NORTHERN TRUST INVESTMENT FUNDS PLC

NORTHERN TRUST INVESTMENT FUNDS PLC

NORTHERN TRUST INVESTMENT FUNDS PLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>NORTHERN</strong> <strong>TRUST</strong> <strong>INVESTMENT</strong> <strong>FUNDS</strong> <strong>PLC</strong><br />

(Investment Company with Variable Capital)<br />

Interim Report and<br />

Financial Statements<br />

Six months ended 30 September 2012<br />

Unaudited

CONTENTS<br />

the nt europe (ex-uk) equit y index fund<br />

investment review ................................................................................... 4<br />

portfolio and schedule of investments ..................................................... 5<br />

portfolio changes – material acquisitions and disposals ..........................18<br />

the nt euro government bond index fund<br />

investment review ................................................................................. 20<br />

portfolio and schedule of investments ................................................... 22<br />

portfolio changes – material acquisitions and disposals ......................... 28<br />

the nt index linked bond index fund<br />

investment review ................................................................................. 30<br />

portfolio and schedule of investments .................................................. 32<br />

portfolio changes – material acquisitions and disposals ........................ 34<br />

the nt japan equit y index fund<br />

investment review ................................................................................ 36<br />

portfolio and schedule of investments ................................................... 37<br />

portfolio changes – material acquisitions and disposals ......................... 48<br />

the nt north americ a equit y index fund<br />

investment review ................................................................................. 50<br />

portfolio and schedule of investments ....................................................51<br />

portfolio changes – material acquisitions and disposals ......................... 72<br />

the nt pacific (ex-japan) equit y index fund<br />

investment review ................................................................................. 74<br />

portfolio and schedule of investments ................................................... 75<br />

portfolio changes – material acquisitions and disposals ......................... 82<br />

the nt uk equit y index fund<br />

investment review ................................................................................. 84<br />

portfolio and schedule of investments ................................................... 85<br />

portfolio changes – material acquisitions and disposals ......................... 90<br />

2 of 162 | Northern Trust Quantitative Fund <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com

the nt emerging markets index fund<br />

investment review ................................................................................. 92<br />

portfolio and schedule of investments ................................................... 93<br />

portfolio changes – material acquisitions and disposals ....................... 120<br />

the nt euro government infl ation linked index fund<br />

investment review ................................................................................122<br />

portfolio and schedule of investments ................................................. 124<br />

portfolio changes – material acquisitions and disposals ....................... 126<br />

the nt all country asia (ex-japan) equit y index fund<br />

investment review ................................................................................128<br />

portfolio and schedule of investments ................................................. 129<br />

portfolio changes – material acquisitions and disposals ....................... 148<br />

profit and loss account ............................................................................... 150<br />

bal ance sheet ...............................................................................................152<br />

statement of changes in net assets attributable to holders of<br />

redeemable participating shares ......................................................................154<br />

profit and loss account (march 2012 comparative) .......................................... 155<br />

bal ance sheet (march 2012 comparative) ..........................................................157<br />

statement of changes in net assets attributable to holders of<br />

redeemable participating shares<br />

(march 2012 comparative) ..............................................................................158<br />

profit and loss account (september 2011 comparative) ......................................159<br />

statement of changes in net assets attributable to holders of<br />

redeemable participating shares<br />

(september 2011 comparatives) ......................................................................... 161<br />

statement of accounting policies ...................................................................162<br />

notes forming part of the financial statements .............................................. 164<br />

directors and other information .................................................................. 184<br />

northerntrust.com | Northern Trust Quantitative Fund <strong>PLC</strong> - Interim Report and Financial Statements | 3 of 162

THE NT EUROPE (EX-UK) EQUITY INDEX FUND<br />

<strong>INVESTMENT</strong> REVIEW - UNAUDITED<br />

FOR THE SIX MONTHS ENDED 30 SEPTEMbER 2012<br />

Launch Date<br />

10th December 2003<br />

Fund Size<br />

€185.95 million<br />

Benchmark<br />

MSCI Europe (ex-UK) Index<br />

Fund Review<br />

During the six months ended 30 September 2012,<br />

the Sub-Fund returned 3.44% against a benchmark<br />

return of 2.90%. Since the Sub-Fund inception date,<br />

in December 2003, the Sub-Fund has posted an<br />

annualised return of 5.07% against an annualised<br />

benchmark return of 4.56%.<br />

MSCI implemented changes to their series of<br />

indexes at the end of May 2012. These changes<br />

included normal investment review changes such as<br />

additions, deletions, and float and shares changes. For<br />

MSCI Europe (ex-UK), there were 10 additions, 14<br />

deletions and a number of free float changes and share<br />

in issue changes. The turnover at the MSCI review in<br />

May 2012 was 1.38%.<br />

The MSCI quarterly review in August 2012 saw no<br />

additions or deletions for the region and only a few<br />

small share in issue and float factor changes, resulting<br />

in minimal turnover for the portfolio and the index.<br />

The index changes were carefully traded to<br />

minimise any deviation from the benchmark (resulting<br />

from trading costs) and were used as an opportunity to<br />

equitise some of the futures exposure.<br />

Northern Trust Global Investments Limited<br />

London<br />

October 2012<br />

4 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

Financial assets at fair value through profit or loss<br />

Investments in transferable securities<br />

EqUITIES: 99.81% (MaRCH 2012: 97.39%)<br />

austria: 0.65% (March 2012: 0.60%)<br />

% of Net<br />

Assets<br />

4,069 Andritz 179,321 0.10<br />

12,054 Erste Bank 209,318 0.11<br />

38,441 Immoeast Rights - -<br />

31,571 Immofinanz Rights - -<br />

51,004 Immofinanz Immobilen 143,984 0.08<br />

8,293 OMV 225,860 0.12<br />

2,561 Raiffeisen Bank International 72,182 0.04<br />

11,937 Telekom Austria 65,653 0.04<br />

4,116 Verbund 66,268 0.04<br />

2,093 Vienna InsuranceWiener Versicherung Gruppe 69,069 0.04<br />

6,334 Voestalpine 147,519 0.08<br />

Total Austria 1,179,174 0.65<br />

Belgium: 2.74% (March 2012: 2.38%)<br />

13,110 Ageas 244,633 0.13<br />

44,782 Anheuser-Busch InBev 2,963,225 1.59<br />

8,608 Belgacom 204,440 0.11<br />

4,337 Colruyt 147,003 0.08<br />

5,502 Delhaize 165,307 0.09<br />

4,467 Groupe Bruxelles Lambert 257,969 0.14<br />

9,034 KBC Groep 168,665 0.09<br />

1,540 Mobistar 37,807 0.02<br />

3,260 Solvay 293,596 0.16<br />

2,555 Telenet 89,042 0.05<br />

5,987 UCB 256,184 0.14<br />

6,272 Umicore 255,114 0.14<br />

Total Belgium 5,082,985 2.74<br />

Denmark: 2.83% (March 2012: 2.59%)<br />

31 AP Moller - Maersk - A Shares 163,509 0.09<br />

73 AP Moller - Maersk - B Shares 406,581 0.22<br />

5,887 Carlsberg 405,904 0.22<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 5 of 184

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

6 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com<br />

% of Net<br />

Assets<br />

1,282 Coloplast 207,741 0.11<br />

36,334 Danske Bank 510,301 0.27<br />

10,201 DSV 178,438 0.10<br />

22,636 Novo Nordisk 2,782,908 1.50<br />

13,402 Novozymes Class B 287,465 0.15<br />

26,935 TDC 152,691 0.08<br />

1,406 Tryg 71,085 0.04<br />

1,464 William Demant 102,120 0.05<br />

Total Denmark 5,268,743 2.83<br />

Finland: 1.76% (March 2012: 2.04%)<br />

6,919 Elisa 121,705 0.07<br />

24,783 Fortum 355,140 0.19<br />

3,691 Kesko Class B 81,387 0.04<br />

8,586 Kone 462,356 0.25<br />

6,882 Metso 191,388 0.10<br />

7,354 Neste Oil 75,011 0.04<br />

210,131 Nokia 422,363 0.23<br />

6,123 Nokian Renkaat 193,793 0.10<br />

5,176 Orion Class B 86,180 0.05<br />

7,561 Pohjola Bank Class A 77,425 0.04<br />

23,338 Sampo Class A 565,013 0.30<br />

31,882 Stora Enso 154,117 0.08<br />

29,638 UPM-Kymmene 260,666 0.14<br />

9,208 Wartsila 248,156 0.13<br />

Total Finland 3,294,700 1.76<br />

France: 20.94% (March 2012: 20.54%)<br />

8,386 Accor 217,659 0.12<br />

1,409 Aeroports de Paris 87,442 0.05<br />

17,359 Air Liquide 1,674,275 0.90<br />

109,832 Alcatel-Lucent 94,346 0.05<br />

11,357 Alstom 309,876 0.17<br />

3,513 Arkema 255,957 0.14<br />

3,123 AtoS 169,391 0.09<br />

98,291 AXA 1,139,193 0.61<br />

53,801 BNP Paribas 1,989,561 1.07

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

% of Net<br />

Assets<br />

10,212 Bouygues 194,028 0.10<br />

3,081 Bureau Veritas 246,233 0.13<br />

8,383 Cap Gemini 276,010 0.15<br />

32,031 Carrefour 516,980 0.28<br />

3,150 Casino Guichard Perrachon 217,003 0.12<br />

3,024 Christian Dior 315,706 0.17<br />

21,795 Cie de St-Gobain 595,766 0.32<br />

7,336 Cie Generale de Geophysique - Veritas 179,732 0.10<br />

7,336 Cie Generale de Geophysique - Veritas Rights 9,214 -<br />

10,081 Cie Generale des Etablissements Michelin 614,538 0.33<br />

11,125 Cie Generale d'Optique Essilor International 810,679 0.44<br />

8,210 CNP Assurances 83,455 0.04<br />

55,133 Credit Agricole 296,064 0.16<br />

32,208 Danone 1,543,085 0.83<br />

3,401 Dassault Systemes 278,066 0.15<br />

9,497 Edenred 207,652 0.11<br />

13,605 Electricite de France 221,829 0.12<br />

1,811 Eurazeo 64,562 0.03<br />

7,171 Eutelsat Communications 179,382 0.10<br />

1,470 Fonciere Des Regions Reits 85,995 0.05<br />

103,141 France Telecom 968,288 0.52<br />

67,603 GDF Suez 1,176,292 0.63<br />

1,260 Gecina 100,372 0.05<br />

30,350 Groupe Eurotunnel 166,379 0.09<br />

1,260 ICADE Reits 79,884 0.04<br />

1,209 Iliad 153,180 0.08<br />

1,436 Imerys 65,568 0.04<br />

3,672 JCDecaux 64,847 0.03<br />

5,410 Klepierre Reits 147,639 0.08<br />

10,321 Lafarge 432,553 0.23<br />

5,716 Lagardere 121,493 0.07<br />

13,338 Legrand 391,203 0.21<br />

13,416 L'Oreal 1,291,424 0.69<br />

14,140 LVMH Moet Hennessy Louis Vuitton 1,654,380 0.89<br />

53,228 Natixis 130,409 0.07<br />

11,812 Pernod-Ricard 1,031,306 0.55<br />

12,193 Peugeot 74,987 0.04<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 7 of 184

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

8 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com<br />

% of Net<br />

Assets<br />

4,191 PPR 500,405 0.27<br />

9,861 Publicis Groupe 429,446 0.23<br />

1,173 Remy Cointreau 104,983 0.06<br />

10,761 Renault 392,992 0.21<br />

6,284 Rexel 98,407 0.05<br />

12,654 Safran 354,122 0.19<br />

66,020 Sanofi 4,380,427 2.36<br />

28,991 Schneider Electric 1,335,180 0.72<br />

9,008 SCOR 180,745 0.10<br />

16,617 SES Receipt 351,699 0.19<br />

1,565 Societe BIC 147,141 0.08<br />

38,780 Societe Generale 857,038 0.46<br />

5,166 Sodexo 302,676 0.16<br />

15,999 Suez Environnement 141,095 0.08<br />

5,513 Technip 476,930 0.26<br />

5,180 Thales 138,436 0.07<br />

118,187 Total 4,562,018 2.45<br />

5,089 Unibail-Rodamco Reits 789,304 0.42<br />

5,824 Vallourec 191,901 0.10<br />

18,463 Veolia Environnement 155,015 0.08<br />

25,513 Vinci 845,628 0.45<br />

71,774 Vivendi 1,089,170 0.59<br />

1,535 Wendel 100,850 0.05<br />

1,657 Zodiac Aerospace 125,899 0.07<br />

Total France 38,975,390 20.94<br />

Germany: 20.26% (March 2012: 19.83%)<br />

11,582 Adidas 739,395 0.40<br />

25,273 Allianz 2,340,027 1.26<br />

2,268 Axel Springer 76,477 0.04<br />

51,037 BASF 3,350,579 1.80<br />

46,115 Bayer 3,081,865 1.66<br />

18,369 Bayerische Motoren Werke 1,045,380 0.56<br />

2,453 Bayerische Motoren Werke - Preference Shares 97,973 0.05<br />

5,516 Beiersdorf 314,964 0.17<br />

2,823 Brenntag 281,171 0.15<br />

4,591 Celesio 63,700 0.03

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

% of Net<br />

Assets<br />

200,279 Commerzbank 278,188 0.15<br />

4,453 Continental 339,319 0.18<br />

50,426 Daimler 1,899,295 1.02<br />

51,743 Deutsche Bank 1,590,839 0.86<br />

10,706 Deutsche Boerse 461,054 0.25<br />

12,978 Deutsche Lufthansa 136,918 0.07<br />

46,822 Deutsche Post 711,694 0.38<br />

156,290 Deutsche Telekom 1,496,477 0.80<br />

99,933 E.ON 1,845,263 0.99<br />

1,643 FraportFrankfurt Airport Services Worldwide 73,943 0.04<br />

6,877 Fresenius 621,268 0.33<br />

11,650 Fresenius Medical Care 664,749 0.36<br />

9,797 GEA 230,670 0.12<br />

3,426 Hannover Rueckversicherung 170,358 0.09<br />

7,863 HeidelbergCement 320,575 0.17<br />

7,234 Henkel 367,270 0.20<br />

9,849 Henkel - Preference Shares 609,555 0.33<br />

1,556 Hochtief 56,732 0.03<br />

1,403 Hugo Boss 96,106 0.05<br />

59,944 Infineon Technologies 296,003 0.16<br />

9,511 K+S 363,938 0.20<br />

4,895 Kabel Deutschland 271,721 0.15<br />

4,530 Lanxess 292,321 0.16<br />

10,266 Linde 1,375,644 0.74<br />

2,400 MAN 171,000 0.09<br />

3,574 Merck 343,104 0.18<br />

6,993 Metro 162,762 0.09<br />

10,000 Muenchener Rueckversicherungs 1,215,000 0.65<br />

8,492 Porsche Automobil - Preference Shares 395,260 0.21<br />

3,972 ProSiebenSat.1 Media - Preference Shares 77,871 0.04<br />

27,241 RWE 948,395 0.51<br />

2,181 RWE - Preference Shares 67,655 0.04<br />

2,260 Salzgitter 67,947 0.04<br />

51,127 SAP 2,817,609 1.52<br />

45,731 Siemens 3,549,183 1.91<br />

3,403 Suedzucker 93,753 0.05<br />

21,532 ThyssenKrupp 356,139 0.19<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 9 of 184

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

10 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com<br />

% of Net<br />

Assets<br />

5,352 United Internet 84,936 0.05<br />

1,614 Volkswagen Class A 210,143 0.11<br />

8,048 Volkswagen - Preference Shares 1,142,414 0.61<br />

822 Wacker Chemie 41,067 0.02<br />

Total Germany 37,705,669 20.26<br />

Greece: 0.12% (March 2012: 0.20%)<br />

10,941 Coca Cola Hellenic Bottling 158,863 0.09<br />

13,327 OPAP 53,308 0.03<br />

Total Greece 212,171 0.12<br />

Ireland: 0.66% (March 2012: 0.66%)<br />

40,424 CRH 606,360 0.33<br />

27,788 Elan 233,141 0.13<br />

66,122 Irish Bank Resolution Corp - -<br />

8,263 Kerry 329,281 0.18<br />

9,188 Ryanair 40,740 0.02<br />

Total Ireland 1,209,522 0.66<br />

Italy: 5.02% (March 2012: 5.17%)<br />

64,550 Assicurazioni Generali 722,315 0.39<br />

18,711 Atlantia 226,029 0.12<br />

6,681 Autogrill 49,406 0.03<br />

332,230 Banca Monte dei Paschi di Siena 74,951 0.04<br />

82,731 Banco Popolare SC 96,382 0.05<br />

365,693 Enel 1,006,387 0.54<br />

101,391 Enel Green Power 133,431 0.07<br />

141,082 ENI 2,401,216 1.29<br />

3,764 Exor 73,661 0.04<br />

48,910 Fiat 203,074 0.11<br />

47,733 Fiat Industrial 363,009 0.20<br />

21,908 Finmeccanica 80,972 0.04<br />

562,889 Intesa Sanpaolo 665,898 0.36<br />

55,983 Intesa Sanpaolo (Non CNV) 56,319 0.03<br />

6,441 Luxottica 177,321 0.10<br />

40,437 Mediaset 59,078 0.03

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

% of Net<br />

Assets<br />

27,555 Mediobanca 114,574 0.06<br />

13,768 Pirelli & C 115,376 0.06<br />

11,140 Prysmian 154,623 0.08<br />

14,661 Saipem 547,882 0.29<br />

92,139 Snam 317,880 0.17<br />

517,874 Telecom Italia 403,942 0.22<br />

324,701 Telecom Italia RSP 221,284 0.12<br />

73,795 Terna Rete Elettrica Nazionale 214,006 0.12<br />

224,850 UniCredit 726,715 0.39<br />

45,658 Unione di Banche Italiane SCPA 131,312 0.07<br />

Total Italy 9,337,043 5.02<br />

Luxembourg: 0.54% (March 2012: 0.56%)<br />

52,380 ArcelorMittal 584,561 0.31<br />

26,500 Tenaris 420,820 0.23<br />

Total Luxembourg 1,005,381 0.54<br />

Netherlands: 6.42% (March 2012: 6.27%)<br />

95,662 Aegon 386,953 0.21<br />

12,908 Akzo Nobel 567,823 0.31<br />

23,201 ASML 964,930 0.52<br />

3,631 Corio Reits 120,132 0.06<br />

32,736 DE Master Blenders 1753 306,900 0.17<br />

7,507 Delta Lloyd 89,071 0.05<br />

22,745 European Aeronautic Defence and Space 561,005 0.30<br />

3,904 Fugro 206,600 0.11<br />

4,315 Gemalto 295,362 0.16<br />

12,794 Heineken 593,514 0.32<br />

5,538 Heineken - A Shares 209,309 0.11<br />

213,084 ING Groep 1,310,254 0.70<br />

54,817 Koninklijke KPN 325,942 0.18<br />

58,021 Koninklijke Ahold 565,531 0.30<br />

3,374 Koninklijke Boskalis Westminster 94,911 0.05<br />

8,665 Koninklijke DSM 336,202 0.18<br />

57,854 Koninklijke Philips Electronics 1,050,339 0.56<br />

3,847 Koninklijke Vopak 210,200 0.11<br />

13,189 QIAGEN 188,866 0.10<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 11 of 184

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

12 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com<br />

% of Net<br />

Assets<br />

6,893 Randstad 178,287 0.10<br />

38,030 Reed Elsevier 395,702 0.21<br />

9,934 SBM Offshore 110,168 0.06<br />

18,511 TNT Express 150,420 0.08<br />

90,420 Unilever 2,489,263 1.34<br />

17,127 Wolters Kluwer 250,568 0.13<br />

Total Netherlands 11,958,252 6.42<br />

Norway: 2.33% (March 2012: 2.24%)<br />

8,900 Aker Solutions 131,114 0.07<br />

54,475 DNB 519,605 0.28<br />

9,581 Gjensidige Forsikring 103,356 0.06<br />

52,671 Norsk Hydro 191,948 0.10<br />

43,699 Orkla 258,161 0.14<br />

19,534 Seadrill 593,317 0.32<br />

61,977 Statoil 1,244,597 0.67<br />

15,802 Subsea 7 283,644 0.15<br />

39,837 Telenor 604,185 0.32<br />

10,289 Yara International 400,945 0.22<br />

Total Norway 4,330,872 2.33<br />

Portugal: 0.41% (March 2012: 0.45%)<br />

115,121 Banco Espirito Santo 65,158 0.04<br />

103,942 EDP - Energias de Portugal 222,644 0.12<br />

12,579 Galp Energia Class B 158,747 0.09<br />

12,577 Jeronimo Martins 163,312 0.09<br />

35,435 Portugal Telecom 136,318 0.07<br />

Total Portugal 746,179 0.41<br />

Spain: 6.88% (March 2012: 6.72%)<br />

19,470 Abertis Infraestructuras 222,932 0.12<br />

1,090 Acciona 48,276 0.03<br />

5,968 Acerinox 52,077 0.03<br />

7,690 ACS Actividades de Construccion y Servicios 123,271 0.07<br />

5 ACS Actividades de Construccion y Servicios Rights 5 -<br />

17,475 Amadeus IT Class A 316,822 0.17<br />

299,469 Banco Bilbao Vizcaya Argentaria 1,830,654 0.98

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

% of Net<br />

Assets<br />

153,893 Banco de Sabadell 321,636 0.17<br />

64,957 Banco Popular Espanol 110,492 0.06<br />

546,793 Banco Santander 3,168,665 1.70<br />

53,048 Bankia 68,962 0.04<br />

43,549 CaixaBank 127,424 0.07<br />

35,242 Distribuidora Internacional de Alimentacion 151,364 0.08<br />

10,051 Enagas 154,283 0.08<br />

22,964 Ferrovial 232,511 0.13<br />

19,432 Gas Natural 214,043 0.12<br />

8,149 Grifols 209,429 0.11<br />

214,929 Iberdrola 758,270 0.41<br />

12,147 Inditex 1,173,765 0.63<br />

51,520 International Consolidated Airlines 96,394 0.05<br />

40,978 Mapfre 87,365 0.05<br />

5,925 Red Electrica 218,603 0.12<br />

45,168 Repsol 681,585 0.37<br />

224,428 Telefonica 2,328,441 1.25<br />

8,324 Zardoya Otis 76,165 0.04<br />

Total Spain 12,773,434 6.88<br />

Sweden: 7.70% (March 2012: 7.37%)<br />

19,266 Alfa Laval 272,029 0.15<br />

18,576 Assa Abloy 469,517 0.25<br />

31,718 Atlas Copco Class A 576,447 0.31<br />

25,446 Atlas Copco Class B 414,494 0.22<br />

14,647 Boliden 190,140 0.10<br />

13,233 Electrolux Class B 254,147 0.14<br />

20,816 Elekta Class B 214,081 0.12<br />

10,847 Getinge Class B 254,874 0.14<br />

52,658 Hennes & Mauritz Class B 1,424,595 0.77<br />

13,405 Hexagon Class B 223,759 0.12<br />

2,974 Holmen Class B 63,287 0.03<br />

23,661 Husqvarna Class B 93,998 0.05<br />

6,414 Industrivarden Class C 71,477 0.04<br />

11,832 InvestmentKinnevik Class B 191,330 0.10<br />

25,409 Investor Class B 435,579 0.23<br />

12,048 Lundin Petroleum 228,675 0.12<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 13 of 184

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

14 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com<br />

% of Net<br />

Assets<br />

3,483 Millicom International Cellular Receipt 251,674 0.14<br />

2,678 Modern Times Class B 92,102 0.05<br />

146,646 Nordea Bank 1,129,174 0.61<br />

11,320 Ratos Class B 77,770 0.04<br />

56,333 Sandvik 595,382 0.32<br />

17,691 Scania Class B 252,727 0.14<br />

14,617 Securitas Class B 85,397 0.05<br />

79,131 Skandinaviska Enskilda Banken 515,966 0.28<br />

21,001 Skanska Class B 264,658 0.14<br />

21,901 SKF Class B 367,913 0.20<br />

8,149 SSAB Class A 45,087 0.02<br />

32,160 Svenska Cellulosa Class B 465,144 0.25<br />

27,587 Svenska Handelsbanken Class A 804,874 0.43<br />

45,598 Swedbank Class A 667,072 0.36<br />

11,395 Swedish Match 358,801 0.19<br />

17,222 Tele2 Class B 243,372 0.13<br />

167,447 Telefonaktiebolaget LM Ericsson Class B 1,188,100 0.64<br />

120,897 TeliaSonera 677,649 0.36<br />

77,532 Volvo Class B 846,549 0.46<br />

Total Sweden 14,307,840 7.70<br />

Switzerland: 20.55% (March 2012: 19.52%)<br />

122,404 ABB 1,785,866 0.96<br />

6,000 Actelion 233,637 0.13<br />

7,430 Adecco 275,064 0.15<br />

4,958 Aryzta 184,943 0.10<br />

2,724 Baloise 166,610 0.09<br />

157 Banque Cantonale Vaudoise 63,304 0.03<br />

105 Barry Callebaut 75,772 0.04<br />

29,049 Cie Financiere Richemont 1,355,080 0.73<br />

67,978 Credit Suisse 1,120,548 0.60<br />

9,685 GAM 98,127 0.05<br />

2,118 Geberit 358,240 0.19<br />

463 Givaudan 341,778 0.18<br />

12,656 Holcim 627,015 0.34<br />

11,499 Julius Baer 311,953 0.17<br />

2,968 Kuehne + Nagel International 260,701 0.14

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

% of Net<br />

Assets<br />

5 Lindt & Spruengli 140,399 0.08<br />

51 Lindt & Spruengli - Participating Non Cumulative Shares 125,533 0.07<br />

2,504 Lonza 101,875 0.05<br />

183,312 Nestle 8,990,842 4.84<br />

127,739 Novartis 6,080,281 3.27<br />

1,530 Pargesa 78,838 0.04<br />

718 Partners 116,217 0.06<br />

39,020 Roche 5,670,402 3.05<br />

1,019 Schindler 97,850 0.05<br />

2,717 Schindler- Participating Non Cumulative Shares 259,778 0.14<br />

304 SGS 485,775 0.26<br />

122 Sika 193,537 0.11<br />

2,698 Sonova 212,104 0.12<br />

36,389 STMicroelectronics 152,579 0.08<br />

454 Straumann 46,975 0.03<br />

1,367 Sulzer 154,897 0.08<br />

1,698 Swatch (Bearer) 526,933 0.28<br />

2,102 Swatch Group 113,614 0.06<br />

1,725 Swiss Life 159,652 0.09<br />

2,714 Swiss Prime Site 174,416 0.09<br />

19,444 Swiss Re 972,158 0.52<br />

1,302 Swisscom 407,059 0.22<br />

5,262 Syngenta 1,529,787 0.82<br />

19,429 Transocean 674,120 0.36<br />

202,624 UBS 1,918,895 1.03<br />

8,160 Zurich Insurance 1,580,636 0.85<br />

Total Switzerland 38,223,790 20.55<br />

Total investments in transferable securities 185,611,145 99.81<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 15 of 184

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Counterparty Fair Value<br />

€<br />

16 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com<br />

No. of<br />

Contracts<br />

FINaNCIaL DERIVaTIVE INSTRUMENTS DEaLT ON a REGULaTED MaRKET<br />

Futures Contracts: (0.01%) (March 2012: (0.04%))<br />

Unrealised<br />

Gain/(Loss) €<br />

% of Net<br />

Assets<br />

Citigroup Euro Stoxx 50 Index Futures December 2012 589,200 24 (27,340) (0.01)<br />

Citigroup OBX Index Futures October 2012 16,939 3 (371) -<br />

Citigroup OMXS 30 Index Futures October 2012 63,722 5 (2,076) -<br />

Citigroup Swiss Market Index Futures December 2012 161,482 3 (1,557) -<br />

Total Futures Contracts (31,344) (0.01)<br />

Total value of investments 185,579,801 99.80<br />

Cash 133,194 0.07<br />

Margin cash 256,173 0.14<br />

Other net liabilities (17,712) (0.01)<br />

Net Assets Attributable to Holders of Redeemable Participating Shares 185,951,456 100.00<br />

PORTFOLIO CLaSSIFICaTION % of Total<br />

Assets<br />

Transferable securities admitted to an official stock exchange listing 99.61<br />

Other current assets 0.39<br />

100.00

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 17 of 184

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO CHaNGES – aCqUISITIONS<br />

Schedule of material changes in investments for the six months ended 30 September 2012<br />

Acquisitions Nominal Asset Name Cost €<br />

27,995 Nestle 1,327,952<br />

19,613 Novartis 860,115<br />

5,974 Roche 806,592<br />

13,014 Sanofi 749,819<br />

146,293 Banco Santander 722,835<br />

18,435 Total 676,062<br />

28,511 ENI 481,744<br />

6,974 Siemens 480,587<br />

81,563 Banco Bilbao Vizcaya Argentaria 460,818<br />

7,870 BASF 458,267<br />

6,945 Anheuser-Busch InBev 405,725<br />

3,488 Novo Nordisk 401,904<br />

13,771 BNP Paribas 393,724<br />

7,068 Bayer 388,502<br />

7,927 SAP 381,799<br />

13,840 Unilever 364,784<br />

33,333 Telefonica 337,788<br />

34,088 DE Master Blenders 1753 311,866<br />

3,919 Allianz 309,155<br />

7,814 Daimler 297,879<br />

18 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com

THE NT EUROPE (EX-UK) EqUITY INDEX FUND<br />

PORTFOLIO CHaNGES – DISPOSaLS<br />

Schedule of material changes in investments for the six months ended 30 September 2012<br />

Disposals Nominal Asset Name Proceeds €<br />

3,395 Synthes 449,313<br />

5,706 Nestle 278,080<br />

5,687 Novartis 256,031<br />

30,213 Koninklijke KPN 218,633<br />

7,062 BNP Paribas 218,353<br />

34,218 Banco Santander 180,891<br />

1,585 Novo Nordisk 180,881<br />

1,209 Roche 175,193<br />

2,537 Sanofi 167,817<br />

3,850 Total 155,898<br />

5,461 Hennes & Mauritz Class B 139,588<br />

7,236 GDF Suez 132,799<br />

1,396 Siemens 108,099<br />

1,635 BASF 104,776<br />

9,366 Telefonica 99,174<br />

1,681 SAP 90,644<br />

4,758 ENI 85,098<br />

1,273 Anheuser-Busch InBev 84,383<br />

1,269 Bayer 81,501<br />

2,919 Unilever 80,151<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 19 of 184

THE NT EURO GOVERNMENT bOND INDEX FUND<br />

<strong>INVESTMENT</strong> REVIEW - UNAUDITED<br />

FOR THE SIX MONTHS ENDED 30 SEPTEMbER 2012<br />

Launch Date<br />

13 February 2004<br />

Fund Size<br />

€101.49 million<br />

Benchmark<br />

Citigroup EMU Government Bond Index<br />

Fund Review<br />

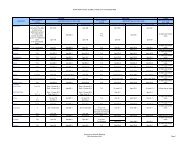

Performance data<br />

6MTD YTD 1 year 3 year<br />

Fund 3.76% 7.51% 7.00% 4.01%<br />

Benchmark 3.78% 7.42% 6.96% 3.92%<br />

Portfolio summary<br />

Portfolio Country Breakdown<br />

■ Austria 4%<br />

■ Belgium 6%<br />

■ Finland 1%<br />

■ France 24%<br />

■ Germany 23%<br />

■ Ireland 2%<br />

■ Italy 22%<br />

■ Netherlands 7%<br />

■ Spain 10%<br />

■ Cash 1%<br />

20 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com

Performance Commentary<br />

For the six months ended 30 September 2012, the Sub-<br />

Fund returned 3.76% versus a benchmark return of<br />

3.78%. The Sub-Fund underperformed the benchmark<br />

by 2 basis points (bps). Since inception the Sub-Fund<br />

has outperformed the benchmark, on an annualized<br />

basis, by 4 basis points and is up 4.41%. During the<br />

period the Sub-Fund was subject to a net inflow of<br />

€10.56 million.<br />

The index reconstitutes on a monthly basis to<br />

include new government bonds that have been issued<br />

and to exclude those bonds, which have fallen below<br />

the minimum maturity of one year. Overall the<br />

modified duration of the benchmark lengthened from<br />

6.22 years to 6.34 years.<br />

The period began on a relatively calm note however<br />

managed to fall into the midst of economic turmoil, as<br />

political uncertainty and financial instability loomed<br />

large across the region. There was a reversal to the<br />

positive start to the year, with the Spanish bailout, a<br />

new Greek government, concerns of contagion and<br />

slowdown in China. The European Central Bank<br />

(ECB) cut key rates by 25bps in July, bringing the main<br />

base interest rate to 0.75% and, more importantly,<br />

the deposit rate to 0.00%, thus entering a new<br />

environment where the ECB no longer paid banks<br />

for leaving money with the central bank. However, it<br />

refrained from relaxing rates any further through the<br />

quarter.<br />

In July, ECB President Mario Draghi also relieved<br />

some tension stating "the ECB is willing to do whatever<br />

it takes to preserve the Euro". Draghi delivered on<br />

his commitment in September, unveiling a new and<br />

ambitious scheme to engage in a potentially unlimited<br />

bond buying program, hoping to address the high<br />

borrowing costs prevalent in the Eurozone. Economic<br />

data in the region persisted on the disappointing path.<br />

After stagnating for the first three months of the year,<br />

the Eurozone contracted 0.2% in the April to June<br />

ending period. Economic confidence in the region,<br />

having fallen for seven months, dropped by 1.1 points<br />

to 85 in September, the lowest since August 2009.<br />

Considering a high probability of Greece exiting<br />

the euro zone, Moody's changed its stance from<br />

‘stable’ to ‘negative’ for Germany, the Netherlands and<br />

Luxembourg, stating that it would result in a chain of<br />

financial sector shocks. Moody’s also downgraded the<br />

European Financial Stability Facility (EFSF), the fund<br />

that seeks to contain the debt crisis from spreading.<br />

Fitch downgraded the credit rating of 18 Spanish<br />

banks while Spain’s bleak economic outlook led to a<br />

three notch downgrade (one notch above junk status).<br />

French President Hollande restated his intentions to<br />

deliver on his deficit cutting promises in France’s first<br />

Socialist budget in a decade. President Hollande has<br />

promised to raise taxes by €20 billion next year, aiming<br />

to reduce the deficit to 3%. Spain ventured into a fifth<br />

round of budget cuts and tax increases, announcing<br />

a crisis budget for 2013 amidst austerity measures, to<br />

meet a budget deficit reduction target of 4.5%. The EU<br />

Summit at the end of June began the arduous path of<br />

mapping out solutions for the debt situation in Europe.<br />

The politicians proposed to recapitalise banks from<br />

EFSF/ESM and to move towards a banking union.<br />

The capital of the European Investment Bank (EIB)<br />

was also to be increased by €10 billion along with a<br />

€120 billion growth pact. Global economic growth<br />

remains weak as downside risks to economic outlook<br />

persist on the back of the euro zone sovereign debt<br />

crisis and allied moderate growth outlook in most<br />

developed economies.<br />

Northern Trust Global Investments Limited<br />

London<br />

October 2012<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 21 of 184

THE NT EURO GOVERNMENT BOND INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

Financial assets at fair value through profit or loss<br />

Investments in transferable securities<br />

BONDS: 98.59% (MaRCH 2012: 96.53%)<br />

austria: 4.18% (March 2012: 4.03%)<br />

22 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com<br />

% of Net<br />

Assets<br />

300,000 Austria Government Bond 3.4% 20/10/2014 320,358 0.32<br />

350,000 Austria Government Bond 3.5% 15/09/2021 398,570 0.39<br />

400,000 Austria Government Bond 4% 15/09/2016 454,168 0.45<br />

250,000 Austria Government Bond 4.15% 15/03/2037 308,037 0.30<br />

400,000 Austria Government Bond 4.3% 15/07/2014 429,892 0.42<br />

600,000 Austria Government Bond 4.35% 15/03/2019 713,988 0.70<br />

700,000 Austria Government Bond 4.65% 15/01/2018 833,469 0.82<br />

100,000 Austria Government Bond 4.85% 15/03/2026 127,902 0.13<br />

450,000 Austria Government Bond 6.25% 15/07/2027 659,601 0.65<br />

Total Austria 4,245,985 4.18<br />

Belgium: 6.31% (March 2012: 6.24%)<br />

550,000 Belgium Government Bond 2.75% 28/09/2016 587,768 0.58<br />

700,000 Belgium Government Bond 3.25% 28/09/2016 763,861 0.75<br />

450,000 Belgium Government Bond 3.5% 28/03/2015 483,214 0.48<br />

900,000 Belgium Government Bond 3.75% 28/09/2020 1,006,254 0.99<br />

700,000 Belgium Government Bond 4% 28/03/2018 795,739 0.78<br />

400,000 Belgium Government Bond 4% 28/03/2022 454,064 0.45<br />

430,000 Belgium Government Bond 4.25% 28/09/2014 463,063 0.46<br />

400,000 Belgium Government Bond 4.25% 28/09/2022 460,340 0.45<br />

250,000 Belgium Government Bond 4.25% 28/03/2041 290,290 0.29<br />

400,000 Belgium Government Bond 5% 28/03/2035 508,352 0.50<br />

450,000 Belgium Government Bond 5.5% 28/03/2028 589,495 0.58<br />

Total Belgium 6,402,440 6.31<br />

Finland: 1.47% (March 2012: 1.57%)<br />

200,000 Finland Government Bond 3.125% 15/09/2014 211,988 0.21<br />

600,000 Finland Government Bond 3.375% 15/04/2020 687,564 0.68<br />

250,000 Finland Government Bond 3.875% 15/09/2017 288,680 0.28<br />

250,000 Finland Government Bond 4% 04/07/2025 304,615 0.30<br />

Total Finland 1,492,847 1.47

THE NT EURO GOVERNMENT BOND INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

France: 23.97% (March 2012: 22.84%)<br />

% of Net<br />

Assets<br />

200,000 France Government Bond 3% 25/04/2022 214,212 0.21<br />

1,940,000 France Government Bond 3.25% 25/04/2016 2,127,676 2.10<br />

1,300,000 France Government Bond 3.75% 25/04/2017 1,470,833 1.45<br />

3,200,000 France Government Bond 3.75% 25/04/2021 3,653,376 3.60<br />

1,800,000 France Government Bond 4% 25/10/2013 1,874,700 1.85<br />

900,000 France Government Bond 4% 25/04/2014 954,495 0.94<br />

450,000 France Government Bond 4% 25/10/2014 485,316 0.48<br />

2,000,000 France Government Bond 4% 25/04/2018 2,308,220 2.27<br />

530,000 France Government Bond 4% 25/04/2055 617,895 0.61<br />

570,000 France Government Bond 4.25% 25/10/2017 661,451 0.65<br />

1,000,000 France Government Bond 4.5% 25/04/2041 1,250,150 1.23<br />

800,000 France Government Bond 4.75% 25/04/2035 1,016,344 1.00<br />

850,000 France Government Bond 5% 25/10/2016 997,696 0.98<br />

650,000 France Government Bond 5.5% 25/04/2029 875,127 0.86<br />

175,000 France Government Bond 5.75% 25/10/2032 247,620 0.24<br />

1,150,000 France Government Bond 6% 25/10/2025 1,585,919 1.56<br />

700,000 France Government Bond 8.5% 25/10/2019 1,025,696 1.01<br />

750,000 France Government Bond 8.5% 25/04/2023 1,184,362 1.17<br />

1,550,000 French Treasury Note BTAN 2% 12/07/2015 1,622,416 1.60<br />

150,000 French Treasury Note BTAN 2.25% 25/02/2016 158,992 0.16<br />

Total France 24,332,496 23.97<br />

Germany: 22.63% (March 2012: 21.96%)<br />

1,350,000 Bundesobligation 0.5% 07/04/2017 1,356,318 1.34<br />

1,100,000 Bundesobligation 2.25% 11/04/2014 1,137,895 1.12<br />

1,000,000 Bundesobligation 2.25% 10/04/2015 1,055,300 1.04<br />

300,000 Bundesobligation 2.5% 10/10/2014 314,964 0.31<br />

650,000 Bundesobligation 4% 11/10/2013 676,585 0.67<br />

700,000 Bundesrepublik Deutschland 0.25% 14/03/2014 702,548 0.69<br />

1,750,000 Bundesrepublik Deutschland 2.25% 04/09/2021 1,896,282 1.87<br />

1,800,000 Bundesrepublik Deutschland 2.5% 04/01/2021 1,992,564 1.96<br />

100,000 Bundesrepublik Deutschland 2.5% 04/07/2044 105,868 0.10<br />

350,000 Bundesrepublik Deutschland 3.25% 04/07/2042 429,090 0.42<br />

800,000 Bundesrepublik Deutschland 3.5% 04/01/2016 887,464 0.87<br />

800,000 Bundesrepublik Deutschland 3.75% 04/01/2015 866,960 0.85<br />

800,000 Bundesrepublik Deutschland 3.75% 04/01/2017 915,584 0.90<br />

650,000 Bundesrepublik Deutschland 3.75% 04/01/2019 768,274 0.76<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 23 of 184

THE NT EURO GOVERNMENT BOND INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

24 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com<br />

% of Net<br />

Assets<br />

1,900,000 Bundesrepublik Deutschland 4% 04/07/2016 2,167,862 2.14<br />

1,500,000 Bundesrepublik Deutschland 4% 04/01/2018 1,767,540 1.74<br />

500,000 Bundesrepublik Deutschland 4% 04/01/2037 668,315 0.66<br />

750,000 Bundesrepublik Deutschland 4.25% 04/07/2014 805,823 0.79<br />

800,000 Bundesrepublik Deutschland 4.75% 04/07/2028 1,096,432 1.08<br />

550,000 Bundesrepublik Deutschland 4.75% 04/07/2034 793,820 0.78<br />

650,000 Bundesrepublik Deutschland 4.75% 04/07/2040 992,752 0.98<br />

500,000 Bundesrepublik Deutschland 5.5% 04/01/2031 755,050 0.74<br />

450,000 Bundesrepublik Deutschland 6.25% 04/01/2024 667,062 0.66<br />

100,000 Bundesrepublik Deutschland 6.5% 04/07/2027 158,967 0.16<br />

Total Germany 22,979,319 22.63<br />

Ireland: 1.81% (March 2012: 1.48%)<br />

1,200,000 Ireland Government Bond 4.5% 18/04/2020 1,159,618 1.14<br />

650,000 Ireland Government Bond 4.6% 18/04/2016 679,484 0.67<br />

Total Ireland 1,839,102 1.81<br />

Italy: 21.82% (March 2012: 21.78%)<br />

600,000 Italy Buoni Poliennali Del Tesoro 3% 01/04/2014 607,350 0.60<br />

1,600,000 Italy Buoni Poliennali Del Tesoro 3% 15/04/2015 1,604,976 1.58<br />

800,000 Italy Buoni Poliennali Del Tesoro 3.75% 15/12/2013 816,160 0.80<br />

1,400,000 Italy Buoni Poliennali Del Tesoro 3.75% 15/04/2016 1,424,304 1.40<br />

2,200,000 Italy Buoni Poliennali Del Tesoro 3.75% 01/08/2021 2,038,078 2.01<br />

1,100,000 Italy Buoni Poliennali Del Tesoro 4.25% 01/08/2014 1,136,410 1.12<br />

2,400,000 Italy Buoni Poliennali Del Tesoro 4.25% 01/02/2019 2,399,995 2.37<br />

2,100,000 Italy Buoni Poliennali Del Tesoro 4.25% 01/03/2020 2,061,891 2.03<br />

1,150,000 Italy Buoni Poliennali Del Tesoro 4.5% 15/07/2015 1,197,069 1.18<br />

150,000 Italy Buoni Poliennali Del Tesoro 4.5% 01/03/2019 151,449 0.15<br />

750,000 Italy Buoni Poliennali Del Tesoro 4.75% 15/09/2016 782,910 0.77<br />

750,000 Italy Buoni Poliennali Del Tesoro 4.75% 01/05/2017 776,887 0.77<br />

2,050,000 Italy Buoni Poliennali Del Tesoro 5% 01/03/2025 1,994,929 1.97<br />

650,000 Italy Buoni Poliennali Del Tesoro 5% 01/08/2034 589,734 0.58<br />

1,000,000 Italy Buoni Poliennali Del Tesoro 5% 01/08/2039 897,438 0.88<br />

950,000 Italy Buoni Poliennali Del Tesoro 5.25% 01/08/2017 1,004,872 0.99<br />

650,000 Italy Buoni Poliennali Del Tesoro 5.75% 01/02/2033 648,055 0.64<br />

700,000 Italy Buoni Poliennali Del Tesoro 6% 01/05/2031 718,711 0.71<br />

1,200,000 Italy Buoni Poliennali Del Tesoro 6.5% 01/11/2027 1,292,448 1.27<br />

Total Italy 22,143,666 21.82

THE NT EURO GOVERNMENT BOND INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

Netherlands: 6.72% (March 2012: 6.12%)<br />

% of Net<br />

Assets<br />

250,000 Netherlands Government Bond 1% 15/01/2014 253,143 0.25<br />

350,000 Netherlands Government Bond 2.75% 15/01/2015 370,741 0.37<br />

300,000 Netherlands Government Bond 3.25% 15/07/2015 325,182 0.32<br />

1,080,102 Netherlands Government Bond 3.5% 15/07/2020 1,250,002 1.23<br />

500,000 Netherlands Government Bond 3.75% 15/07/2014 532,660 0.52<br />

200,000 Netherlands Government Bond 3.75% 15/01/2042 255,664 0.25<br />

800,000 Netherlands Government Bond 4% 15/07/2016 906,544 0.89<br />

500,000 Netherlands Government Bond 4% 15/07/2018 584,930 0.58<br />

450,000 Netherlands Government Bond 4% 15/01/2037 580,554 0.57<br />

400,000 Netherlands Government Bond 4.5% 15/07/2017 471,456 0.47<br />

200,000 Netherlands Government Bond 5.5% 15/01/2028 285,236 0.28<br />

650,000 Netherlands Government Bond 7.5% 15/01/2023 1,000,532 0.99<br />

Total Netherlands 6,816,644 6.72<br />

Spain: 9.68% (March 2012: 10.51%)<br />

850,000 Spain Government Bond 3% 30/04/2015 832,342 0.82<br />

884,000 Spain Government Bond 3.15% 31/01/2016 852,778 0.84<br />

800,000 Spain Government Bond 3.3% 31/10/2014 797,478 0.79<br />

1,100,000 Spain Government Bond 3.8% 31/01/2017 1,057,553 1.04<br />

1,900,000 Spain Government Bond 4% 30/04/2020 1,715,692 1.69<br />

1,000,000 Spain Government Bond 4.1% 30/07/2018 946,380 0.93<br />

350,000 Spain Government Bond 4.2% 31/01/2037 247,387 0.24<br />

1,200,000 Spain Government Bond 4.25% 31/01/2014 1,214,820 1.20<br />

230,000 Spain Government Bond 4.6% 30/07/2019 219,033 0.22<br />

250,000 Spain Government Bond 4.7% 30/07/2041 187,864 0.19<br />

600,000 Spain Government Bond 4.8% 31/01/2024 529,027 0.52<br />

430,000 Spain Government Bond 4.9% 30/07/2040 331,666 0.33<br />

150,000 Spain Government Bond 5.5% 30/04/2021 145,824 0.14<br />

300,000 Spain Government Bond 5.75% 30/07/2032 272,460 0.27<br />

150,000 Spain Government Bond 5.9% 30/07/2026 141,983 0.14<br />

340,000 Spain Government Bond 6% 31/01/2029 322,666 0.32<br />

Total Spain 9,814,953 9.68<br />

Total investments in transferable securities 100,067,452 98.59<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 25 of 184

THE NT EURO GOVERNMENT BOND INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Cash 879,871 0.87<br />

Other net assets 544,592 0.54<br />

Net Assets Attributable to Holders of Redeemable Participating Shares 101,491,915 100.00<br />

PORTFOLIO CLaSSIFICaTION % of Total<br />

Assets<br />

Transferable securities admitted to an official stock exchange listing 95.72<br />

Other current assets 4.28<br />

26 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com<br />

100.00

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 27 of 184

THE NT EURO GOVERNMENT BOND INDEX FUND<br />

PORTFOLIO CHaNGES – aCqUISITIONS<br />

Schedule of material changes in investments for the six months ended 30 September 2012<br />

Acquisitions Nominal Asset Name Cost €<br />

2,300,000 France Government Bond 3.75% 25/04/2021 2,491,247<br />

1,350,000 Bundesobligation 0.5% 07/04/2017 1,362,420<br />

1,150,000 Italy Buoni Poliennali Del Tesoro 4.5% 15/07/2015 1,179,707<br />

1,100,000 Bundesobligation 2.25% 11/04/2014 1,141,358<br />

1,000,000 Bundesrepublik Deutschland 3.5% 04/01/2016 1,116,483<br />

1,000,000 France Government Bond 4% 25/04/2018 1,108,040<br />

950,000 Italy Buoni Poliennali Del Tesoro 5.25% 01/08/2017 1,010,401<br />

900,000 France Government Bond 4% 25/04/2014 958,065<br />

800,000 Bundesrepublik Deutschland 3.75% 04/01/2017 924,400<br />

900,000 Italy Buoni Poliennali Del Tesoro 3.75% 15/04/2016 859,050<br />

600,000 Netherlands Government Bond 4.5% 15/07/2017 712,920<br />

650,000 France Government Bond 3.25% 25/04/2016 712,790<br />

700,000 Bundesrepublik Deutschland 0.25% 14/03/2014 703,605<br />

700,000 Italy Buoni Poliennali Del Tesoro 4.75% 15/09/2016 687,400<br />

600,000 France Government Bond 3.75% 25/04/2017 673,820<br />

700,000 Spain Government Bond 3.8% 31/01/2017 655,758<br />

550,000 Bundesrepublik Deutschland 3.75% 04/01/2015 598,215<br />

550,000 Belgium Government Bond 2.75% 28/09/2016 587,840<br />

500,000 Netherlands Government Bond 4% 15/07/2018 585,538<br />

500,000 Italy Buoni Poliennali Del Tesoro 4.75% 01/05/2017 488,000<br />

28 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com

THE NT EURO GOVERNMENT BOND INDEX FUND<br />

PORTFOLIO CHaNGES – DISPOSaLS aND MaTURITIES<br />

Schedule of material changes in investments for the six months ended 30 September 2012<br />

Disposals Nominal Asset Name Proceeds €<br />

1,600,000 France Government Bond 8.5% 25/10/2019 2,276,608<br />

1,500,000 Bundesrepublik Deutschland 3.5% 04/01/2016 1,677,450<br />

1,450,000 France Government Bond 4% 25/10/2014 1,565,539<br />

1,250,000 Bundesrepublik Deutschland 3.75% 04/07/2013 1,293,813<br />

900,000 Bundesschatzanweisungen 1.75% 14/06/2013 915,030<br />

900,000 Italy Buoni Poliennali Del Tesoro 3% 01/04/2014 906,489<br />

900,000 Italy Buoni Poliennali Del Tesoro 3.75% 15/12/2013 896,780<br />

800,000 Italy Buoni Poliennali Del Tesoro 4.75% 15/09/2016 838,984<br />

700,000 France Government Bond 4% 25/10/2013 737,009<br />

650,000 Belgium Government Bond 4.25% 28/09/2013 676,423<br />

600,000 Netherlands Government Bond 4.25% 15/07/2013 624,210<br />

550,000 Bundesrepublik Deutschland 4.25% 04/07/2014 598,510<br />

544,000 Italy Buoni Poliennali Del Tesoro 3% 15/04/2015 516,365<br />

400,000 Spain Government Bond 4.25% 31/01/2014 405,200<br />

400,000 Italy Buoni Poliennali Del Tesoro 3.75% 15/04/2016 397,868<br />

300,000 French Treasury Note BTAN 2% 12/07/2015 310,815<br />

300,000 Belgium Government Bond 4% 28/03/2013 309,894<br />

400,000 Spain Government Bond 4.9% 30/07/2040 282,780<br />

250,000 Finland Government Bond 3.125% 15/09/2014 265,590<br />

200,000 Netherlands Government Bond 4.5% 15/07/2017 236,112<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 29 of 184

THE NT INDEX LINKED bOND INDEX FUND<br />

<strong>INVESTMENT</strong> REVIEW - UNAUDITED<br />

FOR THE SIX MONTHS ENDED 30 SEPTEMbER 2012<br />

Launch Date<br />

10th December 2003<br />

Fund Size<br />

£22.64 million<br />

Benchmark<br />

FTSE Actuaries Government Securities<br />

Over 5 Years UK Index Linked Gilts Index<br />

Fund Review<br />

Performance data<br />

6MTD YTD 1 year 3 year<br />

Fund -2.40% -4.31% 4.90% 9.26%<br />

Benchmark -2.40% -4.32% 5.02% 9.31%<br />

Portfolio summary<br />

Portfolio Country Breakdown<br />

■ 0-5 yrs; 0.14%<br />

■ 5-10 yrs; 13.78%<br />

■ 10+ yrs; 86.08%<br />

30 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com

Performance Commentary<br />

For the six months ended 30 September 2012, the<br />

Sub-Fund and the benchmark returned -2.40%.<br />

Since inception, the Sub-Fund has outperformed the<br />

benchmark, on an annualized basis, by 19 basis points<br />

and is up 7.60%. During the period there were net<br />

inflows of £0.22 million.<br />

During the past quarter there were a number<br />

of Linker auctions, as the DMO re-opened issues<br />

across the curve. Overall the modified duration of the<br />

benchmark shortened from 19.80 to 17.65.<br />

The Bank of England (BoE) unanimously voted<br />

to keep its base rate at 0.50% while acknowledging<br />

that the circumstances were rather compelling and<br />

required additional easing. An additional £50 billion<br />

easing was implemented at its July meeting pushing<br />

the asset purchase target to £375 billion. The Bank also<br />

announced the creation of a Government and BoE<br />

Funding for Lending Scheme (FLS) while also pushing<br />

for the activation of the Bank’s Extended Collateral<br />

Term Repo Facility (ECTR). The governor indicated<br />

that the struggling economy is beginning to exhibit<br />

signs of recovery; however, its performance is reliant<br />

on global economic health. It noted that downside<br />

risks to the outlook had increased as a result of weak<br />

data across the euro zone, the US and some emerging<br />

markets. However, even in the backdrop of a subdued<br />

economic outlook in Europe, a few positive events<br />

appeared to improve overall sentiment.<br />

The second Greek election resulted in a coalition<br />

of moderate centre aligned parties which calmed the<br />

markets temporarily. Secondly, the EU Summit at<br />

the end of June helped to begin the arduous path of<br />

mapping out solutions for the current situation in<br />

Europe. Despite the guarded optimism, downside risks<br />

to economic outlook persist as a result of the Euro<br />

zone sovereign debt crisis and a moderate growth<br />

outlook in most developed economies. Developments<br />

abroad, particularly in the Euro area, continue to be a<br />

major headwind for the UK economy.<br />

Acknowledging Eurozone’s crisis impact being<br />

greater than envisaged; the BoE cut its economic<br />

growth forecast and is now expecting the economy<br />

to grow about 2 % over two years. Economic data<br />

remained subdued, with the economy mired in<br />

recession, indicating slowed recovery. Second quarter<br />

GDP shrank less than previously estimated, falling to<br />

-0.4% after holding steady at -0.3% quarter on quarter<br />

in Q1. The service sector continued to rise at a gradual<br />

pace with the PMI Services rising from 51 to 53.7 in<br />

August. The manufacturing PMI which recorded its<br />

lowest figure since beginning of 2009, at 45.2, edged<br />

significantly higher, as the volume of activity rose to<br />

49.5. However, despite higher global oil prices, inflation<br />

receded with the Core CPI slipping from 2.3% year<br />

on year to 2.1% year on year in August. The current<br />

account deficit widened to a record £20.8 billion<br />

quarter on quarter compared to the previous £15.4<br />

billion quarter on quarter.<br />

Northern Trust Global Investments Limited<br />

London<br />

October 2012<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 31 of 184

THE NT INDEX LINKED BOND INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Nominal<br />

Holding<br />

Security Description Fair Value<br />

£<br />

Financial assets at fair value through profit or loss<br />

Investments in transferable securities<br />

BONDS: 99.64% (MaRCH 2012: 99.66%)<br />

United Kingdom: 99.64% (March 2012: 99.66%)<br />

32 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com<br />

% of Net<br />

Assets<br />

668,300 United Kingdom Gilt Inflation Linked 0.125% 22/03/2029 691,626 3.05<br />

300,000 United Kingdom Gilt Inflation Linked 0.125% 22/03/2044 281,939 1.25<br />

301,000 United Kingdom Gilt Inflation Linked 0.25% 22/03/2052 291,609 1.29<br />

922,100 United Kingdom Gilt Inflation Linked 0.375% 22/03/2062 977,857 4.32<br />

853,800 United Kingdom Gilt Inflation Linked 0.50% 22/03/2050 1,032,460 4.56<br />

863,200 United Kingdom Gilt Inflation Linked 0.625% 22/03/2040 1,057,730 4.67<br />

843,500 United Kingdom Gilt Inflation Linked 0.625% 22/11/2042 1,064,283 4.70<br />

830,800 United Kingdom Gilt Inflation Linked 0.75% 22/03/2034 965,548 4.26<br />

749,400 United Kingdom Gilt Inflation Linked 0.75% 22/11/2047 1,006,494 4.45<br />

966,500 United Kingdom Gilt Inflation Linked 1.125% 22/11/2037 1,409,315 6.22<br />

881,916 United Kingdom Gilt Inflation Linked 1.25% 22/11/2017 1,266,468 5.59<br />

1,171,384 United Kingdom Gilt Inflation Linked 1.25% 22/11/2027 1,769,358 7.81<br />

1,046,800 United Kingdom Gilt Inflation Linked 1.25% 22/11/2032 1,432,236 6.33<br />

786,226 United Kingdom Gilt Inflation Linked 1.25% 22/11/2055 1,366,886 6.04<br />

1,191,100 United Kingdom Gilt Inflation Linked 1.875% 22/11/2022 1,786,356 7.89<br />

732,555 United Kingdom Gilt Inflation Linked 2.00% 26/01/2035 1,412,731 6.24<br />

498,260 United Kingdom Gilt Inflation Linked 2.50% 16/04/2020 1,835,392 8.11<br />

513,811 United Kingdom Gilt Inflation Linked 2.50% 17/07/2024 1,706,829 7.54<br />

390,843 United Kingdom Gilt Inflation Linked 4.125% 22/07/2030 1,204,852 5.32<br />

Total value of investments in transferable securities 22,559,969 99.64<br />

Cash 17,662 0.08<br />

Other net assets 63,898 0.28<br />

Net Assets Attributable to Holders of Redeemable Participating Shares 22,641,529 100.00

PORTFOLIO CLaSSIFICaTION % of Total<br />

Assets<br />

Transferable securities admitted to an official stock exchange listing 99.59<br />

Other current assets 0.41<br />

The above entities are classified according to the country of risk.<br />

100.00<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 33 of 184

THE NT INDEX LINKED BOND INDEX FUND<br />

PORTFOLIO CHaNGES – aCqUISITIONS<br />

Schedule of material changes in investments for the six months ended 30 September 2012<br />

Acquisitions Nominal Asset Name Cost £<br />

1,231,100 United Kingdom Gilt Inflation Linked 1.875% 22/11/2022 1,463,223<br />

306,000 United Kingdom Gilt Inflation Linked 0.375% 22/03/2062 364,325<br />

312,000 United Kingdom Gilt Inflation Linked 0.125% 22/03/2029 327,062<br />

307,000 United Kingdom Gilt Inflation Linked 0.125% 22/03/2044 312,618<br />

301,000 United Kingdom Gilt Inflation Linked 0.25% 22/03/2052 285,800<br />

184,000 United Kingdom Gilt Inflation Linked 0.75% 22/03/2034 218,403<br />

67,000 United Kingdom Gilt Inflation Linked 0.50% 22/03/2050 86,730<br />

3,000 United Kingdom Gilt Inflation Linked 2.50% 17/07/2024 9,974<br />

34 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com

THE NT INDEX LINKED BOND INDEX FUND<br />

PORTFOLIO CHaNGES – DISPOSaLS aND MaTURITIES<br />

Schedule of material changes in investments for the six months ended 30 September 2012<br />

Disposals Nominal Asset Name Proceeds £<br />

1,271,100 United Kingdom Gilt Inflation Linked 1.875% 22/11/2022 1,523,166<br />

37,600 United Kingdom Gilt Inflation Linked 2.50% 17/07/2024 125,080<br />

80,300 United Kingdom Gilt Inflation Linked 1.25% 22/11/2027 122,734<br />

81,000 United Kingdom Gilt Inflation Linked 1.25% 22/11/2017 116,694<br />

30,200 United Kingdom Gilt Inflation Linked 2.50% 16/04/2020 111,348<br />

72,300 United Kingdom Gilt Inflation Linked 1.25% 22/11/2032 101,368<br />

66,700 United Kingdom Gilt Inflation Linked 1.125% 22/11/2037 100,746<br />

53,700 United Kingdom Gilt Inflation Linked 1.25% 22/11/2055 99,290<br />

49,500 United Kingdom Gilt Inflation Linked 2.00% 26/01/2035 97,880<br />

27,200 United Kingdom Gilt Inflation Linked 4.125% 22/07/2030 85,196<br />

60,000 United Kingdom Gilt Inflation Linked 0.625% 22/03/2040 76,575<br />

56,300 United Kingdom Gilt Inflation Linked 0.625% 22/11/2042 74,381<br />

51,200 United Kingdom Gilt Inflation Linked 0.75% 22/11/2047 72,551<br />

50,500 United Kingdom Gilt Inflation Linked 0.50% 22/03/2050 64,661<br />

40,000 United Kingdom Gilt Inflation Linked 1.875% 22/11/2022 60,055<br />

46,800 United Kingdom Gilt Inflation Linked 0.375% 22/03/2062 52,918<br />

37,000 United Kingdom Gilt Inflation Linked 0.75% 22/03/2034 44,445<br />

25,000 United Kingdom Gilt Inflation Linked 0.125% 22/03/2029 26,228<br />

7,000 United Kingdom Gilt Inflation Linked 0.125% 22/03/2044 6,633<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 35 of 184

THE NT JAPAN EQUITY INDEX FUND<br />

<strong>INVESTMENT</strong> REVIEW - UNAUDITED<br />

FOR THE SIX MONTHS ENDED 30 SEPTEMbER 2012<br />

Launch Date<br />

13th February 2004<br />

Fund Size<br />

€23.55 million<br />

Benchmark<br />

MSCI Japan Index<br />

Fund Review<br />

During the six months ended 30 September 2012,<br />

the Sub-Fund returned 1.67% against a benchmark<br />

return of 1.65%. Since the Sub-Fund inception date, in<br />

February 2004, the Sub-Fund has posted an annualised<br />

return of 1.19% against an annualised benchmark<br />

return of 1.16%.<br />

MSCI implemented changes to their series of<br />

indexes at the end of May 2012. These changes<br />

included normal investment review changes such as<br />

additions, deletions, and float and shares changes. For<br />

MSCI Japan, there were three additions, three deletions<br />

and a number of free float changes and share in issue<br />

changes. The turnover at the MSCI review in May 2012<br />

was 0.89%.<br />

The MSCI quarterly review in August 2012 saw no<br />

additions or deletions for the region and only a few<br />

small share in issue and float factor changes, resulting<br />

in minimal turnover for the portfolio and the index.<br />

The index changes were carefully traded to<br />

minimise any deviation from the benchmark (resulting<br />

from trading costs) and were used as an opportunity to<br />

equitise some of the futures exposure.<br />

Northern Trust Global Investments Limited<br />

London<br />

October 2012<br />

36 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com

THE NT JaPaN EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

Financial assets at fair value through profit or loss<br />

Investments in transferable securities<br />

EqUITIES: 96.33% (MaRCH 2012: 96.92%)<br />

Basic Materials: 5.66% (March 2012: 6.41%)<br />

% of Net<br />

Assets<br />

2,287 Air Water 21,844 0.09<br />

18,000 Asahi Kasei 72,475 0.31<br />

4,000 Daicel 18,703 0.08<br />

4,000 Daido Steel 14,507 0.06<br />

7,000 Denki Kagaku Kogyo 16,925 0.07<br />

1,400 Hitachi Chemical 14,757 0.06<br />

3,000 Hitachi Metals 20,861 0.09<br />

5,000 Japan Steel Works 21,730 0.09<br />

7,000 JFE 72,035 0.31<br />

2,600 JSR 33,250 0.14<br />

4,000 Kaneka 15,026 0.06<br />

3,000 Kansai Paint 25,927 0.11<br />

33,929 Kobe Steel 21,017 0.09<br />

4,700 Kuraray 41,652 0.18<br />

20,000 Mitsubishi Chemical 59,746 0.25<br />

6,000 Mitsubishi Gas Chemical 23,499 0.10<br />

16,000 Mitsubishi Materials 39,325 0.17<br />

12,000 Mitsui Chemicals 18,344 0.08<br />

1,700 Nippon Paper 15,643 0.07<br />

110,015 Nippon Steel 175,866 0.75<br />

10,000 Nisshin Steel 8,392 0.04<br />

2,400 Nitto Denko 89,200 0.38<br />

11,000 OJI Paper 26,157 0.11<br />

5,900 Shin-Etsu Chemical 258,778 1.10<br />

21,000 Showa Denko 26,017 0.11<br />

21,000 Sumitomo Chemical 41,753 0.18<br />

8,000 Sumitomo Metal Mining 78,729 0.33<br />

3,000 Taiyo Nippon Sanso 12,319 0.05<br />

7,000 Tosoh 10,351 0.04<br />

14,000 UBE Industries 23,499 0.10<br />

600 Yamato Kogyo 13,806 0.06<br />

Total Basic Materials 1,332,133 5.66<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 37 of 184

THE NT JaPaN EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

Communications: 6.29% (March 2012: 5.29%)<br />

38 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com<br />

% of Net<br />

Assets<br />

1,500 Dena 38,845 0.16<br />

2,637 Dentsu 52,166 0.22<br />

1,300 Gree 18,560 0.08<br />

340 Hakuhodo DY 17,868 0.08<br />

28 Jupiter Telecommunications 22,156 0.09<br />

3,900 KDDI 236,128 1.00<br />

6,233 Nippon Telegraph & Telephone 231,660 0.98<br />

218 NTT DoCoMo 275,741 1.17<br />

10,300 Rakuten 81,812 0.35<br />

2,980 SBI 14,976 0.06<br />

12,700 Softbank 400,960 1.70<br />

1,500 Trend Micro 32,671 0.14<br />

209 Yahoo! Japan 62,080 0.26<br />

Total Communications 1,485,623 6.29<br />

Consumer, Cyclical: 26.17% (March 2012: 27.58%)<br />

400 ABC-Mart 13,788 0.06<br />

8,600 Aeon 75,870 0.32<br />

2,800 Aisin Seiki 62,104 0.26<br />

16,000 All Nippon Airways 26,216 0.11<br />

2,000 Asics 21,041 0.09<br />

9,200 Bridgestone 166,371 0.71<br />

3,500 Citizen Holdings 13,883 0.06<br />

3,000 Daihatsu Motor 39,025 0.17<br />

7,000 Daiwa House Industry 79,239 0.34<br />

6,900 Denso 168,967 0.72<br />

800 FamilyMart 30,692 0.13<br />

800 Fast Retailing 145,070 0.62<br />

9,000 Fuji Heavy Industries 58,268 0.25<br />

4,000 Hino Motors 20,422 0.09<br />

800 Hitachi High-Technologies 15,050 0.06<br />

23,300 Honda Motor 558,000 2.37<br />

4,880 Isetan Mitsukoshi 39,688 0.17<br />

17,000 Isuzu Motors 64,033 0.27<br />

21,400 Itochu 169,122 0.72<br />

6,800 J Front Retailing 29,757 0.13<br />

2,900 JTEKT 17,877 0.08

THE NT JaPaN EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

% of Net<br />

Assets<br />

1,897 Koito Manufacturing 17,096 0.07<br />

900 Lawson 53,952 0.23<br />

23,993 Marubeni 119,378 0.51<br />

3,000 Marui 16,575 0.07<br />

38,000 Mazda Motor 34,549 0.15<br />

900 McDonald's 19,989 0.08<br />

20,200 Mitsubishi 286,381 1.22<br />

2,000 Mitsubishi Logistics 18,563 0.08<br />

53,000 Mitsubishi Motors 38,126 0.16<br />

25,000 Mitsui 274,254 1.16<br />

2,400 Namco Bandai 31,700 0.13<br />

4,000 NGK Insulators 37,366 0.16<br />

3,000 NGK Spark Plug 24,608 0.10<br />

2,300 NHK Spring 15,396 0.07<br />

1,490 Nintendo 147,229 0.63<br />

35,600 Nissan Motor 236,528 1.00<br />

500 Nitori 36,218 0.15<br />

1,400 NOK 17,470 0.07<br />

700 Oriental Land 71,895 0.31<br />

31,800 Panasonic 163,941 0.70<br />

700 Sankyo 25,422 0.11<br />

600 Sanrio 16,767 0.07<br />

2,900 Sega Sammy 42,911 0.18<br />

6,000 Sekisui Chemical 37,706 0.16<br />

8,000 Sekisui House 61,944 0.26<br />

10,700 Seven & I 256,249 1.09<br />

14,000 Sharp 26,996 0.11<br />

300 Shimamura 27,246 0.12<br />

1,100 Shimano 62,424 0.27<br />

16,700 Sojitz 16,852 0.07<br />

14,500 Sony 133,136 0.57<br />

1,889 Stanley Electric 21,817 0.09<br />

16,000 Sumitomo 168,329 0.71<br />

10,900 Sumitomo Electric Industries 89,844 0.38<br />

2,300 Sumitomo Rubber Industries 21,302 0.09<br />

5,200 Suzuki Motor 78,709 0.33<br />

4,000 Takashimaya 21,421 0.09<br />

13,000 Teijin 24,808 0.11<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 39 of 184

THE NT JaPaN EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

40 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com<br />

% of Net<br />

Assets<br />

1,500 Toho 21,506 0.09<br />

21,000 Toray Industries 96,933 0.41<br />

900 Toyoda Gosei 14,054 0.06<br />

800 Toyota Boshoku 6,474 0.03<br />

2,400 Toyota Industries 52,393 0.22<br />

39,500 Toyota Motor 1,199,724 5.10<br />

3,100 Toyota Tsusho 51,693 0.22<br />

290 USS 23,904 0.10<br />

1,240 Yamada Denki 42,432 0.18<br />

2,100 Yamaha 15,190 0.06<br />

3,900 Yamaha Motor 26,574 0.11<br />

Total Consumer, Cyclical 6,160,457 26.17<br />

Consumer, Non-cyclical: 13.02% (March 2012: 11.20%)<br />

9,000 Ajinomoto 110,061 0.47<br />

600 Alfresa 23,109 0.10<br />

5,500 Asahi 105,725 0.45<br />

6,400 Astellas Pharma 253,533 1.08<br />

1,000 Benesse 37,766 0.16<br />

3,100 Chugai Pharmaceutical 50,640 0.22<br />

898 Coca-Cola 11,610 0.05<br />

8,000 Dai Nippon Printing 43,481 0.18<br />

9,600 Daiichi Sankyo 123,729 0.53<br />

2,100 Dainippon Sumitomo Pharma 18,002 0.08<br />

3,600 Eisai 126,606 0.54<br />

900 Hisamitsu Pharmaceutical 38,800 0.16<br />

12,800 Japan Tobacco 299,507 1.27<br />

7,600 Kao 174,643 0.74<br />

2,000 Kikkoman 21,321 0.09<br />

12,000 Kirin 125,168 0.53<br />

4,000 Kyowa Hakko Kirin 37,686 0.16<br />

2,100 MEDIPAL 22,534 0.10<br />

840 Meiji 32,521 0.14<br />

817 Miraca Holdings 28,610 0.12<br />

3,300 Mitsubishi Tanabe Pharma 39,136 0.17<br />

3,000 Nippon Meat Packers 30,033 0.13<br />

2,500 Nisshin Seifun Group 23,978 0.10<br />

800 Nissin Foods 24,458 0.10

THE NT JaPaN EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

% of Net<br />

Assets<br />

1,200 Ono Pharmaceutical 57,608 0.24<br />

5,276 Otsuka Holdings 127,565 0.54<br />

1,000 Santen Pharmaceutical 35,868 0.15<br />

3,000 Secom 121,991 0.52<br />

4,000 Shimadzu 21,860 0.09<br />

4,100 Shionogi 48,828 0.21<br />

5,200 Shiseido 55,642 0.24<br />

997 Suzuken 25,849 0.11<br />

1,054 Sysmex 39,542 0.17<br />

500 Taisho Pharmaceutical 31,821 0.14<br />

11,300 Takeda Pharmaceutical 405,871 1.72<br />

2,200 Terumo 73,854 0.31<br />

8,000 Toppan Printing 36,207 0.15<br />

1,000 Toyo Suisan Kaisha 19,503 0.08<br />

800 Tsumura 19,598 0.08<br />

1,600 Unicharm 71,616 0.30<br />

1,400 Yakult Honsha 51,754 0.22<br />

1,904 Yamazaki Baking 19,879 0.08<br />

Total Consumer, Non-cyclical 3,067,513 13.02<br />

Energy: 1.53% (March 2012: 1.67%)<br />

8,000 Cosmo Oil 11,510 0.05<br />

300 Idemitsu Kosan 19,183 0.08<br />

31 Inpex 144,176 0.61<br />

400 Japan Petroleum Exploration 12,509 0.05<br />

31,840 JX 135,835 0.58<br />

2,700 Showa Shell Sekiyu 11,168 0.05<br />

4,000 TonenGeneral Sekiyu 27,056 0.11<br />

Total Energy 361,437 1.53<br />

Financial: 16.98% (March 2012: 16.34%)<br />

1,000 Aeon Credit Service 16,785 0.07<br />

1,000 Aeon Mall 19,083 0.08<br />

8,000 Aozora Bank 19,103 0.08<br />

5,000 Bank of Kyoto 33,020 0.14<br />

17,000 Bank of Yokohama 63,013 0.27<br />

11,000 Chiba Bank 49,895 0.21<br />

3,000 Chugoku Bank 32,970 0.14<br />

northerntrust.com | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | 41 of 184

THE NT JaPaN EqUITY INDEX FUND<br />

PORTFOLIO aND SCHEDULE OF <strong>INVESTMENT</strong>S<br />

As at 30 September 2012<br />

Holdings Security Description Fair Value<br />

€<br />

42 of 184 | Northern Trust Investment Funds <strong>PLC</strong> - Interim Report and Financial Statements | northerntrust.com<br />

% of Net<br />

Assets<br />

2,200 Credit Saison 41,477 0.18<br />

121 Dai-ichi Life Insurance 107,110 0.45<br />

1,100 Daito Trust Construction 86,273 0.37<br />

24,000 Daiwa Securities 71,216 0.30<br />

11,000 Fukuoka Financial 34,839 0.15<br />

5,000 Gunma Bank 19,832 0.08<br />

6,000 Hachijuni Bank 25,957 0.11<br />

3,400 Hulic 16,034 0.07<br />

4,000 Iyo Bank 25,417 0.11<br />

9,000 Joyo Bank 34,349 0.15<br />

18,000 Mitsubishi Estate 268,679 1.14<br />

182,550 Mitsubishi UFJ Financial 667,534 2.83<br />

860 Mitsubishi UFJ Lease & Finance 28,269 0.12<br />

12,000 Mitsui Fudosan 187,392 0.80<br />

327,988 Mizuho Financial 416,171 1.77<br />

7,232 MS&AD Insurance 97,617 0.41<br />

9,000 Nishi-Nippon City Bank 16,275 0.07<br />

5,400 NKSJ 82,438 0.35<br />

51,600 Nomura 143,835 0.61<br />

1,300 Nomura Real Estate 17,820 0.08<br />

14 NTT Urban Development 8,868 0.04<br />

1,510 ORIX 118,278 0.50<br />

27,016 Resona 86,374 0.37<br />

7,300 Seven Bank 17,358 0.07<br />

20,858 Shinsei Bank 21,048 0.09<br />

8,000 Shizuoka Bank 63,863 0.27<br />

2,600 Sony Financial 34,757 0.15<br />

19,193 Sumitomo Mitsui Financial 467,890 1.99<br />

45,330 Sumitomo Mitsui Trust 105,071 0.45<br />

5,000 Sumitomo Realty & Development 103,507 0.44<br />