January/February 2021

issue.

issue.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

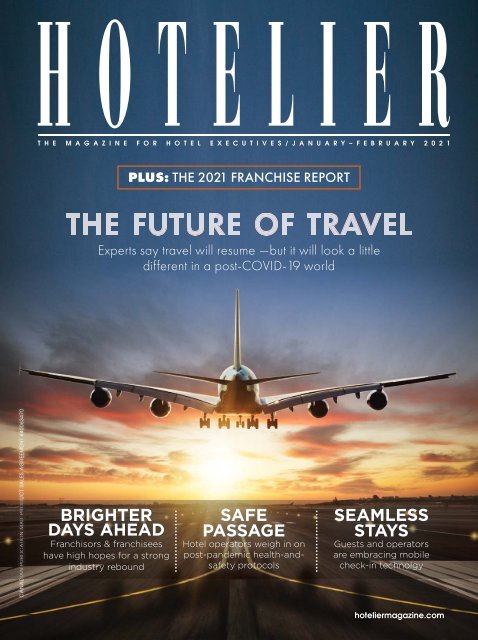

T H E M A G A Z I N E F O R H O T E L E X E C U T I V E S / J A N U A R Y ~ F E B R U A R Y 2 0 2 1<br />

PLUS: THE <strong>2021</strong> FRANCHISE REPORT<br />

THE FUTURE OF TRAVEL<br />

Experts say travel will resume —but it will look a little<br />

different in a post-COVID-19 world<br />

CANADIAN PUBLICATION MAIL PRODUCT SALES AGREEMENT #40063470<br />

BRIGHTER<br />

DAYS AHEAD<br />

Franchisors & franchisees<br />

have high hopes for a strong<br />

industry rebound<br />

SAFE<br />

PASSAGE<br />

Hotel operators weigh in on<br />

post-pandemic health-andsafety<br />

protocols<br />

SEAMLESS<br />

STAYS<br />

Guests and operators<br />

are embracing mobile<br />

check-in technolgy<br />

hoteliermagazine.com

CONTENTS<br />

VOLUME 33, NO. 1 | JANUARY/FEBRUARY <strong>2021</strong><br />

40<br />

29<br />

44<br />

FEATURES<br />

DEPARTMENTS<br />

7 THE FRANCHISED<br />

FUTURE<br />

Hotel-industry experts predict<br />

brighter days ahead<br />

11 THE <strong>2021</strong><br />

FRANCHISE REPORT<br />

A comprehensive listing of<br />

the industry’s top franchises<br />

29 THE FUTURE<br />

OF TRAVEL<br />

Branding success comes from<br />

meeting guests’ expectations<br />

32 SAFE PASSAGE<br />

Hotel leaders discuss new<br />

COVID-19 safety protocols<br />

38 FISHING WHERE THE<br />

FISH ARE<br />

Revenue teams should look to<br />

non-traditional data sources<br />

40 BREAKFAST BARRIERS<br />

COVID-19 has had severe<br />

impacts on breakfast buffets<br />

42 STREAMLINED STAYS<br />

Hotels and guests are<br />

embracing mobile check-in<br />

2 EDITOR’S PAGE<br />

4 CHECKING IN<br />

44 HOTELIER<br />

Ryan Killeen,<br />

The Annex, Toronto<br />

38<br />

hoteliermagazine.com JANUARY/FEBRUARY <strong>2021</strong> | 1

EDITORIAL<br />

INSPIRING<br />

TRAVEL TRENDS<br />

Almost a year after the pandemic surfaced, COVID-<br />

19 continues to fuel uncertainty. And, just as<br />

consumers were finally starting to feel somewhat<br />

optimistic, given the wide distribution of vaccines,<br />

a second wave of the virus hit around the world —<br />

leading us to question when our lives will return to normal.<br />

The answer remains murky and there are a host of variables<br />

to consider: How quickly can the vaccine be distributed around<br />

the world? Will there be a subsequent need for vigilance as the<br />

virus mutates? And, realistically, can we resume travelling before<br />

everyone is vaccinated?<br />

While much remains unclear, the reality is pent-up demand<br />

for travel means consumers will want to return to some sense of<br />

normalcy sooner rather than later. But, what will travel look like<br />

in the post-COVID-19 world? (See story on pg.29). Below are six<br />

key trends from U.S.-based Amadeus Hospitality that will shape<br />

travel in <strong>2021</strong>:<br />

1. Go Big (near or far) or Stay Home: When travel<br />

returns, consumers will likely gravitate towards ‘big-idea’<br />

or ‘bucket-list’ trips to tick off once-in-a-lifetime adventures.<br />

The survey found 55 per cent of travellers said they<br />

would travel for 14 days or more and 60 per cent expected<br />

to take only a few trips a year.<br />

2. Nomadic Travel: Companies such as Airbnb and Love<br />

Home Swap are embracing the trend along with countries<br />

such as Barbados, which offers the “digital-nomad” visa.<br />

With COVID-19 causing travel restrictions and stress, there’s a clear desire for<br />

longer holidays that let people take their work with them.<br />

3. The Loyalty Shift: COVID-19 has caused the definition of loyalty to morph.<br />

Travel providers now demonstrate their loyalty to travellers through their<br />

commitments to health, hygiene and safety.<br />

4. Swipe Right on Tech: Touchless tech will inspire traveller confidence.<br />

That means transparency, clear communication and seamless payments and<br />

boarding are the winners of <strong>2021</strong>.<br />

5. Travel Agents: While the Internet caused the demise of many travel agencies,<br />

the pandemic is now highlighting their critical role. As a result, <strong>2021</strong> will see<br />

travel agents become the fountains of all knowledge.<br />

6. Travel with an impact: Today’s travellers want to minimize their footprint<br />

and make sure their presence is having a positive<br />

impact on their host destination. Travellers also want<br />

to do good: a recent survey found 68 per cent of<br />

travellers want the money they spend<br />

ROSANNA CAIRA rcaira@kostuchmedia.com<br />

CONNECT<br />

WITH US<br />

HotelierMagazine<br />

@hoteliermag<br />

@hoteliermagazine<br />

PHOTO BY NICK WONG<br />

2 | JANUARY/FEBRUARY <strong>2021</strong><br />

hoteliermagazine.com

WEBREZPRO<br />

ROSANNA CAIRA EDITOR & PUBLISHER<br />

rcaira@kostuchmedia.com<br />

AMY BOSTOCK MANAGING EDITOR<br />

abostock@kostuchmedia.com<br />

DANIELLE SCHALK ASSOCIATE EDITOR<br />

dschalk@kostuchmedia.com<br />

DEREK RAE MULTIMEDIA MANAGER<br />

drae@kostuchmedia.com<br />

COURTNEY JENKINS ART DIRECTOR<br />

cjenkins@kostuchmedia.com<br />

JACLYN FLOMEN DESIGN ASSISTANT<br />

jflomen@kostuchmedia.com<br />

JHANELLE PORTER SOCIAL MEDIA MANAGER/<br />

EVENTS CO-ORDINATOR<br />

jporter@kostuchmedia.com<br />

ELEANOR SANTOS ACCOUNT MANAGER<br />

esantos@kostuchmedia.com<br />

KATE WALES SALES & MARKETING ASSISTANT<br />

esantos@kostuchmedia.com<br />

DANIELA PRICOIU CONTROLLER<br />

dpricoiu@kostuchmedia.com<br />

CIRCULATION PUBLICATION PARTNERS<br />

kml@publicationpartners.com<br />

ADVISORY BOARD<br />

Andrew Weir, Tourism Toronto; Anne Larcade, Sequel Hotels & Resorts;<br />

Anthony Cohen, Cresent Hotels — Global Edge Investments; Bonnie<br />

Strome, Hyatt Hotels; Christiane Germain, ; Germain Hotels;<br />

David McMillan, Axis Hospitality International; Don Cleary, Marriott Hotels;<br />

Geoffrey Allan, Project Capital Management Hotels;<br />

Hani Roustom, Friday Harbour Resort; Heather McCrory, Accor;<br />

Reetu Gupta, Easton's Hotels; Ryan Murray, The Pillar + Post Hotel;<br />

Stephen Renard, Renard International Hospitality & Search Consultants<br />

HOTELIER is published eight times a year by Kostuch Media<br />

Ltd., 23 Lesmill Rd., Suite 404, Toronto, Ont., M3B 3P6,<br />

(416) 447-0888, Fax (416) 447-5333. All rights reserved.<br />

Subscription rates: Canada: $25 per year, single issue $4, U.S.A.:<br />

$30 per year; all other countries $40 per year. Canadian<br />

Publication Mail Product Sales Agreement #40063470. Member<br />

of Canadian Circulations Audit Board and Magazines Canada.<br />

Printed in Canada on recycled stock.<br />

Return mail to: Kostuch Media Ltd., 23 Lesmill Rd.,<br />

Suite 404, Toronto, Ont., M3B 3P6<br />

HHHHH<br />

HOTEL<br />

MANAGEMENT<br />

SOFTWARE<br />

SOFTWARE<br />

SOLUTIONS<br />

COVID-19<br />

<br />

WORKING TOGETHER<br />

WebRezPro offers solutions for<br />

many of the challenges faced by<br />

the hospitality industry during the<br />

COVID-19 pandemic.<br />

CONTACTLESS CHECK-IN<br />

AUTO ROOM CLOSEOUTS<br />

BULK EMAILS TO GUESTS<br />

MANY MORE<br />

WEBREZPRO.COM<br />

1-800-221-3429<br />

hoteliermagazine.com

CHECKING IN<br />

THE LATEST INDUSTRY NEWS FOR HOTEL EXECUTIVES FROM CANADA AND AROUND THE WORLD<br />

A LASTING<br />

LEGACY<br />

Tourism industry mourns the<br />

passing of Charlotte Bell<br />

Charlotte was a proud,<br />

"strong and passionate<br />

leader for our collective<br />

cause. She was a role<br />

model for young female<br />

leaders on how to be<br />

tough, effective, and<br />

a visionary, while still<br />

leading with kindness.<br />

She leaves a proud<br />

legacy across Canada<br />

and numerous political<br />

leaders have expressed<br />

their respect, grief and<br />

common loss'<br />

Dave McKenna<br />

Board Chair, TIAC<br />

The passing of Tourism Industry Association of<br />

Canada (TIAC) president and CEO Charlotte Bell<br />

in December shook the Canadian tourism industry.<br />

Bell was appointed president and CEO of<br />

TIAC in 2015 and led the organization in its mission<br />

since, working to improve the Canadian tourism industry’s<br />

global competitiveness as an international destination<br />

through leadership and advocacy. And, throughout the<br />

pandemic, Bell and TIAC advocated on behalf of the<br />

industry and for the future of the visitor economy.<br />

Prior to joining TIAC, Bell was a senior consultant<br />

with Capital Hill Group and had been vice-president of<br />

Corporate Affairs for the Atlantic Lottery Corporation.<br />

Earlier in her career, she spent more than 25 years in the broadcasting sector in Canada and<br />

had an extensive background in advocacy, strategic planning and public affairs.<br />

Bell also served on a number of boards through her career, including Canadian Women<br />

in Communications, The Banff International Television Festival and Advertising<br />

Standards Canada.<br />

Gudie Hutchings, MP for Long Range Mountains, acknowledged Bell’s contributions to<br />

the industry in the House of Commons, saying “Many of us know Charlotte as the CEO of<br />

TIAC, the Tourism Industry Association of Canada. We know her passion for the tourism<br />

and hospitality sectors and we know that during the pandemic that passion only grew. Her<br />

forward thinking and outright love for this industry, its leaders, workers and clients, many<br />

of us have seen fi rst-hand. We have seen the results of her hard work and planning among<br />

the many winding roads that she has travelled throughout our country from coast to coast<br />

to coast. Charlotte is now travelling another road, and wherever this road leads, I know<br />

her passion for tourism will always be with her.”<br />

In her role as president and CEO of the Tourism Industry Association of Canada,<br />

Charlotte embraced her advocacy role to include MMBC and the importance<br />

of business events to the Canadian economy. We will be forever grateful for her<br />

leadership and friendship,” Meetings Mean Business Canada stated in an email.<br />

“Charlotte will always be remembered in the familiar things she touched, spoke<br />

and was passionate about. Her memory will continue to live in the lives of all of<br />

us who knew her and the legacy she leaves behind.<br />

4 | JANUARY/FEBRUARY <strong>2021</strong><br />

hoteliermagazine.com

FROM<br />

BEST<br />

TO<br />

BETTER<br />

Best Western Hotels & Resorts<br />

(BWHR) has selected Franklin-<br />

Covey’s ‘gold standard’ leadership-development<br />

curriculum to<br />

assist in further elevating leadership<br />

excellence in its general<br />

managers across North America.<br />

BWHR will provide general<br />

managers from every hotel in<br />

North America with access to<br />

FranklinCovey’s All Access Pass.<br />

This comprehensive access will<br />

complement BWHR’s existing<br />

training programs, which include<br />

the Care Every Guest Every<br />

Time employee training. Franklin-<br />

Covey’s All Access Pass is an<br />

annually renewable program<br />

providing Passholders with<br />

unlimited access to the<br />

company’s entire collection<br />

of content and solutions<br />

available through a variety<br />

of channels.<br />

LEADING<br />

TOURISM<br />

David Goldstein is Travel Alberta’s new CEO.<br />

He takes over the role from Chris Heseltine,<br />

who served as the acting CEO for six months.<br />

Goldstein has an extensive background in tourism<br />

and media, most recently serving as COO at Gusto<br />

Worldwide Media. Prior to this, he was president<br />

and CEO of Destination Canada for nearly fi ve<br />

years, in addition to his nearly five years as president<br />

and CEO of the Tourism Industry Association<br />

of Canada (TIAC). Heseltine will continue as<br />

vice-president of Economic Development and<br />

Community Engagement for Travel Alberta with<br />

acting responsibility for Strategy, Insights and<br />

Stakeholder Engagement.<br />

After fi ve years at the<br />

Hazelton Hotel, most<br />

recently as the its<br />

managing director, Hani<br />

Roustom has left the<br />

Toronto luxury property.<br />

Roustom is now CEO<br />

of the Friday Harbour<br />

Resort, an all-seasons<br />

waterside resort on Lake<br />

Simcoe, in Innisfi l, Ont.<br />

THAT'S<br />

A WRAP<br />

Hotel-industry icons David<br />

Larone and Brian Stanford are<br />

Brian Stanford<br />

David Larone<br />

beginning their transition into<br />

retirement as CBRE Valuation<br />

and Advisory Services (VAS) embarks on a new chapter.<br />

Larone and Stanford have guided hotel development, investment and operations<br />

decisions for four decades. The pair helped build PKF Consulting into an industry<br />

leader before joining forces with CBRE in 2015.<br />

“Not only are they subject-matter experts, they are also gentlemen,” says Paul<br />

Morassutti, vice-chairman, CBRE. “We have benefitted from their professional<br />

guidance and personal friendship all these years.”<br />

Nicole Nguyen, Rebecca Godfrey and David Ferguson will form the new senior<br />

leadership team of CBRE’s VAS hotels operation.<br />

RECOGNIZING<br />

EXCELLENCE<br />

Mandy Farmer, CEO of Accent Inns and Hotel Zed, was awarded the<br />

RBC Canadian Women Entrepreneur Excellence Awardin November.<br />

The RBC Canadian Women Entrepreneur Awards is the premier<br />

national awards program celebrating the achievements of the<br />

most successful and impactful women who have demonstrated<br />

excellence across multiple sectors. The Entrepreneur Excellence<br />

Award recognizes how Farmer has run her business, contributed<br />

to the community and taken care of her employees.<br />

hoteliermagazine.com JANUARY/FEBRUARY <strong>2021</strong> | 5

SETTING<br />

UP CAMP<br />

Basecamp Resorts opened its newest hotel in<br />

December near downtown Revelstoke, B.C.<br />

Basecamp Revelstoke features 32 units equipped<br />

with remote keyless entry, a full kitchen, washer<br />

and dryer, complimentary wireless Internet, a<br />

fl at-screen LED TV with cable and a private patio<br />

with outdoor seating. The property also offers two<br />

shared rooftop hot tubs, free access to cruiser bikes<br />

for guests and complementary parking. Interiors<br />

feature vaulted living spaces to capitalize on the<br />

scenery and original artwork produced by local<br />

Revelstoke artist, Hayley Stewart. Basecamp<br />

Resorts’ portfolio also includes four properties in<br />

Canmore, Alta. — Basecamp Canmore, Basecamp<br />

Lodge, Lamphouse Hotel and the recently opened<br />

Basecamp Suites.<br />

Reetu Gupta was named<br />

among Women’s Executive<br />

Network’s (WXN) 2020<br />

Canada’s Most Powerful<br />

Women: Top 100 Award<br />

Winners, marking her<br />

second-consecutive year<br />

on the list. Gupta, who was<br />

recognized in the awards’<br />

BMO Entrepreneurs category,<br />

is the president and CEO<br />

of The Easton’s Group of<br />

Hotels and The Gupta Group,<br />

the co-founder and Chief<br />

Strategy Offi cer of Rogue<br />

Insight Capital. and president<br />

and CEO of The Gupta Family<br />

Foundation<br />

NEW FRONTIER<br />

Accor has launched a new Apartments & Villas website, dedicated<br />

entirely to the rental of private residences and extended-stay hotel<br />

properties. The site makes more than 50,000 apartments, villas and<br />

chalets available, drawing from Accor’s 15 extended-stay hotel brands,<br />

as well as the company’s portfolio of branded private residences,<br />

which are privately owned and frequently included in managed-rental<br />

programs, and one-of-a-kind private rentals (onefi nestay), in more than<br />

350 destinations. The Apartments & Villas website offers fully equipped<br />

apartments, villas, houses and suites while allowing guests to enjoying<br />

all the benefi ts of the ALL - Accor Live Limitless program, as well as<br />

Accor’s new cancellation policy and the intensifi ed hygiene-andprevention<br />

measures (Allsafe).<br />

LET’S TALK ABOUT HOW<br />

OUR CANADIAN-BASED<br />

TEAM CAN HELP GROW<br />

YOUR BUSINESS!<br />

1.800.646.2435<br />

development@travelodge.ca<br />

travelodge.ca/development<br />

OVER 100 LOCATIONS<br />

ACROSS CANADA

THE FRANCHISE REPORT<br />

The<br />

FRANCHISED<br />

Future<br />

Hotel franchisors and franchisees<br />

have faced steep challenges in<br />

the past year, but there’s hope<br />

for brighter days ahead<br />

BY DANIELLE SCHALK<br />

OTEL FRANCHISE companies spent much<br />

of 2020 in defense mode, responding to the COVID-19<br />

crisis with franchisee-support packages, new policies and<br />

procedures and heightened levels of communication, while<br />

also working with industry associations to advocate for<br />

government support. And, while navigating the pandemic has<br />

been challenging and forced major hotel companies to make<br />

a lot of tough decisions, the franchisors that most effectively<br />

supported and guided franchisees through the crisis are<br />

expected to see a return on their investment.<br />

Brian Leon, president, Choice Hotels Canada, describes<br />

the current economic uncertainty as a “double-edged<br />

hoteliermagazine.com JANUARY/FEBRUARY <strong>2021</strong> | 7

INDUSTRY<br />

INPUT<br />

MARRIOTT INTERNATIONAL: “We’ve had an<br />

unprecedented level of engagement with [our owner<br />

and franchisee community] this year, including weekly<br />

webinars in many regions and more frequent interactions<br />

with our owner advisory committees,” Arne Sorenson,<br />

president and CEO, Marriott International, said<br />

during the company’s third-quarter<br />

investors’ call. “We’re deeply<br />

committed to working closely<br />

together to manage through these<br />

challenging times. We remain<br />

focused onreducing their costs<br />

as much as possible in this<br />

environment.”<br />

sword”<br />

in terms of its<br />

impact on hotel<br />

franchising. “We<br />

saw very significant<br />

impact and have<br />

seen the availability<br />

of financing [dry up], so<br />

that translates to a negative<br />

impact on new-build growth,”<br />

he explains. “We’ve also seen a<br />

big reduction in hotel transactions, [which] are often a good<br />

source of conversion growth for a system like ours.”<br />

Combined, this has resulted in a “primarily negative impact<br />

on growth in the short term,” says Leon, adding, “We are<br />

seeing that change and there are some positives that come out<br />

of this as well.”<br />

“What we’re going to see, in hotel franchising, is a lot of hotel<br />

owners question what they’re getting out of their franchisors and<br />

wanting to make sure they’re getting [good] value,” says Leon.<br />

“And, those of us that are able to provide that great value [are<br />

going to see] really good opportunities to continue to grow.”<br />

In the current environment, a key part of that value is<br />

consumer confidence. With cleanliness and safety top of mind<br />

for current and future travel, it’s expected that trusted brands<br />

will hold an advantage over their competition going forward.<br />

“What we may have demonstrated to hotels that are not<br />

presently affiliated with any brand is that there’s some solid<br />

merit in having a brand affiliation, because you do get the<br />

weight of global brands to come to the table to create these<br />

policies and procedures in a fast, efficient manner,” says Irwin<br />

Prince, president and COO of Realstar Hospitality — franchisor<br />

of the Days Inn, Motel 6 and Studio 6 brands in Canada.<br />

FUTURE DEVELOPMENT<br />

The circumstances of the past year led to the delay of hotel<br />

openings, as well as a reduction in the number of new<br />

signings, effectively stunting the growth of franchise brands.<br />

But, even by the end of the year, signs were improving.<br />

In its Q3 2020 earnings report, Marriott International indicated<br />

strong openings in the quarter, with net rooms growth for the<br />

year expected to reach 2.5 to three per cent. And, the company’s<br />

president and CEO, Arne Sorenson stated, “Although signings<br />

are not as strong as in 2019, they’re quite solid considering the<br />

extraordinary impact of COVID-19 on our industry…We’re also<br />

encouraged by the increasing number of conversations we’re<br />

having around conversions.”<br />

Leon also stresses that new opportunities will present<br />

themselves. “With the reduced pipeline of new hotels<br />

coming online…as demand comes back to the market,<br />

there will be a more favourable demand-supply<br />

relationship,” he explains. “That’s going to create some<br />

good new-hotel development opportunities.”<br />

That said, Leon expects Choice will see more<br />

immediate gains on the conversion front, as independent<br />

hoteliers recognize the value of branded systems, which<br />

has been proven through the crisis. “The support we’ve been<br />

providing to our hotels has been a good story for our company,”<br />

he says. “Our development team, [is] getting calls from people<br />

saying ‘we hear good things about Choice and we want to talk<br />

about branding in the future.’”<br />

And, Leon isn’t the only one to hold this sentiment. “In<br />

the near term, quality brands should benefit as investors<br />

are expected to focus on brand companies that have shown<br />

they’re out-performing the market based on strong programs<br />

in place in response to COVID-19,” agrees Tim Marvin, EVP<br />

of U.S.-based JLL’s Hotels & Hospitality Group.<br />

And, in May, Ralph Hollister, Travel & Tourism analyst for<br />

London-based GlobalData, noted COVID-19 may accelerate<br />

the trend of independent hotels joining soft brands. “Large,<br />

multi-national chains have the brand and marketing power<br />

to outline new hygiene standards to vast amounts of potential<br />

guests,” he explains. “This may create a new pull factor that<br />

could help large chains consume even more of the global<br />

market share post-pandemic.”<br />

With the industry’s segments impacted to varying degrees<br />

by restrictions and uncertainty — and the resulting effects on<br />

demand — some franchises are expected to outperform others<br />

when it comes to future development.<br />

According to data from CBRE Hotels, Canadian limitedservice<br />

properties saw a 69-per-cent RevPAR decline in Q2<br />

2020, while RevPAR for resorts dropped 83 per cent and 88 per<br />

cent for full-service hotels. The company’s COVID-19 Recovery<br />

Framework also highlights limited-service properties as the<br />

first segment to see recovery as local leisure and local/regional<br />

corporate travel return, followed closely by focused-service and<br />

extended-stay. By comparison, business is not expected to return<br />

to full-service and resort properties until much later, due to their<br />

reliance on group and business travel.<br />

As Marvin points out, companies that specialize in the<br />

property types that have shown resiliency and performed well<br />

through the pandemic “are expected to outperform and it’s<br />

likely more developers will adjust their short-term strategies<br />

to take advantage of these dynamics.”<br />

“We’ve seen that our midscale segment has significantly<br />

outperformed the overall industry,” Leon explains. “From a<br />

standpoint of profitability, [operators have] realized our limitedservice<br />

hotels can be operated efficiently [and] have a great<br />

agility to be able to respond to things like the [fluctuating]<br />

occupancy rates we’ve seen.”<br />

Leon points to Choice’s Quality and Clarion Pointe as<br />

mid-scale conversion brands that are poised to present key<br />

growth opportunities as the industry moves forward. For more<br />

up-scale conversions, he calls out the Ascend Collection soft<br />

brand as a key opportunity.<br />

Choice H<br />

Penticto<br />

Garry H<br />

8 | JANUARY/FEBRUARY <strong>2021</strong><br />

hoteliermagazine.com

LONG-TERM LOOK<br />

There are other shifts expected to develop within hotel<br />

franchising, in the mid- to long-term, as travel recovers and<br />

we move through the post-pandemic world.<br />

Marvin notes the pandemic crisis may have a lasting impact<br />

on the structure of major franchise companies. “Historically,<br />

many brand companies have pushed to maintain a significant<br />

mix of managed assets under their brand portfolios. This<br />

strategic decision is to help protect the brands (particularly<br />

luxury brands) by controlling operations, as well as to provide<br />

revenue to support large management infrastructures,” he<br />

explains. “During COVID-19, brand companies have downsized<br />

their organizations in an effort to reduce expenses. As franchising<br />

requires less support and infrastructure than managing properties,<br />

we’re seeing brands more willing to franchise than in the past.<br />

It’s likely brand companies will use this time to permanently<br />

re-structure their organizations to become more profitable<br />

and franchising will be more prevalent.”<br />

Also among the lasting shifts will be changes to brand<br />

standards. “One of the things we’re looking at pretty aggressively<br />

— and I suspect some of our competitors are, too — is<br />

opportunities to eliminate costs from the business,” says Leon.<br />

As he explains, short-term service changes caused by<br />

COVID-19 restrictions have caused some to re-think offerings.<br />

As an example, he says, “My expectation would be breakfast<br />

isn’t going to go back to exactly the way it was before.<br />

Complimentary breakfast will come back and still be part of<br />

the value proposition for guests, but [will] probably look a<br />

little bit different.”<br />

What will this look like? Leon suggest a greater focus on<br />

grab-and-go offerings could be in store.<br />

Other changes could include more rooms featuring kitchenettes,<br />

eliminating in-room coffee, greater use of technology<br />

and streamlined operations.<br />

“The pandemic has accelerated the pace of change<br />

on some of these fronts,” says Prince, who points to how<br />

frequently rooms are cleaned during a stay as a key area<br />

where shifts are taking place.<br />

In fact, a U.S. customer survey conducted in May by Fuel,<br />

a South Carolina-based software and marketing company,<br />

revealed travellers have varying opinions when it comes to<br />

the level of housekeeping service desired during their future<br />

hotel stays. ‘Only when requested’ emerged as the most<br />

popular response, being the preferred service level for 29 per<br />

cent of respondents. However, this increased to 35 per cent<br />

for the millennial cohort. Daily full-service housekeeping is<br />

still preferred by 22 per cent of respondents, while another 22<br />

per cent would like daily towel changes.◆<br />

PHOTO BY STUART BISH (CHOICE HOTELS CANADA'S HOTEL PENTICTON)<br />

INDUSTRY<br />

INPUT<br />

otels Canada's Hotel<br />

n (above) and Fort<br />

otel<br />

WYNDHAM HOTELS & RESORTS:<br />

“Though it has been a tumultuous time for all of us in our industry, our<br />

teams continue to innovate with an eye towards the future, [and] with<br />

an eye towards maximizing the value we provide to our franchisees. We<br />

recently deployed three state-of-the-art initiatives aimed at increasing<br />

bookings at our hotels and increasing overall franchisee profitability,”<br />

Geoffrey A. Ballotti, president and CEO, Wyndham Hotels & Resorts said<br />

during the company’s 2020 Q3 earnings call, highlighting its broadened<br />

digital investment strategy, Wyndham Direct and the company’s updated<br />

mobile app, which launched in September.<br />

INTERCONTINENTAL HOTEL GROUP (IHG):<br />

“We’re in partnership with our owners, so it’s hugely important to us that<br />

our owners succeed. Many of them we have been in partnership with<br />

for decades, so we’ll do everything we can to bring business into the<br />

hotels — that is the most important thing that we can do right now,” Paul<br />

Edgecliffe-Johnson, CFO, IHG PLC, said during the company’s Q3 2020<br />

results call. “We can help them think about their manning models and<br />

how they reduce costs. We can help them with any information they<br />

might need for re-financing, et cetera, but the greatest benefit we can do<br />

is deploy our systems and our outperformance to drive the greatest possible<br />

level of revenue to their hotels.”<br />

hoteliermagazine.com JANUARY/FEBRUARY <strong>2021</strong> | 9

Open the door to more.<br />

When looking for an investment opportunity that gives more of everything it takes to<br />

help you succeed — open the door to the hotel business. No hotel experience is required.<br />

Choice helps you every step of the way, from reservations, property support, marketing,<br />

technology — we’re with you as you get ready to open for business and every day after.<br />

With more than 25 years of dedicated Canadian expertise, and over 80 years of experience<br />

internationally, we provide every franchisee with the resources it takes to succeed.<br />

Open the door to more, today.<br />

ChoiceHotelsDevelopment.ca<br />

©<strong>2021</strong> Choice Hotels Canada Inc. All Rights Reserved.

THE <strong>2021</strong><br />

FRANCHISE<br />

REPORT<br />

AC HOTELS<br />

Marriott International, Inc.<br />

2425 Matheson Blvd. E., Ste. 100<br />

Mississauga, ON L4W 5K4<br />

905-366-5208<br />

marriottdevelopment.com<br />

Regional VP, Lodging<br />

Development, Canada: Paul Loehr<br />

VP, Lodging Development, Canada:<br />

Aaron Laurie<br />

Director, Lodging Development,<br />

Canada: Duncan Chiu<br />

History, Plans<br />

- first AC Hotel opened in 2011<br />

- one property in Canada; 173<br />

outside of Canada<br />

- one property in the pipeline<br />

for Canada<br />

Franchise Costs<br />

- initial franchise fee US$90,000<br />

plus US$500/room in excess of 150<br />

- royalty fee 5.5% of GRS<br />

- program services contribution<br />

3.85% of GRS (includes a<br />

contribution to the marketing<br />

fund of 2.5% of GRS); plus<br />

US$10,000/year; plus US$220/<br />

room/year<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- staff training<br />

- supplies<br />

ALOFT HOTELS<br />

Marriott International, Inc.<br />

2425 Matheson Blvd. E., Ste. 100<br />

Mississauga, ON L4W 5K4<br />

905-366-5208<br />

marriottdevelopment.com<br />

Regional VP, Lodging<br />

Development, Canada: Paul Loehr<br />

VP, Lodging Development, Canada:<br />

Aaron Laurie<br />

Director, Lodging Development,<br />

Canada: Duncan Chiu<br />

History, Plans<br />

- first Aloft Hotel opened in 2008<br />

- three properties in Canada; 186<br />

outside of Canada<br />

- one property in the pipeline<br />

for Canada<br />

Franchise Costs<br />

- initial franchise fee US$75,000<br />

plus US$500/room in excess of 50<br />

- royalty fee 5.5% of GRS<br />

- program services contribution<br />

3.15% of GRS (includes a contribution<br />

to the marketing fund of 1%<br />

of GRS); plus US$10,000/year; plus<br />

US$220/room/year.<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- site location<br />

- site review and analysis<br />

- staff training<br />

- supplies<br />

ASCEND HOTEL COLLECTION<br />

Choice Hotels Canada Inc.<br />

5015 Spectrum Way, Ste. 400<br />

Mississauga, ON L4W 0E4<br />

905-206-7316<br />

choicehotelsdevelopment.ca<br />

President: Brian Leon<br />

History, Plans<br />

- established in Canada in 2009<br />

- 23 properties in Canada; 300<br />

outside of Canada (all franchised)<br />

Franchise Costs<br />

- initial franchise fee $300/room;<br />

minimum $45,000<br />

- advertising fee 1.25%<br />

- royalty fee 4%<br />

- reservation fee 1.25%<br />

Services<br />

- advertising/marketing<br />

- design<br />

- staff training<br />

- supplies<br />

AUTOGRAPH COLLECTION<br />

Marriott International, Inc.<br />

2425 Matheson Blvd. E., Ste. 100<br />

Mississauga, ON L4W 5K4<br />

905-366-5208<br />

marriottdevelopment.com<br />

Regional VP, Lodging<br />

Development, Canada: Paul Loehr<br />

VP, Lodging Development, Canada:<br />

Aaron Laurie<br />

Director, Lodging Development,<br />

Canada: Duncan Chiu<br />

History, Plans<br />

- first Autograph property opened<br />

in 2010<br />

- five properties in Canada; 197<br />

outside of Canada<br />

- four properties in the pipeline<br />

for Canada<br />

Franchise costs<br />

- initial application fee US$100,000<br />

plus US$400/room in excess of 250<br />

- royalty fee 5% of GRS<br />

- program services contribution<br />

2.02% of GRS (includes a contribution<br />

to the marketing fund of<br />

1.5% of GRS); plus US$40,000/year;<br />

plus US$450/room/year<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- staff training<br />

- supplies<br />

AVID HOTELS<br />

InterContinental Hotels Group (IHG)<br />

2 Robert Speck Pkwy., Ste. 600<br />

Mississauga, ON L4Z 1H8<br />

416-675-6644<br />

avidhotels.com<br />

Regional Director, Upscale and<br />

Mainstream Development, Canada:<br />

Stuart Laurie<br />

History, Plans<br />

- established in 2017<br />

- 14 properties outside of Canada<br />

- plans to add six properties in<br />

Canada<br />

Franchise Costs<br />

- total investment $7,686,735<br />

to $11,210,260<br />

- royalty fee 5% GRR<br />

- marketing fee 3% GRR<br />

- application fee $500/room;<br />

$50,000 minimum<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- site selection<br />

- staff training<br />

- supplies<br />

BAYMONT BY WYNDHAM<br />

Wyndham Hotels & Resorts<br />

22 Sylvan Way<br />

Parsippany, NJ 07054<br />

800-889-9710<br />

wyndhamdevelopment.com<br />

EVP and Chief Development<br />

Officer: Chip Ohlsson<br />

History, Plans<br />

- established in 1974<br />

- three properties in Canada (all<br />

franchised); 522 outside of Canada<br />

Franchise Costs<br />

- initial franchise fee: the greater of<br />

$30,500 or $260 per/room for<br />

conversion; $29,000 or $260 per/<br />

room for new construction<br />

- total investment $86,371 to<br />

$7,026,711<br />

- marketing fee 3.5% of GRR<br />

(marketing contribution of 2%<br />

and basic reservation fee of 1.5%)<br />

- royalty fee 5% of GRR<br />

Services<br />

- advertising/marketing<br />

- development/design<br />

- financial assistance<br />

- lease negotiation<br />

- purchasing<br />

- quality control<br />

- reservation systems<br />

- sales<br />

- staff training<br />

- supplies<br />

- technical services<br />

hoteliermagazine.com<br />

JANUARY/FEBRUARY <strong>2021</strong> | 11

THE <strong>2021</strong><br />

FRANCHISE<br />

REPORT<br />

BEST WESTERN HOTELS<br />

& RESORTS<br />

6557 Mississauga Rd., Unit D<br />

Meadowvale Ct. 1<br />

Mississauga, ON L5N 1A6<br />

905-816-4787<br />

bestwestern.com<br />

President: David Kong<br />

History, Plans<br />

- established in 1946 in Long<br />

Beach, Calif.<br />

- 197 properties in Canada; 3,456<br />

outside of Canada<br />

Franchise Costs<br />

- initial franchise fee $49,000<br />

minimum, plus $200/room<br />

for properties with more than<br />

50 rooms<br />

- marketing fee 0.9% of GRR<br />

- royalty fee $1.57/room/day based<br />

on 100 room hotel<br />

Services<br />

- advertising/marketing<br />

- design<br />

- lease negotiation<br />

- management<br />

- purchasing<br />

- revenue management<br />

- site location<br />

- staff training<br />

- supplies<br />

CAMBRIA SUITES<br />

Choice Hotels International<br />

1 Choice Hotels Cir., Ste. 400<br />

Rockville, MD 20850<br />

800-547-0007<br />

choicehotelsdevelopment.com<br />

President & CEO: Pat Pacious<br />

SVP, Franchise Development,<br />

Upscale Brands: Mark Shalala<br />

History, Plans<br />

- founded in 2007<br />

- no properties in Canada; 53<br />

outside of Canada<br />

Franchise Costs<br />

- application fee $5,000<br />

- initial fee $500/room; minimum<br />

of $60,000<br />

- royalty fee 6% GRR<br />

- system fee 3% GRR<br />

CANADAS BEST VALUE INN<br />

Red Lion Hotels Franchising, Inc.<br />

1550 Market St., Ste. 425<br />

Denver, CO 80202<br />

866-437-4878<br />

franchise.rlhco.com<br />

EVP, Lodging Development &<br />

Franchise Operations:<br />

Harry Sladich<br />

VP, New Development:<br />

Christopher Slattery<br />

History, Plans<br />

- established in 1999<br />

- franchised by Red Lion Hotels<br />

Franchising Canada, Inc.,<br />

since 2017<br />

- 20 properties in Canada<br />

- sister brand, Americas Best Value<br />

Inn, franchised in the U.S., has<br />

562 properties<br />

Franchise Costs<br />

- initial/application Fee $16,500 for<br />

first 50 rooms; $150/room over 50<br />

monthly membership fee:<br />

(royalty) first 50 rooms $23.50/<br />

room/month; 51 to 75 rooms<br />

$19.50/room/month; 76+ rooms<br />

$18.50/room/month ($860<br />

monthly minimum)<br />

- marketing fee $17/room/month<br />

- no loyalty fees<br />

Services<br />

- advertising/marketing<br />

- CRS and CRO<br />

- guest-recognition program<br />

- revenue-management assistance<br />

- sales<br />

CANDLEWOOD SUITES<br />

InterContinental Hotels Group (IHG)<br />

2 Robert Speck Pkwy., Ste. 600<br />

Mississauga, ON L4Z 1H8<br />

416-675-6644<br />

candlewoodsuites.com<br />

Regional Director, Midscale<br />

Franchise Sales & Development,<br />

Canada: Stuart Laurie<br />

History, Plans<br />

- established 1995<br />

- two franchised properties in<br />

Canada; 405 outside of Canada<br />

- plans to add five properties<br />

in Canada<br />

Franchise Costs<br />

- total investment $8,992,560<br />

to $12,373,515<br />

- royalty fee 5% GSR<br />

- marketing fee 2.5 % GSR<br />

- application fee: 500/guest suite;<br />

$50,000 minimum<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- site location<br />

- staff training<br />

- supplies<br />

CLARION<br />

Choice Hotels Canada Inc.<br />

5015 Spectrum Way, Ste. 400<br />

Mississauga, ON L4W 0E4<br />

905-206-7316<br />

choicehotelsdevelopment.ca<br />

President: Brian Leon<br />

History, Plans<br />

- established in 1994 in Canada<br />

- nine properties in Canada; 275<br />

outside of Canada (all franchised)<br />

Franchise Costs<br />

- initial franchise fee $300/room;<br />

minimum $35,000<br />

- advertising fee 1.25%<br />

- royalty fee 2.5%<br />

- reservation fee 1.25%<br />

Services<br />

- advertising/marketing<br />

- design<br />

- staff training<br />

- supplies<br />

CLARION POINTE<br />

Choice Hotels Canada Inc.<br />

5015 Spectrum Way, Ste. 400<br />

Mississauga, ON L4W 0E4<br />

905-206-7316<br />

choicehotelsdevelopment.ca<br />

President: Brian Leon<br />

History, Plans<br />

- established in 2020 in Canada<br />

- no properties in Canada; 20<br />

outside of Canada (all franchised)<br />

Franchise Costs<br />

- initial franchise fee $300/room;<br />

minimum $35,000<br />

- advertising fee 1.25%<br />

- royalty fee 2.5%<br />

- reservation fee 1.25%<br />

Services<br />

- advertising/marketing<br />

- design<br />

- staff training<br />

- supplies<br />

COAST HOTELS<br />

APA Hotel International Limited<br />

700 - 535 Thurlow St.<br />

Vancouver, B.C., V6E 3L2<br />

604-642-4104<br />

coasthotels.com/managementfranchise/<br />

Vice-President, Development:<br />

Mark Hope<br />

History, Plans<br />

- established in 1972 in Gold River/<br />

Tahsis, B.C.<br />

- 27 properties in Canada; 10<br />

outside of Canada (28 franchised)<br />

- continued expansion planned in<br />

Western Canada<br />

Franchise Costs<br />

- initial franchise fee $15,000<br />

minimum or $150 per/room,<br />

whichever is greater<br />

- advertising fee 2%<br />

- distribution fee 1.5%<br />

(reservations fee)<br />

- royalty fee 2%<br />

- revenue management fee 1%<br />

- other fees<br />

Services<br />

- accounting<br />

- advertising/marketing<br />

- design<br />

- lease negotiation<br />

- management<br />

- purchasing<br />

- revenue management<br />

- reservations and distribution<br />

- site location<br />

- staff training<br />

- supplies<br />

12 | JANUARY/FEBRUARY <strong>2021</strong> hoteliermagazine.com

THE <strong>2021</strong><br />

FRANCHISE<br />

REPORT<br />

COMFORT<br />

Choice Hotels Canada Inc.<br />

5015 Spectrum Way, Ste. 400<br />

Mississauga, ON L4W 0E4<br />

905-206-7316<br />

choicehotelsdevelopment.ca<br />

President: Brian Leon<br />

History, Plans<br />

- established in 1989 in Canada<br />

- 149 properties in Canada; 1,954<br />

outside of Canada (all franchised)<br />

Franchise Costs<br />

- initial franchise fee $300/<br />

room; minimum $40,000<br />

- advertising fee 1.3%<br />

- royalty fee 5%<br />

- reservation fee 1.75%<br />

Services<br />

- advertising/marketing<br />

- design<br />

- staff training<br />

- supplies<br />

COUNTRY INN & SUITES<br />

BY RADISSON<br />

Radisson Hotel Group<br />

701 Carlson Pkwy., Ste. 300,<br />

MS 4001<br />

Minnetonka, MN 55305<br />

800-336-3301<br />

countryinn.com<br />

CEO: Jim Alderman<br />

COO, Franchise Operations:<br />

Aly El-Bassuni<br />

Chief Development Officer:<br />

Phil Hugh<br />

History, Plans<br />

- established in 1986 in<br />

Minneapolis, Minn.<br />

- eight properties in Canada;<br />

476 outside of Canada<br />

(465 franchised)<br />

- plans to open a new property<br />

in Ajax, Ont. and elsewhere<br />

throughout Canada<br />

Franchise Costs<br />

- initial franchise fee US$50,000<br />

- total cost US$1,927,024<br />

to $9,625,369<br />

- royalty fee 5%<br />

- advertising fee 2.5%<br />

- distribution fee 1.25%<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- staff training<br />

- supplies<br />

COURTYARD BY MARRIOTT<br />

Marriott International, Inc.<br />

2425 Matheson Blvd. E., Ste. 100<br />

Mississauga, ON L4W 5K4<br />

905-366-5208<br />

marriottdevelopment.com<br />

Regional VP, Lodging<br />

Development, Canada: Paul Loehr<br />

VP, Lodging Development,<br />

Canada: Aaron Laurie<br />

Director, Lodging Development,<br />

Canada: Duncan Chiu<br />

History, Plans<br />

- established in 1983<br />

- 34 properties in Canada; 1,230<br />

outside of Canada<br />

- 13 properties in the pipeline<br />

for Canada<br />

Franchise Costs<br />

- initial franchise fee US$90,000;<br />

plus US$500/room in excess of 150<br />

- royalty fee 6% of GRS<br />

- program services contribution<br />

3.35% of GRS (includes market<br />

ing-fund contribution of 2%<br />

GRS); plus US$10,000/year;<br />

plus US$220/room/year.<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- staff training<br />

- supplies<br />

CROWNE PLAZA HOTELS<br />

AND RESORTS<br />

InterContinental Hotels Group (IHG)<br />

2 Robert Speck Pkwy., Ste. 600<br />

Mississauga, ON L4Z 1H8<br />

416-675-6644<br />

crowneplaza.com<br />

SVP, Upscale Development:<br />

Julienne Smith<br />

Vice-President, Upscale<br />

Development: Jim Erlacher<br />

Vice-President, Upscale<br />

Development (Western Canada):<br />

Jeff Summers<br />

development.ihg.com<br />

History, Plans<br />

- established in 1983<br />

- seven properties in Canada<br />

(all franchised); 418 outside<br />

of Canada<br />

Franchise Costs<br />

- total investment $29,831,350 -<br />

$64,324,700<br />

- royalty fee 5% GRR<br />

- marketing fee 3% GRR<br />

- application fee $500/guest room;<br />

$75,000 minimum<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- site location<br />

- staff training<br />

- supplies<br />

DAYS INNS. HOTELS. SUITES<br />

Days Inns - Canada<br />

Master Franchisor in Canada<br />

Realstar Hotel Services Corp.,<br />

Division of Realstar Hospitality<br />

77 Bloor St. W., Ste. 2000<br />

Toronto, ON M5S 1M2<br />

416-966-8387<br />

daysinn.ca<br />

President and COO: Irwin Prince<br />

History, Plans<br />

- franchising in Canada since 1992<br />

- 115 franchised properties in<br />

Canada; 1,600-plus<br />

outside of Canada<br />

- plans to add five (+/-) properties<br />

in Canada<br />

Franchise Costs<br />

- initial franchise fee minimum<br />

$45,000<br />

- royalty fee 5%<br />

- marketing fee 1.5%<br />

- reservations fee 2.3%<br />

Services<br />

- advertising/marketing<br />

- design<br />

- global reservations<br />

- national sales network<br />

- operational support<br />

- purchasing<br />

- site review and analysis<br />

- staff training<br />

- tradeshow representation<br />

DELTA HOTELS BY MARRIOTT<br />

Marriott International, Inc.<br />

2425 Matheson Blvd. E., Ste. 100<br />

Mississauga, ON L4W 5K4<br />

905-366-5208<br />

marriottdevelopment.com<br />

Regional VP, Lodging<br />

Development, Canada: Paul Loehr<br />

VP, Lodging Development,<br />

Canada: Aaron Laurie<br />

Director, Lodging Development,<br />

Canada: Duncan Chiu<br />

History, Plans<br />

- acquired Delta Hotels and<br />

Resorts in 2015<br />

- 37 properties in Canada; 44<br />

outside of Canada<br />

- three properties in the pipeline<br />

for Canada<br />

Franchise Costs<br />

- initial application fee US$100,000;<br />

plus US$400/room in excess<br />

of 250<br />

- royalty fee 5% of GRS<br />

- program services contribution<br />

2.16% of GRS (includes marketing-fund<br />

contribution of 1.5%<br />

GRS); plus US$45,000/year;<br />

plus US$380/room/year<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- staff training<br />

- supplies<br />

hoteliermagazine.com<br />

JANUARY/FEBRUARY <strong>2021</strong> | 13

THE <strong>2021</strong><br />

FRANCHISE<br />

REPORT<br />

DOUBLETREE BY HILTON<br />

Hilton<br />

7930 Jones Branch Dr.<br />

McLean, VA 22102<br />

703-883-1000<br />

hilton.com/en/corporate/<br />

development/<br />

President & CEO:<br />

Christopher Nassetta<br />

Senior Director, Development,<br />

Canada: Jeff Cury<br />

History, Plans<br />

- established in 1969<br />

- 18 properties in Canada (all<br />

franchised); 592 outside of<br />

Canada<br />

Franchise Costs<br />

- initial franchise fee US$75,000<br />

for the first 250 rooms; plus<br />

US$400 per additional room<br />

- royalty fee: 5% of GRR<br />

Services<br />

- advertising/marketing<br />

- design<br />

- loyalty program<br />

- management<br />

- purchasing<br />

- site location<br />

- staff training<br />

- supplies<br />

ECONO LODGE<br />

Choice Hotels Canada Inc.<br />

5015 Spectrum Way, Ste. 400<br />

Mississauga, ON L4W 0E4<br />

905-206-7316<br />

choicehotelsdevelopment.ca<br />

President: Brian Leon<br />

History, Plans<br />

- established in 1990 in Canada<br />

- 40 properties in Canada; 792<br />

outside of Canada (all<br />

franchised)<br />

Franchise Costs<br />

- initial franchise fee $250/room;<br />

minimum $25,000<br />

- advertising fee 1.25%<br />

- royalty fee 4%<br />

- reservation fee 1.25%<br />

Services<br />

- advertising/marketing<br />

- design<br />

- staff training<br />

- supplies<br />

ELEMENT HOTELS<br />

Marriott International, Inc.<br />

2425 Matheson Blvd. E., Ste. 100<br />

Mississauga, ON L4W 5K4<br />

905-366-5208<br />

marriottdevelopment.com<br />

Regional VP, Lodging<br />

Development, Canada: Paul Loehr<br />

VP, Lodging Development,<br />

Canada: Aaron Laurie<br />

Director, Lodging Development,<br />

Canada: Duncan Chiu<br />

History, Plans<br />

- first Element Hotel opened<br />

in 2008<br />

- five properties in Canada, 57<br />

outside of Canada<br />

- no properties in the pipeline<br />

for Canada<br />

Franchise Costs<br />

- initial franchise fee US$75,000<br />

plus US$500/room in excess<br />

of 150<br />

- royalty fee 5.5% of GRS<br />

- program services contribution<br />

3.15% of GRS (includes marketing-fund<br />

contribution of 1%<br />

GRS); plus US$10,000/year;<br />

plus US$220/room/year<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- staff training<br />

- supplies<br />

EMBASSY SUITES BY HILTON<br />

Hilton<br />

7930 Jones Branch Dr.<br />

McLean, VA 22102<br />

703-883-1000<br />

hilton.com/en/corporate/<br />

development/<br />

President & CEO: Christopher<br />

Nassetta<br />

Senior Director, Development,<br />

Canada: Jeff Cury<br />

History, Plans<br />

- established in 1984<br />

- four properties in Canada<br />

(all franchised); 254 outside<br />

of Canada<br />

Franchise Costs<br />

- initial franchise fee US$75,000<br />

for the first 250 rooms, plus<br />

US$400 per additional room<br />

- royalty Fee 3.5% of GRR year one;<br />

4.5% year two; 5.5% year three<br />

and thereafter<br />

Services<br />

- advertising/marketing<br />

- design<br />

- loyalty program<br />

- management<br />

- purchasing<br />

- site location<br />

- staff training<br />

- supplies<br />

EXECUTIVE HOTELS<br />

AND RESORTS<br />

1080 Howe St., 8th Fl.<br />

Vancouver, BC V6Z 2T1<br />

604-642-5250<br />

executivehotels.net<br />

President: Salim Sayani<br />

History, Plans<br />

- established in 1986 in Vancouver<br />

- 11 properties in Canada, three<br />

outside of Canada<br />

Franchise Costs<br />

- fees available upon request<br />

Services<br />

- advertising/marketing<br />

- design<br />

- lease negotiation<br />

- management<br />

- purchasing<br />

- site location<br />

- staff training<br />

- supplies<br />

FAIRFIELD INN & SUITES<br />

Marriott International, Inc.<br />

2425 Matheson Blvd. E., Ste. 100<br />

Mississauga, ON L4W 5K4<br />

905-366-5208<br />

marriottdevelopment.com<br />

Regional VP, Lodging<br />

Development, Canada: Paul Loehr<br />

VP, Lodging Development,<br />

Canada: Aaron Laurie<br />

Director, Lodging Development,<br />

Canada: Duncan Chiu<br />

History, Plans<br />

- established 1987<br />

- 25 properties in Canada; 1,083<br />

outside of Canada<br />

- 20 properties in the pipeline<br />

for Canada<br />

Franchise Costs<br />

- initial franchise fee US$75,000;<br />

plus US$400/room in excess of<br />

125<br />

- royalty fee 5.5% of GRS<br />

- program services contribution<br />

3.85% of GRS (includes marketing-fund<br />

contribution of 2.5%<br />

GRS); plus US$7,000/year;<br />

plus US$135/room/year.<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- staff training<br />

- supplies<br />

FOUR POINTS BY SHERATON<br />

Marriott International, Inc.<br />

2425 Matheson Blvd. E., Ste. 100<br />

Mississauga, ON L4W 5K4<br />

905-366-5208<br />

marriottdevelopment.com<br />

Regional VP, Lodging<br />

Development, Canada: Paul Loehr<br />

VP, Lodging Development,<br />

Canada: Aaron Laurie<br />

Director, Lodging Development,<br />

Canada: Duncan Chiu<br />

History, Plans<br />

- established 1995<br />

- 35 properties in Canada; 256<br />

outside of Canada<br />

- seven properties in the pipeline<br />

for Canada<br />

14 | JANUARY/FEBRUARY <strong>2021</strong> hoteliermagazine.com

THE <strong>2021</strong><br />

FRANCHISE<br />

REPORT<br />

Franchise Costs<br />

- initial franchise fee US$75,000;<br />

plus US$400/room in excess of 150<br />

- royalty fee 5.5% of GRS<br />

- program services contribution<br />

3.15% of GRS (includes a contribution<br />

to the marketing fund of<br />

1% of GRS); plus US$10,000/year;<br />

plus US$220/room/year.<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- staff training<br />

- supplies<br />

GUESTHOUSE EXTENDED STAY<br />

Red Lion Hotels Franchising, Inc.<br />

1550 Market St., Ste. 425<br />

Denver, CO 80202<br />

866-437-4878<br />

franchise.rlhco.com<br />

EVP, Lodging Development &<br />

Franchise Operations:<br />

Harry Sladich<br />

VP, New Development:<br />

Christopher Slattery<br />

History, Plans<br />

- franchising, Inc. since 2015<br />

- re-launched as extended-stay<br />

brand in late 2020<br />

- 18 properties outside of Canada<br />

- expansion planned for Canada<br />

Franchise Costs<br />

- application fee $20,000 for first<br />

60 rooms; plus $150/room over 70<br />

- flat membership fee $60/room/<br />

month (includes royalty and<br />

marketing)<br />

- no loyalty Fees<br />

Services<br />

- advertising/marketing<br />

- CRM<br />

- CRS and CRO<br />

- design<br />

- guest recognition program<br />

procurement<br />

- revenue-management<br />

assistance<br />

- site selection<br />

- supplies<br />

- sales and support<br />

HAMPTON BY HILTON<br />

Hilton<br />

7930 Jones Branch Dr.<br />

McLean, VA 22102<br />

703-883-1000<br />

hilton.com/en/corporate/<br />

development/<br />

President & CEO: Christopher<br />

Nassetta<br />

Senior director, Development,<br />

Canada: Jeff Cury<br />

History, Plans<br />

- established in 1984<br />

- 62 properties in Canada (57<br />

franchised); 2,583 outside<br />

of Canada<br />

Franchise Costs<br />

- initial franchise fee US$75,000<br />

for the first 150 rooms, plus<br />

US$400 per additional room<br />

- royalty fee 6% of GRR<br />

Services<br />

- advertising/marketing<br />

- design<br />

- Hilton HHonors guest-reward<br />

program<br />

- management<br />

- purchasing<br />

- site location<br />

- staff training<br />

- supplies<br />

HAWTHORN SUITES<br />

BY WYNDHAM<br />

Wyndham Hotels & Resorts<br />

22 Sylvian Way<br />

Parsippany, NJ 07054<br />

800-889-9710<br />

wyndhamdevelopment.com<br />

EVP and Chief Development<br />

Officer: Chip Ohlsson<br />

History, Plans<br />

- 110 properties outside of Canada<br />

Franchise Costs<br />

- initial fee for construction equal<br />

to the greater of $44,500 or<br />

$400/room; for conversion of<br />

$40,000 or $400/room<br />

- royalty fee 5.5% GRR<br />

- marketing/reservation<br />

contribution 2.5% GRR<br />

Services<br />

- architectural services<br />

- advertising/marketing<br />

- design<br />

- development<br />

- field support<br />

- financial assistance<br />

- lease negotiation<br />

- management<br />

- purchasing<br />

- quality control<br />

- reservation systems<br />

- staff training<br />

- supplies<br />

HILTON GARDEN INN<br />

Hilton<br />

7930 Jones Branch Dr.<br />

McLean, VA 22102<br />

703-883-1000<br />

hilton.com/en/corporate/<br />

development/<br />

President & CEO:<br />

Christopher Nassetta<br />

Senior Director, Development,<br />

Canada: Jeff Cury<br />

History, Plans<br />

- established in 1996<br />

- 27 properties in Canada (all<br />

franchised); 861 outside of<br />

Canada<br />

Franchise Costs<br />

- initial franchise fee US$75,000<br />

for the first 150 rooms, plus<br />

US$400 per additional room<br />

- royalty fee 5.5% of GRR<br />

Services<br />

- advertising/marketing<br />

- design<br />

- loyalty program<br />

- management<br />

- purchasing<br />

- site location<br />

- staff training<br />

- supplies<br />

HILTON HOTELS & RESORTS<br />

Hilton<br />

7930 Jones Branch Dr.<br />

McLean, VA 22102<br />

703-883-1000<br />

hilton.com/en/corporate/<br />

development/<br />

President & CEO: Christopher<br />

Nassetta<br />

Senior director, Development,<br />

Canada: Jeff Cury<br />

History, Plans<br />

- established in 1925 in Texas<br />

- 13 properties in Canada (nine<br />

franchised); 565 outside of<br />

Canada<br />

Franchise Costs<br />

- Initial franchise fee: US$75,000<br />

for the first 250 rooms, plus<br />

US$400 per additional room<br />

- Royalty Fee: 5% of Gross<br />

Rooms Revenue<br />

Services<br />

- advertising/marketing<br />

- design<br />

- Hilton HHonors guest-reward<br />

program<br />

- management<br />

- purchasing<br />

- site location<br />

- staff training<br />

- supplies<br />

HOLIDAY INN EXPRESS<br />

InterContinental Hotels Group (IHG)<br />

2 Robert Speck Pkwy., Ste. 600<br />

Mississauga, ON L4Z 1H8<br />

416-675-6644<br />

holidayinnexpress.com<br />

Regional Director, Midscale<br />

Franchise Sales & Development,<br />

Canada: Stuart Laurie<br />

History, Plans<br />

- established in 1991<br />

- 106 Franchised Properties in<br />

Canada; 2,720 outside of Canada<br />

- Plans to add 30 units in Canada<br />

hoteliermagazine.com<br />

JANUARY/FEBRUARY <strong>2021</strong> | 15

THE <strong>2021</strong><br />

FRANCHISE<br />

REPORT<br />

Franchise Costs<br />

- total investment $7,881,597 to<br />

$11,081,667<br />

- royalty fee 6%GRR<br />

- marketing fee 3% GRR<br />

- application fee $500/room;<br />

$50,000 minimum<br />

Services:<br />

- advertising/marketing<br />

- design<br />

- management<br />

- site location<br />

- staff training<br />

- supplies<br />

HOLIDAY INN HOTELS<br />

AND RESORTS<br />

InterContinental Hotels Group (IHG)<br />

2 Robert Speck Pkwy., Ste. 600<br />

Mississauga, ON L4Z 1H8<br />

416-675-6644<br />

holidayinn.com<br />

Regional Director, Midscale<br />

Franchise Sales & Development,<br />

Canada: Stuart Laurie<br />

History, Plans<br />

- established in 1952<br />

- 57 franchised properties in<br />

Canada; 1,192 outside of Canada<br />

- plans to add four properties in<br />

Canada<br />

Franchise Costs<br />

- total investment $14,078,650<br />

to $24,969,320<br />

- royalty fee 5% GRR<br />

- marketing fee 3% GRR<br />

- application fee $500/room;<br />

$50,000 Minimum<br />

Services:<br />

- advertising/marketing<br />

- design<br />

- management<br />

- site location<br />

- staff training<br />

- supplies<br />

HOME2 SUITES BY HILTON<br />

Hilton<br />

7930 Jones Branch Dr.<br />

McLean, VA 22102<br />

703-883-1000<br />

hilton.com/en/corporate/<br />

development/<br />

President & CEO:<br />

Christopher Nassetta<br />

Senior Director, Development,<br />

Canada: Jeff Cury<br />

History, Plans<br />

- established in 2009<br />

- seven franchised properties in<br />

Canada (all franchised); 441<br />

outside of Canada<br />

Franchise Costs<br />

- US$75,000 flat franchise fee<br />

- royalty fee: 5% of GRR<br />

Services<br />

- advertising/marketing<br />

- design<br />

- loyalty program<br />

- management<br />

- purchasing<br />

- site location<br />

- staff training<br />

- supplies<br />

HOMEWOOD SUITES<br />

BY HILTON<br />

Hilton<br />

7930 Jones Branch Dr.<br />

McLean, VA 22102<br />

703-883-1000<br />

hilton.com/en/corporate/<br />

development/<br />

President & CEO: Christopher<br />

Nassetta<br />

Senior Director, Development,<br />

Canada: Jeff Cury<br />

History, Plans<br />

- established in 1989<br />

- 21 properties in Canada (all<br />

franchised); 491 outside of<br />

Canada<br />

Franchise Costs<br />

- initial franchise fee US$75,000<br />

for the first 150 rooms, plus<br />

US$400 per additional room<br />

- royalty fee 3.5% of GRR year one;<br />

4.5% year two; 5.5% year three<br />

and thereafter<br />

Services<br />

- advertising/marketing<br />

- design<br />

- loyalty program<br />

- management<br />

- purchasing<br />

- site location<br />

- staff training<br />

- supplies<br />

HOTEL RL<br />

Red Lion Hotels Franchising, Inc.<br />

1550 Market St., Ste. 425<br />

Denver, CO 80202<br />

866-437-4878<br />

franchise.rlhco.com<br />

EVP, Lodging Development &<br />

Franchise Operations:<br />

Harry Sladich<br />

VP, New Development:<br />

Christopher Slattery<br />

History, Plans<br />

- franchised in the U.S. since 2014<br />

- eight properties outside of<br />

Canada<br />

- expansion underway in Canada<br />

Franchise Costs<br />

- application fee $50,000<br />

- royalty flat fee $83.33/room/<br />

month; marketing program flat<br />

fee $8,333.33/month for one to<br />

150 rooms and $12,500/month<br />

for 151+ rooms<br />

- no loyalty fees<br />

Services<br />

- advertising/marketing<br />

- CRM<br />

- CRS and CRO<br />

- design<br />

- guest recognition program<br />

procurement<br />

- revenue-management<br />

assistance<br />

- site selection<br />

- supplies<br />

- sales and support<br />

HOWARD JOHNSON<br />

BY WYNDHAM<br />

Wyndham Hotels & Resorts<br />

22 Sylvan Way<br />

Parsippany, NJ 07054<br />

800-889-9710<br />

wyndhamdevelopment.com<br />

EVP and Chief Development<br />

Officer: Chip Ohlsson<br />

History, Plans<br />

- established in 1954<br />

- 26 properties in Canada (all<br />

franchised); 296 outside of Canada<br />

Franchise Costs<br />

- initial franchise fee the greater<br />

of $35,000 or $350 per room for<br />

conversion; $38,000 or $350/<br />

room for new construction<br />

- total investment $231,130 to<br />

$9,733,080<br />

- marketing fee 4% GRR<br />

- royalty fee 4.5% GRR<br />

Services<br />

- advertising/marketing<br />

- development/design<br />

- financial assistance<br />

- lease negotiation<br />

- purchasing<br />

- quality control<br />

- reservation systems<br />

- sales<br />

- staff training<br />

- supplies<br />

- technical services<br />

HYATT HOUSE<br />

Hyatt Hotels Corporation<br />

150 N. Riverside Plaza<br />

Chicago, IL 60606<br />

416-300-8215<br />

hyattplace.com<br />

Vice-President, Real Estate and<br />

Development (Canada):<br />

Scott Richer<br />

16 | JANUARY/FEBRUARY <strong>2021</strong> hoteliermagazine.com

THE <strong>2021</strong><br />

FRANCHISE<br />

REPORT<br />

History, Plans<br />

- one franchised property in<br />

Canada; 110 outside of Canada<br />

franchised and managed)<br />

- five in the pipeline for Canada<br />

Franchise Costs<br />

- application fee US$75,000; plus<br />

US$500/room (over 150 rooms)<br />

- royalty fee 5% GRR<br />

- marketing fee 3.5% GRR<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- site location<br />

- staff training<br />

- supplies<br />

HYATT PLACE<br />

Hyatt Hotels Corporation<br />

150 N. Riverside Plaza<br />

Chicago, IL 60606<br />

416-300-8215<br />

hyattplace.com<br />

Vice-President, Real Estate and<br />

Development (Canada):<br />

Scott Richer<br />

History, Plans<br />

- established in/franchising<br />

since 2005<br />

- six franchised property in<br />

Canada; 387 outside of Canada<br />

16 in the pipeline for Canada<br />

Franchise Costs<br />

- application fee US$75,000; plus<br />

US$500/room (over 150 rooms)<br />

- royalty fee 5% GRR<br />

- marketing fee 3.5% GRR<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- site location<br />

- staff training<br />

- supplies<br />

HYATT REGENCY<br />

Hyatt Hotels Corporation<br />

150 N. Riverside Plaza<br />

Chicago, IL 60606<br />

416-300-8215<br />

hyattplace.com<br />

Vice-President, Real Estate and<br />

Development (Canada):<br />

Scott Richer<br />

History, Plans<br />

- established in 1967; franchising<br />

since 2006<br />

- three managed properties in<br />

Canada; 217 outside of Canada<br />

- one property in the pipeline<br />

for Canada<br />

Franchise Costs<br />

- application fee US$100,000 or<br />

US$400/room (whichever is<br />

greater)<br />

- royalty fee 6% GRR; plus 3% F&B<br />

- program fee availble to current<br />

FDD<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- purchasing<br />

- site location<br />

- staff training<br />

- supplies<br />

INTERCONTINENTAL<br />

HOTELS & RESORTS<br />

InterContinental Hotels Group (IHG)<br />

2 Robert Speck Pkwy., Ste. 600<br />

Mississauga, ON L4Z 1H8<br />

416-675-6644<br />

intercontinental.com<br />

SVP, Development Upscale &<br />

Luxury and Transactions & Asset<br />

Management: Julienne Smith<br />

development.ihg.com<br />

History, Plans<br />

- established in 1946<br />

- three properties in Canada<br />

(all managed); 207 outside<br />

of Canada<br />

Franchise Costs<br />

- total investment $76,741,115<br />

to $111,703,605<br />

- royalty fee 5% GRR<br />

- marketing fee 3% GRR<br />

- application fee $500/room;<br />

$75,000 minimum<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- site location<br />

- staff training<br />

- supplies<br />

KIMPTON HOTELS<br />

& RESTAURANTS<br />

InterContinental Hotels Group (IHG)<br />

2 Robert Speck Pkwy., Ste. 600<br />

Mississauga, ON L4Z 1H8<br />

416-675-6644<br />

kimptonhotels.com<br />

Vice-President, Development:<br />

Dan Thorman<br />

development.ihg.com<br />

History, Plans<br />

- established in 1981<br />

- one franchised property in<br />

Canada; 71 outside of Canada<br />

Franchise Costs<br />

- total investment $49,789,087<br />

to $70,127,050<br />

- royalty fee 6% GRR; plus 2% of<br />

gross food-and-beverage sales<br />

- marketing fee 3% GRR<br />

- application fee $500/room;<br />

$75,000 minimum<br />

Services<br />

- advertising/marketing<br />

- design<br />

- management<br />

- site selection<br />

- staff training<br />

- supplies<br />

KNIGHTS INN<br />

Red Lion Hotels Franchising, Inc.<br />

1550 Market St., Ste. 425<br />

Denver, CO 80202<br />

866-437-4878<br />

franchise.rlhco.com<br />

EVP, Lodging Development &<br />

Franchise Operations:<br />

Harry Sladich<br />

VP, New Development:<br />

Christopher Slattery<br />

History, Plans<br />

- franchised by Red Lion Hotels<br />

Franchising, Inc., since 2018<br />

- 20 properties in Canada; 187<br />

outside of Canada<br />

- expansion underway in Canada<br />

Franchise Costs<br />

- initial/application fee $16,500 for<br />

first 50 rooms; $150/room over 50<br />

- royalty for first 50 rooms<br />

$23.50/room/month; 51 to 75<br />

rooms $19.50/room/month; 76+<br />

rooms $18.50/room/month ($860<br />

monthly minimum)<br />

- marketing fee $17/room/month<br />

- no loyalty fees<br />

Services<br />

- advertising/marketing<br />

- CRM<br />

- CRS and CRO<br />

- design<br />

- guest recognition program<br />

- procurement<br />

- revenue-management assistance<br />

- site selection<br />

- supplies<br />

- sales and support<br />

LA QUINTA BY WYNDHAM<br />

Wyndham Hotels & Resorts<br />

22 Sylvan Way<br />

Parsippany, NJ 07054<br />

800-889-9710<br />

wyndhamdevelopment.com<br />

EVP and Chief Development<br />

Officer: Chip Ohlsson<br />

History, Plans<br />

- established in 1968 in San<br />

Antonio, Texas<br />

- two franchised properties in<br />

Canada; 926 outside of Canada<br />

hoteliermagazine.com<br />

JANUARY/FEBRUARY <strong>2021</strong> | 17

THE <strong>2021</strong><br />

FRANCHISE<br />

REPORT<br />

Franchise Costs<br />

- initial franchise fee $55,000<br />

or $550/room<br />

- total investment $3,663,491<br />

to $12,590,023<br />

- advertising fee 4.5%<br />

- royalty fee 4.5%<br />

Services<br />

- advertising/marketing<br />

- development/design<br />

- financial assistance<br />