968. English is the<br />

<strong>of</strong>ficial language <strong>of</strong> the legislative body but Creole is the dominant language with<br />

Bhojpuri and French accounting for about 10% between them.<br />

Just two years before independence, Britain expelled about 2 000 residents <strong>of</strong><br />

the Chagos archipelago and leased islands to the US for 50 years. A military base<br />

was built on the largest island, Diego Garcia. In 2019 the UN International Court<br />

<strong>of</strong> Justice gave a non-binding legal opinion that the islands had not been legally<br />

separated and that Britain should end its control.<br />

Former President Sir Anerood Jugnauth became Prime Minister for the third<br />

time in 2014 but resigned in 2017 to make way for his son Pravind Kumar Jugnauth,<br />

the leader <strong>of</strong> the Militant Socialist Movement party. The president is head <strong>of</strong> state in<br />

a Westminster-type system and the role is largely symbolic.<br />

Credit: Dominik Ruhl/Pexels<br />

Capital: Port Louis. Other towns/cities: Vacoas-Phoenix, Beau Bassin-Rose Hill, Curepipe,<br />

Quatre Bornes. Population: 1.3-million (2022). GDP: $14-billion (2019).<br />

Real GDP per capita: $19 500 (2020). Currency: Mauritian rupee.<br />

Regional Economic Community: Southern <strong>African</strong> Development Community (SADC),<br />

Common Market for Eastern and Southern Africa (COMESA), Indian Ocean Rim Association.<br />

Landmass: 2 040km 2 (all islands), Island <strong>of</strong> Mauritius 1 864km 2 . Coastline: 177km.<br />

Resources: Sugar cane, tea, banana, pulses, potatoes, fish.<br />

Main economic sectors: Sugar milling, textiles, tourism, financial services.<br />

Other sectors: Mining, chemicals, metal products, transport equipment,<br />

machinery. New sectors for investment: Creative sector (film),<br />

higher education, ICT, retail, medical tourism.<br />

Key projects: Positioning as a hub for the rest <strong>of</strong> Africa<br />

for logistics, re-export and trade. Smart city projects.<br />

Chief exports: Clothing, sugar cane, processed fish,<br />

molasses, cut flowers. Top export destinations: France,<br />

US, UK, South Africa, Madagascar, Italy, Spain.<br />

Top import sources: India, China, France, South Africa. Main imports:<br />

Chemicals, equipment, foodstuffs, manufactured goods, petroleum products.<br />

Infrastructure: Export Processing Zone; Sir Seewoosagur Ramgoolam<br />

International Airport at Plaisance about 50km from Port Louis, an airstrip at<br />

Plaine Corail on Rodrigues; 2 150km <strong>of</strong> roads, 98% paved; Port Louis harbour<br />

has a container terminal and terminals for sugar, oil, wheat and cement.<br />

ICT: Mobile subscriptions per 100 inhabitants: 150 (2020). Internet percentage <strong>of</strong><br />

population: 65% (2020). ICT Development Index 2017 (ITU) ranking: 1 in Africa,<br />

72 in world. Climate: Maritime subtropical modified by south-east trade winds. Cyclones<br />

can occur. Warm, dry winter (May to November); hot, wet, humid summer. A fertile<br />

central plateau is surrounded by mountains and the island is ringed by coral reefs.<br />

Religion: Hindu, Christian about 30% (majority Roman Catholic), Muslim, other.<br />

Global investors are shying away from<br />

hydrocarbons, leaving the continent<br />

without the investment it needs if<br />

it is to capitalise on its resources.<br />

Credit: Pixabay<br />

Sara Powell, Managing Director,<br />

Sustainability and ESG at FTI<br />

Consulting United Kingdom<br />

Lake Turkana Wind Farm is not<br />

only one <strong>of</strong> Africa’s biggest wind<br />

projects, it also, at $650-million,<br />

represents the single-largest<br />

private investment in Kenya.<br />

Kenya Power buys power from<br />

the facility, which generates<br />

310MW <strong>of</strong> energy. Credit: LTWP<br />

Please define “captive power”.<br />

There are numerous definitions and types <strong>of</strong> captive power. Most<br />

commonly it is defined as “behind the meter” energy, power that<br />

is generated at the user site, rather than imported from a wider<br />

grid transmission system via an energy meter.<br />

The scale, sources and applications <strong>of</strong> captive power differ<br />

significantly. While it could be at a household level, for this<br />

discussion we are talking about industrial and commercial<br />

applications. This may include manufacturing plants with onsite<br />

generation, such as sugar factories using thermal power from<br />

burning bagasse to generate steam to drive a turbine, industrial<br />

Remote mining destinations such as this one in the Democratic Republic <strong>of</strong> the<br />

Congo must use captive power to support their operations. Credit: Aggreko<br />

Pan-<strong>African</strong> multilateral trade finance institution, the <strong>African</strong><br />

Export-Import Bank (Afreximbank), has signed a Memorandum<br />

<strong>of</strong> Understanding (MoU) with the <strong>African</strong> Petroleum Producers<br />

Organization (APPO) for the creation <strong>of</strong> a multi-billion-dollar<br />

energy bank. Aimed at scaling up private sector investment<br />

in <strong>African</strong> oil and gas projects, the bank will provide critical<br />

financing for new and existing oil and gas projects, as well as<br />

energy developments across the entire value chain. Following<br />

international oil company divestment and the shift in global<br />

investment trends, the bank comes at a particularly critical time<br />

for Africa’s energy sector.<br />

The MoU was signed by Rene Awambeng, Director and Global<br />

Head, Client Relations, Afreximbank, and Dr Omar Farouk,<br />

Secretary General <strong>of</strong> APPO, in the presence <strong>of</strong> HE João Lourenço,<br />

President <strong>of</strong> the Republic <strong>of</strong> Angola, APPO ministers and <strong>African</strong><br />

Energy Chamber (AEC) Executive Chairman NJ Ayuk.<br />

While the developed world calls for the end <strong>of</strong> fossil fuels due<br />

to climate change, Africa continues to face the crisis <strong>of</strong> energy<br />

The demand-side <strong>of</strong> global energy places immense pressure<br />

on the mining sector, which is perceived to make a significant<br />

contribution to CO2 emissions. Now, mining companies with<br />

extensive social and environmental footprints are coming under<br />

greater scrutiny by investors, civil society and governments. In<br />

Africa, the ESG challenge is the legacy <strong>of</strong> environmental damage<br />

Outside <strong>of</strong> a limited number <strong>of</strong> countries, wind turbines have<br />

remained a rare sight in Africa. But this is not for lack <strong>of</strong> potential.<br />

In 2020, a study by the International Finance Corporation<br />

(IFC) found that continental Africa possesses an onshore wind<br />

potential <strong>of</strong> almost 180 000 TWh/annum, enough to satisfy<br />

the entire continent’s electricity needs 250 times over. As the<br />

continent continues to seek ways to expand energy access, the<br />

adoption <strong>of</strong> wind as a source <strong>of</strong> energy is expected to accelerate.<br />

To date, only Morocco, Egypt and South Africa have been<br />

truly successful in harnessing their wind potential and attracting<br />

private capital to set up wind parks. Through its widelyacclaimed<br />

Renewable Energy Independent Power Producer<br />

Procurement Programme (REIPPPP), South Africa has already<br />

commissioned 34 wind farms with an installed capacity <strong>of</strong> over<br />

3.3GW, according to the country’s IPP Office.<br />

And this is far from over. In 2021, the South <strong>African</strong> Ministry<br />

<strong>of</strong> Mineral Resources and Energy announced 25 successful<br />

parks or tea farms with ro<strong>of</strong>top or ground-mounted solar PV<br />

arrays, manufacturing plants with onsite gas power generation<br />

using a turbine or reciprocating engine running on piped gas,<br />

biogas or even associated petroleum gas (flare gas); or even onsite<br />

wind turbines powering mine sites or other commercial or<br />

industrial facilities. The list goes on.<br />

Is this something that is growing in the world?<br />

As with the overall demand for power, there is a growing demand<br />

for captive power globally. Depending on the circumstances,<br />

demand may be driven by environmental, social and governance<br />

poverty. Over 600-million people lack access to electricity and<br />

900-million lack access to clean cooking solutions. This situation<br />

has led stakeholders to call for the rapid expansion <strong>of</strong> the oil and<br />

gas sector, recognising the role these resources play in making<br />

energy poverty history. Despite these calls, global investors are<br />

shying away from hydrocarbons, leaving the continent without<br />

the investment it needs if it is to capitalise on its resources.<br />

According to the AEC’s Q1 2022 report, “The State <strong>of</strong> <strong>African</strong><br />

Energy”, from the peak in 2014 at $60-billion, capital expenditure<br />

in Africa declined to $22.5-billion in 2020. Despite projected<br />

increases to $30-billion, significant levels <strong>of</strong> investment are still<br />

required and for this to happen, the role <strong>of</strong> <strong>African</strong> financial<br />

institutions is vital.<br />

Catalyst for Africa-directed investment<br />

Organisations such as Afreximbank have already made notable<br />

progress to drive oil and gas project developments. At the end<br />

<strong>of</strong> 2020, Afreximbank’s total assets and guarantees stood at<br />

and irresponsible mining practices, therefore there is a need to<br />

create guidelines for the continent.<br />

In “Evolution in <strong>African</strong> Mining: Investing in the Energy<br />

Transition, ESG and the Economies”, FTI Consulting addresses<br />

the questions and possible responses on growth, costs, risks,<br />

capabilities and licences to operate that confront the mining<br />

sector in Africa and globally today.<br />

Based on research gathered through the FTI Consulting<br />

Resilience Barometer 2022, the mining sector seems to be under<br />

the most pressure from the current focus on ESG concerns. In fact,<br />

nearly half <strong>of</strong> the companies polled reported that they are under<br />

increased pressure, and one-third said that they are falling short<br />

on ESG reporting. As a result, while recognising international<br />

decarbonisation goals, mining and metals companies understand<br />

that their own ESG goals are now under ever-closer scrutiny.<br />

“The ESG shift does not mean discarding possible down-side<br />

risks. Instead, it is seen as having a business strategy that seeks<br />

new opportunities from the transition to sustainability that is<br />

underway, understanding that there will be disruptions and<br />

unknown risks to manage within this,” says Petrus Marais, Head<br />

<strong>of</strong> FTI Consulting South Africa practice.<br />

These factors will impact the sector across four major areas<br />

<strong>of</strong> concern.<br />

STAKEHOLDER ENGAGEMENT<br />

While one in five companies in the extractives sector stated<br />

they were under pressure to strengthen external stakeholder<br />

relationships, one in two chief risk <strong>of</strong>ficers felt “extreme<br />

pressure” to improve external stakeholder relationships. Greater<br />

bidders under its REIPPPP Bid Window 5, including 12 wind<br />

farms with a total capacity <strong>of</strong> 1 600MW.<br />

Bid Window 6, which was due to allocate a maximum<br />

capacity <strong>of</strong> 1 600MW <strong>of</strong> wind, with projects ranging from<br />

50MW to 240MW, was doubled in capacity by President<br />

Cyril Ramaphosa very soon after its initial announcement, in<br />

response to the problems the country has been having with<br />

rolling blackouts.<br />

Up north, Morocco and Egypt continue to drive wind-energy<br />

developments. The latter has an installed wind-generation<br />

capacity <strong>of</strong> almost 1.5GW across 13 wind farms, according to<br />

its Ministry <strong>of</strong> Energy. It now expects to commission another<br />

2GW by 2025 with an additional 14 wind farms.<br />

On the other side, Egypt has seen fewer but bigger projects.<br />

Its four wind farms have a current installed capacity <strong>of</strong> 1.6GW.<br />

The most recent one, West Bakr, was commissioned by Lekela<br />

Power in November 2021.<br />

$21.5-billion, with shareholder funds amounting<br />

to $3.4-billion. Other institutions, including<br />

the <strong>African</strong> Development Bank with an active<br />

portfolio <strong>of</strong> projects upwards <strong>of</strong> $12-billion, also<br />

represent critical providers across the <strong>African</strong><br />

energy landscape. However, more needs to be done,<br />

and if large-scale discoveries such as those made<br />

in Namibia and Ivory Coast are to be sufficiently<br />

developed, more capital needs to be made available.<br />

Stepping into this picture, the Afreximbank-<br />

APPO MoU aims to alleviate these challenges,<br />

ensuring the provision <strong>of</strong> capital for Africa’s<br />

upcoming oil and gas projects. Based in Africa,<br />

the bank will operate as an independent entity,<br />

regulated and led by experienced pr<strong>of</strong>essionals who<br />

know and understand Africa’s energy needs. The<br />

proposed bank will not be a substitute for private<br />

investment, however, but rather will serve as a<br />

catalyst for Africa-directed investment.<br />

NJ Ayuk, Executive Chairman <strong>of</strong> the AEC, says:<br />

“The <strong>African</strong> Energy Chamber has been pushing for<br />

the creation <strong>of</strong> an <strong>African</strong> Energy Bank, one that is<br />

<strong>African</strong>-based and Africa-focused, and I am proud<br />

to announce that the Afreximbank and APPO have<br />

taken the first steps towards its creation. The bank<br />

will be critical for Africa’s energy sector, serving as<br />

a catalyst – not a substitute – for private investment<br />

in <strong>African</strong> energy. This is a practical strategy for<br />

prosperity and a pragmatic vision that must be<br />

embraced by all who want to make energy poverty<br />

history and fight climate change.<br />

“Why should our pension funds go to European<br />

banks who say they will not finance <strong>African</strong>s and<br />

call us risky? We need to use that money to finance<br />

oil and gas,” states Ayuk.<br />

The proposed <strong>African</strong> Energy Bank will operate<br />

in the same way as the APPO-created Africa<br />

Energy Investment Corporation – a developmental<br />

financial institution created to channel resources<br />

towards the development <strong>of</strong> Africa’s energy sector.<br />

In addition to ensuring capital is made available for<br />

<strong>African</strong> oil and gas, the bank will serve as a vessel for<br />

mobilising <strong>African</strong>-sourced finance. Rather than<br />

utilising international banks for pension funds, the<br />

bank will serve as an investment corporation that<br />

will channel these funds into <strong>African</strong> projects. This<br />

will ensure high returns <strong>of</strong> investment as well as the<br />

development <strong>of</strong> Africa’s energy sector.<br />

The benefits will be two-fold: the funds will help<br />

drive oil and gas development while the oil and gas<br />

projects will drive socio-economic growth through<br />

the increase in access to energy. Accordingly, the<br />

role this bank will play is pivotal.<br />

collaboration with external stakeholders, including customers<br />

and the supply chain, will be essential in embedding the demands<br />

<strong>of</strong> a circular economy in the mining lifecycle to reduce its carbon<br />

footprint and ensure improved materials footprints.<br />

ESG<br />

The mining sector finds itself at a complex juncture requiring<br />

transition management strategies that acknowledge the<br />

increased demand for raw materials driven by the mineralintensive<br />

clean energy technology and a more aggressive stance<br />

on curbing their environmental impact. The global strategy<br />

along the decarbonisation and ESG compliance route is complex<br />

and multifaceted and it will alter the mining sector, while also<br />

providing opportunities and challenges.<br />

CIRCULAR ECONOMY<br />

The mining sector is aware <strong>of</strong> the complex environmental risks –<br />

primarily from mining waste – that accompany its operations, and<br />

the option <strong>of</strong> displacing those from one environment to another<br />

is no longer tenable. Implementing circular economy thinking,<br />

such as focusing “on getting more from less” and adhering to<br />

waste-reducing principles – reduce, reuse, recycle – will improve<br />

DEVELOPMENT AND MULTILATERAL FINANCE<br />

Across the rest <strong>of</strong> the continent, multilateral and development<br />

finance institutions (DFIs) have played a key role in supporting<br />

the emergence <strong>of</strong> the wind sector.<br />

West Africa has increasingly harnessed its wind potential<br />

with facilities commissioned in Cabo Verde (Cabeólica, 2011),<br />

Senegal (Taiba Ndiaye, 2019) and Mauritania (Boulenouar,<br />

2020). The projects received significant backing from the likes<br />

<strong>of</strong> the Africa Finance Corporation (AFC), the US International<br />

Development Finance Corporation (DFC) and the Arab Fund for<br />

Economic and Social Development (AFESD).<br />

They have successfully laid the ground for more projects to<br />

follow. In December 2021, the DFC notably provided funding for<br />

a feasibility study to expand Senegal’s 158.7MW Taiba Ndiaye<br />

Wind Farm by another 100MW.<br />

East Africa is also joining the game, led by Kenya. After<br />

the expansion <strong>of</strong> the Ngong facility in 2014, the country<br />

commissioned the 310MW Lake Turkana Wind Farm in 2017<br />

and the 100MW Kipeto Wind Farm in 2021. The <strong>African</strong><br />

Development Bank (AfDB) was the mandated lead arranger on<br />

Lake Turkana’s debt package and managed to attract several<br />

leading European DFIs to finance the project. The Kipeto project<br />

was mostly funded by the DFC.<br />

After its success in Cabo Verde, the AFC has moved east where<br />

it is the lead developer on Djibouti’s Red Sea Wind Power Project<br />

in Ghoubet. The 60MW facility is nearing completion and is the<br />

country’s very first independent power producer (IPP).<br />

AN IDEAL CHOICE TO CUT CARBON EMISSIONS<br />

More recently, natural resources and extractive industries<br />

have provided an additional driver <strong>of</strong> wind-energy adoption in<br />

Africa. Publicly-listed oil and gas and mining companies seeking<br />

to decarbonise their portfolio and cut carbon emissions across<br />

their operations are looking at wind projects.<br />

In March 2022, Savannah Energy executed an agreement with<br />

the Ministry <strong>of</strong> Petroleum, Energy and Renewable Energies <strong>of</strong><br />

(ESG) targets, by the high costs <strong>of</strong> implementing peak-utility<br />

tariffs, by intermittency or fluctuations on national grids, or<br />

even by the total absence <strong>of</strong> a grid in many areas <strong>of</strong> the world.<br />

Where captive power can be cleaner, cheaper and/or more<br />

reliable than grid supply, then there is motivation to assess the<br />

return on investment (ROI) by supplementing or substituting<br />

the grid with a captive-power source.<br />

The extractives industry, such as the mining <strong>of</strong> minerals or<br />

oil and gas, <strong>of</strong>ten operates in unconnected regions. Yet the<br />

industry requires stable power to avoid loss <strong>of</strong> production <strong>of</strong><br />

high-value materials which cover the related high operating<br />

and capital costs <strong>of</strong> such industries. In such cases, captive power<br />

is the only option.<br />

However, the question remains, how to secure reliable power<br />

and avoid intermittency while achieving maximum renewable<br />

penetration and remaining cost-effective? This is a question<br />

driving significant investment in the development <strong>of</strong> control<br />

systems and battery storage required to improve the trade<strong>of</strong>f<br />

between carbon reduction via renewable penetration and<br />

CREDIT: Emmaus Studio on Unsplash<br />

the sector’s sustainability and long-term pr<strong>of</strong>its. Such practices<br />

would go a long way towards satisfying stakeholder concerns<br />

around ESG compliance.<br />

SOCIETAL IMPACT OF MINING<br />

There is far more at stake in the mining sector than increasing<br />

exploration costs. The cost <strong>of</strong> ignoring the S in ESG can be massive.<br />

The complex ESG environment means businesses are under the<br />

scrutiny <strong>of</strong> social activists, shareholders, regulators, consumers<br />

and the media. Crucial to this success will be the management and<br />

monitoring <strong>of</strong> carbon and wider materials footprint by accurately<br />

quantifying, measuring and communicating the data collection.<br />

Research shows that 90% <strong>of</strong> the mining sector sees the need to<br />

align business strategy to social purposes. In addition, 90% also saw<br />

the transition to a more sustainable business model opening the<br />

doors to new opportunities. As Sara Powell, Managing Director,<br />

Sustainability and ESG at FTI Consulting United Kingdom, says,<br />

“Organisations – across every industry – that ignore the acceleration<br />

towards net-zero will not only be highly vulnerable to climate risks<br />

but will also be ill-prepared to capture far greater stakeholder value<br />

by acting on transition-led opportunities.”<br />

The full report can be seen at: www.fticonsulting.com<br />

the Republic <strong>of</strong> Niger to develop the country’s first wind farm.<br />

Savannah Energy, operator <strong>of</strong> some <strong>of</strong> the most prolific oil blocks<br />

in Niger, is planning to construct and operate the 250MW<br />

facility in the Tahoua Region. The wind farm will be structured<br />

as an IPP and is currently in feasibility study. It is expected to<br />

be sanctioned in 2023 for a potential commissioning in 2025.<br />

In Zambia, First Quantum Minerals (FQM) entered into a<br />

new partnership with Chariot and Total Eren in 2022 to develop<br />

430MW <strong>of</strong> solar and wind power for its mining operations. The<br />

company operates Africa’s biggest copper mine by production<br />

in Zambia and it seeks to reduce its carbon footprint by 30%<br />

by 2025.<br />

In South Africa, Anglo American is embarking on an even<br />

bigger project with EDF Renewables. Both companies signed<br />

a Memorandum <strong>of</strong> Understanding in March 2022 to work<br />

reliability. This is an endeavour that Aggreko has invested in<br />

significantly in recent years, since it acquired the battery-storage<br />

provider Younicos in 2017.<br />

In much <strong>of</strong> the developing world, grid stability and<br />

electrification are lagging behind the developed world.<br />

Here, value drivers for captive power are more pronounced.<br />

Higher costs and less reliable power encourage captive power<br />

installations in industries that are less power intensive and that<br />

face lower value production losses due to power outages whether<br />

they are connected to a national grid or not. In the developed<br />

world, policies such as net metering provide financial motivation<br />

for commercial and domestic entities to install captive power<br />

solutions as excess power is sold back to the grid via smart meters,<br />

thereby allowing revenue from curtailed power and improving<br />

the ROI <strong>of</strong> the initial investment.<br />

In other geographies, there are regulatory caps and barriers<br />

placed on captive power installations. This is especially true<br />

for grid-connected industrial entities, as state-owned utilities<br />

attempt to prevent loss <strong>of</strong> market to captive solutions. South<br />

Africa experienced the opposite <strong>of</strong> this in 2021 when President<br />

Cyril Ramaphosa announced that the regulatory cap on selfgeneration<br />

in South Africa would increase from 10MW to<br />

100MW, thereby paving the way for increased competition<br />

from captive power installations. This was done in response<br />

to an ageing centralised generation infrastructure dependent<br />

on coal power assets that are not to be overhauled, for obvious<br />

environmental reasons.<br />

And in other parts <strong>of</strong> Africa?<br />

Africa presents an interesting scenario. As mentioned, cost,<br />

instability and access metrics trail much <strong>of</strong> the world and<br />

act to encourage investment in captive power due to a higher<br />

comparative ROI. This is not only driven by large <strong>of</strong>f-grid<br />

extractive <strong>of</strong>f-takers in the mining and oil and gas industry, but<br />

a broader range <strong>of</strong> factors.<br />

The extractives industry has been a leader in the captive power<br />

space for decades due to its <strong>of</strong>ten-remote locations. Capital<br />

investment in transmission and distribution infrastructure to<br />

connect to a high-cost and unreliable grid supply <strong>of</strong>ten does not<br />

make sense from a returns perspective. This is especially true<br />

About FTI Consulting<br />

FTI Consulting, Inc. is a global business<br />

advisory firm dedicated to helping<br />

organisations manage change, mitigate<br />

risk and resolve disputes: financial, legal,<br />

operational, political and regulatory,<br />

reputational and transactional. With<br />

more than 6 900 employees located in 30<br />

countries, FTI Consulting pr<strong>of</strong>essionals<br />

work closely with clients to anticipate,<br />

illuminate and overcome complex<br />

business challenges and make the<br />

most <strong>of</strong> opportunities. The company<br />

generated $2.78-billion in revenues<br />

during fiscal year 2021. In certain<br />

jurisdictions, FTI Consulting’s services<br />

are provided through distinct legal<br />

entities that are separately capitalised<br />

and independently managed.<br />

For more information, visit www.<br />

fticonsulting.com and connect on Twitter<br />

(@FTIConsulting), Facebook and LinkedIn.<br />

Reporting in the mining sector<br />

is becoming ever-more complex.<br />

Credit: Thungela Resources<br />

Akhfenir Wind Farm is owned by<br />

Nareva, a subsidiary <strong>of</strong> Morocco’s<br />

National Investment Company.<br />

Credit: Eurogrues Maroc.<br />

West Bakr Wind Farm, Egypt.<br />

Credit: Lekela<br />

Max Schiff, Head <strong>of</strong> Sales,<br />

Southern East Africa, Aggreko<br />

CONTENTS<br />

MAURITIUS<br />

The financial services sector is vibrant and growing.<br />

COUNTRY PROFILE<br />

Contents<br />

The <strong>Journal</strong> <strong>of</strong><br />

<strong>African</strong> <strong>Business</strong><br />

2<br />

4<br />

6<br />

10<br />

14<br />

16<br />

19<br />

22<br />

24<br />

26<br />

28<br />

29<br />

30<br />

32<br />

FOREWORD<br />

From the editor’s desk.<br />

NEWS FROM THE CONTINENT<br />

Recent investments, expansions and milestones.<br />

THE CASE FOR CAPTIVE POWER IN AFRICA<br />

Aggreko’s Max Schiff outlines how various captive power options can mitigate<br />

disruptions and how the company is investing heavily in battery-storage solutions.<br />

AFRICAN MINING IN THE ESG ERA<br />

FTI Consulting has done a deep-dive into the challenges facing the <strong>African</strong> mining sector<br />

in the era <strong>of</strong> enhanced environmental, social and governance reporting (ESG).<br />

A NEW ENERGY BANK AIMS TO INCREASE PRIVATE INVESTMENT IN AFRICAN OIL AND GAS PROJECTS<br />

Afreximbank and the <strong>African</strong> Petroleum Producers Organization (APPO) have signed a<br />

memorandum <strong>of</strong> understanding (MoU) for the creation <strong>of</strong> a multi-billion-dollar energy bank.<br />

THE WINDS OF ENERGY CHANGE ARE BLOWING IN AFRICA<br />

An International Finance Corporation (IFC) study has found that Africa’s onshore wind potential<br />

is immense. Green Energy Africa Summit records how that potential is being realised.<br />

HOW SOUTH AFRICA CAN POWER GREEN INVESTMENTS AND END LOADSHEDDING<br />

With South Africa’s energy crisis showing no sign <strong>of</strong> slowing down, Wesgro CEO<br />

Wrenelle Stander comments on the urgent need to accelerate green investments.<br />

WHAT ARE THE INTELLECTUAL PROPERTY CONSIDERATIONS OF THE AFCFTA?<br />

Two experts examine the intellectual property implications <strong>of</strong> the AfCFTA agreement.<br />

AFRICAN BUSINESSES SHOULD DIVERSIFY SUPPLY CHAINS TO MITIGATE THE GLOBAL LOGISTICS CRUNCH<br />

Philip Myburgh comments on multiple factors which have caused turmoil in trade and logistics.<br />

“BEST PLACES IN AFRICA” WILL SHINE A SPOTLIGHT ON AFRICAN BRANDS<br />

A new initiative to promote <strong>African</strong> brands in tourism, investment and citizen mobilisation.<br />

VICTORIA FALLS HAS A NEW LUXURY HOTEL<br />

The Palm River Hotel has opened on the banks <strong>of</strong> the Zambezi River.<br />

AFRICAN EVENTS<br />

Upcoming business and trade events in South Africa.<br />

COUNTRY PROFILE: ANGOLA<br />

A major oil producer is trying to diversify its economy<br />

COUNTRY PROFILE: MAURITIUS<br />

The financial services sector is vibrant and growing<br />

M<br />

Photo: Pixabay<br />

3<br />

31<br />

Photo: Pixabay<br />

A NEW ENERGY BANK AIMS TO INCREASE PRIVATE<br />

INVESTMENT IN AFRICAN OIL AND GAS PROJECTS<br />

Afreximbank and the <strong>African</strong> Petroleum Producers Organization (APPO) have signed a<br />

P<br />

memorandum <strong>of</strong> understanding (MoU) for the creation <strong>of</strong> a multi-billion-dollar energy bank.<br />

Tackling energy poverty in Africa will be at the heart <strong>of</strong> the bank’s mission.<br />

AFRICAN MINING IN THE ESG ERA<br />

FTI Consulting has done a deep-dive into the challenges facing the <strong>African</strong> mining sector in the era <strong>of</strong> enhanced<br />

environmental, social and governance reporting (ESG). What follows is a summary <strong>of</strong> the main points <strong>of</strong> the<br />

14-page study, “Evolution in <strong>African</strong> Mining. Investing in the Energy transition, ESG, and the Economies”.<br />

THE WINDS OF ENERGY CHANGE<br />

ARE BLOWING IN AFRICA<br />

T<br />

As the continent<br />

18<br />

Diversification <strong>of</strong> the continent’s wind energy sector is expected in response to the rollout <strong>of</strong> new projects in new<br />

regions. An International Finance Corporation (IFC) study has found that Africa’s onshore wind potential is immense. The<br />

organisers <strong>of</strong> the annual Green Energy Africa Summit compiled this article to record how that potential is being realised.<br />

continues to seek<br />

ways to expand energy<br />

access, the adoption<br />

<strong>of</strong> wind as a source<br />

<strong>of</strong> energy is expected<br />

to accelerate.<br />

T<br />

THE CASE FOR CAPTIVE POWER IN AFRICA<br />

Industry and mining require a stable supply <strong>of</strong> power to operate optimally, a requirement which<br />

cannot always be guaranteed in Africa. Aggreko’s Max Schiff outlines how various captive power<br />

options can mitigate disruptions and how the company is investing heavily in battery-storage<br />

solutions to assist in creating hybrid solutions which combine grid and renewable sources.<br />

24 12<br />

18 12<br />

19 13<br />

8<br />

19<br />

ENERGY FINANCE<br />

The proposed <strong>African</strong> Energy Bank will operate in the same way<br />

as the APPO-created Africa Energy Investment Corporation<br />

– a developmental financial institution created to channel<br />

resources towards the development <strong>of</strong> Africa’s energy sector.<br />

25 13<br />

9<br />

ESG IN POWER<br />

MINING<br />

WIND POWER<br />

Publicly-listed oil and gas<br />

and mining companies<br />

seeking to decarbonise<br />

their portfolio and cut<br />

carbon emissions across<br />

their operations are<br />

looking at wind projects<br />

ENERGY<br />

How to secure reliable<br />

power and avoid<br />

intermittency while<br />

achieving maximum<br />

renewable penetration<br />

and remaining<br />

cost-effective?

NEWS FROM ALL AROUND AFRICA<br />

Recent investments, expansions and milestones.<br />

SHELL ACQUIRES WEST AFRICAN HYBRID-SOLAR-POWER PROVIDER<br />

Daystar Power, a West <strong>African</strong> provider <strong>of</strong> hybrid-solar-power solutions to commercial solutions for commercial and industrial businesses. Daystar Power’s co-founders and<br />

and industrial businesses, will become a wholly-owned subsidiary <strong>of</strong> Shell following its management team will continue to grow its operations in key West <strong>African</strong> markets, while<br />

acquisition by Shell and the approval <strong>of</strong> regulatory authorities. The acquisition will allow expanding the company’s presence to other countries across the continent.<br />

Daystar to grow its operations in the region, while expanding across the <strong>African</strong> continent. Daystar Power’s clients pay a flat monthly fee or a variable tariff (per kilowatt hour)<br />

The existing brand will operate within Shell’s Renewables & Energy Solutions business. for premium power services, which include a power audit and assessment <strong>of</strong> energy<br />

Sub-Saharan Africa has abundant potential as a solar market, which is expected to grow needs, a bespoke proposal, installation and full operation and maintenance. Clients do<br />

due to the chronic energy gap. Daystar Power, which numbers among its projects the fitting not incur any capital expenditure and do not pay up-front costs. By outsourcing the<br />

<strong>of</strong> a solar system to the Brazilian Embassy in Lagos (pictured), aims to increase its installed management <strong>of</strong> their power systems, Daystar Power clients can focus more on running<br />

solar capacity to 400MW by 2025 to become one <strong>of</strong> Africa’s leading providers <strong>of</strong> solar power their core businesses.<br />

HEAD START FOR AFRICAN AIRLINES AFTER PANDEMIC<br />

With no travel allowed during the worst months <strong>of</strong> the Covid-19 pandemic, some airlines<br />

switched to ferrying vital cargo. But most fleets were grounded. Rolls-Royce took the<br />

opportunity to complete an extensive maintenance programme on their AE3007 engines<br />

in the region, upgrading to the latest standards without charge. This allowed operators<br />

Credit: Airlink<br />

to comply with an Airworthiness Directive (necessary for all grounded aircraft) before<br />

operations restarted, giving them an all-important head start.<br />

Rolls-Royce has also signed an important extension <strong>of</strong> its TotalCare maintenanceservice<br />

agreement with South <strong>African</strong> airline, Airlink. The airline’s 28-aircraft<br />

Embraer ERJ fleet is powered by Rolls-Royce engines and the relationship has<br />

been going since 2001. Airlink’s on-time performance is consistently above 97%.<br />

TotalCare is predicated on maintenance schedules running at a fixed cost per engine<br />

flying hour. The service is underpinned by predictive maintenance which relies on<br />

extensive gathering and analysis <strong>of</strong> performance data, which helps engineers to<br />

diagnose potential future faults and act on them to avoid downtime.<br />

Rolls-Royce has stated that it intends to prove that all its aero engines will be able<br />

to run on 100% Sustainable Aviation Fuel by the end <strong>of</strong> 2023. Any sustainable fuel that<br />

meets the D1655 jet fuel standard and requirements is now approved for use in AE3007<br />

engines. Currently, seven different blend varieties can be used, some being certified<br />

to blend up to 50% with conventional jet fuel, dramatically reducing carbon footprints.<br />

4

NEWS<br />

LOW-EARTH ORBIT SATELLITES HOLD POTENTIAL FOR RURAL CONNECTIVITY<br />

World Mobile is expanding its network across<br />

the <strong>African</strong> continent following a series <strong>of</strong><br />

successful pilot tests using low-earth orbit<br />

(LEO) satellites in the US and UK. Positive<br />

results have been found in ongoing tests <strong>of</strong><br />

Starlink, one <strong>of</strong> the many LEO satellites.<br />

The company, which was founded in 2018,<br />

aims to provide affordable connectivity to<br />

rural and remote areas worldwide.<br />

The <strong>African</strong> continent currently sees less<br />

than a quarter the population having access<br />

to reliable Internet. Using innovative satellite<br />

and relay technology with stratospheric balloons, the first efforts <strong>of</strong> World Mobile are<br />

looking to provide connectivity in hard-to-reach areas within Tanzania, Kenya and Nigeria.<br />

World Mobile’s pilot tested the use <strong>of</strong> Starlink’s satellite network as a backhaul option for<br />

providing internet to World Mobile’s AirNodes (the network’s Internet access points). The<br />

connection delivered impressive broadband speeds, latency and stable connectivity with<br />

download speeds <strong>of</strong> up to 400Mbps.<br />

World Mobile’s dynamic network adapts its connectivity infrastructure to the needs <strong>of</strong><br />

each region, allowing it to deliver efficient and affordable connectivity where other mobile<br />

operators cannot reach.<br />

The pilot tests conducted by World Mobile and its partners demonstrated that remote<br />

connectivity with the LEO satellite, which serves as a constellation network connecting World<br />

Mobile’s AirNodes, can provide robust Wi-Fi services. In Zanzibar, World Mobile is targeting<br />

areas where there is minimal or no connectivity. It is underway in deploying its hybridmesh<br />

network to deliver affordable mobile connectivity in the region through a network<br />

<strong>of</strong> AirNodes and aerostats with a coverage radius <strong>of</strong> up to 70km. In addition to rolling out in<br />

Tanzania and Kenya, World Mobile is in advanced talks about expanding its network to other<br />

<strong>African</strong> countries, such as Mozambique and Nigeria. The company’s unique <strong>of</strong>fering provides<br />

low-cost connectivity in areas that traditional operators cannot reach, while also enabling<br />

entrepreneurs to own or operate a portion <strong>of</strong> the network and benefit from its adoption.<br />

Orange Botswana became the first Orange affiliate in Africa to<br />

launch 5G commercially and the country’s first Orange Digital<br />

Center made it the company’s 12th such training centre in<br />

Africa and the Middle East<br />

The Digital Centers are designed to train young people in<br />

digital technology and enhance their employability. Previous<br />

countries to host a Digital Center are Tunisia, Senegal,<br />

Ethiopia, Mali, Ivory Coast, Cameroon, Egypt, Jordan,<br />

Madagascar, Morocco and Liberia.<br />

Spread over 390 square metres, it brings together several<br />

strategic programmes <strong>of</strong> the Orange group, namely, a coding<br />

school, a solidarity FabLab (one <strong>of</strong> the Orange Foundation’s<br />

digital manufacturing workshops) and an Orange Fab start-up<br />

accelerator, supported by Orange Ventures Middle East and<br />

Africa, the investment fund <strong>of</strong> Orange Group.<br />

All the programmes are provided free-<strong>of</strong> charge and are<br />

ORANGE BOTSWANA BLOSSOMED IN 2022 WITH TWO BIG LAUNCHES<br />

open to everyone. They range from digital training for young<br />

people, 90% <strong>of</strong> which are practical, guidance for project<br />

bearers, start-up acceleration and investment in these.<br />

Working as a network, the Orange Digital Centers allow<br />

experiences and expertise to be shared between countries<br />

and <strong>of</strong>fer a simple and inclusive approach to improve<br />

enabled in the country by the 5G technology. The 5G launch<br />

is aligned with the government’s ambition to leverage Fourth<br />

Industrial Revolution (4IR) innovation towards transforming<br />

Botswana into a knowledge-based economy.<br />

5G, with its ultra-high speed and low latency, will support<br />

new disruptive services such as e-health, connected vehicles,<br />

young people’s employability, encourage innovative connected cities, real-time gaming, smart homes and learning<br />

entrepreneurship and promote the local digital ecosystem. through VR and augmented reality. It <strong>of</strong>fers a new world <strong>of</strong><br />

In addition, Orange Botswana, in partnership with<br />

possibilities to companies, innovators and society at large.<br />

Orange Botswana has partnered with MRI Botswana to<br />

create a “Connected Ambulance” project that will allow<br />

doctors to guide paramedics through life-saving procedures<br />

on their way to hospitals. This telemedicine intervention will<br />

change lives and would not have been possible without 5G.<br />

After this first commercial launch <strong>of</strong> its 5G services<br />

in Botswana, Orange Middle East and Africa intends to<br />

maintain its efforts in getting the latest and most advanced<br />

technologies in all its MEA countries, adding value to local<br />

economies and bridging the digital gap.<br />

Orange is present in a total <strong>of</strong> 18 countries in Africa<br />

universities, will train students for free and roll out Orange<br />

Digital Center Clubs, extensions <strong>of</strong> the Orange Digital Center<br />

and the Middle East and has 142-million customers as <strong>of</strong><br />

30 September 2022.<br />

within some universities in the regions. This will complement<br />

the education system to give as many people as possible<br />

access to new technologies and support them in using these<br />

technologies to their full extent.<br />

The 5G network became available in greater Gaborone and<br />

Francistown, covering 30% <strong>of</strong> the population in November<br />

2022. Other cities will follow in early 2023.<br />

New healthcare, education and security services will be<br />

5

THE CASE FOR CAPTIVE POWER IN AFRICA<br />

Industry and mining require a stable supply <strong>of</strong> power to operate optimally, a requirement which<br />

cannot always be guaranteed in Africa. Aggreko’s Max Schiff outlines how various captive power<br />

options can mitigate disruptions and how the company is investing heavily in battery-storage<br />

solutions to assist in creating hybrid solutions which combine grid and renewable sources.<br />

Please define “captive power”.<br />

There are numerous definitions and types <strong>of</strong> captive power. Most<br />

commonly, it is defined as “behind the meter” energy or power<br />

that is generated at the user site, rather than imported from a<br />

wider grid transmission system via an energy meter.<br />

The scale, sources and applications <strong>of</strong> captive power differ<br />

significantly. While it could be at the household level, here we<br />

are talking about industrial and commercial applications. This<br />

may include processing plants with the onsite generation, such<br />

as sugar factories using thermal power from burning bagasse to<br />

generate steam to drive a turbine; industrial parks or farms with<br />

ro<strong>of</strong>top or ground-mounted solar PV arrays; manufacturing<br />

plants with onsite gas power generation such as turbines or<br />

reciprocating engines running on piped gas, biogas or even<br />

associated petroleum gas (flare gas); or onsite wind turbines<br />

powering mine sites or other commercial/industrial facilities.<br />

The list goes on.<br />

Is this something that is growing in the world?<br />

As with the overall power demand, there is a growing demand<br />

for captive power globally. Depending on the circumstances,<br />

demand may be driven by environmental and social governance<br />

Remote mining destinations such as this one in the Democratic Republic <strong>of</strong> the<br />

Congo must use captive power to support their operations. Credit: Aggreko<br />

6

ENERGY<br />

(ESG) targets, high-cost peak utility tariffs, intermittency or<br />

fluctuations <strong>of</strong> grid supplies, or even a total absence <strong>of</strong> a grid in<br />

many areas <strong>of</strong> the world.<br />

Where captive power can be cleaner, cheaper and/or more<br />

reliable than grid supply, then there is motivation to assess the<br />

return on investment (ROI) <strong>of</strong> supplementing or substituting the<br />

grid with a captive-power source.<br />

The extractives industry, such as the mining <strong>of</strong> minerals or<br />

oil and gas, <strong>of</strong>ten takes place in unconnected regions. It also<br />

requires stable power to maintain production <strong>of</strong> high-value<br />

materials to cover the high operating and capital costs <strong>of</strong> such<br />

industries. In such cases, captive power is the only option.<br />

However, today’s question is primarily how to secure reliable<br />

power and avoid intermittency while achieving maximum<br />

renewable penetration and remaining cost-effective? This is a<br />

question driving significant investment in control system and<br />

battery storage development required to improve the trade-<strong>of</strong>f<br />

between carbon reduction via renewable penetration and the<br />

reliability <strong>of</strong> thermal power. This is an endeavour that Aggreko<br />

has invested in significantly in the past six years, particularly<br />

since it acquired the battery storage provider Younicos in 2017.<br />

In much <strong>of</strong> the developing world grid stability and<br />

electrification lag behind the developed world. Here, the value<br />

drivers for captive power are more pronounced. Higher cost<br />

and less reliable power increase the ROI <strong>of</strong> captive power,<br />

even for industries that are less power intensive and produce<br />

lower-value goods and materials. In the developed world, net<br />

metering policies provide financial motivation for commercial<br />

and domestic entities to install captive power solutions as<br />

excess power is sold back to the grid via smart meters, allowing<br />

revenue from curtailed power, hence improving the ROI <strong>of</strong> the<br />

initial investment.<br />

In other geographies, there are regulatory caps and barriers<br />

placed on captive power installations, especially for gridconnected<br />

industrial entities, as state-owned utilities attempt<br />

to prevent loss <strong>of</strong> market to captive solutions. South Africa<br />

experienced the opposite <strong>of</strong> this in 2021 when President<br />

Cyril Ramaphosa announced that the regulatory cap on selfgeneration<br />

in South Africa would increase from 10MW to<br />

100MW, paving the way for increased competitors for the<br />

national grid from captive power installations. This was done<br />

in response to an ageing centralised generation infrastructure<br />

dependent on coal power assets that are not to be overhauled,<br />

for obvious environmental reasons.<br />

And in other parts <strong>of</strong> Africa?<br />

Africa presents an interesting scenario. As mentioned above,<br />

cost, instability and access metrics trail much <strong>of</strong> the world,<br />

thus encouraging investment in captive power due to a higher<br />

comparative ROI. This is not only driven by large <strong>of</strong>f-grid<br />

extractive <strong>of</strong>f-takers in the mining and oil and gas industry, but<br />

a broader range <strong>of</strong> actors.<br />

The extractives industry has been a leader in the captive power<br />

space for decades due to its <strong>of</strong>ten-remote locations. Capital<br />

investment in transmission and distribution infrastructure to<br />

connect to a high-cost and unreliable grid supply <strong>of</strong>ten does not<br />

make sense. This is especially true when critical applications<br />

are considered, such as underground mining where power<br />

outages not only present significant health and safety risks, but<br />

7<br />

How to secure reliable<br />

power and avoid<br />

intermittency while<br />

achieving maximum<br />

renewable penetration<br />

and remaining<br />

cost-effective?<br />

Max Schiff, Head <strong>of</strong> Sales,<br />

Southern East Africa, Aggreko

The extractives<br />

industry has been<br />

a leader in the<br />

captive power space<br />

for decades<br />

Battery storage systems are a vital<br />

component <strong>of</strong> any captive power<br />

solution, enabling hybridisation with<br />

grid or renewable sources. Getting<br />

batteries up to the scale where they<br />

can support large-scale industrial<br />

operations is the next technological<br />

challenge. Credit: Aggreko<br />

the risk <strong>of</strong> production losses, especially if mine shafts are prone<br />

to flooding. In many locations, such as Tanzania and Zambia,<br />

where the national grids have extended successfully in recent<br />

years, mines still require onsite generation as a backup for these<br />

critical applications. In the case <strong>of</strong> oil and gas, where production<br />

values are high, and producers are held accountable for<br />

production targets by their shareholders and, <strong>of</strong>ten, regulators,<br />

captive power is necessary to ensure reliability. Even highercost<br />

diesel applications are preferable to losses resulting from<br />

grid instability causing failure or damage to equipment used<br />

for artificial lift. We see extensive examples <strong>of</strong> this in Egypt’s<br />

Western Desert, where government mandates are now driving<br />

producers to move away from diesel by using flared gas to power<br />

site operations, resulting in significant carbon <strong>of</strong>f-sets without<br />

risking production.<br />

Equally, across the <strong>African</strong> continent, we see an increase in<br />

the application <strong>of</strong> captive power technologies on agricultural and<br />

commercial sites, where solar is proliferating as evidenced by the<br />

growth <strong>of</strong> solar power providers <strong>of</strong>fering industrial-scale solar<br />

PPAs. In many <strong>of</strong> them, PV is integrated with other local sources<br />

<strong>of</strong> power such as hydro or wind. In such cases, <strong>of</strong>f-takers can<br />

benefit from gains in all drivers, environmental, reliability and<br />

cost, while reducing capital investments through executing PPAs<br />

with companies <strong>of</strong>fering financed solutions. Kenya’s tea industry<br />

is a great example <strong>of</strong> this, despite the country’s competitive grid<br />

tariffs and high penetration <strong>of</strong> renewables in its national supply.<br />

As South <strong>African</strong> utility Eskom continues to implement<br />

the reliability maintenance recovery programme to achieve<br />

operational sustainability, many electricity generating units<br />

are taken <strong>of</strong>fline for planned maintenance which leaves the<br />

national power system constrained. The Embedded Generation<br />

Investment Programme (EGIP) is critical for South Africa to<br />

achieve its climate targets and reduce excess demand on Eskom.<br />

What are the reasons for the increased interest in<br />

captive power?<br />

There are several advantages. In the most basic example,<br />

captive solutions deliver power where the grid does not exist.<br />

8<br />

In grid-connected scenarios, captive solutions allow for<br />

the reduction <strong>of</strong> the cost <strong>of</strong> power, both economically and<br />

environmentally. Finally, reliability gains can have a significant<br />

knock-on effect on production, or assist in avoiding production<br />

losses, by overcoming intermittency and instability. Where<br />

grid voltage and frequency stability are a challenge, the same is<br />

true, and <strong>of</strong>f-takers can also avoid damage to costly machinery.<br />

This last point is especially true <strong>of</strong> sensitive processes such as<br />

smelting, clinker production and high-value mineral extraction<br />

and processing, where equipment values and operational costs<br />

are high, and downtime is therefore very costly.<br />

The ESG agenda is, <strong>of</strong> course, driving the captive power<br />

industry as corporates, financiers, regulators, households and<br />

individuals look for avenues to not only reduce their energy bills<br />

but also their environmental footprint. Household-level solar<br />

and battery walls that allow their stored energy to be returned to<br />

the grid if unused are a great example <strong>of</strong> this. We see growth in<br />

these applications in the US, albeit not at a significant scale yet.<br />

Finally, in areas facing challenges <strong>of</strong> energy access, capital<br />

investment in large-scale transmission systems to connect<br />

remote areas presents a hurdle that more local captive power<br />

solutions can overcome. Mini-grids and captive solutions avoid<br />

large-scale transmission investment and the associated losses<br />

while ensuring that locally available resources, such as solar,<br />

wind, tidal, biogas, etc, can be used to meet local demand.<br />

Is the regulatory (or legislative) environment ready for<br />

captive power in Africa?<br />

Regulation in Africa varies from one jurisdiction to another.<br />

In Uganda, distributed energy is regulated as part <strong>of</strong> a broader<br />

isolated-grid system approach administered by the government.<br />

Nigeria’s focused captive power regulation <strong>of</strong>fers clarity to<br />

consumers, operators and developers. In Kenya captive power<br />

systems are regulated through a number <strong>of</strong> separate regulations,<br />

arguably making a more complex environment for these actors.<br />

South Africa has begun an intense programme <strong>of</strong> creating<br />

Special Economic Zones: is this something you are seeing in<br />

other <strong>African</strong> countries, and why is captive power<br />

so particularly suitable for such areas?<br />

According to the United Nations Conference on<br />

Trade and Development (UNCTAD) 2021 report,<br />

there are over 200 Special Economic Zones (SEZs) in<br />

Africa. Around 60 new SEZs are under construction,<br />

and others are being developed or planned. The<br />

report highlights Kenya, Nigeria, Ethiopia and Egypt<br />

as the locations with the highest number <strong>of</strong> SEZs.<br />

Morocco, Mauritius, South Africa, Zanzibar and<br />

Rwanda are all looking to further leverage SEZs to<br />

attain economic development.<br />

Captive power <strong>of</strong>fers power autonomy and<br />

reliability to SEZs that may not be available from<br />

the existing utility infrastructure. For SEZs are<br />

also designed to create job opportunities in remote<br />

locations, captive power remains the only viable<br />

source <strong>of</strong> electricity.

ENERGY<br />

Would mining be another sector that lends itself to captive power?<br />

The key factor affecting the operation <strong>of</strong> mines in South Africa<br />

is the availability <strong>of</strong> a reliable, uninterrupted supply <strong>of</strong> power.<br />

South Africa’s well-publicised energy challenges mean that<br />

mines are not guaranteed to receive a reliable supply from the<br />

national power utility. In the recent months, loadshedding<br />

has reached a point where mining processes can no longer<br />

be organised to mitigate production losses due to power<br />

intermittency. Indeed, the current narrative is one that is<br />

characterised by such losses and pose a major challenge for<br />

the wider industry. Captive power options, particularly those<br />

with cost-effective hybrid elements, present for mines a great<br />

opportunity, especially mines with longer life spans.<br />

What are the cost implications <strong>of</strong> captive power?<br />

The real question is what value can captive power solutions<br />

<strong>of</strong>fer to businesses? This is to ask not only what the implications<br />

are for operating costs, but what benefits will be derived from<br />

a more reliable or a cleaner energy source? Where production<br />

and environmental gains outweigh operating costs, we can<br />

determine the value that underpins a return on investment. The<br />

parameters <strong>of</strong> this ROI vary significantly depending on the cost<br />

and quality <strong>of</strong> the existing supply, the fuel/energy available to be<br />

used to generate power onsite (be these from fossil or renewable<br />

sources), the cost <strong>of</strong> capital available to the investor and the<br />

duration <strong>of</strong> the power requirement, not to mention the value <strong>of</strong><br />

the service, material or goods being produced.<br />

What sort <strong>of</strong> solutions does Aggreko have within this market?<br />

Aggreko’s capabilities speak directly to the captive power space,<br />

particularly for larger industries.<br />

The energy transition is a global mandate for governments,<br />

companies and individuals alike. While the end goal is net<br />

zero, the process must be economically viable for stakeholders,<br />

including <strong>of</strong>f-takers, investors and developers, for the<br />

transmission to progress and be successful.<br />

Within this context, the key question <strong>of</strong> captive power<br />

is, “How to maximise reliability while minimising cost and<br />

environmental impacts?” For now, the trade-<strong>of</strong>f between these<br />

drivers remains a challenge. It will continue to do so until battery<br />

technologies can cost-effectively and seamlessly match large and<br />

complex loads to renewable power sources such that the agility<br />

and reliability <strong>of</strong> fossil-based thermal solutions are no longer<br />

required to perform this function.<br />

At present, it’s not possible to run a factory, mine, oil and gas<br />

site on intermittent class one renewable, such as wind and solar,<br />

without significantly curtailing production, in most cases to the<br />

point <strong>of</strong> the facility being economically unviable. Battery storage<br />

technologies are <strong>of</strong>ten not yet cost-effective enough to overcome<br />

this intermittency at such a scale. Historically, thermal power<br />

solutions, including diesel, gas and HFO, have been used due<br />

to two simple reasons: they are technically capable <strong>of</strong> powering<br />

complex industrial loads 24 hours a day, seven days a week, and<br />

fuels are widely available and easily transportable, especially in<br />

the case <strong>of</strong> diesel and increasingly gas. This is to say that the<br />

supply chains for the required technology and fuel are well<br />

developed and reliable.<br />

Aggreko’s role in the transition is aligned with that <strong>of</strong> the<br />

<strong>of</strong>f-takers in this regard. We recognise that fossil-based thermal<br />

power is necessary to ensure the economic and technical viability<br />

<strong>of</strong> captive solutions for many industries. This said, thermal<br />

generation must be as efficient as possible through investment in<br />

low-emission fuels and engines and application <strong>of</strong> load-sharing<br />

techniques that ensure efficient loading.<br />

Beyond this, Aggreko continues to invest in battery storage<br />

solutions that sit alongside our gas, diesel and HFO <strong>of</strong>ferings<br />

to enable hybridisation with grid or renewable sources. Our<br />

in-house control systems enable us to prioritise energy sources<br />

based on financial or environmental drivers specified by<br />

our customers and to match these to the relevant loads, ensuring<br />

continuity at the site. If the sun is shining or the wind is<br />

blowing, on-site renewable energy sources integrated by Aggreko<br />

can be employed and matched to the site loads. If the energy<br />

source drops, then stored energy can be deployed until a grid<br />

supply or onsite thermal generation is dispatched as a last resort.<br />

We see this as the essence <strong>of</strong> the transition as we continue our<br />

efforts and strive for greater and greater renewable energy<br />

penetration wherever possible. Aggreko will continue to invest<br />

in thermal, storage and controls solutions to enable this while<br />

working with renewable technology providers to ensure we <strong>of</strong>fer<br />

customers the greatest inflexion point between reliability and<br />

environmental protection.<br />

9<br />

Africa has more than 200 Special<br />

Economic Zones (SEZs), such<br />

as the Saldanha Bay Industrial<br />

Development Zone in South Africa’s<br />

Western Cape Province. Captive<br />

power can provide such important<br />

industrial and commercial<br />

areas with power autonomy<br />

and reliability. Credit: SBIDZ<br />

Mini-grids not only<br />

avoid large-scale<br />

transmission<br />

investment but<br />

also avoid the<br />

associated losses

AFRICAN MINING IN THE ESG ERA<br />