notes to the financial statements - Investor Relations

notes to the financial statements - Investor Relations

notes to the financial statements - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

YEAR ENDED 31 DECEMBER 2011<br />

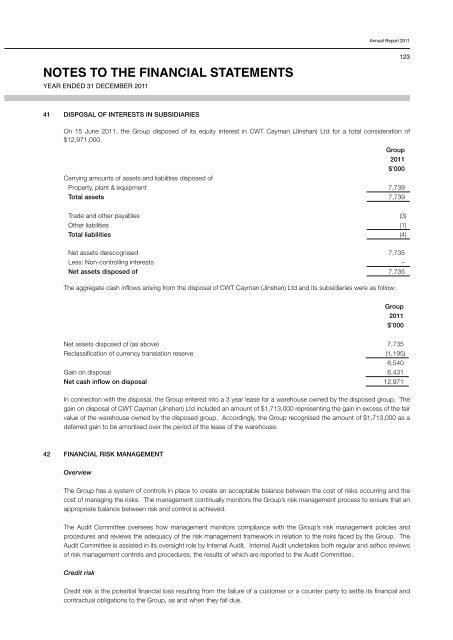

41 DISPOSAL OF INTERESTS IN SUBSIDIARIES<br />

Annual Report 2011<br />

On 15 June 2011, <strong>the</strong> Group disposed of its equity interest in CWT Cayman (Jinshan) Ltd for a <strong>to</strong>tal consideration of<br />

$12,971,000.<br />

Group<br />

2011<br />

$’000<br />

Carrying amounts of assets and liabilities disposed of<br />

Property, plant & equipment 7,739<br />

Total assets 7,739<br />

Trade and o<strong>the</strong>r payables (3)<br />

O<strong>the</strong>r liabilities (1)<br />

Total liabilities (4)<br />

Net assets derecognised 7,735<br />

Less: Non-controlling interests –<br />

Net assets disposed of 7,735<br />

The aggregate cash inflows arising from <strong>the</strong> disposal of CWT Cayman (Jinshan) Ltd and its subsidiaries were as follow:<br />

123<br />

Group<br />

2011<br />

$’000<br />

Net assets disposed of (as above) 7,735<br />

Reclassification of currency translation reserve (1,195)<br />

6,540<br />

Gain on disposal 6,431<br />

Net cash inflow on disposal 12,971<br />

In connection with <strong>the</strong> disposal, <strong>the</strong> Group entered in<strong>to</strong> a 3 year lease for a warehouse owned by <strong>the</strong> disposed group. The<br />

gain on disposal of CWT Cayman (Jinshan) Ltd included an amount of $1,713,000 representing <strong>the</strong> gain in excess of <strong>the</strong> fair<br />

value of <strong>the</strong> warehouse owned by <strong>the</strong> disposed group. Accordingly, <strong>the</strong> Group recognised <strong>the</strong> amount of $1,713,000 as a<br />

deferred gain <strong>to</strong> be amortised over <strong>the</strong> period of <strong>the</strong> lease of <strong>the</strong> warehouse.<br />

42 FINANCIAL RISK MANAGEMENT<br />

Overview<br />

The Group has a system of controls in place <strong>to</strong> create an acceptable balance between <strong>the</strong> cost of risks occurring and <strong>the</strong><br />

cost of managing <strong>the</strong> risks. The management continually moni<strong>to</strong>rs <strong>the</strong> Group’s risk management process <strong>to</strong> ensure that an<br />

appropriate balance between risk and control is achieved.<br />

The Audit Committee oversees how management moni<strong>to</strong>rs compliance with <strong>the</strong> Group’s risk management policies and<br />

procedures and reviews <strong>the</strong> adequacy of <strong>the</strong> risk management framework in relation <strong>to</strong> <strong>the</strong> risks faced by <strong>the</strong> Group. The<br />

Audit Committee is assisted in its oversight role by Internal Audit. Internal Audit undertakes both regular and adhoc reviews<br />

of risk management controls and procedures, <strong>the</strong> results of which are reported <strong>to</strong> <strong>the</strong> Audit Committee.<br />

Credit risk<br />

Credit risk is <strong>the</strong> potential <strong>financial</strong> loss resulting from <strong>the</strong> failure of a cus<strong>to</strong>mer or a counter party <strong>to</strong> settle its <strong>financial</strong> and<br />

contractual obligations <strong>to</strong> <strong>the</strong> Group, as and when <strong>the</strong>y fall due.