Annex FM 1.7 - UK Border Agency

Annex FM 1.7 - UK Border Agency

Annex FM 1.7 - UK Border Agency

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

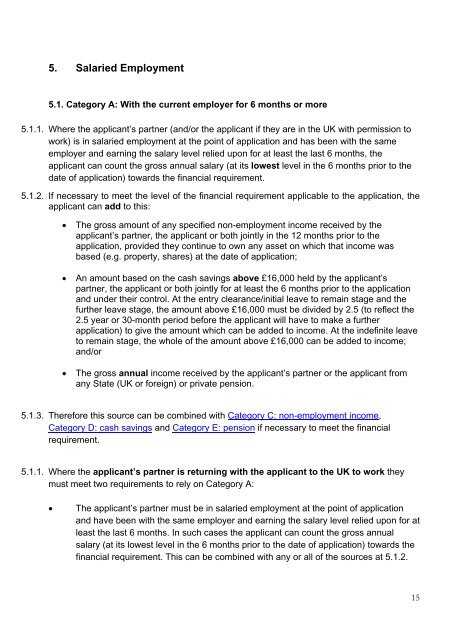

5. Salaried Employment<br />

5.1. Category A: With the current employer for 6 months or more<br />

5.1.1. Where the applicant’s partner (and/or the applicant if they are in the <strong>UK</strong> with permission to<br />

work) is in salaried employment at the point of application and has been with the same<br />

employer and earning the salary level relied upon for at least the last 6 months, the<br />

applicant can count the gross annual salary (at its lowest level in the 6 months prior to the<br />

date of application) towards the financial requirement.<br />

5.1.2. If necessary to meet the level of the financial requirement applicable to the application, the<br />

applicant can add to this:<br />

• The gross amount of any specified non-employment income received by the<br />

applicant’s partner, the applicant or both jointly in the 12 months prior to the<br />

application, provided they continue to own any asset on which that income was<br />

based (e.g. property, shares) at the date of application;<br />

• An amount based on the cash savings above £16,000 held by the applicant’s<br />

partner, the applicant or both jointly for at least the 6 months prior to the application<br />

and under their control. At the entry clearance/initial leave to remain stage and the<br />

further leave stage, the amount above £16,000 must be divided by 2.5 (to reflect the<br />

2.5 year or 30-month period before the applicant will have to make a further<br />

application) to give the amount which can be added to income. At the indefinite leave<br />

to remain stage, the whole of the amount above £16,000 can be added to income;<br />

and/or<br />

• The gross annual income received by the applicant’s partner or the applicant from<br />

any State (<strong>UK</strong> or foreign) or private pension.<br />

5.1.3. Therefore this source can be combined with Category C: non-employment income,<br />

Category D: cash savings and Category E: pension if necessary to meet the financial<br />

requirement.<br />

5.1.1. Where the applicant’s partner is returning with the applicant to the <strong>UK</strong> to work they<br />

must meet two requirements to rely on Category A:<br />

• The applicant’s partner must be in salaried employment at the point of application<br />

and have been with the same employer and earning the salary level relied upon for at<br />

least the last 6 months. In such cases the applicant can count the gross annual<br />

salary (at its lowest level in the 6 months prior to the date of application) towards the<br />

financial requirement. This can be combined with any or all of the sources at 5.1.2.<br />

15