notes to the financial statements - Investor Relations

notes to the financial statements - Investor Relations

notes to the financial statements - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

YEAR ENDED 31 DECEMBER 2011<br />

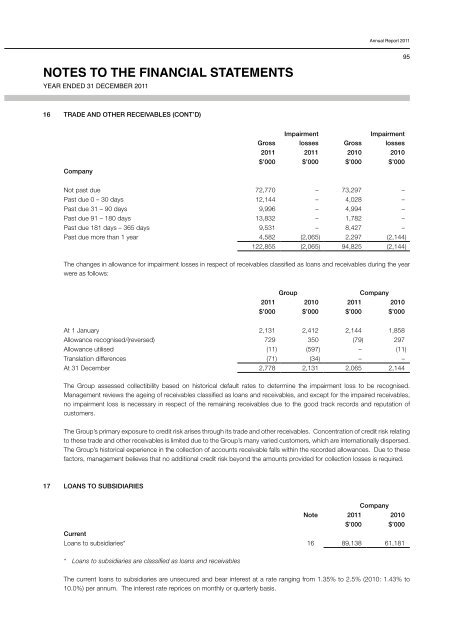

16 TRADE AND OTHER RECEIVABLES (CONT’D)<br />

Company<br />

Gross<br />

Impairment<br />

losses Gross<br />

Annual Report 2011<br />

Impairment<br />

losses<br />

2011 2011 2010 2010<br />

$’000 $’000 $’000 $’000<br />

Not past due 72,770 – 73,297 –<br />

Past due 0 – 30 days 12,144 – 4,028 –<br />

Past due 31 – 90 days 9,996 – 4,994 –<br />

Past due 91 – 180 days 13,832 – 1,782 –<br />

Past due 181 days – 365 days 9,531 – 8,427 –<br />

Past due more than 1 year 4,582 (2,065) 2,297 (2,144)<br />

122,855 (2,065) 94,825 (2,144)<br />

The changes in allowance for impairment losses in respect of receivables classified as loans and receivables during <strong>the</strong> year<br />

were as follows:<br />

Group Company<br />

2011 2010 2011 2010<br />

$’000 $’000 $’000 $’000<br />

At 1 January 2,131 2,412 2,144 1,858<br />

Allowance recognised/(reversed) 729 350 (79) 297<br />

Allowance utilised (11) (597) – (11)<br />

Translation differences (71) (34) – –<br />

At 31 December 2,778 2,131 2,065 2,144<br />

The Group assessed collectibility based on his<strong>to</strong>rical default rates <strong>to</strong> determine <strong>the</strong> impairment loss <strong>to</strong> be recognised.<br />

Management reviews <strong>the</strong> ageing of receivables classified as loans and receivables, and except for <strong>the</strong> impaired receivables,<br />

no impairment loss is necessary in respect of <strong>the</strong> remaining receivables due <strong>to</strong> <strong>the</strong> good track records and reputation of<br />

cus<strong>to</strong>mers.<br />

The Group’s primary exposure <strong>to</strong> credit risk arises through its trade and o<strong>the</strong>r receivables. Concentration of credit risk relating<br />

<strong>to</strong> <strong>the</strong>se trade and o<strong>the</strong>r receivables is limited due <strong>to</strong> <strong>the</strong> Group’s many varied cus<strong>to</strong>mers, which are internationally dispersed.<br />

The Group’s his<strong>to</strong>rical experience in <strong>the</strong> collection of accounts receivable falls within <strong>the</strong> recorded allowances. Due <strong>to</strong> <strong>the</strong>se<br />

fac<strong>to</strong>rs, management believes that no additional credit risk beyond <strong>the</strong> amounts provided for collection losses is required.<br />

17 LOANS TO SUBSIDIARIES<br />

Note<br />

Company<br />

2011 2010<br />

$’000 $’000<br />

Current<br />

Loans <strong>to</strong> subsidiaries* 16 89,138 61,181<br />

* Loans <strong>to</strong> subsidiaries are classified as loans and receivables<br />

The current loans <strong>to</strong> subsidiaries are unsecured and bear interest at a rate ranging from 1.35% <strong>to</strong> 2.5% (2010: 1.43% <strong>to</strong><br />

10.0%) per annum. The interest rate reprices on monthly or quarterly basis.<br />

95