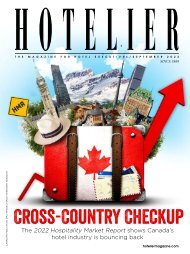

Hotelier Jan/Feb 2022

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DRIVEN TO SUCCEED<br />

Delivering on the<br />

guest experience<br />

is behind every<br />

decision at Opal<br />

Hospitality<br />

T H E M A G A Z I N E F O R H O T E L E X E C U T I V E S / J A N U A R Y ~ F E B R U A R Y 2 0 2 2<br />

CANADIAN PUBLICATION MAIL PRODUCT SALES AGREEMENT #40063470<br />

BREAKING<br />

THE MOULD<br />

New hotel brands are catering<br />

to upscale guest demands<br />

SELLING<br />

POINTS<br />

Hotel operators need new<br />

sales-and-marketing strategies<br />

to succeed post-pandemic<br />

BALANCING<br />

ACT<br />

It's time to envision the future<br />

of hotel F&B offerings<br />

THE <strong>2022</strong><br />

FRANCHISE<br />

REPORT<br />

A comprehensive<br />

listing of the<br />

industry’s top<br />

franchises<br />

hoteliermagazine.com

CONFERENCE • TRADE SHOW • COMPETITIONS • EVENTS<br />

NEW DATES FOR <strong>2022</strong><br />

May 9 - 11, <strong>2022</strong><br />

Enercare Centre, Exhibition Place, Toronto<br />

ATTEND IN-PERSON & VIRTUALLY<br />

REGISTER NOW RCSHOW.COM

T H E M A G A Z I N E F O R H O T E L E X E C U T I V E S / J A N U A R Y ~ F E B R U A R Y 2 0 2 2<br />

New hotel brands are catering<br />

to upscale guest demands<br />

Hotel operators need new<br />

sales-and-marketing strategies<br />

to succeed post-pandemic<br />

It's time to envision the future<br />

of hotel F&B offerings<br />

hoteliermagazine.com<br />

CONTENTS<br />

VOLUME 34, NO. 1 | JANUARY/FEBRUARY <strong>2022</strong><br />

60<br />

40<br />

64<br />

COVER PHOTO BY MARGARET MULLIGAN<br />

FEATURES<br />

10 LOOKING AHEAD<br />

Evolving HR strategies are key<br />

to industry recovery<br />

11 BAR NONE<br />

The lobby bar is back with<br />

a vengeance<br />

14 FÊTING SUCCESS<br />

A look back at the 32ndannual<br />

Pinnacle Awards gala<br />

16 DRIVEN TO SUCCEED<br />

Opal Hospitality builds<br />

community, not just hotels<br />

19 FRESH TAKES<br />

New brand launches are<br />

catering to upscale experiences<br />

23 THE <strong>2022</strong><br />

FRANCHISE REPORT<br />

A comprehensive listing of<br />

the industry’s top franchises<br />

40 PASSION PROJECT<br />

Bonnie Strome discusses the<br />

re-opening of the Park Hyatt<br />

during COVID-19<br />

45 SHAKING THINGS UP<br />

Hotels are mixing it up to aid<br />

post-pandemic recovery<br />

49 SELLING POINTS<br />

Hotels are rolling out new<br />

sales-and-marketing strategies<br />

52 CASTING CALL<br />

In-room entertainment systems<br />

are changing with the times<br />

56 BALANCING ACT<br />

<strong>Hotelier</strong>s are envisioning the<br />

future of hotel F&B offerings<br />

60 TIMELESS SOLUTIONS<br />

COVID-19 is re-shaping hotel<br />

design and architecture<br />

63 SETTING THE STAGE<br />

Hotel kitchens are bringing<br />

guests back with contactless<br />

technology<br />

DEPARTMENTS<br />

2 EDITOR’S PAGE<br />

5 CHECKING IN<br />

64 HOTELIER<br />

James Hague, Baker Creek<br />

Mountain Resort, Banff, Alta.<br />

CANADIAN PUBLICATION MAIL PRODUCT SALES AGREEMENT #40063470<br />

DRIVEN TO SUCCEED<br />

BREAKING<br />

THE MOLD<br />

SELLING<br />

POINTS<br />

BALANCING<br />

ACT<br />

Deliving on the guest<br />

experience is behind<br />

every decision at<br />

Opal Hospitality<br />

THE <strong>2022</strong><br />

FRANCHISE<br />

REPORT<br />

A comprehensive<br />

listing of the<br />

industry’s top<br />

franchises<br />

ON THE COVER<br />

(l to r) Opal Hospitality's<br />

Sean Hogan director of<br />

Food and Beverage & Social<br />

Marketing; Perry Vashee,<br />

president; and Jeff Waters<br />

vice-president of<br />

Operations<br />

hoteliermagazine.com JANUARY/FEBRUARY <strong>2022</strong> | 1

EDITORIAL<br />

HIGH STAKES<br />

When you work with words, it’s an occupational<br />

hazard to choose them with the utmost care and a<br />

great deal of thought. After all, the right word can<br />

make all the difference between evoking a certain<br />

emotion or feeling, and conveying just the right sentiment.<br />

In the past year, we’ve repeatedly heard a handful of words to<br />

describe the severity of the effects of the pandemic — unprecedented,<br />

devastating, tumultuous and challenging are only a few<br />

of the words we’ve heard ad nauseum. We’ve also been inundated<br />

by the overuse of key words such as pivot, re-set, re-build,<br />

re-structure and evolve.<br />

But now, almost two years into a pandemic that continues to<br />

wreak havoc, individuals and industries are craving to move forward<br />

with a plan to re-build themselves and the industry. Where to start<br />

and what to focus on are a few questions we need to ask ourselves.<br />

As a recent article in Inc. magazine suggests, a good exercise to<br />

undertake at the start of every year is to focus on a word that will<br />

serve as a guiding principle for the year ahead. For those looking to<br />

attain more balance in their lives, for example, they might zero in<br />

on words such as calm, relaxation or meditation. But which word<br />

would you choose in your professional lives to focus on in <strong>2022</strong>?<br />

Certainly, Recovery — with a capital R — comes to mind as a key<br />

word the entire industry will focus on this year. But you will need<br />

to dig deeper to determine what will fuel the recovery.<br />

Certainly, the hotel industry has undergone an avalanche of<br />

change in the past year, as hotels have been among the hardesthit<br />

industries in the world and, now with new variants surging,<br />

the reality is that tourism will be under siege for the long term. The work at hand is<br />

mammoth and will require intestinal fortitude.<br />

As a message from the Tourism Industry Association of Ontario recently stated, the<br />

“stakes for our industry have never been higher: Two years into the pandemic, saddled<br />

with increasing levels of debts, increased fixed costs and non-existent revenues, our<br />

industry has had period of re-opening — but never recovery. That’s why we remain<br />

relentless in our pursuit for continued economic supports and to fix programs that don’t<br />

meet the needs of our industry.”<br />

That will be the ongoing focus for associations that advocate on behalf of the industry.<br />

But while they solider on with this important work, hopefully pushing government to<br />

continue to provide the essential supports the industry so desperately needs to survive,<br />

operators will need to work harder than ever to re-build and re-make themselves in<br />

innovative and creative ways to ensure success once the<br />

pandemic is finally over — whenever that may be.<br />

ROSANNA CAIRA rcaira@kostuchmedia.com<br />

CONNECT<br />

WITH US<br />

<strong>Hotelier</strong>Magazine<br />

@hoteliermag<br />

@hoteliermagazine<br />

PHOTO BY NICK WONG<br />

2 | JANUARY/FEBRUARY <strong>2022</strong><br />

hoteliermagazine.com

T H E M A G A Z I N E F O R H O T E L E X E C U T I V E S / J U L Y | A U G U S T 2 0 1 9 $ 4<br />

ROSANNA CAIRA EDITOR & PUBLISHER<br />

rcaira@kostuchmedia.com<br />

AMY BOSTOCK MANAGING EDITOR<br />

abostock@kostuchmedia.com<br />

NICOLE DI TOMASSO ASSISTANT EDITOR<br />

nditomasso@kostuchmedia.com<br />

COURTNEY JENKINS ART DIRECTOR<br />

cjenkins@kostuchmedia.com<br />

JENNIFER O'NEILL DESIGN ASSISTANT<br />

joneill@kostuchmedia.com<br />

JHANELLE PORTER SOCIAL MEDIA MANAGER/<br />

EVENTS CO-ORDINATOR<br />

jporter@kostuchmedia.com<br />

WENDY GILCHRIST<br />

DIRECTOR OF BUSINESS DEVELOPMENT<br />

wgilchrist@kostuchmedia.com<br />

ELEANOR SANTOS ACCOUNT MANAGER<br />

esantos@kostuchmedia.com<br />

KIMONE CLUNIS SALES & MARKETING ASSISTANT<br />

kwales@kostuchmedia.com<br />

DANNA SMITH ADMINISTRATIVE ASSISTANT<br />

dsmith@kostuchmedia.con<br />

DANIELA PRICOIU ACCOUNTING SERVICES<br />

dpricoiu@kostuchmedia.com<br />

CIRCULATION PUBLICATION PARTNERS<br />

kml@publicationpartners.com<br />

ADVISORY BOARD<br />

Andrew Weir, Destination Toronto; Anne Larcade, Sequel<br />

Hotels & Resorts; Anthony Cohen, Cresent Hotels — Global<br />

Edge Investments; Bonnie Strome, Hyatt Hotels; Christiane<br />

Germain, Germain Hotels; David McMillan, Axis Hospitality<br />

International; Don Cleary, Marriott Hotels; Geoffrey Allan,<br />

Project Capital Management Hotels; Hani Roustom, Friday<br />

Harbour Resort; Heather McCrory, Accor; Reetu Gupta, Easton's<br />

Hotels; Ryan Killeen, The Annex Hotel Ryan Murray,<br />

The Pillar + Post Hotel; Stephen Renard, Renard International<br />

Hospitality & Search Consultants<br />

GET HOTELIER<br />

CANADIAN PUBLICATION MAIL PRODUCT SALES AGREEMENT #40063470<br />

Lasting<br />

Legacy<br />

Hilton celebrates 100<br />

years of exceeding<br />

guest expectations<br />

GREAT<br />

ESCAPES<br />

In-room wellness<br />

options are coming<br />

of age<br />

CHALLENGES +<br />

OPPORTUNITIES<br />

Hotel operators address<br />

issues impacting the<br />

industry<br />

MAGAZINE<br />

ON YOUR IPAD<br />

With the <strong>Hotelier</strong> magazine app, you<br />

can access all the latest issues. View the<br />

entire issue page by page or jump directly<br />

to your favourites. All the departments and<br />

features you’ve come to know and love,<br />

all at the tap of a screen.<br />

hoteliermagazine.com<br />

FORM MEETS<br />

FUNCTION<br />

A look at 21st century<br />

kitchen design<br />

CHAMPIONING<br />

CHANGE<br />

Coverage of the annual<br />

WITH Summit<br />

INSPIRED<br />

TASTES<br />

<strong>Hotelier</strong>s seek new<br />

strategies to raise<br />

F&B revenue<br />

C E L E B R AT I N G<br />

HOTELIER is published eight times a year by Kostuch Media<br />

Ltd., 14 – 3650 Langstaff Rd. Ste. 33, Woodbridge, ON L4L 9A8,<br />

(416) 447-0888, Fax (416) 447-5333. All rights reserved. Subscription<br />

rates: Canada: $25 per year, single issue $4, U.S.A.: $30 per year;<br />

all other countries $40 per year. Canadian Publication Mail<br />

Product Sales Agreement #40063470. Member of Canadian<br />

Circulations Audit Board and Magazines Canada. Printed in<br />

Canada on recycled stock.<br />

Return mail to: Publication Partners 1025 Rouge Valley Dr.,<br />

Pickering, Ontario L1V 4N8<br />

hoteliermagazine.com<br />

JANUARY/FEBRUARY <strong>2022</strong> | 3

Get your<br />

money’s worth.<br />

At Quality ® brand hotels, our guests want real value for their<br />

hard-earned dollars. They need to know they’ll get their money’s<br />

worth so they can relax and focus on the people and experiences<br />

they came for. And in Canada, we’re delivering!<br />

Get your money’s worth. It’s not just a promise to our guests;<br />

it’s a promise to our franchisees, too. The Quality brand delivers<br />

great performance and also provides owners with a great<br />

opportunity to enhance property value and strengthen market<br />

positioning. Plus, the brand’s flexible product extensions fit most<br />

building types and locations.<br />

ChoiceHotelsDevelopment.ca<br />

Development@choicehotels.ca<br />

The Quality brand is all about delivering on the value that both<br />

guests and hotel owners need.<br />

THERE’S NEVER BEEN A BETTER TIME TO INVEST IN QUALITY.<br />

©<strong>2022</strong> Choice Hotels Canada Inc. All Rights Reserved.

CHECKING IN<br />

THE LATEST INDUSTRY NEWS FOR HOTEL EXECUTIVES FROM CANADA AND AROUND THE WORLD<br />

The Arne Sorenson<br />

Social Impact<br />

Leadership Award<br />

will be presented<br />

annually to a seniorlevel<br />

executive in the<br />

lodging industry who<br />

strives to drive change<br />

through strong leadership<br />

and community<br />

engagement. Nominations<br />

are reviewed<br />

by AHLA’s Executive<br />

Committee and representatives<br />

from ALIS.<br />

LEADING<br />

THE WAY<br />

David Kong receives inaugural Arne<br />

Sorenson Social Impact Leadership Award<br />

David Kong, recently retired president and<br />

CEO of BWH Hotel Group, has been<br />

named the inaugural recipient of the<br />

Arne Sorenson Social Impact Leadership<br />

Award on behalf of The American Hotel<br />

& Lodging Association (AHLA), The American Hotel<br />

& Lodging Foundation and The BHN Group.<br />

When Kong emmigrated to the U.S. from Hong Kong<br />

as a young adult, he began his career in hospitality as a<br />

dishwasher and quickly climbed the ladder, securing his<br />

role as president and CEO of BWH Hotel Group from<br />

2004-2021. During his career, Kong developed initiatives<br />

focused on women in the hotel sector, provided scholarships<br />

to hospitality students in partnership with the AHLA<br />

Foundation and spearheaded BWH Hotel Group’s Future Leaders Group initiative.<br />

This new award is named after Arne Sorenson, former president and CEO of Marriott<br />

International, who passed away in <strong>Feb</strong>ruary 2021.<br />

“Like Arne, David is an industry icon — an amazing leader and among the most<br />

respected people in our industry,” says Chip Rogers, president and CEO, AHLA. “The<br />

story of David’s career trajectory, from dishwasher to CEO, is inspiring to us all, as is his<br />

commitment to the next generation of hotel leaders and the communities we serve. It<br />

has been a joy to work with David, and I can think of no better way to honour him at<br />

the conclusion of his illustrious career<br />

than with this award.”<br />

“The humanity-meets-business crossroads<br />

David Kong was<br />

that Arne and David built their leadership<br />

honoured this month<br />

styles around are more important than ever,<br />

during the AHLA<br />

so it’s an honour to acknowledge Arne’s<br />

Foundation’s premier<br />

legacy by having David as the inaugural<br />

fundraising gala,<br />

recipient of this award,” says Jeff Higley,<br />

the Night of a<br />

president of The BHN Group. “The impact<br />

of embracing a people-centric approach by<br />

Thousand Stars,<br />

prominently addressing key social issues<br />

as well as during the<br />

serves as an agent of change far beyond<br />

21st Annual Americas<br />

the boundaries of the hotel industry. We<br />

Lodging Investment<br />

should all be proud of the impact that Arne<br />

Summit (ALIS).<br />

and David have contributed by being kind,<br />

thoughtful and forward-looking leaders.”◆<br />

hoteliermagazine.com JANUARY/FEBRUARY <strong>2022</strong> | 5

FAIRMONT CHATEAU<br />

LAURIER NAMES<br />

NEW GM<br />

AccorHotels has appointed Geneviève Dumas as<br />

general manager of the iconic Fairmont Chateau<br />

Laurier in Ottawa. Dumas is a dynamic leader<br />

with more than 25 years’ experience in the luxury<br />

hospitality and tourism industry.<br />

In her most recent position as general manager<br />

of the historic Fairmont Château Montebello,<br />

Dumas raised the hotel to new heights, seeing it<br />

recognized as the third-best hotel in Canada from<br />

Condé Nast Traveler magazine. She also successfully<br />

guided a massive renovation and restoration<br />

of the “world’s largest red-cedar log cabin” ahead<br />

of its 90th anniversary.<br />

In her new role, Dumas will oversee the Fairmont Chateau Laurier’s day-to-day<br />

operations and guest experience. Dumas’ career journey has taken her across the<br />

globe, to the Middle East, Europe and Asia. She’s held progressive leadership roles<br />

at the Fairmont Tremblant, Fairmont Empress, Hilton Homewood Suites and<br />

Marriott Residence Inn. She’s been recognized many times by her peers; among the<br />

2021 Top 30 most-influential people in the industry in Quebec; as an Exceptional<br />

Woman of the Year by the local Chamber of Commerce in 2020; as a recipient of<br />

the Industry Performance Award from ESG UQAM’s School of Management in<br />

2013; and as a 2011 Ambassador of the Year for the Hotel Industry by the Minister<br />

of Tourism, Quebec.<br />

EXPANDING<br />

PORTFOLIOS<br />

Sonder Holdings Inc. increased<br />

its footprint in Canada in 2021<br />

by opening new properties and<br />

contracting hundreds of additional<br />

units across Montreal and Toronto.<br />

In Montreal, Sonder recently<br />

opened the Sonder Saint Paul,<br />

a 20-unit hotel in a heritage<br />

building in Old Montreal, as well<br />

as the Sonder Maisonneuve, a<br />

157-unit new-build property,<br />

located in the heart of downtown<br />

Montreal. Sonder also continues<br />

to expand in Toronto and recently<br />

contracted more than 110 units in<br />

four additional locations, spread<br />

across desired neighbourhoods<br />

such as the St. Lawrence Market<br />

and the Entertainment District.<br />

These units are in addition to<br />

the more than 120 live units<br />

across five existing Sonder<br />

locations in Toronto.<br />

From L to R: Mark Shalala, SVP Development, Upscale Brands, Choice Hotels; John Percy, president Destination<br />

Niagara USA; <strong>Jan</strong>is Cannon, senior vice-president, upscale brands, Choice Hotels; Frank Strangio, co-owner,<br />

Plati Niagara Inc.; Antonio Strangio, co-owner, Plati Niagara Inc.; Anthony Strangio, co-owner, Plati Niagara<br />

Inc.; Angelo Morinello, assemblyman, New York State Assembly; Anthony Vilardo, president of USA Niagara<br />

Development Corp. (Cambria Hotel Niagara Falls )<br />

6 | JANUARY/FEBRUARY <strong>2022</strong><br />

ROOM<br />

WITH<br />

A VIEW<br />

Cambria Hotels by Choice Hotels<br />

International has started construction<br />

on the Cambria Hotel Niagara Falls,<br />

which is expected to open in spring<br />

2023. Developed by Plati Niagara<br />

Inc., the 120-room hotel will feature<br />

indoor and outdoor common spaces,<br />

contemporary and sophisticated<br />

guestrooms, spa-style bathrooms and<br />

Bluetooth mirrors, bar and restaurant,<br />

meeting-and-event spaces and a<br />

fitness centre.<br />

hoteliermagazine.com

K2 GROUP ACQUIRES<br />

TRAVELODGE LUNDY’S<br />

LANE IN NIAGARA FALLS<br />

K2 Group, an independent investment company, has acquired Travelodge by<br />

Wyndham Niagara Falls Lundy’s Lane. The property will be fully renovated<br />

with enhancements to the indoor and outdoor pools, restaurant, fitness centre,<br />

meeting spaces, banquet halls and 118 guestrooms.<br />

“We’re happy to welcome K2 Group as the newest owners of a Travelodge by<br />

Wyndham property within Canada,” says Trevor Hagel, executive vice-president<br />

of Operations, Travelodge Canada. “As the current ownership and operating<br />

group of the nearby Ramada Fallsview, one of the only hotels in the region to<br />

have remained open throughout the pandemic, they’ll certainly provide strong<br />

leadership and leading-edge improvements to the property.”<br />

“Through recent and pending transactional activity, we’re refining, enhancing<br />

and growing our existing hotel portfolio while increasing our exposure to a<br />

market with already strong growth trajectories,” says Kailash Kasal, president of<br />

K2 Group. “Niagara Falls is one of Canada’s most visited tourist destinations, and<br />

we look forward to working with Superior Lodging and Wyndham to enhance<br />

the already exceptional Travelodge experience and offer our guests the highest<br />

standard of hospitality.”<br />

“We’re excited to see K2 Group continue to invest in Niagara Falls,” says<br />

Niagara Falls Mayor Jim Diodati. “We look forward to working closely with<br />

the K2 team as they continue their work in up-levelling and developing more<br />

properties in our community.”<br />

NOW<br />

OPEN<br />

THE<br />

PEARLE<br />

HOTEL<br />

& SPA<br />

Ontario’s first Autograph<br />

Collection Hotel, The Pearle<br />

Hotel & Spa, has opened.<br />

Designed by Studio Munge,<br />

the 151-room hotel is located<br />

on the waterfront and features<br />

a Hammam steam room, an<br />

indoor swimming pool and a<br />

fitness centre in addition to<br />

the spa. The Pearle Hotel &<br />

Spa offers two dining concepts,<br />

Isabelle and Earth to Table:<br />

Bread Bar. Isabelle is headed<br />

by chef Ben Heaton and offers<br />

a lakeside terrace and patio<br />

seating while Earth to Table:<br />

Bread Bar is more casual.<br />

Much of their menu offerings<br />

are grown on Pearle Hospitality’s<br />

farmland roughly 20<br />

minutes from the hotel. The<br />

hotel also offers elegant spaces<br />

for weddings, retreats and<br />

other special events.<br />

BACK IN<br />

BUSINESS<br />

The town of Hornepayne, Ont. is set to<br />

open its first hotel in a decade within the<br />

next year. The new hotel will be a Studio<br />

6 franchise, with construction estimated<br />

to cost $7.6 million. Construction is<br />

expected to start in the spring and<br />

completed by December <strong>2022</strong>.<br />

8 | JANUARY/FEBRUARY <strong>2022</strong><br />

hoteliermagazine.com

PASSING<br />

THE TORCH<br />

Best Western Hotels & Resorts has elected John L. Kelly as its Board<br />

Chairman for <strong>2022</strong>. In his new role, Kelly will drive Best Western’s<br />

recovery, growth and future success. Kelly brings 28 years of Best<br />

Western ownership to his new role as Chairman, as well as decades of<br />

hospitality experience. He was initially elected to the Board of Directors<br />

in 2016 to represent the interests of hoteliers in District V, which<br />

includes Texas, Oklahoma, Arkansas, Louisiana and Mississippi. In<br />

fact, he owns and operates the Best Western Plus Yukon in Oklahoma,<br />

earning perfect quality-assurance scores and numerous accolades.<br />

“It’s a privilege to be elected as the Chairman of the Board for Best<br />

Western Hotels & Resorts,” says Kelly. “My membership with this<br />

remarkable organization has been a point of pride throughout my<br />

career and I’m honoured to serve in this leadership role on behalf<br />

of our family of hoteliers. Our organization has shown tremendous<br />

strength throughout the pandemic, and with the hope of recovery<br />

on the horizon, I look forward to working with my fellow directors to<br />

help lead our family into a brighter future. I believe the best is yet to<br />

come for Best Western Hotels & Resorts.”<br />

TOP HONOURS<br />

Trip Advisor has named The Hazelton in Toronto as the number-1<br />

hotel in Canada for the fifth-consecutive year. The Hazelton was also<br />

ranked among the top one per cent of hotels worldwide and received<br />

Traveller’s Choice Best of the Best award by Trip Advisor.<br />

“I’m honoured to lead a team of hospitality experts who continue<br />

to excel at the highest level. The Hazelton is committed to providing<br />

outstanding customer service across the property. The Trip Advisor<br />

awards we have earned are a testament to our dedicated team, as well<br />

as our guests – both new and returning – who have taken valuable time<br />

to share their experiences and support by rating us after their stay,” says<br />

Gaurav Dutta, general manager of The Hazelton Hotel.<br />

Additionally, The Hazelton renewed its five-year collaboration<br />

with Leading Hotels of the World. The hotel will also be unvieling<br />

its extensive renovation and the introduction of the new Presidential<br />

Bellair Suite designed by Yabu Pushelberg. Other renovations include<br />

ONE restaurant’s indoor dining room and bar, meeting spaces and the<br />

private Silver Screening Room.<br />

CURIO<br />

COMING TO<br />

CANADA<br />

Easton’s Group of Hotels will be building<br />

Canada’s first Curio by Hilton near Toronto’s<br />

Distillery District. Construction is expected to<br />

begin mid-<strong>2022</strong>.<br />

The new full-service 31-storey hotel will<br />

feature 392 guestrooms, as well as a rooftop<br />

bar and restaurant. Other features and amenities<br />

will include: ballrooms and conference spaces,<br />

spa and gym, main floor lobby, lounge and restaurant,<br />

five underground levels (four reserved for<br />

parking) and innovative loading dock. The<br />

hotel’s design will be led by IBI Architects,<br />

ERA Heritage Architects and Studio Munge.<br />

hoteliermagazine.com JANUARY/FEBRUARY <strong>2022</strong> | 9

RECRUITMENT<br />

JOB INTERVIEW<br />

state of today’s<br />

THE workforce is<br />

characterized by chronic<br />

understaffing and challenges<br />

attracting and retaining<br />

talent and it's keeping<br />

our leaders up at night. In<br />

November 2021, Tourism<br />

HR Canada reported<br />

“unprecedented job vacancies,”<br />

with nearly 200,000<br />

vacant jobs and 14.4 per cent<br />

of industry jobs understaffed.<br />

With the rise of new<br />

COVID-19 variants, our<br />

colleagues nationally and<br />

globally are once again<br />

experiencing mounting<br />

uncertainty and new sets<br />

of restrictions. Although<br />

we may not know what the<br />

coming months will bring, we<br />

know we must look ahead for<br />

solutions with new, flexible<br />

and agile recruitment strategies<br />

to support recovery.<br />

A STRATEGIC MINDSET<br />

‘The Great Resignation’<br />

made headlines in 2021,<br />

with record numbers of<br />

employees quitting their jobs<br />

in search of greater flexibility,<br />

autonomy, belonging and<br />

purpose. But what if we shift<br />

our mindset to view this as<br />

an opportunity for ‘a great<br />

acquisition?’<br />

Acquiring talent starts<br />

with a strategic plan that lays<br />

out the course of action for<br />

identifying, recruiting, hiring<br />

and retaining talent. The<br />

most effective plans think<br />

beyond past practices of<br />

“post and pray” and instead<br />

deploy sales, marketing and<br />

digital-marketing approaches<br />

to capture talent market<br />

SUPPORTING<br />

RECOVERY<br />

Evolving recruitment strategies<br />

are key to recovery<br />

share. This includes developing<br />

a compelling employer<br />

brand which highlights<br />

organizational mission and<br />

campaigns directly to the<br />

ideal target candidate. If you<br />

are re-defining your employer<br />

brand, be unique and inclusive,<br />

but also genuine in what<br />

you’re offering.<br />

THE EMPLOYEE<br />

EXPERIENCE<br />

Today’s employees are<br />

subscribing to a new set of<br />

ideals, including an employee<br />

experience that will enhance<br />

their life and align with<br />

their values. Job descriptions<br />

remain a key touchpoint<br />

with prospective candidates<br />

and should be a thoughtfully<br />

crafted part of the marketing<br />

campaign. Your job descriptions<br />

should be a communication<br />

piece that speaks<br />

to your candidates about<br />

mission, leadership philosophy,<br />

opportunity for growth and<br />

contribution, and paints a<br />

clear picture of the employee<br />

BY CAYLEY DOW<br />

experience. Most importantly,<br />

you should re-write<br />

job descriptions in a way that<br />

welcomes diverse groups and<br />

speaks to candidates’ purpose<br />

as a member of your team.<br />

BUILD A TALENT<br />

COMMUNITY<br />

The key to finding candidates<br />

is to cast the net wide. The<br />

best way to do this is to<br />

establish an expectation that<br />

everyone in the organization<br />

has a role in recruitment.<br />

Some of the best candidates<br />

are lingering within your<br />

employee’s networks and<br />

social-media feeds. Looking<br />

at ways to activate these<br />

networks to build a talent<br />

community of passive candidates<br />

should be included in<br />

your recruitment strategy.<br />

LEVERAGE THE<br />

POWER OF SOCIAL<br />

With so many socialmedia<br />

outlets, it is difficult<br />

to know which is the most<br />

effective for attracting talent.<br />

Although LinkedIn and<br />

Indeed are the most common<br />

go-to’s for recruiting, Facebook<br />

groups allow employers to<br />

engage in genuine conversations<br />

with candidates. Videos<br />

on LinkedIn and Twitter<br />

are effective in discussing a<br />

job role instead of reading<br />

a standard job description.<br />

YouTube is valuable to leverage<br />

your employer brand and<br />

allows you to upload videos,<br />

build walk-throughs, employee<br />

testimonials and other<br />

content to showcase your<br />

employee experience. Short<br />

videos on TikTok are ideal to<br />

attract new workers, interns<br />

or graduates. Twitter is best<br />

for engaging millennials,<br />

while Instagram works to<br />

attract candidates seeking<br />

creative jobs.<br />

Moving forward, we need<br />

to recruit with a strategic<br />

mindset targeting passive<br />

candidates and highlighting<br />

the employee experience.<br />

Employers will need to act<br />

quickly in today’s competitive<br />

recruitment market.◆<br />

Cayley Dow is the founder<br />

and CEO of Thrivity Inc., a<br />

human-resources consulting<br />

and coaching firm that helps<br />

service-oriented businesses to<br />

thrive in the ever-evolving world<br />

of work.<br />

FREEPIK.COM<br />

10 | JANUARY/FEBRUARY <strong>2022</strong><br />

hoteliermagazine.com

OPERATIONS<br />

LONG LIVE<br />

LOBBY BARS<br />

The lobby bar is back with a vengeance<br />

BY LARRY AND ADAM MOGELONSKY<br />

Larry and Adam Mogelonsky<br />

are partners of Hotel Mogel<br />

Consulting Limited, a Toronto-based<br />

consulting practice. Larry<br />

focuses on asset management,<br />

sales and operations while Adam<br />

specializes in hotel technology and<br />

marketing. You can reach Larry at<br />

larry@hotelmogel.com or<br />

Adam at adam@hotelmogel.com<br />

ISTOCK.COM/EXPLORA_2005<br />

Call it wishful thinking,<br />

but we’re anticipating<br />

the steadfast return of the<br />

hotel lobby bar now that<br />

COVID-19 restrictions<br />

are lifting. In fact, we<br />

predict such outlets stand a good chance<br />

at becoming big attractions in the year<br />

ahead, with hoteliers able to use them to<br />

differentiate their marketing approach<br />

and garner more bookings.<br />

The lobby bar (or rooftop bar) is<br />

a point of pride for many.With first<br />

impressions so important, it’s one thing<br />

to approach the front desk to check-in<br />

with music billowing the halls from<br />

a nearby lounge with most tables<br />

occupied by chattering patrons; it’s an<br />

entirely different matter to be greeted<br />

by an empty hall.<br />

hoteliermagazine.com JANUARY/FEBRUARY <strong>2022</strong> | 11

Both of us have long been big fans<br />

of the upscale and hobnobbing lounges<br />

that hotels have painstakingly created<br />

because of the attention to detail in the<br />

decor, F&B, theme and overall vibe at<br />

these establishments. They are often<br />

attractions in their own right. Importantly,<br />

and in contrast to an empty lobby<br />

when checking in, this ‘scene’ acts to<br />

boost overall guest satisfaction and word<br />

of mouth to draw in more paying guests.<br />

The pandemic sadly shuttered<br />

many of these outlets, and the lack<br />

of foot traffic can make a place feel<br />

less welcoming. Without the hubbub,<br />

something feels off; it’s a void that<br />

bleeds into the hotel experience, subtly<br />

diminishing one’s appreciation for the<br />

guestroom product or other amenities.<br />

What we’re seeing on the ground<br />

right now, though, tells a different story<br />

— one of revival. With many lobby<br />

bars setting up gated entrances to check<br />

vaccination status, this conspicuous<br />

security chokepoint now elicits an<br />

air of safety, so much so that patrons<br />

are increasingly confident about<br />

returning to the pre-pandemic lifestyle<br />

of gathering at kinetic, close-quarters<br />

locations. Barring a major surge in virus<br />

caseloads that hammers this renewed<br />

spirit for socialization back down to<br />

its 2020 levels, our forecast is that the<br />

lobby bar only gets busier as global<br />

travel resumes.<br />

How do you take advantage of this<br />

emerging renaissance? How do you<br />

re-start a beverage-driven establishment<br />

to be both quantifiably profitable and<br />

work intrinsically to boost room reservations?<br />

In balancing these two realities,<br />

the latter is one that may not be readily<br />

measurable but is perhaps the more critical<br />

of the two as it drives total revenues<br />

for the property and gives your property<br />

a zero-base marketing tool.<br />

It’s no longer just about thinking<br />

of your bar or restaurant as a siloed<br />

revenue generator, but in its contribution<br />

to TRevPAR (Total Revenue<br />

Per Available Room). Does the lobby<br />

bar encourage more room reservations?<br />

Can the lobby bar positively influence<br />

TripAdvisor scores? Are there certain<br />

guest profiles that would be more<br />

inclined to spend at the lobby bar,<br />

thereby giving you a more detailed<br />

lookalike audience to hone your<br />

marketing efforts? These are a few<br />

cross-departments questions to ask.<br />

Design is critical here as your restaurant<br />

or bar has to be ready. If you have a<br />

renovation planned, the winter is the<br />

time to do it before what may be a<br />

great summer of travel come May <strong>2022</strong>.<br />

Then, in addition to having such an<br />

operation already in place<br />

(big CAPEX is not exactly on the table<br />

at the moment) or making the binary<br />

decision about whether to re-open,<br />

most crucial is having the right staffing.<br />

Labour shortages severely limit your<br />

topline sales from this outlet, as well as<br />

perhaps forcing you to reduce your bar’s<br />

operating hours.<br />

Our top recommendation on the<br />

labour front is less is more. Food menus<br />

should be uncomplicated, featuring<br />

only your bestsellers to limit requirements<br />

on the kitchen and speed<br />

up table turns. Similarly, where it<br />

concerns beverages, it’s easier to crack<br />

a beer bottle or pour a glass of wine<br />

than to prepare an elaborate cocktail,<br />

even though the latter may have a<br />

price point set at several dollars above<br />

such simpler options. While cocktails<br />

help to differentiate your product in a<br />

unique way, it’s a balancing act because<br />

of the time drain involved.<br />

Next, from a design perspective,<br />

less is also more as you may need to<br />

contend with backlogged workorders<br />

and supply-chain issues that might<br />

make complex decor purchases<br />

harder to implement. Most guests<br />

would simply be happy just to have a<br />

home-base option at their disposal.<br />

Some hotel brands have great bar<br />

components and are poised to make it<br />

big as travellers return. Remember, a<br />

great bar not only provides marginal<br />

ancillary sales, but it also can produce<br />

a halo effect to subsequently drive<br />

more loyalty and bookings. And that’s<br />

ultimately what hotels need right now,<br />

so consider how your bar, or any restaurant<br />

outlet for that matter, can work<br />

holistically towards re-building your<br />

guestroom bookings where most hotels<br />

make the majority of their profits. ◆<br />

Coming in<br />

March <strong>2022</strong><br />

• THE BUYER’S GUIDE<br />

• Trends: The Labour Shortage - Recruitment & Retention<br />

• Decor & Design: Bathrooms<br />

• Operations: Housekeeping & Laundry – Post COVID-19<br />

Cleanliness Standards & Protocols – Are they Sustainable?<br />

• Equipment/Technology: New Cleaning Technology<br />

• F&B: Health-Conscious Food Trends

EDITORIAL<br />

TIME TO<br />

KML fêtes the best-of-thebest<br />

at the 32nd-annual<br />

Pinnacle Awards<br />

1<br />

PHOTOGRAPHY BY<br />

JENNIFER O’NEILL<br />

2<br />

14 | JANUARY/FEBRUARY <strong>2022</strong><br />

hoteliermagazine.com

3 4<br />

5<br />

6<br />

7 8<br />

9<br />

10 11<br />

1. Registration desk at the 32nd-Annual Pinnacle Awards 2. (l to r) Peter Gillis, general manager<br />

Westin Harbour Castle Hotel, Toronto; Harmeet Chugh, hotel manager at Westin Harbour<br />

Castle, Toronto; Mike Truscott, area director of Operations, Canada at Marriott International;<br />

Don Cleary, president at Marriott Hotels of Canada; and Hiren Prabhakar, general manager &<br />

Chairman, Marriott Business Council for Central Canada at Marriott International 3. Anne Marie<br />

Johns with her son Tim, and sponsors of the <strong>Hotelier</strong> of the Year award, Nikola Bozic,<br />

national strategic key account manager, Foodservice & Hospitality, Nestlé Nespresso S.A. and<br />

Sandeep Kapoor, regional key account manager, Nespresso Professional / EVS Canada 4. Chris<br />

Siedel, vice-president, Encore Canada 5. Deepak Ruparell, president of Silver Hotel Group;<br />

6. Edwin Frizzell, regional vice-president Accor Central Canada & general manager, Fairmont<br />

Royal York 7. Supplier of the Year, Susie Grynol, her parents and her team from Hotel Association<br />

of Canada; 8. Company of the Year, Silver Hotel Group; 9. Rosanna Caira and Susie<br />

Grynol, president, Hotel Association of Canada; 10. Rosanna Caira, editor/publisher, KML 11.<br />

Amy Bostock, managing editor, KML<br />

hoteliermagazine.com JANUARY/FEBRUARY <strong>2022</strong> | 15

(l tor) Sean Hogan, director of<br />

Food and Beverage & Social<br />

Marketing; Perry Vashee,<br />

president and Jeff Waters vicepresident<br />

of Operations<br />

16 | JANUARY/FEBRUARY <strong>2022</strong><br />

hoteliermagazine.com

PROFILE<br />

BUILDING<br />

COMMUNITY<br />

Community becomes Opal Hospitality’s<br />

competitive advantage<br />

BY NICOLE DI TOMASSO | PHOTOGRAPHY BY MARGARET MULLIGAN<br />

erry Vashee says guest<br />

experience is more than<br />

just a tailored hotel term<br />

for customer service.<br />

When financial value<br />

plays a role in whether<br />

travellers will choose a<br />

property, the founder and president of Opal<br />

Hospitality says taking guest experience to the<br />

next level will ultimately ensure guest satisfaction<br />

and repeat bookings. For Opal Hospitality, it’s<br />

their number-1 priority.<br />

“We’re driven by creating experiences for<br />

[our guests],” says Vashee. “We know people<br />

are looking for something unique and different,<br />

so we cater to that.”<br />

Leaders in the development and management<br />

of hospitality spaces, Opal Hospitality has<br />

been led by Vashee since its inception in<br />

2018. Previously, Vashee was the director of<br />

Asset Management for Silver Hotel Group.<br />

He was also the director of Operations at<br />

Northampton Group for more than a decade,<br />

developing several award-winning hotels<br />

across Canada, including Fairfield Inn &<br />

Suites by Marriott in Ottawa and the first-ofits-kind<br />

Aloft Hotel by Marriott in Montreal.<br />

Vashee also sat on the owner’s boards for<br />

Holiday Inn and Sheraton Hotels & Resorts.<br />

Today, Opal Hospitality’s team of experts<br />

also includes Jeff Waters, vice-president of<br />

Operations; Jay Mori, project manager; Sean<br />

Hogan, director of Food and Beverage and<br />

Social Marketing; and Reema Padia, controller.<br />

Together, they deliver a full range of services:<br />

hotel management, asset re-positioning,<br />

brand-product development, strategic<br />

consulting and project management.<br />

In just over three years, Opal Hospitality has<br />

grown its portfolio to include four casual-luxury<br />

hotels and one restaurant, including Double-<br />

Tree by Hilton and its onsite restaurant The<br />

Little Sparo in St. John’s, Nfld.; Canvas<br />

Moncton, Tapestry Collection by Hilton in<br />

Moncton, N.B.; The Walper Hotel in Kitchener,<br />

Ont.; and The Insignia Hotel in Sarnia, Ont.<br />

The company also has two properties currently<br />

in development.<br />

“We’ve seen a significant change in the<br />

hotel industry over the last two decades<br />

as more guests are in tune with design and<br />

technology,” says Vashee. “When we look at<br />

developing a hotel, we don’t necessarily go for<br />

whatever the latest design is. We look at form,<br />

functionality and community.”<br />

“Our hotels are community oriented,” says<br />

Waters. “They’re popular amongst people that<br />

live in those areas, and that makes them more<br />

interesting to stay in for those visiting from<br />

out of town. It allows tourists to experience<br />

the cities they’re in as if they’re locals.”<br />

Opal Hospitality honed in on the growing<br />

demand for localism for the significant investment<br />

and development of its east-coast properties.<br />

In fact, DoubleTree by Hilton was Opal<br />

Hospitality’s first purchase and<br />

hoteliermagazine.com JANUARY/FEBRUARY <strong>2022</strong> | 17

e-positioning. In spite of COVID-19<br />

setbacks, the hotel opened in June<br />

2020, giving the company the opportunity<br />

to capture local business. Located<br />

on the waterfront near St. John’s<br />

downtown core, the property embraces<br />

the province’s prolific fishing grounds<br />

in its design, from wall vinyl blueprints<br />

of dories (traditional fishing boats) to<br />

refrigerators resembling lobster cages.<br />

“DoubleTree was completely gutted,<br />

right down to the bare bones,” says<br />

Vashee. “Our design lends itself to the<br />

island’s fishing industry without being<br />

overly done. [We wanted to create] a<br />

chic and upscale environment.”<br />

Then, in October 2020, The Little<br />

Sparo restaurant opened at DoubleTree<br />

by Hilton. With views of the harbour,<br />

The Little Sparo offers an array of Italian<br />

cuisine — such as beef carpaccio, squidink<br />

bucatini and squash risotto — curated<br />

by executive chef Tony Mackenzie.<br />

“We look to see what’s happening in<br />

the community and design food-andbeverage<br />

programs that complement<br />

that,” says Hogan. “Another big<br />

focus of ours is the finer details on<br />

how we deliver F&B, from decor and<br />

atmosphere perspectives to the type<br />

of products offered, and the level of<br />

service and experience that’s provided.<br />

That’s a big thing that attracts local<br />

clientele to our spots.”<br />

Hogan continues, “We’re really<br />

focused on the onsite dining experience<br />

and ensuring people feel comfortable<br />

and safe. But as restrictions started<br />

loosening up, naturally, people want to<br />

be out more, so we have also adapted<br />

to extend the guest experience off-site<br />

to incorporate ourselves in other adventures,<br />

[like our on-the-go hiking lunch<br />

concept, for example.]”<br />

Canvas Moncton, Tapestry Collection<br />

by Hilton, on the other hand, was a<br />

new build. It was announced in<br />

November 2019 as the first Canadian<br />

hotel in the Tapestry Collection<br />

by Hilton. Colliers Hotels recently<br />

negotiated a joint-venture transaction<br />

between FiveFive Queen Developments<br />

and Opal Hospitality, which will<br />

co-own and manage Canvas. Focused<br />

on artistic luxury, the hotel has been<br />

re-imagined as a vibrant social hub,<br />

with plenty of dining experiences and<br />

daily events to spark guests’ interest. Its<br />

coffee-to-cocktail bar has proven to be<br />

a successful concept, offering consumers<br />

the best of both worlds. Its on-site<br />

restaurant, Gahan House Pub & Oyster<br />

Bar, also doubles as a brewery.<br />

“We have an incredible partnership<br />

with 55Queen group in Moncton to<br />

develop Canvas hotel. They’re a<br />

visionary group that saw the potential and<br />

need for a lifestyle hotel in Moncton<br />

and supported the idea,” says Vashee.<br />

“Together we’re constantly assessing<br />

how we can continue to be a truly<br />

community-driven hotel.”<br />

At both DoubleTree and Canvas,<br />

Opal Hospitality delivers a multisensory<br />

experience upon arrival. Restobar<br />

concepts occupy lobby spaces,<br />

emerging as the focal point of design<br />

and inducing positive moods. “Our<br />

check-in desk is off to the side because<br />

we wanted the bar to be the centrepoint<br />

of the lobby,” says Vashee. “It’s a<br />

high-energy space, and that initial<br />

feeling when someone enters the hotel<br />

is critical to us. It doesn’t matter what<br />

time of day it is.”<br />

Vashee says the hotels have<br />

performed relatively well despite<br />

ongoing pandemic-related challenges<br />

plaguing the industry. While Double-<br />

Tree by Hilton’s performance was<br />

hindered by some of the toughest travel<br />

restrictions in the country, forcing<br />

its closure for a few months, Canvas<br />

remained operational.<br />

“St. John’s was more difficult because<br />

the island was closed off to the rest of<br />

Canada, but it re-opened in July 2021.<br />

We’re still penetrating the market as a<br />

new hotel, but we’ve seen good results<br />

from August to September,” says Vashee.<br />

Since the onset of the pandemic,<br />

Opal Hospitality has been laserfocused<br />

on establishing a social-media<br />

presence for its properties, which has<br />

become a lifeline for engaging its communities<br />

in the darkest of times. “We’ve<br />

been strategic about how we position<br />

ourselves on social media,” says Hogan.<br />

“I always knew utilizing social media<br />

was valuable, but we’ve really been able<br />

to turn on business by telling our audience,<br />

whether it’s on Facebook or Instagram,<br />

about the things we’re doing and offering,”<br />

says Waters. “We’ve been able to strike<br />

the right cord, and [our audience] relates<br />

to those things. We’ve seen great success<br />

utilizing our social media to tell stories<br />

that people find appealing.”<br />

Opal Hospitality’s approach to its guests<br />

extends to its staff, too. Its social media<br />

taps into the history of its properties and<br />

expresses genuine interest in the staff<br />

they hire, demonstrating company<br />

values to potential travellers who, in<br />

turn, will feel good about their<br />

accommodation choice.<br />

“We’re lucky to have such incredible<br />

teams at all of our hotels,” says Vashee.<br />

“Labour is a challenge right now, so<br />

we’re focusing on our people. [However,]<br />

in Moncton, we’re finding that people<br />

are actually seeking out work at Canvas<br />

because of our social-media presence<br />

and the perception of the property. Job<br />

satisfaction is a huge consideration in<br />

addition to pay scale, and housekeeping<br />

is difficult to attract and retain, so we’re<br />

working on providing flexible hours.<br />

We’re going to be spending a lot more<br />

time and energy working with our staff<br />

to create a positive environment.”<br />

In 2020, Opal Hospitality was<br />

awarded the Hilton New Developer of<br />

the Year Canada award in recognition<br />

of its work accomplishments and has<br />

hit the ground running in <strong>2022</strong>, with<br />

new developments and projects already<br />

underway. The team is currently<br />

working on Bloom Hotel in Mississauga,<br />

Ont., a Tapestry Collection by<br />

Hilton featuring a destination restaurant<br />

and unique event space, as well<br />

as The Wellington Hotel in Prince<br />

Edward County, Ont. with multiple<br />

F&B concepts and a spa. Both hotels<br />

are set to open this year.<br />

For hotel owners, managers and<br />

developers that will be forced to<br />

navigate a fourth wave at the start of<br />

a new year, Vashee offers some advice.<br />

“There’s a fine line between costcutting<br />

because of the times we’re in<br />

and penalizing the customer that is<br />

coming to the hotel. We still have to<br />

let those customers know that even<br />

though other people aren’t travelling,<br />

they [aren’t receiving anything less.]<br />

They should be given a true experience<br />

and feel as though they have spent their<br />

dollars on something that mattered. It’s<br />

a fine balance, a very fine balance.”◆<br />

18 | JANUARY/FEBRUARY <strong>2022</strong><br />

hoteliermagazine.com

FEATURE<br />

JIVE PHOTOGRAPHY [THE MUIR]; SIMON HAVENHAND [KING BLUE HOTEL]<br />

New brand launches are catering to<br />

the upscale guest experience<br />

BY DENISE DEVEAU<br />

Tempo Milwaukee Downtown<br />

The Muir, Autograph<br />

Collection, Halifax, N.S.<br />

King Blue Hotel Toronto<br />

hoteliermagazine.com JANUARY/FEBRUARY <strong>2022</strong> | 19

The ups and downs of recent months<br />

may have slowed down development<br />

efforts in some regions, but operators<br />

haven’t been shying away from<br />

introducing new concepts to the<br />

market. Many new projects launched<br />

over the past year are targeting a<br />

growing customer base seeking more<br />

upscale experiences that hold a distinct<br />

appeal outside the cookie-cutter norm.<br />

Here is a look at some recently introduced<br />

concepts across Canada that are<br />

setting themselves up for success in<br />

<strong>2022</strong> and beyond.<br />

Signature Styles<br />

Over the past year, Marriott did not let<br />

the pandemic halt expansion plans for<br />

its Autograph Collection portfolio in<br />

Canada. December 2021 for example,<br />

marked the launch of the Muir Hotel<br />

in Halifax, a new-build property located<br />

in the heart of the city’s coveted waterfront<br />

location.<br />

“We always wanted to offer a distinct<br />

hospitality experience for Haligonians<br />

and guests coming to town,” says<br />

Eugénie Jason, general manager. “Some<br />

travel restrictions led to construction<br />

delays, but that part is now behind us.”<br />

The guest profile runs the gamut<br />

from corporate to leisure, and international<br />

to local travellers. “It can cater<br />

to families travelling over weekends or<br />

business travellers, or couples enjoying a<br />

staycation on the waterfront,” she says.<br />

The hotel’s design, inspired by<br />

Maritime-Canada themes, complements<br />

the district, which includes luxury<br />

residences, office spaces, upscale<br />

restaurants and more than 75,000 sq.<br />

ft. of public spaces.<br />

Despite the instability that COVID-<br />

19 has brought to the industry, Jason<br />

believes there was no better time than<br />

December 2021 to launch their brand.<br />

“With new variants every other month,<br />

at some point you just have to put your<br />

toe in the water. This is a good time for<br />

us to ramp up and be ready for what we<br />

hope will be a busy summer season.”<br />

Humaniti Hotel in Montreal, another<br />

Marriott Autograph Collection hotel,<br />

opened in June 2021. Located at the<br />

intersection of Old Montreal and<br />

St. Catherine Street, the 193-room<br />

boutique hotel is one of the first to<br />

PHOTOS SUBMITTED BY MUIR HOTEL; SIMON HAVENHAND [KING BLUE HOTEL]<br />

(clockwise from top right)<br />

guest suite at the Muir Hotel,<br />

bike rentals at the Muir Hotel,<br />

King Blue Hotel Toronto, Drift<br />

Bar at the Muir Hotel<br />

20 | JANUARY/FEBRUARY <strong>2022</strong><br />

hoteliermagazine.com

(clockwise from top left) bathroom at the Tempo by<br />

Hilton, Get Ready Zone at Tempo by Hilton, Drift<br />

Restaurant at the Muir Hotel, Muir Hotel's GM<br />

Eugénie Jason<br />

NICOLE LAPIERRE PHOTGRAPHY [EUGÉNIE JASON]; PAULINE YU [DRFIT RESTAURANT]<br />

open in Canada since the start of<br />

the pandemic, says general manager<br />

Mathieu Duguay. “We appeal to the<br />

individualist traveller, who prefers the<br />

diverse, one-of-a-kind experiences that<br />

independent hotels offer.”<br />

Features include a ground-floor<br />

boulangerie, high-end supermarket,<br />

restaurants and lounges, rooftop pool,<br />

state-of-the-art fitness facilities and a<br />

vibrant art collection by local artists<br />

that starts on the street and ends in<br />

the guestrooms. Duguay likes to describe<br />

Humaniti as “a city within a building<br />

that draws visitors that share the<br />

creative spirit.”<br />

As for opening during the pandemic,<br />

it’s about instilling hope for the future<br />

of the industry, he says. “The entire<br />

industry has been heavily impacted by<br />

COVID, but we see the opening as an<br />

important symbol of confident optimism<br />

for the future of Canadian tourism.”<br />

This year, Accor introduced its first<br />

MGallery Hotel Collection property<br />

in the Canadian market with the acquisition<br />

and refurbishment of the Hotel<br />

Belmont in Vancouver. The five-storey,<br />

82-room ultra-premium heritage<br />

boutique hotel located on Granville<br />

Street, is now part of a global network<br />

of more than 100 MGallery properties<br />

around the world.<br />

“It was important to bring the brand<br />

to Canada, which is Accor’s home in<br />

North & Central America,” says Anatoly<br />

Kondratenko, VP, Development, Accor<br />

North & Central America, in Toronto.<br />

The Hotel Belmont is just the first<br />

step in the MGallery strategy for<br />

Canada, he adds. “Our aim is to have 10<br />

MGallery hotels in Canada by 2026.”<br />

Toronto saw a new upscale offering<br />

with the opening of the independent<br />

King Blue Hotel in the fall of 2021.<br />

It’s been described as a contemporary<br />

luxury boutique hotel inspired by<br />

Toronto’s Entertainment District.<br />

“Our front façade was built from the<br />

original six stories of the Canadian<br />

Westinghouse Company Building that<br />

date back to 1917,” says Robert Pratt,<br />

president, Sandman and Sutton Place<br />

Hotels in Vancouver.<br />

“Looking into the rear-view mirror,<br />

with four waves of COVID-19 behind<br />

us and still managing the uncertainty<br />

associated with new variants, what we<br />

have created is a boutique-style hotel<br />

with a proud and unique style that<br />

perfectly complements its new<br />

neighbourhood,” he says.<br />

Beyond the Borders<br />

Outside of Canada, the past year has<br />

seen new brand launches that will be<br />

making their way to Canada sometime<br />

in the future.<br />

Hilton is making its play for the<br />

upscale traveller with the launch of<br />

a new Tempo brand, which will be<br />

introduced to Canada soon, says global<br />

brand head, Kevin Morgan, Fairfax<br />

hoteliermagazine.com JANUARY/FEBRUARY <strong>2022</strong> | 21

County, Va. “We’re looking at bringing<br />

Tempo to Toronto, Montreal and<br />

Calgary, among other locations within<br />

the next two to three years.”<br />

Morgan describes Tempo as “an elevated<br />

and approachable lifestyle brand<br />

that sits in the middle — above Hilton<br />

Garden Inn and below Canopy. The key<br />

audience is the rising class of modern<br />

achievers who don’t want boring and<br />

banal anymore or staying at cookie-cutter<br />

properties. They’ve reached a point in<br />

their career where they’ve received a few<br />

promotions and can afford to stay at a<br />

higher-end hotel centered on wellness,<br />

mindfulness and sustainability.”<br />

While COVID-19 delayed the<br />

project, Morgan sees it as a plus in<br />

some ways. “That extra time gave us<br />

the chance to go back and sharpen our<br />

pencils and make sure we would hit the<br />

mark 100 per cent. We looked back at<br />

everything, including the furniture, to<br />

find ways to improve our product.”<br />

Wyndham Hotels & Resorts’ new<br />

Registry Collection Hotels concept<br />

is specifically focused on the luxury<br />

segment. “The brand fills an important<br />

space at the upper end of our portfolio,<br />

allowing us to provide support to<br />

those who meet the highest standards<br />

of luxury service and accommodations,”<br />

says Chip Ohlsson, EVP, Chief<br />

Development Officer, North America,<br />

Wyndham Hotels & Resorts Registry<br />

Collection Hotels, Parsippany, N.J.<br />

He notes that a noteworthy<br />

outcome of the pandemic was a strong<br />

increase in demand for leisure travel<br />

just ahead of the 2021 summer travel<br />

season, making the launch of the<br />

brand all the more timely. “In this<br />

new, remote, work-from-anywhere<br />

world, we saw a trend of ‘longer long<br />

weekends,’ with Thursday and Sunday<br />

night occupancy climbing to record<br />

highs last quarter.”<br />

The pandemic has not only opened<br />

potential new markets, but it is also<br />

transforming the entire guest experience,<br />

says Jason. “Whatever we are seeing<br />

in terms of change and service in<br />

luxury hotels is pretty much going<br />

to be the new norm, both in the way<br />

rooms are serviced and the equipment<br />

we provide, such as mobile check-in<br />

and keys.”<br />

But one important aspect will<br />

continue, she adds. “The human<br />

connection will always remain.” ◆<br />

MUIR HOTEL<br />

INCREASE YOUR<br />

BOTTOM LINE WITH<br />

OUR CANADIAN<br />

BASED TEAM<br />

1.800.646.2435<br />

development@travelodge.ca<br />

travelodge.ca/development<br />

OVER 100 LOCATIONS<br />

ACROSS CANADA<br />

Scan to<br />

view more<br />

information

THE <strong>2022</strong><br />

FRANCHISE<br />

REPORT<br />

AC HOTELS<br />

Marriott International, Inc.<br />

2425 Matheson Blvd. E., Ste. 100<br />

Mississauga, ON L4W 5K4<br />

905-366-5208<br />

marriottdevelopment.com<br />

Senior Director, Lodging<br />

Development, Canada:<br />

Aaron Laurie<br />

Director, Lodging Development,<br />

Canada: Duncan Chiu<br />

History, Plans<br />

- first AC Hotel opened in 2011<br />

- one property in Canada; 197<br />

outside of Canada<br />

- one property in development<br />

for Canada<br />

Franchise Costs<br />

- initial franchise fee US$90,000<br />

plus US$500/room in excess<br />

of 150<br />

- royalty fee 5.5% of GRS<br />

- program services contribution<br />

3.85% of GRS (includes a contribution<br />

to the marketing fund of<br />

2.5% of GRS); plus US$10,000/year;<br />

plus US$220/room/year<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- staff training<br />

- supplies<br />

AIDEN BY BEST WESTERN<br />

Best Western Hotels & Resorts<br />

6557 Mississauga Rd., Unit D<br />

Meadowvale Ct. 1<br />

Mississauga, ON L5N 1A6<br />

905-816-4787<br />

bestwestern.com<br />

President: Lawrence M. Cuculi<br />

Chief Development Officer:<br />

Brad LeBlanc<br />

History, Plans<br />

- established in 2018.<br />

- 13 properties outside of Canada<br />

Franchise Costs<br />

- initial franchise fee $49,000<br />

minimum, plus $200/room for<br />

properties with more than<br />

50 rooms<br />

- marketing fee 1% of GRR plus<br />

$13.65/room/month<br />

- royalty fee 5% of GRRR; for a<br />

qualifying existing Best Western<br />

owner fee is 3.5% of GRR<br />

Services<br />

- advertising/marketing<br />

- design<br />

- lease negotiation<br />

- management<br />

- purchasing<br />

- revenue management<br />

- site location<br />

- staff training<br />

- supplies<br />

ALOFT HOTELS<br />

Marriott International, Inc.<br />

2425 Matheson Blvd. E., Ste. 100<br />

Mississauga, ON L4W 5K4<br />

905-366-5208<br />

marriottdevelopment.com<br />

Senior Director, Lodging<br />

Development, Canada:<br />

Aaron Laurie<br />

Director, Lodging Development,<br />

Canada: Duncan Chiu<br />

History, Plans<br />

- first Aloft Hotel opened in 2008<br />

- three properties in Canada; 202<br />

outside of Canada<br />

- one property in development<br />

for Canada<br />

Franchise Costs<br />

- initial franchise fee US$75,000<br />

plus US$500/room in excess<br />

of 150<br />

- royalty fee 5.5% of GRS<br />

- program services contribution<br />

3.15% of GRS (includes a contribution<br />

to the marketing fund of 1%<br />

of GRS); plus US$10,000/year; plus<br />

US$220/room/year.<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- site location<br />

- site review and analysis<br />

- staff training<br />

- supplies<br />

ASCEND HOTEL COLLECTION<br />

Choice Hotels Canada Inc.<br />

5015 Spectrum Way, Ste. 400<br />

Mississauga, ON L4W 0E4<br />

905-206-7316<br />

choicehotelsdevelopment.ca<br />

President, Choice Hotels Canada<br />

Inc.: Brian Leon<br />

History, Plans<br />

- established in Canada in 2009<br />

- 24 properties in Canada; 286<br />

outside of Canada (all franchised)<br />

Franchise Costs<br />

- initial franchise fee: $300 per<br />

room; minimum $45,000<br />

- advertising fee 1.25%<br />

- royalty fee 4%<br />

- reservation fee 1.25%<br />

Services<br />

- advertising/marketing<br />

- design<br />

- staff training<br />

- supplies<br />

AUTOGRAPH COLLECTION<br />

Marriott International, Inc.<br />

2425 Matheson Blvd. E., Ste. 100<br />

Mississauga, ON L4W 5K4<br />

905-366-5208<br />

marriottdevelopment.com<br />

Senior Director, Lodging<br />

Development, Canada:<br />

Aaron Laurie<br />

Director, Lodging Development,<br />

Canada: Duncan Chiu<br />

History, Plans<br />

- first Autograph property opened<br />

in 2010<br />

- six properties in Canada; 238<br />

outside of Canada<br />

- four properties in development<br />

for Canada<br />

Franchise costs<br />

- initial application fee US$100,000<br />

plus US$400/room in excess of 250<br />

- royalty fee 5% of GRS<br />

- program services contribution<br />

2.02% of GRS (includes a<br />

contribution to the marketing fund<br />

of 1.5% of GRS); plus US$40,000/<br />

year; plus US$450/room/year<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- staff training<br />

- supplies<br />

AVID HOTELS<br />

InterContinental Hotels Group (IHG)<br />

2 Robert Speck Pkwy., Ste. 600<br />

Mississauga, ON L4Z 1H8<br />

416-675-6644<br />

avidhotels.com<br />

Regional Director, Upscale and<br />

Mainstream Development, Canada:<br />

Stuart Laurie<br />

History, Plans<br />

- established in 2017<br />

- 43 properties outside of Canada<br />

- plans to add five properties<br />

in Canada<br />

Franchise Costs<br />

- total investment $ 7,7062,820<br />

to $9,398,535<br />

- royalty fee 5% GRR<br />

- marketing fee 3% GRR<br />

- application fee $500/room;<br />

$50,000 minimum<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- site selection<br />

- staff training<br />

- supplies<br />

hoteliermagazine.com<br />

JANUARY/FEBRUARY <strong>2022</strong> | 23

THE <strong>2022</strong><br />

FRANCHISE<br />

REPORT<br />

Wyndham Hotels & Resorts<br />

22 Sylvan Way<br />

Parsippany, NJ 07054<br />

800-889-9710<br />

wyndhamdevelopment.com<br />

Executive Vice-President and Chief<br />

Development Officer: Chip Ohlsson<br />

History, Plans<br />

- established in 1974<br />

- five properties in Canada; 514<br />

properties outside of Canada<br />

Franchise Costs<br />

- initial franchise fee: new<br />

construction & conversion<br />

$2,500 plus the greater of<br />

$26,000 or $260 per room<br />

- total investment $208,813 -<br />

$7,304,504<br />

- application: $2,500<br />

- royalty: 5% of GRR<br />

- marketing: 3.5% GRR<br />

Services<br />

- architectural services/design<br />

- advertising/marketing<br />

- conventions and area meetings<br />

- development & design<br />

- field support<br />

- financial assistance<br />

- group tour material<br />

- group savings<br />

- lease negotiation<br />

- purchasing<br />

- quality assurance audits<br />

- quality control<br />

- reservation systems<br />

- staff training<br />

- supplies<br />

- technical services<br />

- worldwide sales<br />

BEST WESTERN<br />

Best Western Hotels & Resorts<br />

6557 Mississauga Rd., Unit D<br />

Meadowvale Ct. 1<br />

Mississauga, ON L5N 1A6<br />

905-816-4787<br />

bestwestern.com<br />

President: Lawrence M. Cuculi<br />

Chief Development Officer:<br />

Brad LeBlanc<br />

History, Plans<br />

- established in 1946 in Long<br />

Beach, Calif.<br />

- 59 properties in Canada; 1,805<br />

outside of Canada<br />

Franchise Costs<br />

- initial franchise fee $49,000<br />

minimum, plus $200/room<br />

for properties with more than<br />

50 rooms<br />

- marketing fee 1% of GRR plus<br />

$13.65/room/month<br />

- royalty fee 5% of GRRR; for a<br />

qualifying existing Best Western<br />

owner fee is 3.5% of GRR<br />

Services<br />

- advertising/marketing<br />

- design<br />

- lease negotiation<br />

- management<br />

- purchasing<br />

- revenue management<br />

- site location<br />

- staff training<br />

- supplies<br />

BEST WESTERN PLUS<br />

Best Western Hotels & Resorts<br />

6557 Mississauga Rd., Unit D<br />

Meadowvale Ct. 1<br />

Mississauga, ON L5N 1A6<br />

905-816-4787<br />

bestwestern.com<br />

President: Lawrence M. Cuculi<br />

Chief Development Officer:<br />

Brad LeBlanc<br />

History, Plans<br />

- established in 2011 in<br />

North America<br />

- 113 properties in Canada; 1,136<br />

outside of Canada<br />

Franchise Costs<br />

- initial franchise fee $49,000<br />

minimum, plus $200/room<br />

for properties with more than<br />

50 rooms<br />

- marketing fee 1% of GRR plus<br />

$13.65/room/month<br />

- royalty fee 5% of GRRR; for a<br />

qualifying existing Best Western<br />

owner fee is 3.5% of GRR<br />

Services<br />

- advertising/marketing<br />

- design<br />

- lease negotiation<br />

- management<br />

- purchasing<br />

- revenue management<br />

- site location<br />

- staff training<br />

- supplies<br />

BEST WESTERN PREMIER<br />

Best Western Hotels & Resorts<br />

6557 Mississauga Rd., Unit D<br />

Meadowvale Ct. 1<br />

Mississauga, ON L5N 1A6<br />

905-816-4787<br />

bestwestern.com<br />

President: Lawrence M. Cuculi<br />

Chief Development Officer:<br />

Brad LeBlanc<br />

History, Plans<br />

- established in 2003 in Europe<br />

and Asia, 2011 in Canada and U.S.<br />

- 12 properties in Canada; 121<br />

outside of Canada<br />

Franchise Costs<br />

- initial franchise fee $49,000<br />

minimum, plus $200/room<br />

for properties with more than<br />

50 rooms<br />

- marketing fee 1% of GRR plus<br />

$13.65/room/month<br />

- royalty fee 5% of GRRR; for a<br />

qualifying existing Best Western<br />

owner fee is 3.5% of GRR<br />

Services<br />

- advertising/marketing<br />

- design<br />

- lease negotiation<br />

- management<br />

- purchasing<br />

- revenue management<br />

- site location<br />

- staff training<br />

- supplies<br />

BW PREMIER COLLECTION<br />

BY BEST WESTERN<br />

Best Western Hotels & Resorts<br />

6557 Mississauga Rd., Unit D<br />

Meadowvale Ct. 1<br />

Mississauga, ON L5N 1A6<br />

905-816-4787<br />

bestwestern.com<br />

President: Lawrence M. Cuculi<br />

Chief Development Officer:<br />

Brad LeBlanc<br />

History, Plans<br />

- established in 2014<br />

- 14 properties in Canada; 89<br />

outside of Canada<br />

Franchise Costs<br />

- initial franchise fee $25,000 plus<br />

application fee of $4,000<br />

- monthly fee (sales, marketing<br />

and technology fee) 5% of GRR<br />

Services<br />

- advertising/marketing<br />

- design<br />

- lease negotiation<br />

- management<br />

- purchasing<br />

- revenue management<br />

- site location<br />

- staff training<br />

- supplies<br />

CAMBRIA HOTELS<br />

Choice Hotels International<br />

1 Choice Hotels Circle, Ste. 400<br />

Rockville, MD 20850<br />

800-547-0007<br />

development@choicehotels.com<br />

choicehotelsdevelopment.com<br />

President & CEO, Choice Hotels<br />

International: Pat Pacious<br />

SVP, Franchise Development,<br />

Upscale Brands: Mark Shalala<br />

History, Plans<br />

- founded in 2007<br />

- zero properties in Canada; 58<br />

outside of Canada<br />

24 | JANUARY/FEBRUARY <strong>2022</strong> 2021 hoteliermagazine.com

THE <strong>2022</strong><br />

FRANCHISE<br />

REPORT<br />

Franchise Costs<br />

- initial fee: $500 per room (new<br />

franchises), minimum of $60,000;<br />

$750 per room (transfers/renewals),<br />

minimum $65,000<br />

- royalty fee: 6% GRR<br />

- system fee 3% GRR<br />

Sonesta RL Hotels Franchising, Inc.<br />

255 Washington St Ste 270<br />

Newton, MA, 02458-1634<br />

development@sonesta.com<br />

franchise.sonesta.com<br />

SVP, Franchise Development:<br />

Mike Castro<br />