2019 - 2021 FMA Magazine

FMA Magazine covers events and programming for 2019 - 2021, including Auburn University Student Investment Fund performance.

FMA Magazine covers events and programming for 2019 - 2021, including Auburn University Student Investment Fund performance.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

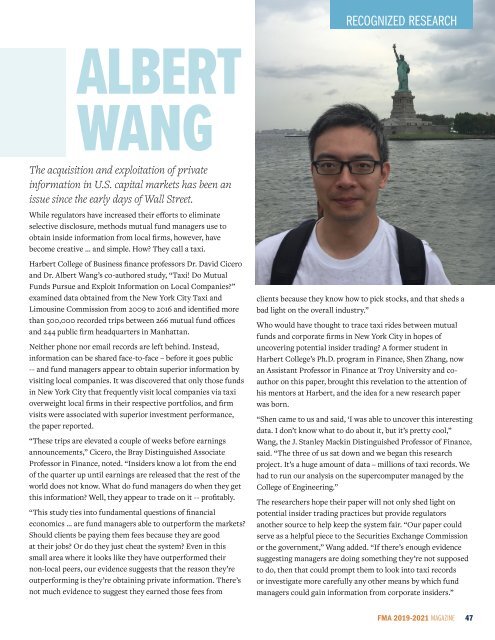

RECOGNIZED RESEARCH<br />

ALBERT<br />

WANG<br />

The acquisition and exploitation of private<br />

information in U.S. capital markets has been an<br />

issue since the early days of Wall Street.<br />

While regulators have increased their efforts to eliminate<br />

selective disclosure, methods mutual fund managers use to<br />

obtain inside information from local firms, however, have<br />

become creative ... and simple. How? They call a taxi.<br />

Harbert College of Business finance professors Dr. David Cicero<br />

and Dr. Albert Wang’s co-authored study, “Taxi! Do Mutual<br />

Funds Pursue and Exploit Information on Local Companies?”<br />

examined data obtained from the New York City Taxi and<br />

Limousine Commission from 2009 to 2016 and identified more<br />

than 500,000 recorded trips between 266 mutual fund offices<br />

and 244 public firm headquarters in Manhattan.<br />

Neither phone nor email records are left behind. Instead,<br />

information can be shared face-to-face – before it goes public<br />

-- and fund managers appear to obtain superior information by<br />

visiting local companies. It was discovered that only those funds<br />

in New York City that frequently visit local companies via taxi<br />

overweight local firms in their respective portfolios, and firm<br />

visits were associated with superior investment performance,<br />

the paper reported.<br />

“These trips are elevated a couple of weeks before earnings<br />

announcements,” Cicero, the Bray Distinguished Associate<br />

Professor in Finance, noted. “Insiders know a lot from the end<br />

of the quarter up until earnings are released that the rest of the<br />

world does not know. What do fund managers do when they get<br />

this information? Well, they appear to trade on it -- profitably.<br />

“This study ties into fundamental questions of financial<br />

economics … are fund managers able to outperform the markets?<br />

Should clients be paying them fees because they are good<br />

at their jobs? Or do they just cheat the system? Even in this<br />

small area where it looks like they have outperformed their<br />

non-local peers, our evidence suggests that the reason they’re<br />

outperforming is they’re obtaining private information. There’s<br />

not much evidence to suggest they earned those fees from<br />

clients because they know how to pick stocks, and that sheds a<br />

bad light on the overall industry.”<br />

Who would have thought to trace taxi rides between mutual<br />

funds and corporate firms in New York City in hopes of<br />

uncovering potential insider trading? A former student in<br />

Harbert College’s Ph.D. program in Finance, Shen Zhang, now<br />

an Assistant Professor in Finance at Troy University and coauthor<br />

on this paper, brought this revelation to the attention of<br />

his mentors at Harbert, and the idea for a new research paper<br />

was born.<br />

“Shen came to us and said, ‘I was able to uncover this interesting<br />

data. I don’t know what to do about it, but it’s pretty cool,”<br />

Wang, the J. Stanley Mackin Distinguished Professor of Finance,<br />

said. “The three of us sat down and we began this research<br />

project. It’s a huge amount of data – millions of taxi records. We<br />

had to run our analysis on the supercomputer managed by the<br />

College of Engineering.”<br />

The researchers hope their paper will not only shed light on<br />

potential insider trading practices but provide regulators<br />

another source to help keep the system fair. “Our paper could<br />

serve as a helpful piece to the Securities Exchange Commission<br />

or the government,” Wang added. “If there’s enough evidence<br />

suggesting managers are doing something they’re not supposed<br />

to do, then that could prompt them to look into taxi records<br />

or investigate more carefully any other means by which fund<br />

managers could gain information from corporate insiders.”<br />

<strong>FMA</strong> <strong>2019</strong>-<strong>2021</strong> MAGAZINE 47