notes to the financial statements - Investor Relations

notes to the financial statements - Investor Relations

notes to the financial statements - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

YEAR ENDED 31 DECEMBER 2011<br />

42 FINANCIAL RISK MANAGEMENT (CONT’D)<br />

Commodity price risk<br />

Annual Report 2011<br />

The Group uses derivative <strong>financial</strong> instruments such as commodity futures and commodity option contracts <strong>to</strong> hedge certain<br />

exposures. The two markets used are <strong>the</strong> London Metal Exchange (“LME”) for Base Metals, such as copper, lead and zinc,<br />

and <strong>the</strong> London Bullion Market Association (“LBMA”) for gold and silver.<br />

As <strong>the</strong> majority of <strong>the</strong> physical contract pricing is based on <strong>the</strong> average of <strong>the</strong> quotational pricing period (Q/P), <strong>the</strong> hedge<br />

department will lock in <strong>the</strong> average of <strong>the</strong> month by hedging over <strong>the</strong> counter (OTC) averaging contracts with one of its<br />

brokers which are <strong>the</strong>n converted <strong>to</strong> LME or LBMA contracts once <strong>the</strong> averaging has been completed. Thus <strong>the</strong> physical<br />

contract will be back <strong>to</strong> back with <strong>the</strong> futures contract, locking in <strong>the</strong> price risk.<br />

In addition, <strong>the</strong> hedge department will endeavour <strong>to</strong> lock in <strong>the</strong> spread (<strong>the</strong> difference between <strong>the</strong> Intake Q/P and <strong>the</strong> Outgo<br />

Q/P) relating <strong>to</strong> <strong>the</strong> physical shipment, ei<strong>the</strong>r by borrowing or lending in <strong>the</strong> relevant time period. Usually in a backwardation<br />

market <strong>the</strong> physical outgo should be priced before <strong>the</strong> physical intake and <strong>the</strong>refore <strong>the</strong> hedge department would lend <strong>the</strong><br />

spread. In a contango market <strong>the</strong> inverse applies.<br />

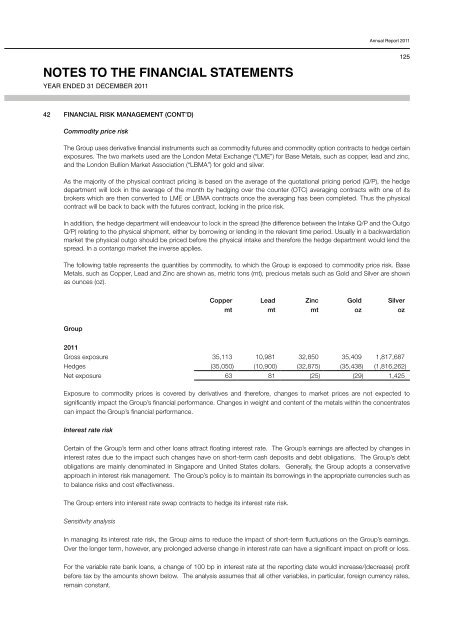

The following table represents <strong>the</strong> quantities by commodity, <strong>to</strong> which <strong>the</strong> Group is exposed <strong>to</strong> commodity price risk. Base<br />

Metals, such as Copper, Lead and Zinc are shown as, metric <strong>to</strong>ns (mt), precious metals such as Gold and Silver are shown<br />

as ounces (oz).<br />

Group<br />

Copper Lead Zinc Gold Silver<br />

mt mt mt oz oz<br />

2011<br />

Gross exposure 35,113 10,981 32,850 35,409 1,817,687<br />

Hedges (35,050) (10,900) (32,875) (35,438) (1,816,262)<br />

Net exposure 63 81 (25) (29) 1,425<br />

Exposure <strong>to</strong> commodity prices is covered by derivatives and <strong>the</strong>refore, changes <strong>to</strong> market prices are not expected <strong>to</strong><br />

significantly impact <strong>the</strong> Group’s <strong>financial</strong> performance. Changes in weight and content of <strong>the</strong> metals within <strong>the</strong> concentrates<br />

can impact <strong>the</strong> Group’s <strong>financial</strong> performance.<br />

Interest rate risk<br />

Certain of <strong>the</strong> Group’s term and o<strong>the</strong>r loans attract floating interest rate. The Group’s earnings are affected by changes in<br />

interest rates due <strong>to</strong> <strong>the</strong> impact such changes have on short-term cash deposits and debt obligations. The Group’s debt<br />

obligations are mainly denominated in Singapore and United States dollars. Generally, <strong>the</strong> Group adopts a conservative<br />

approach in interest risk management. The Group’s policy is <strong>to</strong> maintain its borrowings in <strong>the</strong> appropriate currencies such as<br />

<strong>to</strong> balance risks and cost effectiveness.<br />

The Group enters in<strong>to</strong> interest rate swap contracts <strong>to</strong> hedge its interest rate risk.<br />

Sensitivity analysis<br />

In managing its interest rate risk, <strong>the</strong> Group aims <strong>to</strong> reduce <strong>the</strong> impact of short-term fluctuations on <strong>the</strong> Group’s earnings.<br />

Over <strong>the</strong> longer term, however, any prolonged adverse change in interest rate can have a significant impact on profit or loss.<br />

For <strong>the</strong> variable rate bank loans, a change of 100 bp in interest rate at <strong>the</strong> reporting date would increase/(decrease) profit<br />

before tax by <strong>the</strong> amounts shown below. The analysis assumes that all o<strong>the</strong>r variables, in particular, foreign currency rates,<br />

remain constant.<br />

125