South African Business 2022

Welcome to the 10th edition of the South African Business journal. First published in 2011, the publication has established itself as the premier business and investment guide to South Africa, supported by the website www.southafricanbusiness.co.za. Regular pages cover all the main economic sectors of the South African economy and give a snapshot of each of the country’s provinces. This issue has a focus on Special Economic Zones which are being rolled out across the country with specific economic areas of focus. The importance of the revival of minerals exploration and the significance of onshore and offshore gas discoveries is the subject of another special feature.

Welcome to the 10th edition of the South African Business journal. First published in 2011, the publication has established itself as the premier business and investment guide to South Africa, supported by the website www.southafricanbusiness.co.za. Regular pages cover all the main economic sectors of the South African economy and give a snapshot of each of the country’s provinces. This issue has a focus on Special Economic Zones which are being rolled out across the country with specific economic areas of focus. The importance of the revival of minerals exploration and the significance of onshore and offshore gas discoveries is the subject of another special feature.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SOUTH AFRICAN<br />

BUSINESS<br />

<strong>2022</strong> EDITION<br />

THE GUIDE TO BUSINESS AND INVESTMENT<br />

IN SOUTH AFRICA<br />

SOUTH AFRICAN<br />

BUSINESS<br />

THE GUIDE TO BUSINESS AND INVESTMENT<br />

IN SOUTH AFRICA<br />

2021 EDITION<br />

JOIN US ONLINE WWW.GLOBALAFRICANETWORK.COM | WWW.SOUTHAFRICANBUSINESS.CO.ZA<br />

JOIN US ONLINE WWW.GLOBALAFRICANETWORK.CO.ZA | WWW.SOUTHAFRICANBUSINESS.CO.ZA

1<br />

0<br />

1<br />

1<br />

0<br />

1<br />

1<br />

0<br />

1<br />

BUY LOCAL<br />

INVEST LOCAL<br />

0<br />

11<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

0<br />

11<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

0<br />

11<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

Let’s come together and heal as a nation.<br />

Let’s focus on Renewing, Restoring and Rebuilding<br />

successful partnerships and investment opportunities so we<br />

can get back to promoting our city as the ideal destination<br />

for business and pleasure to the rest of the world.<br />

Your support coupled with our world-class infrastructure,<br />

innovative business environment and ever evolving<br />

investment opportunities, means we can get back to<br />

‘connecting continents’ in no time.<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

1<br />

1<br />

0<br />

1<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

0<br />

11<br />

Tel: +27 31 311 4227<br />

Email: invest@durban.gov.za<br />

web: invest.durban<br />

1

0<br />

0<br />

11<br />

1<br />

0<br />

1<br />

0<br />

11<br />

0<br />

0<br />

11<br />

1<br />

0<br />

1<br />

0<br />

11<br />

The city of<br />

Durban (eThekwini<br />

Municipality) is <strong>South</strong><br />

Africa’s second most<br />

important economic<br />

region<br />

01<br />

1<br />

0<br />

11<br />

01<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

1<br />

01<br />

1<br />

0<br />

11<br />

01<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

1<br />

Extensive first-world<br />

road, rail, sea and air<br />

0<br />

01<br />

00<br />

1<br />

001<br />

11<br />

0<br />

0<br />

01<br />

0<br />

11<br />

0<br />

11<br />

00<br />

1 0<br />

01<br />

1<br />

0<br />

3<br />

0<br />

11<br />

1<br />

0<br />

1<br />

0<br />

11<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

1<br />

0<br />

3<br />

0<br />

11<br />

1<br />

0<br />

1<br />

0<br />

11<br />

1<br />

1<br />

0<br />

1<br />

Dube<br />

TradePort<br />

and King<br />

Shaka<br />

International 1<br />

Airport - 60-<br />

year Master<br />

Plan - driving<br />

growth of<br />

aerotropolis,<br />

or airport<br />

city<br />

0<br />

11<br />

001<br />

11<br />

01<br />

00<br />

Rated in top 5<br />

‘Quality of Living’<br />

cities in Africa and<br />

Middle East by<br />

Mercer Consulting in<br />

2015<br />

Named one of the<br />

New 7 Wonders Cities<br />

by the Swiss-based<br />

New 7 Wonders<br />

Foundation in 2014<br />

1<br />

01<br />

00<br />

1<br />

0<br />

01<br />

00<br />

1

Building the <strong>South</strong> <strong>African</strong> Nation Brand<br />

The Brand <strong>South</strong> <strong>South</strong> Africa Africa Acting of today Chief is definitely Marketing not Officer the same Mpumi country Mabuza administration outlines the can be achieved, i<br />

strategic<br />

that<br />

steps<br />

emerged<br />

being<br />

from<br />

taken<br />

a tumultuous<br />

to position<br />

history<br />

the<br />

only<br />

country<br />

25 years<br />

in the<br />

ago<br />

region<br />

in viewed<br />

and the<br />

against<br />

world.<br />

the background<br />

1994. During 2019, the country’s sixth democratically elected of the broader competitive and<br />

Brand administration <strong>South</strong> Africa took is taking office, active under steps the leadership economic of infrastructure. President <strong>South</strong> comparative Africa is also one advantages of the up its<br />

Cyril Ramaphosa. to take a critical look at the current state highest-ranking developing proverbial economies and sleeve. surpasses<br />

As the of country the country completes and propose its first quarter possible century countries of democracy, such as Hungary, the Italy, Brazil <strong>South</strong> and Africa Thailand. is, for example<br />

solutions on how we can successfully Diverse sectors: <strong>South</strong> Africa has the most<br />

strategic objectives of the sixth administration were made clear during one of the most transparen<br />

navigate our way to a better tomorrow in terms of dynamic economy on the continent, with key<br />

his positively first State positioning of the Nation the Nation Address Brand. (SONA) of the productive new administration sectors ranging state from governance finance, mining, systems in<br />

(20 June We 2019). recently In hosted this SONA, the Nation the President Brand Forum stated that, manufacturing, “As we enter agriculture, this the pharmaceuticals world. Ranking and second ou<br />

new under administration, the theme #BelieveinSA. we will focus Brand on <strong>South</strong> seven Africa priorities: healthcare, transport and logistics, of 102 communications<br />

countries in the Open<br />

• sought Economic to create transformation a platform that and kind job of creation forward and information technology Budget Index, and also ranking<br />

thinking. It also aimed to highlight the objectives Ease of doing business: According to the World<br />

• Education, skills and health<br />

as first out of 141 countries fo<br />

of the Reconstruction and Recovery Plan, in order Bank, it costs just R175 to start a business in <strong>South</strong><br />

•<br />

to<br />

Consolidating<br />

reassure <strong>South</strong> Africa<br />

the social<br />

and the<br />

wage<br />

world<br />

through<br />

that we are<br />

reliable<br />

Africa,<br />

and<br />

which<br />

quality<br />

is cheaper<br />

basic<br />

than<br />

Budget<br />

90% of the<br />

Transparency,<br />

rest of the<br />

in the<br />

a services country committed to rebuilding and creating a world. Reserving a company World name Economic and registering Forum Globa<br />

• better Spatial country integration, for all. human settlements and local with government<br />

the Companies and Competitiveness Intellectual Property Index (WEF GCI)<br />

• Social <strong>South</strong> cohesion <strong>African</strong>s have and proven safe communities<br />

themselves as a very Commission (CIPC) can cost In terms less than of its R200. financial <strong>South</strong> systems it is<br />

• resilient A capable, nation. ethical We pride and ourselves developmental on our ability state Africa is ranked 10th for its evident start-up that affordability, the country is a world<br />

to overcome adversity. Brand <strong>South</strong> Africa has to with a total cost relative to the monthly average<br />

• A better Africa and world.”<br />

leader in that it ranks 19th in the<br />

remind the world, and sometimes <strong>South</strong> <strong>African</strong>s, income of 3%. Most neighbouring countries have<br />

that The we <strong>South</strong> continue Africa to be a of nation the inspiring sixth administration new ways. considerably is a country higher with cost-to-income Finance percentages. pillar of the WEF GCI. Bu<br />

much to offer its citizens, and the world. Objectives set by the current it does not stop there.<br />

<strong>South</strong> Africa’s unique selling points<br />

Covid-19 collaboration<br />

Economic prowess: <strong>South</strong> Africa is the economic We have highlighted the cross-sectoral collaboration<br />

SOUTH powerhouse AFRICAN of the BUSINESS <strong>African</strong> continent, 2020 with a Gross that 4 has taken place with a broad spectrum of<br />

Domestic Product (GDP) of R1.9-trillion (US$283bn) stakeholders who have found innovative solutions<br />

– four times that of its <strong>South</strong>ern <strong>African</strong> neighbours to the health, economic and social challenges<br />

and comprising 30% of the entire GDP of Africa. caused by the pandemic.<br />

<strong>South</strong> Africa has strong entrepreneurial and dynamic <strong>South</strong> Africa has reiterated the importance of<br />

investment environment due to highly developed equitable access to vaccines which will ensure that<br />

SOUTH AFRICAN BUSINESS <strong>2022</strong><br />

4

f<br />

,<br />

t<br />

t<br />

r<br />

l<br />

.<br />

t<br />

we end the pandemic sooner and then we can<br />

build-back-better.<br />

We also firmly believe that our call for the World<br />

Trade Organisation to waive intellectual property<br />

rights tied to Covid-19 vaccines would be the correct<br />

decision for humanity, and if implemented it would<br />

allow more pharmaceutical companies, including our<br />

own, to manufacture life-saving vaccines.<br />

Encouraging active citizenship and Nation<br />

Brand Advocacy<br />

Play Your Part was in its 10th year in 2021 and<br />

continues to encourage all <strong>South</strong> <strong>African</strong>s to be<br />

active citizens, placing it upon themselves to be<br />

the change that they want to see and impact those<br />

around them to do the same. Play Your Part has<br />

been successful in highlighting what ordinary <strong>South</strong><br />

<strong>African</strong>s are doing to change the social and material<br />

conditions of the most vulnerable sections of <strong>South</strong><br />

<strong>African</strong> society. The most impactful projects through<br />

the PYP campaign are those related to education<br />

and gender-based violence.<br />

PYP has become an important slogan, an<br />

essential part of <strong>South</strong> <strong>African</strong> society, where we<br />

are all tasked with contributing positively in order<br />

to create the country that we all deserve.<br />

Equally important is the Global <strong>South</strong> <strong>African</strong>s<br />

programme which aims to build Nation Brand<br />

advocacy among <strong>South</strong> <strong>African</strong>s in the diaspora.<br />

<strong>South</strong> <strong>African</strong> living abroad are encouraged to be<br />

patriotic and fly the <strong>South</strong> <strong>African</strong> flag high wherever<br />

they are. Brand <strong>South</strong> Africa’s role is to create<br />

opportunities and platforms for Global <strong>South</strong> <strong>African</strong>s<br />

to connect and also empower them with messages<br />

and information about key issues in the country.<br />

Promoting <strong>South</strong> Africa in the region and beyond<br />

Regional forums such as SADC and the AU are hugely<br />

important for <strong>South</strong> Africa in that they continue to<br />

highlight the role we play as a key player, especially<br />

in terms of regional governance, peace and security.<br />

Health and climate diplomacy are proving to be<br />

key pillars of foreign policy for many states. Through<br />

our TRIPS (Trade-Related Aspects of Intellectual<br />

Property Rights) waiver request to the World Trade<br />

Organization, <strong>South</strong> Africa showed its commitment<br />

to ensuring equitable access to vaccines for <strong>African</strong><br />

countries. <strong>South</strong> Africa is a country brand that is<br />

synonymous with championing causes that seek to<br />

improve the lives of all <strong>African</strong>s.<br />

Mpumi Mabuza, Brand SA Acting Chief<br />

Marketing Officer<br />

The BRICS nations (Brazil, Russia, India, China<br />

and <strong>South</strong> Africa) have identified the need to<br />

strengthen cooperation among themselves to<br />

support economic recovery, ensure financial stability<br />

and guard against future uncertainties, such as those<br />

brought about by Covid-19. The strengthening of<br />

international cooperation and establishing a crossborder<br />

regulatory mechanism for further improving<br />

the investment environment and enhancing capital<br />

flows is the next goal for BRICS countries. Some<br />

notable outcomes are the New Development Bank<br />

and the Contingent Reserve Arrangement which<br />

have marked significant progress in expanding the<br />

tangible financial cooperation among BRICS nations.<br />

The fact that the Secretary General of the <strong>African</strong><br />

Continental Free Trade Area (AfCFTA) is <strong>South</strong> <strong>African</strong><br />

is a great selling point for the country and Brand<br />

<strong>South</strong> Africa. We have a well-established relationship<br />

with the Secretariat and we aim to collaborate on a<br />

number of strategic projects that will seek to better<br />

educate <strong>South</strong> <strong>African</strong>s and the rest of the continent<br />

on what opportunities are available through the<br />

AfCFTA. We are also keen to bring the Nation Brand<br />

message to the continent by proposing that <strong>African</strong><br />

nations adopt Nation Brand strategies with the aim<br />

of creating carefully curated narratives that seek to<br />

position them better as key destinations for trade and<br />

investment under the AfCFTA. We believe that our<br />

experience as the oldest Nation Brand agency in Africa<br />

will be of great benefit to our brothers and sisters on<br />

the continent. ■

CONTENTS<br />

CONTENTS<br />

<strong>South</strong> <strong>African</strong> <strong>Business</strong> <strong>2022</strong> Edition<br />

Introduction<br />

Foreword 9<br />

A unique guide to business and investment in <strong>South</strong> Africa.<br />

Special features<br />

An economic overview of <strong>South</strong> Africa 10<br />

Growing the economy while simultaneously paying off debt<br />

presents a huge challenge but infrastructure plans and green<br />

financing options offer opportunities.<br />

Provinces of <strong>South</strong> Africa 13<br />

Special Economic Zones 16<br />

Several SEZs are focussing on green energy and green technology.<br />

A snapshot of <strong>South</strong> Africa’s provinces.<br />

Gas exploration is reaping dividends –<br />

mining could be next 32<br />

A vital refinery could start receiving new feedstock<br />

to prolong its life.<br />

Economic sectors<br />

Agriculture 40<br />

Rooibos has won the battle for unique regional status.<br />

Mining 44<br />

Record earnings for miners have been good for the national Treasury.<br />

Energy 48<br />

Generation exemption has changed the energy landscape.<br />

Oil, gas and petrochemicals 54<br />

Offshore gas discoveries could boost <strong>South</strong> Africa’s economy.<br />

Water 58<br />

A three-year programme will tackle dam storage problems.<br />

SOUTH AFRICAN BUSINESS <strong>2022</strong><br />

6

GOING BEYOND?<br />

THAT’S IN OUR NATURE.<br />

At Kemtek Imaging Systems, we’re hard-wired to source the highest quality products and<br />

advanced technologies from the world’s leading manufacturing brands. Then we distribute<br />

digital and large format printing solutions direct to industry and, via our network of resellers,<br />

AM/3D print, auto ID, barcoding, labelling and sustainable resource products to their<br />

respective markets. But far beyond this, we provide valuable advice, insight and technical<br />

support from our very own, and very human, industry specialists. To view our vast product<br />

line-up, visit our website and contact us directly for more information.<br />

3DSystems I ABG I Akhani 3D I Argox I Artec I Bartender I Bentsai I Brother I Caldera I Creality I Cipherlab<br />

CrossCall I Datalogic I Digital Persona I DLyte I Dragon by EBN I DyeMansion I Envisiontec I EOS I Epson<br />

Geomagic I Godex I Highcon I Honeywell I HP I Hydrus I ITW Thermal Films I Ivanti I Kompac I Markforged<br />

Marson I Materialise I NiceLabel I Pro-Glove I Rapid 3D I SATO I Scodix I Seiko I Sewoo I SMS I Spectrum<br />

Summa I Sysdev Mobile I Todaytec I TTR Ribbon Material I UIC I VXL Software I Zhouli I Zortrax<br />

National 0861 KEMTEK Johannesburg +27 (0)11 624 8000 Pretoria +27 (0)12 804 1410<br />

Durban +27 (0)31 700 9363 Cape Town +27 (0)21 521 9600 Port Elizabeth +27 (0)41 364 3690<br />

www.kemtek.co.za<br />

J27668

THE GUIDE TO BUSINESS AND INVESTMENT<br />

IN SOUTH AFRICA<br />

CONTENTS<br />

Engineering 62<br />

Renewable energy projects are coming on stream.<br />

Construction and property 64<br />

Covid-19 has shaken up sector priorities.<br />

Manufacturing 65<br />

Vaccine manufacturing is accelerating.<br />

Transport and logistics 66<br />

The private sector is set to play a bigger role in transport.<br />

Automotive 72<br />

Total manufacture and exports rebounded well in 2021.<br />

ICT 73<br />

Covid-19 has increased demand for faster data speeds.<br />

Tourism 74<br />

The summer of 2021/22 will be vital for the sector.<br />

Banking and financial services 75<br />

120 years on, Cape Town has a stock exchange again.<br />

Development finance and SMME support 76<br />

The IDC has assets of R144-billion.<br />

References<br />

Key sector contents 38<br />

Overviews of the main economic sectors of <strong>South</strong> Africa.<br />

Index 80<br />

SOUTH AFRICAN<br />

BUSINESS<br />

THE GUIDE TO BUSINESS AND INVESTMENT<br />

IN SOUTH AFRICA<br />

SOUTH AFRICAN<br />

BUSINESS<br />

2021 EDITION<br />

<strong>2022</strong> EDITION<br />

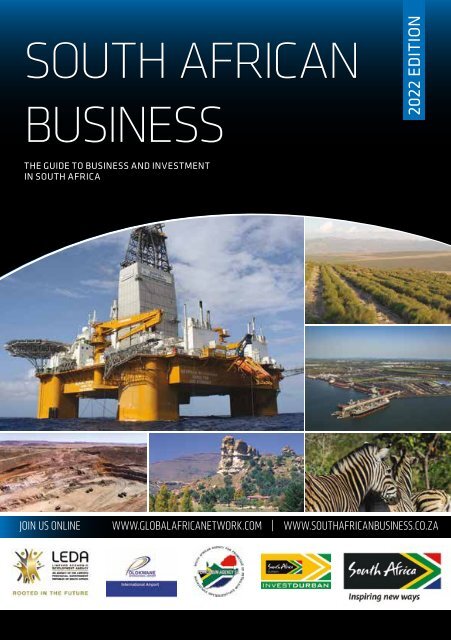

ABOUT THE COVER:<br />

The Deepsea Stavanger oil drilling rig has been active off <strong>South</strong> Africa’s coast (PASA). Top right<br />

to bottom left: Rooibos is now protected (SA Rooibos Council); the Port of Richards Bay (TNPA);<br />

zebras (Sifiso/Brand SA); a farmhouse near Clarens in the Free State (Flickr/SA Tourism); the zinc<br />

project in the Northern Cape (Kevin Wright/Vedanta Zinc International).<br />

JOIN US ONLINE WWW.GLOBALAFRICANETWORK.COM | WWW.SOUTHAFRICANBUSINESS.CO.ZA<br />

JOIN US ONLINE WWW.GLOBALAFRICANETWORK.CO.ZA | WWW.SOUTHAFRICANBUSINESS.CO.ZA<br />

SOUTH AFRICAN BUSINESS <strong>2022</strong><br />

8

<strong>South</strong> <strong>African</strong> <strong>Business</strong><br />

A unique guide to business and investment in <strong>South</strong> Africa.<br />

FOREWORD<br />

Credits<br />

Publishing director:<br />

Chris Whales<br />

Editor: John Young<br />

Managing director: Clive During<br />

Online editor: Christoff Scholtz<br />

Designer: Tyra Martin<br />

Production: Aneeqah Solomon<br />

Ad sales:<br />

Gavin van der Merwe<br />

Sam Oliver<br />

Jeremy Petersen<br />

Gabriel Venter<br />

Vanessa Wallace<br />

Shiko Diala<br />

Tahlia Wyngaard<br />

Administration & accounts:<br />

Charlene Steynberg<br />

Kathy Wootton<br />

Distribution and circulation<br />

manager: Edward MacDonald<br />

Printing: FA Print<br />

Welcome to the 10th edition of the <strong>South</strong><br />

<strong>African</strong> <strong>Business</strong> journal. First published in<br />

2011, the publication has established itself as<br />

the premier business and investment guide<br />

to <strong>South</strong> Africa, supported by an e-book edition at www.<br />

southafricanbusiness.co.za.<br />

Regular pages cover all the main economic sectors<br />

of the <strong>South</strong> <strong>African</strong> economy and give a snapshot of<br />

each of the country’s provinces. This issue has a focus on<br />

Special Economic Zones which are being rolled out across<br />

the country with specific economic areas of focus. The<br />

importance of the revival of minerals exploration and the<br />

significance of onshore and offshore gas discoveries is the<br />

subject of another special feature.<br />

<strong>South</strong> <strong>African</strong> <strong>Business</strong> is complemented by nine<br />

regional publications covering the business and investment<br />

environment in each of <strong>South</strong> Africa’s provinces. The e-book<br />

editions can be viewed online at www.globalafricanetwork.<br />

co.za. These unique titles are supported by a monthly<br />

business e-newsletter with a circulation of over 23 000. In<br />

2020, the inaugural <strong>African</strong> <strong>Business</strong> joined the Global <strong>African</strong><br />

Network stable of publications. ■<br />

Chris Whales<br />

Publisher, Global Africa Network | Email: chris@gan.co.za<br />

DISTRIBUTION<br />

<strong>South</strong> <strong>African</strong> <strong>Business</strong> is distributed internationally on outgoing<br />

and incoming trade missions, through trade and investment<br />

agencies; to foreign offices in <strong>South</strong> Africa’s main trading<br />

partners around the world; at top national and international<br />

events; through the offices of foreign representatives in<br />

<strong>South</strong> Africa; as well as nationally and regionally via chambers<br />

of commerce, tourism offices, airport lounges, provincial<br />

government departments, municipalities and companies.<br />

PUBLISHED BY<br />

Global Africa Network Media (Pty) Ltd<br />

Company Registration No: 2004/004982/07<br />

Directors: Clive During, Chris Whales<br />

Physical address: 28 Main Road, Rondebosch 7700<br />

Postal address: PO Box 292, Newlands 7701<br />

Tel: +27 21 657 6200 | Fax: +27 21 674 6943<br />

Email: info@gan.co.za | Website: www.gan.co.za<br />

Member of the Audit Bureau<br />

of Circulations ISSN 2221-4194<br />

COPYRIGHT | <strong>South</strong> <strong>African</strong> <strong>Business</strong> is an independent publication<br />

published by Global Africa Network Media (Pty) Ltd. Full copyright to<br />

the publication vests with Global Africa Network Media (Pty) Ltd.<br />

No part of the publication may be reproduced in any form without<br />

the written permission of Global Africa Network Media (Pty) Ltd.<br />

PHOTO CREDITS | Addo Elephant National Park; Bosch Holdings; BTE<br />

Renewables; Council for Geoscience; Dedisa Peaking Plant; Dominic<br />

Bonnesse Architects; Eskom; Fortress REIT; Gestamp Renewable<br />

Industries; Glencore; Harmony; Kristof Basson Architects; PASA; PG<br />

Bison; Pilanesberg Platinum Mines; Primocane Capital; Renergen; Seda; Sun<br />

International; Thungela Resources; Transnet National Port Authority.<br />

.<br />

DISCLAIMER | While the publisher, Global Africa Network Media (Pty) Ltd,<br />

has used all reasonable efforts to ensure that the information contained in<br />

<strong>South</strong> <strong>African</strong> <strong>Business</strong> is accurate and up-to-date, the publishers make no<br />

representations as to the accuracy, quality, timeliness, or completeness of<br />

the information. Global Africa Network will not accept responsibility for any<br />

loss or damage suffered as a result of the use of or any reliance placed on<br />

such information.<br />

9 SOUTH AFRICAN BUSINESS <strong>2022</strong>

SPECIAL FEATURE<br />

AN ECONOMIC OVERVIEW OF<br />

SOUTH AFRICA<br />

Growing the economy while simultaneously paying off debt presents<br />

a huge challenge but infrastructure plans and green financing<br />

options offer opportunities.<br />

By John Young<br />

Two numbers came to the fore in<br />

2021, one quite modest, the other<br />

extremely large. Both the 100MW<br />

extension granted on the ability of<br />

private power generators to go ahead with<br />

a project without the need for licensing and<br />

the R130-billion pledged in green financing<br />

to <strong>South</strong> Africa by several rich countries<br />

at the COP26 conference could have farreaching<br />

consequences for the trajectory of<br />

<strong>South</strong> Africa’s economy.<br />

<strong>South</strong> Africa’s economy has to grow and<br />

the country’s debt has to be reduced. How to<br />

do these things simultaneously is the challenge<br />

for the country’s new Minister of Finance, Enoch<br />

Godongwana, who was appointed in August<br />

2021, replacing Tito Mboweni, who asked to be<br />

relieved of his duties. Like many of his cabinet<br />

colleagues and the president, Godongwana cut<br />

his political teeth in the trade union movement<br />

but in his first budget presentation, the midterm<br />

budget in November, he did not present<br />

any new items of expenditure. Rather, he<br />

presented a budget that reflected the fact that<br />

there is currently no money to spend on new<br />

programmes. There has to be less spending,<br />

fewer borrowings and the public debt has to be<br />

controlled. Finding a way to grow the economy<br />

in that environment will be tough.<br />

As to signals of what the new Finance<br />

Minister intends doing in the future, one<br />

commentator found significance in how<br />

Godongwana spent the unexpected windfall<br />

of R120-billion that came the way of Treasury<br />

because of the high prices of commodities in<br />

2021. Professor Haroon Bhorat of the University<br />

of Cape Town broke down “every R1 of tax<br />

revenue the government received from this<br />

lottery” as follows: 51 cents on debt; 17 cents to<br />

civil servant wages; 32 cents on relief packages.<br />

SOUTH AFRICAN BUSINESS <strong>2022</strong><br />

10

SPECIAL FEATURE<br />

Bhorat’s conclusion was that government is<br />

committed to fiscal consolidation “while being<br />

willing to spend within limits on direct transfers”.<br />

Which is why the two numbers mentioned<br />

above become so critical. When President<br />

Ramaphosa announced that private power<br />

investors could create up to 100MW of power<br />

without having to wait for licensing, he<br />

potentially opened up a path to growth, a path<br />

that has been constrained for some time by the<br />

limitations of the national utility, Eskom. Eskom’s<br />

inability to provide enough electricity to power<br />

the economy (and its huge debt) rank as the<br />

biggest risks to the <strong>South</strong> <strong>African</strong> economy.<br />

Opportunities for private consortiums such as<br />

the Dedisa Peaking Power Plant at the Coega<br />

SEZ (pictured) will expand.<br />

Eskom’s unbundling will be another spur to<br />

growth. The legal separation of transmission is<br />

expected to be completed by December 2021<br />

with the other two elements, generation and<br />

distribution, to follow. The idea is not to privatise<br />

the entities but to find private partners and to<br />

allow for competition within the various fields.<br />

The R130-billion pledged by the EU,<br />

the US, Germany, France and the UK is not<br />

straightforward; it comes as a mixture of grants,<br />

risk-sharing instruments and concessional<br />

finance but it will allow <strong>South</strong> Africa to fund<br />

projects that will help the country to move<br />

away from fossil fuels without further stretching<br />

Eskom’s precarious finances.<br />

The commodities attracting the most<br />

attention are those which have the potential<br />

to power the green economy, platinum group<br />

metals (PGMs) and chrome among them. In<br />

August 2021, exports were reportedly 44%<br />

higher than the year before. Covid obviously had<br />

a lot to do with that figure, but R166.5-billion<br />

still represented a good number.<br />

Recovery plan<br />

The government’s recovery plan is called the<br />

Economic Reconstruction and Recovery Plan<br />

(ERRP) and it has a focus on expanding and<br />

improving infrastructure, a public employment<br />

stimulus, local industrial development and the<br />

expansion of energy generation.<br />

The plan intends to unlock R1-trillion in<br />

private investment. Furthermore, a commitment<br />

is made to improving the capability of the state<br />

and to remove barriers to doing business or<br />

investing in the country.<br />

Enabled in 2020 by an amendment to<br />

legislation that allowed them to work with<br />

the evidence presented to the state capture<br />

commission, National Prosecuting Authority<br />

(NPA) prosecutors quickly finalised cases and<br />

arrests started happening. After a decade in which<br />

it seemed that immunity was guaranteed for<br />

corrupt officials and employees of state-owned<br />

enterprises, the tide started to turn. In 2021 expresident<br />

Zuma’s refusal to appear before the<br />

commission led to him spending time in jail. His<br />

trial on substantive corruption charges lies ahead.<br />

The outbreak of looting and violence that<br />

appeared to be triggered by Zuma’s jailing probably<br />

had more to do with the frustration felt by many<br />

<strong>South</strong> <strong>African</strong>s at the culture of impunity which has<br />

surrounded many politicians and thieving business<br />

people than it did with the specifics of the Zuma<br />

case. The looting happened at supermarkets after<br />

all, not where Zuma was incarcerated.<br />

Prosecutions obviously do not provide certainty<br />

against future corruption, but at least the prospect<br />

of arrest might be a deterrent. One of the biggest<br />

obstacles to economic recovery is <strong>South</strong> Africa’s level of<br />

debt, and that is caused largely by the state electricity<br />

utility, Eskom, where corruption was rife for years.<br />

The government’s directory lists 131 stateowned<br />

entities but there are said to be about<br />

700 altogether, at various levels of government.<br />

Entities include the Central Energy Fund, the<br />

Commission for Conciliation, Mediation and<br />

Arbitration, the Commission for Employment<br />

Equity and the Companies and Intellectual<br />

Property Commission (CIPC) but the three<br />

biggest, all of which fall under the Department<br />

of Public Enterprises, are Eskom, <strong>South</strong> <strong>African</strong><br />

Airways (SAA) and Transnet, with five large<br />

divisions covering ports, railways and logistics.<br />

Eskom and SAA are significant drains on the<br />

country’s finances and getting control of all of<br />

the country’s SOEs is another major priority.<br />

At municipal level, the decision by Clover to<br />

relocate their large cheese factory away from<br />

11<br />

SOUTH AFRICAN BUSINESS <strong>2022</strong>

SPECIAL FEATURE<br />

The Council for Geoscience is running a passive water remediation pilot project in Mpumalanga. Credit: CGS<br />

Lichtenberg in the North West to Queensburgh<br />

in KwaZulu-Natal had everything to do with<br />

a dysfunctional local government unable to<br />

supply basic services. If <strong>South</strong> Africa’s rural<br />

areas and smaller towns are to thrive, more<br />

interventions at this level are needed.<br />

Agriculture was another industry that saw<br />

some positives during the Covid-19 lockdown.<br />

Although sectors like wine suffered badly, a<br />

reported increase in maize exports, as well as<br />

greater international demand for citrus fruits<br />

and pecan nuts, helped the industry expand by<br />

15% (StatsSA). Grain crops such as maize, wheat,<br />

barley and soya beans are among the county’s<br />

most important crops. Only rice is imported.<br />

Wine, corn and sugar are other major exports.<br />

Basing economic growth on a devaluing<br />

currency is not always the best long-term method<br />

of boosting economic growth, but high-value<br />

agricultural exports and increased numbers of<br />

high-spending international tourists hold some<br />

promise for helping to get the <strong>South</strong> <strong>African</strong><br />

economy back on a growth path. Horticulture in<br />

particular is seen as holding great potential not<br />

only for increased earnings, but for creating jobs.<br />

<strong>South</strong> Africa’s traditional strength in minerals<br />

still holds good. Although gold mining is<br />

declining in volumes (even while prices rise), the<br />

major investment of Vedanta Zinc International<br />

in a project in the Northern Cape and Sibanye-<br />

Stillwater’s acquisition drive in the PGM sector are<br />

significant economic drivers. Coal and iron ore<br />

continue to be exported in large volumes through<br />

the Richards Bay Coal Terminal on the east coast<br />

and the Port of Saldanha on the west coast.<br />

Automotive manufacturing and automotive<br />

components remain vital sectors, with major<br />

investments by most of the major marques and<br />

increased exports a feature of recent activity. There<br />

has been inward investment in recent years, most<br />

notably by the Beijing Automotive International<br />

Corporation (BAIC) in the Coega Special Economic<br />

Zone outside Port Elizabeth. The Tshwane<br />

Automotive Special Economic Zone (TASEZ) has<br />

been launched at Silverton in Pretoria.<br />

A new SEZ has been formally declared in the<br />

northern part of Limpopo, the Musina-Makhado<br />

SEZ. The Namakwa SEZ in the Northern Cape is<br />

awaiting its license, as is the Fetakgomo-Tubatse<br />

SEZ in eastern Limpopo. ■<br />

SOUTH AFRICAN BUSINESS <strong>2022</strong><br />

12

SPECIAL FEATURE<br />

Provinces of <strong>South</strong> Africa<br />

A snapshot of <strong>South</strong> Africa’s nine provinces.<br />

SPECIAL FEATURE<br />

Eastern Cape<br />

Capital: Bhisho<br />

Main towns: Port Gqeberha Elizabeth, (formerly East<br />

London, Port Elizabeth), Uitenhage, East London, Graaff-<br />

Reinet, Kariega Mthatha, (formerly Grahamstown<br />

Uitenhage),<br />

(Makhanda)<br />

Graaff-Reinet, Mthatha, Makhanda<br />

Population: 6 916 200 (2015)<br />

Area: 168 966km² (13.8%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

Lubabalo Oscar Mabuyane (ANC)<br />

Key sectors: Automotive,<br />

agriculture, agri-processing,<br />

agro-processing,<br />

forestry, finance, retail, tourism,<br />

renewable energy.<br />

Infrastructure: Coega Industrial<br />

Development Zone, East London<br />

Industrial Development Zone,<br />

ports of East London, Port<br />

Elizabeth and Ngqura, airports at<br />

Port Gqeberha Elizabeth and and East East London. London.<br />

Notable tourism assets: Addo<br />

Elephant National Park, Mountain<br />

Zebra National Park, Wild Coast,<br />

Jeffreys Bay, National Arts Festival.<br />

Provincial government website:<br />

www.ecprov.gov.za<br />

Eastern Cape Development<br />

Corporation: www.ecdc.co.za<br />

Free State<br />

Capital: Bloemfontein<br />

Main towns: Welkom, Sasolburg,<br />

Parys, Kroonstad<br />

Population: 2 817 900 (2015)<br />

Area: 129 825km² (10.6%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

Sefora Hixsonia Ntombela (ANC)<br />

Key sectors: Agriculture,<br />

agri-processing, agro-processing, chemical<br />

manufacturing, mining, transport<br />

and logistics.<br />

Infrastructure: Maluti-A-Phofung<br />

Special Economic Zone, Bram<br />

Fischer International Airport,<br />

University of the Free State,<br />

Central University of Technology,<br />

N8 Corridor.<br />

Notable tourism assets: Vaal<br />

River, Gariep Dam, Golden Gate<br />

Highlands National Park, Cherry<br />

Festival, Mangaung <strong>African</strong><br />

Cultural Festival (Macufe).<br />

Provincial government website:<br />

www.freestateonline.fs.gov.za<br />

Free State Development<br />

Corporation: www.fdc.co.za<br />

Gauteng<br />

Capital: Johannesburg<br />

Main towns: Tshwane (including<br />

(including Pretoria), Ekurhuleni, Pretoria), Ekurhuleni, Vanderbijl-<br />

Vanderbijlpark, Roodepoort Roodepoort<br />

Population: 13 200 300 (2015)<br />

Area: 18 178km² (1.5%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

David Makhura (ANC)<br />

Key sectors: Financial and banking,<br />

banking, manufacturing, manufacturing, trade, creative trade,<br />

creative industries, industries, media. media.<br />

Infrastructure: OR Tambo<br />

International Airport, Gautrain, ORT Special<br />

major Economic universities Zone, Gautrain, and research major<br />

institutions, universities and large research convention institutions,<br />

large FNB convention Stadium (Soccer centres, City).<br />

centres,<br />

FNB Stadium (Soccer City).<br />

Notable tourism assets: Cradle of<br />

Humankind, Notable tourism Apartheid assets: Museum, Cradle of<br />

Constitution Humankind, Hill, Apartheid Magaliesberg, Museum,<br />

Soweto Constitution tours, Hill, Dinokeng. Magaliesberg,<br />

Soweto tours, Dinokeng.<br />

Provincial government website:<br />

www.gauteng.gov.za<br />

Provincial government website:<br />

Gauteng www.gauteng.gov.za<br />

Growth and<br />

Development Gauteng Growth Agency: and Development<br />

Agency: www.ggda.co.za www.ggda.co.za<br />

SOUTH AFRICAN BUSINESS 2021 2020 16 20

SPECIAL<br />

SPECIAL FEATURE<br />

SPECIAL FEATURE<br />

KwaZulu-Natal<br />

Capital: Pietermaritzburg<br />

Main towns: Durban, Newcastle,<br />

Ballito, Port Shepstone,<br />

Empangeni, Ulundi<br />

Population: 10 919100 100 (2015)<br />

Area: 125 755km² (7.7% of<br />

of <strong>South</strong> <strong>South</strong> Africa) Africa)<br />

Premier:<br />

Premier: Sihle Zikalala (ANC)<br />

Sihle Zikalala (ANC)<br />

Key sectors: Chemicals, dissolving<br />

Key pulp sectors: manufacture, Chemicals, sugar, dissolving forestry,<br />

pulp automotive, manufacture, textiles sugar, and forestry, footwear,<br />

automotive, mining, oil textiles and gas, and logistics. footwear,<br />

mining, Infrastructure: oil and gas, King logistics. Shaka<br />

Infrastructure: International King Airport, Shaka Dube<br />

International<br />

TradePort, Richards<br />

Airport, Dube<br />

Bay Industrial<br />

TradePort,<br />

Richards<br />

Development<br />

Bay Industrial<br />

Zone,<br />

Development<br />

ports of<br />

Zone,<br />

Richards<br />

ports<br />

Bay<br />

of Richards<br />

and Durban,<br />

Bay and<br />

Albert<br />

Durban,<br />

Luthuli International<br />

Albert Luthuli International<br />

Convention<br />

Convention<br />

Centre Complex.<br />

Centre Complex.<br />

Notable<br />

Notable<br />

tourism<br />

tourism<br />

assets:<br />

assets:<br />

HluhluweiMfolozi<br />

HluhluweiMfolozi<br />

Park,<br />

Park,<br />

the<br />

the<br />

Drakensberg<br />

Drakensberg<br />

mountains,<br />

mountains,<br />

iSimangilso<br />

iSimangaliso<br />

Wetlands<br />

Wetland<br />

Park,<br />

Park,<br />

Durban<br />

Durban<br />

beaches,<br />

beaches,<br />

<strong>South</strong><br />

<strong>South</strong><br />

Coast,<br />

Zulu<br />

Coast,<br />

cultural<br />

Zulu<br />

heritage,<br />

cultural<br />

historical<br />

heritage,<br />

historical battlefields.<br />

battlefields.<br />

Provincial government website:<br />

Provincial government website:<br />

www.kznonline.gov.za<br />

www.kznonline.gov.za<br />

Trade and Investment KwaZulu-<br />

Trade and Investment KwaZulu-<br />

Natal: www.tikzn.co.za<br />

Natal: www.tikzn.co.za<br />

Limpopo<br />

Capital: Polokwane<br />

Main towns: Musina, Ba-Phalabora,<br />

Ba-Phalabora, Bela-Bela, Steelpoort, Bela-Bela, Tzaneen,<br />

Steelpoort, Thohoyandou Tzaneen, Thohoyandou<br />

Population: 5 726 800 (2015)<br />

Area: 125 755km² (10.2% of<br />

of <strong>South</strong> <strong>South</strong> Africa) Africa)<br />

Premier:<br />

Premier: Chupu Stanley Mathabatha (ANC)<br />

Chupu Stanley Mathabatha (ANC)<br />

Key sectors: Mining, agriculture,<br />

Key tourism, sectors: logistics. Mining, agriculture,<br />

tourism, logistics.<br />

Infrastructure: Musina-Makhado<br />

Infrastructure: Special Economic Musina-Makhado<br />

Zone,<br />

Special<br />

Fetakgomo-Tubatse<br />

Economic Zone,<br />

Special<br />

N1<br />

highway<br />

Economic<br />

and<br />

Zone,<br />

rail<br />

N1<br />

network,<br />

highway<br />

new<br />

and<br />

Medupi<br />

rail network,<br />

power<br />

new<br />

station.<br />

Medupi power<br />

station.<br />

Notable<br />

Notable<br />

tourism<br />

tourism<br />

assets:<br />

assets:<br />

Kruger<br />

Kruger<br />

National<br />

National<br />

Park,<br />

Park,<br />

Mapungubwe<br />

Mapungubwe<br />

Heritage<br />

World Heritage<br />

Site, Makapans<br />

Site, Makapans<br />

Valley,<br />

Marula<br />

Valley, Marula<br />

Festival,<br />

Festival,<br />

Waterberg<br />

Waterberg<br />

Biosphere.<br />

Biosphere.<br />

Provincial government website:<br />

Provincial government website:<br />

www.limpopo.gov.za<br />

www.limpopo.gov.zaLimpopo<br />

Limpopo Economic<br />

Economic Development Agency:<br />

Development Agency:<br />

www.lieda.gov.za<br />

www.lieda.gov.za<br />

Mpumalanga<br />

Capital: Mbombela<br />

Main towns: Emalahleni,<br />

Middelburg,<br />

Middelburg, Sabie,<br />

Sabie,<br />

Lydenburg<br />

Lydenburg<br />

Population:<br />

Population: 4<br />

283<br />

283<br />

900<br />

900<br />

(2015)<br />

(2015)<br />

Area: 76 495km² (6.3% of<br />

Area: 76 495km² (6.3%<br />

<strong>South</strong> Africa)<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

Refilwe Premier: Mtshweni-Tsipane (ANC)<br />

Refilwe Mtshweni-Tsipane (ANC)<br />

Key sectors: Agriculture, forestry,<br />

mining, steel manufacturing,<br />

petrochemicals,<br />

Key sectors: Agriculture,<br />

pulp and<br />

forestry,<br />

paper,<br />

power mining, generation, steel manufacturing, tourism.<br />

petrochemicals, pulp and paper,<br />

Infrastructure: power generation, Nkomazi tourism. Special<br />

Economic Infrastructure: Zone, Nkomazi Mbombela Special<br />

International Economic Zone, Fresh Mbombela Produce<br />

Market, International Maputo Fresh Development<br />

Produce<br />

Corridor, Market, Maputo Kruger Development<br />

Mpumalanga<br />

International Corridor, Kruger Airport. Mpumalanga<br />

International Airport.<br />

Notable tourism assets: Kruger<br />

National Park, Blyde River Canyon,<br />

Canyon, Barberton Barberton Makhonjwa Makhonjwa Mountains<br />

Mountains (a UNESCO World (a UNESCO Heritage World Site).<br />

Heritage Site).<br />

Provincial government website:<br />

Provincial www.mpumalanga.gov.za<br />

government website:<br />

www.mpumalanga.gov.za<br />

Mpumalanga Economic Growth<br />

Mpumalanga Agency: www.mega.gov.za<br />

Economic Growth<br />

Agency: www.mega.gov.za<br />

21<br />

17 SOUTH AFRICAN BUSINESS 2021<br />

SOUTH AFRICAN BUSINESS 2020<br />

SOUTH AFRICAN BUSINESS <strong>2022</strong> 14

SPECIAL FEATURE<br />

SPECIAL FEATURE<br />

Northern Cape<br />

Northern Cape<br />

Capital: Kimberley<br />

Capital: Main towns: Kimberley Douglas, Upington,<br />

Main De Aar, towns: Port Nolloth, Douglas, Colesberg Upington,<br />

De Aar, Port Nolloth, Colesberg<br />

Population: 1 185 600 (2015)<br />

Population: Area: 372 889km² 1 185 600 (30.5% (2015) of<br />

Area: <strong>South</strong> 372 Africa) 889km² (30.5%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

Premier: Dr Zamani Saul (ANC)<br />

Dr Zamani Saul (ANC)<br />

Key sectors: Agriculture, mining,<br />

Key renewable sectors: energy, Agriculture, astronomy. mining,<br />

renewable energy, astronomy.<br />

Infrastructure: Upington Special<br />

Economic Zone, Sol Plaatje<br />

Infrastructure: University, Vaalharts Upington Irrigation Special<br />

Economic Scheme, Square Zone, Kilometre Sol Plaatje Array<br />

University, telescope project, Vaalharts Namakwa Irrigation<br />

Scheme. Special Economic Zone<br />

(proposed).<br />

Notable tourism assets: Six<br />

Notable national tourism parks including assets: Six the<br />

national Kgalagadi parks Transfrontier including Park, the<br />

Kgalagadi Orange River, Transfrontier spring flower Park,<br />

Orange displays, River, diamond spring routes. flower<br />

displays, diamond routes.<br />

Provincial government website:<br />

www.northern-cape.gov.za<br />

Department of Economic<br />

Development and Tourism:<br />

www.northern-cape.gov.za/dedat<br />

North West<br />

North West<br />

Capital: Mahikeng<br />

Capital: Main towns: Mahikeng Klerksdorp,<br />

Main Rustenburg, towns: Klerksdorp, Brits, Potchefstroom<br />

Rustenburg, Brits, Potchefstroom<br />

Population: 3 707 000 (2015)<br />

Area: 104 882km² (8.6% of<br />

Population: <strong>South</strong> Africa) 3 707 000 (2015)<br />

Area: 104 882km² (8.6%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

Premier: Bushy Maape Professor (ANC) Tebogo Job<br />

Mokgoro (ANC)<br />

Key sectors: Mining, agriculture,<br />

Key agri-processing, sectors: Mining, automotive agriculture,<br />

agri-processing, components. automotive<br />

components.<br />

Infrastructure: Hartbeespoort<br />

Infrastructure: Dam, Pelindaba Hartbeespoort<br />

nuclear research<br />

Dam, unit, North Pelindaba West nuclear University, research<br />

unit, Bakwena North Platinum West University, Highway.<br />

Bakwena Platinum Highway.<br />

Notable tourism assets: Sun City,<br />

Mmbatho Palms Hotel Casino<br />

Notable Convention tourism Resort, assets: Pilanesberg Sun City,<br />

Mmbatho National Park, Palms 18 Hotel luxury Casino lodges in<br />

Convention Madikwe Game Resort, Reserve. Pilanesberg<br />

National Park, 18 luxury lodges in<br />

Madikwe Game Reserve.<br />

Provincial government website:<br />

Provincial www.nwpg.gov.za government website:<br />

www.nwpg.gov.za<br />

North West Development<br />

North Corporation: West Development<br />

www.nwdc.co.za<br />

Corporation: www.nwdc.co.za<br />

Western Cape<br />

Western Cape<br />

Capital: Cape Town<br />

Capital: Main towns: Cape Stellenbosch,<br />

Town<br />

Main George, towns: Plettenberg Stellenbosch, Bay, Beaufort<br />

George, West, Oudtshoorn, Plettenberg Worcester, Bay, Beaufort<br />

West, Malmesbury Oudtshoorn, Worcester,<br />

Malmesbury<br />

Population: 6 200 100 (2015)<br />

Population: Area: 129 462km² 6 200 100 (10.6% (2015) of<br />

Area: <strong>South</strong> 129 Africa) 462km² (10.6%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

Premier: Alan Winde (DA)<br />

Alan Winde (DA)<br />

Key sectors: Agriculture, agriprocessing,<br />

sectors: wine Agriculture, and grapes, agri-<br />

Key<br />

processing, financial services, wine and manufacturing, grapes,<br />

financial tourism, oil services, and gas, manufacturing,<br />

boatbuilding.<br />

tourism, Infrastructure: oil and Ports gas, of boatbuilding. Cape Town,<br />

Infrastructure: Saldanha and Mossel Ports of Bay, Cape Mossgas<br />

Town, oil-to-gas Saldanha refinery, and Cape Mossel Town Bay,<br />

Mossgas International oil-to-gas Airport, refinery, Cape Town Cape<br />

Town International International Convention Airport, Centre, Cape<br />

Town Koeberg International nuclear power Convention station.<br />

Centre, Notable Koeberg tourism nuclear assets: Table power<br />

station. Mountain, Garden Route National<br />

Notable Park, Karoo tourism National assets: Park, Table West<br />

Mountain, Coast National Garden Park, Route Kirstenbosch National<br />

Park, Botanical Karoo Gardens, National Cape Park, Point, West<br />

Coast V&A Waterfront, National Park, Plettenberg Kirstenbosch<br />

Botanical Bay, Route Gardens, 62, Zeitz Cape Museum Point, of<br />

V&A Contemporary Waterfront, Art. Plettenberg<br />

Bay, Route 62, Zeitz Museum of<br />

Contemporary Provincial government Art. website:<br />

www.westerncape.gov.za<br />

Provincial Wesgro: www.wesgro.co.za<br />

government website:<br />

www.westerncape.gov.za<br />

Wesgro: www.wesgro.co.za<br />

15 SOUTH AFRICAN BUSINESS <strong>2022</strong><br />

SOUTH AFRICAN BUSINESS 2021 2020 18 22

Special Economic Zones<br />

Several SEZs are focussing on green energy and green technology.<br />

A<br />

key component of the strategy to boost<br />

the value of <strong>South</strong> <strong>African</strong> mineral and<br />

agricultural products is to develop<br />

infrastructure where manufacturing can<br />

take place, namely Special Economic Zones (SEZs)<br />

and industrial parks.<br />

<strong>South</strong> Africa has 12 registered SEZs and several<br />

more are in the planning or registration phase.<br />

National and provincial incentives are in place to<br />

attract investors to the SEZs, with the added benefits<br />

of existing infrastructure and access to companies<br />

relevant to an investor’s value chain. A 2021 report<br />

by the Centre for Development and Enterprise has<br />

suggested that the zones are not sufficiently special,<br />

and that experimentation with greater flexibility in<br />

terms of labour regulations would reap dividends.<br />

The CDE notes that if companies were exporting,<br />

the issue of competing with local concerns would<br />

not arise. The CDE has suggested the Coega SEZ as<br />

the site for such an experiment.<br />

Each province has been allocated SEZs that<br />

play to regional strengths. Limpopo has two<br />

SEZs, both of which aim to use the province’s rich<br />

mineral resource as a base for other economic<br />

activities. One is already attracting investors and<br />

the other is in the process of being registered.<br />

The Musina-Makhado SEZ (MMSEZ) in the far<br />

north and the Fetakgomo-Tubatse SEZ (FTSEZ) in<br />

the east are central to the strategy of expanding<br />

Limpopo’s manufacturing capacity. Building<br />

new industrial parks and reviving existing areas<br />

support the same goal.<br />

As of February 2020, Shaanxi CEI Investment<br />

Holdings had committed to a $5-billion investment<br />

in a vanadium and titanium smelter project at<br />

the MMSEZ and a further $1.1-billion had been<br />

pledged from other sources. The first-phase focus<br />

is on energy and metallurgical processes but agroprocessing,<br />

logistics and general manufacturing<br />

are expected to follow.<br />

The FTSEZ is located in the heart of the one<br />

of the most mineral-rich localities on earth, the<br />

SOUTH AFRICAN BUSINESS <strong>2022</strong><br />

16

SPECIAL FEATURE<br />

• Auto-catalysts from PGMs.<br />

• Components for vehicle and trucking industry<br />

(and assembly of the same).<br />

Investors in education and skills are invited to<br />

collaborate with MERSETA, the Limpopo Economic<br />

Development Agency (LEDA) and companies in the<br />

mining sector.<br />

GRI Towers <strong>South</strong> Africa is making wind turbine towers<br />

in the Atlantis SEZ, a green technology hub. Credit: Gestamp<br />

Renewable Industries<br />

eastern limb of the Bushveld Igneous Complex<br />

which includes the Merensky reef. Dozens of<br />

mining operations are in the Sekhukhune District,<br />

all of which need mining supplies. A Mining Input<br />

Suppliers Park has been developed and a budget of<br />

R20-million has been allocated for the integration of<br />

that facility into the SEZ.<br />

The existence of the mines and the supplier<br />

park will be leveraged to create opportunities to<br />

industrialise the manufacturing of these supplies<br />

and also to beneficiate the mined product. The<br />

broader aim is to build the regional economy<br />

with strong upstream and downstream links in<br />

the mining value chain, particularly with regard to<br />

platinum group metals (PGMs).<br />

Within the Fetakgomo-Tubatse SEZ there are<br />

opportunities for investors in the manufacture of:<br />

• Vehicle components designed for green<br />

hydrogen fuel cells and electrolytes energy<br />

from PGMs.<br />

• Vehicle batteries and related components.<br />

Green focus<br />

One of the unique selling propositions of the FTSEZ<br />

is in its potential as a hub for green technology,<br />

both in terms of energy generation and in terms<br />

of manufacturing. It is being billed as a “Centre of<br />

Excellence on advanced energy technology”.<br />

Several minerals and metals mined in the area<br />

are vital components for the manufacture of items<br />

that the world needs to transition away from a fossilfuel<br />

economy to a greener, renewable future. This<br />

includes hydrogen fuel cells and battery technology.<br />

A pre-feasibility study related to battery minerals is<br />

underway at the Burgersfort Nickel Project.<br />

Another SEZ that is tackling the challenges of<br />

the green economy is the Atlantis SEZ, about 40km<br />

north of Cape Town.<br />

The focus at Atlantis is green manufacturing such<br />

as solar panels, wind turbines and battery storage.<br />

With the <strong>South</strong> <strong>African</strong> automotive manufacturing<br />

sector heavily dependent on exports, it will have to<br />

comply with tougher environmental requirements<br />

being implemented in Europe, the US and the UK.<br />

The year 2030 has been designated as the last for the<br />

petrol car in Europe. Atlantis intends to be the site for<br />

the manufacture of the components that will cater<br />

to the new market for cleaner vehicles.<br />

Two of the earliest investors at Atlantis SEZ<br />

are Kaytech, manufacturers of construction<br />

sheeting made out of recycled plastic, and GRI<br />

Towers <strong>South</strong> Africa, a subsidiary of the giant<br />

international renewable energy company,<br />

Gestamp Renewable Industries.<br />

Making industrial parks themselves greener is<br />

the focus of a programme of the National Cleaner<br />

Production Centre (NCPC) in partnership with<br />

the National Department of Trade, Industry and<br />

Competition (the dtic) and the United National<br />

Industrial Development Organisation (UNIDO).<br />

17 SOUTH AFRICAN BUSINESS <strong>2022</strong>

SPECIAL FEATURE<br />

The Glencore Magareng Chrome Mine opened in 2011 and is one of the many mines in the vicinity of<br />

the Fetakgomo-Tubatse SEZ. Credit: Glencore<br />

The Global Eco-Industrial Parks Programme<br />

(GEIPP) aims to create eco-industrial parks out of<br />

older, dirtier facilities. The first three parks to be<br />

targeted are the state-owned parks in East London<br />

(ELIDZ) and in the Free State (Phuthaditjhaba<br />

Industrial Park) and Gauteng (Ekandustria).<br />

The key components of the GEIPP are:<br />

• Park management services and governance.<br />

• Resource-efficient and cleaner production.<br />

• Industrial and infrastructure synergies.<br />

• Healthy and integrated workforce and industryurban<br />

synergies.<br />

• Special planning and zoning.<br />

Areas of focus<br />

Fairly near to Atlantis is the Saldanha Bay SEZ, where<br />

the focus is oil and gas and marine engineering and<br />

related activities. As of October 2021, the SEZ had 35%<br />

occupancy and has launched a facility to support<br />

small, medium and micro-enterprises (SMMEs) in<br />

terms of workspace and Internet connectivity.<br />

In the Pretoria area, already home to several<br />

Original Equipment Manufacturers (OEMs), the<br />

Tshwane Automotive Special Economic Zone<br />

(TASEZ) has been launched. It is a joint project<br />

of the Gauteng Province, the Department of<br />

Trade, Industry and Competition, and the City of<br />

Tshwane. The implementing agent is the Coega<br />

Development Corporation (CDC), the developer<br />

and operator of the Coega Special Economic Zone.<br />

Coega SEZ is at the Port of Ngqura near Gqeberha<br />

(formerly Port Elizabeth) in the Eastern Cape and it too<br />

has an automotive component, recently strengthened<br />

by the large investment of the Beijing International<br />

Automobile Corporation (BIAC). East London’s<br />

Industrial Zone has many companies that sell to and<br />

service the nearby Mercedes-Benz plant while both<br />

coastal SEZs have a strong suite in logistics and are<br />

planning expanded aquaculture parks.<br />

Energy is a key infrastructural requirement for<br />

the growth of any economy, and SEZs are playing<br />

a role. The Coega SEZ has been named as the site<br />

for one of two liquefied natural gas (LNG) plants to<br />

be built (if partners can be found) in terms of the<br />

national gas-to-power plan.<br />

The Richards Bay Industrial Development<br />

Zone (RBIDZ) in KwaZulu-Natal is the other site<br />

designated for a LNG plant, with the capacity<br />

planned for 2 000MW. RBIDZ is also the location of a<br />

new biomass plant.<br />

The OR Tambo SEZ in Gauteng underscores<br />

Ekurhuleni’s strengths in manufacturing and<br />

logistics. The OR Tambo SEZ has launched the<br />

biggest food processing operation in the southern<br />

hemisphere (and the world’s second-largest<br />

refrigeration plant). With a special focus on exportoriented<br />

value-added industry, the OR Tambo SEZ<br />

leverages its connection to the country’s busiest<br />

airport. The focus of this SEZ is on agro-processing,<br />

jewellery manufacturing and mineral beneficiation<br />

as well as the development of hydrogen fuel cell<br />

technology. The SEZ is a subsidiary of the Gauteng<br />

Growth and Development Agency (GGDA). ■<br />

SOUTH AFRICAN BUSINESS <strong>2022</strong><br />

18

10 REASONS<br />

WHY YOU SHOULD INVEST IN SOUTH AFRICA<br />

01.<br />

HOT EMERGING<br />

MARKET<br />

Growing middle class, affluent consumer<br />

base, excellent returns on investment.<br />

02.<br />

MOST DIVERSIFIED<br />

ECONOMY IN AFRICA<br />

<strong>South</strong> Africa (SA) has the most industrialised economy in Africa.<br />

It is the region’s principal manufacturing hub and a leading<br />

services destination.<br />

LARGEST PRESENCE OF MULTINATIONALS<br />

ON THE AFRICAN CONTINENT<br />

SA is the location of choice of multinationals in Africa.<br />

03.<br />

Global corporates reap the benefits of doing business in<br />

SA, which has a supportive and growing ecosystem as a<br />

hub for innovation, technology and fintech.<br />

05.<br />

FAVOURABLE ACCESS TO<br />

GLOBAL MARKETS<br />

ADVANCED FINANCIAL SERVICES<br />

& BANKING SECTOR<br />

SA has a sophisticated banking sector with a major<br />

footprint in Africa. It is the continent’s financial hub,<br />

with the JSE being Africa’s largest stock exchange by<br />

market capitalisation.<br />

The <strong>African</strong> Continental Free Trade Area will boost<br />

intra-<strong>African</strong> trade and create a market of over one<br />

billion people and a combined gross domestic product<br />

(GDP) of USD2.2-trillion that will unlock industrial<br />

development. SA has several trade agreements in<br />

place as an export platform into global markets.<br />

YOUNG, EAGER LABOUR FORCE<br />

09.<br />

SA has a number of world-class universities and colleges<br />

producing a skilled, talented and capable workforce. It<br />

boasts a diversified skills set, emerging talent, a large pool<br />

of prospective workers and government support for training<br />

and skills development.<br />

07.<br />

04.<br />

06.<br />

08.<br />

PROGRESSIVE<br />

CONSTITUTION<br />

& INDEPENDENT<br />

JUDICIARY<br />

SA has a progressive Constitution and an independent judiciary. The<br />

country has a mature and accessible legal system, providing certainty<br />

and respect for the rule of law. It is ranked number one in Africa for the<br />

protection of investments and minority investors.<br />

ABUNDANT NATURAL<br />

RESOURCES<br />

SA is endowed with an abundance of natural resources. It is the leading producer<br />

of platinum-group metals (PGMs) globally. Numerous listed mining companies<br />

operate in SA, which also has world-renowned underground mining expertise.<br />

WORLD-CLASS<br />

INFRASTRUCTURE<br />

AND LOGISTICS<br />

A massive governmental investment programme in infrastructure development<br />

has been under way for several years. SA has the largest air, ports and logistics<br />

networks in Africa, and is ranked number one in Africa in the World Bank’s<br />

Logistics Performance Index.<br />

10.<br />

SA offers a favourable cost of living, with a diversified cultural, cuisine and<br />

sports offering all year round and a world-renowned hospitality sector.<br />

EXCELLENT QUALITY<br />

OF LIFE<br />

Page | 2<br />

19<br />

SOUTH AFRICAN BUSINESS 2020

MESSAGE<br />

Limpopo’s Special Economic<br />

Zones to drive industrialisation<br />

MEC for Economic Development, Environment and Tourism Thabo Mokone<br />

invites investors to be part of an exciting journey to creating a green energy<br />

supply to bolster localised manufacturing.<br />

MEC Thabo Mokone<br />

The Provincial Government of Limpopo<br />

invites investors to partner with us in<br />

developing a low-carbon green economy<br />

while at the same time enhancing energy<br />

security and developing local industries.<br />

Special Economic Zones (SEZs) are the key<br />

tools within our Economic Reconstruction plans to<br />

ensure that we create sustainable job opportunities<br />

for all. This applies to both the Fetakgomo-Tubatse<br />

SEZ as well as the Musina Makhado SEZ.<br />

True development is about people<br />

When <strong>South</strong> Africa achieved democracy nearly<br />

three decades ago, who would have dreamed of a<br />

Special Economic Zone in the Steelpoort area. But<br />

today, a Special Economic Zone is our new reality.<br />

The proposed FTSEZ is gearing up to become a<br />

centre of excellence for green energy manufacturing,<br />

agro-processing and mineral beneficiation. The SEZ<br />

is positioned to be a game-changer in shaping and<br />

adding momentum to the industrialisation growth<br />

path as espoused in the socio-economic recovery<br />

plan of Limpopo Province.<br />

It is strategically located in the industrial<br />

hub of Steelpoort between two huge mining<br />

establishments, the Samancor smelter and the Lion<br />

ferrechrome smelter, which are strategic landmarks<br />

for the establishment of the SEZ.<br />

The Fetakgomo-Tubatse SEZ will not only play<br />

the role of a consumer of hydrogen in the Special<br />

Economic Zone but will strive to become a producer<br />

of hydrogen and other clean energy technologies.<br />

In Limpopo we see the Hydrogen Economy<br />

as a potential game-changer to reindustrialise the<br />

provincial economy.<br />

For the Fetakgomo-Tubatse SEZ, the Hydrogen<br />

Valley platform has the potential to drive the demand<br />

for mining inputs supplies, thereby creating an<br />

opportunity for large-scale industrialisation for<br />

both the manufacturing of mining inputs and the<br />

beneficiation of mining outputs.<br />

The efforts which we have put into Fetakgomo-<br />

Tubatse SEZ have so far led to us acquiring:<br />

• 1 220ha of land.<br />

• An EIA process is currently underway.<br />

• The application for a Record of Decision (RoD)<br />

process has commenced.<br />

• The SEZ Master Plan (Development Framework) and<br />

layout is complete with full infrastructure designs<br />

and costs in readiness for infrastructure roll-out.<br />

• 16 companies have shown a keen interest in the<br />

SEZ by signing letters of intent (combined investment<br />

value of approximately R38-billion).<br />

• Four companies have shown a readiness to locate<br />

inside the SEZ by <strong>2022</strong>. A due diligence process<br />

is underway.<br />

We envisage creating 8 000 jobs in the short<br />

term and 20 000 jobs in 10 years. The main objective<br />

of this SEZ is to develop a low-carbon green<br />

economy which will offer promising opportunities<br />

not only to fight climate change, but to enhance<br />

energy security and develop local industries.<br />

The strategic aim of the SEZ is to develop a green<br />

primary energy supply for localised manufacturing<br />

of both upstream and downstream activities of the<br />

platinum group metals and chrome value chains.<br />

Our passion in ensuring operational Special<br />

Economic Zones within local municipalities as well<br />

as working with various private partners is a clear<br />

indication that we are committed to “Building better<br />

communities together”. ■

Deputy Minister oversight<br />

visit highlights SEZ potential<br />

The Fetakgomo-Tubatse Special Economic Zone will establish a centre of excellence<br />

for green energy technology and mineral beneficiation as well as manufacturing of<br />

mining equipment.<br />

The Deputy Minister of Trade, Industry and<br />

Competition, Mr Fikile Majola, conducted<br />

an oversight visit to the proposed<br />

Fetakgomo-Tubatse Special Economic<br />

Zone in Steelpoort, Limpopo, in October 2021.<br />

Deputy Minister Majola was joined by the MEC for<br />

Economic Development, Environment and Tourism<br />

in Limpopo, Mr Thabo Mokone, MEC for Finance in<br />

Limpopo, Mr Seaparo Sekwati, the Executive Mayor<br />

of Sekhukhune District Municipality, Councillor<br />

Stanley Ramaila, and the Acting Mayor of Fetakgomo-<br />

Tubatse Local Municipality, Councillor Hlatsoayo.<br />

The purpose of the oversight visit was to<br />

assess progress registered in the implementation<br />

of the proposed Special Economic Zone (SEZ)<br />

project and to meet with potential private sector<br />

partners. According to Mr Majola, the visit was part<br />

of a consultative process on the SEZ Programme.<br />

Information on the new approach in the<br />

implementation of the Programme was also shared.<br />

“This new approach encourages collaborative<br />

engagements through which the implementation of<br />

the SEZ Programme is aligned with national, provincial<br />

and local objectives, as well as planning strategies to<br />

maximise synergies and promote cooperation. This<br />

will result in provinces and municipalities benefiting<br />

from strong National Government support in areas of<br />

limited capacity,” said Mr Majola.<br />

He added that the <strong>South</strong> <strong>African</strong> Government<br />

was seeking to transform the economy into a<br />

globally competitive economy, built on the full<br />

potential of all citizens and regions.<br />

“To achieve this, the government is driving a<br />

robust industrialisation agenda supported by Spatial<br />

Industrial Development Programmes such as the<br />

SEZ Programme. Our department is driving the SEZ<br />

Programme as one of the strategic interventions to<br />

catalyse economic and industrial development in<br />

the country,” he added. ■<br />

Solly Kgopong, Executive Manager<br />

Solly Kgopong is the Executive<br />

Manager of the Fetakgomo-<br />

Tubatse SEZ. Before joining<br />

the Department for Economic<br />

Development, Environment and<br />

Tourism, he was General Manager<br />

of Absa Bank. His work experience<br />

started as <strong>Business</strong> Analyst at Trade<br />

and Investment Limpopo until he became Executive<br />

Manager Strategic and Economic Planning. During this<br />

period, Solly was a part-time lecturer at the University<br />

of Limpopo. A USA-Mandela Scholar Alumni, Solly<br />

holds a MSc in Economics degree from the Ohio State<br />

University. He was recently seconded to Head the<br />

Fetakgomo-Tubatse SEZ Project Management Unit by<br />

the Provincial Government.<br />

Contact details<br />

Tel: 082 455 4220<br />

Email: Solly.Kgopong@lieda.co.za<br />

Bunjiwe Gwebu, Project Executive<br />

Bunjiwe Gwebu is the Project Executive<br />

for the Fetakgomo-Tubatse Special<br />

Economic Zone, having joined the<br />

Limpopo Economic Development<br />

Agency in 2014 when the Special<br />

Economic Zones programme was<br />

being rolled out nationally. She is an<br />

Economic Development Specialist who<br />

holds a Master’s in Development Studies from the University<br />

of KwaZulu-Natal. She has held positions at executive and<br />

senior management levels in government and nongovernmental<br />

institutions such as eThekwini Municipality,<br />

Slum Dwellers International, uTshani Fund and the Housing<br />

Development Agency where she was responsible for<br />

strategy, programme planning and management,<br />

implementation and monitoring and evaluation.<br />

Contact details<br />

Tel: 076 521 5077<br />

Email: Bunjiwe.Gwebu@lieda.co.za

SEZ project pipeline<br />

A globally recognised Centre of Excellence for Green Energy Technology and Mineral Beneficiation<br />

Tubatse SEZ – Getting Platinum Moving- A world centre of excellence<br />

for PGMs.”<br />