notes to the financial statements - Investor Relations

notes to the financial statements - Investor Relations

notes to the financial statements - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CWT Limited<br />

100<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

YEAR ENDED 31 DECEMBER 2011<br />

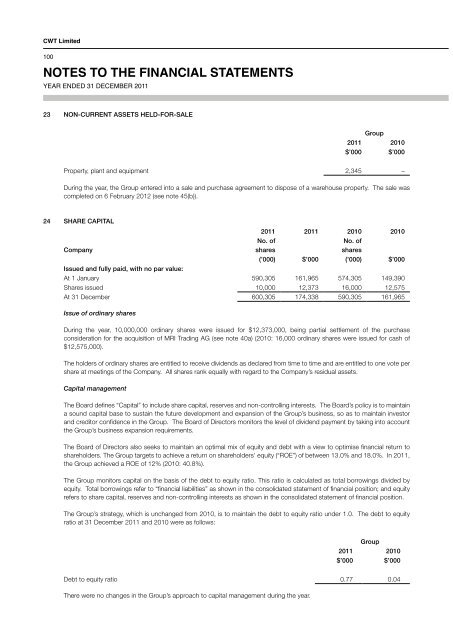

23 NON-CURRENT ASSETS HELD-FOR-SALE<br />

Group<br />

2011 2010<br />

$’000 $’000<br />

Property, plant and equipment 2,345 –<br />

During <strong>the</strong> year, <strong>the</strong> Group entered in<strong>to</strong> a sale and purchase agreement <strong>to</strong> dispose of a warehouse property. The sale was<br />

completed on 6 February 2012 (see note 45(b)).<br />

24 SHARE CAPITAL<br />

2011 2011 2010 2010<br />

No. of<br />

No. of<br />

Company<br />

shares<br />

shares<br />

(’000) $’000 (’000) $’000<br />

Issued and fully paid, with no par value:<br />

At 1 January 590,305 161,965 574,305 149,390<br />

Shares issued 10,000 12,373 16,000 12,575<br />

At 31 December 600,305 174,338 590,305 161,965<br />

Issue of ordinary shares<br />

During <strong>the</strong> year, 10,000,000 ordinary shares were issued for $12,373,000, being partial settlement of <strong>the</strong> purchase<br />

consideration for <strong>the</strong> acquisition of MRI Trading AG (see note 40a) (2010: 16,000 ordinary shares were issued for cash of<br />

$12,575,000).<br />

The holders of ordinary shares are entitled <strong>to</strong> receive dividends as declared from time <strong>to</strong> time and are entitled <strong>to</strong> one vote per<br />

share at meetings of <strong>the</strong> Company. All shares rank equally with regard <strong>to</strong> <strong>the</strong> Company’s residual assets.<br />

Capital management<br />

The Board defines “Capital” <strong>to</strong> include share capital, reserves and non-controlling interests. The Board’s policy is <strong>to</strong> maintain<br />

a sound capital base <strong>to</strong> sustain <strong>the</strong> future development and expansion of <strong>the</strong> Group’s business, so as <strong>to</strong> maintain inves<strong>to</strong>r<br />

and credi<strong>to</strong>r confidence in <strong>the</strong> Group. The Board of Direc<strong>to</strong>rs moni<strong>to</strong>rs <strong>the</strong> level of dividend payment by taking in<strong>to</strong> account<br />

<strong>the</strong> Group’s business expansion requirements.<br />

The Board of Direc<strong>to</strong>rs also seeks <strong>to</strong> maintain an optimal mix of equity and debt with a view <strong>to</strong> optimise <strong>financial</strong> return <strong>to</strong><br />

shareholders. The Group targets <strong>to</strong> achieve a return on shareholders’ equity (“ROE”) of between 13.0% and 18.0%. In 2011,<br />

<strong>the</strong> Group achieved a ROE of 12% (2010: 40.8%).<br />

The Group moni<strong>to</strong>rs capital on <strong>the</strong> basis of <strong>the</strong> debt <strong>to</strong> equity ratio. This ratio is calculated as <strong>to</strong>tal borrowings divided by<br />

equity. Total borrowings refer <strong>to</strong> “<strong>financial</strong> liabilities” as shown in <strong>the</strong> consolidated statement of <strong>financial</strong> position; and equity<br />

refers <strong>to</strong> share capital, reserves and non-controlling interests as shown in <strong>the</strong> consolidated statement of <strong>financial</strong> position.<br />

The Group’s strategy, which is unchanged from 2010, is <strong>to</strong> maintain <strong>the</strong> debt <strong>to</strong> equity ratio under 1.0. The debt <strong>to</strong> equity<br />

ratio at 31 December 2011 and 2010 were as follows:<br />

Group<br />

2011 2010<br />

$’000 $’000<br />

Debt <strong>to</strong> equity ratio 0.77 0.04<br />

There were no changes in <strong>the</strong> Group’s approach <strong>to</strong> capital management during <strong>the</strong> year.