Journal of African Business Issue 4

Welcome to Journal of African Business, your guide to business and investment on the continent. The fourth edition of Journal of African Business is the second issue of this magazine to be published as a quarterly. The first two journals were published as annual publications in 2020 and 2021. The Journal of African Business covers a wide range of subjects within the broader economic sectors: energy; mining and exploration; trade; finance; technology and tourism. In addition to this, special features on topical matters are included, along with country profiles.

Welcome to Journal of African Business, your guide to business and investment on the continent. The fourth edition of Journal of African Business is the second issue of this magazine to be published as a quarterly. The first two journals were published as annual publications in 2020 and 2021.

The Journal of African Business covers a wide range of subjects within the broader economic sectors: energy; mining and exploration; trade; finance; technology and tourism. In addition to this, special features on topical matters are included, along with country profiles.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE JOURNAL OF<br />

AFRICAN<br />

BUSINESS<br />

SEPT / OCT / NOV 2022<br />

POWERING MINING<br />

IN AFRICA<br />

The rise <strong>of</strong> the mini-grid<br />

and the captive model<br />

ENERGY PARTNERSHIPS<br />

MUST BENEFIT SOCIETY<br />

Localisation can support<br />

women and children<br />

BLOCKCHAIN IS A<br />

DRIVER OF INCLUSION<br />

COUNTRY PROFILES:<br />

GHANA & KENYA<br />

THE EFFECT OF TRAVEL<br />

BANS ON TOURISM<br />

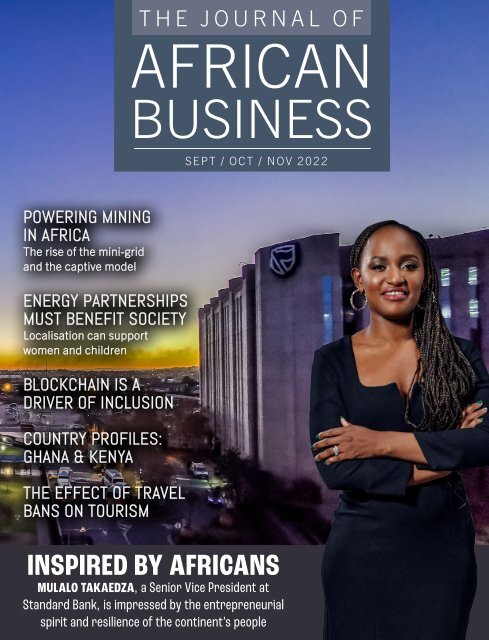

INSPIRED BY AFRICANS<br />

MULALO TAKAEDZA, a Senior Vice President at<br />

Standard Bank, is impressed by the entrepreneurial<br />

spirit and resilience <strong>of</strong> the continent’s people

CUTTING-EDGE<br />

SKILLS FOR<br />

REVOLUTIONARY<br />

LEADERS!<br />

Get ahead <strong>of</strong> the curve and stand out<br />

from the crowd through Executive<br />

Education at Wits <strong>Business</strong> School.<br />

For more information, visit: courses.wbs.ac.za

DIGITAL<br />

BUSINESS<br />

EXECUTIVE<br />

EDUCATION<br />

MANAGEMENT<br />

DEVELOPMENT<br />

LEADERSHIP<br />

&<br />

COACHING<br />

SPECIALISED<br />

FEATURED<br />

COURSES

FOREWORD<br />

<strong>Journal</strong> <strong>of</strong><br />

<strong>African</strong> <strong>Business</strong><br />

A unique guide to business and investment in Africa.<br />

Welcome to <strong>Journal</strong> <strong>of</strong> <strong>African</strong> <strong>Business</strong>, your guide to business and investment<br />

on the continent. The fourth edition <strong>of</strong> <strong>Journal</strong> <strong>of</strong> <strong>African</strong> <strong>Business</strong> is the second<br />

issue <strong>of</strong> this magazine to be published as a quarterly. The first two journals were<br />

published as annual publications in 2020 and 2021.<br />

Quarterly publication affords our team more opportunities to bring to readers<br />

up-to-date information and opinions and <strong>of</strong>fers our clients increased exposure at<br />

specific times <strong>of</strong> the year, either related to events and conferences or in conjunction<br />

with feature articles on specific topics.<br />

Our aim is to cover a wide range <strong>of</strong> subjects within the broader economic sectors:<br />

energy; mining and exploration; trade; finance; technology and tourism.<br />

POWERING MINING<br />

IN AFRICA<br />

The rise <strong>of</strong> the mini-grid<br />

and the captive model<br />

ENERGY PARTNERSHIPS<br />

MUST BENEFIT SOCIETY<br />

Localisation can support<br />

women and children<br />

BLOCKCHAIN IS A<br />

DRIVER OF INCLUSION<br />

COUNTRY PROFILES:<br />

GHANA & KENYA<br />

THE EFFECT OF TRAVEL<br />

BANS ON TOURISM<br />

THE JOURNAL OF<br />

AFRICAN<br />

BUSINESS<br />

SEPT / OCT / NOV 2022<br />

INSPIRED BY AFRICANS<br />

MULALO TAKAEDZA, a Senior Vice President at<br />

Standard Bank, is impressed by the entrepreneurial<br />

spirit and resilience <strong>of</strong> the continent’s people<br />

In addition to this, special features<br />

on topical matters will be published<br />

periodically, along with country pr<strong>of</strong>iles.<br />

In this issue, Ghana and Kenya are pr<strong>of</strong>iled.<br />

In an interview, Mulalo Takaedza,<br />

a Senior Vice President in Structured<br />

Capital Team at Standard Bank, shares her<br />

perspective on Africa’s prospects and relates<br />

how she found some entrepreneurship<br />

within herself while doing business in<br />

Nigeria. Her own philanthropic work<br />

and reflections on the role <strong>of</strong> women in<br />

mentoring also form part <strong>of</strong> the interview.<br />

Former South <strong>African</strong> deputy president<br />

Phumzile Mlambo-Ngcuka writes on how important it is for energy partnerships<br />

in Africa to benefit society, especially women and children through a process <strong>of</strong><br />

localisation. Mlambo-Ngcuka, who also served as Director <strong>of</strong> UN Women, argues<br />

that resource companies need to be carefully monitored to ensure that a country’s<br />

developmental needs are addressed as resources are exploited.<br />

The potential <strong>of</strong> mini-grids for mining operations in Africa is explored<br />

by two experts from Norton Rose Fulbright. Finding reliable, cost-effective<br />

and green energy solutions are key factors for resource companies,<br />

particularly where the existing grid has suboptimal generation, transmission and<br />

distribution infrastructure.<br />

We record a speech made to the 1st Africa-Caribbean Trade and Investment<br />

Forum by AfCFTA Secretary-General Wamkele Mene. The Forum was held under<br />

the theme “One People, One Destiny: Uniting And Reimagining Our Future” and<br />

Meme spoke about the steps that have been taken, and will be taken, to enable<br />

and promote private-sector investment in terms <strong>of</strong> the <strong>African</strong> Continental Free<br />

Trade Area (AfCFTA) agreement. All <strong>of</strong> the measures being introduced are further<br />

strengthening the case for investing in Africa.<br />

Environmental scientists Alexander Richard Braczkowski and Duan Biggs have<br />

been studying the data on the effects <strong>of</strong> Covid-19 lockdowns on tourism in Africa.<br />

In an article first published on The Conversation, the authors illustrate how bad the<br />

absence <strong>of</strong> visitors has been for <strong>African</strong> lodges and reserves and suggest some ways<br />

in which the industry can recover.<br />

Global <strong>African</strong> Network is a proudly <strong>African</strong> company which has been producing<br />

region-specific business and investment guides since 2004, including South <strong>African</strong><br />

<strong>Business</strong> and Nigerian <strong>Business</strong>, in addition to its online investment promotion<br />

platform www.globalafricanetwork.com<br />

JOHN YOUNG<br />

Editor, <strong>Journal</strong> <strong>of</strong> <strong>African</strong> <strong>Business</strong><br />

Email: john.young@gan.co.za<br />

Editor: John Young<br />

Publishing director: Chris Whales<br />

Managing director: Clive During<br />

Online editor: Christ<strong>of</strong>f Scholtz<br />

Design: Simon Lewis. Production: Yonella Ncaba<br />

Ad sales: Venesia Fowler, Tennyson Naidoo,<br />

Tahlia Wyngaard, Gavin van der Merwe, Sam Oliver,<br />

Graeme February, Shiko Diala, Gabriel Venter<br />

and Vanessa Wallace<br />

Administration & accounts: Charlene Steynberg,<br />

Kathy Wootton<br />

Distribution & circulation manager: Edward MacDonald<br />

The <strong>Journal</strong> <strong>of</strong> <strong>African</strong> <strong>Business</strong> magazine is<br />

published by Global Africa Network Media (Pty) Ltd<br />

Company Registration No: 2004/004982/07<br />

Directors: Clive During, Chris Whales<br />

Physical address: 28 Main Road, Rondebosch 7700<br />

Postal: PO Box 292, Newlands 7701<br />

Tel: +27 21 657 6200 | Email: info@gan.co.za<br />

Website: www.gan.co.za<br />

No portion <strong>of</strong> this book may be reproduced<br />

without written consent <strong>of</strong> the copyright owner.<br />

The opinions expressed are not necessarily those<br />

<strong>of</strong> The <strong>Journal</strong> <strong>of</strong> <strong>African</strong> <strong>Business</strong> magazine, nor<br />

the publisher, none <strong>of</strong> whom accept liability <strong>of</strong><br />

any nature arising out <strong>of</strong>, or in connection with,<br />

the contents <strong>of</strong> this book. The publishers would<br />

like to express thanks to those who Support this<br />

publication by their submission <strong>of</strong> articles and<br />

with their advertising. All rights reserved.<br />

Printing: FA Print<br />

2

CONTENTS<br />

2<br />

4<br />

6<br />

FOREWORD<br />

From the editor’s desk.<br />

NEWS FROM THE CONTINENT<br />

Recent investments, expansions and milestones.<br />

INSPIRED BY AFRICANS’ RESILIENCE<br />

Before working on <strong>African</strong> deals, Standard Bank Senior Vice President<br />

Mulalo Takaedza found her entrepreneurial spirit awakened in Nigeria.<br />

12<br />

POWERING MINING IN AFRICA – THE RISE OF THE MINI-GRID<br />

Miners have multiple considerations to weight up when they decide how to power<br />

their operations, write Simon Cudennec and Laura Kiwelu <strong>of</strong> Norton Rose Fulbright.<br />

14<br />

18<br />

THE MUSINA-MAKHADO SPECIAL ECONOMIC ZONE<br />

A regional plan with a continental impact.<br />

ENERGY PARTNERSHIPS IN AFRICA MUST BENEFIT SOCIETY<br />

Phumzile Mlambo-Ngcuka, the former Director <strong>of</strong><br />

UN Women and South Africa’s first female deputy president<br />

argues for broader social goals in energy policy.<br />

20<br />

HOW TO ACCELERATE PRIVATE SECTOR INVESTMENT<br />

The speech given by AfCFTA Secretary-General Wamkele Mene to the<br />

1st Africa-Caribbean Trade and Investment Forum in September 2022 outlined how the<br />

continental agreement will create a conducive environment for investment.<br />

22<br />

24<br />

A SURGE IN DDOS ATTACKS – WHAT TO DO<br />

Patrick Ndegwa, SEACOM <strong>Business</strong> Sales Lead, explains<br />

how <strong>African</strong> businesses can protect themselves.<br />

BLOCKCHAIN IS A DRIVER OF FINANCIAL INCLUSION<br />

Africa’s biggest banker is researching and developing<br />

transformative fintech and blockchain products.<br />

26<br />

WHAT TRAVEL BANS HAVE DONE TO CONSERVATION TOURISM<br />

Researchers Alex Braczkowski and Duan Biggs<br />

analyse the damage done and suggest strategies to help it<br />

recover. This article first appeared in The Conversation.<br />

28<br />

30<br />

32<br />

COUNTRY PROFILES:<br />

GHANA AND KENYA<br />

EVENTS IN AFRICA<br />

Global Africa Network<br />

(GAN) is the media partner<br />

<strong>of</strong> many upcoming events.<br />

HOW TO BUY A BUSINESS<br />

Contents<br />

The <strong>Journal</strong> <strong>of</strong><br />

<strong>African</strong> <strong>Business</strong><br />

3

NEWS FROM ALL AROUND AFRICA<br />

Recent investments, expansions and milestones.<br />

CREDIT: Pexels by Perry Tintin<br />

GHANA AND SCOTLAND BUSINESS LEADERS AGREE TO NETWORK<br />

National Theatre, Ghana. Credit Kojo Nana on Unsplash<br />

Africa Scotland <strong>Business</strong> Network has signed its first intra-<strong>African</strong> partnership agreement<br />

with UK Ghana Chamber <strong>of</strong> Commerce. UKGCC and ASBN have signed the agreement to crosspromote<br />

each other’s organisations for intra-<strong>African</strong> and international trade and relations<br />

within Ghana, Scotland and with their networks across the world.<br />

Under the partnership, UKGCC and ASBN will also work to ensure increased brand awareness<br />

and leverage from this to deliver reputation value and credibility, thus enhancing the value <strong>of</strong><br />

their brands and those <strong>of</strong> their internal member companies. To achieve these objectives, both<br />

organisations have committed to focus on five key sectors: energy, healthcare, agriculture,<br />

technology and training education. ASBN has been commissioned to produce an Africa-<br />

Scotland Economic Impact Report for Scottish Development International (SDI). The report, the<br />

first <strong>of</strong> its kind, will showcase the impact and successful business activity <strong>of</strong> Scottish firms in<br />

Africa. Africa Scotland <strong>Business</strong> Network will be working with 25 Scottish companies featuring<br />

in the report including ASBN member companies Craig International, Ascensos, Riiot Digital,<br />

Workstreme, Abergower, SAFER Training and Solariskit.<br />

SOLAR PROJECTS ARE SHINING IN NAMIBIA<br />

Solar projects are moving ahead in Namibia with the support <strong>of</strong> the Development Bank <strong>of</strong> Namibia. So far,<br />

the DBN has made funding available across Namibia for renewable projects to the value <strong>of</strong> N$1.2-billion.<br />

One example <strong>of</strong> this is the 18.5MW solar plant to be located at Kokerboom in Keetmanshoop. This plant is<br />

to be constructed and operated by Alpha Namibia Industries Renewable Power Limited (ANIREP), while an<br />

<strong>of</strong>ftake agreement has been signed with Dundee Precious Metals Tsumeb.<br />

A consortium known as Anirep Aussenkjerr Solar One received N$193-million in financing from DBN for<br />

the construction <strong>of</strong> the 20MW Khan solar plant, where NamPower has signed a 25-year <strong>of</strong>ftake contract.<br />

The company is made up <strong>of</strong> two local companies, ANIREP (which is listed on the Namibian Stock Exchange)<br />

and Aussenkjer Energy Investments.<br />

The Development Bank <strong>of</strong> Namibia (DBN) has funded renewable<br />

projects in the country to the value <strong>of</strong> N$1.2-billion. Credit: ANIREP<br />

4

NEWS<br />

AFRICA ON THE RADAR FOR WORLD-LEADING BLOCKCHAIN RESEARCH INSTITUTE<br />

With the unique capabilities <strong>of</strong> blockchain technology set to average, only 11% <strong>of</strong> executives have a good understanding<br />

revolutionise transparency, record-keeping, efficiency and <strong>of</strong> blockchain, with only 4% having had hands-on experience<br />

the effectiveness <strong>of</strong> transactions in the business world, with the technology. As a result, companies have limited<br />

boardrooms across Africa are beginning to incorporate the knowledge <strong>of</strong> how blockchain can be used in their organisation.<br />

technology and applications such as Web3.0, decentralised Despite this, research shows a clear appreciation among<br />

finance (DeFi), and the metaverse in discussions around business leadership for the significant role that blockchain<br />

corporate innovation and digital strategy.<br />

will play in the transformation <strong>of</strong> traditional industries and<br />

But while conversations around this technology are business models.”<br />

becoming popular among board members, more needs to be To enhance knowledge and understanding <strong>of</strong> blockchain, and<br />

done to enhance executive-level knowledge, understanding its applications towards driving sustainable development on<br />

and buy-in <strong>of</strong> blockchain technology and its applications the continent across multiple industries, the Standard Bank<br />

for businesses in traditional <strong>African</strong> industries such as Group has partnered with Canada-based Blockchain Research<br />

mining, agriculture and manufacturing. This is according to Institute (BRI) to expand its research capabilities to Africa.<br />

Ian Putter, Head <strong>of</strong> the Blockchain Centre <strong>of</strong> Excellence at In doing so, the organisation seeks to bring together top<br />

Standard Bank Group and Regional Director <strong>of</strong> the Blockchain industry leaders, academics, policymakers, entrepreneurs<br />

Research Institute Africa.<br />

and researchers from across the continent, to collaborate<br />

He explains, “Peer-reviewed research has found that, on on ground-breaking research on blockchain technology<br />

in an effort to bridge the gap between its technological<br />

functionality and real-world needs <strong>of</strong> the market.<br />

In support <strong>of</strong> these goals, BRI Africa hosted an online<br />

seminar where global experts discussed real-world<br />

applications for blockchain technology beyond crypto assets<br />

and unpacked opportunities for collaboration with BRI Africa<br />

Ian Putter (above), Head <strong>of</strong> the Blockchain Centre<br />

<strong>of</strong> Excellence at Standard Bank Group and Regional<br />

Director <strong>of</strong> the Blockchain Research Institute Africa.<br />

TALK360 RAISES $4-MILLION FOR AFRICAN EXPANSION<br />

International calling app Talk360 has secured $4-million<br />

in funding as it prepares to launch a new pan-<strong>African</strong><br />

payment platform in 2022. The seed round <strong>of</strong> funding was<br />

led by leading <strong>African</strong> venture capital investor HAVAÍC, 4Di<br />

Capital and several prominent fintech angel investors. The<br />

company intends to expand its calling business, build an<br />

<strong>African</strong> payment platform and open its payment platform<br />

to other merchants.<br />

While the Talk360 app is seeing rapid growth on<br />

the continent, with a growing number <strong>of</strong> paying<br />

users, accessibility has been an issue for 500-million<br />

underserviced people. Users either don’t have online<br />

banking to buy Talk360 airtime, or their local currencies<br />

or payment methods are not supported. The new payment<br />

Co-founders <strong>of</strong> Talk360, Hans Osnabrugge and Dean Hiine.<br />

platform aims to address inaccessibility by providing<br />

users with the option to buy products and services using<br />

any currency and more than 160 payment methods. It will<br />

also be opened to other service providers.<br />

Talk360 was co-founded in 2016 by South <strong>African</strong><br />

venture builder Dean Hiine and Dutch entrepreneurs Hans<br />

Osnabrugge and Jorne Schamp. With <strong>of</strong>fices in South<br />

Africa, the Netherlands, India and Nigeria, it connected<br />

more than two-million people in 2021.<br />

The angel investors include several unicorn founders<br />

and executives such as Gaston Aussems (ex-Mollie),<br />

Robert Kraal (ex-Adyen), Gabriel de Montessuss (President<br />

WorldPay International) and Marnix van der Ploeg, ex-<br />

Booking.com and EQT (<strong>African</strong> Media Agency).<br />

UNITED PLANS TO LINK MORE AFRICAN CITIES WITH WASHINGTON<br />

A range <strong>of</strong> flights have resumed to Cape Town in South Africa and a new direct flight has been the Namibian city <strong>of</strong> Windhoek. KMIA is a short hop from several entrances to the iconic Kruger<br />

added to take European tourists directly to the Kruger National Park. In addition, United National Park, South Africa’s biggest game and nature reserve.<br />

Airlines has announced that it has applied to fly directly from Washington to Cape Town.<br />

Mbombela, the capital <strong>of</strong> Mpumalanga Province in South Africa and the host <strong>of</strong> KMIA,<br />

KLM Royal Dutch Airlines will take on additional flights from Amsterdam to Cape Town from becomes Eurowings Discover’s seventh <strong>African</strong> destination. The newly-created leisure line has<br />

November 2022, lifting the total number <strong>of</strong> flights to Cape Town to 10 per week. This year is established or planned flights from Frankfurt to Mombasa, Zanzibar, Mauritius, Windhoek,<br />

the 30th anniversary <strong>of</strong> KLM Royal Dutch Airlines flying between Amsterdam and Cape Town. Victoria Falls and Kilimanjaro.<br />

United Airlines is another airline that resumed flying to Cape<br />

Town after a halt caused by Covid-19 restrictions. There are<br />

United’s 787-Dreamliner flies the Cape Town – Newark route.<br />

three weekly flights between New York’s Newark Airport and<br />

Cape Town, and a further seven to and from Johannesburg.<br />

United Airlines has also made an application to the US<br />

Department <strong>of</strong> Transportation for three weekly nonstop<br />

flights to be granted between Washington DC and Cape<br />

Town. United intends for the service to begin in November<br />

2022, if approved.<br />

United’s Washington Dulles Airport hub caters to more than<br />

230 daily flights to nearly 100 destinations, including more<br />

than 10 world capitals and new services that have recently<br />

come online to Accra, Ghana, and Lagos, Nigeria.<br />

Eurowings Discover, a new division <strong>of</strong> Lufthansa that was<br />

launched in 2021, will fly to Kruger Mpumalanga International<br />

Airport (KMIA) from November 2022, with a short stopover in<br />

5

Y<br />

Standard Bank’s Mulalo Takaedza<br />

6

BANKING<br />

INSPIRED BY AFRICANS’ RESILIENCE<br />

AND INDUSTRIOUSNESS<br />

As someone who travelled widely in Africa before working on <strong>African</strong> deals, Mulalo Takaedza found her entrepreneurial<br />

spirit awakened in Nigeria. She is Senior Vice President, Structured Capital Team at Standard Bank.<br />

Your first experience <strong>of</strong> working outside South Africa on<br />

the continent was in Nigeria. Had you been to other <strong>African</strong><br />

countries before that?<br />

I had travelled Africa quite extensively before that. I had been to<br />

East Africa, Tanzania, Kenya and Zanzibar. I had also travelled to<br />

the SADC-region countries quite a bit. I had done Africa for travel,<br />

but never as part <strong>of</strong> my pr<strong>of</strong>essional career. Nigeria was the first<br />

time I had lived and worked in a different country on the <strong>African</strong><br />

continent outside <strong>of</strong> South Africa.<br />

Why did you want to travel in Africa?<br />

I have always been very open-minded and I think part <strong>of</strong> that<br />

comes from the fact that I was not raised in a nuclear family. I was<br />

raised very much by a village, having to listen to other people,<br />

having to take other people’s views into consideration and having<br />

to be very considerate.<br />

I love the <strong>African</strong> continent. It is part <strong>of</strong> me wanting to see what<br />

else was there, it came from knowing that there is more to us as a<br />

continent than just South Africa.<br />

What were you expecting in Nigeria and what did you find<br />

there? Was it different?<br />

My experience <strong>of</strong> Nigeria started through colleagues that I met<br />

before I travelled there. They had been very warm and kind to<br />

me so I already knew that I was going to have a s<strong>of</strong>ter landing<br />

and that there were some familiar faces that I would find. I think<br />

what surprised me was the intensity and the ubiquitous spirit <strong>of</strong><br />

entrepreneurship in Nigeria. Literally from the bottom all the<br />

way up, everybody thinks very much as an entrepreneur: how do<br />

I turn this into an opportunity, how do I turn this into some sort<br />

<strong>of</strong> economic benefit?<br />

For me, it woke up some sort <strong>of</strong> entrepreneurship in me. Even<br />

if you don’t necessarily work as a business owner, there is a level<br />

<strong>of</strong> entrepreneurship we all need to apply in what we do every day,<br />

how we spend our time and how we make decisions. How we assess<br />

risk versus reward. That was something that I really enjoyed.<br />

I probably expected that aspect but the forthrightness <strong>of</strong> the<br />

people – how Nigerians tell it like it is and you know what they<br />

are thinking and how they are feeling – I appreciated that. That is<br />

kind <strong>of</strong> the person that I am. So being part <strong>of</strong> the culture <strong>of</strong> people<br />

like that, I definitely enjoyed that.<br />

How long did you have in Nigeria on that first stint?<br />

It was quite intermittent because <strong>of</strong> visas and travelling back and<br />

forth, but overall, it was for a period <strong>of</strong> about eight months that<br />

I was in and out <strong>of</strong> Nigeria.<br />

And does your current role take you around the continent?<br />

Partly because <strong>of</strong> Covid and because we have all adjusted to being<br />

able to work remotely, all the work we have done has been done<br />

virtually. I have done deals for companies that operate on the<br />

continent in my current role but I have not travelled yet.<br />

What did your travels plus your experience in Nigeria tell you<br />

about the potential <strong>of</strong> Africa?<br />

Oh, that’s its booming, that it is absolutely booming. That we are<br />

so industrious. We have always known this about ourselves: we are<br />

full <strong>of</strong> potential, we are resilient. At the time Nigeria was the secondlargest<br />

economy on the continent but there was still a lot <strong>of</strong> poverty<br />

and inequality in Nigeria. The resilience <strong>of</strong> an average Nigerian, or<br />

an average <strong>African</strong> actually, is something that is inspiring.<br />

We need to find the ability to be there for each other and be<br />

able to relate with one another from different walks <strong>of</strong> life. It is<br />

something that gives you a great sense <strong>of</strong> pride to be part <strong>of</strong> this<br />

continent that is so full <strong>of</strong> hope and so full <strong>of</strong> life, irrespective <strong>of</strong> all<br />

the challenges that we have in this country and on this continent.<br />

7<br />

There is a level <strong>of</strong><br />

entrepreneurship we<br />

all need to apply in<br />

what we do every day<br />

Below: The Standard Bank building in<br />

Cape Town. Credit: Standard Bank.

BIOGRAPHY<br />

___ ___ ___ ____<br />

Mulalo Takaedza grew up in<br />

Soweto, Johannesburg. When<br />

she was young, her mother took<br />

on a position in Saudi Arabia<br />

as a cardiac nurse so Mulalo’s<br />

aunt and grandmother played<br />

a big role in her upbringing.<br />

She attended primary school in<br />

Lenasia and matriculated out <strong>of</strong><br />

Holy Family College in Rosebank.<br />

Attendance at the private<br />

school was made possible partly<br />

through scholarships that the<br />

school provided based on good<br />

academic results. She achieved<br />

an A in accounting but English<br />

was a favourite subject. She<br />

did a lot <strong>of</strong> writing and loved<br />

literature. Mulalo enrolled at<br />

Rhodes University primarily to<br />

pursue writing, script-writing<br />

and drama but discovered that<br />

drama tutorials and accounting<br />

tutorials clashed. As she says,<br />

“that dream faded very quickly<br />

because I was on a scholarship<br />

and I needed to pass”.<br />

Three years <strong>of</strong> articles<br />

persuaded Mulalo that auditing<br />

was not for her. Her first<br />

exposure to investment banking<br />

was working on mergers and<br />

acquisitions (M&A) for three<br />

years at RMB. This included<br />

a spell <strong>of</strong> working in Nigeria<br />

for part <strong>of</strong> that time.<br />

She then joined a private equity<br />

fund that was investing in<br />

impact investing in Sub-Saharan<br />

Africa but returned to M&A<br />

within a property company<br />

that owns many shopping<br />

centres. She has been with<br />

Standard Bank for a year.<br />

You mention being “there for each other”. Do you do any<br />

philanthropic work?<br />

I run a formal mentorship programme. I co-founded an<br />

organisation in 2016 called Women for Girls. We identify 10 to 15<br />

high-performing girls in matric, girls who do really well from lessprivileged<br />

backgrounds and have financial aid or sometimes they<br />

are self-funded, who then go and study at universities in Gauteng.<br />

They come from both rural areas and townships. We give them the<br />

psycho-social mentorship which involves personal development,<br />

career development, literacy in the form <strong>of</strong> financial literacy as well<br />

as computer literacy. Along with mentorship, CV writing, interview<br />

skills and personal counselling over a three-year period.<br />

We are full <strong>of</strong> potential, we are resilient<br />

How do you choose your mentors and how do you get<br />

funding for them?<br />

We are currently self-funded. My co-founder and I found eight<br />

other women from very diverse backgrounds – corporate South<br />

Africa, legal, science, creative fields, accounting, public service,<br />

teaching, nursing – across the spectrum and so we are now 10. All<br />

using their time and resources as volunteers. We have one Saturday<br />

a month where we have a specific programme or theme that we<br />

tackle. It could be mental health, how do you get your CV to be<br />

noticed, interview skills and that kind <strong>of</strong> thing. We call ourselves<br />

the big sisters and then we mentor two to three girls girls at a time.<br />

You don’t have a sponsor?<br />

No, but we have had a lot <strong>of</strong> support from the Nelson Mandela<br />

Foundation as host <strong>of</strong> some <strong>of</strong> our events. Most <strong>of</strong> the funding<br />

needed is around venues and catering. Then we are having to pay<br />

to get them there. Those are the two to three big costs that we<br />

incur for each event.<br />

8<br />

Have you found other women to be supportive in your<br />

business journey?<br />

I have actually found women quite supportive. I have gravitated<br />

towards women and I am talking about women across the value<br />

chain, so it hasn’t necessarily been women who are my peers.<br />

I have gravitated towards women who were cleaning the places<br />

that we work at or who would make us tea, PAs or anyone.<br />

Women have been very supportive in my personal life, but also<br />

pr<strong>of</strong>essionally. This has helped my career in a big way in terms<br />

<strong>of</strong> giving me the confidence, a safe space or a safe landing for me<br />

to have conversations, a place where I can be vulnerable, a place<br />

where I can ask questions and get guidance.<br />

Did you have you role models in your family?<br />

My mother is a brilliant, senior cardiac ICU nurse at the Alberton<br />

Netcare Hospital. I think in the early years <strong>of</strong> my career I probably<br />

didn’t reach out to her as much as I could have and I should have<br />

for advice. I am realising now that she is the person that I actually<br />

get a lot <strong>of</strong> my career advice from. She knows nothing about<br />

investment banking or what we do but I think what I get from<br />

her is two things: that she is really good with people so she knows<br />

people but more importantly, she knows me well. She is able to<br />

give me context <strong>of</strong> a situation without a lot <strong>of</strong> other complexities.<br />

There could be a lot more women that I can mention but one<br />

very key woman in my life growing up was my aunt who was<br />

responsible for raising me; she helped with my physical and<br />

emotional needs. My grandmother was very much a community<br />

builder. She was very entrepreneurial and through the proceeds<br />

<strong>of</strong> her enterprises, she was able to support and fund the entire<br />

community. I think I get a lot <strong>of</strong> my philanthropic side from her,<br />

having seen that growing up. To see that whatever little she had,<br />

she always had just enough to give everybody something and<br />

maintain her values through all <strong>of</strong> that.<br />

Standard Bank has a presence in 20 <strong>African</strong> countries, including<br />

in the capital <strong>of</strong> Mozambique, Maputo. Credit: Standard Bank

BANKING<br />

Are there any conclusions one can draw about the qualities<br />

<strong>of</strong> <strong>African</strong> women?<br />

I don’t want to speak for all <strong>African</strong> women. We so <strong>of</strong>ten get<br />

painted with the same brush which in itself deprives <strong>African</strong><br />

women <strong>of</strong> who we really are, because each one <strong>of</strong> us has walked<br />

such a different walk, each one <strong>of</strong> us carries such different burdens.<br />

I know I can tell you that I love all the <strong>African</strong> women on this<br />

continent. I love the hope that we carry, that we continue to rise<br />

above many things that we shouldn’t even be expected to. As sad<br />

as it is we have had to be the ones who are there for ourselves. We<br />

have had to be the ones that look after ourselves and look after each<br />

other, unfortunately.<br />

Evidence suggests that loans to women tend to be well<br />

used. In Bangladesh, micro-finance worked best among<br />

women in helping people out <strong>of</strong> poverty and many stokvels<br />

in South Africa are run by women, not so?<br />

Yes, there definitely is that. I recently went to an event for a<br />

gender-lens lending fund that has raised money to fund women<br />

entrepreneurs and women-run businesses.<br />

It is only in recent history that we put this kind <strong>of</strong> gender<br />

lending into perspective. I don’t know if we can confidently<br />

say we have the real statistics over a period <strong>of</strong> time to know all<br />

the facts. But we have seen the benefits <strong>of</strong> being able do that,<br />

we have seen how communities get enriched through that. We<br />

have seen, anecdotally, market-related and even above market<br />

returns on loans.<br />

What has surprised a lot <strong>of</strong> people is that people just assumed<br />

that their returns would have to be at some sort <strong>of</strong> a discount<br />

but they are actually competitive. I don’t think that should be<br />

something that surprises us. It is something we should have been<br />

doing for much longer and much deeper across the sectors.<br />

Which brings us to the work you do at Standard Bank. What<br />

is your title and what do you do?<br />

My current title is Senior Vice President in the Structured Capital<br />

Team. We originate and structure subordinated-equity funding<br />

in South Africa and across the continent for large and mediumsized<br />

corporates, investment holding vehicles as well as BEE<br />

investment vehicles. The team I work in is called Equity Finance<br />

and Investments.<br />

Is there a cap on your fund?<br />

There is no cap on how big we can be. I can’t say what the size <strong>of</strong><br />

the book is because then our competitors will know how big our<br />

book is but there is no limit to that. There’s obviously a limit to the<br />

9<br />

Above: A new trend is funds to lend<br />

to women entrepreneurs. Credit:<br />

Christina@wocintechchat.com/<br />

Unsplash<br />

I love the<br />

<strong>African</strong> continent

BANKING<br />

ABOUT STANDARD BANK GROUP<br />

Standard Bank Group is the largest<br />

<strong>African</strong> bank by assets, operating in<br />

20 <strong>African</strong> countries and five global<br />

financial centres. Headquartered<br />

in Johannesburg, South Africa, the<br />

group is listed on the Johannesburg<br />

Stock Exchange, with share code<br />

SBK, and the Namibian Stock<br />

Exchange, share code SNB.<br />

Standard Bank has a 159-year history<br />

in South Africa and started building a<br />

franchise outside Southern Africa in<br />

the early 1990s. The group’s strategic<br />

position, which enables it to connect<br />

Africa to other select emerging<br />

markets as well as pools <strong>of</strong> capital in<br />

developed markets, and a balanced<br />

portfolio <strong>of</strong> businesses, provide<br />

significant opportunities for growth.<br />

The group has over 46 000 employees<br />

excluding Liberty, more than 1 143<br />

branches and over 6 600 ATMs on the<br />

<strong>African</strong> continent, which enable it to<br />

deliver a complete range <strong>of</strong> services<br />

across personal and business<br />

banking, corporate and investment<br />

banking and wealth management.<br />

The group’s largest shareholder is<br />

the Industrial and Commercial Bank <strong>of</strong><br />

China (ICBC), the world’s largest bank,<br />

with a 20.1% shareholding. In addition,<br />

Standard Bank Group and ICBC share a<br />

strategic partnership that facilitates<br />

trade and deal flow between Africa,<br />

China and select emerging markets.<br />

For further information, go<br />

to www.standardbank.com<br />

Renewable energy<br />

is attracting a lot <strong>of</strong><br />

investment finance.<br />

Credit: Standard Bank<br />

size <strong>of</strong> signed deals we could do based on exposure and risk and<br />

structure and limits so that’s very much dependent on the deal.<br />

You don’t do infrastructure<br />

projects with government and<br />

that sort <strong>of</strong> thing?<br />

No, we don’t in my specific team,<br />

but Standard Bank through its<br />

wholesale franchise would have<br />

exposure to some <strong>of</strong> the largest<br />

infrastructure projects. The Equity<br />

Finance Team would fund the<br />

shareholder who in investing in<br />

infrastructure projects.<br />

Our funding is at shareholder<br />

level. The focus is on how we can<br />

fund the shareholder for them<br />

to be able to facilitate their value<br />

creation and grow their business. It<br />

allows you to get a foot in the door.<br />

The shareholder would still need to<br />

service this, it is still a commercial transaction and the returns<br />

still need to make sense economically. It allows us and whoever<br />

we partner with to take a view on the business. A lot <strong>of</strong> the risk we<br />

are taking is equity risk. As the dividends come in, we can then<br />

service the debt. Once you have serviced the debt to us, all the<br />

returns then come to you.<br />

Above: <strong>African</strong> entrepreneurship and resilience are inspiring.<br />

Credit: Jean Papillon on Unsplash<br />

We need to find the ability<br />

to be there for each other<br />

A<br />

In which sectors are you currently<br />

finding the most activity?<br />

There are a lot <strong>of</strong> industrialists who<br />

are very entrepreneurial who we are<br />

looking to fund. Currently the biggest<br />

sector with a lot <strong>of</strong> activity is renewable<br />

energy. We are seeing a lot <strong>of</strong> secondary<br />

deals (somebody is trading and selling<br />

<strong>of</strong>f to another person) and we are seeing<br />

many new deals as well. There’s a lot <strong>of</strong><br />

activity in construction and building<br />

<strong>of</strong> renewable energy infrastructure. We<br />

come in and fund the shareholder.<br />

Left: Women 4 Girls involves mentoring<br />

and caring. Credit: Women 4 Girls<br />

10

POWER<br />

POWERING MINING IN AFRICA –<br />

THE RISE OF THE MINI-GRID AND THE CAPTIVE MODEL<br />

Simon Cudennec and Laura Kiwelu weigh up the many factors which miners must<br />

consider when they decide how to power their operations.<br />

Access to reliable, cost-effective (and, increasingly, green) energy<br />

in Sub-Saharan Africa is a major challenge for the mining industry.<br />

The mining industry is one <strong>of</strong> the most important energy<br />

consumers in the region and its energy demand is set to increase<br />

significantly in upcoming years, coupled with the increased<br />

importance <strong>of</strong> the industry in providing the raw materials<br />

necessary to power the energy transition. While the <strong>African</strong><br />

mining industry is a key part <strong>of</strong> the global energy transition, it<br />

sits within a region where the energy sector is <strong>of</strong>ten subject to<br />

the monopoly control <strong>of</strong> state-owned utilities and reliant on suboptimal<br />

generation, transmission and distribution infrastructure.<br />

Mining companies have historically had no choice but to be<br />

connected to a grid and be the victim <strong>of</strong> frequent power outages<br />

or, for those in more remote locations, to use on-site diesel or<br />

heavy fuel oil (HFO) gensets for self-consumption (<strong>of</strong>ten at a<br />

premium price) or an inefficient combination <strong>of</strong> the two. Now,<br />

however, mining companies are increasingly committing to<br />

considering more innovative and green sources <strong>of</strong> energy to power<br />

their operations.<br />

WHAT IS A MINI-GRID PROJECT<br />

IN THE CONTEXT OF A MINE?<br />

A mini-grid project can broadly be defined as an energy<br />

distribution network isolated from the national grid involving<br />

one or more small-scale power generation source. In relation to a<br />

single mine or group <strong>of</strong> mining concessions, a mini-grid project<br />

could power the mines but also the local communities <strong>of</strong> mine<br />

workers and related infrastructure.<br />

Below: Exxaro Resources Limited,<br />

through its wholly-owned renewable<br />

energy subsidiary, Cennergi, is<br />

developing the 70MW Lephalale<br />

Solar Project to supply renewable<br />

energy to the Grootegeluk coal<br />

mine in Limpopo Province, South<br />

Africa. The company’s microgrid at<br />

Tshikondeni mine is shown here.<br />

Photo: Cennergi<br />

11

POWER<br />

Africa’s biggest solar project (the<br />

Noor-Ouarzazate Solar complex in<br />

Morocco) hosts the launch <strong>of</strong> the<br />

World Bank Middle East & North<br />

Africa Concentrated Solar Power<br />

Knowledge & Innovation Program.<br />

Photo: Michael Taylor©IRENA<br />

A local mini-grid provides an efficient solution to powering<br />

mines as it avoids the transmission <strong>of</strong> large volumes <strong>of</strong> power over<br />

long distances (with the accompanying power losses) and leads to<br />

a more reliable local grid system (avoiding the loss <strong>of</strong> production<br />

time and potential property damage associated with electricity<br />

supplied from the main grid with its propensity for load shedding)<br />

which also benefits the local community. With a renewable power<br />

generation source, the mini-grid would decrease the dependence<br />

<strong>of</strong> mining projects on diesel or HFO, which are expensive to<br />

transport, subject to significant price fluctuations and increase<br />

the carbon footprint <strong>of</strong> mining operations.<br />

THE GROWING CASE FOR RENEWABLES<br />

The cost <strong>of</strong> renewable power is diminishing at the same time<br />

as its performance is improving. Many mining locations in<br />

Sub-Saharan Africa <strong>of</strong>fer an abundance <strong>of</strong> high-quality wind,<br />

solar, hydropower and biomass resources. Mining companies<br />

are also increasingly under pressure to decarbonise and the<br />

use <strong>of</strong> green and sustainable energy at a competitive cost <strong>of</strong>fers<br />

such a possibility.<br />

Fast-paced improvements in renewable technologies enable a<br />

power generation system which is matched to the load pr<strong>of</strong>ile <strong>of</strong><br />

the mine, whether through hybrid systems (such as a mix <strong>of</strong> solar<br />

PV and diesel) or renewable systems coupled with battery storage.<br />

CHALLENGES ARISING FROM THE<br />

REGULATORY ENVIRONMENT<br />

The importance <strong>of</strong> the prevailing energy regulatory regime cannot<br />

be underestimated. The legal and regulatory framework, as well<br />

as the political or economic sensitivities, vary from one country<br />

to another (and sometimes within the country). In general terms,<br />

there is no common legal framework providing a simple and<br />

clearly applicable set <strong>of</strong> rules when it comes to mini-grid or captive<br />

project development. This is due to the fact that energy sectors<br />

in Sub-Saharan Africa, both in terms <strong>of</strong> generation, distribution<br />

and supply <strong>of</strong> power, have historically been the subject <strong>of</strong> state<br />

monopolies, and countries are at different stages in the unbundling<br />

process, approaching deregulation in different ways.<br />

In this context, the standard independent power project model,<br />

according to which the mini-grid or captive project is built and<br />

the energy is generated and delivered by an independent power<br />

producer to the mining company under a power purchase<br />

agreement, is still relatively uncommon. Project structuring<br />

options are <strong>of</strong>ten limited by the requirement for an ad hoc and<br />

potentially politicised authorisation to generate (which can be<br />

very difficult to obtain and may raise potential legal issues) or the<br />

existence <strong>of</strong> a self-consumption regime only.<br />

In the case <strong>of</strong> self-consumption (or “auto-producteur” in<br />

Francophone Africa), electricity is produced, supplied and<br />

12

POWER<br />

consumed by the mining company (using a directly procured EPC<br />

contractor for construction and an O&M contractor for operation)<br />

but in this scenario, due to the lack <strong>of</strong> private distribution or<br />

supply licence, the benefit <strong>of</strong> the plant cannot unfortunately be<br />

shared with the local community and there is no clear enabling<br />

regime for a mini-grid or captive supply <strong>of</strong> power to the mine on<br />

a PPA basis by a third party.<br />

The energy regulatory environment will be instrumental in<br />

determining the structure that will be used to develop the minigrid<br />

or captive project (whether build-own-operate-transfer, EPC<br />

or a lease/services structure). In our experience, where a selfconsumption<br />

regime only is permitted and it is not possible to<br />

use the PPA structure, a mini-grid or captive project supplying a<br />

mine can be contractually structured in two different ways:<br />

The “ownership business model” and in particular the “lease<br />

purchase model”, under which a developer or equipment supplier<br />

(lessor) retains ownership <strong>of</strong> the plant and equipment but provides<br />

the equipment to the mining company for a contracted period <strong>of</strong><br />

time in exchange for regular payments. The lessor is responsible<br />

for sourcing, financing and installing the equipment, and for<br />

maintaining it during the contract period. Depending on the<br />

provisions <strong>of</strong> the contract, at the end <strong>of</strong> the contract period<br />

ownership <strong>of</strong> the equipment can either remain with the lessor or<br />

pass to the lessee (sometimes for an additional amount).<br />

A local mini-grid provides an efficient solution<br />

to powering mines as it avoids the transmission<br />

<strong>of</strong> large volumes <strong>of</strong> power over long distances<br />

and leads to a more reliable local grid system<br />

which also benefits the local community.<br />

The “service business model” according to which the power<br />

plant is built and operated by a service company supplying the<br />

energy to the mining company. The mining company pays an<br />

agreed fee that can be adjusted based on the performance <strong>of</strong> the<br />

plant or on the cost savings for the mining company against a<br />

predefined baseline.<br />

Where the energy regulatory regime is inconsistent or unclear,<br />

obtaining the relevant licences and permits in the timescales<br />

required may prove challenging and burdensome. This in turn<br />

may make it difficult to obtain long-term project financing.<br />

Accordingly, in responding to approaches from renewable<br />

project developers, mining companies must require that thorough<br />

analysis <strong>of</strong> the energy regulatory environment has been carried<br />

out prior to commercial negotiations taking place.<br />

The willingness <strong>of</strong> the mining industry to support the<br />

development <strong>of</strong> renewables, combined with improving<br />

technological performance (including the wide-scale deployment<br />

<strong>of</strong> energy storage) and reduction <strong>of</strong> the costs associated with<br />

such energy, <strong>of</strong>fers increased opportunities for collaboration<br />

for renewables developers and mining companies but the pitfalls<br />

<strong>of</strong> the energy regulatory regime must be tackled at the outset<br />

and the risk <strong>of</strong> any change to the regime clearly allocated in the<br />

project documents.<br />

Africa is as dynamic a market as it is diverse. We<br />

understand that changes impacting your business<br />

can arise rapidly and vary significantly across<br />

the continent. Our understanding <strong>of</strong> Africa’s<br />

markets stems from extensive experience on the<br />

ground. Through our Inside Africa blog, we aim<br />

to apply this insight to provide you with timely<br />

commentary on the latest developments across<br />

Africa, as well as insight into the many nations<br />

that make up this vast continent.<br />

13<br />

A unit at the University <strong>of</strong> Pretoria<br />

working on transdisciplinary<br />

skills transfer programmes,<br />

Future Africa, is partnering with<br />

Nepoworx, a skills development<br />

and training institution accredited<br />

by the South <strong>African</strong> Photovoltaic<br />

Industry Association, to train<br />

900 people over three years<br />

in green economy skills.<br />

Photo: University <strong>of</strong> Pretoria<br />

ABOUT THE AUTHORS<br />

Simon Cudennec is a project and<br />

corporate lawyer based in Paris.<br />

Laura Kiwelu is a projects,<br />

renewables and carbon-finance<br />

lawyer based in London, with a<br />

particular focus on Africa, the<br />

energy transition and the move<br />

to a low-carbon economy.

THE MUSINA-MAKHADO SPECIAL ECONOMIC ZONE<br />

– A REGIONAL PLAN WITH CONTINENTAL IMPACT<br />

South Africa’s newest Special Economic Zone takes advantage <strong>of</strong> its strategic position to enhance regional<br />

and sub-regional links.<br />

TThe Musina-Makhado Special Economic Zone (MMSEZ) is an<br />

initiative <strong>of</strong> the Limpopo Provincial Government.<br />

The MMSEZ state-owned company (MMSEZ SOC) has<br />

been established as the implementing agent <strong>of</strong> the project and<br />

is a subsidiary <strong>of</strong> the Limpopo Economic Development Agency<br />

(LEDA), which reports to the Limpopo Department <strong>of</strong> Economic<br />

Development, Environment and Tourism (LEDET).<br />

Investment in infrastructure is underway with several levels <strong>of</strong><br />

government contributing to new and upgraded facilities in areas<br />

such as water, electricity, ICT, roads, transport, human settlement,<br />

airport, education and training.<br />

REGIONAL IMPLICATIONS<br />

SADC enables dutyfree<br />

trade within a<br />

growing market <strong>of</strong><br />

more than 360-million.<br />

The Musina-Makhado SEZ is located in the vicinity <strong>of</strong> the<br />

Beitbridge Border Post which is one <strong>of</strong> the busiest ports <strong>of</strong> entry<br />

to South Africa and a gateway to countries in the Southern<br />

<strong>African</strong> Development Community (SADC).<br />

The SADC Industrialisation Strategy and the <strong>African</strong><br />

Continental Free Trade Area (AfCFTA) will boost regional and<br />

SADEC REGION<br />

inter-regional trade volumes, giving the MMSEZ’s prime location<br />

further importance.<br />

The MMSEZ has the potential to become an inland intermodal<br />

terminal, facilitated by its anchoring position along the North-<br />

South Corridor, and directly connecting to the country’s major<br />

ports through both the N1 highway and the Johannesburg-<br />

Musina railway line, for the trans-shipment <strong>of</strong> sea cargo and<br />

manufactured goods.<br />

With many companies and countries wanting to decentralise<br />

and diversify their distribution hubs (either because <strong>of</strong> Covid-19<br />

or potential unrest in some areas), there is an opportunity for the<br />

MMSEZ North Site as a potential regional inland port.<br />

Credit: Pexels<br />

The position <strong>of</strong> the MMSEZ<br />

in South Africa in the north<br />

<strong>of</strong> the Limpopo province<br />

MMSEZ<br />

ABOUT SADC<br />

South Africa is a member <strong>of</strong> one <strong>of</strong> Africa’s oldest regional<br />

organisations, the 16-member Southern <strong>African</strong> Development<br />

Community (SADC). Country members include Angola,<br />

Botswana, Comores, Democratic Republic <strong>of</strong> Congo, Eswatini,<br />

Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia,<br />

Seychelles, Tanzania, Zambia and Zimbabwe.<br />

This enables duty-free trade within a growing market <strong>of</strong><br />

more than 360-million people. All goods shipped under SADC<br />

Certificate <strong>of</strong> Origin receive duty-free status.<br />

FOCUS<br />

Credit: Wikipedia<br />

Developing small towns into cities<br />

The MEC <strong>of</strong> Limpopo Economic<br />

Development Environment and Tourism<br />

(LEDET), Thabo Mokone, stated 14 on the

SPECIAL ECONOMIC ZONE<br />

AfCFTA<br />

The <strong>African</strong> Continental Free Trade Area (AfCFTA) has been<br />

agreed on by almost all <strong>African</strong> nations and holds the potential<br />

to change the nature and size <strong>of</strong> trading on the continent in<br />

pr<strong>of</strong>ound ways. The MMSEZ, located in Limpopo Province, is<br />

strategically positioned to <strong>of</strong>fer companies a perfect launching<br />

pad into a wide range <strong>of</strong> countries served by good logistics and<br />

infrastructure.<br />

The burgeoning <strong>African</strong> middle-class is<br />

a global trend that economists are carefully<br />

watching. As more sophisticated infrastructure<br />

is rolled out across Africa, having a base with<br />

good connections via road and rail connectivity<br />

will be vital. Limpopo has all <strong>of</strong> that.<br />

Improving and increasing intra-<strong>African</strong> trade will change the way<br />

countries do business and include a much broader range <strong>of</strong> countries<br />

and products into the global market. Foreign direct investment<br />

is expected to grow rapidly, as investment opportunities such as<br />

those on <strong>of</strong>fer at the MMSEZ attract the attention <strong>of</strong> international<br />

companies and institutions. The World Bank and<br />

other experts have estimated that AfCFTA could:<br />

• increase the continent’s exports by $560-billion<br />

• increase continental business and consumer<br />

spending to $6.7-trillion by 2030<br />

• boost regional income by 7% or $450-billion<br />

• improve wages by up to 10%.<br />

The burgeoning <strong>African</strong><br />

middle-class is a global<br />

trend that economists are<br />

carefully watching.<br />

NORTH SITE<br />

The environmental impact assessment<br />

(EIA) for the site has been approved, as has<br />

the engineering planning phase for bulk<br />

infrastructure. Infrastructure installation<br />

is envisaged to begin in the course <strong>of</strong> 2022.<br />

Phase 1 projects:<br />

• Fresh produce market: partnership<br />

• Regional fuel terminal: partnership<br />

• Trucks and buses manufacturing: investor<br />

• Chemicals manufacturing: investor<br />

• Vhembe TVET College<br />

• Rail connectivity<br />

• Solar energy plant<br />

Credit: Anglo Platinum<br />

Regional Integration - AfCFTA<br />

North Site Layout<br />

ENERGY<br />

The plan to build a coal-powered<br />

power station has been phased out.<br />

A memorandum <strong>of</strong> understanding<br />

was signed in December 2021 with<br />

a Chinese investor to build a<br />

1 000MW solar power plant. A<br />

pre-feasibility study for the project<br />

has been done. A project-based EIA<br />

application will begin after a site has<br />

been chosen and confirmed.<br />

SOUTH SITE<br />

The South Site’s EIA application was approved<br />

on 23 February 2022. The action plan in the<br />

post-EIA approval phase encompasses:<br />

• Rezoning <strong>of</strong> the South Site<br />

• Finalising the short- and mediumterm<br />

water solution<br />

• Bulk infrastructure engineering design<br />

• Site clearance and fencing<br />

• Installation <strong>of</strong> bulk infrastructure<br />

• Ramping up skills development.<br />

15

THE MUSINA-MAKHADO SPECIAL ECONOMIC ZONE<br />

CAN BE A CONTINENTAL LEADER<br />

PPlease comment on the location <strong>of</strong> the MMSEZ in terms <strong>of</strong><br />

The CEO <strong>of</strong> the MMSEZ, Lehlogonolo Masoga, explains how the SEZ’s unique combination <strong>of</strong> strategic<br />

location and local resources can bolster the industrialisation plans <strong>of</strong> both South Africa and SADC.<br />

Lehlogonolo Masoga,<br />

CEO <strong>of</strong> the MMSEZ<br />

Please comment on the location <strong>of</strong> the MMSEZ in terms <strong>of</strong><br />

regional trade and logistics.<br />

The SADC North-South Corridor connects the South <strong>African</strong><br />

port <strong>of</strong> Durban to Lusaka (Zambia) and Lubumbashi (DRC)<br />

through Johannesburg and Gaborone (Botswana). The Beitbridge<br />

Border Post is the second-busiest port <strong>of</strong> entry in South Africa and<br />

handles a significant number <strong>of</strong> trucks, averaging about 500 per<br />

day and about 1 000 passenger vehicles per day within the North-<br />

South Corridor.<br />

The transportation system in the SADC region comprises<br />

an integrated road, railway and port system principally<br />

serving regional transit traffic. The transformation <strong>of</strong> the<br />

traditional transport corridors into development corridors, or<br />

Spatial Development Initiatives (SDIs), represents a landmark<br />

achievement for SADC’s long-term development. The concept<br />

<strong>of</strong> development corridors is to view the major transport routes<br />

from the sea ports to the hinterlands that they serve not merely<br />

as transport, but economic corridors with activities related to<br />

agriculture, industry, commerce, communications and tourism.<br />

The MMSEZ aims to become a leading innovative, sustainable<br />

and inclusive high-tech <strong>African</strong> gateway city, driven by residents<br />

and visionary investment within a prosperous rural-urban<br />

integrated region and operating as a highly-connected freight,<br />

warehousing, logistics, transport, retail and manufacturing<br />

industrial hub supporting the SEZ within a super-efficient<br />

Gauteng-Limpopo-Zimbabwe economic corridor. The Musina-<br />

Makhado region is a regional development anchor and exists<br />

along a key national road, the N1.<br />

What facilities are intended to leverage this factor?<br />

The development <strong>of</strong> the Musina-Makhado Corridor is a function<br />

<strong>of</strong> multi-party stakeholders across various spheres <strong>of</strong> government.<br />

Among the key stakeholders is the South <strong>African</strong> National Roads<br />

Agency (SANRAL) which has already invested over half-abillion<br />

rand in the construction <strong>of</strong> the Musina Ring Road and the<br />

continuing rehabilitation <strong>of</strong> the N1 freeway between Musina and<br />

Makhado. The Department <strong>of</strong> Home Affairs, through the National<br />

Border Management Authority, has launched the first phase <strong>of</strong><br />

providing 24/7 border patrol units while working on a plan to roll<br />

out the One-Stop Border Post. The MMSEZ is involved in ongoing<br />

discussions with various players to partner for the development <strong>of</strong><br />

the Inland Dry Port to move cargo from land to sea and vice versa.<br />

Please comment on the expected impact <strong>of</strong> the <strong>African</strong><br />

Continental Free Trade Area (AfCFTA).<br />

The MMSEZ has all the features to become a leading <strong>African</strong><br />

Continental Free Trade Area project in view <strong>of</strong> the growing<br />

interest for intra-Africa trade collaboration. The ambitious goal<br />

<strong>of</strong> creating an inland dry port in Musina has the great potential <strong>of</strong><br />

becoming a game-changer in the movement <strong>of</strong> cargo from across<br />

The AfCFTA will further enhance the<br />

importance <strong>of</strong> the location <strong>of</strong> the MMSEZ.<br />

MMSEZ, artist’s impression.<br />

Credit: MMSEZ<br />

16

SPECIAL ECONOMIC ZONE<br />

the Limpopo River to global destinations, taking advantage <strong>of</strong> the<br />

road to rail and sea intermodal infrastructure already operational<br />

in Musina.<br />

The MMSEZ SOC has entered into a partnership with the Musina<br />

Intermodal Terminal (MIT) for the use <strong>of</strong> the existing facilities to<br />

promote regional trade. With the plans afoot to develop a regional<br />

airport, the town <strong>of</strong> Musina will soon become the melting-pot <strong>of</strong><br />

economic activity for the SADC region and beyond.<br />

How does the MMSEZ fit into the various regional and<br />

provincial planning initiatives?<br />

The Limpopo Development Plan 2020-2025 and Medium-Term<br />

Strategic Framework identify nine priorities, which include:<br />

• Transformation and modernisation <strong>of</strong> the provincial economy<br />

• Integrated and sustainable socio-economic infrastructure<br />

development<br />

• Spatial transformation for integrated socio-economic<br />

development<br />

• Economic transformation and job creation through regional<br />

integration<br />

These policy priorities reinforce the Musina-Makhado Special<br />

Economic Zone business case in line with the vision <strong>of</strong> the<br />

provincial administration. A successful MMSEZ will result in<br />

South Africa’s active participation and leadership in the AfCFTA,<br />

and in SADC’s industrialisation strategy.<br />

Are new rail links planned?<br />

The MMSEZ is working closely with Transnet to develop the<br />

enabling infrastructure to support the two sites <strong>of</strong> the SEZ.<br />

A plan is underway to conduct a feasibility study to determine<br />

the infrastructure requirements for the MMSEZ, including the<br />

associated costs implications.<br />

What is meant by a “catalytic” project, and how does the<br />

MMSEZ qualify for that title?<br />

In economics terms a catalytic project is the one that spurs change<br />

and triggers multiplier spin<strong>of</strong>fs. An example is the OR Tambo<br />

International Airport and its effect on the Gauteng economy.<br />

In the same way, the MMSEZ is likely to become catalytic to the<br />

economy <strong>of</strong> Limpopo.<br />

What sectoral strengths in the Limpopo economy are<br />

reflected in the location <strong>of</strong> the Musina-Makhado SEZ?<br />

Limpopo is renowned for being the bread basket <strong>of</strong> the country<br />

due to its abundance <strong>of</strong> agricultural resources. Our province<br />

is also an undisputed home <strong>of</strong> platinum group metals (PGMs),<br />

chrome, diamonds and other mineral resources. Limpopo<br />

Province, supplemented by the Musina-Makhado Corridor, is the<br />

real passage and gateway to the rest <strong>of</strong> the continent. Our SEZ is<br />

located at the busy Beitbridge Border Post, with great potential<br />

to become a new inland dry port. Similarly, the development <strong>of</strong><br />

a medium-size fresh-produce market in Musina to service the<br />

inland and cross-border markets will go a long way in boosting<br />

the agriculture sector by supporting local farmers to penetrate<br />

regional and global value chains. The Musina-Makhado Corridor<br />

represents a strategic breeding ground for some <strong>of</strong> the most<br />

Artistic Impression <strong>of</strong> the MMSEZ.<br />

Developing small towns into cities<br />

The MEC <strong>of</strong> Limpopo Economic<br />

Development Environment and Tourism<br />

(LEDET), Thabo Mokone, stated on the<br />

occasion <strong>of</strong> the launch <strong>of</strong> the MMSEZ<br />

Corporate Identity, “We are pleased that<br />

finally the province has established a<br />

capable and agile entity seized with a<br />

mandate to implement the MMSEZ.<br />

Our ambition is not just to build an<br />

industrial park but rather to use the SEZ<br />

as a catalyst to unlock a plethora <strong>of</strong> other<br />

economic opportunities, including the<br />

potential <strong>of</strong> realising a new Smart City in<br />

our province.” It is our anticipation that<br />

the MMSEZ as a mega-industrial project<br />

will transform the spatial configuration <strong>of</strong><br />

the two towns <strong>of</strong> Musina and Makhado.<br />

According to the external masterplan<br />

report, the two towns requires an<br />

investment <strong>of</strong> R133-billion in socioeconomic<br />

infrastructure such as roads,<br />

rail, human settlement, schools, health<br />

facilities, ICT infrastructure, airport,<br />

electricity, water and sewerage.<br />

Catalytic projects such as the envisaged<br />

High-Speed Rail Project connecting Johannesburg<br />

and Musina will add the much-desired impetus<br />

<strong>of</strong> engendering the creation <strong>of</strong> a new smart city.<br />

The province is currently developing a model<br />

for a new smart city based on the principles <strong>of</strong><br />

smart economy, smart mobility, smart housing,<br />

smart environment, smart governance, artificial<br />

intelligence and the internet-<strong>of</strong>-things. With the<br />

creation <strong>of</strong> opportunities for local people to earn a<br />

decent income, entrepreneurs to create wealth and<br />

investment in socio-economic infrastructure, such<br />

conditions will lay a solid base for the new smart<br />

city to take shape.<br />

sought-after fresh produce and exotic fruits. With the roadto-rail<br />

infrastructure at our disposal, we are well positioned to<br />

participate in global value chains.<br />

Do you see the concept <strong>of</strong> a “Smart City” which you are<br />

rolling out for the MMSEZ as something that could have a<br />

bigger impact?<br />

By 2050 more than two-thirds <strong>of</strong> the world’s population is likely<br />

to live in urban areas. To ensure that this trend is managed, it<br />

is necessary to plan the future. This future is being enabled by<br />

technology built in one corner <strong>of</strong> the world that can easily be<br />

CONTACTS<br />

MUSINA-MAKHADO SEZ SOC<br />

29 Market Street,<br />

Polokwane,<br />

Limpopo Province (RSA)<br />

www.mmsez.co.za<br />

MR SHAVANA MUSHWANA<br />

Marketing and<br />

Communication Manager<br />

Tel: +27(0) 15 295 5120<br />

Cell: +27 (0)66 173 8957<br />

Shavana.Mushwana@lieda.co.z<br />

transported to another corner, <strong>of</strong>ten with the click <strong>of</strong> a button.<br />

This is called frontier technology – the intersection where radical<br />

forward thinking and real-world implementation meet. We are<br />

pleased that from the very beginning, our SEZ will embrace<br />

technology and become smart through the investment by our<br />

technology partner.<br />

The MMSEZ Smart City Framework will have a lasting impact<br />

on Limpopo with a corridor <strong>of</strong> smartness from Polokwane to<br />

Beitbridge. Within this corridor there will be nodes that impact<br />

on settlements and economic activity. In addition, this corridor<br />

will extend and form part <strong>of</strong> the Gauteng City Region footprint<br />

in a real and dynamic way and extend to Zimbabwe, thereby<br />

contributing to an integrated and prosperous Africa.<br />

Limpopo is renowned<br />

for being the bread<br />

basket <strong>of</strong> the country<br />

due to its abundance<br />

<strong>of</strong> agricultural<br />

resources.<br />

17<br />

FOCUS<br />

Investment opportunities outside the zone<br />

SEZ projects are by their nature catalytic. They<br />

stimulate growth and development which is felt<br />

outside the delimited geographic space. In Musina<br />

and Makhado towns various stimulus packages<br />

have been identified as investment opportunities<br />

for the private sector outside the confinement <strong>of</strong><br />

the SEZ spaces. Among such opportunities are<br />

the new Musina Dam, High Speed Rail Project,<br />

Manaledzi Mega Housing Project in Makhado,<br />

An artist’s impression<br />

<strong>of</strong> the new bridge over<br />

the Limpopo River.<br />

Musina Airport, MMSEZ human settlement, private<br />

hospital, private schools and training centres, retail<br />

property and hotels.<br />

Lehlogonolo Masoga (below) has more<br />

than 20 years <strong>of</strong> experience as an<br />

administrator and public servant,<br />

most recently as Deputy Speaker <strong>of</strong><br />

The launch <strong>of</strong> the MMSEZ Corporate Identity.<br />

the Limpopo Provincial Legislature<br />

It is for this reason, among others, that the<br />

Musina-Makhado Special Economic Zone is “a<br />

world <strong>of</strong> game-changing opportunities”. ■<br />

and MEC for Roads and Transport.<br />

He served as the spokesperson for<br />

MR RICHARD ZITHA<br />

Executive Manager:<br />

Investment Promotion<br />

Tel: +27(0) 15 295 5120<br />

Cell: +27 (0)71 391 8188<br />

Richard.Zitha@lieda.co.za<br />

the former LEDET MEC and Minister<br />

<strong>of</strong> Public Administration the late Mr<br />

Collins Chabane. Lehlogonolo holds<br />

three Master’s degrees: Governance<br />

and Public Leadership (Wits),<br />

29 SOUTH AFRICAN BUSINESS 2020/21<br />

Development Studies (Limpopo) and<br />

an MSc in Leadership and Change<br />

(Leeds Beckett University, UK). He<br />

has B-Tech HRM from UNISA and a<br />

pr<strong>of</strong>essional diploma in Humanitarian<br />

Assistance from the Liverpool<br />

School <strong>of</strong> Tropical Medicine (UK)<br />

and is currently a registered PhD<br />

candidate in Public Administration.

ENERGY PARTNERSHIPS IN AFRICA MUST BENEFIT<br />

SOCIETY, ESPECIALLY WOMEN AND CHILDREN,<br />

THROUGH LOCALISATION<br />

Africa’s capability has grasped the world’s attention in recent times as conflict in Eastern Europe and rising energy costs<br />

have highlighted the globe’s precarious energy position. Recent discoveries <strong>of</strong> oil and gas across the continent serve as a<br />

reminder that Africa has the potential to be an international energy supplier. Africa, nevertheless, must also be focused<br />

on increased production <strong>of</strong> clean energy as part <strong>of</strong> the just transition and fight against climate change. Additionally,<br />