notes to the financial statements - Investor Relations

notes to the financial statements - Investor Relations

notes to the financial statements - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

YEAR ENDED 31 DECEMBER 2011<br />

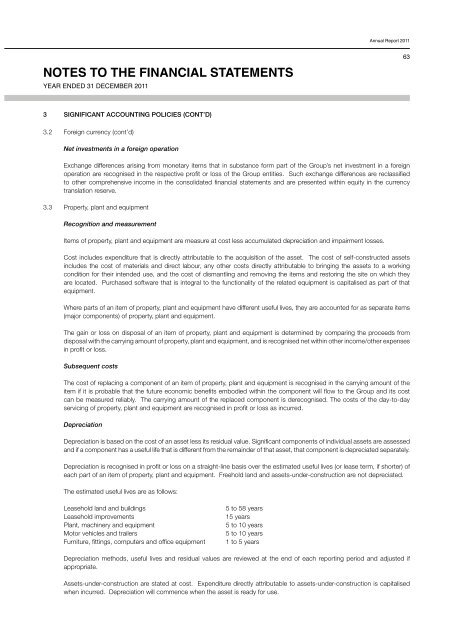

3 SIGNIFICANT ACCOUNTING POLICIES (CONT’D)<br />

3.2 Foreign currency (cont’d)<br />

Net investments in a foreign operation<br />

Annual Report 2011<br />

Exchange differences arising from monetary items that in substance form part of <strong>the</strong> Group’s net investment in a foreign<br />

operation are recognised in <strong>the</strong> respective profit or loss of <strong>the</strong> Group entities. Such exchange differences are reclassified<br />

<strong>to</strong> o<strong>the</strong>r comprehensive income in <strong>the</strong> consolidated <strong>financial</strong> <strong>statements</strong> and are presented within equity in <strong>the</strong> currency<br />

translation reserve.<br />

3.3 Property, plant and equipment<br />

Recognition and measurement<br />

Items of property, plant and equipment are measure at cost less accumulated depreciation and impairment losses.<br />

Cost includes expenditure that is directly attributable <strong>to</strong> <strong>the</strong> acquisition of <strong>the</strong> asset. The cost of self-constructed assets<br />

includes <strong>the</strong> cost of materials and direct labour, any o<strong>the</strong>r costs directly attributable <strong>to</strong> bringing <strong>the</strong> assets <strong>to</strong> a working<br />

condition for <strong>the</strong>ir intended use, and <strong>the</strong> cost of dismantling and removing <strong>the</strong> items and res<strong>to</strong>ring <strong>the</strong> site on which <strong>the</strong>y<br />

are located. Purchased software that is integral <strong>to</strong> <strong>the</strong> functionality of <strong>the</strong> related equipment is capitalised as part of that<br />

equipment.<br />

Where parts of an item of property, plant and equipment have different useful lives, <strong>the</strong>y are accounted for as separate items<br />

(major components) of property, plant and equipment.<br />

The gain or loss on disposal of an item of property, plant and equipment is determined by comparing <strong>the</strong> proceeds from<br />

disposal with <strong>the</strong> carrying amount of property, plant and equipment, and is recognised net within o<strong>the</strong>r income/o<strong>the</strong>r expenses<br />

in profit or loss.<br />

Subsequent costs<br />

The cost of replacing a component of an item of property, plant and equipment is recognised in <strong>the</strong> carrying amount of <strong>the</strong><br />

item if it is probable that <strong>the</strong> future economic benefits embodied within <strong>the</strong> component will flow <strong>to</strong> <strong>the</strong> Group and its cost<br />

can be measured reliably. The carrying amount of <strong>the</strong> replaced component is derecognised. The costs of <strong>the</strong> day-<strong>to</strong>-day<br />

servicing of property, plant and equipment are recognised in profit or loss as incurred.<br />

Depreciation<br />

Depreciation is based on <strong>the</strong> cost of an asset less its residual value. Significant components of individual assets are assessed<br />

and if a component has a useful life that is different from <strong>the</strong> remainder of that asset, that component is depreciated separately.<br />

Depreciation is recognised in profit or loss on a straight-line basis over <strong>the</strong> estimated useful lives (or lease term, if shorter) of<br />

each part of an item of property, plant and equipment. Freehold land and assets-under-construction are not depreciated.<br />

The estimated useful lives are as follows:<br />

Leasehold land and buildings 5 <strong>to</strong> 58 years<br />

Leasehold improvements 15 years<br />

Plant, machinery and equipment 5 <strong>to</strong> 10 years<br />

Mo<strong>to</strong>r vehicles and trailers 5 <strong>to</strong> 10 years<br />

Furniture, fittings, computers and office equipment 1 <strong>to</strong> 5 years<br />

Depreciation methods, useful lives and residual values are reviewed at <strong>the</strong> end of each reporting period and adjusted if<br />

appropriate.<br />

Assets-under-construction are stated at cost. Expenditure directly attributable <strong>to</strong> assets-under-construction is capitalised<br />

when incurred. Depreciation will commence when <strong>the</strong> asset is ready for use.<br />

63