Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FISCAL YEAR 2022<br />

STRATEGIC PLAN UPDATE<br />

+ BUDGET REPORT

CORE VALUES<br />

EXCELLENCE<br />

ACCOUNTABILITY<br />

SERVICE<br />

INTEGRITY<br />

The Leadership Team<br />

Ray<br />

Rushing<br />

Jonathan<br />

Hoekstra<br />

Gail<br />

Lawrence<br />

Mike<br />

Reeser<br />

Jeff<br />

Kilgore<br />

Rick<br />

Herrera<br />

Michael<br />

Bettersworth<br />

2<br />

STRATEGIC PLAN & BUDGET REPORT

APPROVED BY BOARD OF REGENTS 8/19/2021<br />

a letter from the cfo<br />

To our Regents,<br />

Ten years ago, the Board did not receive a single budget<br />

proposal from TSTC. They heard 5 different budget<br />

presentations in support of different plans. At that time,<br />

the $165 million combined budget supported 7 campuses<br />

and 2,500 employees, which graduated about 2,000<br />

students per year. That’s when the Board appointed Mike<br />

Reeser Chancellor.<br />

Immediately, Chancellor Reeser challenged the College<br />

to no longer pursue perfection of the irrelevant. To take a<br />

focused look at our mission, he rallied the firm under the<br />

mantra “Place More Texans in Great Paying Jobs.”<br />

Today, as a single TSTC community, it is clear that our<br />

transformation has been substantial. We are highly<br />

focused, boldly challenging conventional ideas, and<br />

bringing the team together and forward on the journey.<br />

Last year, it would have been understandable to allow the<br />

extraordinary circumstances of COVID to slow our progress. Instead, we recognized the change-accelerating<br />

nature of the moment and charged ahead.<br />

This year, we’ve taken the opportunity during our natural rhythm of planning and budgeting to retrace some<br />

of our steps. We’re proud of the story and especially the results. This year, we expect to produce over 2,800<br />

graduates from across 10 different campuses. These students’ employment prospects far exceed the cohorts<br />

of students before them.<br />

We now have an enviable culture. It is truly a great place to work for the 1,617 people committed to our cause.<br />

For a decade, TSTC prepared for disruptive change and found itself ready to respond to the challenges of<br />

COVID-19. Tomorrow’s market leaders must imagine and continue preparing for a different kind of future. We<br />

invite you to participate in that process during the next year.<br />

I trust that our story, our plan update and our budget overview provide clear context surrounding the $240<br />

million budget proposed for the Board’s consideration.<br />

With deep appreciation,<br />

Jonathan Hoekstra, CPA, MBA, Vice Chancellor & Chief Financial Officer<br />

STRATEGIC PLAN & BUDGET REPORT<br />

3

CONTENTS<br />

3<br />

5<br />

A LETTER FROM THE CFO<br />

CONTEXT FOR PLANNING<br />

PRE-PANDEMIC<br />

COVID: A ONE-OFF YEAR<br />

7<br />

PREPARING FOR WHAT’S NEXT<br />

STRATEGIC PLAN UPDATE<br />

WILDLY IMPORTANT GOAL 1<br />

10<br />

11<br />

12<br />

16<br />

17<br />

18<br />

19<br />

WILDLY IMPORTANT GOAL 3<br />

FISCAL YEAR 2022 BUDGET PRESENTATION<br />

FISCAL YEAR 2022 ANNUAL OPERATING BUDGET<br />

OPERATING REVENUES<br />

OPERATING EXPENSES<br />

COVID-19 RELIEF<br />

CAPITAL BUDGET<br />

EXHIBITS<br />

4<br />

STRATEGIC PLAN & BUDGET REPORT

APPROVED BY BOARD OF REGENTS 8/19/2021<br />

CONTEXT FOR PLANNING<br />

<strong>Plan</strong>ning and budgeting cycles at TSTC begin<br />

with an assessment of the environmental<br />

situation as context for planning. For fiscal<br />

year 2022, this is dominated by the impact of<br />

COVID-19. Indeed, as the world emerges from<br />

the pandemic and the related shutdown, the<br />

context for TSTC’s planning and budgeting is<br />

best organized from the perspective of TSTC<br />

before, during and after the pandemic.<br />

Pre-Pandemic<br />

In the years leading up to the pandemic, TSTC<br />

clarified its purpose with a simple message<br />

that summed up its mission: Place More<br />

Texans in Great Paying Jobs. However, before<br />

setting its course, leadership took note of<br />

the disruptive environment facing the higher<br />

education industry. The College recognized<br />

the Texas Legislature’s increasing appetite<br />

for accountability from public colleges and<br />

universities, the broader culture’s growing<br />

skepticism about the value proposition of<br />

higher education, and employers’ angst about<br />

an expanding skills gap (increasing demand<br />

for skills that is historically flat in supply). In<br />

addition, the contrast of higher education’s<br />

old operating model with the exponentially<br />

changing environment heavily influenced TSTC’s<br />

messaging and plans.<br />

Leveraging its differentiation, the College<br />

reached many historical milestones in the years<br />

that approached the pandemic including the<br />

following:<br />

1.<br />

2.<br />

Pioneering the nation’s only placement<br />

and wage-based funding formula, linking<br />

the interests of the College to needs of<br />

employers and students.<br />

Expanding the College’s footprint into<br />

fast-growing regions of East Austin, South<br />

Dallas, and West Houston.<br />

3.<br />

4.<br />

5.<br />

Streamlining and focusing the functions<br />

of the College through a merger of college<br />

accreditations, operations, and curriculum.<br />

Shaping and sustaining a new, valuescentered<br />

culture under the recognition that<br />

healthy organizations are more effective<br />

organizations.<br />

Establishing a program vitality framework<br />

for measurement and assessment<br />

of program outcomes towards the<br />

achievement of student and employer<br />

success.<br />

These milestones were achieved as the College<br />

pursued the goals of its first statewide strategic<br />

plan. In February 2020, after assessing the<br />

College’s progress to date, leadership and the<br />

Board established new targets under the same<br />

strategic plan goal areas.<br />

A month later, the COVID-19 virus arrived in the<br />

United States.<br />

COVID: A One-Off Year<br />

Years of implementing organizational change in<br />

preparation for a vastly different future enabled<br />

TSTC to react with confidence during the global<br />

pandemic. Much like the rest of the world, TSTC<br />

operations shifted to a remote format while the<br />

College prepared for the next version of TSTC<br />

and higher education.<br />

TSTC leadership activated the College’s<br />

Emergency Response Team at the first sign of<br />

concern in 2020. This foresight and discernment<br />

was not shared across the industry, but the<br />

College provided a path for its peers and<br />

the state by adopting the following guiding<br />

principles and persevering through the unknown:<br />

Protect the health and safety of students<br />

and employees.<br />

Protect the health and safety of our<br />

communities.<br />

Do our job of teaching and placing students.<br />

Keep TSTC and our employees as fiscally<br />

sound as we possibly can.<br />

STRATEGIC PLAN & BUDGET REPORT<br />

5

These pillars provided clarity and comfort<br />

to TSTC’s team as they resumed classes and<br />

continued innovating. Accelerating new teaching<br />

modalities and modifying facilities to deliver<br />

hands-on instruction in a new and sociallydistant<br />

format kept the College open. These<br />

procedures would ensure the teammates and<br />

students were safe and productive.<br />

TSTC will emerge from the pandemic, one-off<br />

season as the college that first brought its<br />

students back to campus. This occurred without<br />

incident. Though operations were slightly<br />

disrupted, they resumed in either a remote or<br />

socially-distant manner.<br />

Legions of TSTC personnel adapted swiftly to<br />

the new requirements, resuming service to our<br />

students and transitioning to new methods of<br />

working and teaching.<br />

Preparing for What’s Next<br />

The competitive advantages in higher education<br />

have been leveled and new imperatives have<br />

emerged. No one could have predicted the<br />

pandemic, but TSTC did anticipate rapid and<br />

dramatic change to higher education. This<br />

anticipation and readiness was a true advantage<br />

through this season. TSTC continues to keep its<br />

focus on the horizon to maintain its leadership<br />

position in the changing times ahead.<br />

TSTC will become the market-relevant and<br />

laser-focused skills provider in Texas, but<br />

planning for this next phase includes deepening<br />

relationships with industry and student-centric<br />

operations while continuing to build upon<br />

the values and principles that make TSTC an<br />

employer of choice.<br />

TSTC leadership and the Board will explore this<br />

changing landscape during fiscal year 2022<br />

as insights from the last decade and this most<br />

recent one-off pandemic season inform the next<br />

iteration of the strategic plan.<br />

6<br />

STRATEGIC PLAN & BUDGET REPORT

APPROVED BY BOARD OF REGENTS 8/19/2021<br />

STRATEGIC PLAN UPDATE<br />

Changing Up The Mix<br />

In reviewing WIG 1, consider this scenario:<br />

Operational <strong>Plan</strong>ning & Assessment<br />

<strong>Plan</strong>, budget, execute, then measure. Sustaining<br />

the College’s operational planning and<br />

assessment cycle is an ongoing process. The<br />

outcomes of this process allow leaders to<br />

make evidence-based decisions for continuous<br />

improvement.<br />

All divisions of the College set goals and<br />

evaluate performance under the overarching<br />

Wildly Important Goals (WIGs) set by the Board.<br />

TSTC’s first strategic plan was adopted 4 years<br />

ago. Since then the Board and College narrowed<br />

their plans to two WIGs focusing on Student<br />

Success and Organizational Health.<br />

Wildly Important Goal 1:<br />

Student Success<br />

In contrast to traditional academic institutions,<br />

TSTC was established to be an economic<br />

generator for the State of Texas. Wildly<br />

Important Goal 1 prioritizes the optimization<br />

and innovation of the student pipeline that<br />

produces graduates to go into the Texas<br />

workforce. From recruiting to job placement,<br />

the TSTC student experience must meet student<br />

needs and industry demand.<br />

TSTC’s pipeline involves a curated mix of<br />

programs and a modern day learning platform<br />

with curriculum calibrated specifically to the<br />

needs of Texas industry. Instructional leadership<br />

continually tracks program performance using<br />

core indicators such as enrollment, persistence,<br />

graduates and first year wage growth. As is true<br />

of any pipeline, events occurring upstream have<br />

downstream effects. For the College’s pipeline,<br />

this means that circumstances defining a single<br />

cohort of students impacts the entire pipeline<br />

until that cohort exits the pipeline into the<br />

workforce.<br />

Prior to 2019, TSTC offered a program in<br />

agricultural technology. Through the College’s<br />

ongoing program assessment process,<br />

leadership concluded several programs no<br />

longer delivered student outcomes worthy of<br />

inclusion in its mix of programs. The College<br />

would replace the low performing program with<br />

the higher performing electrical lineworker<br />

program.<br />

In this scenario, you can easily assess the impact<br />

on two hypothetical students.<br />

One is an agricultural technology graduate. She<br />

can expect a wage of $39,000 a few years after<br />

transferring and completing her studies at a<br />

four-year institution. By that time the electrical<br />

lineworker student will graduate and earn<br />

$119,000, a salary that started at $67,000 and<br />

grew over the next five years.<br />

It’s obvious which program and which outcome<br />

is better for the student, and therefore better for<br />

TSTC and Texas Industry. However, these choices<br />

create short term challenges for the College.<br />

Closing programs and replacing that capacity<br />

stalls TSTC’s production of graduates, which is<br />

reflected in the goals.<br />

01<br />

Time At TSTC<br />

Time At TSTC<br />

Time At University<br />

Time At University<br />

Starting Salary<br />

Salary After 3 Years<br />

Starting Salary<br />

WIG 1: Student Success<br />

High-Tech & High-Demand<br />

WIG 1: Student Success<br />

High-Tech & High-Demand<br />

2 years<br />

2 years<br />

2 years<br />

2 $26,000 years<br />

$39,000<br />

$26,000<br />

20 months<br />

20 months<br />

none<br />

$67,000<br />

$119,000<br />

none<br />

$67,000<br />

Salary After 3 Years<br />

$39,000<br />

STRATEGIC PLAN & BUDGET REPORT<br />

$119,000<br />

7

02<br />

3750<br />

WIG 1: Student Success<br />

Performance Trend & Forecast<br />

Actuals<br />

2021 Original Forecast<br />

2022 Revised Forecast<br />

WIG Goal<br />

3500<br />

3,549<br />

3,382<br />

3,334<br />

3250<br />

3,065<br />

3,257<br />

3,145<br />

3,164<br />

3,238<br />

3,035<br />

3,106<br />

3000<br />

3,046<br />

2,949<br />

2750<br />

2,838 2,844<br />

2016 2017 2018 2019 2020 2021 2022 2023 2024<br />

In February 2020, when establishing the WIG<br />

1 goals, leadership and the Board accounted<br />

for some of these cohort-impacting events.<br />

Specifically, in 2019, leadership closed 14<br />

instructional programs which no longer<br />

delivered student placement and wage<br />

outcomes worthy of inclusion in TSTC’s program<br />

mix. The College factored in the phase-out<br />

of the students historically enrolled in these<br />

programs in establishing a new trajectory of<br />

graduate production. The long-term goal would<br />

return production of graduates to the 2019 high<br />

water-mark by fiscal year 2022. Ultimately, the<br />

graduates lost will be replaced with those in<br />

programs with higher employability outcomes<br />

under this new, curated program mix.<br />

The renewed strategic plan anticipated<br />

6% growth in annual enrollment and a 6%<br />

increase in our graduate rate production for the<br />

programs that remained after the 2019 closures.<br />

Leadership and management accepted a 3 year<br />

goal of returning the graduate count from 3,257<br />

in fiscal year 2019 to 3,238 in fiscal year 2022.<br />

Returning to 2019 levels will be delayed based<br />

on our latest forecast. The impact of COVID<br />

reduced the student cohorts of fiscal year<br />

2020 and 2021, impacting TSTC’s 3 and 5 year<br />

plans. TSTC produced 10% fewer graduates in<br />

2020 than hoped for in the original goal, with<br />

the impact persisting in the following years.<br />

The downstream effect of COVID’s impact on<br />

the 2020 and 2021 cohorts is illustrated in<br />

the revised trajectory (the line graph). Based<br />

on the most recent count of students, TSTC is<br />

anticipating 3,035 students will graduate in<br />

fiscal year 2022 and 3,334 will graduate in<br />

fiscal year 2024.<br />

3-YEAR GOAL<br />

Return the graduate count from 3,257<br />

in fiscal year 2019 to 3,238 by fiscal<br />

year 2022.<br />

5-YEAR GOAL<br />

Increase the graduate count from 3,257<br />

in fiscal year 2019 to 3,549 by fiscal<br />

year 2024.<br />

8<br />

STRATEGIC PLAN & BUDGET REPORT

APPROVED BY BOARD OF REGENTS 8/19/2021<br />

Wildly Important Goal 3:<br />

Organizational Health<br />

3-YEAR GOAL<br />

Increase the overall score on the Survey<br />

of Employee Engagement to 400 by<br />

fiscal year 2022.<br />

5-YEAR GOAL<br />

Increase and maintain the overall<br />

score on the Survey of Employee<br />

Engagement to 400 through<br />

fiscal year 2024.<br />

TSTC’s focus on organizational health provided<br />

a clear advantage during fiscal year 2020<br />

and 2021. Like the rest of the world, TSTC’s<br />

workplace dynamics changed abruptly with<br />

virtually no warning. The College immediately<br />

activated the Emergency Response Team at the<br />

first signs of the disruption before the nation<br />

had really braced for impact. TSTC assembled<br />

and deployed a team of contact tracers to<br />

monitor all cases through resolution and<br />

throttled up communication protocols ensuring<br />

the TSTC community received constant and clear<br />

updates.<br />

The College continued developing its ranks<br />

of leaders and managers and launched a<br />

new Pay for Performance compensation<br />

strategy. The result is a renewed focus on<br />

recognizing and rewarding employees for<br />

performance excellence and outcomes.<br />

Phase 1 of this initiative saw over 320<br />

employees receive a “Pay for Performance”<br />

compensation increases in recognition of<br />

their sustained work excellence.<br />

TSTC exceeded its goal with an overall score<br />

of 404 on the 2021 Survey of Employee<br />

Engagement. The College exceeded its<br />

sustainability goal of 400 despite the abrupt<br />

changes affecting the workforce last year.<br />

Through TSTC’s dedication to the creation of<br />

a healthy, productive culture, insights have<br />

emerged and TSTC is assembling these into a<br />

declaration of our principles and beliefs.<br />

03<br />

WIG 3: Organizational Health<br />

Performance Trend & Forecast<br />

410<br />

400<br />

407<br />

404<br />

400<br />

400<br />

400<br />

Survey of Employee Engagement<br />

390<br />

380<br />

370<br />

360<br />

372<br />

378<br />

388<br />

350<br />

2017 2018 2019 2020 2021 2022 2023 2024<br />

STRATEGIC PLAN & BUDGET REPORT<br />

9

FISCAL YEAR 2022<br />

BUDGET PRESENTATION<br />

Organizational Structure &<br />

<strong>Budget</strong> Framework<br />

TSTC’s organizational and leadership structures<br />

continuously evolve and this year was no<br />

exception. Leadership restructured with the<br />

creation of a new division, External Relations,<br />

combining all departments that interact with<br />

external constituents, including potential<br />

students, graduates, donors, industry, or<br />

legislative stakeholders. External Relations<br />

will strengthen and deepen relationships<br />

with industry and external constituents by<br />

strategically aligning the outward facing<br />

departments of the College to unify TSTC’s voice<br />

and brand.<br />

The new organizational structure and resulting<br />

allocation of resources across the College is<br />

illustrated below.<br />

04<br />

Presentation, Assumptions & Estimates<br />

Various line items in prior year budget and<br />

actual amounts are reclassified to align<br />

with the current organizational structure<br />

and budget framework for consistency in<br />

comparative analysis.<br />

Fiscal year 2021 forecast amounts and<br />

certain fiscal year 2022 budget amounts<br />

use available data and related estimates<br />

as of May 31, 2021.<br />

The College will realize appropriation<br />

revenues in accordance with bill patterns<br />

established by the 87th Legislature.<br />

TSTC prepares budgets using a cash basis<br />

of accounting, including budgeting debt<br />

service payments (principal and interest),<br />

and excluding depreciation expense from<br />

the budget.<br />

The annual budget report is a starting<br />

point. TSTC anticipates many refinements<br />

to this budget throughout the year as<br />

the needs and circumstances of all<br />

TSTC departments continually change,<br />

especially given the many financial<br />

uncertainties related to the COVID-19<br />

pandemic.<br />

4%<br />

Finance<br />

6%<br />

External<br />

Relations<br />

13%<br />

Shared<br />

Resources<br />

13%<br />

Statewide<br />

Benefits<br />

16%<br />

Student<br />

Services<br />

2%<br />

Statewide<br />

Administration<br />

2022 <strong>Budget</strong><br />

$240,490,937<br />

25%<br />

Instruction<br />

21%<br />

Student<br />

Financial Aid<br />

10<br />

STRATEGIC PLAN & BUDGET REPORT

APPROVED BY BOARD OF REGENTS 8/19/2021<br />

FISCAL YEAR 2022<br />

ANNUAL OPERATING BUDGET<br />

FY 2020 FY 2021 FY 2021 FY 2022<br />

REVENUE Actual <strong>Budget</strong> Forecast <strong>Budget</strong><br />

Appropriations - Returned Value Formula 66,124,351 66,124,351 66,124,351 69,944,409<br />

Special Items & Other Appropriations 23,000,122 23,169,199 23,169,199 24,328,988<br />

Appropriations - HEAF 8,662,500 8,662,500 8,662,500 8,662,500<br />

Appropriations - TRB Retirement 3,758,881 3,757,232 3,757,232 3,752,809<br />

Appropriations - Group Insurance 14,335,594 14,163,822 14,163,822 13,930,449<br />

Appropriations - Benefits Match 10,454,389 10,721,329 9,838,467 10,789,000<br />

Tuition 43,833,112 44,192,647 43,100,000 43,966,000<br />

Student Financial Aid 31,142,956 33,369,711 31,869,206 31,595,000<br />

Auxiliary Services 10,448,791 10,118,700 8,160,000 9,003,284<br />

Fees & Educational Sales 3,745,122 3,738,936 3,708,000 3,127,500<br />

Industry Relations 1,520,662 3,314,000 1,550,000 2,575,400<br />

Grants 9,739,178 9,006,112 19,984,515 15,431,075<br />

Contracts & Other 3,882,858 3,717,700 2,940,030 2,408,366<br />

230,648,516 234,056,239 237,027,322 239,514,780<br />

Carryforward / Reserves 1,914,868 976,157<br />

EXPENSE<br />

Instruction 62,283,651 66,809,201 61,598,005 61,223,499<br />

Financial Aid 37,876,030 38,529,711 38,924,120 36,860,968<br />

Benefits 31,592,691 31,492,672 29,747,393 30,937,761<br />

Finance 9,506,441 10,756,887 9,243,118 10,027,838<br />

External Relations 15,110,315 16,429,279 15,324,261 14,038,386<br />

Auxiliary Services 10,221,668 10,966,612 8,771,586 9,333,756<br />

Student Services 8,968,579 11,064,571 9,344,799 10,319,289<br />

Facilities 9,355,980 9,961,314 8,894,104 9,179,100<br />

Facilities - Transfer to Capital <strong>Budget</strong> 3,690,836 1,808,924 1,832,924 1,114,958<br />

Information Technology 8,464,657 9,649,790 9,656,314 9,070,488<br />

Statewide Administration 4,171,313 4,608,063 4,351,175 4,534,902<br />

Debt Service 11,927,567 11,964,640 13,115,652 16,078,645<br />

Utilities and Other 6,706,931 7,808,277 9,570,002 6,842,785<br />

Grants 5,703,318 4,121,166 15,433,144 12,928,562<br />

<strong>Strategic</strong> Pool 0 0 0 8,000,000<br />

225,579,977 235,971,107 235,806,597 240,490,937<br />

Operating <strong>Budget</strong> Margin 5,068,539 0 1,220,725 0<br />

STRATEGIC PLAN & BUDGET REPORT<br />

11

OPERATING REVENUES<br />

Revenue Mix<br />

TSTC derives its budget from several sources<br />

of funds. State appropriations are the most<br />

significant revenue source, contributing 55<br />

percent of the College’s total revenues. Student<br />

tuition is the second largest category of<br />

revenues, contributing 18 percent of the total<br />

in fiscal year 2022. Student Financial Assistance<br />

passes through the College as revenue and<br />

is eventually applied to students’ accounts<br />

through an offsetting/equal expense. Other<br />

supplemental revenues including grants, pilot<br />

training fees, housing rents, retail sales and<br />

contract-related income combine to account<br />

for a smaller but still significant amount of<br />

revenues. The illustration below demonstrates<br />

the relative contributions from the different<br />

sources of funds.<br />

State Appropriations<br />

Total General Revenue appropriations for fiscal<br />

year 2022 increased approximately $5 million<br />

over amounts received in fiscal year 2021. By<br />

the conclusion of the 87th Legislative Session<br />

in May 2021, the Texas Legislature once again<br />

affirmed TSTC’s Returned-Value Formula by<br />

funding TSTC for the full amount earned in the<br />

formula, which was the primary factor for the<br />

increase in total appropriations. TSTC also saw<br />

a slight increase in the E&G Space Support<br />

appropriation, as the Texas Legislature generally<br />

increased these amounts for all institutions<br />

across the state.<br />

Other components of appropriation funding<br />

are considered “non-formula support”, which<br />

include the Small Institution Supplement,<br />

Institutional Enhancement, System Office<br />

Operations, and Startup Funding strategies.<br />

Capital improvement funding from the Higher<br />

Education Assistance Funds (HEAF) appropriation<br />

and specific appropriations that pay for Tuition<br />

Revenue Bond retirement (debt service) also<br />

contribute to total TSTC appropriations.<br />

05 06<br />

18%<br />

Tuition<br />

55%<br />

State<br />

Appropriations<br />

2022 Revenues<br />

$239,514,780<br />

14%<br />

Other*<br />

18%<br />

Tuition<br />

13%<br />

Student<br />

Financial<br />

Assistance 2022 Revenues<br />

55%<br />

State<br />

Appropriations<br />

$239,514,780<br />

14%<br />

Other*<br />

19%<br />

Benefits<br />

13%<br />

Student<br />

Financial<br />

Assistance<br />

53%<br />

Returned-Value<br />

Formula<br />

2022 Revenues:<br />

Appropriations<br />

$131,408,1553%<br />

Returned-Value<br />

Formula<br />

19%<br />

Special<br />

Items 19% and<br />

Benefits<br />

Other*<br />

6%<br />

2022 HEAF Revenues:<br />

Appropriations<br />

$131,408,155 3%<br />

Debt<br />

Service<br />

19%<br />

Specia<br />

Items an<br />

Other*<br />

H<br />

D<br />

Se<br />

Other*<br />

Grants<br />

7%<br />

Auxiliary Services<br />

4%<br />

Industry Relations Other* 1%<br />

7% Fees & Educational SalesE&G Space 1% Support<br />

4% Contracts & Other 1%<br />

1%<br />

1%<br />

1%<br />

12<br />

Start Up Funding<br />

4%<br />

Small Institution Supplement<br />

3%<br />

Institutional Enhancement<br />

3%<br />

System Office Operations & Other 2%<br />

Dual Credit 1%<br />

STRATEGIC PLAN & BUDGET REPORT<br />

Other*<br />

E&G Space Support<br />

6%<br />

Start Up Funding<br />

4%<br />

Small Institution Supplement<br />

3%<br />

Institutional 6% Enhancement<br />

3%<br />

System Office Operations & Other 2%<br />

Dual Credit 1%

APPROVED BY BOARD OF REGENTS 8/19/2021<br />

Returned-Value Formula Performance<br />

TSTC’s unique Returned-Value funding formula<br />

continues to pioneer a new way of higher<br />

education funding in Texas with positive results.<br />

In the most recent formula calculation used<br />

for the 87th Legislative Session, the number<br />

of graduates included in the formula remained<br />

consistent with prior years, while the average<br />

wages of those graduates over the five-year<br />

calculation period climbed to higher levels.<br />

These higher wages resulted in the increase in<br />

formula funding TSTC is realizing for fiscal year<br />

2022.<br />

TSTC increased its capability for estimating<br />

future returned formula forecasts. With an<br />

increasing but less than full confidence, TSTC<br />

anticipates this trend of higher wages to<br />

continue for at least two more biennia. The<br />

number of graduates at that time may trail<br />

off associated with the program closures that<br />

occurred in fiscal year 2019.<br />

By solely focusing on training in programs with<br />

high performance pay outcomes for students,<br />

TSTC has benefited from the funding drivers<br />

embedded in the formula, and the State of Texas<br />

continues to see the related economic growth,<br />

just as the original formula design intended.<br />

07<br />

TSTC's Returned-Value Formula<br />

Actual<br />

Forecast<br />

TSTC Student<br />

Wages<br />

2014-2015<br />

83rd<br />

275.47M<br />

2016-2017<br />

84th<br />

264.96M ▼4%<br />

2018-2019<br />

85th<br />

340.22M ▲28%<br />

2020-2021<br />

86th<br />

2022-2023<br />

87th<br />

371.87M ▲9% 389.51M ▲5%<br />

2024-2025<br />

88th<br />

458.74M ▲18%<br />

2026-2027<br />

89th<br />

650.78M ▲42%<br />

Commission Rate 36%<br />

36%<br />

36%<br />

36%<br />

36%<br />

36%<br />

36%<br />

Funded Rate 33% 36%<br />

28%<br />

36%<br />

36%<br />

TBD TBD<br />

234M<br />

Returned-Value<br />

Funding<br />

98M<br />

94M<br />

Earned<br />

Funded<br />

121M<br />

132M<br />

140M<br />

165M<br />

TBD<br />

TBD<br />

90M<br />

94M<br />

94M<br />

132M<br />

140M<br />

STRATEGIC PLAN & BUDGET REPORT<br />

13

Tuition<br />

Significant demand inconsistencies related to<br />

the pandemic created substantial uncertainty<br />

for long-range estimates of tuition revenue.<br />

Considering this environment, TSTC budgeted<br />

tuition at a conservative amount for fiscal year<br />

2022. Fiscal year 2021 actual tuition revenues<br />

are forecasted to finish at approximately $43<br />

million, and the fiscal year 2022 budget only<br />

slightly increases that amount to $44 million.<br />

Very early enrollment projections for the Fall<br />

2021 semester appear promising, but unusually<br />

high levels of uncertainty still dominate all<br />

aspects of society and business as the pandemic<br />

lingers into its second year. Accordingly, the<br />

tuition revenue budget for fiscal year 2022 is<br />

being held close to prior year (pandemic era)<br />

levels until more certainty comes into focus.<br />

08<br />

Tuition Trends<br />

2018 2019 2020 2021 - Forecast 2022 - <strong>Budget</strong><br />

44.96M<br />

45.43M<br />

47.28M<br />

44.19M<br />

43.97M<br />

42.43M 43.66M 43.83M 43.10M 43.97M<br />

* Bar Chart Figures represent the <strong>Budget</strong>ed Tuition Revenue for the specific Fiscal Year.<br />

* The line chart figures represent the Actual & Forecasted Tuition revenue for the specific Fiscal Year.<br />

<strong>Budget</strong>ed Tuition Revenue<br />

Actuals & Forecasted Tuition Revenue<br />

14<br />

STRATEGIC PLAN & BUDGET REPORT

APPROVED BY BOARD OF REGENTS 8/19/2021<br />

Other Revenues<br />

In addition to the primary revenue sources of<br />

state appropriations and tuition, TSTC generates<br />

other revenues from a variety of services,<br />

initiatives and contracts. Many of these services<br />

are referred to as Auxiliary Enterprises, which<br />

provide needed services for students, faculty,<br />

and staff and charge a fee related to that<br />

service. In fiscal year 2022, similar to tuition<br />

revenue, an extremely high level of uncertainty<br />

exists around future demand and the ability to<br />

accurately predict these revenue sources.<br />

TSTC has seen material declines in these<br />

supplemental revenue producing activities with<br />

the onset and continuation of the pandemic,<br />

much like many other institutions of higher<br />

education across the nation. Although TSTC<br />

is not nearly as reliant on these activities to<br />

produce significant revenue compared to<br />

traditional four-year universities, the decline<br />

still has an impact on TSTC’s overall budget.<br />

Retail Operations were affected the most due<br />

to the transition to online learning, which has<br />

greatly reduced foot traffic on campus. Training<br />

programs like Industry Relations and Flight<br />

Training also experienced material declines.<br />

Employers engaged in less on-site workforce<br />

training, and continuing education saw a drop<br />

in demand as well. Additionally, a phase-out<br />

of TSTC’s helicopter pilot training program was<br />

initiated in fiscal year 2020, which added to the<br />

overall revenue decline compared to prior years.<br />

As a result of the revenue declines, managers of<br />

these business units reduced expense budgets<br />

in fiscal year 2022 to minimize overall losses<br />

where possible.<br />

The potential for the volume of these services<br />

to ever return to pre-pandemic levels is still very<br />

uncertain, and a “new normal” will likely affect<br />

these functions for years to come.<br />

09<br />

FY 2020 FY 2021<br />

FY 2022<br />

Actual <strong>Budget</strong> Forecast <strong>Budget</strong><br />

Other Revenues<br />

Retail Operations 4,166,506 5,386,500 3,965,000 4,570,000<br />

Housing 4,219,032 3,420,000 2,904,000 3,321,284<br />

Industry Relations 1,520,662 3,314,000 1,550,000 2,575,400<br />

Flight Training 1,497,859 2,050,000 1,643,000 1,600,000<br />

SkillsEngine 890,509 1,280,000 949,000 950,000<br />

Airport 1,991,535 1,112,000 1,291,000 1,112,000<br />

Total Other Revenues 14,286,103 16,562,500 12,302,000 14,128,684<br />

STRATEGIC PLAN & BUDGET REPORT<br />

15

OPERATING EXPENSES<br />

10<br />

FY 2020 FY 2021 FY 2022<br />

<strong>Budget</strong> <strong>Budget</strong> <strong>Budget</strong><br />

Operating Expenditures<br />

Operating Costs 111,709,898 104,031,984 109,389,827<br />

Statewide Benefits 29,742,672 31,201,472 30,937,761<br />

Personnel Costs 93,567,521 100,737,651 92,163,349<br />

<strong>Strategic</strong> Pool 5,000,000 - 8,000,000<br />

Total Operating Expenditures 240,020,091 235,971,107 240,490,937<br />

Total operating expenditures budgeted for<br />

fiscal year 2022 are $240 million, compared<br />

to $236 million budgeted for fiscal year 2021.<br />

Of note, however, is that budgeted CARES grant<br />

expenditures are included in the fiscal year<br />

2022 total. Excluding CARES expenses, the<br />

total operating expense budget has decreased<br />

by approximately $4 million from fiscal year<br />

2021. The decrease in budgeted expenditures<br />

is the result of a conservative, “base budget”<br />

approach by management for fiscal year 2022,<br />

with material room for contingencies. TSTC is<br />

utilizing a <strong>Strategic</strong> Pool in the upcoming year<br />

as a mechanism to allow management to nimbly<br />

react and allocate resources as needed to<br />

quickly changing demands and circumstances.<br />

In addition to utilizing a <strong>Strategic</strong> Pool for<br />

managing contingencies, the fiscal year 2022<br />

budget has been prepared by removing all<br />

vacant positions that were previously budgeted<br />

but unfilled. As a result, the personnel budget<br />

appears significantly decreased, when in<br />

actuality it has simply been reduced to real-time<br />

staffing levels. The <strong>Strategic</strong> Pool will serve as a<br />

way for the College to more proactively manage<br />

hiring growth in this uncertain time, while still<br />

allowing for quickly accelerated growth if and<br />

when necessary.<br />

One other noteworthy item in the fiscal year<br />

2022 budget is an increase in debt service<br />

expenditures of approximately $3 million. This<br />

increase reflects the new debt service payments<br />

due on $30 million of Revenue Financing<br />

System bonds issued in August 2020. These<br />

bonds are payable over a ten year period, and<br />

the proceeds have been allocated to fund<br />

expansion projects in Instruction and Student<br />

Recruiting.<br />

In summary, uncertainty once again dominates<br />

the budgeting and planning approach at TSTC<br />

for a second consecutive year. A myriad of<br />

external factors such as unpredictable revenues,<br />

supply chain delays, rising construction costs,<br />

inflation, near zero interest rates and a very tight<br />

job market all play a role in defining the fiscal<br />

year 2022 budget. TSTC was fortunate to dodge<br />

many of the hurdles that have set back other<br />

colleges. Strong pandemic protocols along<br />

with tremendous resilience exhibited by TSTC<br />

faculty, staff and students placed the College<br />

in a sound, flexible financial position despite<br />

of all the unusual challenges the pandemic has<br />

presented.<br />

16<br />

STRATEGIC PLAN & BUDGET REPORT

APPROVED BY BOARD OF REGENTS 8/19/2021<br />

COVID-19 RELIEF<br />

Coronavirus Aid, Relief and Economic<br />

Security Act<br />

In response to the economic disruption caused<br />

by COVID-19, the federal government passed<br />

the CARES Act in March 2020 to provide<br />

funding for students and institutions of higher<br />

education. Multiple awards have been made<br />

from the Department of Education in the sixteen<br />

months since the original Act was authorized. In<br />

total, TSTC was awarded just over $40 million<br />

for institutional purposes, and approximately<br />

$28 million for direct aid to students. These<br />

funds carry time and purpose restrictions, and<br />

TSTC is currently deploying a Capital Allocation<br />

<strong>Plan</strong> to successfully and strategically invest<br />

these funds to their highest and best use.<br />

In TSTC’s annual operating budget, CARES funds<br />

are accounted for in the “Grants” line item, in<br />

both revenue and expense. TSTC expects to<br />

expend much of the remaining student portion<br />

in fiscal year 2021, as relief funds have been<br />

disbursed quickly to students. A large portion<br />

of the institutional funds are budgeted in fiscal<br />

year 2022, with more to be added to the budget<br />

in the very near future as plans are finalized and<br />

executed.<br />

Restrictions regarding the purpose and timing of<br />

these funds increase the complexity for efficient<br />

deployment of these funds. TSTC leadership<br />

is closely monitoring execution velocity of the<br />

related projects and will redeploy the related<br />

capital as necessary. The College will report<br />

to the Board of Regents on the deployment of<br />

these funds throughout the life of the COVID-19<br />

relief grants.<br />

BUDGET<br />

PLAN<br />

11<br />

MEASURE<br />

COVID-19 Relief<br />

EXECUTE<br />

CARES Grant (March 2020) Institutional Student<br />

Higher Education Emergency Relief Funds (HEERF) 4,982,000 4,982,000<br />

HEERF - Minority Serving Institution Funds 1,139,000<br />

CARES Grant - Amendment / Addition (December 2020)<br />

Higher Education Emergency Relief Funds (HEERF) 16,309,000 4,982,000<br />

HEERF - Minority Serving Institution Funds 627,000<br />

American Rescue <strong>Plan</strong> (April 2021) 18,500,000 18,500,000<br />

TOTAL Federal Pandemic Relief Funding 41,557,000 28,464,000<br />

STRATEGIC PLAN & BUDGET REPORT<br />

17

CAPITAL BUDGET<br />

TSTC’s capital budget consists of inflows and<br />

outflows of funds specifically identified for the<br />

acquisition, construction, and renovation of<br />

facilities and other long-term improvements.<br />

The most common source of funding for capital<br />

projects is debt and TSTC issued $30 million of<br />

new debt (Series 2020 RFS bonds) in August<br />

2020 to fund much needed expansion and<br />

renovation projects. The expenditure of the<br />

proceeds of this bond spans multiple fiscal<br />

years and $15.9 million is planned to be spent<br />

in fiscal year 2022 on the projects outlined in<br />

the table below.<br />

Similar to the operating budget of the College,<br />

the capital budget has changed significantly in<br />

the last year as the pandemic upended almost<br />

every aspect of how TSTC functions. Initial, prepandemic<br />

capital plans included a $15 million<br />

renovation of the Industrial Technology Center<br />

in Waco for administrative offices to be utilized<br />

by those departments that were displaced by<br />

the abatement and demolition project. But, as all<br />

TSTC employees transitioned to remote work in<br />

March 2020, this project was put on hold and is<br />

postponed indefinitely as remote work at TSTC<br />

has proven to be efficient and effective. In place<br />

of the administrative office project are new<br />

projects that more directly impact Instruction,<br />

External Relations, and Student Life.<br />

In 2019, TSTC received a one-time,<br />

supplemental appropriation of $29.6 million<br />

from the Texas Legislature to fund a large-scale<br />

abatement and demolition project at the Waco<br />

campus. Although many individual projects<br />

related to this appropriation are still ongoing or<br />

have yet to begin, all funds were obligated in<br />

fiscal year 2021, and as a result, the expenditure<br />

of the supplemental appropriation is complete,<br />

and does not appear in the fiscal year 2022<br />

capital budget.<br />

12<br />

Capital Project Uses<br />

Capital<br />

Reserves<br />

EDA Grant<br />

Capital Funding Sources<br />

2020 RFS<br />

Bond<br />

Operating<br />

Transfers In<br />

Deferred Maintenance - - - 1,114,958 1,114,958<br />

Harlingen Multi-Function Center - - 2,100,000 - 2,100,000<br />

Waco EEC/TSC Renovation 2,583,594 3,400,000 - - 5,983,594<br />

Waco JBC 1st and 2nd Floor Renovation - - 5,200,000 - 5,200,000<br />

Waco Kultgen Automotive Renovation - - 1,900,000 - 1,900,000<br />

Plumbing Licensure Testing Sites - - 2,400,000 - 2,400,000<br />

Waco North Interceptor (Sewer) - - 1,500,000 - 1,500,000<br />

Other Projects - - 1,399,512 - 1,399,512<br />

Reserves for Future Use 2,416,406 - 1,378,780 - 3,795,186<br />

Total <strong>FY22</strong> Expenses 5,000,000 3,400,000 15,878,292 1,114,958 25,393,250<br />

Total<br />

18<br />

STRATEGIC PLAN & BUDGET REPORT

APPROVED BY BOARD OF REGENTS 8/19/2021<br />

EXHIBITS<br />

STRATEGIC PLAN & BUDGET REPORT<br />

19

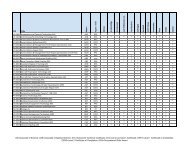

EXHIBIT I: Detailed Operating Expense <strong>Budget</strong><br />

2020 2021 2022<br />

Expense Type Original <strong>Budget</strong> Original <strong>Budget</strong> Original <strong>Budget</strong><br />

Instruction<br />

Academics Personnel Costs 9,991,875 9,149,308 7,873,583<br />

Operating Costs 926,177 755,084 685,718<br />

Total Academics 10,918,052 9,904,392 8,559,301<br />

Aerospace Personnel Costs 3,360,963 3,746,679 2,739,787<br />

Operating Costs 2,213,547 1,479,990 1,242,707<br />

Total Aerospace 5,574,510 5,226,669 3,982,494<br />

Allied Health Personnel Costs 4,275,915 4,129,305 3,886,986<br />

Operating Costs 522,993 617,534 539,930<br />

Total Allied Health 4,798,908 4,746,839 4,426,916<br />

C4EO Personnel Costs 1,396,641 1,530,140 1,667,388<br />

Operating Costs 418,464 343,774 343,774<br />

Total C4EO 1,815,105 1,873,914 2,011,162<br />

Construction & Safety Personnel Costs 1,394,117 1,433,741 1,455,865<br />

Operating Costs 215,149 212,166 212,166<br />

Total Construction & Safety 1,609,266 1,645,907 1,668,031<br />

Digital Transformation Personnel Costs 5,539,987 5,213,300 4,686,006<br />

Operating Costs 408,255 316,351 316,351<br />

Total Digital Transformation 5,948,242 5,529,651 5,002,357<br />

Electrical Instrumentation Personnel Costs 5,278,988 6,062,626 5,984,687<br />

Operating Costs 551,508 492,738 552,832<br />

Total Electrical Instrumentation 5,830,496 6,555,364 6,537,519<br />

Industrial Manufacturing Personnel Costs 5,684,414 7,334,024 6,587,549<br />

Operating Costs 1,744,896 1,267,210 1,297,210<br />

Total Industrial Manufacturing 7,429,310 8,601,234 7,884,759<br />

Instructional Pool Personnel Costs 2,623,000 3,307,044 3,554,000<br />

Operating Costs 6,663,897 6,519,830 4,257,298<br />

Total Instructional Pool 9,286,897 9,826,874 7,811,298<br />

Instructional Sales Personnel Costs 730,373 701,812 476,328<br />

Operating Costs 75,713 60,762 60,762<br />

Total Instructional Sales 806,086 762,574 537,090<br />

Provosts & Admin Personnel Costs 4,005,080 5,216,464 6,097,403<br />

Operating Costs 1,161,613 702,076 871,086<br />

Total Provosts & Admin 5,166,693 5,918,540 6,968,489<br />

<strong>Strategic</strong> Partnerships Personnel Costs 459,232 125,744 84,324<br />

Operating Costs 1,686,846 56,200 56,200<br />

Total <strong>Strategic</strong> Partnerships 2,146,078 181,944 140,524<br />

Transportation Personnel Costs 3,516,725 3,772,873 3,665,374<br />

Operating Costs 491,858 414,933 414,933<br />

Total Transportation 4,008,583 4,187,806 4,080,307<br />

Vision & Alignment Personnel Costs 1,268,675 1,398,534 1,164,293<br />

Operating Costs 475,839 448,959 448,959<br />

Total Vision & Alignment 1,744,514 1,847,493 1,613,252<br />

Total Instruction 67,082,740 66,809,201 61,223,499<br />

Financial Aid<br />

College Work Study Personnel Costs 0 637,308 441,468<br />

Operating Costs 500,000 682,403 480,000<br />

Total College Work Study 500,000 1,319,711 921,468<br />

Equal Opportunity Grants Operating Costs 3,295,256 2,800,000 2,520,000<br />

Total Equal Opportunity Grants 3,295,256 2,800,000 2,520,000<br />

Institutional Scholarship Operating Costs 500,000 1,092,000 1,102,500<br />

Total Institutional Scholarship 500,000 1,092,000 1,102,500<br />

Loans Operating Costs 650,000 650,000 650,000<br />

Total Loans 650,000 650,000 650,000<br />

Pell Grants Operating Costs 28,650,000 28,000,000 27,000,000<br />

Total Pell Grants 28,650,000 28,000,000 27,000,000<br />

Tuition Set Asides Operating Costs 6,092,234 4,668,000 4,667,000<br />

Total Tuition Set Asides 6,092,234 4,668,000 4,667,000<br />

Total Financial Aid 39,687,490 38,529,711 36,860,968<br />

Statewide Benefits 29,742,672 31,492,672 30,937,761<br />

20<br />

Finance<br />

STRATEGIC PLAN & BUDGET REPORT<br />

<strong>Budget</strong>, Accounting & <strong>Report</strong>ing Personnel Costs 2,311,793 2,289,092 2,016,340<br />

Operating Costs 232,414 245,356 184,756

College Work Study Personnel Costs 0 637,308 441,468<br />

Operating Costs 500,000 682,403 480,000<br />

Total College Work Study 500,000 1,319,711 921,468<br />

Equal Opportunity Grants Operating Costs 3,295,256 2,800,000 2,520,000<br />

Total Equal Opportunity Grants 3,295,256 2,800,000 2,520,000<br />

Institutional Scholarship Operating Costs 500,000 1,092,000 1,102,500<br />

Total Institutional Scholarship 500,000 1,092,000 1,102,500<br />

Loans Operating Costs 650,000 650,000 650,000<br />

Total Loans 650,000 650,000 650,000<br />

Pell Grants Operating Costs 28,650,000 28,000,000 27,000,000<br />

Total Pell Grants 28,650,000 28,000,000 27,000,000<br />

Tuition Set Asides Operating Costs 6,092,234 4,668,000 4,667,000<br />

Total Tuition Set Asides 6,092,234 4,668,000 4,667,000<br />

Total Financial Aid 2020 39,687,490 2021 38,529,711 2022 36,860,968<br />

EXHIBIT I: Detailed Operating Expense <strong>Budget</strong><br />

APPROVED BY BOARD OF REGENTS 8/19/2021<br />

Expense Type Original <strong>Budget</strong> Original <strong>Budget</strong> Original <strong>Budget</strong><br />

Instruction<br />

Statewide Benefits<br />

Academics Personnel Costs<br />

29,742,672<br />

9,991,875<br />

31,492,672<br />

9,149,308<br />

30,937,761<br />

7,873,583<br />

Operating Costs 926,177 755,084 685,718<br />

Total Academics 10,918,052 9,904,392 8,559,301<br />

Finance Aerospace Personnel Costs 3,360,963 3,746,679 2,739,787<br />

<strong>Budget</strong>, Accounting & <strong>Report</strong>ing Operating Personnel Costs 2,213,547 2,311,793 1,479,990 2,289,092 1,242,707 2,016,340<br />

Total Operating Aerospace Costs 5,574,510 232,414 5,226,669 245,356 3,982,494 184,756<br />

Allied Health Personnel Total <strong>Budget</strong>, Costs Accounting & <strong>Report</strong>ing 2,544,207 4,275,915 2,534,448 4,129,305 2,201,096 3,886,986<br />

Business Intelligence Operating Personnel Costs 1,075,772 522,993 1,091,732 617,534 1,336,772 539,930<br />

Total Operating Allied Costs Health 4,798,908 245,347 4,746,839 175,812 4,426,916 175,812<br />

C4EO Personnel Total Business CostsIntelligence 1,321,119 1,396,641 1,267,544 1,530,140 1,512,584 1,667,388<br />

Finance - Admin Operating Personnel Costs 418,464 425,820 343,774 468,044 343,774 402,540<br />

Total Operating C4EOCosts 1,815,105 210,770 1,873,914 189,693 2,011,162 264,693<br />

Construction & Safety Personnel Total Finance Costs- Admin 1,394,117 636,590 1,433,741 657,737 1,455,865 667,233<br />

Human Resources Operating Personnel Costs 2,281,755 215,149 2,535,800 212,166 2,306,703 212,166<br />

Total Operating Construction Human Costs Resources & Safety 1,609,266 2,956,415 674,660 1,645,907 3,097,500 561,700 1,668,031<br />

2,890,187 583,484<br />

Digital Institutional Transformation Effectiveness Personnel Costs 5,539,987 628,719 5,213,300 743,795 4,686,006 619,767<br />

Operating Costs 408,255 187,866 316,351 180,805 316,351 119,305<br />

Total Digital Institutional Transformation Effectiveness 5,948,242 816,585 5,529,651 924,600 5,002,357 739,072<br />

Electrical Procurement Instrumentation Personnel Costs 5,278,988 1,951,744 6,062,626 2,035,920 5,984,687 1,770,272<br />

Operating Costs 551,508 312,209 492,738 239,138 552,832 247,394<br />

Total Procurement Electrical Instrumentation 5,830,496 2,263,953 6,555,364 2,275,058 6,537,519<br />

2,017,666<br />

Total Industrial Finance Manufacturing Personnel Costs 10,538,869 5,684,414 10,756,887 7,334,024 10,027,838 6,587,549<br />

Operating Costs 1,744,896 1,267,210 1,297,210<br />

Total Industrial Manufacturing 7,429,310 8,601,234 7,884,759<br />

External Instructional Relations Pool Personnel Costs 2,623,000 3,307,044 3,554,000<br />

External Relations Admin Operating Personnel Costs 6,663,897 394,588 6,519,830 264,164 4,257,298 344,748<br />

Total Operating Instructional Costs Pool 9,286,897 17,050 9,826,874 14,865 7,811,298 230,000<br />

Instructional Sales Personnel Total External Costs Relations Admin 411,638 730,373 279,029 701,812 574,748 476,328<br />

Advancement & Communications Operating Personnel Costs 3,607,568 75,713 3,923,938 60,762 3,891,026 60,762<br />

Total Operating Instructional Costs Sales 3,478,313 806,086 2,398,155 762,574 2,409,816 537,090<br />

Provosts & Admin Personnel Total Advancement Costs & Communications 7,085,881 4,005,080 6,322,093 5,216,464 6,300,842 6,097,403<br />

College Readiness Operating Personnel Costs 1,161,613 1,069,092 1,129,688 702,076 871,086 595,861<br />

Total Operating Provosts Costs & Admin 5,166,693 456,361 5,918,540 370,137 6,968,489 583,092<br />

<strong>Strategic</strong> Partnerships Personnel Total College Costs Readiness 1,525,453 459,232 1,499,825 125,744 1,178,953 84,324<br />

Government Affairs Operating Personnel Costs 1,686,846 856,781 773,125 56,200 597,856 56,200<br />

Total Operating <strong>Strategic</strong> CostsPartnerships 2,146,078 208,429 181,944 187,586 140,524 187,586<br />

Transportation Personnel Total Government Costs Affairs 1,065,210 3,516,725 3,772,873 960,711 3,665,374 785,442<br />

Industry Relations Personnel Costs 2,291,138 2,791,346 1,690,773<br />

Operating Costs 1,508,932 1,336,527 852,437<br />

Total Industry Relations 3,800,070 4,127,873 2,543,210<br />

Recruitment Personnel Costs 1,709,692 1,935,776 1,454,972<br />

Operating Costs 382,500 285,127 289,127<br />

Total Recruitment 2,092,192 2,220,903 1,744,099<br />

Talent Management Personnel Costs 747,056 824,442 716,689<br />

Operating Costs 226,446 194,403 194,403<br />

Total Talent Management 973,502 1,018,845 911,092<br />

Total External Relations 16,953,946 16,429,279 14,038,386<br />

Auxiliary Services<br />

Airport & Farm Personnel Costs 337,559 322,411 148,728<br />

Operating Costs 428,342 428,342 429,842<br />

Total Airport & Farm 765,901 750,753 578,570<br />

Bookstore Personnel Costs 836,238 832,587 587,228<br />

STRATEGIC PLAN & BUDGET REPORT<br />

21

Government Affairs Personnel Costs 856,781 773,125 597,856<br />

Operating Costs 208,429 187,586 187,586<br />

Total Government Affairs 1,065,210 960,711 785,442<br />

Industry Relations Personnel Costs 2,291,138 2,791,346 1,690,773<br />

Operating Costs 1,508,932 1,336,527 852,437<br />

Total Industry Relations 3,800,070 4,127,873 2,543,210<br />

Recruitment Personnel Costs 1,709,692 1,935,776 1,454,972<br />

Operating Costs 382,500 285,127 289,127<br />

Total Recruitment 2,092,192 2,220,903 1,744,099<br />

EXHIBIT I: Detailed Operating Expense <strong>Budget</strong><br />

Talent Management Personnel Costs 747,056 824,442 716,689<br />

Operating Costs 226,446 194,403 194,403<br />

Total Talent Management 973,502 1,018,845 911,092<br />

Total External Relations 16,953,946 16,429,279 14,038,386<br />

2020 2021 2022<br />

Expense Type Original <strong>Budget</strong> Original <strong>Budget</strong> Original <strong>Budget</strong><br />

Auxiliary Services<br />

Instruction<br />

Operating Costs 428,342 428,342 429,842<br />

Operating Costs 926,177 755,084 685,718<br />

Total Airport & Farm 765,901 750,753 578,570<br />

Total Academics 10,918,052 9,904,392 8,559,301<br />

Bookstore Personnel Costs 836,238 832,587 587,228<br />

Aerospace Personnel Costs 3,360,963 3,746,679 2,739,787<br />

Airport & Farm<br />

Academics<br />

Personnel Costs<br />

Personnel Costs<br />

337,559<br />

9,991,875<br />

322,411<br />

9,149,308<br />

148,728<br />

7,873,583<br />

Operating<br />

Operating<br />

Costs<br />

Costs<br />

2,649,895<br />

2,213,547<br />

2,495,456<br />

1,479,990<br />

1,608,850<br />

1,242,707<br />

Total<br />

Total Aerospace<br />

Bookstore 3,486,133<br />

5,574,510<br />

3,328,043<br />

5,226,669<br />

2,196,078<br />

3,982,494<br />

Food<br />

Allied<br />

Service<br />

Health<br />

Personnel<br />

Personnel<br />

Costs<br />

Costs 4,275,915<br />

932,812<br />

4,129,305<br />

968,100<br />

3,886,986<br />

718,092<br />

Operating<br />

Operating<br />

Costs<br />

Costs<br />

1,041,880<br />

522,993<br />

837,300<br />

617,534<br />

801,400<br />

539,930<br />

Total<br />

Total Allied<br />

Food Service<br />

Health<br />

1,974,692<br />

4,798,908<br />

1,805,400<br />

4,746,839<br />

1,519,492<br />

4,426,916<br />

Housing<br />

C4EO<br />

Personnel<br />

Personnel<br />

Costs<br />

Costs<br />

1,712,793<br />

1,396,641<br />

1,531,226<br />

1,530,140<br />

1,416,007<br />

1,667,388<br />

Operating<br />

Operating<br />

Costs<br />

Costs<br />

2,500,377<br />

418,464<br />

3,033,975<br />

343,774<br />

3,261,866<br />

343,774<br />

Total<br />

Total C4EO<br />

Housing 4,213,170<br />

1,815,105<br />

4,565,201<br />

1,873,914<br />

4,677,873<br />

2,011,162<br />

Printing<br />

Construction<br />

Production<br />

& Safety<br />

Div Personnel<br />

Personnel<br />

Costs<br />

Costs 1,394,117<br />

281,928<br />

1,433,741<br />

302,424<br />

1,455,865<br />

150,552<br />

Operating<br />

Operating<br />

Costs<br />

Costs<br />

232,695<br />

215,149<br />

214,791<br />

212,166<br />

211,191<br />

212,166<br />

Total<br />

Total Construction<br />

Printing Production<br />

& Safety 1,609,266<br />

514,623<br />

1,645,907<br />

517,215<br />

1,668,031<br />

361,743<br />

Total<br />

Digital<br />

Auxiliary<br />

Transformation<br />

Services<br />

Personnel Costs<br />

10,954,519<br />

5,539,987<br />

10,966,612<br />

5,213,300<br />

9,333,756<br />

4,686,006<br />

Operating Costs 408,255 316,351 316,351<br />

Total Digital Transformation 5,948,242 5,529,651 5,002,357<br />

Enrollment Electrical Instrumentation Management<br />

Personnel Costs 5,278,988 6,062,626 5,984,687<br />

Operating Costs 551,508 492,738 552,832<br />

Enrollment Management Personnel Costs 7,771,645 8,328,465 7,459,614<br />

Total Electrical Instrumentation 5,830,496 6,555,364 6,537,519<br />

Operating Costs 2,775,930 2,248,176 2,280,377<br />

Industrial Manufacturing Personnel Costs 5,684,414 7,334,024 6,587,549<br />

Total Enrollment Management 10,547,575 10,576,641 9,739,991<br />

Operating Costs 1,744,896 1,267,210 1,297,210<br />

Student Services - Admin Personnel Costs 416,274 308,840 334,208<br />

Total Industrial Manufacturing 7,429,310 8,601,234 7,884,759<br />

Operating Costs 184,099 179,090 245,090<br />

Instructional Pool Personnel Costs 2,623,000 3,307,044 3,554,000<br />

Total Student Services Admin 600,373 487,930 579,298<br />

Operating Costs 6,663,897 6,519,830 4,257,298<br />

Total Enrollment Management 11,147,948 11,064,571 10,319,289<br />

Total Instructional Pool 9,286,897 9,826,874 7,811,298<br />

Instructional Sales Personnel Costs 730,373 701,812 476,328<br />

Facilities<br />

Operating Costs 75,713 60,762 60,762<br />

Total Instructional Sales 806,086 762,574 537,090<br />

Fleet Provosts & Admin Personnel Costs 4,005,080 73,276 5,216,464 135,456 6,097,403 138,820<br />

Operating Costs 1,304,314 1,161,613 1,171,445 702,076 1,171,645 871,086<br />

Total Fleet Provosts & Admin 1,377,590 5,166,693 1,306,901 5,918,540 1,310,465<br />

6,968,489<br />

Maintenance <strong>Strategic</strong> Partnerships & Physical <strong>Plan</strong>t Personnel Costs 4,072,910 459,232 4,669,718 125,744 3,935,291 84,324<br />

Operating Costs 3,174,837 1,686,846 2,666,884 56,200 2,754,826 56,200<br />

Total Maintenance <strong>Strategic</strong> Partnerships & Physical <strong>Plan</strong>t 7,247,747 2,146,078 7,336,602 181,944 6,690,117 140,524<br />

<strong>Plan</strong>ning, Transportation Construction & Admin Personnel Costs 3,516,725 831,724 1,182,247 3,772,873 3,665,374 924,988<br />

Operating Costs 1,122,676 135,564 253,530<br />

Total <strong>Plan</strong>ning, Construction & Admin 1,954,400 1,317,811 1,178,518<br />

Total Facilities 10,579,737 9,961,314 9,179,100<br />

Facilities - Transfer to Capital <strong>Budget</strong> 3,690,836 1,808,924 1,114,958<br />

Information Technology<br />

Infrastructure & Equipment Personnel Costs 511,276 529,440 266,844<br />

Operating Costs 893,561 246,721 193,920<br />

Total Infrastructure & Equipment 1,404,837 776,161 460,764<br />

Management Support & Operations Personnel Costs 3,178,390 3,263,702 2,784,697<br />

Operating Costs 493,860 449,076 554,076<br />

Total Management Support & Operations 3,672,250 3,712,778 3,338,773<br />

Shared Expenses Operating Costs 5,063,078 5,160,851 5,270,951<br />

Total Shared Expenses 5,063,078 5,160,851 5,270,951<br />

Total Information Technology 10,140,165 9,649,790 9,070,488<br />

Statewide Administration<br />

General Counsel Personnel Costs 2,391,586 2,412,404 2,194,866<br />

Operating Costs 703,854 622,417 713,964<br />

Total General Counsel 3,095,440 3,034,821 2,908,830<br />

Internal Audit Personnel Costs 362,592 382,772 406,236<br />

Operating Costs 19,529 20,300 19,800<br />

STRATEGIC PLAN & BUDGET REPORT<br />

Total Internal Audit 382,121 403,072 426,036<br />

Office of the CEO Personnel Costs 662,194 844,470 874,336<br />

Operating Costs 365,795 325,700 325,700<br />

Total Office of the CEO 1,027,989 1,170,170 1,200,036<br />

22

Information Technology<br />

Infrastructure & Equipment Personnel Costs 511,276 529,440 266,844<br />

Operating Costs 893,561 246,721 193,920<br />

Total Infrastructure & Equipment 1,404,837 776,161 460,764<br />

Management Support & Operations Personnel Costs 3,178,390 3,263,702 2,784,697<br />

Operating Costs 493,860 449,076 554,076<br />

Total Management Support & Operations 3,672,250 3,712,778 3,338,773<br />

Shared Expenses Operating Costs 5,063,078 5,160,851 5,270,951<br />

Total Shared Expenses 5,063,078 5,160,851 5,270,951<br />

Total Information Technology<br />

2020<br />

10,140,165<br />

2021<br />

9,649,790<br />

2022<br />

9,070,488<br />

EXHIBIT I: Detailed Operating Expense <strong>Budget</strong><br />

APPROVED BY BOARD OF REGENTS 8/19/2021<br />

Expense Type Original <strong>Budget</strong> Original <strong>Budget</strong> Original <strong>Budget</strong><br />

Instruction<br />

Statewide Administration<br />

Academics Personnel Costs 9,991,875 9,149,308 7,873,583<br />

General Counsel Personnel Costs 2,391,586 2,412,404 2,194,866<br />

Operating Costs 926,177 755,084 685,718<br />

Operating Costs 703,854 622,417 713,964<br />

Total Academics 10,918,052 9,904,392 8,559,301<br />

Total General Counsel 3,095,440 3,034,821 2,908,830<br />

Aerospace Personnel Costs 3,360,963 3,746,679 2,739,787<br />

Internal Audit Personnel Costs 362,592 382,772 406,236<br />

Operating Costs 2,213,547 1,479,990 1,242,707<br />

Operating Costs 19,529 20,300 19,800<br />

Total Aerospace 5,574,510 5,226,669 3,982,494<br />

Total Internal Audit 382,121 403,072 426,036<br />

Allied Health Personnel Costs 4,275,915 4,129,305 3,886,986<br />

Office of the CEO Personnel Costs 662,194 844,470 874,336<br />

Operating Costs 522,993 617,534 539,930<br />

Operating Costs 365,795 325,700 325,700<br />

Total Allied Health 4,798,908 4,746,839 4,426,916<br />

Total Office of the CEO 1,027,989 1,170,170 1,200,036<br />

C4EO Personnel Costs 1,396,641 1,530,140 1,667,388<br />

Total Statewide Administration 4,505,550 4,608,063 4,534,902<br />

Operating Costs 418,464 343,774 343,774<br />

Total C4EO 1,815,105 1,873,914 2,011,162<br />

Construction & Safety Personnel Costs 1,394,117 1,433,741 1,455,865<br />

Shared Resources<br />

Operating Costs 215,149 212,166 212,166<br />

Grants Total Personnel Construction Costs & Safety 1,609,266 200,721 1,645,907 38,633 1,668,031 1,968,562<br />

Digital Transformation Personnel Operating Costs 5,539,987 327,802 5,213,300 4,082,533 10,960,000<br />

4,686,006<br />

Operating Total Grants Costs 408,255 528,523 4,121,166 316,351 12,928,562 316,351<br />

<strong>Strategic</strong> Pool Total Personnel Digital Costs Transformation 5,948,242 5,000,000 5,529,6510 5,002,357 4,584,280<br />

Electrical Instrumentation Personnel Operating Costs 5,278,9880 6,062,6260 5,984,687 3,415,720<br />

Operating Total <strong>Strategic</strong> Costs Pool 5,000,000 551,508 492,7380 8,000,000 552,832<br />

Utilities & Other Total Personnel Electrical CostsInstrumentation 5,830,496 102,624 6,555,364 118,992 6,537,519 36,120<br />

Industrial Manufacturing Personnel Operating Costs 5,684,414 7,794,425 7,334,024 7,689,285 6,587,549 6,806,665<br />

Operating Total Utilities Costs & Other 1,744,896 7,897,049 1,267,210 7,808,277 1,297,210<br />

6,842,785<br />

Debt Services & Leases Total Personnel Industrial CostsManufacturing 7,429,310 13,476 8,601,2340 7,884,7590<br />

Instructional Pool Personnel Operating Costs 11,556,571 2,623,000 11,940,640 3,307,044 16,078,645<br />

3,554,000<br />

Operating Total Debt Costs Service & Leases 11,570,047 6,663,897 11,940,640 6,519,830 16,078,645<br />

4,257,298<br />

Total Shared Resources Total Instructional Pool 24,995,619 9,286,897 23,870,083 9,826,874 43,849,992<br />

7,811,298<br />

Instructional Sales Personnel Costs 730,373 701,812 476,328<br />

Total Operating Expenses Operating Costs 240,020,091 75,713 235,947,107 60,762 240,490,937 60,762<br />

Total Instructional Sales 806,086 762,574 537,090<br />

Provosts & Admin Personnel Costs 4,005,080 5,216,464 6,097,403<br />

Operating Costs 1,161,613 702,076 871,086<br />

Total Provosts & Admin 5,166,693 5,918,540 6,968,489<br />

<strong>Strategic</strong> Partnerships Personnel Costs 459,232 125,744 84,324<br />

Operating Costs 1,686,846 56,200 56,200<br />

Total <strong>Strategic</strong> Partnerships 2,146,078 181,944 140,524<br />

Transportation Personnel Costs 3,516,725 3,772,873 3,665,374<br />

STRATEGIC PLAN & BUDGET REPORT<br />

23

EXHIBIT II: TSTC Definitions<br />

EXHIBIT III: TSTC Fund Accounting<br />

CARES - Coronavirus Aid, Relief, and Economic<br />

Summary<br />

Security Act<br />

Core Ops – A group of Vice Chancellors that<br />

have oversight of the College’s core operations:<br />

Student Learning, Student Service, Advancement &<br />

Communications, and Finance.<br />

ERP – Enterprise Resource <strong>Plan</strong>ning software<br />

used to transform business processes, people and<br />

technology.<br />

Pipeline – The progression of a student through<br />

TSTC from time of application to measuring wages<br />

in a placed job in the Texas workforce.<br />

Program Vitality – The analysis of enrollment,<br />

graduation, job placement, persistence, student<br />

wage reports and other metrics to inform program<br />

mix.<br />

Definitions<br />

<strong>Budget</strong> – An expenditure plan.<br />

Scorecard – A periodic report of key student<br />

success and performance indicators and outcomes<br />

designed to support the strategic direction of the<br />

College’s Student Learning division.<br />

SEE – Survey of Employee Engagement, an annual<br />

survey that TSTC participates in to gather data on<br />

the teammates perception of the College.<br />

WIG – Wildly Important Goal, a Franklin Covey<br />

term from the book 4 Disciplines of Execution.<br />

24 STRATEGIC PLAN & BUDGET REPORT<br />

TSTC budgets are essentially expenditure plans.<br />

TSTC expenditure plans must be balanced against<br />

revenues for each fund, including use of prior<br />

revenues within a fund balance.<br />

TSTC establishes budgets at the unit level. Once<br />

budgets are established, TSTC maintains fiscal<br />

control by monitoring expenditures against the<br />

budget.<br />

The Board adopts an original budget for each fiscal<br />

year. During the year, the budget is adjusted to<br />

account for any necessary changes, including new<br />

gifts, grants and other revenue sources as they<br />

occur. Only budget changes over $500,000 require<br />

Board approval.<br />

Contribution Margin – Revenue minus direct cost.<br />

Describes the unit’s ability to cover variable or<br />

direct costs with revenue.<br />

Fund – A sum of money saved or made available<br />

for a particular purpose.<br />

Fund Accounting – The accounting for funds that<br />

serve different or separate purposes. In effect,<br />

accounting for various funds can be compared to<br />

accounting for different companies or different<br />

divisions of a company. All transactions are<br />

separately accounted for to keep the fund<br />

balances separate even though actual cash from<br />

some of the funds may be co- mingled in local<br />

bank accounts.<br />

Fund Accounting Equation – Beginning Balance +<br />

Revenues – Expenditures = Ending Balance.<br />

Unit – An account code that is associated with a<br />

department or unique purpose. Any number of<br />

units make up a TSTC fund.

APPROVED BY BOARD OF REGENTS 8/19/2021<br />

TSTC Funds<br />

Fund Numbers<br />

1. Education & General (E&G) – Appropriated by<br />

the state of Texas, kept in and expended from<br />

state treasury. Includes state tuition collected<br />

by TSTC (Fund 237) and general revenue of the<br />

state (Fund 001) for the purpose of instruction,<br />

student development, administration, operating<br />

and maintenance of plant, employee benefits<br />

and other authorized uses.<br />

8. <strong>Plan</strong>t Funds – Funds set aside for construction,<br />

renovation, repairs and debt service. <strong>Plan</strong>t funds<br />

are unique in that they generally originate in<br />

the other funds and are then moved into plant<br />

funds through the budgeting process. Includes<br />

both funds held in the state treasury as well as<br />

funds in TSTC local bank accounts.<br />

9. Balance Sheet Accounts – This fund is a<br />

repository for all TSTC balance sheet accounts<br />

including assets, liabilities and net assets.<br />

2. Loan Funds – Gifts and tuition set-asides for<br />

student loans. Not budgeted. These funds are<br />

kept in TSTC local bank accounts.<br />

3. Designated Funds – Funds for instruction,<br />

administration, operating and maintenance of<br />

plant, capital improvements, student services<br />

and other College uses. These funds are kept in<br />

TSTC local bank accounts.<br />

4. Auxiliary Funds – Includes funds related to TSTC<br />

operations that charge for services provided<br />

such as bookstores, food service, housing,<br />

airport and lease of property. These funds are<br />

kept in TSTC local bank accounts.<br />

5. Endowment Funds – Includes gifts or funds<br />

raised for providing long-term revenue<br />

for the College, from which only earnings<br />

are expendable. These funds are generally<br />

transferred to another fund prior to expenditure,<br />

not budgeted in Fund 5. These funds are kept in<br />

TSTC local bank accounts.<br />

6. Restricted Funds – Gifts and grants to be used<br />

for specific purposes defined by the external<br />

originating source: federal, state and local<br />

governments or private sources. These funds<br />

are kept in TSTC local bank accounts, but most<br />

operate on a reimbursement basis.<br />

7. Agency Funds – Funds which are other<br />

peoples’ money; administered by TSTC acting as<br />

custodian, such as for student organizations, The<br />

TSTC Foundation, etc. These funds are kept in<br />

TSTC local bank accounts. <strong>Budget</strong>s are set by the<br />

organization served.<br />

STRATEGIC PLAN & BUDGET REPORT<br />

25

EXHIBIT IV: Acknowledgements<br />

This presentation, accompanied by the video<br />

series, is the collaborative effort of many<br />

teammates across the College. Represented in the<br />

creation of these presentations are TSTC’s values<br />

of Excellence, Accountability, Service, and Integrity.<br />

The following teams and individuals contributed to<br />

this report and/or video representation of the past<br />

and future meaningful work done to Place More<br />

Texans in Great Paying Jobs while also making<br />

TSTC a Great(er) Place to Work.<br />

Thank you to these exceptional teammates:<br />

<strong>Budget</strong>, Accounting and <strong>Report</strong>ing Team<br />

Business Intelligence Team<br />

Communication and Creative Services Team<br />

Finance Administration Team<br />

Institutional Effectiveness Team<br />

Printshop Team<br />

Key Contributors:<br />

Ben Ranzinger, Rabenwolf Entertainment, LLC, Video Production<br />

Caitlin Simmonds, Publication Specialist II, Creative Services<br />

Chad Wooten, Associate Vice Chancellor for Finance<br />

Dawn Parker, Executive Assistant to the Vice Chancellor and Chief Financial Officer<br />

Jonathan Hoekstra, Vice Chancellor and Chief Financial Officer<br />

Jonathan Lasley, Executive Vice President for Business Intelligence<br />

Madelynne Johnston, Finance Chief of Staff<br />

Additional Contributors:<br />

Celina Garza, Vice President for Institutional Effectiveness<br />

Dave Huynh, Data Scientist I<br />

David Kofnovec, Senior Financial Analyst<br />